|

|

市場調査レポート

商品コード

1396695

ポリブチレンテレフタレート(PBT)の世界市場-2023年~2030年Global Polybutylene Terephthalate (PBT) Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ポリブチレンテレフタレート(PBT)の世界市場-2023年~2030年 |

|

出版日: 2023年12月15日

発行: DataM Intelligence

ページ情報: 英文 192 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

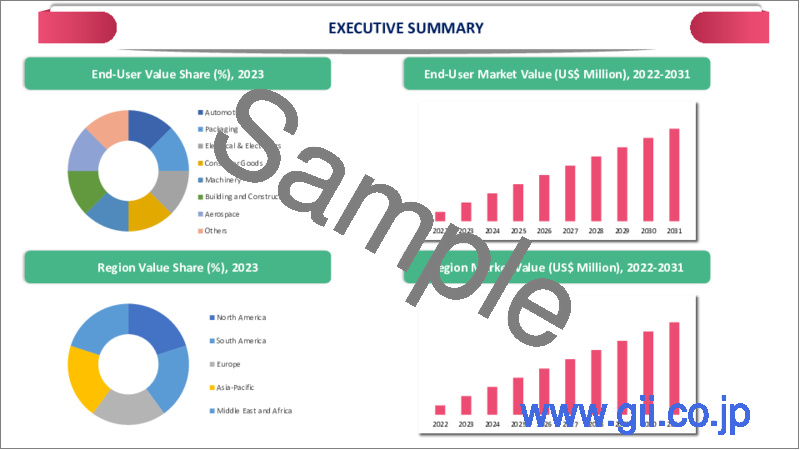

ポリブチレンテレフタレート(PBT)の世界市場は、2022年に30億米ドルに達し、2023-2030年の予測期間中にCAGR 6.6%で成長し、2030年には49億米ドルに達すると予測されています。

通信セクターのPBT需要は、5G技術の展開に後押しされています。PBTは、5Gインフラの他の部品の中でも、アンテナ、接続、電子モジュール用ハウジングの製造に利用されています。電気絶縁性に優れ、過酷な外部環境にも耐えることから、この素材は急速に発展する5Gネットワーク・インフラにとって最有力候補となっています。

PBTのリサイクル性は広く認知されており、持続可能性が重視されるようになるにつれて、この製品に対する需要が高まっています。PBTはそのリサイクル可能な性質から有利なポジションを占めており、さまざまな産業でますます受け入れられている環境目標によく合致しています。製造業者と消費者が同様に持続可能性を優先し始めるにつれて、いくつかの用途でPBTの需要が増加すると思われます。

アジア太平洋は、世界のポリブチレンテレフタレート(PBT)市場の1/3以上を占める成長地域のひとつです。アジア太平洋はエレクトロニクスと自動車分野の世界の中心地です。中産階級の富裕化が進んだ結果、自動車や電子機器に対する需要が増加しています。PBTは、電気絶縁性、耐熱性、耐久性など、その有利な特性により、いくつかの産業で広く利用されています。

力学

電気・電子製品の用途拡大

市場を牽引しているのは、電気・電子産業におけるポリブチレンテレフタレートの使用量の増加です。PBTは、優れた電気絶縁性、高温耐性、寸法安定性により、スイッチ、ソケット、接続部、サーキットブレーカーなどの電気部品の生産に推奨される材料です。

例えば、BASFは2022年に、自動車用途で繊細な電子機器を保護するために設計されたポリブチレンテレフタレート(PBT)であるUltradur B4335G3 HR HSPを発売しました。ユニークな特性の組み合わせで知られるこの素材は、ホイールスピードセンサーのような重要な部品に信頼性の高い保護機能を提供します。

ABSやESPシステムに不可欠なセンサーは、緊急時に車両の安定性を維持する上で重要な役割を果たします。Ultradur B4335G3 HR HSPは、極端な気候条件や、飛沫水や塩分などの外的要素から保護する能力において、代替材料よりも際立っており、耐久性と最適な性能を保証します。

自動車用途で高まるPBTの需要

自動車産業におけるポリブチレンテレフタレートへのニーズの高まりが、世界のPBT市場を後押ししています。高い機械的強度、耐薬品性、低吸湿性といったPBTの優れた特性は、センサー、接続部、ボンネット部品など、さまざまな自動車部品にとって理想的な材料となっています。

例えば、SABICは2020年に、レーダーを吸収する2つの新しいLNP STAT-KONコンパウンドを導入することで、自動車レーダーセンサー用の専門材料の範囲を拡大しました。この新グレードは、自動車用化学薬品に対してより優れた耐性を持つPBT素材のレドームと統合することができます。新グレードはPBT樹脂をベースにしています。

原材料の高コスト

原材料の価格変動は、ポリブチレンテレフタレート(PBT)の世界市場を制限する重要な要因です。PBTの生産は石油化学原料と密接に結びついており、これらの原料のコストと入手可能性は製品の製造に大きく影響します。

原油価格の変動や地政学的な不確実性は、PBTメーカーに予測不可能なコストをもたらし、利益率に影響を与え、安定した製品価格を維持するための課題となります。PBTは原料価格の変動に影響されやすいため、メーカーはリスクにさらされ、長期的なコスト計画と管理能力が複雑になります。

競合代替品と原料代替品

PBT市場は、代替品や代替材料との競争の激化によっても阻害されています。強い耐熱性、電気絶縁性、寸法安定性などの優れた特性はPBTが提供しているが、他のテクニカル・プラスチックや熱可塑性プラスチックも絶えず開発されています。競合材料は、さまざまな価格帯で同等の、または改善された特性を持つ可能性があり、生産者は他の選択肢に目を向けるよう促されています。

ポリアミド(PA)やポリエチレンテレフタレート(PET)のような材料は、特に特定の用途の特定のニーズをより手頃な価格で満たすことができる場合、用途によってはPBTの代替品として考慮されることがあります。PBTメーカーは、変化し続ける市場環境の中で、代替素材に対する競争力を維持するために、常に商品を開発し、差別化を図らなければならないです。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 電気・電子製品の使用の増加

- 自動車用途でのPBT需要の増加

- 抑制要因

- 原料コストの高騰

- 競合代替品と材料代替

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- 強化ポリブチレンテレフタレート

- 15%強化

- 30%強化

- 50%強化

- 50%超強化

- 非強化ポリブチレンテレフタレート

第8章 加工方法別

- 射出成形

- ブロー成形

- 押出成形

- その他

第9章 エンドユーザー別

- 自動車

- ボディパネル

- イグニッションコイルボビン

- 被覆断熱材

- 排気系部品

- 点火システム

- その他

- 包装

- 食品

- 化粧品

- その他

- 電気・電子

- トランスコイルボビン

- アダプターコイルボビン

- 偏向コイル

- CRT&ポテンショメータースタンド

- スイッチング・コネクター

- モーターカバー&ブッシュ

- その他

- 消費財

- スポーツ用品

- キッチン用品

- その他

- 機械

- 輸送機械部品

- ミシン

- 繊維機械部品

- 電動工具部品

- その他

- 建築・建設

- 航空宇宙

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- BASF SE

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Chang Chun Group

- Hengli Group Co., Ltd.

- SABIC

- Celanese Corporation

- Polyplastics Co., Ltd.

- Evonik Industries AG

- Koninklijke DSM N.V.

- Lanxess AG

- Mitsubishi Chemical Corporation

第13章 付録

Overview

Global Polybutylene Terephthalate (PBT) Market reached US$ 3.0 billion in 2022 and is expected to reach US$ 4.9 billion by 2030, growing with a CAGR of 6.6% during the forecast period 2023-2030.

The telecommunication sector's demand for PBT is being fueled by the rollout of 5G technology. PBT is utilized in the production of antennas, connections and housing for electronic modules, among other parts of 5G infrastructure. Because of its superior electrical insulating capabilities and resistance to harsh outside environments, this material is a top pick for the quickly developing 5G network infrastructure.

The recyclability of PBT is widely recognized and with the growing emphasis on sustainability, there is an increasing demand for this product. PBT holds a favorable position due to its recyclable nature, aligning well with the increasingly embraced environmental goals of various industries. There will likely be a rise in demand for PBT in several applications as manufacturers and consumers alike start to prioritize sustainability.

Asia-Pacific is among the growing regions in the global polybutylene terephthalate (PBT) market covering more than 1/3rd of the market. Asia-Pacific is a major globally center for the electronics and automobile sectors. The demand for cars and electronics has increased as a result of the middle class's increasing wealth in the area. PBT is widely utilized in several industries due to its advantageous qualities, which include electrical insulation, heat resistance and durability.

Dynamics

Increasing Use of Electrical and Electronic Products

The market is driven by the growing usage of polybutylene terephthalate in the electrical and electronic industries. PBT is a recommended material for the production of electrical components including switches, sockets, connections and circuit breakers due to its superior electrical insulating qualities, resilience to high temperatures and dimensional stability.

For Instance, in 2022, BASF launched Ultradur B4335G3 HR HSP, a polybutylene terephthalate (PBT) designed to protect sensitive electronics in automotive applications. The material, known for its unique combination of properties, provides reliable safeguarding for crucial components like wheel speed sensors.

The sensors, integral for ABS and ESP systems, play a vital role in maintaining vehicle stability during emergencies. Ultradur B4335G3 HR HSP ensures durability and optimal performance, standing out from alternative materials in its ability to shield against extreme climatic conditions and external elements like splash water and salt.

Growing Demand for PBT in Automobile Applications

The increasing need for polybutylene terephthalate in the automotive industry is propelling the globally PBT market forward. PBT's exceptional properties, such as high mechanical strength, resistance to chemicals and low moisture absorption, position it as an ideal material for various automotive components, including sensors, connections and under-the-hood parts.

For Instance, in 2020, SABIC expanded its range of specialist materials for automobile radar sensors by introducing two new LNP STAT-KON compounds that absorb radar. The new grades may be integrated with radomes made of PBT material, which can offer better resistance to automotive chemicals. The new grades are based on PBT resin.

High Cost of Raw Material

The price volatility of raw materials is a key factor limiting the globally market for polybutylene terephthalate (PBT). The production of PBT is closely tied to petrochemical feedstocks and the cost and availability of these raw materials significantly influence the manufacturing of the product.

Fluctuations in oil prices and geopolitical uncertainties can result in unpredictable costs for PBT manufacturers, impacting their profit margins and creating challenges in maintaining stable product prices. The susceptibility of PBT to changes in raw material prices exposes manufacturers to risks, complicating their ability to plan and control costs over the long term.

Competitive Substitutes and Material Substitution

The PBT market is also being impeded by the increasing competition from substitutes and alternative materials. Excellent qualities including strong heat resistance, electrical insulating ability and dimensional stability are provided by PBT, but other technical plastics and thermoplastics are also constantly developing. Rival materials could have comparable or improved properties at varying price points, prompting producers to look at other choices.

Materials such as polyamide (PA) or polyethylene terephthalate (PET) may be taken into consideration as PBT alternatives in some applications, particularly if they can fulfill the particular needs of a certain application at a more affordable price. PBT producers must constantly develop and distinguish their goods in this ever-changing market environment to keep a competitive edge against substitute materials.

Segment Analysis

The global polybutylene terephthalate (PBT) market is segmented based on type, processing method, end-user and region.

Rising Electrical & Electronics Due to High Production of Electric Components

The Electrical & Electronics segment is among the growing regions in the Global Polybutylene Terephthalate (PBT) Market covering more than 1/3rd of the market. The growing Electrical and Electronics sector is one of the primary forces of the polybutylene terephthalate (PBT) market. PBT has emerged as a preferred material for manufacturing electrical components, thanks to its outstanding electrical insulating properties, thermal stability and resistance to flames.

The adoption of PBT in connectors, switches, sockets and various electrical elements has experienced a notable surge, particularly driven by the increasing demand for electronic devices in sectors like consumer electronics, automotive electronics and industrial equipment. Moreover, PBT is well-suited for applications in electronic devices requiring reliable performance across diverse temperature ranges, attributed to its high melting point and dimensional stability.

Geographical Penetration

Growing Applications of Polybutylene Terephthalate in Asia-Pacific and Growing Use of Automotive Polymers in Passenger Cars

The Asia-Pacific has been a dominant force in the global polybutylene terephthalate market. A notable share of the polymers employed in passenger vehicles, especially within the automotive sector, is predominantly derived from polybutylene terephthalate. Although it is mostly utilized in automobile electric systems, polybutylene terephthalate has applications both indoors and outdoors.

PBT finds widespread applications in power relays, switches, motor components, ignition system parts, fuse boxes, actuator cases, windshield wiper covers, connections, mirror housings, cowl vents, handles, fans and fuel system components. Furthermore, China boasts the world's largest automotive manufacturing base, catering to both domestic and international needs.

Furthermore, in March 2021, Toyota Kirloskar Motor witnessed a substantial growth of 114%, selling 15,001 components in India. Anticipated to reach 27 million in 2021, vehicle sales, as reported by the China Association of Automobile Producers, are poised for a 6.7% increase compared to the previous year. Japan, China and South Korea are notable for being major producers of electronics and diverse consumer goods, where polybutylene terephthalate assumes a crucial role as a key component, alongside its substantial impact in the automotive sector.

The demand for polybutylene terephthalate in the area increased in 2020 when China's trading sales of consumer products reached US$ 6 trillion, up 20% from the year before. It is anticipated that polybutylene terephthalate's use will increase in this field since it is also used in industries to make conveyor chain components and housings for power tools. Because of this, the Asia-Pacific area now represents a significant portion of the globally market for polybutylene terephthalate.

COVID-19 Impact Analysis

The global market for polybutylene terephthalate (PBT) has been significantly impacted by the COVID-19 pandemic. Key PBT customers in the automobile, electronics and consumer goods sectors were among the industries affected by the pandemic's lockdowns, supply chain disruptions and economic downturns. During the early stages of the pandemic, the PBT market faced difficulties in production and delivery due to manufacturing facilities temporarily closing and a decline in demand.

The general market for PBT-based goods was further impacted by the uncertainty surrounding the intensity and duration of the pandemic, which also affected investment choices. There is anticipated growth in the Polybutylene Terephthalate market as the world economy progressively recovers from the epidemic. PBT demand is expected to be driven by an increased emphasis on sustainability as well as the expanding need for lightweight, high-performance materials in sectors like electronics and the automotive industry.

The COVID-19 epidemic has highlighted the significance of robust and flexible supply chains, leading businesses to reevaluate and broaden their approaches to procuring raw materials. It is crucial to remember that the precise effects of COVID-19 on the PBT market might change according to geographical variables, governmental actions and the rate at which certain industries recover.

The COVID-19 pandemic's ongoing effects on the supply chain have also had an impact on the cost and availability of raw materials required to make polybutylene terephthalate (PBT). For producers in the PBT sector, fluctuations in the cost of petrochemicals and other essential components have created an extra degree of complication.

Russia-Ukraine War Impact Analysis

The availability and cost of raw resources might be unclear due to supply chain disruption caused by geopolitical conflicts, particularly when they include major manufacturing or resource-producing countries like Russia and Ukraine. Electronics and the automobile industry, among others, frequently employ polybutylene terephthalate (PBT).

The global PBT market may be impacted by any supply chain interruption caused by the war if Russia or Ukraine are major suppliers of essential raw materials for PBT manufacture. Further impacting the market for PBT-containing products, geopolitical tensions may also result in wider economic worries that undermine consumer confidence and investment decisions.

It is advised to consult recent reports from industry experts, market research companies and news sources covering the most recent developments in the region and their potential effects on the global supply chain to obtain the most accurate and up-to-date information on the specific impact of the Russia-Ukraine conflict on the Polybutylene Terephthalate (PBT) market.

By Type

- Reinforced Polybutylene Terephthalate

- 15% Reinforced

- 30% Reinforced

- 50% Reinforced

- >50% Reinforced

- Unreinforced Polybutylene Terephthalate

By Processing Method

- Injection Molding

- Blow Molding

- Extrusion

- Others

By End-User

- Automotive

- Body Panels

- Ignition Coil Bobbins

- Covered Insulations

- Exhaust System part

- Ignition System

- Others

- Packaging

- Food Products

- Cosmetics

- Others

- Electrical & Electronics

- Transformer Coil Bobbins

- Adapter Coil Bobbins

- Deflection Coils

- CRT & Potentiometer Stands

- Switching connectors

- Motor Cover and Bushings

- Others

- Consumer Goods

- Sporting Goods

- Kitchen Appliances

- Others

- Machinery

- Transport Machinery Parts

- Sewing Machines

- Textile Machinery Parts

- Power Tool Parts

- Others

- Building and Construction

- Aerospace

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On February 14, 2023, Polyplastics Group introduced a novel electrically conductive variant of DURANEX polybutylene terephthalate (PBT) tailored for millimeter-wave radar applications in the automotive sector. DURANEX PBT 201EB not only possesses electrical conductivity but also offers the advantage of electromagnetic wave shielding. The dual functionality aids in minimizing assembly efforts and, consequently, leads to cost reductions in the production process.

- On February 23, 2022, the manufacturing capacity of BASF (Malaysia) Sdn Bhd expanded by 5,000 metric tons annually for its Ultramid polyamide (PA) and Ultradur polybutylene terephthalate (PBT) products. In Q2 2023, the debottlenecking of BASF's production facility in Pasir Gudang, Malaysia, is expected to be finished

- On June 23, 2021, Global chemical and specialty materials giant Celanese Corporation acquired some technology related to the manufacture of polyacetal (POM) products from Grupa Azoty S.A. of Tarnow, Poland, after it decided to stop producing POM. Celanese will assume all current Tarnoform contracts to provide customer service to Azoty.

Competitive Landscape

The major global players in the market include: BASF SE, Chang Chun Group, Hengli Group Co., Ltd., SABIC, Celanese Corporation, Polyplastics Co., Ltd., Evonik Industries AG, Koninklijke DSM N.V., Lanxess AG and Mitsubishi Chemical Corporation.

Why Purchase the Report?

- to visualize the global polybutylene terephthalate (PBT) market segmentation based on type, processing method, end-user and region and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of polybutylene terephthalate (PBT) market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global polybutylene terephthalate (PBT) market report would provide approximately 61 tables, 62 figures and 192 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Processing Method

- 3.3. Snippet by End-User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Use of Electrical and Electronic Products

- 4.1.1.2. Growing Demand for PBT in Automobile Applications

- 4.1.2. Restraints

- 4.1.2.1. High Cost of Raw Material

- 4.1.2.2. Competitive Substitutes and Material Substitution

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Reinforced Polybutylene Terephthalate*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.3. 15% Reinforced

- 7.2.4. 30% Reinforced

- 7.2.5. 50% Reinforced

- 7.2.6. >50% Reinforced

- 7.3. Unreinforced Polybutylene Terephthalate

8. By Processing Method

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing Method

- 8.1.2. Market Attractiveness Index, By Processing Method

- 8.2. Injection Molding*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Blow Molding

- 8.4. Extrusion

- 8.5. Others

9. By End-User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.1.2. Market Attractiveness Index, By End-user

- 9.2. Automotive*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.2.3. Body Panels

- 9.2.4. Ignition Coil Bobbins

- 9.2.5. Covered Insulations

- 9.2.6. Exhaust System part

- 9.2.7. Ignition System

- 9.2.8. Others

- 9.3. Packaging

- 9.3.1. Food Products

- 9.3.2. Cosmetics

- 9.3.3. Others

- 9.4. Electrical & Electronics

- 9.4.1. Transformer Coil Bobbins

- 9.4.2. Adapter Coil Bobbins

- 9.4.3. Deflection Coils

- 9.4.4. CRT & Potentiometer Stands

- 9.4.5. Switching connectors

- 9.4.6. Motor Cover and Bushings

- 9.4.7. Others

- 9.5. Consumer Goods

- 9.5.1. Sporting Goods

- 9.5.2. Kitchen Appliances

- 9.5.3. Others

- 9.6. Machinery

- 9.6.1. Transport Machinery Parts

- 9.6.2. Sewing Machines

- 9.6.3. Textile Machinery Parts

- 9.6.4. Power Tool Parts

- 9.6.5. Others

- 9.7. Building and Construction

- 9.8. Aerospace

- 9.9. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing Method

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing Method

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Russia

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing Method

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing Method

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing Method

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. BASF SE*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Chang Chun Group

- 12.3. Hengli Group Co., Ltd.

- 12.4. SABIC

- 12.5. Celanese Corporation

- 12.6. Polyplastics Co., Ltd.

- 12.7. Evonik Industries AG

- 12.8. Koninklijke DSM N.V.

- 12.9. Lanxess AG

- 12.10. Mitsubishi Chemical Corporation

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us