|

|

市場調査レポート

商品コード

1396671

炭素繊維強化熱可塑性複合材料(CFRTP)の世界市場-2023年~2030年Global Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 炭素繊維強化熱可塑性複合材料(CFRTP)の世界市場-2023年~2030年 |

|

出版日: 2023年12月15日

発行: DataM Intelligence

ページ情報: 英文 201 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

炭素繊維強化熱可塑性複合材料(CFRTP)の世界市場は、2022年に34億米ドルに達し、2023-2030年の予測期間中にCAGR 10.6%で成長し、2030年には76億米ドルに達すると予測されています。

ボーイングやロッキード・マーチンのような企業は、航空部品にCFRTPを多用しており、これらの複合材料の世界の需要を押し上げています。例えば、Tri-Mack Plastics Manufacturing Corp.は、2022年に最新の製品開発成果を発表しました。それは、わずか8プライの一方向(UD)炭素繊維強化熱可塑性(CFRTP)テープと厚さ4万分の1インチ(0.40インチ)から作られた高強度・軽量の筐体です。その結果、米国が地域市場の拡大に貢献し、世界のCFRTP市場を牽引しています。

力学

成長するハイブリッド技術

各構成要素の特質を生かした複合構造を開発するために多様な材料を組み合わせることは、ハイブリッド技術を構成します。CFRTPは、金属、セラミック、複合材料などの他の材料と組み合わせることで、より高い強度、耐久性、適応性などの品質を向上させたハイブリッド構造を製造することができます。

例えば、スイスの製造ソリューションOEMは、構造用炭素繊維強化熱可塑性複合材料のハイブリッドシステムの需要が昨年から増加しています。9T Labsのハイブリッド技術プラットフォームは、炭素繊維強化熱可塑性複合材料(CFRTP)による高性能構造部品の製造を、年間100個から1万個の生産数で可能にします。

同社の「Red Series」プラットフォームは、シミュレーションツールと3Dプリンティングを、適合する金型による圧縮成形と組み合わせることで、迅速なサイクルタイム、高い生産速度、優れた再現性と再現性といったさまざまな利点を実現しています。大企業も中小企業も、金属やプラスチックよりも大幅に硬く、強く、軽い高性能の製品を作ることができます。

技術の進歩

絶え間ない技術的ブレークスルーは、CFRTPの新たな用途と市場への道を提供します。強化された性能と製造可能性により、以前は制約のためにCFRTPの採用に消極的であった産業界も、今ではさまざまな製品や部品にCFRTPを採用することが現実的な選択肢であると考えています。

例えば、旭化成は2022年12月14日、独立行政法人新エネルギー・産業技術総合開発機構(NEDO)の「エネルギー・新環境技術導入可能性調査事業(2021年度~2022年度)」の支援を受けた「自動車用炭素繊維の循環経済化プログラム」(プロジェクト)の一環として、連続炭素繊維をリサイクルするための基盤技術を開発しました。

本プロジェクトは、自動車用炭素繊維強化プラスチック(CFRP)や炭素繊維強化熱可塑性(CFRTP)の廃材から得られる炭素繊維を、自動車用CFRPやCFRTPとして再利用するリサイクルシステムの実用化を目指すもの。自動車から廃棄される炭素繊維を連続炭素繊維としてリサイクルすることで、高品質かつ経済的なCFRTPを製造することができ、自動車の軽量化やエネルギー消費量の削減が期待できます。

台頭する複合材料産業

技術や製造技術の発展に伴い、コンポジット分野では高性能材料が重視されています。CFRTPは優れた強度対重量比と機械的性質を持つため、耐久性と性能を必要とする用途に魅力的な選択肢となり、需要と市場の成長を後押ししています。

複合材料、特にCFRTPへの関心の高まりと投資は、研究開発プロジェクトを後押ししています。産業界、研究機関、政府の協力によりCFRTP技術が進歩し、新たな用途が生まれ、市場の成長を後押ししています。

米国複合材料工業会(ACMA)によると、様々な自動車用途に使用される複合材料は、毎年40億ポンド(約8,000億円)販売されています。複合材料産業は米国経済の原動力であり、毎年222億米ドルを米国経済に貢献しています。複合材料最終製品市場は、2022年までに1,132億米ドルに達すると予想されています。

高い製造コストと限られた原材料の入手可能性

標準的な材料と比較すると、CFRTPの製造コストは比較的高いかもしれないです。原材料、製造技術、特殊な設備はすべて製造コストの上昇につながり、特に価格に敏感な市場では、業界全体への普及を妨げる可能性があります。CFRTPの製造には、炭素繊維と特定の熱可塑性樹脂が必要です。様々な原材料のサプライチェーンにおける入手可能性の制限や変動が、生産量や材料コストに影響を及ぼし、市場の成長を制限する可能性があります。

CFRTPの生産には複雑で高度な工程が伴う。硬化、成形、圧密などの生産手順が複雑になると、リードタイムが長くなり、生産が困難になり、スケールアップの課題が生じる可能性があり、市場成長が制限されます。CFRTP製品全体で一貫した性能と業界標準への準拠を確保するのは難しいかもしれないです。材料特性のばらつき、品質管理の難しさ、要求の厳しい産業要件の遵守により、セーフティクリティカルな用途や分野での使用が制限される可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- ハイブリッド技術の成長

- 技術の進歩

- 抑制要因

- 高い生産コストと限られた原材料の入手可能性

- 複合材料産業の台頭

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 材料別

- ポリアクリロニトリル(PAN)ベースのCFRTP

- ピッチベースCFRTP

- その他

第8章 合成樹脂別

- ポリエーテルエーテルケトン

- ポリウレタン

- ポリエーテルスルホン

- ポリエーテルイミド

- その他

第9章 製品別

- 長炭素繊維

- 短炭素繊維

第10章 用途別

- 航空宇宙・防衛

- 自動車

- 建築・建設

- 電気・電子

- 海洋

- スポーツ機器

- 風力タービン

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- BASF SE

- 会社概要

- 素材ポートフォリオと説明

- 財務概要

- 主な発展

- Celanese Corporation

- Dupont

- Hexcel Corporation

- Mitsubishi Chemical Corporation

- PolyOne Corporation

- SABIC

- Solvay

- SGL Carbon

- Teijin Limited

第14章 付録

Overview

Global Carbon Fiber Reinforced Thermoplastic Composites (CFRTP) Market reached US$ 3.4 billion in 2022 and is expected to reach US$ 7.6 billion by 2030, growing with a CAGR of 10.6% during the forecast period 2023-2030.

Companies like Boeing and Lockheed Martin rely heavily on CFRTP for aviation components, driving up global demand for these composites. For instance, Tri-Mack Plastics Manufacturing Corp. announced its latest product development achievement in 2022: a high-strength and lightweight enclosure made from only eight plies of unidirectional (UD) carbon fiber-reinforced thermoplastic (CFRTP) tape and forty-thousandths of an inch (0.40-inch) thick. As a result, U.S. is contributing to the expansion of the regional market, which is driving the global CFRTP market.

Dynamics

Growing Hybrid Technologies

Combining diverse materials in order to develop composite constructions that harness the qualities of each component constitutes hybrid technologies. CFRTP can be coupled with other materials such as metals, ceramics or composites to produce hybrid structures with improved qualities like as higher strength, durability and adaptability.

For instance, the Swiss manufacturing solution OEM has experienced an increase in demand in its hybrid system for structural carbon fiber-reinforced thermoplastic composites over the last year. The hybrid technology platform from 9T Labs enables the manufacturing of high-performance structural parts in carbon fiber-reinforced thermoplastic composites (CFRTP) in production numbers ranging from 100 to 10,000 pieces per year.

The company's Red Series platform combines simulation tools and 3D printing with compression molding in matched metal dies, resulting in a range of advantages such as quick cycle times, high production rates and good repeatability and reproducibility. Large and small firms can create high-performance goods that are significantly stiffer, stronger and lighter than metals and plastics.

Technological Advancements

Continuous technical breakthroughs provide a pathway to new CFRTP uses and markets. Due to enhanced performance and manufacturability, industries that were previously unwilling to embrace CFRTP due to restrictions now consider it a viable option for a variety of products and components.

For instance, on December 14, 2022, Asahi Kasei developed basic technology for recycling continuous carbon fiber as part of a project called "Circular Economy Program for the Automotive Carbon Fiber" (the Project), which was supported by the New Energy and Industrial Technology Development Organization's (NEDO) Feasibility Study Program on Energy and New Environmental Technology from fiscal 2021 to fiscal 2022).

The Project aims for the practical use of a recycling system in which carbon fiber obtained from waste automobile carbon fiber reinforced plastic (CFRP) or carbon fiber reinforced thermoplastic (CFRTP) is repurposed as CFRP or CFRTP for automobiles. High-quality and economical CFRTP can be produced by recycling carbon fiber discarded from automobiles as continuous carbon fiber, resulting in vehicle weight reduction and reduced energy consumption.

Rising Composites Industry

With developments in technology and manufacturing techniques, the composites sector is placing a greater emphasis on high-performance materials. CFRTP has a good strength-to-weight ratio and mechanical qualities, making it an appealing choice for applications requiring durability and performance, boosting demand and market growth.

The growing interest in and investment in composite materials, particularly CFRTP, drives R&D projects. Collaborative efforts among industrial players, research institutions and governments result in advances in CFRTP technology, generating the new applications and bolstering the growth of the market.

As per American Composites Manufacturers Association (ACMA), four billion pounds of composite materials are sold each year for use in various automobile applications. The composites sector is a driving economic force in U.S. The industry contributes US$ 22.2 billion to US economy each year. The composites end-product market is anticipated to reach US$ 113.2 billion by 2022.

High Production Costs and Limited Availability of Raw Materials

As compared to standard materials, the cost of manufacturing CFRTP might be relatively expensive. Raw materials, manufacturing techniques and specialized equipment all contribute to higher production costs, which might stymie wider adoption across industries, particularly in price-sensitive markets. The availability of carbon fibers and particular thermoplastic resins is required for the production of CFRTP. Limited availability or volatility in the supply chain for various raw materials might have an influence on production volumes and material costs, limiting market growth.

CFRTP production entails complex and highly advanced processes. Complexity in production procedures, such as curing, molding and consolidation, can result in longer lead times, greater production difficulties and potential scaling-up challenges, limiting market growth. It might be difficult to ensure consistent performance and compliance with industry standards across CFRTP products. Material property variability, quality control difficulties and adherence to demanding industrial requirements may limit its use in safety-critical applications and sectors.

Segment Analysis

The global carbon fiber reinforced thermoplastic composites (CFRTP) market is segmented based on Material, Resin, Product, Application and region.

Transforming Injection Molding with CFRTP Composites Drives the Short Carbon Fibers Market

Considering the part's intricacy and the volume of manufacturing required, only injection molding could fulfill the customer's price point. MCAM developed a 30% FWF short carbon fiber-reinforced polyphenylene sulfide (PPS) composite (KyronMAX S-8230) that met all mechanical requirements, including the most difficult fatigue targets and effectively substituted magnesium in this application.

The CFRTP compounds are designed for injection molding, allowing for a wide range of part sizes and complexity. Molding complicated shapes and sizes is a considerable benefit over standard materials. Therefore, the short carbon fibers capture the majority of the total global segmental shares.

Geographical Penetration

Market Expansion Strategies Drives the Regional Growth

Manufacturing facility expansion leads to increased production capacity for CFRTP materials. Companies with larger facilities may produce higher volumes of CFRTP compounds to meet increased demand from a variety of industries. For instance, in March 2022, Mitsubishi Chemical Corporation has opened a new carbon fiber reinforced thermoplastic (CFRTP) pilot facility. Operations have begun and samples will begin to be shipped in April 2022.

Localized production is enabled by establishing manufacturing facilities in the Asia-Pacific. The decreases transportation costs, speeds up supply chains and allows for faster delivery of CFRTP materials to consumers in the region, improving market accessibility and competitiveness. Increased manufacturing capacity can result in economies of scale, lowering production costs per unit. As a result, companies may offer competitive prices for CFRTP materials, making them more appealing to Asia-Pacific manufacturers. Therefore, Asia-Pacific holds for the nearly half of the global market share.

COVID-19 Impact Analysis

Lockdowns, movement restrictions and temporary closures of manufacturing sites globally affected supply networks. Transportation delays impeded manufacture and delivery of raw materials, components and finished CFRTP products. Lockdown measures, reduced consumer spending and a slowdown in economic activity all contributed to a drop in demand in industries such as automotive, aerospace and manufacturing. The drop in demand had a direct impact on the demand for CFRTP materials utilized in these industries.

Many ongoing projects in industries such as automotive, construction and infrastructure were pushed back or canceled, affecting demand for CFRTP materials. Uncertainty regarding future market conditions prompted the deferral of new project investments.

Russia-Ukraine War Impact Analysis

Russia and Ukraine are both important players in the global raw material supply chain. Any disruption in the supply of important raw materials (such as particular polymers, additives or components required in CFRTP manufacture) from these countries could impact global CFRTP manufacturing, resulting in supply shortages or price increases.

Geopolitical tensions can cause market instability and undermine investor confidence. Uncertainty frequently leads to conservative spending and investment decisions, which may have an impact on the growth and expansion plans of CFRTP manufacturers and users in Europe and globally. Economic sanctions or trade restrictions implemented as a result of geopolitical tensions can have an impact on bilateral economic relations. It could have an influence on the import/export of CFRTP materials.

By Material

- Polyacrylonitrile (PAN)-Based CFRTP

- Pitch-Based CFRTP

- Others

By Resin

- Polyether Ether Ketone

- Polyurethane

- Polyethersulfone

- Polyetherimide

- Others

By Product

- Long Carbon Fiber

- Short Carbon Fiber

By End-User

- Media & Entertainment

- Healthcare

- Government & Law Enforcement

- Education

- Banking, Financial Services and Insurance (BFSI)

- Industrial

- Aerospace & Defense

- Automotive

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On March 31, 2022, Mitsubishi Chemical Corporation has opened a new carbon fiber reinforced thermoplastic (CFRTP) pilot facility. Operations have begun and samples will begin to be shipped in April 2022.

- On December 14, 2022, Asahi Kasei developed basic technology for recycling continuous carbon fiber as part of a project called "Circular Economy Program for the Automotive Carbon Fiber" (the Project), which was supported by the New Energy and Industrial Technology Development Organization's (NEDO) Feasibility Study Program on Energy and New Environmental Technology from fiscal 2021 to fiscal 2022).

- On January 5, 2021, MCC has announced plans to build a pilot compounding factory for carbon fiber-reinforced thermoplastic (CFRTP) compounds in Fukui Prefecture, Japan. MCC has a long history of effectively deploying CFRP in applications like as automotive products and the company has a variety of carbon fiber and plastic modification technology.

Competitive Landscape

The major global players in the market include: BASF SE, Celanese Corporation, Dupont, Hexcel Corporation, Mitsubishi Chemical Corporation, PolyOne Corporation, SABIC, Solvay, SGL Carbon and Teijin Limited.

Why Purchase the Report?

- To visualize the global carbon fiber reinforced thermoplastic composites (CFRTP) market segmentation based on Material, Resin, Product, Application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of carbon fiber reinforced thermoplastic composites (CFRTP) market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Material mapping available as excel consisting of key products of all the major players.

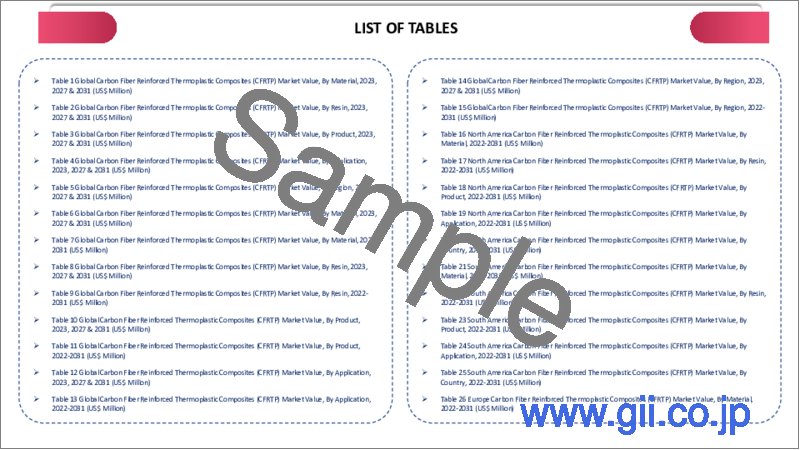

The global carbon fiber reinforced thermoplastic composites (CFRTP) market report would provide approximately 69 tables, 72 figures and 201 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Material

- 3.2. Snippet by Resin

- 3.3. Snippet by Product

- 3.4. Snippet by Application

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Hybrid Technologies

- 4.1.1.2. Technological Advancements

- 4.1.2. Restraints

- 4.1.2.1. High Production Costs and Limited Availability of Raw Materials

- 4.1.2.2. Rising Composites Industry

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Material

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 7.1.2. Market Attractiveness Index, By Material

- 7.2. Polyacrylonitrile (PAN)-Based CFRTP*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Pitch-Based CFRTP

- 7.4. Others

8. By Resin

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin

- 8.1.2. Market Attractiveness Index, By Resin

- 8.2. Polyether Ether Ketone*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Polyurethane

- 8.4. Polyethersulfone

- 8.5. Polyetherimide

- 8.6. Others

9. By Product

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 9.1.2. Market Attractiveness Index, By Product

- 9.2. Long Carbon Fiber*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Short Carbon Fiber

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Aerospace & Defense*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Automotive

- 10.4. Building and Construction

- 10.5. Electrical & Electronics

- 10.6. Marine

- 10.7. Sports Equipment

- 10.8. Wind Turbines

- 10.9. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Resin

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. BASF SE*

- 13.1.1. Company Overview

- 13.1.2. Material Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Celanese Corporation

- 13.3. Dupont

- 13.4. Hexcel Corporation

- 13.5. Mitsubishi Chemical Corporation

- 13.6. PolyOne Corporation

- 13.7. SABIC

- 13.8. Solvay

- 13.9. SGL Carbon

- 13.10. Teijin Limited

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us