|

|

市場調査レポート

商品コード

1396631

スーパーアプリの世界市場- 2023年~2030年Global Super Apps Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| スーパーアプリの世界市場- 2023年~2030年 |

|

出版日: 2023年12月15日

発行: DataM Intelligence

ページ情報: 英文 201 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

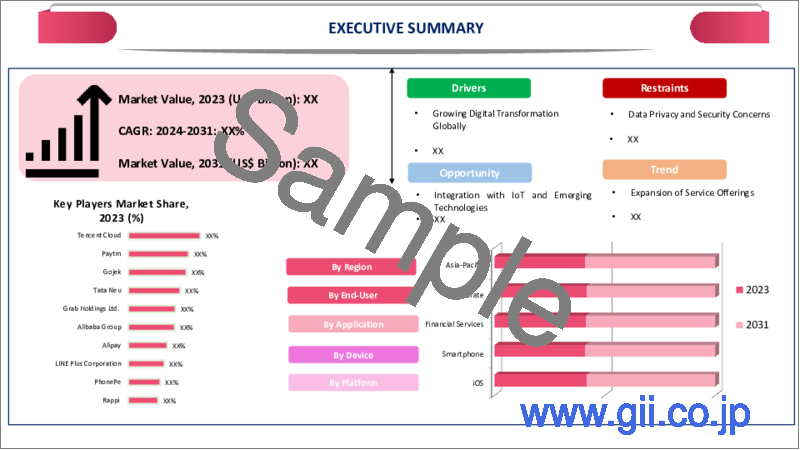

世界のスーパーアプリ市場は、2022年に578億米ドルに達し、2023-2030年の予測期間中にCAGR 28.8%で成長し、2030年には4,376億米ドルに達すると予測されます。

世界のスーパーアプリ市場は、ユーザー導入の大幅な増加と市場の拡大により、著しい成長を遂げています。多種多様なサービスを単一のプラットフォームに統合するスーパーアプリのコンセプトは、絶大な支持を得ています。スーパーアプリは、ユーザーの日常生活を簡素化し、一元化されたエクスペリエンスとして機能します。決済、eコマース、交通、ヘルスケアなどの機能をひとつ屋根の下で提供し、利便性を高めています。

スーパーアプリ市場は活況を呈しており、合理化されたオールインワンのソリューションを求める消費者の需要に応えています。金融サービス、eコマース統合、地域カスタマイズの優位性の高まり。拡張現実と仮想現実の革新がユーザー体験を形成し、持続可能性への取り組みが環境に優しい実践を促進します。利便性とパーソナライズされたサービスに重点を置くことで、スーパーアプリは継続的な成長と進化を遂げようとしています。

アジア太平洋は、中国のテンセント・ホールディングスとアリペイを筆頭に、スーパーアプリ市場を独占しています。中国政府はスーパーアプリを活用し、ミニプログラムを通じて約200の公共サービスを提供しており、従来の身分証明書をテンセント・ホールディングスのIDに置き換える議論もあります。IDに置き換えるという議論もあります。公共サービスとデジタルイノベーションの広範な統合により、アジア太平洋、特に中国がスーパーアプリ市場の世界シェアの最前線に位置しています。

力学

消費者の適応とともに拡大するスーパーアプリの需要

ガートナーによると、スーパーアプリ市場は大きく成長する態勢にあり、2027年までに世界のユーザーの50%以上が複数のスーパーアプリを導入すると予想されています。PayPalとPYMNTSが実施した調査でも明らかなように、消費者はコネクテッド・エコノミーをナビゲートするための合理的なソリューションをますます求めるようになっています。この調査は、数カ国にまたがる約1万人の消費者からの回答に基づくもので、コネクテッド・エコノミーのさまざまな側面に効果的に対処できる単一のアプリを強く好む傾向が浮き彫りになっています。

スーパーアプリは、エレガントで一元的な体験を提供し、ユーザーとデジタル環境とのインタラクションを簡素化します。また、この調査では、特定の消費者ペルソナ、特に利便性を優先する消費者は、スーパーアプリを生活の複数の側面に統合する傾向が強いことが明らかになっています。スーパーアプリに対する需要の高まりは、よりまとまりのある効率的なデジタルソリューションに対するニーズを反映しています。

デジタル化で金融情勢が変化し、市場は活況を呈する

絶え間ない技術の進歩により、金融業界ではスーパーアプリの利用が増加しています。デジタル・プラットフォームは様々な金融サービスや商品の統合ソリューションを提供し、金融の意思決定プロセスを合理化し、アクセシビリティを高めています。例えば、インドのハイテクに精通した若年層は、FinTechのスーパーアプリが提供する利便性によく合致しています。

中でも注目すべきは、包括的な決済ソリューションと即時送金を提供するキャッシュフリーペイメントです。FiはFederal Bankと提携し、デジタル貯蓄口座と革新的な金融ツールを提供しています。ジュピターは、洞察力、支出追跡、請求書支払い、投資で銀行業務を簡素化します。Naviは、ローンから保険まで、多様な個人金融ニーズに対応します。OneStackは銀行のデジタルトランスフォーメーションをサポートし、銀行サービスやサードパーティの金融商品の統一的なビューを提供します。FinTech Super Appsは、インド全土のユーザーの金融イノベーションと利便性を促進しています。

高い開発・保守コスト

スーパーアプリの開発・保守コストは、様々な要因に影響され、相当なものになる可能性があります。その要因とは、プロジェクトの種類、機能、開発チームの所在地、アプリのプラットフォームなどです。インドでは、スーパーアプリ開発の1時間当たりの平均コストは25米ドルから45米ドルです。欧米では、このコストは1時間当たり100~150米ドルにまで上昇します。

さらに、スーパーアプリの開発にかかる全体的なコストは、プロジェクトの複雑さにもよりますが、通常40,000米ドルから250,000米ドルと大きく変動します。また、継続的なメンテナンスとアップデートを考慮することが重要であり、これが全体的な支出にさらに貢献する可能性があるため、企業がスーパーアプリ市場に参入する際には、コストとメリットを比較検討することが不可欠となります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 消費者の適応により拡大するスーパーアプリ需要

- デジタル化に伴う金融情勢の変化による市場の活性化

- 抑制要因

- 高い開発・保守コスト

- 機会

- 影響分析

- 促進要因

第5章 業界分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19の分析

第7章 プラットフォーム別

- iOS

- Android

- その他

第8章 用途別

- 金融サービス

- 運輸・物流サービス

- eコマース

- ソーシャルメディア&メッセージング

- その他

第9章 デバイス別

- スマートフォン

- タブレット

- その他

第10章 エンドユーザー別

- ビジネス

- コンシューマー

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Tencent Holdings Ltd.

- 企業概要

- プラットフォーム・ポートフォリオと概要

- 財務概要

- 主な発展

- Paytm E-commerce Pvt. Ltd.

- Gojek tech

- TATA NEU

- Grab Holdings Ltd.

- Rappi Inc.

- Revolut Ltd

- Line Corporation

- Alipay(Ant Group CO., Ltd.)

- PhonePe

第14章 付録

Overview

Global Super Apps Market reached US$ 57.8 billion in 2022 and is expected to reach US$ 437.6 billion by 2030, growing with a CAGR of 28.8% during the forecast period 2023-2030.

The global super apps market is experiencing remarkable growth, with a substantial increase in user adoption and market expansion. The concept of Super Apps, which consolidate a wide array of services into a single platform, is gaining immense traction. Super Apps serve as a centralized experience, simplifying users' daily lives. It offers features like payments, e-commerce, transportation, healthcare and more under one roof, enhancing convenience.

Super app market is booming, meeting consumer demands for streamlined, all-in-one solutions. The growing dominance of financial services, e-commerce integration and regional customization. Innovations in augmented and virtual reality are shaping user experiences, while sustainability initiatives drive eco-friendly practices. With a focus on convenience and personalized offerings, the super app landscape is poised for continued growth and evolution.

Asia-Pacific dominates the Super Apps market, with China's Tencent Holdings Ltd. and AliPay at the forefront. The Chinese government is leveraging Super Apps to provide around 200 public services through mini-programs and there are discussions about replacing traditional ID documentation with a Tencent Holdings Ltd. ID. The extensive integration of public services and digital innovations places the Asia-Pacific, particularly China, at the forefront of the super app market's global share.

Dynamics

Super Apps Demand Growing with Consumer Adaptation

Super Apps market is poised for significant growth, with more than 50% of global users expected to embrace multiple Super Apps by 2027, according to Gartner. Consumers are increasingly looking for streamlined solutions to navigate the connected economy, as evidenced by a study conducted by PayPal and PYMNTS. The study, based on responses from nearly 10,000 consumers across several countries, underscores a strong preference for a single app that can effectively address the various aspects of the connected economy.

Super Apps offer an elegant and centralized experience, simplifying the user's interaction with the digital landscape. The study also highlights that specific consumer personas, particularly those prioritizing convenience, are highly inclined to integrate Super Apps into multiple facets of their lives. The growing demand for Super Apps reflects the need for more cohesive and efficient digital solutions.

Market Thriving by Changing Financial Landscape with Digitalization

The emergence of the usage of Super Apps in the financial landscape, driven by constant technological advancements is rising the growth of Super Apps. The digital platforms offer a consolidated solution for various financial services and products, streamlining the financial decision-making process and enhancing accessibility. For instance, India's tech-savvy and youthful population is well-aligned with the convenience provided by the FinTech Super Apps.

Notable among them is Cashfree Payments, offering comprehensive payment solutions and instant money transfers. Fi, in collaboration with Federal Bank, provides a digital savings account and innovative financial tools. Jupiter simplifies banking with insights, expense tracking, bill payments and investments. Navi caters to diverse personal finance needs, from loans to insurance. OneStack supports banks in digital transformation, providing a unified view of banking services and third-party financial products. The FinTech Super Apps are driving financial innovation and convenience for users across India.

High Development and Maintenance Costs

The development and maintenance costs of Super Apps can be substantial and are influenced by various factors. The factors include project type, features, development team location and the app platform. In India, the average hourly cost for super app development ranges from US$ 25 to US$ 45. In Europe and U.S., this cost can escalate to US$ 100-US$ 150 per hour.

Furthermore, the overall cost of developing a super app can vary significantly which can typically range from US$ 40,000 to US$ 250,000, also depend on project complexity. Also, it's important to consider ongoing maintenance and updates, which can further contribute to the overall expenditure, making it essential for businesses to weigh the benefits against the costs when venturing into the super app market.

Segment Analysis

The global super apps market is segmented based on Platform, Application, Device, End-User and region.

Android's Dominance in the Super Apps Market

Android dominates the Super Apps market due to its extensive user base. According to the Demand Sage blog, with 3.3 billion Android OS users globally in 2023, it holds a massive 71.8% share of the global mobile operating systems market. The wide adoption provides a significant advantage for Super Apps, as they can target a vast and diverse audience through the Android platform.

The large user base not only enhances the reach of Super Apps but also promotes their continued growth and innovation, making Android the preferred choice for developers and businesses looking to tap into the Super Apps trend and deliver a wide range of services within a single, integrated platform.

Geographical Penetration

Asia-Pacific Leads the Super Apps Market

Asia-Pacific, particularly in countries like China, holds the largest share in the Super Apps market. For over a decade, the Asian tech ecosystem has been dominated by Super Apps like Tencent Holdings Ltd., Alipay and Meituan, offering a wide range of integrated services within a single app. The Super Apps have gained a massive user base, with Tencent Holdings Ltd. boasting over a billion active monthly users and more than a million "mini-programs.

The trend reflects the success of the super app model, offering convenience and versatility to users. The continual growth and widespread adoption of Super Apps in Asia-Pacific underscore their transformative impact on the region's digital landscape and consumer behavior. From messaging and social networking to e-commerce, finance and transportation services, Super Apps have become indispensable tools that streamline the daily lives of users.

COVID-19 Impact Analysis

The COVID-19 pandemic has had a mixed impact on Super Apps, especially in South-East Asia. While the pandemic proved disastrous for many businesses, it has only acted as a minor roadblock for Super Apps. Some sectors have seen a significant rise during the pandemic, such as on-demand delivery services, including food and grocery delivery. Fortunately, Super App companies offer these services, allowing them to thrive in these challenging times.

During COVID-19 South-East Asia has become a hub for Super Apps, with fierce competition between Grab Holdings Ltd. and Gojek, two arch-rival Super Apps. Gojek began as a bike ride-hailing service in Jakarta in 2010 and has since evolved into a comprehensive Super App offering 18 services, including finance and food delivery, with a valuation of US$ 10 billion. Grab Holdings Ltd., launched in 2012, initially focused on taxi booking but has expanded into a Super App, providing services like food delivery and financial services and operates in eight countries with a valuation of US$ 14 billion.

Russia-Ukraine War Impact Analysis

The Russia-Ukraine war has had a significant impact on the use of apps and software in the region. As the conflict escalated, access to free-flowing information and a functional internet became restricted. Russian President Vladimir Putin disabled major Western websites, including Facebook, Twitter, TikTok and Netflix, as part of a propaganda control strategy. In Ukraine, constant bombing disrupted internet access in many areas. Despite these obstacles, both Russian and Ukrainian people found ways to access and share information online.

The conflict prompted a shift in priorities for app downloads. While social media and online gaming apps saw a decline in downloads, VPNs and communication apps witnessed a significant increase. Ukrainian citizens prioritized encrypted messaging apps like Telegram and Signal and downloaded air raid alert apps. The alert apps provide real-time warnings of imminent airstrikes. Ukrainians have also developed apps to report Russian troop movements via geotagged videos, contributing valuable intelligence.

By Platform

- iOS

- Android

- Others

By Application

- Financial Services

- Transportation & Logistics Services

- E-commerce

- Social Media & Messaging

- Others

By Device

- Smartphone

- Tablets

- Others

By End-User

- Businesses

- Consumers

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In September 2023, Tingo Group, Inc. has announced the launch of the next-generation version of its super app, TingoPay.

- In January 2023, OV Loop announced the launch of its Community Empowering Super-App Platform at CES (Consumer Electronics Show) in Las Vegas. The platform is designed to offer omnichannel commerce tools for brands and includes a private wallet and messenger for users.

- In August 2022, AirAsia's Chief, Tony Fernandes, made a strategic move by enlisting the support of Google to fortify the airline's foray into the super app domain. Recognizing the imminent rebound in travel during the summer, AirAsia aims to leverage its super app to provide a comprehensive range of on-demand services, encompassing everything from car-hailing to flight bookings.

Competitive Landscape

The major global players in the market include: Tencent Holdings Ltd., Paytm E-commerce Pvt. Ltd., Gojek tech, Tata Neu, Grab Holdings Ltd., Rappi Inc., Revolut Ltd, Line Corporation, Alipay (Ant Group CO., Ltd.), PhonePe.

Why Purchase the Report?

- To visualize the global super apps market segmentation based on platform, application, device, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of Super Apps market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Platform mapping available as excel consisting of key Platforms of all the major players.

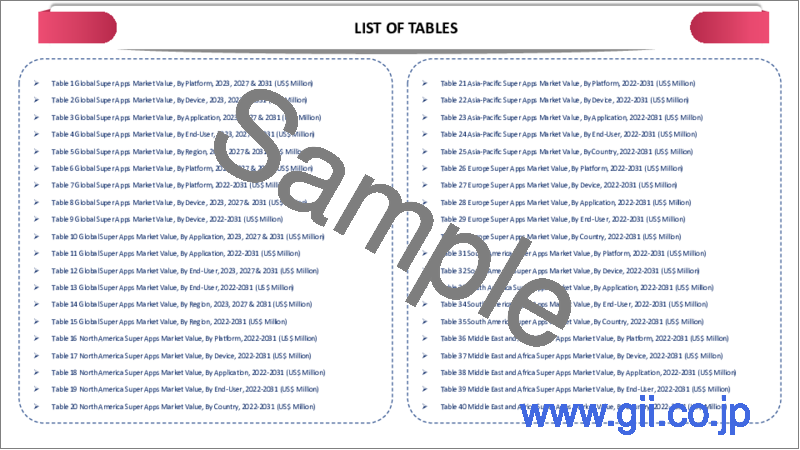

The global super apps market report would provide approximately 75 tables, 68 figures and 201 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Platform

- 3.2. Snippet by Application

- 3.3. Snippet by Device

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Super Apps Demand Growing with Consumer Adaptation

- 4.1.1.2. Market Thriving by Changing Financial Landscape with Digitalization

- 4.1.2. Restraints

- 4.1.2.1. High Development and Maintenance Costs

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Platform

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Platform

- 7.1.2. Market Attractiveness Index, By Platform

- 7.2. iOS*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Android

- 7.4. Others

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Financial Services*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Transportation & Logistics Services

- 8.4. E-commerce

- 8.5. Social Media & Messaging

- 8.6. Others

9. By Device

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device

- 9.1.2. Market Attractiveness Index, By Device

- 9.2. Smartphone*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Tablets

- 9.4. Others

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Businesses*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Consumers

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Platform

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Platform

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Platform

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Platform

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Platform

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Device

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Tencent Holdings Ltd.*

- 13.1.1. Company Overview

- 13.1.2. Platform Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Paytm E-commerce Pvt. Ltd.

- 13.3. Gojek tech

- 13.4. TATA NEU

- 13.5. Grab Holdings Ltd.

- 13.6. Rappi Inc.

- 13.7. Revolut Ltd

- 13.8. Line Corporation

- 13.9. Alipay (Ant Group CO., Ltd.)

- 13.10. PhonePe

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us