|

|

市場調査レポート

商品コード

1382531

家具用金具の世界市場:2023年~2030年Global Furniture Fittings Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 家具用金具の世界市場:2023年~2030年 |

|

出版日: 2023年11月17日

発行: DataM Intelligence

ページ情報: 英文 212 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

家具用金具の世界市場は2022年に75億米ドルとなり、2023年~2030年の予測期間中にCAGR5.8%で成長し、2030年までに118億米ドルに達すると予測されています。

商業空間における家具需要の増加、美的外観とともに研究・技術進歩の拡大が、市場の潜在的促進要因のひとつです。さらに、家具の機能性と魅力を高める、高品質で実現可能かつ審美的に美しい部品に対する消費者の需要により、家具用金具の市場は活気に満ちており、競合も激しいです。

北米は、GDPの高い市場で主要な市場企業が存在するため、2022年には26.2%近いシェアを占め、市場を独占すると予想されます。米国は、家具用金具の技術的進歩や顧客の製品採用への投資増加により、地域の家具用金具市場で最も高いシェアを占めています。

ダイナミクス

家具産業の成長

家具用金具の需要は家具産業の成長によって直接影響を受ける。家具産業が成長し、より多くの種類の家具が生産されるにつれて、家具用金具の需要も増加しています。例えば、業界の推計によると、家具市場は毎年3.98%成長し(CAGR 2023年~2027年)、2023年には2,529億米ドルの収益が見込まれます。さらに、小売eコマースを通じた家具・家庭用品の販売による収益は、2021年に1,327億米ドルに達し、2025年には2,082億米ドルを超えると予測されています。

ノブ、引き出しスライド、ヒンジ、取っ手のような家具用金具は、家具の全体的な使用感と機能性を高める不可欠な部品です。家具市場の拡大は、家具のスタイルやデザインの多様化につながります。家具メーカーの多様なニーズを満たすため、家具用金具メーカーはデザイン、コーティング、サイズの幅広いバリエーションを提供する必要があります。

リノベーションとリフォーム活動への投資の拡大

リフォームや修復プロジェクトの増加は、家具用金具の世界市場に大きな影響を与えています。現代的なデザインのアイデアや機能的なニーズを補完する家具用金具の需要はますます高まっています。リフォームやリノベーションのプロジェクトでは、空間のレイアウトやスタイル、一般的な雰囲気が頻繁に変更されるため、機能性を高め、新しい美観を補完する新しい家具を設置することが可能になります。

このため、ノブ、取っ手、蝶番、引き出しのスライドなど、家具の全体的な使いやすさと美的魅力に欠かせない様々な金具の需要が高まる。さらに、特注家具やビルトイン家具はリフォームの際に作られることが多く、既存のアーキテクチャとのスムーズな統合を保証するために専門的な金具が必要とされます。

変動する原材料価格

家具用金具の製造コストは、原材料価格の変動に直接影響されます。原材料費の高騰は、メーカーの製造コストの上昇を招き、収益性を低下させます。顧客のために品質を落としたり値上げしたりすることなく、競争力のある価格設定を維持することは困難になります。

さらに、結果としてサプライチェーンが混乱する可能性もあります。サプライヤーが価格と供給力を一定に保てなければ、メーカーが原材料を予定通りに受け取る能力に影響を及ぼす可能性があります。その結果、生産に遅れが生じたり、顧客の需要に応えられなかったり、在庫管理に問題が生じたりする可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 家具産業の成長

- リノベーションとリフォームへの投資拡大

- 抑制要因

- 原材料価格の変動

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 製品別

- ハンドルと引き手

- ねじ・締め具

- 蝶番

- コネクター

- 引き出しスライド

- ノブ

- 脚

- その他

第8章 材料別

- ステンレス

- アルミニウム合金

- 亜鉛合金

- プラスチック

- 鉄

- その他

第9章 用途別

- 寝室

- リビングルーム

- ダイニングルーム

- ダイニングルーム

- ホテル

- オフィス

- バスルーム

- その他

第10章 エンドユーザー別

- 住宅用

- 商業用

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Julius Blum GmbH

- 会社概要

- 製品ポートフォリオと概要

- 財務概要

- 主な発展

- Kanpe & Vogt Manufacturing Company

- SALICE-P.IVA

- ERA Teknik Metal Dis Ticaret A.S

- ACCURIDE INTERNATIONAL INC

- Hettich Holding GmbH & Co. oHG

- Ebco-Furniture Fittings and Accessories

- Sugatsune America,Inc.

- Guangdong SACA Precision Manufacturing Co., Ltd

- Guangdong Dongtai Hardware Group

第14章 付録

Overview

Global Furniture Fittings Market reached US$ 7.5 billion in 2022 and is expected to reach US$ 11.8 billion by 2030, growing with a CAGR of 5.8% during the forecast period 2023-2030.

Increasing demand for furniture among commercial spaces and growing research & technological advancement along with aesthetic appearance are among the potential drivers of the market. Furthermore, the market for furniture fittings is vibrant and competitive due to consumer demand for high-quality, feasible and aesthetically beautiful parts that enhance the functionality and appeal of furniture.

North America is expected to dominate the market covering nearly 26.2% share in 2022 due to the presence of key market players in the market with high GDP. U.S. holds the highest share in the regional furniture filling market due to technological advancement in furniture fittings and the rising investment of customers in the adoption of the product.

Dynamics

Growing Furniture Industry

The demand for furniture fittings is directly impacted by the growing furniture industry. As the furniture industry grows and more types of furniture are produced, there is a growing demand for furniture fittings. For example, according to industry estimates, the furniture market is expected to grow by 3.98% annually (CAGR 2023-2027) and generate US$252.90 billion in revenue in 2023. Additionally, the revenue generated by the sale of furniture and home goods through retail e-commerce reached 132.7 billion US dollars in 2021 and is projected to surpass 208.2 billion US dollars by 2025.

Furniture fittings like knobs, drawer slides, hinges and handles are essential components that enhance the furniture's overall use and functionality. The expanding furniture market leads to a greater variety of furniture styles and designs. In order to satisfy the diverse needs of furniture makers, furniture fitting manufacturers need to offer a broad variety of designs, coatings and sizes.

Growing Investments in Renovation and Remodeling Activities

Growing remodeling and restoration projects have a big effect on the global market for furniture fittings. Fittings for furniture that complement contemporary design ideas and functional needs are becoming more and more in demand. The layout, style and general atmosphere of the space are frequently modified during renovation and remodeling projects, allowing for the installation of new furniture pieces that both enhance functionality and complement the updated aesthetics.

This fuels demand for a broad variety of furniture fittings, such as knobs, handles, hinges, drawer slides and other hardware elements essential to the overall usability and aesthetic appeal of the furniture. Furthermore, custom or built-in furniture is frequently created during renovations; this calls for specialist fittings to guarantee a smooth integration with the existing architecture.

Fluctuating Raw Material Prices

The cost of making furniture fittings is directly impacted by changes in the price of raw materials. Growing costs for raw materials could cause manufacturers to pay higher production costs, which would reduce their profitability. It becomes challenging to maintain competitive pricing without compromising quality or raising prices for customers.

Furthermore, the supply chain may also be disrupted as a result. If suppliers don't keep their prices and availability consistent, it could affect manufacturers' ability to receive raw materials on time. The could result in production delays, issues meeting customer demand and issues with inventory management.

Segment Analysis

The global furniture fittings market is segmented based on product, material, application, end-user and region.

Handles and Pulls Functionality and Aesthetic Quality

Handles and Pulls in furniture fittings are a growing market based on product and are expected to cover more than 23.9% market share in 2022. In the furniture fittings market, handles and pulls are crucial parts. The hardware pieces are made to offer a stylish and useful way of opening and shutting cabinets, drawers, doors and other furniture parts. The components act as gripping and pulling mechanisms, handles and pulls help users open and close drawers, doors and other furniture components with ease.

Furthermore, they add to the ease of use and functionality of furniture by being made to withstand frequent use and offer a firm grip. The products come in a wide range of designs, styles and finishes, thus making them an integral part of furniture aesthetics. The segment has seen immense popularity in the furniture fitting market due to its functional and aesthetic purposes.

Geographical Penetration

Asia-Pacific's Dominant Consumer Electronics and Automotive Sectors

The Asia-Pacific furniture fittings industry is a significant and dynamic market that serves the growing demand for furniture components and hardware in the region. The furniture industry in Asia-Pacific has grown significantly, especially in China, India, Japan, South Korea and Southeast Asian nations.

For instance, 2015 saw a roughly 50% increase in the value of the Asia-Pacific furniture market over 2010. In terms of the consumption of furniture, this was the region with the best performance globally. Furthermore, the furniture market in Asia-Pacific is expected to grow by more than 5% between 2021 and 2025, with a projected value of US$614 billion in 2023. The growth has coincided with an increase in demand for furniture fittings.

Asia-Pacific is home to numerous manufacturers, including both large-scale production facilities and smaller, specialized workshops. The region is a global centre for the production of furniture which is a major driver for the furniture fitting market to grow in the region.

COVID-19 Impact Analysis

The furniture industry has been significantly impacted by the COVID-19 pandemic. Each aspect of the industry has been impacted by the pandemic, including sales, production, design and consumer behavior.

The COVID-19 pandemic caused the production of furniture to be interrupted. Lockdowns and disruptions in the supply chain caused many furniture factories to close or reduce their production. Production was delayed as a result and some furniture types were in short supply.

Furthermore, Sales of furniture were also impacted by the COVID-19 pandemic. There has been a surge in demand for home office furniture and furniture for leisure and entertainment at home since so many people are locked up at home. However, there was also a decline in the general demand for furniture because so many people were experiencing financial instability. Thus, above mentioned factors have a direct impact on the furniture filling market as they are vital components in the industry.

Russia-Ukraine War Impact Analysis

The conflict between Russia and Ukraine has a significant effect on international trade, particularly the timber market. The escalation of sanctions against Russian trade, coupled with complex financial transactions, may cause global shipments of forest products to be redirected and interrupted. As a result, trade with Russia is expected to decrease, posing a threat to the region's long-standing international forest product trade flows.

Furthermore, One of the biggest globally users of wood for furniture manufacturing is IKEA. All imports and exports into and out of Belarus and Russia have been suspended by the Inter IKEA Group. The will directly affect the fifteen thousand employees of IKEA. Furthermore, IKEA has stopped producing and selling its products in Russia, except for daily necessities. Thus the above impact on the furniture industry has directly hampered the furniture filling market at a global level

By Product

- Handles and Pulls

- Screws or Fasteners

- Hinges

- Connectors

- Drawer Slides

- Knobs

- Legs

- Others

By Material

- Stainless Steel

- Aluminum Alloy

- Zinc Alloy

- Plastic

- Iron

- Others

By Application

- Bedroom

- Living Room

- Dining Room

- Dining Room

- Hotel

- Office

- Bathroom

- Others

By End-User

- Residential

- Commercial

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On July 31, 2023, The latest campaign from Ebco, a well-known furniture hardware manufacturer in India, highlights the significant influence that high-quality furniture can have on people's lives. The ad, "Ebco Fittings - They Change You," highlights how Ebco's creative fittings elevate spaces and change lives. It highlights the ideal union of functionality and style.

- On March 24, 2021, In Pune, India, Hafele, a global leader in kitchen fittings, furniture and architectural hardware, provided its first exclusive Hafele ICONIC Sanitary Store. For more than a decade, Hafele has led the way in the sales of fixtures in India. Since it is a German company, providing customers with high-quality products at competitive prices along with solution-based services has always been its top priority. With the launch of the Hafele ICONIC brand, which stands for the "Best of the Best" in each product category, Hafele is now expanding on this idea.

Competitive Landscape

major global players in the market include: Julius Blum GmbH, Kanpe & Vogt Manufacturing Company, SALICE- P.IVA, ERA Teknik Metal Dis Ticaret A.S., ACCURIDE INTERNATIONAL INC, Hettich Holding GmbH & Co. oHG, Ebco- Furniture Fittings and Accessories, Sugatsune America, Inc., Guangdong SACA Precision Manufacturing Co., Ltd and Guangdong Dongtai Hardware Group.

Why Purchase the Report?

- To visualize the global furniture fittings market segmentation based on product, material, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of furniture fittings market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global furniture fittings market report would provide approximately 69 tables, 79 figures and 212 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

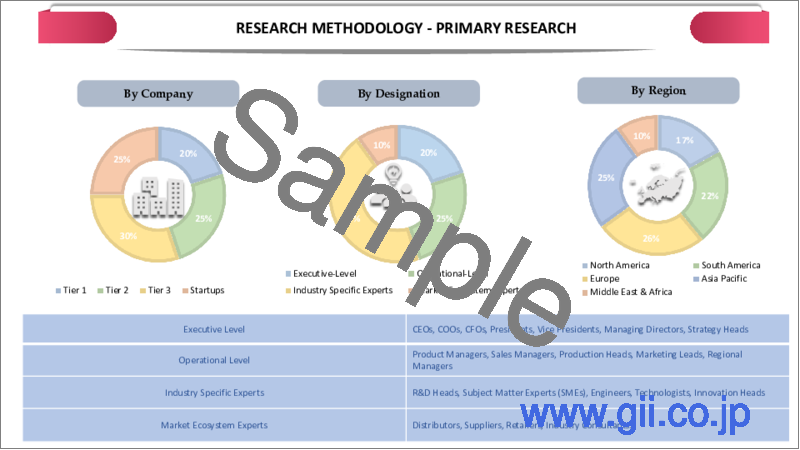

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

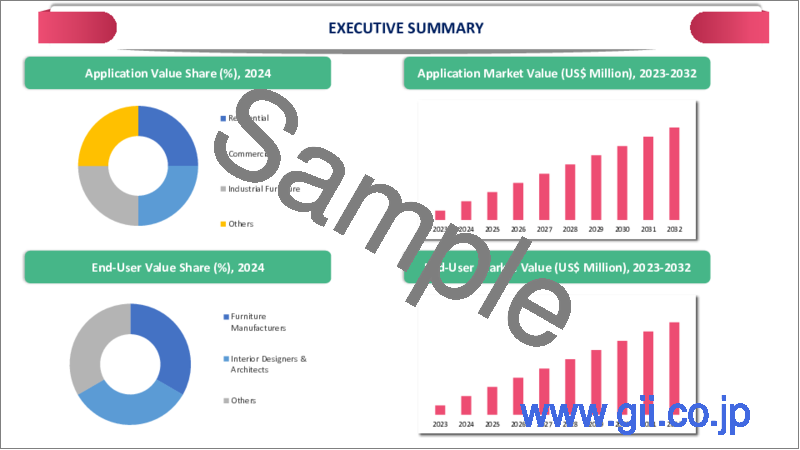

3. Executive Summary

- 3.1. Snippet by Product

- 3.2. Snippet by Material

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Furniture Industry

- 4.1.1.2. Growing Investments in Renovation and Remodeling Activities

- 4.1.2. Restraints

- 4.1.2.1. Fluctuating Raw Material Prices

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2. Market Attractiveness Index, By Product

- 7.2. Handles and Pulls*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Screws or Fasteners

- 7.4. Hinges

- 7.5. Connectors

- 7.6. Drawer Slides

- 7.7. Knobs

- 7.8. Legs

- 7.9. Others

8. By Material

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 8.1.2. Market Attractiveness Index, By Material

- 8.2. Stainless Steel*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Aluminum Alloy

- 8.4. Zinc Alloy

- 8.5. Plastic

- 8.6. Iron

- 8.7. Others

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Bedroom*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Living Room

- 9.4. Dining Room

- 9.5. Dining Room

- 9.6. Hotel

- 9.7. Office

- 9.8. Bathroom

- 9.9. Others

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Residential*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Commercial

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Russia

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Julius Blum GmbH*

- 13.1.1. Company Overview

- 13.1.2. Type Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Kanpe & Vogt Manufacturing Company

- 13.3. SALICE- P.IVA

- 13.4. ERA Teknik Metal Dis Ticaret A.S

- 13.5. ACCURIDE INTERNATIONAL INC

- 13.6. Hettich Holding GmbH & Co. oHG

- 13.7. Ebco- Furniture Fittings and Accessories

- 13.8. Sugatsune America,Inc.

- 13.9. Guangdong SACA Precision Manufacturing Co., Ltd

- 13.10. Guangdong Dongtai Hardware Group

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us