|

|

市場調査レポート

商品コード

1374787

心血管超音波システムの世界市場-2023年~2030年Global Cardiovascular Ultrasound System Market -2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 心血管超音波システムの世界市場-2023年~2030年 |

|

出版日: 2023年11月01日

発行: DataM Intelligence

ページ情報: 英文 180 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

心臓血管超音波システムは、心エコーシステムとも呼ばれ、体内の心臓と血管の非侵襲的評価と可視化に使用される医療用画像診断装置です。高周波の音波(超音波)を用いて、心臓の構造、機能、血流パターンをリアルタイムで画像や映像にします。この技術は、心臓弁膜症、先天性心疾患、心筋障害、血管異常など、さまざまな心血管系疾患の診断やモニタリングに不可欠です。

心臓超音波検査は、肋骨の間に収まる小さなフットプリントを持つ低周波プローブを用い、心臓セッティングを用いて行う。超音波とは、周波数が20,000ヘルツ(Hz)以上のものをいう。超音波プローブは、患者が聞いたり感じたりしない音波を体中に送る。音波が体内構造物に跳ね返ると、戻ってくる波の「エコー」を技術が解釈し、患者の心臓の動画像をリアルタイムで再構築します。

市場力学:促進要因

高度心臓血管超音波システムに対する需要の増加

高度な心臓血管超音波システムに対する需要の増加は、予測期間にわたって市場を牽引すると予想されます。高度なシステムには人工知能機能が搭載されており、低侵襲な処置を行うことで患者の予後を改善します。これらの高度なシステムは、臨床医がより迅速で再現性の高い検査を取得できるようにするのに役立ちます。

例えば、2023年8月25日、Siemens Healthineersは、新しい堅牢な人工知能(AI)機能を備えた心臓血管超音波専用システム、Acuson Originを発売しました。Acuson Originは、患者の予後を改善し、医師が低侵襲の心臓処置をより効率的に行えるように設計されており、診断、構造心臓、電気生理学的処置、小児処置を含む、心臓血管患者の治療の全過程に対応します。

さらに、2020年10月12日、GEヘルスケアは、臨床医がより速く、より再現性の高い検査を一貫して取得することを可能にする人工知能(AI)に基づく新機能を搭載したVivid心臓血管超音波システムのUltra Editionパッケージの米国FDA 510kクリアランスを発表しました。

さらに、超音波技術の継続的な進歩は、より高度で洗練された心血管超音波システムの開発につながっています。これらのシステムは、より高画質で診断精度が向上し、3Dや4D画像、歪み画像、造影画像などの機能が強化されています。これらの技術革新により、心血管疾患の診断と治療が効果的に行えるようになりました。

例えば、2023年1月22日、フィリップスは次世代小型循環器ポータブル超音波診断装置Compact 5000シリーズを世界的に発売しました。この新しい超音波は、画質や性能を犠牲にすることなく、携帯性と汎用性を重視して設計されており、プレミアムカートベースの超音波システムに関連する診断品質をより多くの患者に提供することを目的としています。

さらに、この先進的な装置は、画質の向上と利便性の向上に役立っています。例えば、2021年9月30日、サムスン電子の関連会社で世界の医療機器企業であるサムスン・メディソンは、すべての医療専門家向けに画質、操作性、利便性を強化した新しいプレミアム心臓超音波システムであるV8を発表しました。

さらに、心血管疾患の有病率の増加、FDA承認の増加、非侵襲的診断方法に対する需要の高まり、認知度の向上、新奇なシステム開拓における技術進歩が、予測期間にわたって市場を牽引すると予想される要因です。

阻害要因

機械に関連する合併症、心血管超音波システムの高コスト、訓練された専門家の不足などの要因が市場の妨げになると予想されます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 先進心臓血管超音波システムに対する需要の増加

- 抑制要因

- 装置の高コスト

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- 特許分析

- DMI意見

第6章 COVID-19分析

第7章 タイプ別

- ストレス心エコー図

- 経食道心エコー図検査

- 経胸壁心エコー図

- 造影心エコー図

- ドップラー心エコー図

- その他

第8章 技術別

- 2D超音波

- 3D超音波

- 4D超音波

- その他

第9章 携帯性別

- 携帯型

- ハンドヘルド

第10章 エンドユーザー別

- 病院

- 専門クリニック

- 心臓血管診断センター

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Siemens Healthineers AG

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Koninklijke Philips N.V.

- GE HealthCare

- Hitachi, Ltd.

- CANON MEDICAL SYSTEMS CORPORATION

- ESAOTE SPA

- SAMSUNG HEALTHCARE

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- FUJIFILM Holdings Corporation

- Whale Imaging Inc.

第14章 付録

Overview

A cardiovascular ultrasound system also known as an echocardiography system is a medical imaging device used for non-invasive assessment and visualization of the heart and blood vessels within the body. It employs high-frequency sound waves (ultrasound) to create real-time images and videos of the heart's structure, function, and blood flow patterns. This technology is essential for diagnosing and monitoring various cardiovascular conditions, such as heart valve diseases, congenital heart defects, heart muscle disorders, vascular abnormalities and others.

Cardiac ultrasound should be performed with a low-frequency probe that has a small footprint that can fit between the ribs, using a cardiac setting. Ultrasound is defined as a frequency greater than 20,000 Hertz (Hz). The ultrasound probe sends sound waves, which the patient does not hear or feel, through the body. When the sound waves bounce off internal structures, the technology interprets the "echos" of the returning waves and reconstructs a moving picture of the patient's heart in real-time.

Market Dynamics: Drivers

Increasing demand for advanced cardiovascular ultrasound systems

The increasing demand for advanced cardiovascular ultrasound systems is expected to drive the market over the forecast period. The advanced systems include artificial intelligence features that are responsible for better patient outcomes by performing minimally invasive procedures. These advanced systems helps to enable clinicians to acquire faster and more repeatable tests.

For instance, on August 25, 2023, Siemens Healthineers launched the Acuson Origin, a dedicated cardiovascular ultrasound system with new, robust artificial intelligence (AI) features. Designed to improve patient outcomes and help physicians perform minimally invasive cardiac procedures more efficiently, the Acuson Origin addresses the entire continuum of cardiovascular patient care, including diagnostic, structural heart, electrophysiological, and pediatric procedures.

Additionally, on October 12, 2020, GE Healthcare released U.S. FDA 510k clearance for its Ultra Edition package on Vivid cardiovascular ultrasound systems, which includes new features based on artificial intelligence (AI) that enable clinicians to acquire faster, more repeatable exams consistently.

Moreover, ongoing advancements in ultrasound technology have led to the development of more advanced and sophisticated cardiovascular ultrasound systems. These systems offer higher image quality, improved diagnostic accuracy, and enhanced features such as 3D and 4D imaging, strain imaging, and contrast-enhanced imaging. These innovations make it easier to diagnose and treat cardiovascular conditions effectively.

For instance, on January 22, 2023, Philips launched globally their next-generation compact cardiovascular portable ultrasound solution, the Compact 5000 Series. This new ultrasound is designed for portability and versatility without compromising image quality or performance and aims to bring the diagnostic quality associated with premium cart-based ultrasound systems to more patients.

In addition, the advanced devices helps to provide enhanced image quality and convenience. For instance, on September 30, 2021, Samsung Medison, a global medical equipment company and an affiliate of Samsung Electronics, introduced the V8, a new premium cardiology ultrasound system that provides enhanced image quality, usability, and convenience for all medical professionals.

Further, the increasing prevalence of cardiovascular conditions, rising FDA approvals, rising demand for non-invasive diagnostic methods, increasing awareness and technological advancements in the development of novel systems are the factors expected to drive the market over the forecast period.

Restraints

Factors such as complications associated with the machines, the high cost of the cardiovascular ultrasound systems and lack of trained professionals are expected to hamper the market.

Segment Analysis

The global cardiovascular ultrasound system market is segmented based on type, technology, portability, end-user and region.

The transesophageal echocardiogram segment accounted for approximately 46.2% of the cardiovascular ultrasound system market share

The transesophageal echocardiogram segment is expected to hold the largest market share over the forecast period. A transesophageal echocardiogram is valuable for diagnosing conditions that may not be adequately visualized with other tests, and it is often used in cases of suspected infective endocarditis, aortic dissection, or complex valve pathology. The transesophageal echocardiography system is mainly used to manage and guide care for many cardiovascular patients.

For instance, on June 30, 2022, Clarius Mobile Health and ImaCor Inc. announced a partnership and launched a handheld transesophageal echocardiography (TEE) system designed to manage and guide care for the most critically ill patients in the Intensive Care Unit (ICU).

Moreover, a transesophageal echocardiogram shows a detailed view of the heart's structure and function. It can help diagnose and manage many different cardiovascular conditions. The transesophageal echocardiogram uses transesophageal echocardiography for the diagnosis and management of many diseases.

In May 2022, Philips announced the international launch of EchoNavigator 4.0, EPIQ CVXi interventional cardiology ultrasound system. By integrating real-time transoesophageal echocardiography (TEE), which places the ultrasound transducer close to the heart, and X-ray fluoroscopy, EchoNavigator 4.0 helps interventional teams to decide, guide, treat, and confirm complex structural heart disease therapy, such as heart valve repair or replacement.

Geographical Analysis

North America accounted for approximately 39.2% of the market share

North America region is expected to hold the largest market share over the forecast period owing to the strong presence of major players and technological advancements. North America especially the United States is very well known for its strong presence of major players such as pharmaceutical companies and medical device companies. The presence of major players actively performing in research activities, leads to the launch of advanced cardiovascular ultrasound systems with better features.

For instance, on August 25, 2023, GE HealthCare launched the Vscan Air SL, a handheld, wireless ultrasound imaging system designed for rapid cardiac and vascular assessments at the point of care to help clinicians accelerate diagnoses and treatment decisions. The latest addition to the Vscan product suite, Vscan Air SL features GE HealthCare's proprietary SignalMax and Xdclear technology that provide high levels of penetration, resolution, and sensitivity in imaging performance with an industry-leading single crystal transducer technology.

Furthermore, the technological advancements in the region is also a considerable factor in the region. North America is home to several universities and research institutions that collaborate with the healthcare industry. These collaborations lead to the development of technologically innovative cardiovascular ultrasound systems, which increases the knowledge about their benefits, leading to market dominance in the region.

Competitive Landscape

The major global players in the cardiovascular ultrasound system market include: Siemens Healthineers AG, Koninklijke Philips N.V., GE HealthCare, Hitachi, Ltd., CANON MEDICAL SYSTEMS CORPORATION, ESAOTE SPA, SAMSUNG HEALTHCARE, Shenzhen Mindray Bio-Medical Electronics Co. Ltd., FUJIFILM Holdings Corporation, Whale Imaging Inc. and among others.

Key Developments

- On June 23, 2023, UltraSight, a digital health pioneer transforming cardiac imaging through the power of artificial intelligence, released the announcement about the partnership with point-of-care ultrasound innovator EchoNous, to enable more healthcare professionals to perform cardiac ultrasound and help increase patient access to cardiac care. The new collaboration was announced at ASE 2023, the premier event for bringing together echo professionals.

- On January 27, 2023, FUJIFILM Sonosite, Inc., specialists in developing cutting-edge point-of-care ultrasound (POCUS) solutions, and part of the larger Fujifilm Healthcare portfolio, launched the new Sonosite PX ultrasound system. Sonosite PX is the next generation in Sonosite POCUS, with the most advanced image clarity ever seen in a Sonosite system, a suite of workflow efficiency features, and an adaptable form factor.

- In April 2022, FUJIFILM Sonosite, Inc. launched a new T8-3 transesophageal transducer and Cardiac Resuscitation exam type, to assist clinicians in using transesophageal ultrasound (TEU) at the point of care.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly impacted the global cardiovascular ultrasound system market. During the early stages of the pandemic, many healthcare facilities postponed or canceled elective medical procedures, including non-urgent cardiac imaging tests such as cardiovascular ultrasounds. This led to a temporary decline in the demand for cardiovascular ultrasound systems. The pandemic also disrupted the supply chain of these devices globally.

Why Purchase the Report?

- To visualize the global cardiovascular ultrasound system market segmentation based on type, technology, end-user and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development

- Excel data sheet with numerous data points of cardiovascular ultrasound system market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

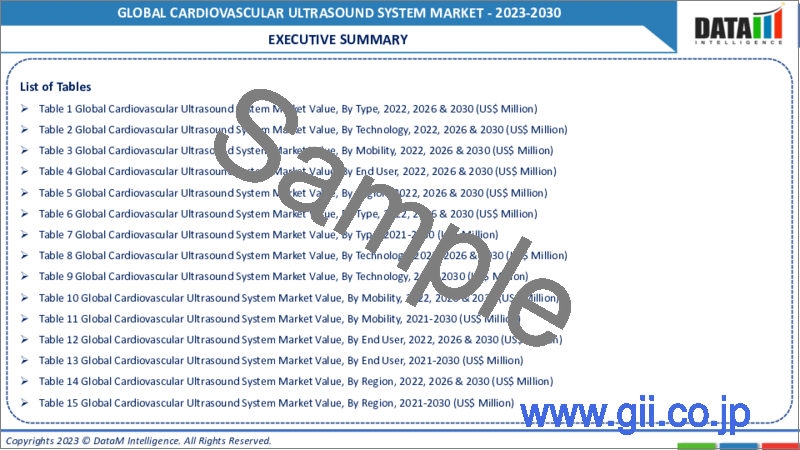

The global cardiovascular ultrasound system market report would provide approximately 69 tables, 71 figures, and 188 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Technology

- 3.3. Snippet by Portability

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Demand for Advanced Cardiovascular Ultrasound Systems

- 4.1.2. Restraints

- 4.1.2.1. High Cost of the Equipment

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Patent Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Stress Echocardiogram*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Transesophageal Echocardiogram

- 7.4. Transthoracic Echocardiogram

- 7.5. Contrast Echocardiogram

- 7.6. Doppler Echocardiogram

- 7.7. Others

8. By Technology

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 8.1.2. Market Attractiveness Index, By Technology

- 8.2. 2D Ultrasound*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. 3D Ultrasound

- 8.4. 4D Ultrasound

- 8.5. Others

9. By Portability

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Portability

- 9.1.2. Market Attractiveness Index, By Portability

- 9.2. Portable*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Handheld

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Hospitals*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Specialty Clinics

- 10.4. Cardiovascular Diagnostic Centers

- 10.5. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.6.1. U.S.

- 11.2.6.2. Canada

- 11.2.6.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.6.1. Germany

- 11.3.6.2. UK

- 11.3.6.3. France

- 11.3.6.4. Italy

- 11.3.6.5. Spain

- 11.3.6.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.6.1. Brazil

- 11.4.6.2. Argentina

- 11.4.6.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.6.1. China

- 11.5.6.2. India

- 11.5.6.3. Japan

- 11.5.6.4. Australia

- 11.5.6.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Siemens Healthineers AG*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Koninklijke Philips N.V.

- 13.3. GE HealthCare

- 13.4. Hitachi, Ltd.

- 13.5. CANON MEDICAL SYSTEMS CORPORATION

- 13.6. ESAOTE SPA

- 13.7. SAMSUNG HEALTHCARE

- 13.8. Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- 13.9. FUJIFILM Holdings Corporation

- 13.10. Whale Imaging Inc.

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us