|

|

市場調査レポート

商品コード

1372599

サイロバッグの世界市場-2023年~2030年Global Silo Bags Market - 2023-2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| サイロバッグの世界市場-2023年~2030年 |

|

出版日: 2023年10月18日

発行: DataM Intelligence

ページ情報: 英文 210 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

概要

サイロバッグの世界市場は2022年に5億2,040万米ドルに達し、2030年には8億7,020万米ドルに達すると予測され、予測期間2023-2030年のCAGRは6.6%で成長する見込みです。

世界のサイロバッグ市場は、いくつかの重要な要因によって力強い成長を遂げています。主な要因の1つは世界人口の拡大で、今後30年間で20億人近くが増加すると予測されています。人口の急増は、食糧需要の増加と農業生産の増加につながります。その結果、サイロバッグのような効率的な穀物貯蔵ソリューションは、増加する人口を養うために必要な豊富な収穫物を保存・管理するために高い需要があります。

さらに、穀物の利用および取引パターンの変化は、安全で効率的な穀物貯蔵を保証するサイロバッグの重要性をさらに強調しています。これらの要因が総合的にサイロバッグの世界市場拡大に寄与し、現代農業と食糧安全保障の極めて重要な要素となっています。

アジア太平洋における穀物市場の成長は、サイロバッグ市場の重要な促進要因です。この地域では穀物の需要が増加し続けているため、サイロバッグのような効率的な穀物貯蔵ソリューションは、増加する収穫物を保存するために不可欠となっています。アジア太平洋地域は人口が急増し、食糧消費量が増加しているため、穀物生産量も増加しています。

ダイナミクス

世界の穀物生産の急増

食糧農業機関」による2023/24年の世界穀物生産予測からも明らかなように、世界的にサイロバッグ市場は成長を遂げています。世界の穀物生産量は前年比0.9%増の28億1,500万トンに達し、2021年の記録的な生産量に匹敵すると予測されています。特に、トウモロコシの生産量は、ブラジルとウクライナの作柄改善により、米国とEUの減産を相殺し、過去最高の12億1,500万トンに達すると予想されています。

穀物生産量の増加は、こうした豊富な収穫を保存・管理するための、サイロバッグを含む効率的な穀物貯蔵ソリューションに対する継続的なニーズを反映しています。穀物の利用や取引パターンが進化するにつれて、サイロバッグは穀物の安全で効率的な貯蔵を保証する上で重要な役割を果たし、世界規模でのサイロバッグ市場の拡大に貢献しています。

世界人口の増加がサイロバッグ市場の成長を後押し

サイロバッグの世界市場は、世界人口の増加によって成長軌道に乗っています。国連による人口予測は大幅な増加を示しており、今後30年間で世界の人口は20億人近く急増すると予想されています。人口の増加は、食糧需要の増加と農業生産の増加を示しています。

この需要増に対応するためには、サイロバッグのような効率的な穀物貯蔵ソリューションが不可欠です。サイロバッグは気密性と防水性を備えた保管庫で、穀物を腐敗や害虫から守り、食料安全保障を確保し、収穫後のロスを減らします。拡大する人口を養うために農業生産が拡大するにつれて、信頼できる貯蔵ソリューションとしてのサイロバッグの需要は増加の一途をたどっています。

短い寿命とコストへの影響

サイロバッグの寿命は通常1年から5年と比較的短いため、サイロバッグ市場に大きな影響を与える可能性があります。耐久性が限られているため、農家や農業事業者は、老朽化したり破損したりした袋を交換するために経常的な費用を負担しなければなりません。定期的に新しいサイロバッグを購入するコストは、特に予算に制約のある小規模な経営にとっては抑止力になり得ます。

さらに、頻繁な交換の必要性は、穀物貯蔵とサプライチェーンに物流上の課題と中断をもたらします。この限界に対処するため、メーカーはサイロバッグの長寿命化に継続的に取り組んでいます。しかし、より長持ちするソリューションが普及するまでは、サイロバッグの寿命の短さは、穀物貯蔵のためのサイロバッグの採用と費用対効果における顕著な制約であり続けます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 世界の穀物生産の急増

- 世界人口の増加がサイロバッグ市場の成長を促進

- 抑制要因

- 寿命の短さとコストへの影響

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 素材別

- 低密度ポリエチレン(LDPE)

- 直鎖状低密度ポリエチレン(LLDPE)

- その他

第8章 容量別

- 100トン未満

- 100トン以上200トン未満

- 201~250トン

- 250トン以上

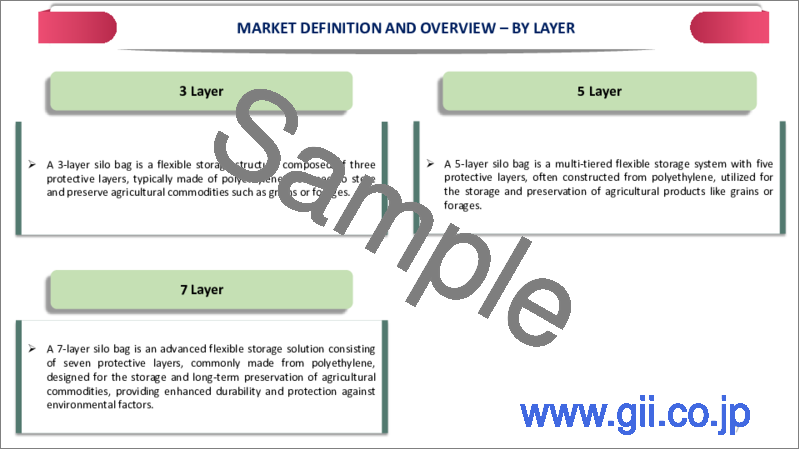

第9章 レイヤー別

- 3層

- 5層

- 7層

第10章 エンドユーザー別

- 穀類

- 豆類

- 豆類

- 油糧種子

- 綿実

- 肥料

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Ag Flex

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- IG Industrial Plastics, LLC

- GreenPro Ventures

- Rishi FIBC SOLUTIONS PVT. LTD.

- Poly-Ag Corp.

- Up North Plastics, Inc.

- RKW Group

- Flex Pack

- GEM Silage Products

- Pacifil Brasil

第14章 付録

Overview

Global Silo Bags Market reached US$ 520.4 million in 2022 and is expected to reach US$ 870.2 million by 2030, growing with a CAGR of 6.6% during the forecast period 2023-2030.

The global silo bags market is experiencing robust growth with several key factors. One major driver is the world's expanding population, with projections indicating an increase of nearly 2 billion people in the next three decades. The population surge translates into higher food demand and increased agricultural production. As a result, efficient grain storage solutions like silo bags are in high demand to preserve and manage the abundant harvests necessary to feed the growing population.

Furthermore, shifting cereal utilization and trade patterns further emphasize the importance of silo bags in ensuring safe and efficient grain storage. The factors collectively contribute to the expanding global silo bags market, making it a pivotal component of modern agriculture and food security.

The growing cereal market in Asia-Pacific is a significant driver of the market for silo bags. As the demand for cereals continues to rise in this region, efficient grain storage solutions like silo bags become essential for preserving the increasing harvests. Asia-Pacific is home to a large and rapidly growing population, which fuels higher food consumption and, consequently, greater cereal production.

Dynamics

Global Cereal Production Surge

The globally silo bag market is experiencing growth, as evidenced by the 2023/24 global cereal production forecast by "Food and Agriculture Organization". Global cereal production is projected to increase by 0.9 percent year-on-year and have reached 2,815 million tonnes, on par with the record outturn of 2021. Notably, maize production is expected to reach a record high of 1,215 million tonnes due to improved crops in Brazil and Ukraine, offsetting production cuts in U.S. and the European Union.

The growth in cereal production reflects an ongoing need for efficient grain storage solutions, including silo bags, to preserve and manage these abundant harvests. As cereal utilization and trade patterns evolve, silo bags play a crucial role in ensuring the safe and efficient storage of grains, contributing to the expansion of the silo bag market on a global scale.

Rising Global Population Fuels Growth in the Silo Bags Market

The global silo bags market is on a growth trajectory, driven by growing globally population. Population projections by United Nations indicate a significant increase, with the world's population expected to surge by nearly 2 billion people over the next 30 years. The population growth shows the higher food demand and increased agricultural production.

To meet this growing demand, efficient grain storage solutions like silo bags are essential. Silo bags offer airtight and waterproof storage, protecting grains from spoilage and pests, ensuring food security and reducing post-harvest losses. As agricultural production scales up to feed the expanding population, the demand for silo bags as a reliable storage solution continues to rise.

Short Lifespan and Cost Implications

The relatively low lifespan of silo bags, typically ranging from one to five years, can significantly impact the silo bags market. The limited durability means that farmers and agricultural businesses must incur recurring expenses to replace aging or damaged bags. The cost of regularly purchasing new silo bags can be a deterrent, especially for smaller operations with budget constraints.

Furthermore, the need for frequent replacements introduces logistical challenges and interruptions in grain storage and supply chains. To address this limitation, manufacturers are continually working on improving the longevity of silo bags. However, until longer-lasting solutions become widespread, the short lifespan remains a notable constraint in the adoption and cost-effectiveness of silo bags for grain storage.

Segment Analysis

The global silo bags market is segmented based on material, capacity, layers, end-user and region.

3-Layer Silo Bags: Efficient Grain Storage and Preservation Innovations

The 3 Layer segment holds about half of the global market share, due to its effectiveness in preserving grains and providing cost-efficient storage solutions. Silo bags are made of three layers of polyethylene, with the external layer reflecting sunlight and the internal layer blocking it. The bags are typically 60 meters long, 3 meters in diameter and can store upto 200 tons of grains.

Storing grains in silo bags offers several advantages. The bags are waterproof when properly sealed, maintaining a high degree of tightness that prevents the interaction of atmospheric oxygen and carbon dioxide with stored grains. The storage method reduces capital investments compared to building steel bins and simplifies harvest logistics, especially in areas with limited access to permanent storage facilities. Silo bags also facilitate on-farm grain segregation and help maintain the moisture content, creating an air-tight or hermetic environment for grain preservation.

The bags, such as 250 microns thickness provides shield for grains effectively. The white outer layer reflects solar radiation, while the black inner layer blocks sunlight, preventing moisture damage. Silo bags excel in storing large grain volumes with speed and efficiency. The bags become waterproof and maintain gas-tightness when tightly sealed, preserving grain quality.

Moreover, they offer cost-effective, flexible storage and require no fumigation for up to 18 months. Organizational advantages include reduced capital investment, ideal buffer storage, simplified logistics and easy specialty grain segregation. Silo bags also maintain moisture content and adapt to a wide range of temperatures. Rishi FIBC, a top silo bag manufacturer, ensures quality and reliability, making them the preferred choice for users seeking high-quality grain storage solutions.

Geographical Penetration

Asia-Pacific Leads the Silo Bags Market: Meeting Global Grain Storage Demand

Asia-Pacific holds a dominant position in the silo bags market. As per United Nations Population Fund, with 60% of the world's population residing in this region, including populous nations like China and India, the demand for efficient grain storage solutions is substantial. The region's diverse agricultural landscape, ranging from large-scale farming in China and India to smaller economies in the Pacific, necessitates versatile storage options like silo bags.

Changing demographics, urbanization and a shift in dietary habits drive the demand for grain storage as food production increases to feed growing urban populations. Moreover, Asia-Pacific's role as a major agricultural exporter further underscores the importance of silo bags in preserving the quality of exported crops. The factors collectively establish the region's prominence in the global silo bags market.

China, as the world's largest silo bags producer, has been strategically exporting silo bags and clinker to neighboring countries, contributing to the growth of the silo bags market in Asia-Pacific. The Chinese government's emphasis on promoting green and sustainable development has also led to the adoption of eco-friendly silo bags technologies and practices.

COVID-19 Impact Analysis:

The COVID-19 pandemic has had a multifaceted impact on the silo bags market. The disruptions caused by the pandemic, including supply chain interruptions, labor shortages and changes in agricultural practices, have affected food production systems and crop management. The immediate impacts of the pandemic, such as disruptions in critical input availability and labor shortages, influenced crop management decisions, including planting area and crop yields.

The disruptions in the agricultural supply chain have had cascading effects on the entire food system, including grain storage. Farmers and agricultural businesses faced challenges in managing their grain stocks due to logistical constraints and uncertainties. Silo bags, as a grain storage solution, became even more critical in ensuring food security during the pandemic.

Russia-Ukraine War Impact Analysis

The conflict between Russia and Ukraine made a significant impact on the silo bags market, primarily due to its effect on grain exports. Ukraine, one of the major grain producers in the world is facing disruptions in its grain export routes, particularly via the Black Sea. The conflict also lead to uncertainty and interruptions in the shipment of grains, including wheat, corn and barley. Ukraine's role as a major grain producer and exporter is crucial for global food security. It accounts for a significant portion of the world's wheat, corn and barley markets.

The disruptions in Ukraine's grain exports is leading to serious consequences for global food security which is in turn, is leading to potential shortages and price fluctuations in the grain market. The conflict has also affected the logistics and infrastructure related to grain exports, which can impact the storage and transportation of grains. In such uncertain times, the need for efficient grain storage solutions, like silo bags, becomes even more pronounced to ensure the preservation and management of grain stocks.

By Material

- Low-density Polyethylene (LDPE)

- Linear Low-density Polyethylene (LLDPE)

- Others

By Capacity

- Less than 100 Tons

- 100 to 200 Tons

- 201 to 250 Tons

- Above 250 Tons

By Layers

- 3 Layer

- 5 Layer

- 7 Layer

By End-User

- Cereals

- Pulses

- Legumes

- Oil seed

- Cotton seed

- Fertilizers

- Other

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

Competitive Landscape

The major global players in the market include: Ag Flex, IG Industrial Plastics, LLC, GreenPro Ventures, Rishi FIBC SOLUTIONS PVT. LTD., Poly-Ag Corp., Up North Plastics, Inc., RKW Group, Flex Pack, GEM Silage Products and Pacifil Brasil.

Why Purchase the Report?

- To visualize the global silo bags market segmentation based on material, capacity, layers, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of silo bags market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

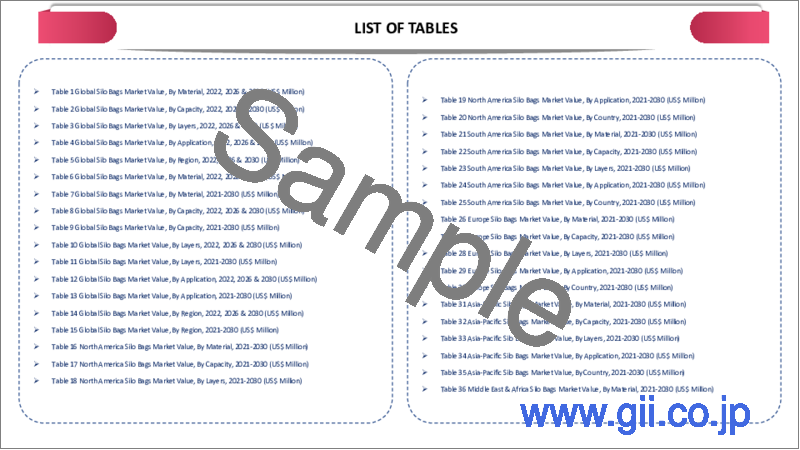

The global silo bags market report would provide approximately 69 tables, 72 figures and 210 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Material

- 3.2. Snippet by Capacity

- 3.3. Snippet by Layers

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Global Cereal Production Surge

- 4.1.1.2. Rising Global Population Fuels Growth in the Silo Bags Market

- 4.1.2. Restraints

- 4.1.2.1. Short Lifespan and Cost Implications

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Material

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 7.1.2. Market Attractiveness Index, By Material

- 7.2. Low-density Polyethylene (LDPE)*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Linear Low-density Polyethylene (LLDPE)

- 7.4. Others

8. By Capacity

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 8.1.2. Market Attractiveness Index, By Capacity

- 8.2. Less than 100 Tons*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. 100 to 200 Tons

- 8.4. 201 to 250 Tons

- 8.5. Above 250 Tons

9. By Layers

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Layers

- 9.1.2. Market Attractiveness Index, By Layers

- 9.2. 3 Layer*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. 5 Layer

- 9.4. 7 Layer

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Cereals*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Pulses

- 10.4. Legumes

- 10.5. Oil seed

- 10.6. Cottonseed

- 10.7. Fertilizers

- 10.8. Other

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Layers

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Layers

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Layers

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Layers

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Capacity

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Layers

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Ag Flex*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. IG Industrial Plastics, LLC

- 13.3. GreenPro Ventures

- 13.4. Rishi FIBC SOLUTIONS PVT. LTD.

- 13.5. Poly-Ag Corp.

- 13.6. Up North Plastics, Inc.

- 13.7. RKW Group

- 13.8. Flex Pack

- 13.9. GEM Silage Products

- 13.10. Pacifil Brasil

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us