|

|

市場調査レポート

商品コード

1372106

ステンレス鋼棒・線の世界市場-2023年~2030年Global Steel Wire Rod and Wire Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ステンレス鋼棒・線の世界市場-2023年~2030年 |

|

出版日: 2023年10月18日

発行: DataM Intelligence

ページ情報: 英文 196 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のステンレス鋼棒・線市場は2022年に1,745億米ドルに達し、2030年には2,695億米ドルに達すると予測され、予測期間2023~2030年のCAGRは5.6%で成長します。

ステンレス線市場は、電気自動車の成長により可能性を秘めています。電気モーター、充電ステーション、バッテリー部品などの用途で、EVは特殊ステンレス鋼棒を必要とします。EVの普及が進むにつれて、こうした特殊ステンレス鋼棒の需要は増加すると予想されます。技術改良により、ステンレス鋼棒・線業界では製品の品質、製造効果、持続可能性が継続的に向上しています。

ステンレス鋼棒・線製品は、メッシュやフェンスを作ったり、コンクリート建物を補強したりする建設分野で多用されています。都市化やインフラ開発プロジェクトが世界的に広がる中、ステンレス線製品の需要は依然として高いです。家具、レクリエーション用品、家庭用家具など、多くの消費財はステンレス鋼で作られています。このセグメントの成長は、これらの製品に対する消費者の需要に後押しされています。

アジア太平洋はステンレス鋼棒市場の53.4%近くを占めており、中国やインドを含む世界最大の自動車市場はアジア太平洋にあります。この地域の自動車産業が拡大した結果、サスペンション・システム、タイヤ補強、その他の自動車用途に使用されるステンレス線部品の需要が高まっています。バッテリー部品や電気モーター用途では、電気自動車(EV)への移行が特殊ワイヤー製品の可能性を広げています。

力学

建設および自動車産業からの需要増加

自動車産業では、ステンレス鋼棒やステンレス線がシート構造、タイヤ補強、サスペンション・システムなど様々な用途に使用されています。燃費を最大化し、排出ガスを低減するために軽量化が重視されているため、強度と軽量化を兼ね備えた高度なステンレス鋼製品への需要が高まっています。

例えば、2022年、Kobe Steelは11月14日、Millcon Steel Public Company Limitedと株式譲渡契約を締結したと発表しました。この契約により、Kobe Steelは線材メーカーであるKobelco Millcon Steel Co., Ltd(KMS)の発行済み株式の25%を取得しました。KMSの発行済み株式の25%を取得しました。この株式譲渡により、KMSはKobe Steelの連結子会社となっています。

ステンレス鋼棒生産における技術開発

より高い生産性と効率性の追求は、ステンレス鋼棒の製造における技術開発の主な原動力のひとつです。鉄鋼メーカーは常に操業を改善し、エネルギー使用量を削減し、生産量を高める方法を模索しています。自動化、ロボット工学、データ解析の進歩により、製造工程のより正確な管理が可能になり、その結果、資源の利用を抑えて生産量を増やすことができるようになっています。

例えば、タタ・スチールの一部門であるインディアン・スチール・ワイヤー・プロダクツ(ISWP)は、2023年にジャムシェドプルの生産能力を増強する予定です。提案されているプロジェクトは、伸線工場でHC・MS GIワイヤー・ステンレス線ー製品を強化し、線材工場で現在の鉄筋と線材の生産能力を増強し、増大する市場需要を満たすものです。

環境規制の強化と持続可能性への懸念

環境規制により、よりクリーンでエネルギー効率の高い工業方法の使用が求められています。公害や温室効果ガスの排出を削減するために、最先端のツールや技術を導入することが頻繁に行われています。例えば、ステンレス鋼棒やステンレス線の製造では、電気アーク炉を使用し、再生可能エネルギーを生産工程に取り入れることで、二酸化炭素排出量を大幅に削減することができます。

炭素排出量の削減は、地球が気候変動との戦いに集中する中、主要な関心事です。鉄鋼メーカーは、エネルギー使用量を削減し、資源を最大限に活用し、廃棄物を減らすためにリサイクルを実施する方針を打ち出すことで、環境への影響を改善する必要に迫られています。こうした行動は、持続可能性の目標を支え、鉄鋼の製造に使われる炭素の量を減らすことになります。

原料価格の変動

鉄スクラップや鉄鉱石のような原材料の価格を決定する上で、需要と供給の力学は重要な役割を担っています。ビジネス上の問題や地政学的な出来事など、サプライチェーンに何らかの支障が生じると、価格が迅速に大きく変動する可能性があります。例えば、ロシア・ウクライナ紛争による供給の途絶や、中国のような主要市場からの需要の変動は、価格に即時かつ顕著な影響を与える可能性があります。

さらに、ステンレス鋼棒・線メーカーは利益率が低いことが多く、原材料価格の変動の影響を特に受けやすいです。特に需要が一定または弱い場合、価格が上昇すると、生産者はより大きなコストを価格上昇という形で顧客に転嫁することが難しくなります。利益率は影響を受け、業界企業の財務安定性にも影響を及ぼす可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 建設産業と自動車産業からの需要の増加

- ステンレス鋼棒生産における技術開発

- 抑制要因

- 環境規制と持続可能性への懸念の高まり

- 原料価格の変動

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMI意見

第6章 COVID-19分析

第7章 製品別

- ステンレス鋼棒

- 6mm

- 8mm

- 10mm

- 10mm以上

- ステンレス線

- 0.01~0.08mm

- 0.09~1.6mm

- 1.7~4mm

- 4mm以上

第8章 材質別

- 炭素鋼

- ステンレス鋼棒

- ステンレス線

- 合金鋼

- ステンレス鋼棒

- ステンレス線

- ステンレス鋼

- ステンレス鋼棒

- ステンレス線

- その他

- 線材

- ステンレス線

第9章 流通チャネル別

- B2B

- ステンレス鋼棒

- ステンレス線

- B2C

- 線材

- ステンレス線

第10章 用途別

- 建設

- ステンレス鋼棒

- ステンレス線

- 自動車

- ステンレス鋼棒

- ステンレス線

- エネルギー

- ステンレス鋼棒

- ステンレス線

- 産業用

- ステンレス鋼棒

- ステンレス線

- 農業

- ステンレス鋼棒

- ステンレス線

- その他

- ステンレス鋼棒

- ステンレス線

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- ArcelorMittal

- Nippon Steel Corporation

- Emirates Steel

- Hebei Sakaguchi Stainless Steel

- Ivaco Rolling Mills

- Kobe Steel Ltd.

- JFE Steel Corporation

- EVRAZ

- Fagersta Stainless

- Tata Steel Limited

第14章 付録

Overview

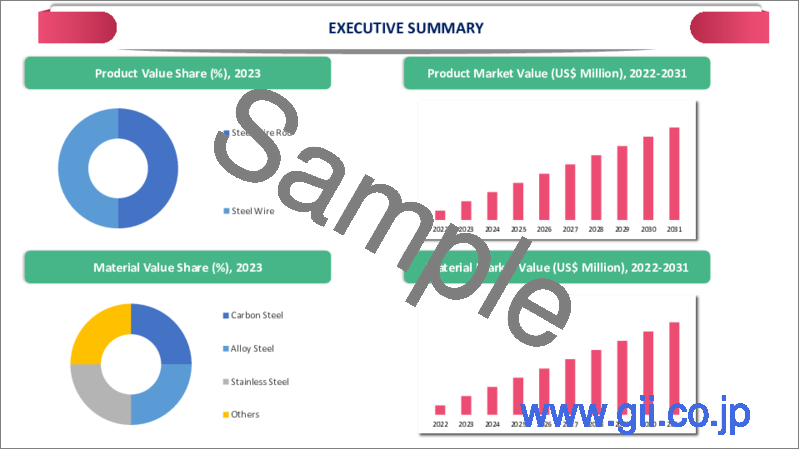

Global Steel Wire Rod and Wire Market reached US$ 174.5 billion in 2022 and is expected to reach US$ 269.5 billion by 2030, growing with a CAGR of 5.6% during the forecast period 2023-2030.

The market for steel wire has potential due to the growth of electric cars. For applications such as electric motors, charging stations and battery components, EVs need specialized steel wire materials. Demand for these specialty wire goods is anticipated to rise as EV usage keeps escalating. Technology improvements have been continuously enhancing product quality, manufacturing effectiveness and sustainability in the steel wire rod and wire industry.

Steel wire rods and wire products are heavily used in the construction sector, where they are used to create mesh and fences as well as to reinforce concrete buildings. The demand for steel wire goods is still high as urbanization and infrastructure development projects spread globally. Many consumer items, such as furniture, recreational equipment and home furnishings, are made with steel wire materials. It segment's growth is fueled by consumer demand for these products.

Asia-Pacific dominates the steel wire rod and wire market covering nearly 53.4% market share and the greatest automobile markets in the world, including China and India, are found in Asia-Pacific. Steel wire components used in suspension systems, tire reinforcement and other automotive applications are in higher demand as a result of the region's expanding automotive industry. In battery component and electric motor applications, the march towards electric vehicles (EVs) has also opened up prospects for specialized wire products.

Dynamics

Increasing Demand from the Construction and Automotive Industries

Steel wire rods and wire are used in the automobile industry for many different purposes, such as seat structures, tire reinforcement and suspension systems. Due to the industry's emphasis on lightweight to maximize fuel economy and lower emissions, there is now more demand for sophisticated steel wire products that combine strength and weight reduction.

For Instance, in 2022, Kobe Steel, Ltd. stated on November 14 that it signed a share transfer contract with Millcon Steel Public Company Limited. By the agreement, Kobe Steel bought 25% of Millcon Steel's issued shares in Kobelco Millcon Steel Co., Ltd. (KMS), a wire rod manufacturing facility in Thailand that was formed in 2016 as a joint venture with Millcon Steel. The share transfer has resulted in KMS being a consolidated subsidiary of Kobe Steel.

Technological Developments in the Production of Steel Wire Rod

The drive for higher productivity and efficiency is one of the main forces behind technical developments in the manufacture of steel wire rods. Steel producers are always looking for methods to improve their operations, cut back on energy use and boost output. Automation, robotics and data analytics advancements have enabled more accurate management of the manufacturing process, resulting in increased output with less utilization of resources.

For Instance, in 2023, Indian Steel & Wire Products (ISWP), a division of Tata Steel, intends to increase its capacity in Jamshedpur. The proposed project comprises strengthening HC & MS GI Wires & wire products at the Wire Mill and enhancing its current Rebars and wire Rods capacity at the Wire Rod Mill to satisfy the growing market demands.

Increasing Environmental Regulations and Sustainability Concerns

The use of cleaner, more energy-efficient industrial methods is required by environmental regulations. It frequently entails the employment of cutting-edge tools and technology to cut back on pollution and greenhouse gas emissions. For instance, the fabrication of steel wire rods and wire may drastically lower its carbon footprint by using electric arc furnaces and incorporating renewable energy sources into the production process.

Reducing carbon emissions is a primary concern as the globe concentrates on combating climate change. Steel manufacturers are under pressure to improve their environmental effects by putting policies in place to reduce energy use, maximize resource utilization and embrace recycling practices to lessen waste. The actions support sustainability objectives and lessen the amount of carbon that goes into making steel.

Price of the Raw Materials Volatility

Supply and demand dynamics have a significant role in determining the price of raw commodities like steel scrap and iron ore. Any interruptions in the supply chain, whether brought on by business problems or geopolitical events, can cause swift and significant price changes. For example, supply disruptions due to the Russia-Ukraine conflict or fluctuations in demand from key markets like China can have immediate and pronounced effects on prices.

Additionally, Steel wire rod and wire producers frequently have slim profit margins, which makes them especially susceptible to fluctuations in the price of raw materials. It becomes difficult for producers to pass on greater costs to customers in the form of higher pricing when prices rise, especially if demand is constant or weak. Profit margins may be impacted and it may also affect the industry's businesses' financial stability.

Segment Analysis

The global steel wire rod and wire market is segmented based on product, material, distribution channel, application and region.

Increasing Demand for Expanding Building Activity in Construction Industry

The increasing demand for wires, ropes and rods made of carbon steel to sustain infrastructure and transport large pieces of construction equipment and machinery. Market expansion is anticipated to be fueled by expanding building activity and accelerated industrialization in emerging nations. Steel wires are increasingly finding application in various car components and structures due to their ease of production and desirable qualities such as ductility, exceptional tensile strength and corrosion resistance.

The growth of residential zones, healthcare facilities and educational institutions has driven up the demand for steel wire in the construction sector leading it to cover more than 45.2% share in 2022. Its exceptional attributes, including high strength, resistance to abrasion and corrosion and ability to withstand deformation, make it versatile for a wide range of applications, including reinforcing and binding rebar, contributing to the structural integrity of buildings. A framework of the mesh made of steel wire holds all contemporary constructions together.

Geographical Penetration

Rising Demand for Automobiles, Propelling the Need for Steel Wire Rods and Wire in Asia-Pacific

Asia-Pacific has been a dominant force in the global steel wire rod and wire market and China is among the highest share holders which has covered nearly 1/3rd in 2022. The Asia-Pacific automobile market has been growing quickly. It industry largely depends on steel wire products for a variety of uses, such as building structures and automobile parts. The demand for vehicles is increasing along with the middle class, which is driving up the price of steel wire rods and wire.

Additionally, the market is expanding as a result of the region's thriving industrial industry, which includes electronics and machinery. In recent years, the steel wire rod and wire market's rise has been significantly fueled by Asia-Pacific, due to these reasons as well as increasing investment in cutting-edge production technology.

The market for steel wires is anticipated to develop as a result of rising demand for high-rise structures. The major building components used in high-rise projects are steel and reinforced concrete. Residential buildings often utilize concrete in their construction, whereas skyscrapers predominantly employ steel frames.

For Instance, the urban population numbered 7.8 billion in 2021, with an estimated additional 2.5 billion expected to inhabit cities and urban areas over the next two to two-and-a-half decades. In highly crowded cities where unoccupied plots are present, high-rise structures, particularly residential ones, have shown to be advantageous. As a result, the market expands as high-rise development demand increases.

For instance, in 2020, the India-based Steel Authority of India's Iisco Steel Plant Burnpur (SAIL- ISP) released a premium line of wire rod goods as part of its efforts to increase market share across multiple industries and meet the expanding demands of its clients. The organization created the Cable Armour Quality Wire Rod, which offers mechanical protection and enables the cable to tolerate more stress.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly affected the steel wire rod and wire market globally in 2021, causing the sector to undergo a period of recovery and adaptation. In the early stages of the pandemic, widespread lockdowns and restrictions interrupted building and industrial operations, which decreased demand for steel goods, especially wire rods and wire. As a result, production levels declined, capacity sat idle and supply chains encountered difficulties as steel mills adapted to the new market circumstances.

The industry proved its adaptability as the year went on by evolving with the environment. Infrastructure expenditure was raised in many regions to boost economic growth, which sparked a rebound in manufacturing and construction. It was the driving force behind the recovery. A key user of steel wire goods, the automobile industry also recovered because of changes in the supply chain and customer demand.

Steel producers, however, continued to face difficulties due to supply-side issues, such as changes in the price of raw materials and delays in shipment. Additionally, the epidemic increased the steel industry's mechanization and digitization. In order to increase productivity and decrease the need for on-site staff, businesses started using remote monitoring and repair of equipment.

Furthermore, the market for steel wire rods and wire products has been affected by sustainability and environmental concerns, which have become more prominent and place a higher focus on eco-friendly production methods and materials. Overall, the industry handled the pandemic's difficulties with flexibility, proving its ability to bounce back and change in response to shifting global conditions.

Russia-Ukraine War Impact Analysis

The international market for steel wire rods and wire may be significantly impacted by the ongoing conflict between Russia and Ukraine. Both countries are prominent actors in the global steel industry, with Ukraine generating a sizeable quantity of iron ore, a necessary raw material for creating steel and Russia contributing a sizeable share of the world's supply of steel.

Supply shortages and higher production costs for steel wire rod and wire makers globally may result from the war's disruption of iron ore mining and shipping, as well as possible infrastructure damage and logistical difficulties. The dynamics of the market might change as a result, leading to price instability, decreased availability and the requirement for steel companies to look for other raw material suppliers.

The market for steel wire rods and wire will likely be significantly impacted by the Russia-Ukraine war. A large source of the primary raw material required for the production of steel is Ukraine, which is well known for its iron ore output. In the meantime, Russia's participation in the global steel supply chain strengthens the ties between these two nations.

Iron ore transport and extraction are expected to be disrupted as the battle progresses and infrastructure damage is also a possibility. Manufacturing of steel wire rods and wire products may be affected by these interruptions, which might lead to shortages of supplies and higher manufacturing costs. In turn, this is likely to lead to price changes, restrict product availability and force steel makers to look for alternate raw material sources, thereby changing the competitive landscape of the sector.

Additionally, the global unpredictability brought on by the conflict might influence financing alternatives, global trade agreements, investor confidence and commercial opportunities in the steel wire rod and wire sector. In order to minimize disruptions and be ready for future long-term changes in the steel sector's landscape, industry players must actively watch developments, diversify their supply networks and modify their strategies.

By Product

- Steel Wire Rod

6mm

8mm

10mm

Above 10mm

- Steel Wire

0.01-0.08mm

0.09-1.6mm

1.7-4mm

Above 4mm

By Material

- Carbon Steel

Steel Wire Rod

Steel Wire

- Alloy Steel

Steel Wire Rod

Steel Wire

- Stainless Steel

Steel Wire Rod

Steel Wire

- Others

Steel Wire Rod

Steel Wire

By Distribution Channel

- B2B

Steel Wire Rod

Steel Wire

- B2C

Steel Wire Rod

Steel Wire

By Application

- Construction

Steel Wire Rod

Steel Wire

- Automotive

Steel Wire Rod

Steel Wire

- Energy & Power

Steel Wire Rod

Steel Wire

- Industrial

Steel Wire Rod

Steel Wire

- Agriculture

Steel Wire Rod

Steel Wire

- Others

Steel Wire Rod

Steel Wire

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On February 06, 2023, JFE Steel Corporation plans an additional expansion for a launch in the fiscal year beginning April 2026 while also increasing the electrical steel sheet capacity of its West Japan Works for startup scheduled for the first half of the fiscal year beginning in April 2024. The further expansion, which would cost around 50.0 billion yen, will increase the factory's present output of the highest-quality non-oriented electrical steel sheets used in the electric cars' primary engine motors.

- On December 20, 2022, the shares of metal-producing company Shyam Metalics and Energy rose about 9% to Rs 317 after the company had entered the stainless-steel industry by acquiring Mittal Corp. in an NCLT-led resolution procedure. With the acquisition, Shyam Metalics increased its capacity for stainless steel, wire rods and bar milling to 1,50,000 tons annually. According to a BSE filing, the firm would invest Rs 7,500 crore over the next 4-5 years to further diversify its metals operations.

- On 1 March 2023, Bekaert announced a deal with its present partners to sell them a 136 million dollar stake in its Steel Wire Solutions businesses in Chile and Peru. The transaction is a part of Bekaert's plan to expand into areas that are expanding more quickly, particularly those that provide higher profit margins and higher returns on investment, such as innovative transportation, green energy and low-carbon concrete solutions.

Competitive Landscape

The major global players in the market include: ArcelorMittal, Nippon Steel Corporation, Emirates Steel, Hebei Sakaguchi Stainless Steel, Ivaco Rolling Mills, Kobe Steel Ltd., JFE Steel Corporation, EVRAZ, Fagersta Stainless and Tata Steel Limited.

Why Purchase the Report?

- To visualize the global steel wire rod and wire market segmentation based on product, material, distribution channel, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of steel wire rod and wire market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

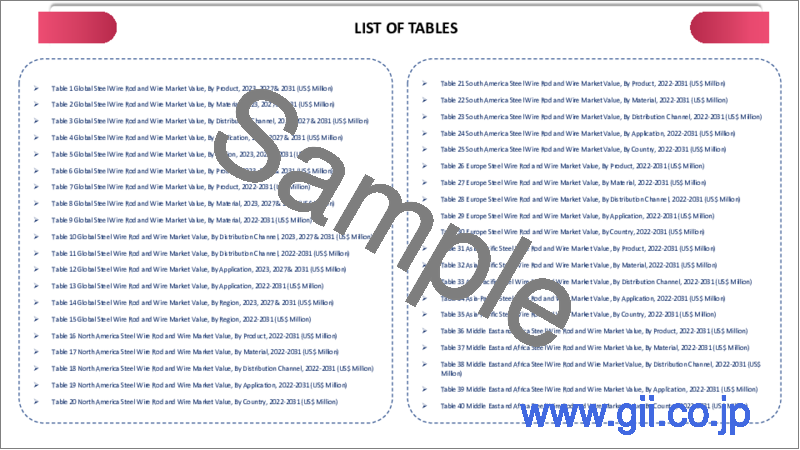

The global steel wire rod and wire market report would provide approximately 70 tables, 70 figures and 196 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product

- 3.2. Snippet by Material

- 3.3. Snippet by Distribution Channel

- 3.4. Snippet by Application

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Demand from the Construction and Automotive Industries

- 4.1.1.2. Technological Developments in the Production of Steel Wire Rod

- 4.1.2. Restraints

- 4.1.2.1. Increasing Environmental Regulations and Sustainability Concerns

- 4.1.2.2. Price of the Raw Materials Volatility

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2. Market Attractiveness Index, By Product

- 7.2. Steel Wire Rod*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.3. 6mm

- 7.2.4. 8mm

- 7.2.5. 10mm

- 7.2.6. Above 10mm

- 7.3. Steel Wire

- 7.3.1. 0.01-0.08mm

- 7.3.2. 0.09-1.6mm

- 7.3.3. 1.7-4mm

- 7.3.4. Above 4mm

8. By Material

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 8.1.2. Market Attractiveness Index, By Material

- 8.2. Carbon Steel*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.2.3. Steel Wire Rod

- 8.2.4. Steel Wire

- 8.3. Alloy Steel

- 8.3.1. Steel Wire Rod

- 8.3.2. Steel Wire

- 8.4. Stainless Steel

- 8.4.1. Steel Wire Rod

- 8.4.2. Steel Wire

- 8.5. Others

- 8.5.1. Steel Wire Rod

- 8.5.2. Steel Wire

9. By Distribution Channel

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 9.1.2. Market Attractiveness Index, By Distribution Channel

- 9.2. B2B*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.2.3. Steel Wire Rod

- 9.2.4. Steel Wire

- 9.3. B2C

- 9.3.1. Steel Wire Rod

- 9.3.2. Steel Wire

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Construction*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.2.3. Steel Wire Rod

- 10.2.4. Steel Wire

- 10.3. Automotive

- 10.3.1. Steel Wire Rod

- 10.3.2. Steel Wire

- 10.4. Energy & Power

- 10.4.1. Steel Wire Rod

- 10.4.2. Steel Wire

- 10.5. Industrial

- 10.5.1. Steel Wire Rod

- 10.5.2. Steel Wire

- 10.6. Agriculture

- 10.6.1. Steel Wire Rod

- 10.6.2. Steel Wire

- 10.7. Others

- 10.7.1. Steel Wire Rod

- 10.7.2. Steel Wire

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Russia

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. ArcelorMittal*

- 13.1.1. Company Overview

- 13.1.2. Type Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Nippon Steel Corporation

- 13.3. Emirates Steel

- 13.4. Hebei Sakaguchi Stainless Steel

- 13.5. Ivaco Rolling Mills

- 13.6. Kobe Steel Ltd.

- 13.7. JFE Steel Corporation

- 13.8. EVRAZ

- 13.9. Fagersta Stainless

- 13.10. Tata Steel Limited

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us