|

|

市場調査レポート

商品コード

1360039

集積回路の世界市場-2023年~2030年Global Integrated Circuits Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 集積回路の世界市場-2023年~2030年 |

|

出版日: 2023年10月11日

発行: DataM Intelligence

ページ情報: 英文 201 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要:

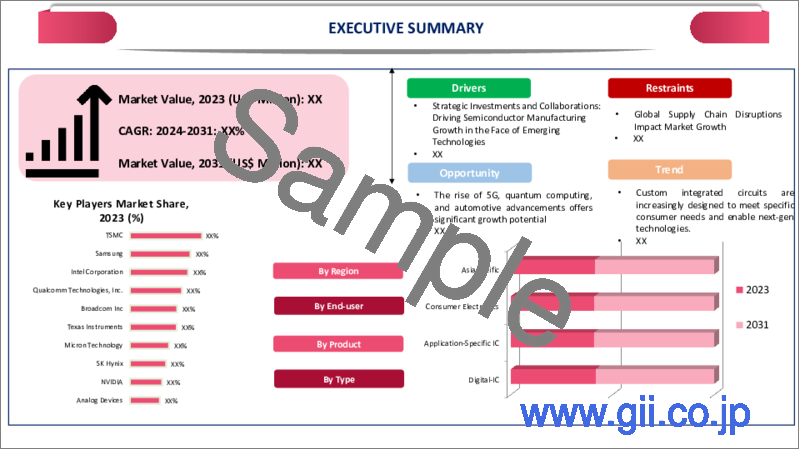

集積回路の世界市場は2022年に4,743億米ドルに達し、2030年には1兆1,035億米ドルに達すると予測され、予測期間2023-2030年のCAGRは12.6%で成長します。

半導体産業は常に高速で効率的な集積回路を開発しています。スマートフォンやその他の民生用電子機器の普及が市場成長の主な要因となっています。電子機器製造の世界化により、集積回路の利用範囲が拡大し、世界中の市場で利用できるようになっています。

2020年には、中国は集積回路分野で世界最大かつ最速の成長市場となり、純資産は8,800億元に達します。5カ年計画の間に、市場は約20%成長し、8,848億元に達し、これは世界の拡大率の4倍です。現在も研究開発が進められており、市場を牽引する成果を上げています。

予測期間中、世界の集積回路市場の約1/4を占める北米は健全な成長を示すと予想されます。様々な産業からのエレクトロニクス需要の増加により、より高度で専門的な集積回路が必要とされています。例えば、2023年9月20日、米国を拠点とする著名なプリント回路基板メーカーであり、電子製造サービスを提供するAmitron Corporationは、米国の製造技術の促進を目的とした新しい業界コラムを発表しました。

ダイナミクス:

ファブの生産能力の向上による市場需要の増大

スマートフォン、タブレット、ノートパソコン、IoT機器、自動車用電子機器など、電子製品の需要が増加しているため、IC生産能力の向上が求められています。高度で特殊なICは、5G、AI、機械学習、モノのインターネットなどの新興技術に必要であり、これらの技術が認知されるにつれて、これらのアプリケーションをサポートできるICを開発するファブの需要が高まっています。

2023年9月のSemiFabの報告書によると、ファブ設備支出は過去最高の995億米ドルに達しました。2023年には前年比(YoY)15%減の840億米ドルが予想され、この減少はチップ需要の軟化と民生用およびモバイルデバイスの在庫の増加に起因しています。2024年の製造装置支出の回復は、いくつかの要因によって牽引されると予想されます。主な要因のひとつは、2023年の半導体在庫調整の終了です。

超低コストのフレキシブル集積回路への需要拡大

IoTが大きな成長を遂げた理由として、産業が台頭し、センサー、ウェアラブルデバイス、スマートフォンなど様々なデバイスに統合される低コストICの需要が増加したことが挙げられます。超低コスト・フレキシブルICは、コスト削減を目指す製造業にとって魅力的な選択肢です。

例えば、2021年10月18日、フレキシブル・エレクトロニクスのリーダーであるプラグマティック・セミコンダクターは、シリーズCで8,000万米ドルの資金を確保しました。この投資は、Internet of Everything(IoE)向けの超低コストのフレキシブル集積回路(FlexICs)への需要の高まりに対応するため、イングランド北東部に2つ目のFlexLogIC工場を設立するために使用され、このイニシアチブは、次世代半導体の主要な設計・製造者としての英国の地位を強化することを目的としています。

企業間のコラボレーションによる市場促進

世界の政府、研究機関、半導体企業間の協力は技術革新を促し、新技術の開発を早めます。標準規格は互換性と相互運用性を保証するため、半導体ビジネスにとって不可欠です。これらの標準の作成と採用にはコラボレーションが必要です。エンドユーザーに包括的なソリューションを提供するため、半導体企業はソフトウェア開発者、デバイス・メーカー、その他のエコシステム・パートナーと頻繁に協力しています。

例えば、2023年9月19日、本田技研工業株式会社は、台湾セミコンダクター・マニュファクチャリング社との戦略的協業契約を発表しました。この協業は、EV市場におけるホンダの地位を向上させ、車載半導体技術を進歩させることを目的としています。ホンダは、半導体ファウンドリーのトップ企業であるTSMCと緊密に協力し、EV専用チップを開発します。この契約は、集積回路の製造に関するものです。

デバイスの互換性と過熱

ICの物理的サイズには限りがあり、電子機器の小型化が進むにつれて、1つのチップに集積できる部品の数にも制約が出てきます。ICは動作時に熱を発生し、高出力のICは追加の冷却機構を必要とする場合があります。過度の電力消費は、携帯機器のバッテリー寿命を制限する可能性があります。ICは数十億個のトランジスタを含むことができますが、個々のチップをどれだけ複雑に設計・製造できるかには現実的な限界があります。極めて複雑なICは、製造が困難で高価になる可能性があります。

ICを設計・製造する過程では、製造施設や設備に多額の投資が必要であり、このコストは中小企業や新興企業にとって参入障壁となり得ます。ICが高性能になるにつれ、放熱の管理が課題となります。過熱は性能の低下や寿命の低下につながります。デジタルICはバイナリ・データの処理と保存に優れていますが、アナログ信号処理には限界があります。オーディオや無線周波数(RF)回路などのアプリケーションには、特殊なアナログICが必要になることが多いです。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- ファブの生産能力の向上による市場需要の増大

- 超低コストのフレキシブル集積回路への需要の高まり

- 企業間のコラボレーションによる市場促進

- 抑制要因

- デバイスの互換性と過熱

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 種類別

- デジタルIC

- アナログIC

- ミックスドシグナルIC

第8章 製品別

- 汎用IC

- 特定用途IC (ASIC)

第9章 用途別

- 標準型コンピュータ

- 携帯電話

- タブレット

- STB(セットトップボックス)

- ゲーム機

第10章 エンドユーザー別

- 民生用電子機器

- 自動車

- IT・通信

- 製造業・オートメーション

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Samsung

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- Intel Corporation

- Qualcomm Technologies, Inc.

- Texas Instruments

- SK Hynix

- NVIDIA

- Avago Technologies

- Micron Technology, Inc.

- AMI Semiconductor

- Toshiba Electronic Devices & Storage Corporation

第14章 付録

Overview:

Global Integrated Circuits Market reached US$ 474.3 billion in 2022 and is expected to reach US$ 1,103.5 billion by 2030, growing with a CAGR of 12.6% during the forecast period 2023-2030.

The semiconductor industry constantly develops fast and efficient integrated circuits. The adoption of smartphones and other consumer electronics items has been a major driver for the growth of the market. Globalization of electronics manufacturing has expanded the reach of integrated circuits and makes them accessible in the market worldwide.

In 2020, China became world's largest and fastest growing market in the field of integrated circuit sector and has net worth of Yuan 880 billion. During its five year plan the market grows about 20% and reached up to Yuan 884.8 billion that is 4 times higher than global expansion rate. Further ongoing research and development is going and results breakouts which drives the market.

During the forecast period, with around 1/4th of the global integrated circuits market, North America is expected to show a healthy growth. More advanced and specialized integrated circuits are required due to the increasing demand for electronics from various industries. For instance, on 20 September 2023, Amitron Corporation, a prominent U.S. based manufacturer of printed circuit boards and provider of electronic manufacturing services, introduced a new industry column aimed at promoting American manufacturing technology.

Dynamics:

Rising Fab Capacities Increases the Market Demand

Higher IC production capacities are required because there is increasing demand for electronic products, including smartphones, tablets, laptops, IoT devices, automotive electronics and more. Advanced and specialized ICs are necessary for emerging technologies like 5G, AI, machine learning and the Internet of Things and there is a demand for fabs to develop ICs that can support these applications as these technologies gain acknowledgment.

According to the report by SemiFab in September 2023, fab equipment spending reached a record high of US$ 99.5 billion. in 2023, there is an expected decline of 15% year-over-year (YoY) to US$ 84 billion and this decline is attributed to softening chip demand and an elevated inventory of consumer and mobile devices. The recovery in fab equipment spending in 2024 is expected to be driven by several factors. One of the key factors is the end of the semiconductor inventory correction in 2023.

Growing Demand for Ultra-Low-Cost Flexible Integrated Circuits

The internet of Things witnessed significant growth is the rising industries and increased demand for low-cost ICs and which is integrated into various devices like sensors, wearable devices and smartphones. Ultra-low-cost flexible ICs leads to offer cost advantages which in terms for production for making them an attractive choice for manufacturing which aims to reduce expenses.

For instance, on 18 October 2021, PragmatIC Semiconductor, a leader in flexible electronics, has secured US$ 80 million in Series C funding. The investment will be used to establish a second FlexLogIC fab in the North East of England to meet the rising demand for ultra-low-cost flexible integrated circuits (FlexICs) for the Internet of Everything (IoE) and this initiative aims to strengthen UK's position as a leading designer and manufacturer of next-generation semiconductor.

Collaboration between Companies Boosts the Market

Collaboration between global governments, research institutions and semiconductor businesses encourage innovation and hastens the development of new technologies. Standards are essential to the semiconductor business because they ensure compatibility and interoperability. The creation and adoption of these standards requires collaboration. To provide comprehensive solutions for end users, semiconductor companies frequently work with software developers, device manufacturers and other ecosystem partners.

For instance, on 19 September 2023, Honda Motor Co. announced a strategic collaboration deal with Taiwan Semiconductor Manufacturing Co. The collaboration aims to boost Honda's position in the market for EVs and advance automotive semiconductor technologies. Honda will collaborate closely with TSMC, a top semiconductor foundry, to create specialized chips made just for EVs. The deal is for manufacturing the integrated circuits.

Compatibility and Overheating of the Device

ICs have a finite physical size and as electronic devices become smaller and more compact, there are constraints on how many components can be integrated onto a single chip. ICs generate heat when in operation and high-power ICs may require additional cooling mechanisms. Excessive power consumption can limit battery life in portable devices. ICs can contain billions of transistors, there is a practical limit to how complex an individual chip can be designed and manufactured. Extremely complex ICs may be difficult and expensive to produce.

The process of designing and manufacturing ICs requires significant investment in fabrication facilities and equipment and this cost can be a barrier to entry for smaller companies and startups. As ICs become more powerful, managing heat dissipation becomes a challenge. Overheating can lead to reduced performance and decreased lifespan. Digital ICs excel at processing and storing binary data, they have limitations in analog signal processing. Specialized analog ICs are often required for applications like audio and radio frequency (RF) circuits.

Segment Analysis:

The global integrated circuits market is segmented based on type, product, application, end-user and region.

Adoption of Digital IC Increases the Growth of the Market

During the forecast period 2023-2030, digital ICs are estimated to account for about 1/3rd of the global integrated circuits market. Digital ICs are integral to emerging technologies such as quantum computing, edge computing and neuromorphic computing and these technologies open new avenues for digital IC innovation and growth. Collaborating with partners in different regions or industries can help digital IC manufacturers expand their market reach. Joint ventures or partnerships can open doors to new customer segments and applications.

More compact, energy-efficient and potent digital ICs may now be produced because of continuous advances in semiconductor manufacturing methods, including lower nodes. For instance, in December 2021, Taiwan Semiconductor Manufacturing Company declared a collaboration with Sony in December 2021, with the two companies investing US$ 7 billion to develop a chip manufacturing facility in Japan. The advancements will raise Digital IC production and market growth.

Geographical Penetration:

Rising Consumption of Semiconductors in Asia-Pacific

Asia-Pacific is the fastest as well as dominant region in the global integrated circuits market covering more than 1/3rd of the market. Due to the ongoing movement of diversified electronic equipment to China, the consumption of semiconductor parts in China, South Korea and Japan is fast expanding in comparison to other nations.

Furthermore, the largest sector of China's Integrated Circuits industry, IC design, has evolved from a focus on low-margin consumer applications to include advanced communication and computing semiconductors across growth markets such as automotive, the Internet of Things (IoT), crypto mining and artificial intelligence (AI).

For example, in August 2021, SiEn (Qingdao) Integrated Circuits Co, a foundry, began production of 8-inch silicon wafers and tested a new 12-inch production line in Qingdao. Furthermore, Semiconductor Manufacturing International Corp (SMIC) announced a US$ 8.87 billion investment in the construction of a chip manufacturing plant in Shanghai in September 2021. The company's strategy has been centered on integrated circuit foundry and technology services at process nodes of 28 nanometers and above.

Competitive Landscape

The major global players in the market include: Samsung, Intel Corporation, Qualcomm Technologies, Inc., Texas Instruments, SK Hynix, NVIDIA, Avago Technologies, Micron Technology, Inc., AMI Semiconductor and Toshiba Electronic Devices & Storage Corporation.

COVID-19 Impact Analysis

The IC industry which heavily relies on global supply chains for raw materials, equipment and manufacturing. Many IC manufacturers faced challenges in sourcing materials and components, causing delays in chip manufacturing. To curb the spread of the virus, many semiconductor manufacturing facilities had to shut down or operate at reduced capacity.

The pandemic also led to increased demand for certain types of ICs. With the shift to remote work and online activities, there was a surge in demand for laptops, tablets and other devices, driving the need for ICs used in these products. As there was a decrease in demand for ICs used in industries hit hardest by the pandemic, such as automotive. As car manufacturing slowed down, the demand for automotive ICs decreased.

The pandemic disrupted the workforce, leading to labor shortages in some semiconductor manufacturing plants and this further impacted production capacity. The pandemic accelerated the digital transformation in various industries, including healthcare, e-commerce and remote work and this led to increased demand for ICs used in data centers, networking equipment and telemedicine devices.

AI Impact

AI algorithms, particularly machine learning and neural networks, are being used to optimize the design of ICs. AI can explore a vast design space to find configurations that meet specific performance and power requirements. Electronic Design Automation (EDA) tools are incorporating AI to enhance their capabilities. AI-driven EDA tools can automate many aspects of the design process, speeding up chip development.

AI is helping design ICs that are more power-efficient and this is critical for mobile devices and IoT applications where battery life is a concern. AI is used for fault detection and quality control during IC manufacturing. It can identify defects in chips more accurately and quickly than manual inspection. AI-driven testing methods can quickly validate IC designs, ensuring that they meet specifications and are free from defects.

For instance, on 21 September 2023, Intel's Innovation 2023 focused on accelerating the convergence of AI and security. Intel adapts to use AI to enhance security in various fields. Massive volumes of data may be analyzed in real-time by AI algorithms, making it possible to more quickly identify and address security issues. Intel also plans to develop specific integrated circuits which will lead to a reduction of millions of software.

Russia- Ukraine War Impact

Ukraine is home to several semiconductor and electronic component manufacturers. The war could disrupt the supply of critical components and materials needed for IC production and this includes items like rare earth minerals, which are essential for manufacturing semiconductors. The conflict may force semiconductor manufacturing plants in Ukraine to suspend operations or operate at reduced capacity due to safety concerns and infrastructure damage, this can disrupt the global supply chain.

Disruptions in the supply chain which leads to shortages of ICs and related electronic components and this can affect various industries, including consumer electronics, automotive and telecommunications, which rely heavily on ICs. Shortages and supply chain disruptions often lead to price volatility. Prices of certain ICs may increase due to high demand and limited supply affecting production costs for various products.

By Type

- Digital IC

- Analog IC

- Mixed-Signal IC

By Product

- General-Purpose IC

- Application-Specific IC

By Application

- Standard Computers

- Cell Phones

- Tablets

- Set Top Box

- Gaming Consoles

By End-User

- Consumer Electronics

- Automotive

- IT & Telecommunications

- Manufacturing and Automation

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In August 2023, Analog Devices completed its acquisition of Maxim Integrated Products, Inc and this acquisition strengthened ADI's position as a high-performance analog semiconductor company, with pro forma trailing twelve-month revenue of over US$ 9 billion, leading margins and significant free cash flow.

- In March 2022, Micross Components, Inc. announced an exclusive partnership with Apogee Semiconductor, a leader in Radiation-Hardened-by-Design semiconductors, using the patented TalRad (Transistor-Adjusted-Layout for Radiation) process. In this partnership, Micross becomes the global supplier of die and packaged devices utilizing Apogee Semiconductor technology.

- In March 2022, Toshiba expanded its lineup of stepping motor driver ICs with the release of the "TB67S549FTG," a small-package stepping motor driver IC with built-in constant-current control that doesn't require external circuit components and this driver is suitable for industrial equipment such as office automation and financial equipment and helps save space on circuit boards.

Why Purchase the Report?

- To visualize the global integrated circuits market segmentation based on type, product, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of integrated circuits market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global integrated circuits market report would provide approximately 69 tables, 70 figures and 201 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Product

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rising Fab Capacities Increases the Market Demand

- 4.1.1.2. Growing Demand for Ultra-Low-Cost Flexible Integrated Circuits

- 4.1.1.3. Collaboration between Companies Boosts the Market

- 4.1.2. Restraints

- 4.1.2.1. Compatibility and Overheating of the Device

- 4.1.3. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Digital IC*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Analog IC

- 7.4. Mixed-Signal IC

8. By Product

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 8.1.2. Market Attractiveness Index, By Product

- 8.2. General-Purpose IC*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Application-Specific IC

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Standard Computers*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Cell Phones

- 9.4. Tablets

- 9.5. Set Top Box

- 9.6. Gaming Consoles

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Consumer Electronics*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Automotive

- 10.4. IT & Telecommunications

- 10.5. Manufacturing and Automation

- 10.6. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.2.7.4. Europe

- 11.2.8. Introduction

- 11.2.9. Key Region-Specific Dynamics

- 11.2.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.11. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.2.12. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.13. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.14. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.14.1. Germany

- 11.2.14.2. UK

- 11.2.14.3. France

- 11.2.14.4. Italy

- 11.2.14.5. Russia

- 11.2.14.6. Rest of Europe

- 11.3. South America

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Brazil

- 11.3.7.2. Argentina

- 11.3.7.3. Rest of South America

- 11.4. Asia-Pacific

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. China

- 11.4.7.2. India

- 11.4.7.3. Japan

- 11.4.7.4. Australia

- 11.4.7.5. Rest of Asia-Pacific

- 11.5. Middle East and Africa

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Samsung*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Intel Corporation

- 13.3. Qualcomm Technologies, Inc.

- 13.4. Texas Instruments

- 13.5. SK Hynix

- 13.6. NVIDIA

- 13.7. Avago Technologies

- 13.8. Micron Technology, Inc.

- 13.9. AMI Semiconductor

- 13.10. Toshiba Electronic Devices & Storage Corporation

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us