|

|

市場調査レポート

商品コード

1352167

非鉄金属リサイクルの世界市場-2023年~2030年Global Non Ferrous Metals Recycling Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 非鉄金属リサイクルの世界市場-2023年~2030年 |

|

出版日: 2023年09月27日

発行: DataM Intelligence

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

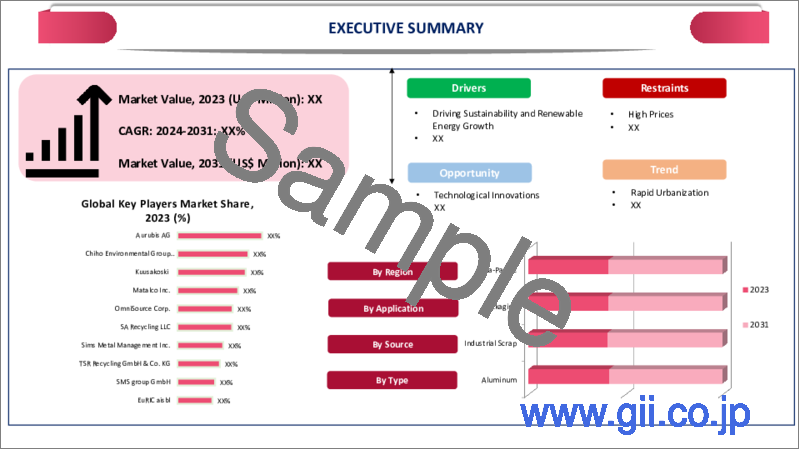

世界の非鉄金属リサイクル市場は、2022年に2億6,750万米ドルに達し、2030年には3億4,500万米ドルに達すると予測され、予測期間2023年~2030年のCAGRは3.3%で成長する見込みです。

様々な最終用途産業から集められ、リサイクル施設で処理される非鉄スクラップの需要は、この情報の結果として上昇します。市場拡大を促進する要因の一つは、これらの金属のリサイクルに関連する環境、経済、省エネルギーに対する国民の意識の高まりです。

可処分所得の増加は、世界の非鉄金属リサイクル産業の主な発展要因です。特にニッケル、銀、銅、アルミニウム、スズは、元の品質を失うことなく無限のリサイクル工程を経ることができる非鉄金属です。また、特にアルミニウムのような一般的な金属では、すでに採掘された材料を使用する方がゼロから始めるよりも安価であるため、リサイクルは賢明な経済的行動でもあります。

アジア太平洋は、非鉄金属リサイクル市場の世界シェアの1/3以上を占めています。この地域の国々は相当量の非鉄金属スクラップを生産していますが、大規模な未組織市場が存在せず、知識も不足しているため、この材料の大部分はリサイクル施設ではなく埋立地に供給されています。

インドのリサイクル率は約25%で、世界平均の約45%を大きく下回っています。この数字は、市場の巨大な成長の可能性を浮き彫りにしています。同国で生産された120キロトンのアルミスクラップは、そのほとんどがエネルギー産業と自動車産業によるものです。

ダイナミクス

急速な都市化と住宅・インフラ建設への政府・消費者投資の増加

金属リサイクルの世界市場は、都市化、工業化、商品消費の増加、より多くの天然資源の使用とそれに伴う枯渇の結果として成長しています。Nucor Corporation、Aurubis AGなどの市場企業は、金属リサイクル業界における製品提供の多様化の成功のアプローチとして、新製品を生み出し、買収を行っています。

温室効果ガス排出、天然資源保護、エネルギー消費管理の方法として、廃金属は新しい製品にリサイクルされます。カナダ、米国、英国などの先進国の政府は、効率的なゴミ収集、分離、選別システムを導入することで、金属リサイクル事業の支援に取り組んできました。

例えば、金属製品の再利用とリサイクルを奨励するため、カナダ政府は州、準州、産業界と提携しています。これはカナダの金属産業とリサイクル産業を助けるだろうと予測されています。例えば、2019年5月、Aurubis AGはベルギーとスペインの金属リサイクルサービスを提供するMetallo Groupを買収しました。この買収の主な目的は、提供する金属リサイクルサービスの種類を増やすことでした。

技術革新による非鉄金属のリサイクル方法の革新

非鉄金属のリサイクルは、最近の技術的進歩により、効率性と持続可能性の新時代を迎えています。分離、選別、精製手順の進歩により、リサイクル業者は比類のない精度で、複雑な廃棄物の流れから貴金属を回収できるようになりました。

リサイクル原料の需要は高まっています。例えば、この10年で初めて、リサイクル・アルミニウムの生産量が未加工アルミニウムの生産量を上回ると予想されています。再生アルミニウムを使用すると、バージン・アルミニウムの生産に必要なエネルギーが95%削減されます。

フィンランドで唯一、再生アルミニウムを生産しているのはクーサコスキです。2022年には、新造旅客機2,000機分に相当するアルミニウムがクウサコスキの顧客に供給されます。現在、クウサコスキは大規模な新製造ラインへの投資を行っています。その目的は、非鉄金属リサイクルの効率とアルミニウム処理能力の向上です。2,500万米ドルの投資が行われています。

スクラップ金属の効率的・組織的な回収システムの欠如

非鉄金属リサイクル部門の発展と可能性は、地域によってはよく組織化された効率的な金属スクラップ回収システムの欠如によって著しく妨げられています。リサイクル工場が最高の機能を発揮するためには、一流の供給原料の入手が不可欠です。それにもかかわらず、回収手順が効果的でなかったり、混沌としていたりすると、リサイクル会社は十分な金属スクラップの供給を見つけるのに苦労します。

このような原料の不足は、リサイクル事業の規模を制限するだけでなく、部門全体に影響を及ぼすいくつかの問題を引き起こします。原料が限られているためにリサイクルが経済的に成り立たなくなり、より良い回収インフラへの投資が困難になるというループに陥る可能性があります。このため、非鉄金属リサイクル分野では、環境の持続可能性も、これらの分野での経済成長も、その潜在能力を十分に発揮することはできません。

非鉄金属の高価格

非鉄金属リサイクル事業は、非鉄金属の価格変動の結果、大きな困難を抱えています。様々な経済セクターにおける特定の金属の需要と供給のアンバランス、サプライチェーンを混乱させるかもしれない地政学的危機、世界経済の状態の不合理は、この変動の原因となるいくつかの変数です。これらの変動要因が組み合わさって金属価格が下落すると、リサイクルの経済性が影響を受けます。

金属価格が低迷すると、リサイクルの経済的動機は低下します。リサイクル業者が事業を存続させるためには、リサイクル価格と原料金属の市場価格との差に依存することが多いです。金属価格が下落するとこの格差は縮小し、リサイクルの収益性が低下します。その結果、リサイクル事業者の収益性が低下し、既存事業の継続が困難になる可能性があります。

今回の事故は、非鉄金属リサイクル業界にとって、安全で奨励的な雰囲気が必要であることを示しています。そのような環境は、市場の変動の影響を緩和し、長期的なリサイクル事業の存続を保証するのに役立つかもしれません。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 急速な都市化と住宅・インフラ建設への政府・消費者投資の増加

- 技術革新による非鉄金属のリサイクル方法の革新

- 抑制要因

- スクラップ金属の効率的・組織的な回収システムの欠如

- 非鉄金属の高コスト

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- アルミニウム

- 銅

- 鉛

- 亜鉛

- ニッケル

- チタン

- コバルト

- クロム

- その他

第8章 金属資源別

- 消費者系スクラップ

- 産業廃棄物

- 建設・解体スクラップ

- 廃インフラ

第9章 用途別

- 触媒再生

- エレクトロニクス

- 家電製品

- バッテリー

- 包装

- その他

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Umicore

- 企業概要

- 製品ポートフォリオと概要

- 財務概要

- 主な動向

- PX Group

- Materion Corporation

- Sims Recycling Solutions

- Emak Refining & Recycling

- BASF SE

- Dowa Holdings

- AMG Vanadium

- Heraeus

- Hensel Recycling

第13章 付録

Overview

Global Non-Ferrous Metals Recycling Market reached US$ 267.5 million in 2022 and is expected to reach US$ 345.0 million by 2030, growing with a CAGR of 3.3% during the forecast period 2023-2030.

The demand for non-ferrous scrap metal, gathered from various end-use industries and processed at recycling facilities, rises as a result of this information. One factor driving market expansion is rising public awareness of the environment, economy and energy savings associated with recycling these metals.

The rise in disposable income is the main development driver for the non-ferrous metal recycling industry globally. Nickel, silver, copper, aluminum and tin, in particular, are non-ferrous metals that can undergo an endless number of recycling processes without losing their original qualities. Recycling is also a wise financial move because using already mined materials is less expensive than starting from scratch, particularly for common metals like aluminum.

Asia-Pacific dominates the non-ferrous metals recycling market covering more than 1/3rd share globally. The nations in the region are producing a substantial amount of nonferrous metal scrap, but due to the absence of a large unorganized market and a lack of knowledge, the majority of this material is supplied to landfills rather than recycling facilities.

India's recycling rate is about 25%, well below the worldwide average of about 45%. The figures highlight the market's enormous growth potential. The 120 kilotonnes of aluminum scrap produced in the country were mostly contributed by the energy and automotive industries.

Dynamics

Rapid Urbanization Coupled with Increasing Government and Consumer Investment in Housing and Infrastructure Building

The global market for metal recycling is growing as a result of rising urbanization, industrialization and commodity consumption, as well as the use of more natural resources and their subsequent depletion. Market companies like Nucor Corporation, Aurubis AG and others create new products and make acquisitions as a successful approach for diversifying their product offerings in the metal recycling industry.

As a way greenhouse gas emissions, safeguard natural resources and manage energy consumption, waste metal is recycled into new products. Governments in industrialized nations like Canada, U.S., UK and others have worked to support the metal recycling business by putting in place efficient rubbish collection, separation and sorting systems.

For instance, to encourage the reuse and recycling of metal products, the Canadian government has partnered with the provinces, territories and industry. It is predicted that this would help Canada's metal and recycling industries. For instance, in May 2019, Aurubis AG acquired Metallo Group, a provider of Belgian-Spanish metal recycling services. The acquisition's main objective was to increase the variety of metal recycling services offered.

Technological Innovations Revolutionise Recycling Methods for Non-Ferrous Metals

The recycling of non-ferrous metals is entering a new era of efficiency and sustainability because of recent technical advancements. With unmatched accuracy, recyclers are now able to recover precious metals from complicated waste streams because of advancements in separation, sorting and purifying procedures.

Recycled raw materials are in greater demand. For instance, for the first time in this decade, the recycled aluminum output will surpass that of raw aluminum. The energy required to generate virgin aluminum is reduced by 95% when recycled aluminum is used.

The sole producer of recycled aluminum in Finland is Kuusakoski. The equivalent of all the aluminum required for 2,000 brand-new passenger airplanes was provided to Kuusakoski's clients in 2022. Currently, the business is making a substantial new manufacturing line investment. The goal is to increase non-ferrous metal recycling efficiency and aluminum processing capacity. There has been a $25 million investment.

Lack of Efficient and Organized Collection Systems for Scrap Metals

The development and potential of the non-ferrous metals recycling sector are significantly hampered by the lack of well-organized and efficient scrap metal collecting systems in some areas. The availability of top-notch feedstock is essential for recycling plants to function at their best. Recycling companies struggle to find a sufficient supply of scrap metals, nevertheless, when collection procedures are ineffective or chaotic.

This lack of feedstock not only restricts the size of recycling operations but also creates several problems that have an effect on the sector as a whole. This can lead to a loop where the limited feedstock makes recycling less economically viable and makes it difficult to invest in better-collecting infrastructure. Because of this, neither environmental sustainability nor economic growth in these areas can reach its full potential in the non-ferrous metals recycling sector.

High Price of Non-Ferrous Metals

The non-ferrous metal recycling business has major difficulties as a result of the shifting pricing of non-ferrous metals. Unbalances in the supply and demand of certain metals in various economic sectors, geopolitical crises that might disrupt supply chains and the irrationality of the status of the global economy are a few variables that contribute to this volatility. The economics of recycling are affected when these variables combine to drive metal prices lower.

The financial motivation for recycling declines when metal prices are low. For their business to remain viable, recyclers often rely on a difference between the price of recycling and the market price of raw metals. This disparity narrows as metal prices fall, which reduces the profitability of recycling. The effect might be a decline in profitability for recycling businesses, which would make it challenging for them to continue with their existing operations.

The accident illustrates the need for a secure and encouraging atmosphere for the non-ferrous metals recycling industry. Such an environment may help mitigate the impacts of market volatility and guarantee the viability of recycling operations over the long term.

Segment Analysis

The global non-ferrous metals recycling market is segmented based on type, metal source, application and region.

Increased Focus on Sustainability and Environmentally Friendly Practices Resulted in Increased Aluminum Recycling

Enormous interest in aluminum has resulted from the need for materials that are strong, lightweight and resistant to corrosion in industries including construction, aircraft, automotive and packaging. Aluminum is ideally suited to meet the needs of these sectors because of its distinctive mix of features. The demand for recycled aluminum has increased as a result of the increased focus on sustainability and environmentally friendly practices, which is precisely in line with the goals of industries that value environmentally friendly materials.

The most prevalent metal in the Earth's crust and one of the metals that get recycled the most is aluminum. It is not only feasible economically but also environmentally good and energy-efficient to recover aluminum for recycling. The above factor has made the segment contribute nearly 29.6% in the global market.

Furthermore, rising research in the metal is also escalating the segmental growth. The primary study conducted by BIR, "Review of Global Non-Ferrous Scrap Flows," is mostly focused on copper and aluminum. There are just a few nations in the world that do not deal in scrap copper, copper alloy or aluminum due to the economic importance of these metals. From 5.9 million tonnes to 8.3 million tonnes or over US$ 46 billion at the time, more copper scrap was used globally between 2000 and 2015, a 41% increase.

This growth was shown in both the manufacture of secondary refined copper as well as direct use of scrap. From 8.4 million tonnes in 2000 to 15.6 million tonnes in 2015 or around US$ 26 billion at the time, there was an increase in the production of aluminum from scrap of about 86%.

Geographical Penetration

Rising Demand for Electric Products in Asia-Pacific

Asia-Pacific has been a dominant force in the global non-ferrous metals recycling market and expected to more more than 52.6% in the forecast period. The Asia-Pacific is proving itself as the world's center for both the production and consumption of electronics. The region now faces a special difficulty and potential as a result of the region's strong position in the electronics industry: the production of large volumes of electronic garbage.

For Instance, in 2022, One of Canada's leading e-scrap companies, eCycle Solutions, was acquired by the Japanese corporation JX Nippon Mining and Metals. It's the second instance in the last month of an Asian smelting behemoth acquiring North American e-waste businesses to guarantee a consistent supply of feedstock. On August 3, JX Nippon Mining and Metals said it had acquired all outstanding shares of eCycle Solutions from Montreal-based Horizon Capital Holdings. The sale price was omitted from a news announcement.

Furthermore, increased building, infrastructure development and manufacturing activity have been brought on by Asia-Pacific's rapid urbanization and industrial expansion. Metals like aluminum and copper are in greater demand as cities grow and industry prospers. This leads to a significant supply of scrap metal from buildings, machinery and end-of-life items, giving the recycling sector a solid base.

COVID-19 Impact Analysis

The impact of the pandemic on the non-ferrous metal recycling business is examined in this study from both a global and local perspective. The market size, market characteristics and market growth for the non-ferrous metal recycling business are described in the publication and are classed by type, utility and consumer sector.

It also provides a comprehensive review of the chemicals used to enhance the market both before and after the COVID-19 pandemic. The report also conducted a survey examination of the industry to identify major influencers and entry-level barriers. The market for non-ferrous metals was impacted by financial uncertainties brought on by the epidemic and the drop in consumer demand. Metal prices changed as a result of decreased industrial activity and interruptions in international commerce.

The profitability and feasibility of recycling operations may be impacted by these price variations. The global supply lines were severely disrupted due to the emergence of the COVID-19 pandemic. Lockdowns, travel limitations and a smaller workforce impeded the gathering, transportation and processing of non-ferrous scrap materials. The problem of finding enough scrap for their operations was one that recycling plants confronted.

Thus, to stop the virus's spread, governments enacted lockdowns and social seclusion policies. There were fewer end-of-life items and industrial scraps available for recycling as a result of the decline in industrial production and manufacturing activities. The dynamics of the recycling market's supply were impacted by lower scrap production.

Russia-Ukraine War Impact Analysis

This is possible that the conflict and geopolitical tensions between Russia and Ukraine will affect the supply of non-ferrous metals. Copper, aluminum, nickel and other non-ferrous metals are among those with substantial production in both nations. Supply chain instability might affect the availability and pricing of certain metals on the international market.

A wider geopolitical rift that threatens the world economy's stability may result from the Russia-Ukraine war. A downturn in the economy or other unpredictabilities can alter industrial output, which can affect the demand for non-ferrous metals and their recycling. Prices of commodities, particularly non-ferrous metals, might change as a result of any unpredictability in the area.

Political developments frequently elicit a response from markets and investors, which might enhance metal price volatility. The outcome of the conflict may subject one or both of the nations to trade restrictions, embargoes or penalties. These regulations could affect the import and export of non-ferrous metals and associated items, which might make these resources less available to the recycling industry.

By Type

- Aluminum

- Copper

- Lead

- Zinc

- Nickel

- Titanium

- Cobalt

- Chromium

- Others

By Metal Source

- Post-Consumer Scrap

- Industrial Scrap

- Construction and Demolition Scrap

- Obsolete Infrastructure

By Application

- Catalyst Regeneration

- Electronics

- Consumer Appliances

- Battery

- Packaging

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On March 29, 2023, Romco Group is expanding its recycling activities at its facility in Lagos, Nigeria, from recycling aluminum to recycling copper to support the international aim for a "circular economy" that produces no emissions.

- On March 14, 2023, Umicore launched a new business unit named Battery Recycling Solutions to concentrate on this quickly expanding industry. Umicore intends to significantly increase capacity as part of this and a 150,000-tonne battery recycling facility in Europe is anticipated to be operational by 2026. This facility, which will be the largest battery recycling facility in Europe, will use specialized metal extraction methods created by the engineering and research departments of Umicore.

- On April 03, 2020, Sims Metal Management, a worldwide metal recycling company, will continue to reduce the amount of non-ferrous metal scrap it acquired across all of its global operations as demand falls due to the coronavirus epidemic. Sims recently temporarily halted collecting ferrous and nonferrous trash from third parties in their UK yards and closed parts of their US facilities to the public as a precaution to lessen the spread of coronavirus in workplaces.

Competitive Landscape

The major global players in the market include: Umicore, PX Group, Materion Corporation, Sims Recycling Solutions, Emak Refining & Recycling, BASF SE, Dowa Holdings, AMG Vanadium, Heraeus and Hensel Recycling.

Why Purchase the Report?

- To visualize the global non-ferrous metals recycling market segmentation based on type, metal source, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of non-ferrous metals recycling market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global non-ferrous metals recycling market report would provide approximately 61 tables, 67 figures and 186 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Metal Source

- 3.3. Snippet by Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rapid Urbanization Coupled with Increasing Government and Consumer Investment in Housing and Infrastructure Building

- 4.1.1.2. Technological Innovations Revolutionize Recycling Methods for Non-Ferrous Metals

- 4.1.2. Restraints

- 4.1.2.1. Lack of Efficient and Organized Collection Systems for Scrap Metals

- 4.1.2.2. High Cost of Non-Ferrous Metals

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Aluminum*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Copper

- 7.4. Lead

- 7.5. Zinc

- 7.6. Nickel

- 7.7. Titanium

- 7.8. Cobalt

- 7.9. Chromium

- 7.10. Others

8. By Metal Source

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal Source

- 8.1.2. Market Attractiveness Index, By Metal Source

- 8.2. Post-Consumer Scrap*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Industrial Scrap

- 8.4. Construction and Demolition Scrap

- 8.5. Obsolete Infrastructure

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Catalyst Regeneration*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Electronics

- 9.4. Consumer Appliances

- 9.5. Battery

- 9.6. Packaging

- 9.7. Others

- 9.8. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal Source

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal Source

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Russia

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal Source

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal Source

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal Source

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Umicore*

- 12.1.1. Company Overview

- 12.1.2. Type Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. PX Group

- 12.3. Materion Corporation

- 12.4. Sims Recycling Solutions

- 12.5. Emak Refining & Recycling

- 12.6. BASF SE

- 12.7. Dowa Holdings

- 12.8. AMG Vanadium

- 12.9. Heraeus

- 12.10. Hensel Recycling

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us