|

|

市場調査レポート

商品コード

1675651

非鉄金属市場:タイプ別、用途別、地域別、2025-2033年Non-Ferrous Metals Market Report by Type (Aluminum, Copper, Lead, Tin, Nickel, Titanium, Zinc, and Others), Application (Automobile Industry, Electronic Power Industry, Construction Industry, and Others), and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 非鉄金属市場:タイプ別、用途別、地域別、2025-2033年 |

|

出版日: 2025年03月01日

発行: IMARC

ページ情報: 英文 145 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

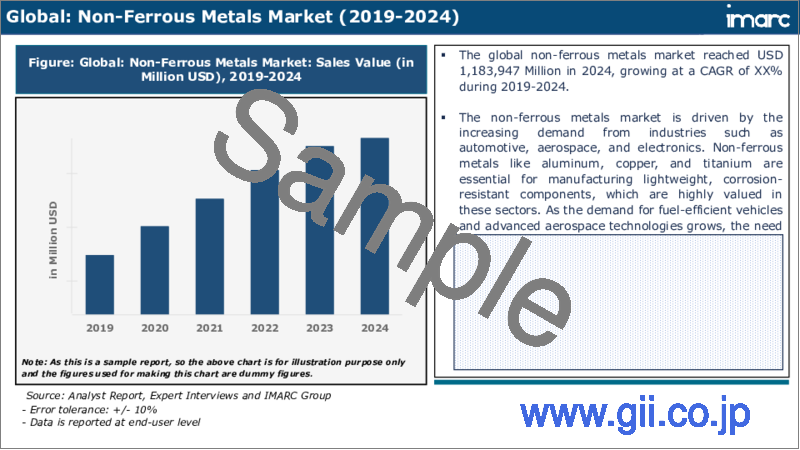

非鉄金属市場の世界市場規模は2024年に1兆1,839億米ドルに達しました。今後、IMARC Groupは、2033年には1兆7,469億米ドルに達し、2025~2033年の成長率(CAGR)は4.2%になると予測しています。自動車産業での製品利用率の上昇、建設分野での需要の増加、コーティングと治療における最近の進歩、持続可能な生産とリサイクル技術の採用が、市場需要を促進する主な要因です。

非鉄金属とは、主成分として鉄(Fe)を含まない金属物質を指します。銅、亜鉛、鉛、アルミニウム、錫、ニッケル、チタン、クロム、マグネシウム、銀、プラチナ、金などが含まれます。非鉄金属は、電子機器、自動車部品、宝飾品、家電製品、装飾品、航空機、人工衛星、防衛機器、医療機器、電池、建材、包装材、産業機械などに広く使われています。非鉄金属は非磁性体であり、高耐食性、低融点、優れた熱伝導性・電気伝導性、延性、展性など、いくつかの特性を備えています。また、費用対効果が高く、軽量で入手しやすく、リサイクルしやすい物質であるため、エネルギー消費を抑え、環境への悪影響を最小限に抑えることができます。その結果、非鉄金属は、自動車、航空宇宙、ヘルスケア、防衛、家電、建設、製造業など幅広い用途で使用されています。

非鉄金属市場動向:

自動車産業における製品利用の増加は、市場成長の原動力となる主な要因の一つです。非鉄金属は、ボディパネル、エンジンブロック、ピストン、シリンダーヘッド、ホイール、配線、ラジエーター、トランスミッションケーシング、ステアリング、インテリアトリム、サスペンション部品、排気システム、触媒コンバーターなどの様々な自動車部品に広く使用されています。これとともに、バッテリーパック、エンクロージャー、充電部品、シャーシ、ヒートシンク、電気モーター、冷却システムなど、電気自動車(EV)における製品用途の増加が、もうひとつの成長促進要因として作用しています。さらに、窓、ドア、カーテンウォールシステム、配管パイプや継手、屋根材や遮蔽部品、梁や柱などの構造材を製造する建設業界における製品需要の増加が、市場成長の推進力となっています。加えて、耐食性と耐摩耗性を向上させ、光沢を与え、非鉄金属製品の美的魅力を高める、電気めっき、陽極酸化、薄膜蒸着技術などの高度な表面コーティングや治療の最近の市場開拓は、市場成長にプラスの影響を与えています。これに加えて、廃棄物の発生を減らし、金属回収を向上させる持続可能な生産・リサイクル技術の採用が市場成長に寄与しています。さらに、電線、コネクター、変圧器、筐体、スイッチ、リレー、プリント回路基板(PCB)を生産する電気・電子産業における製品採用の増加が市場成長を支えています。その他の要因としては、急速な工業化活動、高度な抽出技術の開発への投資の増加、インフラ開拓活動の活発化などが挙げられ、市場成長の原動力になると予想されます。

本レポートで扱う主な質問

- 世界の非鉄金属市場の市場規模は?

- 2025-2033年における世界の非鉄金属市場の予想成長率は?

- 世界の非鉄金属市場を牽引する主要因は何か?

- 世界の非鉄金属市場に対するCOVID-19の影響は?

- 世界の非鉄金属市場のタイプ別内訳は?

- 世界の非鉄金属市場の用途別内訳は?

- 世界の非鉄金属市場における主要地域は?

- 世界の非鉄金属市場における主要プレイヤー/企業は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の非鉄金属市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:タイプ別

- アルミニウム

- 銅

- 鉛

- 錫

- ニッケル

- チタン

- 亜鉛

- その他

第7章 市場内訳:用途別

- 自動車業界

- 電動業界

- 建設業界

- その他

第8章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第9章 促進要因・抑制要因・機会

- 概要

- 促進要因

- 抑制要因

- 機会

第10章 バリューチェーン分析

第11章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第12章 価格分析

第13章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Aditya Birla Group

- Alcoa Corporation

- Aluminum Corporation of China Limited

- Anglo American plc

- BHP

- RUSAL(En+Group MKPAO)

- Glencore Plc

- Norilsk Nickel

- Rio Tinto Group

- Sumitomo Metal Mining Co. Ltd.

- Vale S.A

List of Figures

- Figure 1: Global: Non-Ferrous Metals Market: Major Drivers and Challenges

- Figure 2: Global: Non-Ferrous Metals Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Non-Ferrous Metals Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 4: Global: Non-Ferrous Metals Market: Breakup by Type (in %), 2024

- Figure 5: Global: Non-Ferrous Metals Market: Breakup by Application (in %), 2024

- Figure 6: Global: Non-Ferrous Metals Market: Breakup by Region (in %), 2024

- Figure 7: Global: Non-Ferrous Metals (Aluminum) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 8: Global: Non-Ferrous Metals (Aluminum) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 9: Global: Non-Ferrous Metals (Copper) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 10: Global: Non-Ferrous Metals (Copper) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 11: Global: Non-Ferrous Metals (Lead) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: Non-Ferrous Metals (Lead) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 13: Global: Non-Ferrous Metals (Tin) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Non-Ferrous Metals (Tin) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Non-Ferrous Metals (Nickel) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Non-Ferrous Metals (Nickel) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Non-Ferrous Metals (Titanium) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: Non-Ferrous Metals (Titanium) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: Non-Ferrous Metals (Zinc) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: Non-Ferrous Metals (Zinc) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: Non-Ferrous Metals (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: Non-Ferrous Metals (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: Global: Non-Ferrous Metals (Automobile Industry) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: Global: Non-Ferrous Metals (Automobile Industry) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Non-Ferrous Metals (Electronic Power Industry) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Non-Ferrous Metals (Electronic Power Industry) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Global: Non-Ferrous Metals (Construction Industry) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Global: Non-Ferrous Metals (Construction Industry) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Global: Non-Ferrous Metals (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Global: Non-Ferrous Metals (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: North America: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: North America: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: United States: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: United States: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Canada: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Canada: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: Asia-Pacific: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: Asia-Pacific: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: China: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 40: China: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Japan: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Japan: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: India: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: India: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 45: South Korea: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 46: South Korea: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 47: Australia: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 48: Australia: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 49: Indonesia: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 50: Indonesia: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 51: Others: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 52: Others: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 53: Europe: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 54: Europe: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 55: Germany: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 56: Germany: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 57: France: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 58: France: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 59: United Kingdom: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 60: United Kingdom: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 61: Italy: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 62: Italy: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 63: Spain: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 64: Spain: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 65: Russia: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 66: Russia: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 67: Others: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 68: Others: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 69: Latin America: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 70: Latin America: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 71: Brazil: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 72: Brazil: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 73: Mexico: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 74: Mexico: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 75: Others: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 76: Others: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 77: Middle East and Africa: Non-Ferrous Metals Market: Sales Value (in Million USD), 2019 & 2024

- Figure 78: Middle East and Africa: Non-Ferrous Metals Market: Breakup by Country (in %), 2024

- Figure 79: Middle East and Africa: Non-Ferrous Metals Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 80: Global: Non-Ferrous Metals Industry: Drivers, Restraints, and Opportunities

- Figure 81: Global: Non-Ferrous Metals Industry: Value Chain Analysis

- Figure 82: Global: Non-Ferrous Metals Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Non-Ferrous Metals Market: Key Industry Highlights, 2024 & 2033

- Table 2: Global: Non-Ferrous Metals Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 3: Global: Non-Ferrous Metals Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 4: Global: Non-Ferrous Metals Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 5: Global: Non-Ferrous Metals Market: Competitive Structure

- Table 6: Global: Non-Ferrous Metals Market: Key Players

The global non-ferrous metals market size reached USD 1,183.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,746.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. The rising product utilization in the automotive industry, growing demand in the construction sector, recent advancements in coatings and treatments, and the adoption of sustainable production and recycling techniques are key factors driving market demand.

Non-ferrous metals refer to metallic substances that do not contain iron (Fe) as their principal component. It includes copper, zinc, lead, aluminum, tin, nickel, titanium, chromium, magnesium, silver, platinum, and gold. They are widely used in electronic devices, automobile parts, jewelry, home appliances, decorative items, aircraft, satellites, defense equipment, medical instruments, batteries, building materials, packaging, and industrial machinery. Non-ferrous metals are non-magnetic substances and offer several characteristic properties, such as high corrosion resistance, lower melting point, excellent thermal and electrical conductivities, ductility, and malleability. They are cost-effective, lightweight, readily available, and easy to recycle substances, which aids in reducing energy consumption, and minimizing adverse environmental impact. As a result, non-ferrous metals find extensive applications across the automotive, aerospace, healthcare, defense, consumer electronics, construction, and manufacturing industries.

Non-Ferrous Metals Market Trends:

The rising product utilization in the automotive industry is one of the primary factors providing an impetus to the market growth. Non-ferrous metals are widely used in various automotive parts, such as body panels, engine blocks, pistons, cylinder heads, wheels, wiring, radiator, transmission casing, steering, interior trim, suspension parts, exhaust systems, and catalytic converters. Along with this, the increasing product application in electric vehicles (EVs), such as battery packs, enclosures, charging components, chassis, heat sinks, electric motors, and cooling systems, is acting as another growth-inducing factor. Furthermore, the growing product demand in the construction industry to manufacture windows, doors, curtain wall systems, plumbing pipes and fittings, roofing and shielding components, and structural materials, such as beams and columns, is providing a thrust to the market growth. Additionally, the recent development of advanced surface coatings and treatments, such as electroplating, anodizing, and thin film deposition techniques, which improve corrosion and wear resistance, provide lustrous properties, and enhance the aesthetic appeal of non-ferrous metal products, is positively influencing the market growth. Besides this, the adoption of sustainable production and recycling techniques, which reduces waste generation, and improves metal recovery, is contributing to the market growth. Moreover, the rising product adoption in the electrical and electronics industry to produce wires, connectors, transformers, enclosures, switches, relays, and printed circuit boards (PCBs) is supporting the market growth. Other factors, including rapid industrialization activities, increasing investments in the development of advanced extraction techniques, and growing infrastructural development activities, are anticipated to drive the market growth.

Key Market Segmentation:

Type Insights:

- Aluminum

- Copper

- Lead

- Tin

- Nickel

- Titanium

- Zinc

- Others

Application Insights:

- Automobile Industry

- Electronic Power Industry

- Construction Industry

- Others

Regional Insights:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for non-ferrous metals. Some of the factors driving the Asia Pacific non-ferrous metals market included rapid industrialization, increasing infrastructural development activities, and significant technological advancements.

Competitive Landscape:

- The report has also provided a comprehensive analysis of the competitive landscape in the global non-ferrous metals market. Detailed profiles of all major companies have been provided. Some of the companies covered include Aditya Birla Group, Alcoa Corporation, Aluminum Corporation of China Limited, Anglo American plc, BHP, RUSAL (En+ Group MKPAO), Glencore Plc, Norilsk Nickel, Rio Tinto Group, Sumitomo Metal Mining Co. Ltd., Vale S.A, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Key Questions Answered in This Report

- 1.How big is the global non-ferrous metals market?

- 2.What is the expected growth rate of the global non-ferrous metals market during 2025-2033?

- 3.What are the key factors driving the global non-ferrous metals market?

- 4.What has been the impact of COVID-19 on the global non-ferrous metals market?

- 5.What is the breakup of the global non-ferrous metals market based on the type?

- 6.What is the breakup of the global non-ferrous metals market based on the application?

- 7.What are the key regions in the global non-ferrous metals market?

- 8.Who are the key players/companies in the global non-ferrous metals market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Non-Ferrous Metals Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Type

- 6.1 Aluminum

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Copper

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Lead

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Tin

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Nickel

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

- 6.6 Titanium

- 6.6.1 Market Trends

- 6.6.2 Market Forecast

- 6.7 Zinc

- 6.7.1 Market Trends

- 6.7.2 Market Forecast

- 6.8 Others

- 6.8.1 Market Trends

- 6.8.2 Market Forecast

7 Market Breakup by Application

- 7.1 Automobile Industry

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Electronic Power Industry

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Construction Industry

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Others

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

8 Market Breakup by Region

- 8.1 North America

- 8.1.1 United States

- 8.1.1.1 Market Trends

- 8.1.1.2 Market Forecast

- 8.1.2 Canada

- 8.1.2.1 Market Trends

- 8.1.2.2 Market Forecast

- 8.1.1 United States

- 8.2 Asia-Pacific

- 8.2.1 China

- 8.2.1.1 Market Trends

- 8.2.1.2 Market Forecast

- 8.2.2 Japan

- 8.2.2.1 Market Trends

- 8.2.2.2 Market Forecast

- 8.2.3 India

- 8.2.3.1 Market Trends

- 8.2.3.2 Market Forecast

- 8.2.4 South Korea

- 8.2.4.1 Market Trends

- 8.2.4.2 Market Forecast

- 8.2.5 Australia

- 8.2.5.1 Market Trends

- 8.2.5.2 Market Forecast

- 8.2.6 Indonesia

- 8.2.6.1 Market Trends

- 8.2.6.2 Market Forecast

- 8.2.7 Others

- 8.2.7.1 Market Trends

- 8.2.7.2 Market Forecast

- 8.2.1 China

- 8.3 Europe

- 8.3.1 Germany

- 8.3.1.1 Market Trends

- 8.3.1.2 Market Forecast

- 8.3.2 France

- 8.3.2.1 Market Trends

- 8.3.2.2 Market Forecast

- 8.3.3 United Kingdom

- 8.3.3.1 Market Trends

- 8.3.3.2 Market Forecast

- 8.3.4 Italy

- 8.3.4.1 Market Trends

- 8.3.4.2 Market Forecast

- 8.3.5 Spain

- 8.3.5.1 Market Trends

- 8.3.5.2 Market Forecast

- 8.3.6 Russia

- 8.3.6.1 Market Trends

- 8.3.6.2 Market Forecast

- 8.3.7 Others

- 8.3.7.1 Market Trends

- 8.3.7.2 Market Forecast

- 8.3.1 Germany

- 8.4 Latin America

- 8.4.1 Brazil

- 8.4.1.1 Market Trends

- 8.4.1.2 Market Forecast

- 8.4.2 Mexico

- 8.4.2.1 Market Trends

- 8.4.2.2 Market Forecast

- 8.4.3 Others

- 8.4.3.1 Market Trends

- 8.4.3.2 Market Forecast

- 8.4.1 Brazil

- 8.5 Middle East and Africa

- 8.5.1 Market Trends

- 8.5.2 Market Breakup by Country

- 8.5.3 Market Forecast

9 Drivers, Restraints, and Opportunities

- 9.1 Overview

- 9.2 Drivers

- 9.3 Restraints

- 9.4 Opportunities

10 Value Chain Analysis

11 Porters Five Forces Analysis

- 11.1 Overview

- 11.2 Bargaining Power of Buyers

- 11.3 Bargaining Power of Suppliers

- 11.4 Degree of Competition

- 11.5 Threat of New Entrants

- 11.6 Threat of Substitutes

12 Price Analysis

13 Competitive Landscape

- 13.1 Market Structure

- 13.2 Key Players

- 13.3 Profiles of Key Players

- 13.3.1 Aditya Birla Group

- 13.3.1.1 Company Overview

- 13.3.1.2 Product Portfolio

- 13.3.1.3 Financials

- 13.3.2 Alcoa Corporation

- 13.3.2.1 Company Overview

- 13.3.2.2 Product Portfolio

- 13.3.2.3 Financials

- 13.3.2.4 SWOT Analysis

- 13.3.3 Aluminum Corporation of China Limited

- 13.3.3.1 Company Overview

- 13.3.3.2 Product Portfolio

- 13.3.3.3 Financials

- 13.3.4 Anglo American plc

- 13.3.4.1 Company Overview

- 13.3.4.2 Product Portfolio

- 13.3.4.3 Financials

- 13.3.4.4 SWOT Analysis

- 13.3.5 BHP

- 13.3.5.1 Company Overview

- 13.3.5.2 Product Portfolio

- 13.3.5.3 Financials

- 13.3.5.4 SWOT Analysis

- 13.3.6 RUSAL (En+ Group MKPAO)

- 13.3.6.1 Company Overview

- 13.3.6.2 Product Portfolio

- 13.3.7 Glencore Plc

- 13.3.7.1 Company Overview

- 13.3.7.2 Product Portfolio

- 13.3.7.3 Financials

- 13.3.7.4 SWOT Analysis

- 13.3.8 Norilsk Nickel

- 13.3.8.1 Company Overview

- 13.3.8.2 Product Portfolio

- 13.3.8.3 Financials

- 13.3.8.4 SWOT Analysis

- 13.3.9 Rio Tinto Group

- 13.3.9.1 Company Overview

- 13.3.9.2 Product Portfolio

- 13.3.9.3 Financials

- 13.3.9.4 SWOT Analysis

- 13.3.10 Sumitomo Metal Mining Co. Ltd.

- 13.3.10.1 Company Overview

- 13.3.10.2 Product Portfolio

- 13.3.10.3 Financials

- 13.3.10.4 SWOT Analysis

- 13.3.11 Vale S.A

- 13.3.11.1 Company Overview

- 13.3.11.2 Product Portfolio

- 13.3.11.3 Financials

- 13.3.11.4 SWOT Analysis

- 13.3.1 Aditya Birla Group

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.