|

|

市場調査レポート

商品コード

1348000

通信企業向けサービスの世界市場-2023年~2030年Global Telecom Enterprise Services Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 通信企業向けサービスの世界市場-2023年~2030年 |

|

出版日: 2023年09月11日

発行: DataM Intelligence

ページ情報: 英文 189 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の通信企業向けサービス市場は、2022年に18億米ドルに達し、2023年から2030年の予測期間中にCAGR 6.1%で成長し、2030年には29億米ドルに達すると予測されています。

業務を合理化し、顧客体験を向上させ、競争力を維持するような通信企業向けサービスの採用が増加しています。通信サービスは、クラウドコンピューティング、IoT、AIを含むDXの取り組みを支援する上で重要な役割を果たします。5Gネットワークの展開により、接続性が向上して帯域幅が広くなり、拡張現実、遠隔ロボット工学、リアルタイムデータ分析などの高度なアプリケーションが可能になります。

IoTの成長には、信頼性と拡張性の高い接続ソリューションが必要です。通信サービスは、製造業・医療・物流など、さまざまな業界のIoTデバイスの接続と管理に不可欠です。企業はアプリケーションやデータをクラウドプラットフォームに移行しつつあります。通信サービスはシームレスなクラウド接続を可能にし、クラウドリソースへの信頼性の高いアクセスを確保し、ハイブリッドクラウドの展開を促進します。

アジア太平洋は、2022年の世界の通信企業向けサービス市場の1/3以上を占める主要地域です。同地域はIoT成長の主要拠点であり、企業は農業、物流、製造業など様々な使用事例にIoTソリューションを導入しています。通信サービスは、IoTデバイスの接続と管理に不可欠です。クラウドプラットフォームへのシームレスなアクセスを容易にし、ハイブリッド化をサポートします。

ダイナミクス

5Gネットワークの採用拡大

5Gネットワークは、旧世代と比較して大幅に高速なデータ通信を提供し、より高速なダウンロード、アップロード、リアルタイム通信を可能にし、生産性とユーザー体験を向上させます。5Gネットワークは超低遅延を提供し、データ伝送の遅延を低減します。これは、リアルタイムのビデオ会議、遠隔監視、即時応答が必要なIoTデバイスなどのアプリケーションにとって極めて重要です。

例えば、2023年8月19日、ノキア・インディアにより、企業によるプライベート5Gネットワークの採用が2024年後半から大幅に増加しました。プライベート5Gネットワークは、企業の特定のニーズに合わせた高速接続と低遅延を提供するローカライズされたネットワーク専用です。5Gネットワークは、より成熟し、カバレッジが広く、信頼性が向上すると予想されるため、プライベート・ネットワークの導入を目指す企業にとって、より魅力的な選択肢となります。

企業間のコラボレーションの拡大

通信事業者は、ネットワークインフラ、クラウドサービス、サイバーセキュリティ、マネージドサービスなど、多様なサービスポートフォリオを持つことが多いです。協業により、より幅広い顧客ニーズに対応した包括的なソリューションを提供できるようになります。協業は市場リーチの拡大にもつながります。特に地理的に異なる地域の他社と提携することで、通信事業者は新たな顧客層や市場にアクセスしやすくなります。

例えば、2023年2月27日、世界のテクノロジー企業であるHCLTechは、通信サービスプロバイダーや企業向けに通信ネットワークの近代化を加速させるため、Dell Technologiesとの協業を発表しました。この協業は、5Gや高度なネットワーキング技術の採用を促進することを目的としています。この協業は、さまざまな技術コンポーネントやパートナーを統合することで、オープンなクラウドネイティブ・ネットワークへの移行を簡素化することを目的としています。

技術進歩

エッジコンピューティングは、コンピューティングリソースをデータソースに近づけることで注目を集めています。通信事業者は、エッジコンピューティング・ソリューションをネットワークに統合し、リアルタイムのデータ処理と遅延の低減を可能にしており、これは自律走行車や産業オートメーションなどの活用領域に不可欠なものです。通信企業向けサービスでは、クラウド技術の活用が進んでいます。クラウドベースのソリューションにより、企業はスケーラブルで柔軟なコンピューティングリソースにアクセスできるようになり、コスト削減と俊敏性の向上につながります。

例えば、2023年6月9日、Motivity Labsは通信ソフトウェア開発に特化し、デジタルイノベーションの旅に乗り出し、通信セクター向けにカスタマイズされたソリューションを作成するための業界専門知識を提供しています。通信業界は、スマートフォンやアプリケーションによって大きな変革を遂げ、従来のコミュニケーションからテクノロジー革命へと移行しています。

時間の浪費とコスト効率

通信サービス、特に高速インターネットや高度な通信ソリューションは、高額になりがちです。導入コスト、加入料、継続的なメンテナンス費用は、組織の予算を圧迫しかねません。5Gのような高度な通信サービスを採用するには、インフラの大幅なアップグレードが必要になることが多く、これには新しいネットワーク機器の設置や適切なカバレッジの確保などが含まれ、時間とコストがかかります。

通信サービスへの依存度が高まることで、組織はサイバー脅威や攻撃に対して脆弱になります。機密データの保護とネットワーク・セキュリティの確保は、常に課題となります。多様な通信サービス、ベンダー、テクノロジーの管理は複雑です。組織は、統合、相互運用性、トラブルシューティングの問題で苦労するかもしれません。通信サービスには、さまざまな規制やコンプライアンス基準が適用されます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 5Gネットワークの採用拡大

- 企業間コラボレーションの拡大

- 技術進歩

- 抑制要因

- 時間の浪費とコスト効率

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 ソリューション別

- クラウドサービス

- データ/インターネットサービス

- ワイヤレス/モビリティ

- マネージドサービス

- 音声サービス

- その他

第8章 収益源別

- マスターエージェント

- キャリア

- その他

第9章 エンドユーザー別

- 消費者

- 企業

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- AT & T Inc.

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- NTT

- China Mobile Ltd.

- Deutsche Telekom AG

- SoftBank Group Crop.

- Telefonica SA

- Vodafone Group

- KT Corporation

- Verizon Communication Inc.

- Bharati Airtel Limited

第13章 付録

Overview

Global Telecom Enterprise Services Market reached US$ 1.8 billion in 2022 and is expected to reach US$ 2.9 billion by 2030, growing with a CAGR of 6.1% during the forecast period 2023-2030.

The increasing adoption of telecom enterprise services that enhance streamline operations, enhance customer experiences and stay competitive. Telecom services play an important role in supporting digital transformation initiatives that include cloud computing, IoT and AI. The rollout of 5G networks which provides higher bandwidth with improved connectivity and enables advanced applications like augmented reality, remote robotics and real-time data analytics.

The growth of the Internet of Things demands reliable and scalable connectivity solutions. Telecom services are integral for connecting and managing IoT devices in various industries, including manufacturing, healthcare and logistics. Enterprises are migrating their applications and data to cloud platforms. Telecom services enable seamless cloud connectivity, ensuring reliable access to cloud resources and facilitating hybrid cloud deployments.

Asia-Pacific is the dominant region in the global telecom enterprise services market covering more than 1/3rd of the market in 2022. The region is a major hub for IoT growth, with businesses deploying IoT solutions for various use cases, including agriculture, logistics and manufacturing. Telecom services are essential for connecting and managing IoT devices. It facilitates seamless access to the cloud platform and supports to hybrid.

Dynamics

Rising Adoption of 5G Networks

5G networks provide significantly higher data speeds compared to previous generations and this enables faster downloads, uploads and real-time communication, enhancing productivity and user experiences. 5G networks offer ultra-low latency, reducing the delay in data transmission and this is crucial for applications like real-time video conferencing, remote monitoring and IoT devices that require instant responses.

For instance, on 19 August 2023, a significant increase in the adoption of private 5G networks by enterprises started in the second half of 2024 by Nokia India. The private 5G networks are dedicated to localized networks that provides high-speed connectivity and low latency tailored to the specific needs of businesses. 5G networks are expected to be more mature, with wider coverage and improved reliability and this makes it a more attractive option for enterprises seeking to deploy private networks.

Growing Collaboration Between Companies

Telecom companies often have diverse service portfolios, including network infrastructure, cloud services, cybersecurity and managed services. Collaborations allow them to offer comprehensive solutions that meet a broader range of customer needs. Collaborations can lead to expanded market reach. Partnering with other companies, especially in different geographic regions, helps telecom providers access new customer segments and markets.

For instance, on 27 February 2023, HCLTech, a global technology company, announced a collaboration with Dell Technologies to accelerate telecom network modernization for communication service providers and enterprises and this collaboration aims to facilitate the adoption of 5G and advanced networking technologies. The collaboration aims to simplify the transition to open, cloud-native networks by integrating various technology components and partners.

Advancement in Technology

Edge computing is gaining prominence as it brings computing resources closer to the data source. Telecom providers are integrating edge computing solutions into their networks, enabling real-time data processing and reducing latency and this is essential for applications like autonomous vehicles and industrial automation. Telecom enterprise services increasingly leverage cloud technologies. Cloud-based solutions enable businesses to access scalable and flexible computing resources, leading to cost savings and improved agility.

For instance, on 9 June 2023, Motivity Labs specializes in telecom software development, offering industry expertise to embark on digital innovation journeys and create customized solutions for the telecom sector. The telecom industry has undergone a significant transformation, driven by smartphones and applications, resulting in a shift from traditional communication to a technology revolution.

Time Consuming and Cost-Effective

Telecom services, especially high-speed internet and advanced communication solutions, can be expensive. Implementation costs, subscription fees and ongoing maintenance expenses can strain an organization's budget. Adopting advanced telecom services like 5G often requires significant infrastructure upgrades and this includes installing new network equipment and ensuring proper coverage, which can be time-consuming and costly.

The increasing reliance on telecom services makes organizations vulnerable to cyber threats and attacks. Protecting sensitive data and ensuring network security is a constant challenge. Managing diverse telecom services, vendors and technologies can be complex. Organizations may struggle with integration, interoperability and troubleshooting issues. Telecom services are subject to various regulations and compliance standards.

Segment Analysis

The global telecom enterprise services market is segmented based solution, revenue stream, end-user and region.

Growing Adoption of Cloud-Service Boosts the Market

Cloud-service is expected to drive the market by holding a share of 1/3rd of the global market in 2022. Telecom providers offer solutions that seamlessly connect businesses to cloud platforms, making them leverage cloud resources for agility, scalability and innovation. The rising adoption of cloud computing for various workloads, such as infrastructure as a service, platform as a service and software as a service, drives the demand for high-quality, reliable network connectivity to access and utilize cloud resources.

For instance, in 2020, AppSmart, a business technology services provider, announced the acquisition of MicroCorp, a leading national master agent specializing in telecommunications, data center, security and cloud services. The acquisition is part of AppSmart's strategic expansion efforts and reflects its commitment to providing a comprehensive range of technology services to its customers.

Geographical Penetration

Adoption of Digital Technologies in North America

During the forecast period, North America is among the growing regions in the global telecom enterprise services market covering around 1/4th of the market. The region embracing digital transformation initiatives to improve efficiency, enhance customer experiences and gain a competitive edge. Telecom services play a crucial role in enabling digital technologies such as cloud computing, IoT and AI.

For instance, on 30 July 2023, 3M launched a new website that serves as a comprehensive resource for telecom solutions. The website is designed for user convenience and offers a Solutions Tool Product Selector to help users find industry-proven telecom solutions tailored to their specific needs. It covers a wide range of applications, from military and government to various telecom network scenarios.

Competitive Landscape

The major global players in the market include: AT & T Inc., NTT, China Mobile Ltd., Deutsche Telekom AG, SoftBank Group Crop., Telefonica SA, Vodafone Group, KT Corporation, Verizon Communication Inc. and Bharati Airtel Limited.

COVID-19 Impact Analysis

Lockdowns and social distancing measures in place, organizations rapidly shifted to remote work and this sudden surge in demand placed immense pressure on telecom networks to provide reliable connectivity for remote employees. As more people worked from home, engaged in online learning and streamed content, telecom networks experienced increased traffic and congestion, which sometimes led to reduced network performance and slower internet speeds.

The rapid adoption of remote work raised cybersecurity concerns. Organizations had to ensure the security of data and communications as employees accessed corporate networks from various locations and devices. Many organizations accelerated their digital transformation initiatives in response to the pandemic, this included the adoption of cloud services, IoT solutions and advanced communication tools. Telecom providers had to support these transformations effectively.

The need for remote collaboration tools led to the widespread adoption of video conferencing, cloud-based collaboration platforms and unified communications solutions. Telecom providers had an opportunity to offer and enhance these services. The healthcare industry embraced telehealth services to provide remote consultations and medical care. Telecom services played a crucial role in enabling telehealth solutions.

AI Impact

AI algorithms can process sensor data more efficiently and accurately. For example, AI can enhance the processing of data from accelerometers and gyroscopes, enabling better motion tracking and gesture recognition AI-driven image processing techniques, such as computational photography, have become integral to smartphone cameras. AI can optimize image quality, reduce noise, improve low-light performance and offer features like portrait mode and scene recognition and augmented reality experiences.

AI is behind the rapid advancements in facial recognition technology. It enables secure and accurate face unlocking and authentication through sensors like depth sensors and front-facing cameras. AI-driven voice recognition and natural language processing technologies are used in conjunction with microphones to enable voice commands, voice assistants and real-time translation services.

Ericsson, AWS and Hitachi America's R&D division joined forces to conduct this trial. Each company brought its expertise in telecom, cloud services and industrial solutions to the project. Telecom companies generate vast amounts of data, leading to high infrastructure costs for data management. Consumer data is dispersed across various sources, making manual data management time-consuming and costly.

Russia- Ukraine War Impact

Conflict zones in Eastern Ukraine have witnessed damage to critical telecom infrastructure, including cell towers, fiber-optic cables and data centers and this has resulted in service disruptions and challenges in restoring connectivity. The conflict has led to the displacement of populations, including employees and businesses. Telecom providers have had to adapt to the changing demographics and needs of these populations.

The ongoing conflict has had a negative impact on the economies of Ukraine and neighboring countries, this economic strain can affect telecom service subscriptions and investments. The conflict has given rise to increased cybersecurity threats, with reports of cyberattacks originating from or targeting entities in the region. Telecom providers have had to bolster their cybersecurity measures.

By Solution

- Cloud Service

- Data/Internet Service

- Wireless/Mobility

- Managed Services

- Voice

- Others

By Revenue Stream

- Master Agent

- Carriers

- Others

By End-User

- Consumer

- Business

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On 14 August 2023, TPG Telecom and Ericsson announced a multi-year agreement to launch a cloud-native and AI-powered analytics tool in Australia. TPG Telecom and Ericsson have partnered to introduce a cloud-native and AI-powered analytics tool. The tool is designed to enhance mobile network performance for TPG Telecom's subscribers.

- On 19 August 2022, The Department of Telecommunications (DoT) issued spectrum assignment letters to telecom service providers (TSPs). The DoT has expedited the process of allocating 5G spectrum to TSPs, reducing the timeline for network deployment, Communications Minister Ashwini Vaishnaw announced the issuance of spectrum assignment letters on Twitter, he urged TSPs to prepare for the launch of 5G services.

- On 12 May 2023, Amdocs, a leading provider of software and services for communications and media companies, signed an agreement to acquire Teoco's service assurance business for US$ 90 million. The acquisition is subject to regulatory approvals and customary closing conditions.

Why Purchase the Report?

- To visualize the global telecom enterprise services market segmentation based on solution, revenue stream, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of telecom enterprise services market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

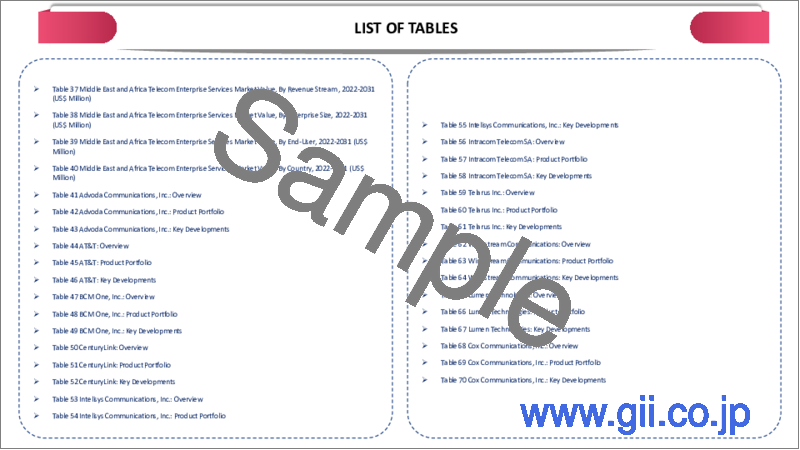

The global telecom enterprise services market report would provide approximately 61 tables, 59 figures and 189 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Solution

- 3.2. Snippet by Revenue Stream

- 3.3. Snippet by End-User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Rising Adoption of 5G Networks

- 4.1.1.2. Growing Collaboration Between Companies

- 4.1.1.3. Advancement in Technology

- 4.1.2. Restraints

- 4.1.2.1. Time Consuming and Cost-Effective

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Solution

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 7.1.2. Market Attractiveness Index, By Solution

- 7.2. Cloud Service*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Data/Internet Service

- 7.4. Wireless/Mobility

- 7.5. Managed Services

- 7.6. Voice

- 7.7. Others

8. By Revenue Stream

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Revenue Stream

- 8.1.2. Market Attractiveness Index, By Revenue Stream

- 8.2. Master Agent*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Carriers

- 8.4. Others

9. By End-User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.1.2. Market Attractiveness Index, By End-User

- 9.2. Consumer*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Business

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Revenue Stream

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Revenue Stream

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Russia

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Revenue Stream

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Revenue Stream

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Solution

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Revenue Stream

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. AT & T Inc.*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. NTT

- 12.3. China Mobile Ltd.

- 12.4. Deutsche Telekom AG

- 12.5. SoftBank Group Crop.

- 12.6. Telefonica SA

- 12.7. Vodafone Group

- 12.8. KT Corporation

- 12.9. Verizon Communication Inc.

- 12.10. Bharati Airtel Limited

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us