|

|

市場調査レポート

商品コード

1347992

ロボットソフトウェアプラットフォームの世界市場-2023年~2030年Global Robotic Software Platforms Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ロボットソフトウェアプラットフォームの世界市場-2023年~2030年 |

|

出版日: 2023年09月11日

発行: DataM Intelligence

ページ情報: 英文 203 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のロボットソフトウェアプラットフォーム市場は、2022年に8億米ドルに達し、2023-2030年の予測期間中にCAGR 45.3%で成長し、2030年には71億米ドルに達すると予測されています。

高性能で洗練されたロボットの開発により、ロボットの機能を効果的に制御・管理するソフトウェア・プラットフォームの需要が生まれました。ロボットの用途が複雑化し多様化するにつれて、適応性の高いソフトウェアプラットフォームの必要性が高まっています。インダストリー4.0の成長とスマートマニュファクチャリングの台頭が、さまざまなプラットフォームにおけるロボットソフトウェアの採用を後押ししています。IFR(国際ロボット連盟)によると、2021年にはロボットの73%がアジア太平洋地域に導入されました。

医療、ホスピタリティ、小売、物流などのサービス分野でのロボットの利用が大幅に拡大しています。サービスロボットは、ナビゲーション、インタラクション、データ処理などのタスクを可能にするソフトウェアプラットフォームを必要とし、ロボットソフトウェア市場の成長を牽引しています。AIと機械学習機能をロボットソフトウェアプラットフォームに統合することで、ロボットの学習、適応、インテリジェントな意思決定が可能になっています。

予測期間中、北米は世界のロボットソフトウェアプラットフォーム市場の1/3以上を占める成長地域の一つです。この地域には、ロボット技術を積極的に開発・導入しているロボット企業、研究機関、大学の強固なエコシステムがあり、このエコシステムがイノベーションを促進し、高度なロボットソフトウェアプラットフォームの需要を促進しています。

ダイナミクス

政府機関のロボットシステムの導入

ロボットソフトウェアプラットフォームにより、政府機関はルーチンワークや反復作業を自動化することができ、業務効率の向上と手作業の軽減につながります。政府機関はデジタルトランスフォーメーションのイニシアチブを採用するようになっており、ロボットソフトウェアプラットフォームはプロセスの近代化と合理化において重要な役割を果たしています。

例えば、シンガポール国防科学技術庁は2021年10月13日、フィラデルフィアに本拠を置くロボット企業Ghost Roboticsとパートナーシップを締結し、安全保障、防衛、人道的用途に向けた脚式ロボットの開発とテストを行っています。この協働は、都市部の厳しい地形や過酷な環境における移動ロボットシステムプラットフォームの利用を模索することを目的としています。

企業間の事業協力・提携

ロボットソフトウェアプラットフォームは、包括的なソリューションを生み出すために、ハードウェア、ソフトウェア、専門的な専門知識の組み合わせを必要とすることが多いです。さまざまな企業と協働することで、さまざまなコンポーネントや技術を統合し、完全で堅牢なロボットシステムを実現することができます。コラボレーションは、異なるパートナーの強みを活用することで、カスタマイズされたソリューションの作成を可能にします。

例えば、2023年7月27日、産業用コンピューティング技術のプロバイダーであるアドバンテックは、自律移動ロボットの開発と展開を合理化するために、ロボットソフトウェアプラットフォーム企業であるMOV.AIとパートナーシップを締結しました。この協働は、アドバンテックの堅牢なハードウェアとMOV.AIのロボットエンジンプラットフォームを組み合わせることで、AMRメーカーやインテグレーター向けの包括的なソリューションを構築することを目的としています。

技術進歩

コンピュータビジョン技術は、ロボットが環境からの視覚情報を解釈することを可能にし、これには物体の検出、認識、追跡、シーン理解が含まれます。コンピュータビジョンは、物体の選別や障害物の識別など、視覚処理を必要とするタスクを実行するロボットの能力を向上させます。センサーフュージョンと統合により、ロボットは正確なデータを収集し、複雑な環境をナビゲートし、物体や人間と安全に相互作用することができます。

例えば、2023年8月25日、NASAはテキサス州に本拠を置くApptronik社との協働により、NASAが地球と宇宙の両方に応用できるヒューマノイドロボットを開発する専門知識を強調しました。Apptronik社のヒューマノイドロボット「Apollo」は、NASAの中小企業技術革新研究契約を通じて開発されました。

複雑なロボットソフトウェアと社会的スキルの展示

ロボットソフトウェアの開発やプログラミングは複雑で、専門的なスキルを必要とします。開発者やオペレーターを含むユーザーは、これらのプラットフォームを効果的に利用するために険しい学習曲線を経る必要があるかもしれません。ロボットソフトウェアプラットフォームは、特定のハードウェア構成やロボットモデルに合わせる必要があることが多く、このようなハードウェア依存性は柔軟性や相互運用性を制限し、異なるロボットやブランド間の切り替えを困難にします。

センサーは、ロボットの知覚や意思決定に使用される重要な機能です。しかし、センサー技術の限界は、特に低照度や悪天候などの厳しい条件下で、ロボットが環境を正確に認識する能力に影響を与える可能性があります。様々な文脈で人間と効果的に対話し、自然言語を理解し、社会的スキルを発揮できるロボットの創造は、ロボットソフトウェアプラットフォームが現在も取り組んでいる複雑な課題です。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 政府機関のロボットシステムの導入

- 企業間の事業協力・提携による市場促進

- 技術進歩

- 抑制要因

- 複雑なロボット・ソフトウェアと社会的スキル

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 ソフトウェア別

- 認識ソフトウェア

- シミュレーションソフトウェア

- 予知保全ソフトウェア

- データ管理・分析ソフトウェア

- 通信管理ソリューション

第8章 ロボット別

- サービスロボット

- 産業ロボット

第9章 展開モデル別

- オンプレミス

- オンデマンド

第10章 企業規模別

- 中小企業

- 大企業

第11章 エンドユーザー別

- 自動車

- 小売業・eコマース

- 医療

- 運輸・物流

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- ABB

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- Brain Crop

- AIBrain

- CloudMinds

- Energid Technologies

- Furhat Robotics

- H2O.ai

- IBM

- NVIDIA

- Oxbotica

第15章 付録

Overview

Global Robotic Software Platforms Market reached US$ 0.8 billion in 2022 and is expected to reach US$ 7.1 billion by 2030, growing with a CAGR of 45.3% during the forecast period 2023-2030.

The development of capable and more sophisticated robots created a demand for software platforms that effectively control and manage robot functionalities. As robots become more complex and diverse in their application, the need for adaptable software platforms has grown. The growth of Industry 4.0 and rising smart manufacturing have driven the adoption of robotic software in various platforms. According to IFR - International Federation of Robotics, in 2021 73% of robots were installed in Asia-Pacific.

The use of robots in service sectors such as healthcare, hospitality, retail and logistics has expanded significantly. Service robots require software platforms to enable tasks like navigation, interaction and data processing, driving the growth of the robotic software market. Integration of AI and machine learning capabilities into robotic software platforms has enabled robots to learn, adapt and make intelligent decisions.

During the forecast period, North America is among the growing regions in the global robotic software platforms market covering more than 1/3rd of the market. The region has a robust ecosystem of robotics companies, research institutions and universities that are actively developing and deploying robotic technologies and this ecosystem fosters innovation and drives the demand for advanced robotic software platforms.

Dynamics

Government Agencies Adopts Robotic Systems

Robotic software platforms enable government agencies to automate routine and repetitive tasks leading to increased operational efficiency and reduced manual effort and this allows government employees to focus on more complex and value-added activities. Government agencies are increasingly adopting digital transformation initiatives and robotic software platforms play a crucial role in modernizing and streamlining processes.

For instance, on 13 October 2021, the Defense Science and Technology Agency of Singapore entered into a partnership with Ghost Robotics, a Philadelphia-based robotics company, to develop and test legged robots for security, defense and humanitarian applications. The collaboration aims to explore the use of mobile robotic systems platforms in challenging urban terrain and harsh environments.

Collaboration and Partnership Between Companies

Robotic software platforms often require a combination of hardware, software and specialized expertise to create comprehensive solutions. Collaborating with different companies allows for the integration of various components and technologies to deliver complete and robust robotic systems. Collaboration enables the creation of customized solutions by leveraging the strengths of different partners.

For instance, on 27 July 2023, Advantech, a provider of industrial computing technology, entered into a partnership with MOV.AI, a robotics software platform company, to streamline the development and deployment of autonomous mobile robots. The collaboration aims to combine Advantech's rugged hardware with MOV.AI's Robotics Engine Platform to create a comprehensive solution for AMR manufacturers and integrators.

Technology Advancement

Computer vision technologies enable robots to interpret visual information from the environment and this includes object detection, recognition, tracking and scene understanding. Computer vision enhances robots' ability to perform tasks that require visual processing, such as sorting objects or identifying obstacles. Sensor fusion and integration enable robots to gather accurate data, navigate complex environments and interact safely with objects and humans.

For instance, on 25 August 2023, NASA's collaboration with Apptronik, a Texas-based company, highlights the agency's expertise in developing humanoid robots for both Earth-based and space applications. Apptronik's humanoid robot, named Apollo, has been developed through NASA's Small Business Innovation Research contracts.

Complex Robotic Software and Exhibits Social Skills

Developing and programming robotic software can be complex and require specialized skills. Users, including developers and operators, may need to undergo a steep learning curve to effectively utilize these platforms. Robotic software platforms often need to be tailored to specific hardware configurations and robot models and this hardware dependency can limit flexibility and interoperability, making it challenging to switch between different robots or brands.

Sensors are important features used in robots for perception and decision-making. However, limitations in sensor technology can impact a robot's ability to accurately perceive its environment, especially in challenging conditions like low light or adverse weather. Creating robots that can effectively interact with humans in various contexts, understand natural language and exhibit social skills is a complex challenge that robotic software platforms are still working to address.

Segment Analysis

The global robotic software platforms market is segmented based Software, Robot, deployment, enterprise size, end-user and region.

Adoption of Service Robots for Automate Task

Service robots are expected to be the major segment fueling the market growth with a share of more than 1/3rd in 2022. Businesses across industries are seeking ways to automate routine tasks and increase operational efficiency. Service robots offer a solution by handling repetitive tasks, such as delivery, cleaning and customer service, allowing human workers to focus on more complex and value-added activities. Service robots can fill the gap by performing tasks that would otherwise require human labor, helping businesses maintain consistent operations.

For instance, on 24 August 2023, KEENON Robotics, a prominent global robotic service provider announced a partnership with Daesung Industrial Co., Ltd., a well-known energy and electrical product company based in Korea and this collaboration signifies a significant step for KEENON's expansion in the Korean market, aiming to provide cutting-edge service robots to businesses and transform customer experiences.

Geographical Penetration

Rapid Industrialization in Asia-Pacific Boost the Market

Asia-Pacific is among the major regions in the global robotic software platforms market covering about 1/4th of the market. The region is undergoing rapid industrialization, leading to increased demand for automation and robotics in manufacturing and other industries. Robotic software platforms enable efficient deployment and management of robotic systems in these sectors.

For instance, on 30 May 2022, Amazon announced plans to develop software for its consumer robots in India. The company is working to expand its capabilities in the robotics field and is reportedly looking to tap into India's talent pool in artificial intelligence and robotics. Amazon has been actively investing in robotics and automation to improve its fulfillment and delivery processes.

Competitive Landscape

The major global players in the market include: ABB, Brain Crop, AIBrain, CloudMinds, Energid Technologies, Furhat Robotics, H2O.ai, IBM, NVIDIA and Oxbotica.

COVID-19 Impact Analysis

The pandemic highlighted the need for automation to reduce human contact and maintain business operations during lockdowns. Robotic software platforms that enable automation have seen increased demand in industries such as manufacturing, logistics and healthcare. Robotic software platforms have facilitated the development of delivery robots, drones and autonomous vehicles for contactless deliveries, reducing the risk of virus transmission.

Robotic software platforms have been used in healthcare settings for tasks such as disinfection, remote patient monitoring and telemedicine, minimizing exposure between healthcare professionals and patients. Robotic software platforms equipped with AI have enabled remote monitoring and predictive maintenance of machines and equipment, reducing the need for on-site technicians.

The pandemic disrupted global supply chains, affecting the production and distribution of components necessary for robotic systems and potentially slowing down growth. Economic uncertainties caused by the pandemic led to reduced investment in technology and automation projects, impacting the expansion of robotic software platforms. Lockdowns and social distancing measures limited the deployment of robotic systems in certain industries, hindering their growth potential.

AI Impact

AI technologies like machine learning, deep learning and computer vision these technologies used algorithms that enable robotic software platforms to perform tasks with greater autonomy and adaptability. AI algorithms allow robots to learn from their environments train them to make real-time decisions and adjust their actions based on changing conditions and this results in more efficient and capable robotic systems that can operate autonomously in various environments.

AI-powered robotic software platforms generate a large amount of sensor data which process later and extract information that other sensors accurately perceive and understand their surroundings and this enhances their ability to navigate complex environments, avoid obstacles and interact with objects and humans safely and effectively. It also enables cognitive abilities and use of natural language processing that understand human gestures.

For instance, on 23 August 2023, The Singapore MIT-Alliance for Research and Technology launched an interdisciplinary research group called Mens, Manus and Machina to address challenges related to the rise of artificial intelligence (AI), automation and robotics. M3S will work on topics like human-machine collaboration, AI ethics, human capital development and economic growth. The collaboration involves a team of professors from MIT and institutions in Singapore, aiming to enhance the country's AI ecosystem and support workforce training and mentorship in AI.

Russia- Ukraine War Impact

As there could be an increased demand for robotic systems and software platforms during time of conflict, for defense and security purposes and these platforms could be used for surveillance, reconnaissance and even in combat scenarios to reduce the risk to human soldiers. Robotic software platforms designed for disaster response and humanitarian aid could be utilized in conflict zones to assist with tasks such as search and rescue, delivering supplies and providing medical support to affected populations.

Robotic software platforms equipped with advanced sensors and AI could be used for remote monitoring of conflict areas and borders and provides real-time data to military and security personnel. The urgency of the conflict might lead to increased innovation and collaboration among researchers, engineers and organizations working on robotic software platforms for military and defense applications.

By Software

- Recognition Software

- Simulation Software

- Predictive Maintenance Software

- Data Management and Analysis Software

- Communication Management Solution

By Robot

- Service Robots

- Industrial Robots

By Deployment

- Service Robots

- On-Premise

- On-Demand

By Enterprise Size

- Small and Medium Enterprises

- Large Enterprises

By End-User

- Automotive

- Retail and E-commerce

- Healthcare

- Transportation & Logistics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On 30 March 2022, Oceaneering International introduced a new lineup of autonomous mobile robots and launched three new models in North America. The new robots are designed to enhance efficiency in various industries. The UniMover D 100 is a small vehicle for transporting light goods such as boxes and totes.

- On 21 March 2023, CoEvolution Technology has introduced its multi-robot orchestration software to the U.S. market, with a focus on enhancing logistics and warehouse operations. The software powered by AI enables the control and coordination of various types of robots to work together seamlessly as a unified fleet.

- On 12 April 2022, ABB Robotics introduced a groundbreaking software solution called High Speed Alignment, aimed at enhancing speed and precision in electronics assembly. The software leverages 50 years of ABB's software expertise and employs Visual Servoing technology combined with computer vision systems to control the positioning of 6-axis robots relative to workpieces.

Why Purchase the Report?

- To visualize the global robotic software platforms market segmentation based on software, robot, deployment, enterprise size, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of robotic software platforms market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

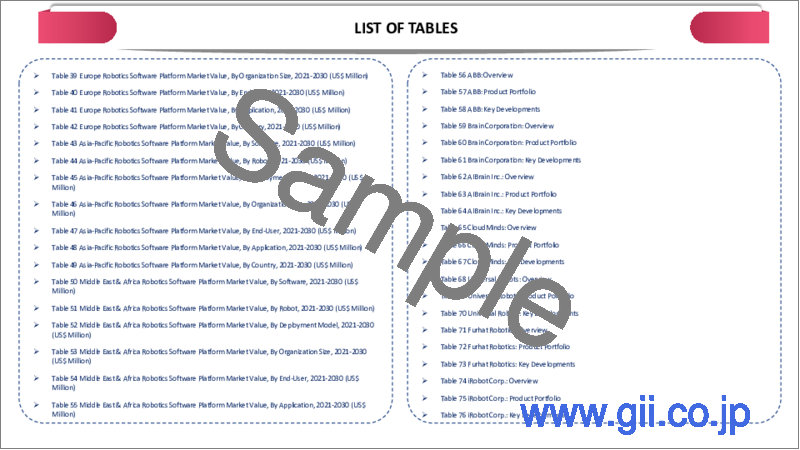

The global robotic software platforms market report would provide approximately 77 tables, 78 figures and 203 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Software

- 3.2. Snippet by Robot

- 3.3. Snippet by Deployment

- 3.4. Snippet by Enterprise Size

- 3.5. Snippet by End-User

- 3.6. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Government Agencies Adopts Robotic Systems

- 4.1.1.2. Collaboration and Partnership Between Companies Boosts the Market

- 4.1.1.3. Technology Advancement

- 4.1.2. Restraints

- 4.1.2.1. Complex Robotic Software and Exhibits Social Skills

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Software

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 7.1.2. Market Attractiveness Index, By Software

- 7.2. Recognition Software *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Simulation Software

- 7.4. Predictive Maintenance Software

- 7.5. Data Management and Analysis Software

- 7.6. Communication Management Solution

8. By Robot

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Robot

- 8.1.2. Market Attractiveness Index, By Robot

- 8.2. Service Robots *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Industrial Robots

9. By Deployment Model

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment Model

- 9.1.2. Market Attractiveness Index, By Deployment Model

- 9.2. On-Premise *

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. On-Demand

10. By Enterprise Size

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 10.1.2. Market Attractiveness Index, By Enterprise Size

- 10.2. Small and Medium Enterprises*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Large Enterprises

11. By End-User

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.1.2. Market Attractiveness Index, By End-User

- 11.2. Automotive *

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Retail and E-commerce

- 11.4. Healthcare

- 11.5. Transportation & Logistics

- 11.6. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Robot

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Robot

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. UK

- 12.3.8.3. France

- 12.3.8.4. Italy

- 12.3.8.5. Russia

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Robot

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Robot

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. Australia

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Software

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Robot

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Deployment

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Enterprise Size

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. ABB *

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. Brain Crop

- 14.3. AIBrain

- 14.4. CloudMinds

- 14.5. Energid Technologies

- 14.6. Furhat Robotics

- 14.7. H2O.ai

- 14.8. IBM

- 14.9. NVIDIA

- 14.10. Oxbotica

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us