|

|

市場調査レポート

商品コード

1347924

建設機械レンタルの世界市場-2023年~2030年Global Construction Equipment Rental Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 建設機械レンタルの世界市場-2023年~2030年 |

|

出版日: 2023年09月11日

発行: DataM Intelligence

ページ情報: 英文 181 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の建設機械レンタル市場は、2022年に1,123億米ドルに達し、2030年には1,651億米ドルに達すると予測され、予測期間2023-2030年のCAGRは5.1%で成長する見込みです。

建設機械のレンタルは、特に短期プロジェクトの場合、購入よりも費用対効果が高いです。建設会社は、新しい機器を購入する際の高額なコストを回避し、代わりに特定のプロジェクト期間中に必要な機器のみを支払うことができます。レンタル企業では、小型の工具から重機まで幅広い建設機械を提供しています。

レンタル企業は、最新技術や最新モデルの機材を頻繁に更新しています。レンタルすることで、建設会社は、購入するにはコストがかかりすぎる最先端の機械を利用することができます。レンタルを利用することで、建設会社は時代遅れの機械を所有するリスクを回避し、最新かつ効率的な機械に確実にアクセスすることができます。予測期間2023-2030年には、アジア太平洋地域が最も高い成長率を示すと予想されています。

アジア太平洋地域の新興経済諸国政府は、高速道路、空港、ダム、経済特区(SEZ)の開発に多額の投資を行い、交通の便を改善し、商業を活性化し、一般経済を強化しています。このような活動は、巨額の投資とこの地域でのプレゼンス確立を熱望する大手建設機械メーカーの注目を集めています。キャタピラー、日立製作所、リープヘル、住友商事などは、この地域で商品やサービスを提供している世界の建設機械メーカーです。

ダイナミクス

インフラ投資の増加

インフラプロジェクトでは、要件が変化し、作業量も変化することが多いです。レンタル機器は、プロジェクトの需要に迅速に対応し、必要に応じて規模を拡大または縮小する柔軟性を提供します。レンタル企業は、請負業者が機器を安全かつ効率的に操作できるよう、技術サポートやオペレーター訓練を提供しており、特に複雑な機械の場合、こうしたサポートは貴重なものとなります。

インド・ブランド・エクイティ財団によると、インドは2025年までにインフラを強化し、5兆米ドルを目標としています。インドは、接続性と機動性を高めるため、交通網の改善に多額の投資を行っています。道路、鉄道、空港の拡張と近代化は主要な重点分野です。高速道路や国道の整備は、輸送時間とコストを削減し、貿易と商業を促進することを目的としています。

建設機械レンタル市場は民間企業に豊かな機会を提供しています。建設業界は拡大を続けており、インフラプロジェクトや都市開発の需要が高まっているため、建設機械に対するニーズは絶えず高まっており、レンタルサービス市場は堅調に推移しています。

例えば、2023年1月18日、オレンジ色の建設機械で有名なブランドである斗山は、世界的にDEVELONと呼ばれるようになります。DEVELONは、インフラ業界に革新的な製品とソリューションを提供し続け、建設機械の世界リーダーとしての地位を確固たるものにすることを目指しています。DEVELONは、重要なインフラを構築し、代替エネルギー源を通じた持続可能な開発を促進するための建設機械の製造に注力しています。

建設産業への政府投資

政府は、高速道路、橋、道路、空港、公共施設の建設を含むインフラ整備に多額の投資を行っており、これらの大規模プロジェクトには幅広い建設機械が必要であるため、公的機関および民間機関の両方からレンタルサービスの需要が高まっています。

例えば、2023年2月2日、財務相は24年度の設備投資支出を19年度の3倍に増やすことを提案しましたが、これはインフラ整備への強いコミットメントを示しています。設備投資の増加は、建設プロジェクトに対する資金の増加につながり、ひいては建設会社にとってより多くの機会を創出し、経済成長全体を押し上げることになります。

政府は、設備レンタルサービスを含む建設会社に対して税制優遇措置や補助金を提供しており、こうした優遇措置は建設プロジェクトの総コストを削減し、より多くの企業がレンタルソリューションを選択するよう促すことができます。また、政府は建設労働者の技能開発・訓練プログラムにも投資しています。

例えば、2023年3月11日に発表されたインド連邦予算2023-24は、不動産、産業成長、公共支出に取り組むと同時に、インフラ整備と開発努力の促進に重点を置いており、インフラ整備に10兆ルピーの大幅な配分を行うことで、都市間の接続性を高め、様々なインフラプロジェクトを実施することを目的としています。PMアワス・ヨジャナの拡大や減税は、手頃な価格の住宅へのアクセスを増やすことを目的としています。

メンテナンスの必要性

レンタル機器は、適切な機能と安全性を確保するために定期的なメンテナンスが必要です。特に古い機械や、顧客がレンタルした機械を適切に手入れしない場合、メンテナンス費用は高額になります。建設機械の寿命は有限であり、時間の経過とともに減価していきます。

建設機械を所有し維持するには、多額の資本投資と継続的な経費がかかります。ダウンタイムの期間中、レンタル企業は、機器が収益を生んでいないにもかかわらず、メンテナンス費用、保険料、保管料、その他の諸経費を負担する必要があります。

設備の更新と管理

レンタル企業は、顧客の需要に応えるため、機器の在庫を常に最新の状態に保つ必要があります。機器の在庫と市場の需要のバランスを取り、適切な保管を確保することは、物流上の課題となり得ます。業界の動向を常に把握することは、業者にとって難しい課題です。

契約更新や延長の管理は、特に複数のレンタル契約が同時に進行している場合、時間のかかるプロセスです。レンタル企業は契約の有効期限を把握し、更新や延長の可能性について顧客と積極的に話し合う必要があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- インフラ投資の増加

- 建設産業への政府投資

- 抑制要因

- 設備の更新と管理

- メンテナンスの必要性

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 製品別

- 土木機械

- マテリアルハンドリング装置

- 重建設車両

- その他

第8章 推進方法別

- ディーゼル

- ガソリン

- 建設車両

- その他

第9章 駆動方式別

- 油圧式

- 電動式

- ハイブリッド

第10章 用途別

- 住宅用

- 商業用

- 産業用

- インフラ用

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- United Rentals Inc.

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- Kanmoto Co Ltd.

- Herc Rentals Inc.

- Hitachi Construction Machinery Co., Ltd

- Caterpillar Inc.

- Loxam Group

- Liebherr

- H&E Equipment Services, Inc.

- Boels Rental

- Ahern Rentals

第14章 付録

Overview

Global Construction Equipment Rental Market reached US$ 112.3 billion in 2022 and is expected to reach US$ 165.1 billion by 2030, growing with a CAGR of 5.1% during the forecast period 2023-2030.

Renting construction equipment can be more cost-effective than purchasing, especially for short-term projects. It allows construction companies to avoid the high costs of buying new equipment and instead pay only for the equipment they need during specific project durations. It offers a wide range of construction equipment from small tools to heavy machinery.

Rental companies often update their equipment inventory with the latest technology and models. By renting, construction companies can access state-of-the-art machinery that may be too costly to purchase outright. Renting allows construction companies to avoid the risk of owning obsolete equipment and ensures access to modern and efficient machinery. Asia-Pacific is expected to witness the highest growth rate during the forecast period 2023-2030.

Governments in Asia-Pacific's emerging economies are heavily investing in the development of highways, airports, dams and special economic zones (SEZs) to improve connectivity, stimulate commerce and strengthen the general economy. The activities are attracting the attention of major construction equipment companies, who are eager to invest heavily and establish a presence in the region. Caterpillar, Hitachi, Liebherr and Sumitomo Corporation are among the global construction equipment manufacturers that offer their goods and services in the region.

Dynamics

Increasing Investment in Infrastructure

Infrastructure projects often involve changing requirements and varying workloads. Renting equipment provides flexibility that quickly adapts project demands and scales up or down as needed. Rental companies offer technical support and operator training which ensures that contractors can operate the equipment safely and efficiently and this support can be valuable, especially for complex machinery.

According to India Brand Equity Foundation, India enhances its infrastructure upto 2025 and has targeted US$ 5 trillion. India is heavily investing in improving its transportation network to enhance connectivity and mobility. The expansion and modernization of roads, railways and airports are major focus areas. The development of expressways, national highways and the country aims to reduce transportation time and costs, boosting trade and commerce.

The construction equipment rental market offers a lucrative opportunity for private companies as the construction industry continues to expand, with the increasing demand for infrastructure projects and urban development, there is a constant need for construction equipment, create a robust market for rental services.

For instance, on 18 January 2023, Doosan, a well-known brand of orange construction equipment, will now be called DEVELON worldwide. DEVELON aims to continue providing innovative products and solutions for the infrastructure industry, solidifying its position as a global leader in construction equipment. DEVELON will focus on manufacturing construction equipment to build critical infrastructure and promote sustainable development through alternative energy sources.

Government Investment in Construction Industry

The government heavily invests in the development of infrastructure that includes the construction of highways, bridges, roads, airports and public facilities, these large-scale projects require a wide range of construction equipment which increases demand for rental services from both public and private organizations.

For instance, on 2 February 2023, finance minister's proposal to increase the capital investment outlay for FY24 by three times from the FY19 level indicates a strong commitment to infrastructure development. Higher capital investment leads to increase funding for construction projects, which in turn can create more opportunities for construction companies and boost overall economic growth.

Governments offer tax incentives and subsidies for construction companies which include equipment rental services, these incentives can reduce the overall cost of construction projects and encourage more companies to opt for rental solutions. The government also invested in skill development and training programs for construction workers.

For instance, on 11 March 2023, the Union Budget 2023-24 in India focuses on promoting infrastructure and development efforts while also addressing real estate, industrial growth and public spending and with a significant allocation of 10 trillion rupees to infrastructure development, the budget aims to boost connectivity between cities and implement various infrastructure projects. The expansion of the PM Awas Yojana and tax reductions aims to increase access to affordable housing.

Need Maintenance

Rental equipment needs regular maintenance to ensure proper functioning and safety. The cost of maintenance is high, especially for older equipment or in cases where customers do not take proper care of the rented machines. Construction equipment has a finite lifespan which will depreciates over time.

Owning and maintaining a construction equipment involves significant capital investment and ongoing expenses. During periods of downtime, rental companies still need to cover maintenance costs, insurance, storage and other overhead expenses, even though the equipment is not generating revenue.

The Updation and Management of Equipment

Rental companies need to maintain an updated inventory of equipment to meet customer demands. Balancing equipment availability with market demand and ensuring proper storage can be a logistical challenge. Staying up to date with industry trends is a challenging situation for contractors.

Managing contract renewals and extensions is a time-consuming process, especially when multiple rental agreements are ongoing simultaneously. Rental companies need to keep track of contract expiration dates and proactively engage with customers to discuss potential renewals or extensions.

Segment Analysis

The global construction equipment rental market is segmented based on product, propulsion, drive, application and region.

Rising Demand for Hydraulic Technology

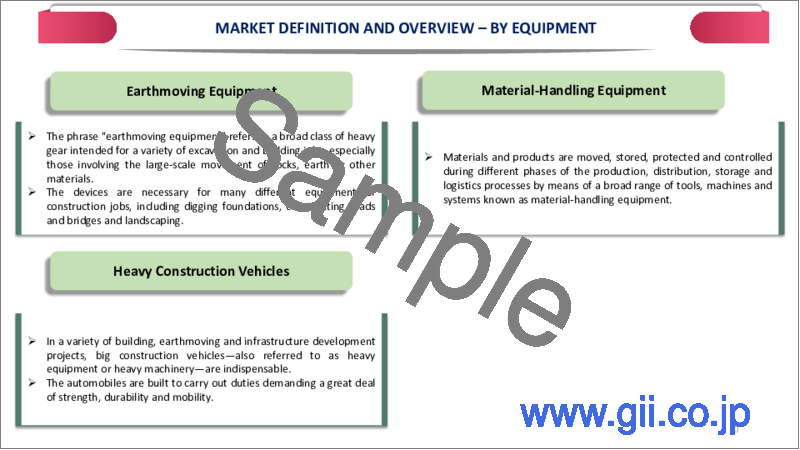

Earthmoving equipment is expected to hold a share of more than 1/3rd of the global market in 2022. The increased use of earthmoving excavators among the agricultural, mining and building sectors considerably promotes corporate growth. Backhoe loaders, crawler excavators, skid-steer loaders and compact excavators, on the contrary hand, have a bigger load capacity and more powerful engines.

The characteristics of earthmoving equipment allow it to be used in severe operating settings. A well-developed infrastructure is required to improve trade and commerce activities and road connectivity has the potential to affect the economy's destiny. The federal government of U.S. passed The Bipartisan Infrastructure Deal (Infrastructure Investment and Jobs Act) in November 2021, allowing an investment of US$ 110 billion to upgrade roads, bridges and other infrastructure in five years.

Geographical Penetration

The Rapid Expansion of Construction Industry in North America

North America is expected to hold around 1/3rd of the global construction equipment rental market during period 2023-2030. The construction industry in North America is experiencing robust growth, driven by increased investment in real estate, industrial and commercial sectors, this expansion creates a higher demand for construction equipment, prompting companies to opt for rental solutions. Rental companies continuously upgrade their technology and also contractors prefer renting new machines with advanced technology.

For instance, on 3 October 2022, H&E Equipment Services Inc. completed its acquisition of One Source Equipment Rentals Inc., with this acquisition, H&E adds 10 new equipment rental locations to its branch network, including initial locations in Illinois and Kentucky. The addition of One Source also strengthens H&E's presence in the southern U.S. and contributes approximately US$ 138 million in assets based on original equipment cost.

North America is witnessing significant investments in infrastructure projects which include the construction of roads, bridges, airports and public utilities, these projects require a wide range of construction equipment and renting them provides cost-effective solutions for contractors and project developers.

For instance, on 7 February 2023, Sunbelt U.S., a prominent equipment rental company, completed the acquisition of the business and assets of Key Rentals Group LLC and TBG Equipment LLC. The two entities were specialty businesses operating in Montana, with this acquisition, Sunbelt U.S. further expands its presence and offerings in the region, enhancing its capabilities to serve customers in the equipment rental industry.

Competitive Landscape

The major global players include: United Rentals Inc., Kanmoto Co Ltd., Herc Rentals Inc., Hitachi Construction Machinery Co., Ltd, Caterpillar Inc., Loxam Group, Liebherr, H&E Equipment Services, Inc., Boels Rental and Ahern Rentals.

COVID-19 Impact Analysis

Globally the pandemic disrupted the supply chain management system and leads to delays in the manufacturing and delivery of construction equipment, this affected the availability of rental equipment, causing shortages and increased lead times. During the initial phase of the pandemic, construction industries face slowdown or halt in many regions.

The decline in rental revenue and ongoing expenses, such as maintenance and overhead costs, put a financial strain on rental companies. Some smaller or less financially stable rental firms faced difficulties in stabilizing their companies during the pandemic. Due to these factors, the market faced downfall during COVID-19.

COVID-19 accelerated the adoption of technology in the construction industry, including telematics, remote monitoring and online rental platforms. Rental companies had to adapt to these changes and provide digital solutions to customers. As construction industries gradually started to resume there activities, rental companies experienced increased demand for specific equipment.

To minimize physical contact and comply with social distancing guidelines, rental companies moved towards contactless transactions, online bookings and digital documentation. Physical paperwork and manual documentation have been replaced by digital alternatives. Customers receive rental agreements, invoices and receipts electronically, reducing the need for paper exchanges and in-person visits to rental offices.

AI Impact

AI-powered sensors and analytics can monitor the condition of rental equipment in real-time. By analyzing data such as machine performance, usage patterns and environmental factors, AI can predict potential equipment failures or maintenance needs, which enables rental companies to schedule maintenance proactively, reducing downtime and improving equipment reliability.

AI algorithms analyze historical rental data, market demand and project requirements to optimize equipment allocation, this ensures that the right equipment is available at the right place and time and maximizes rental utilization and revenue for the company, these factors boost market growth.

AI-powered chatbots can handle customer inquiries, rental bookings and provide instant support. As they can answer common queries, guide customers through the rental process and offer personalized recommendations, enhancing customer satisfaction and reducing the workload on rental company staff.

In large construction projects, AI can identify potential clashes in equipment allocation. By analyzing project timelines and equipment requirements, AI can prevent situations where multiple projects require the same equipment simultaneously, avoiding conflicts and improving project efficiency.

Russia- Ukraine War Impact

In areas directly affected by the conflict, there is significant damage to infrastructure, including roads, bridges, buildings and utilities. Rebuilding and reconstruction efforts would require construction equipment and materials. Geopolitical tension between region disrupts the supply chain and make a challenging situation to procure construction materials.

Ongoing hostilities and security concerns lead to delays or cancellations of construction projects in the affected areas. The conflict causes labor shortages, as workers may migrate to safer regions or face difficulties in commuting to work due to security concerns. Due to these factors, the construction industry in the affected region witnessed a downfall in the market.

Many roads and bridges in the conflict-affected regions have been damaged or destroyed due to military actions, which makes transportation and logistics challenging, this has affected the movement of goods, people and aid and these factors hinder economic activities. The conflicts resulted in destruction of homes and public facilities.

The war had significant economic consequences for both Russia and Ukraine. The destruction of infrastructure has affected industries along with agriculture, production and trade, leading to economic losses and demanding situations in reconstruction. The ongoing struggle has created an ecosystem of instability within the region, deterring funding and economic development.

By Product

- Earthmoving Equipment

- Material-Handling Equipment

- Heavy Construction Vehicles

- Others

By Propulsion

- Diesel

- Gasoline

- Construction Vehicles

- Others

By Drive

- Hydraulic

- Electric

- Hybrid

By Application

- Residential

- Commercial

- Industrial

- Infrastructure

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On 19 March 2023, Durante Rentals, based in New Rochelle, N.Y., recently launched Durante Rentals Event Services. Durante Rentals aims to make an immediate impact on their projects, leveraging their assets and expertise in construction equipment rentals.

- On 11 July 2023, Cooper Equipment Rentals, based in Canada, has recently acquired Warner Rentals and Scotty's Rentals and Landscaping, expanding its branch and specialty footprint in western Canada. The acquisition of Warner Rentals strengthens Cooper's presence in central British Columbia and enhances its service coverage in the rapidly growing western Canadian market.

- On 18 June 2023, Quebec-based Simplex Equipment Rental has acquired Skytec Rentals, an Ontario-based equipment rental company specializing in aerial work platforms. The two companies share common values and a customer-focused business vision, making the acquisition a strategic move to strengthen Simplex's leadership position.

Why Purchase the Report?

- To visualize the global construction equipment rental market segmentation based on product, propulsion, drive, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of construction equipment rental market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

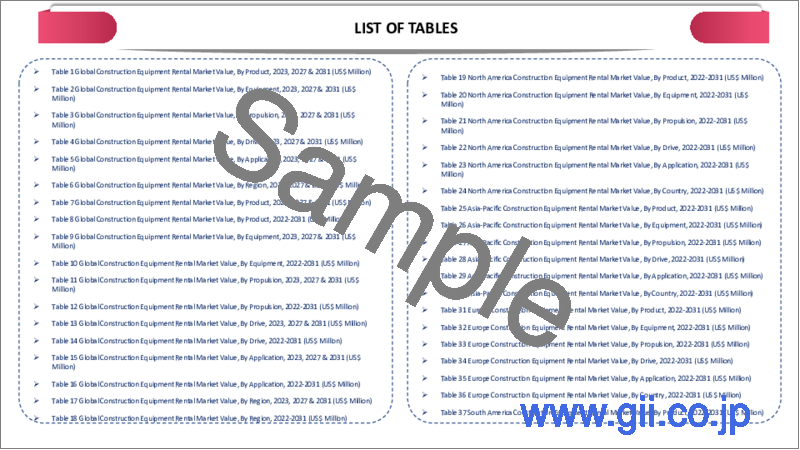

The global construction equipment rental market report would provide approximately 69 tables, 70 figures and 181 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product

- 3.2. Snippet by Propulsion

- 3.3. Snippet by Drive

- 3.4. Snippet by Application

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Investment in Infrastructure

- 4.1.1.2. Government Investment in Construction Industry

- 4.1.2. Restraints

- 4.1.2.1. Updation and Managing Equipment

- 4.1.2.2. Need Maintenance

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2. Market Attractiveness Index, By Product

- 7.2. Earthmoving Equipment *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Material-Handling Equipment

- 7.4. Heavy Construction Vehicles

- 7.5. Others

8. By Propulsion

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 8.1.2. Market Attractiveness Index, By Propulsion

- 8.2. Diesel *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Gasoline

- 8.4. Construction Vehicles

- 8.5. Others

9. By Drive

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drive

- 9.1.2. Market Attractiveness Index, By Drive

- 9.2. Hydraulic *

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Electric

- 9.4. Hybrid

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Residential *

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Commercial

- 10.4. Industrial

- 10.5. Infrastructure

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drive

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drive

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drive

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drive

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Drive

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. United Rentals Inc. *

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Kanmoto Co Ltd.

- 13.3. Herc Rentals Inc.

- 13.4. Hitachi Construction Machinery Co., Ltd

- 13.5. Caterpillar Inc.

- 13.6. Loxam Group

- 13.7. Liebherr

- 13.8. H&E Equipment Services, Inc.

- 13.9. Boels Rental

- 13.10. Ahern Rentals

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us