|

|

市場調査レポート

商品コード

1345417

光干渉断層計の世界市場-2023年~2030年Global Optical Coherence Tomography Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 光干渉断層計の世界市場-2023年~2030年 |

|

出版日: 2023年09月06日

発行: DataM Intelligence

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

光干渉断層計(OCT)の世界市場は、2022年に15億米ドルに達し、2023年から2030年にかけてCAGR 8.7%で成長し、2030年には28億米ドルに達すると予測されています。

光干渉断層計は、ミクロン単位の組織配置をその場でリアルタイムに断面画像化するために光を利用します。光干渉断層計は、非侵襲的なイメージング手順であり、光生検を実施するために採用されます。従来のイメージング・アプローチが利用できない部位で採用されています。OCTは光ファイバーで確立されており、カテーテル、腹腔鏡、内視鏡、手術用プローブなど、体内のイメージングを容易にするツールと組み合わせることができます。

網膜硝子体疾患管理におけるOCTの眼底鏡検査に対する大きな利点は、硝子体、網膜、網膜外膜の3次元的な関連性を把握できることです。OCTの応用には、黄斑円孔、黄斑浮腫、黄斑サッカー、緑内障、加齢黄斑変性、中心性漿液性網膜症、硝子体牽引、糖尿病網膜症など、さまざまな眼疾患の診断が含まれます。現在、OCTは心血管疾患、非黒色腫皮膚がん、前立腺がん、加齢黄斑疾患など、その他の疾患の検出や診断にも利用されています。

光干渉断層計は、主に眼科疾患の症例の増加、合併、買収、製品発売などの市場開拓の増加によって後押しされています。さらに、眼科疾患に関する認識を広めるための取り組みが増加していることや、心血管疾患、非黒色腫皮膚がん、前立腺がん、加齢黄斑疾患など、他の慢性疾患の症例が増加していることも、予測期間における世界市場の成長に寄与しています。

ダイナミクス

眼科疾患の症例増加

不可逆的な失明を引き起こす進行性の視神経障害である緑内障の診断と管理には、早期発見とモニタリングが不可欠です。光干渉断層計(OCT)は、構造的な緑内障の悪化の検出とモニタリングに役立つ、一般的に使用される画像診断法として発展してきました。このように、糖尿病性網膜症の有病率の高さは、予測期間中の世界市場の成長を後押しすると期待されています。例えば、糖尿病性網膜症は、血液中の高血糖レベルに起因する眼の網膜の損傷に関するものです。糖尿病網膜症は、1型糖尿病と2型糖尿病の両方に罹患している数百万人の人々に影響を与える、糖尿病の複雑性であると予想されています。

さらに、他の眼科疾患の症例が増加していることも、予測期間における世界市場の成長に寄与していると予想されます。例えば、WHOの2023年の発表によると、世界全体では少なくとも22億人が近見または遠見の視力障害を抱えており、このうち約10億人の視力障害は回避できた可能性があるか、まだ対処できていないです。多国籍レベルで視力障害や失明の原因のトップは屈折障害と白内障です。

この10億人のうち、遠方の視力障害や失明を引き起こす主な疾患は、9,400万人以上が罹患している白内障、約8,840万人が罹患している屈折異常、800万人以上が罹患している加齢黄斑変性症、約770万人が罹患している緑内障、390万人以上が罹患している糖尿病性網膜症などです。近見視力障害を引き起こす主な疾患は老眼で、約8億2,600万人が影響を受けている加齢性疾患です。

市場開拓の増加

合併、提携、製品発売、買収などを含む市場開拓の増加は、予測期間における世界市場の成長を後押ししています。例えば、2021年11月、ハイデルベルグ・エンジニアリングは、シフト技術を提供し、OCTAとOCTの生産性を向上させ、また、臨床医がよりパーソナライズされた評価のためにOCTスキャンペースを切り替えることを可能にするSpectralisプラットフォームを明らかにしました。Spectralisプラットフォームは、20kHz、85kHz、125kHzの3つのスキャンレートを提供します。

さらに、キヤノン・シンガポールは2021年7月、1回のスキャンで最大23×20mmの高解像度画像を撮影できる革新的な広視野掃引光干渉トポグラフィであるXephilio OCT-S1を発表しました。また、2021年6月には、ペリメーター・メディカル・イメージングAI社が、ミネトロニクス・メディカル社との間で、光干渉断層計(OCT)イメージング装置の製造手法の技術移転を行っています。2021年10月、NIDEKは眼底カメラとOCTを統合したRetina Scan Duo 2を発表しました。Retina Scan Duo 2は、スクリーニングと臨床効果を高める特徴を備えており、さらに臨床ワークフローの強化にも貢献します。

光干渉断層計デバイスの高コスト

光干渉断層計デバイスのコストが高いため、設備投資の少ない開業医は新しい機器を購入する余裕がなく、代わりに再生品を使用するため、市場の成長が鈍化すると予想されます。例えば、ツァイスのPRIMUS 200は約19,999米ドル、同メーカーのOCT cirrus 5000は約15,999米ドル、トプコンのOCT 2000は約7,500米ドル、DRI OCT Tritonは約12,900米ドルです。

光干渉断層計デバイスのコストは、搭載されている機能によって異なります。例えば、Optovue社のiScan OCTは、基本的な機能を搭載している同メーカーのivue OCTが約9,999.00米ドルであるのに対し、簡素化された操作を実現する高度な機能を搭載しているため、基本的な機能を搭載しているものに比べ、高度な機能を搭載しているものは約12,000.00米ドルかかります。

眼科医の労働力不足

眼科医の労働力不足は、予測期間中の世界市場の成長を鈍化させると予想されます。例えば、王立眼科医協会(Royal College of Ophthalmologists)によると、NHSの眼科サービスの大部分はかなりの能力的ストレスに遭遇しており、4分の3以上(76%)のチームは既存の患者のニーズを満たすのに十分な数のコンサルタントを含んでおらず、半数以上(52%)は過去12ヶ月間にコンサルタントを採用するのがさらに困難であることを発見しています。

さらに、2023年1月、イングランドでは眼科の待機患者数が632,000人を超え、そのうち24,000人が1年以上待機しています。眼科の約74%は、12ヶ月前よりも外来患者の滞留が患者の維持に与える影響を懸念しており、63%は外来患者の滞留を緩和するには1年以上かかると評価しています。さらに、労働力のNHS眼科医療支援不足は減少すると予想され、英国の眼科医の4分の1(26%)は今後5年間で労働力を辞めようと考えています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 眼科疾患患者の増加

- 市場開拓の増加

- 抑制要因

- 光干渉断層計デバイスの高コスト

- 眼科医の労働力不足

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- 特許分析

- エンドユーザー動向

- SWOT分析

- DMIの見解

第6章 COVID-19分析

第7章 製品タイプ別

- ハンドヘルド型

- 卓上型

- ドップラー

- カテーテルベース

- その他

第8章 ボリュームスキャン別

- 環状

- ラスター

- ラジアル

- その他

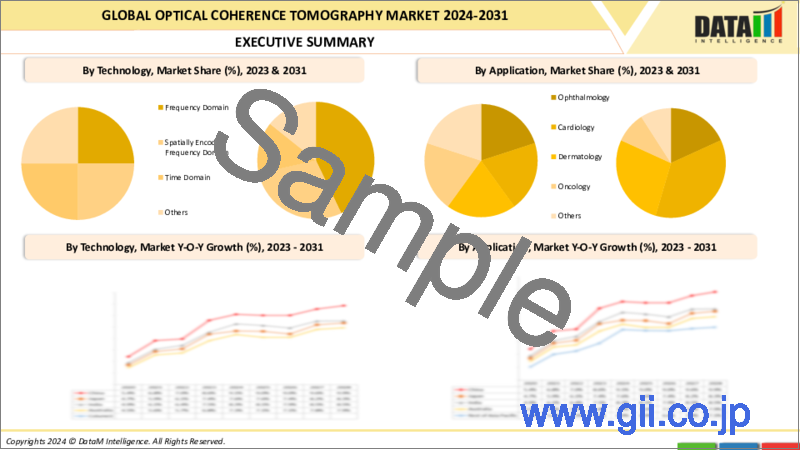

第9章 技術別

- 周波数領域

- 空間エンコード周波数領域

- 時間領域

- その他

第10章 用途別

- 眼科

- 心臓病

- 皮膚科

- 腫瘍

- その他

第11章 エンドユーザー別

- 病院

- 専門クリニック

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- Thorlabs, Inc.

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- ZEISS

- Topcon Corporation

- Leica Microsystems

- NIDEK CO., LTD.

- Heidelberg Engineering Inc.

- Alcon Inc.

- Canon Medical Systems, USA.

- Visionix Ltd.

- Abbott

- Icare USA, Inc.

- OPTOPOL Technology Sp

第15章 企業概要付録

Overview

Global Optical Coherence Tomography Market reached US$ 1.5 billion in 2022 and is expected to reach US$ 2.8 billion by 2030, growing with a CAGR of 8.7% during the forecast period 2023-2030.

Optical coherence tomography utilizes light for the cross-sectional imaging of the tissue arrangement on the micron scale, in situ, and in real time. It is a non-invasive imaging procedure, which is employed to conduct optical biopsies. It is employed in sites where conventional imaging approaches cannot be utilized. OCT is established on fiber optics and can be combined with the tools, like catheters, laparoscopes, endoscopes, and surgical probes, which facilitate imaging of the body.

A significant benefit of OCT over the ophthalmoscopic investigation in vitreoretinal disorder management is the capacity to confine three-dimensional associations between the vitreous, retina, and extraretinal membranes. The applications of OCT enclose the diagnosis of various eye disorders such as the macular hole, macular edema, macular pucker, glaucoma, age-related macular degeneration, central serous retinopathy, vitreous traction, diabetic retinopathy, etc. Presently, OCT is also utilized for the detection and diagnosis of other additional disorders such as cardiovascular diseases, non-melanoma skin cancer, prostate cancer, and age-related macular disease, among other.

The Optical coherence tomography is primarily boosted by the growing cases of opthalmic disorders, increasing market developments including mergers, acquisitions, and product launches among others. Further, the increasing efforts to spread awareness about opthamic disorders and growing cases of other chronic disorders including cardiovascular disorders, non-melanoma skin cancer, prostate cancer, and age-related macular disease, among others are also contributing to the global market growth in the forecast period.

Dynamics

Increasing Cases of Ophthalmic Disorder

Early detection and monitoring are essential to the diagnosis and management of glaucoma, an advanced optic neuropathy that induces irreversible blindness. Optical coherence tomography (OCT) has evolved into a typically employed imaging modality that assists in the detection and monitoring of structural glaucomatous deterioration. Thus, the high prevalence of diabetic retinopathy is expected to boost the global market growth during the forecast period. For instance, the diabetic retinopathy concerns injury to the eye's retina owing to high blood sugar levels in the blood. It is an expected intricacy of diabetes, impacting millions of individuals with both type 1 and type 2 diabetes.

Further, the growing cases of other ophthalmic disorders are also expected to be contributing to the global market growth in the forecast period. For instance, according to the WHO 2023, globally, at least 2.2 billion individuals are with near or distant vision impairment, and out of these around 1 billion vision impairment could have been averted or is yet to be handled. The top reasons for vision impairment and blindness at a multinational level are refractive disorders and cataracts.

Among these 1 billion individuals, the primary disorders inducing distance eyesight impairment or blindness include cataracts affecting over 94 million individuals, refractive error impacting around 88.4 million people, age-related macular degeneration with over 8 million cases, glaucoma affecting about 7.7 million individuals, and the diabetic retinopathy with over 3.9 million cases. The major disorder inducing near eyesight impairment is presbyopia an age-associated disease with around 826 million individuals impacted.

Increasing Number of Market Developments

The increasing number of market developments including, mergers, collaboration, product launches, and takeovers, among others are boosting the global market growth in the forecast period. For instance, in November 2021, Heidelberg Engineering revealed the Spectralis platform, which is provided with shift technology, improves productivity in OCTA and OCT, and also allows clinicians to switch OCT scan pace for a better-personalized assessment. The Spectralis platform delivers three scan rates, 20 kHz, 85 kHz, and 125 kHz.

Moreover, in July 2021, Canon Singapore introduced the Xephilio OCT-S1, an innovative wide-field swept-source optical coherence topography competent for capturing high-resolution images of up to 23×20 mm in a single scan. Also, in June 2021, Perimeter Medical Imaging AI, Inc. conducted the technology transfer of its manufacturing methodology for the production of its optical coherence tomography (OCT) imaging systems with Minnetronix Medical. Again, in October 2021, NIDEK introduced the Retina Scan Duo 2, an integration of a fundus camera and OCT. The Retina Scan Duo 2 is provided with characteristics that enhance screening, and clinical effectiveness, and additionally helps enhance clinical workflow.

High Optical Coherence Tomography Device Cost

The high cost of the optical coherence tomography devices is expected to hamper the global market growth as due to the high cost the practitioners with low capital investments can not afford to buy a new device and instead of which use refurbished ones, slowing the market growth. For instance, the PRIMUS 200 from Zeiss costs around US$ 19,999.00, the OCT cirrus 5000 from the same manufacturer costs about US$ 15,999.00, Topcon OCT 2000 and DRI OCT Triton both from Topocon costs about US$ 7,500.00 and US$ 12,900.00 respectively.

The optical coherence tomography device cost varies based upon the features included the device with advanced features costs more compared to the one with basic features for example iScan OCT from Optovue costs around US$ 12,000.00 as it includes some advanced features which deliver simplified operations while the ivue OCT from the same manufacturer costs about US$ 9,999.00 having basic features.

Opthalmologists Workforce Shortage

The shortage of ophthalmologists workforce is expected to slow the global market growth during the forecast period. For instnace, according to the Royal College of Ophthalmologists, the extensive bulk of NHS ophthalmology services are encountering substantial capability stresses, with more than three-quarters (76%) of teams not including an adequate number of consultants to satisfy existing patient needs and more than a half (52%) discovering it is additionally challenging to recruit consultants over the previous 12 months.

Moreover, in January 2023, there were more than 632,000 patients on ophthalmology waiting checklists in England sole and 24,000 of which were waiting for more than a year. Around 74% of eye units are additionally concerned regarding the effect of outpatient backlogs on patient upkeep than they were 12 months back and 63% assess it might take over a year to alleviate their outpatient backlogs. Further, the workforce's lack of NHS eyecare assistance is expected to decline, with a quarter (26%) of ophthalmologists in the UK thinking to exit the workforce over the next five years.

Segment Analysis

The global optical coherence tomography market is segmented based on product type, volume scan, technology, application, end-user and region.

Cancer Application of OCT Expected to Dominate Market

The oncology application of the OCT is expected to dominate the global market owing to the increasing number of positive outcomes from investigations intended to assess the efficacy of OCT in cancer diagnosis. For instance, in an investigation, investigators corresponded the diagnostic precision of clinical and dermoscopic examination (CDE) with that of CDE integrated with OCT for detecting recurrent or residual BCC post topical therapy of superficial BCC. When utilized in integration with the clinical and dermoscopic study, optical coherence tomography remarkably enhanced the capability to notice recurrent or residual basal cell carcinomas post-topical treatment.

Moreover, in July 2023, a transnational group of investigators improved the procedure of optical coherence tomography (OCT) which carries importance for ophthalmology, dermatology, cardiology, and the early diagnosis of cancer. The work was instructed by the University of Adelaide, Technical University of Denmark (DTU), Aerospace Corp., and the University of St. Andrews.

Also, in August 2022, the Lancet Oncology presented ground-breaking conclusions on Michelson Diagnostics, the UK-based medical device corporation that uses multi-beam Optical Coherence Tomography ('OCT') technology, which can convert patient therapy and maintenance of basal cell carcinomas (BCC). It was inferred that OCT-guided diagnosis, when corresponding to a classic punch biopsy could decrease the number of consultations and invasive approaches by a huge 66%.

Geographical Penetration

Increasing Number of Ophthalmic Disorders Cases in North America

The increasing prevalence of ophthalmic disorders in North America is expected to boost regional market growth in the forecast period. For instance, in the United States independently, almost 12 million individuals aged 40 and overhead encountered eyesight impairment, with almost a million suffering from blindness. The CDC notifies that 17.2% of Americans above 40 years of age have a cataract in at least one eye accounting for around 20.5 million individuals. By 2028, above 30 million individuals are expected to suffer from cataracts. The CDC assesses that 4.1 million Americans are impacted with diabetic retinopathy, and almost 900,000 Americans are threatened with vision-damaging retinopathy.

With the growth in life expectancy, diabetes, and other chronic conditions, the cases of eye disorders are anticipated to increase twofold by the year 2050. Age-related macular degeneration (AMD) is the highly expected reason for irreversible eyesight loss in older adults (70 years and older), with an assessed 9 million Americans suffering from intermediate or progressive AMD. Moreover, in 2021, an assessed 9.6 million individuals in the United States, 26% of those having diabetes encountered eye disease, and almost 2 million suffered the most extreme form, "vision-threatening diabetic retinopathy" (VTDR).

Further, the increasing government initiatives to fight against the growing prevalence of eye disorders in the region also contribute to the regional market growth in the forecast period. For instance, in December 2022, congress declared its long-awaited Fiscal Year (FY) 2023 expenditure ruling, which retains a sum of $6.5 million for vision and eye health agendas at the Centers for Disease Control and Prevention (CDC).

In certain, the omnibus spending ruling would sponsor the Vision Health Initiative (VHI) at $2.5 million in FY2023, a $1 million growth over FY2022. The addition would support measures to revise national preponderance assessments on vision impairment and eye disorder. The CDC's Glaucoma project, which supports community-based agendas that unite high-risk patients to eye care, would persist to be sponsored at $4 million.

COVID-19 Impact Analysis

Presently, ophthalmic practice widely relies on optic coherence tomography (OCT) and optical coherence tomography angiography (OCT-A), which are objective, reliable, and repeatable structural difficulties for both earlier diagnosis and detection of the advancement of various ocular conditions. The missed clinic visits advanced dramatically during the COVID-19 pandemic, particularly among elderly and nonwhite patients. These findings reflect differences in eye care delivery during the pandemic and they indicate possibilities to target barriers to care, even during non-pandemic eras.

However, individuals responded in diverse patterns to COVID-19 conditions. While some individuals produced mild to extreme respiratory issues, others encounter no manifestations at all. Pink eye remained the most typical manifestation of COVID in the eyesight of children and adults. Thus, COVID-19 is estimated to hold intermediate impact over the global market growth in the forecast period.

Russia-Ukraine Impact

The Russia Ukraine conflict is expected to have a very little impact over the global market, since the foremost weeks of the attack, Eyes on Ukraine, a humanitarian effort directed by ophthalmologists from across the nation, has been raising funds and shipping medication and surgical supplies to Ukraine ophthalmologists, with multiple reports from hospitals and war crews close to the front that the cargoes are making a general distinction.

Obtaining reserves into the nation, however, has demanded invention and the forging of a trusted network of people, including European ophthalmologists and Polish and Ukrainian mountain defenses, to assure safe transportation of the goods via Poland to Western Ukraine. There, they are distributed by the Ukrainian Vitreoretinal Society to where they are needed considerable. The initiative is believed to be the most active and organized humanitarian help initiatives sustaining eye trauma in the Russian invasion of Ukraine.

By Product Type

- Handheld

- Tabletop

- Doppler

- Catheter Based

- Others

By Volume Scan

- Annular

- Raster

- Radial

- Others

By Technology

- Frequency Domain

- Spatially Encoded Frequency Domain

- Time Domain

- Others

By Application

- Ophthalmology

- Cardiology

- Dermatology

- Oncology

- Others

By End-User

- Hospitals

- Specialty Clinics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In January 2023, Thorlabs acquired JML Optical, a US-based precision optics firm. The acquisition of JML Optical broadens Thorlabs' optical elements offerings. Cashing on JML's optic abilities and manufacturing & innovation presence in Rochester, New York allows Thorlabs to provide revolutionary innovations for the photonics market.

- In February 2023, NIDEK launched AL-Scan M Optical Biometer and MV-1 Myopia Viewer software. The AL-Scan is crucial for assessing young children and provides smooth patient flow. The biometer measures axial length, which is believed to be an perfect parameter for evaluating myopia.

- In October 2022, the European Association of Neurosurgical Societies and ZEISS Medical Technology formed a strategic cooperation (EANS). The business expects that through this association, it expects to be capable of assisting in the training and additional education of neurosurgical professionals, facilitating the exchange of knowledge between users and medical equipment manufacturers, and enhancing scientific progress in the domain of neurosurgery.

Competitive Landscape

The major global players in the market include: Thorlabs, Inc., ZEISS, Topcon Corporation, Leica Microsystems, NIDEK CO., LTD., Heidelberg Engineering Inc., Alcon Inc., Canon Medical Systems, USA., Visionix Ltd. , Abbott, Icare USA, Inc., and OPTOPOL Technology Sp among others.

Why Purchase the Report?

- To visualize the global optical coherence tomography market segmentation based on product type, volume scan, technology, application, end-user and region as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of optical coherence tomography market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key product of all the major players.

The global optical coherence tomography market report would provide approximately 61 tables, 58 figures and 186 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product Type

- 3.2. Snippet by Volume Scan

- 3.3. Snippet by Technology

- 3.4. Snippet by Application

- 3.5. Snippet by End-User

- 3.6. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Cases of Ophthalmic Disorder

- 4.1.1.2. Increasing Number of Market Developments

- 4.1.2. Restraints

- 4.1.2.1. High Optical Coherence Tomography Device Cost

- 4.1.2.2. Ophthalmologists Workforce Shortage

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Patent Analysis

- 5.6. End-User Trend

- 5.7. SWOT Analysis

- 5.8. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 7.1.2. Market Attractiveness Index, By Product Type

- 7.2. Handheld*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.2.3. Tabletop

- 7.2.4. Doppler

- 7.2.5. Catheter Based

- 7.2.6. Others

8. By Volume Scan

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Volume Scan

- 8.1.2. Market Attractiveness Index, By Volume Scan

- 8.2. Annular*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.2.3. Raster

- 8.2.4. Radial

- 8.2.5. Others

9. By Technology

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 9.1.2. Market Attractiveness Index, By Technology

- 9.2. Frequency Domain*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Spatially Encoded Frequency Domain

- 9.4. Time Domain

- 9.5. Others

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Ophthalmology*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Cardiology

- 10.4. Dermatology

- 10.5. Oncology

- 10.6. Others

11. By End-User

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.1.2. Market Attractiveness Index, By End-User

- 11.2. Hospitals*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Specialty Clinics

- 11.4. Others

12. By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Volume Scan

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Volume Scan

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. UK

- 12.3.8.3. France

- 12.3.8.4. Italy

- 12.3.8.5. Spain

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Volume Scan

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Volume Scan

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. Australia

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Volume Scan

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

13. Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Company Profiles

- 14.1. Thorlabs, Inc.*

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Financial Overview

- 14.1.4. Key Developments

- 14.2. ZEISS

- 14.3. Topcon Corporation

- 14.4. Leica Microsystems

- 14.5. NIDEK CO., LTD.

- 14.6. Heidelberg Engineering Inc.

- 14.7. Alcon Inc.

- 14.8. Canon Medical Systems, USA.

- 14.9. Visionix Ltd.

- 14.10. Abbott

- 14.11. Icare USA, Inc.

- 14.12. OPTOPOL Technology Sp

LIST NOT EXHAUSTIVE

15. Appendix

- 15.1. About Us and Services

- 15.2. Contact Us