|

|

市場調査レポート

商品コード

1325321

機能性食品成分の世界市場-2023年~2030年Global Functional Food Ingredients Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 機能性食品成分の世界市場-2023年~2030年 |

|

出版日: 2023年08月04日

発行: DataM Intelligence

ページ情報: 英文 190 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

世界の機能性食品成分市場は2022年に844億米ドルに達し、2023-2030年の予測期間中にCAGR 7.1%で成長し、2030年には1,478億米ドルに達すると予測されています。機能性食品成分市場では、個別化栄養の動向が高まっています。消費者は、特定の栄養ニーズや目標に対応するオーダーメイドのソリューションを求めています。

機能性食品成分市場は世界的に大きな成長を遂げています。消費者は、基本的な栄養を超えた健康上のメリットを提供する食品を求めるようになってきています。主な促進要因には、予防医療への注目の高まりと、自然で健康増進に役立つソリューションへの需要が含まれます。プロバイオティクス、食物繊維、ビタミンなどの機能性食品成分は、消費者が自分の健康を優先するにつれて需要が高まっています。

クリーンラベルの動向は、機能性食品成分市場における顕著な動きです。消費者は、認知度の高い天然素材に焦点を当てた、食品表示の透明性と簡便性の向上を求めています。例えば、エンドウタンパク質やココナッツ油のような植物由来の機能性食品成分は、クリーンラベルのトレンドに合致しているため、需要が増加しています。

市場力学

イノベーションと製品開拓が機能性食品成分市場を牽引する

機能性食品成分市場の動向はイノベーションと市場開拓に向かっており、これが機能性食品成分市場の牽引役として重要な役割を果たしています。機能性食品に対する消費者の需要が増加する中、メーカーは研究開発に投資し、新しく改良された原料を生み出しています。メーカー各社は、こうした成分の機能性と有効性を高めるため、新規の供給源、抽出方法、配合を模索しています。

この原動力は絶え間ないイノベーションを促進し、進化する消費者ニーズに対応するユニークで魅力的な機能性食品成分を導入することで、市場を前進させます。新しい生物活性化合物の発見であれ、革新的な送達システムの開発であれ、機能性食品成分技術の進歩は市場の成長と拡大に寄与します。

予防医療とウェルネスへの関心の高まりが機能性食品成分市場の成長を促進する

消費者は健康を維持し、健康上の問題を回避することに関心が高まっています。消費者は健康を促進するために機能性食品を毎日の食事に取り入れています。健康志向の人々は、抗酸化物質、プロバイオティクス、オメガ 3系脂肪酸などの機能性食品要素を求めています。優れた食生活が病気を避け、全般的な健康を維持する上で重要であるという認識が、この動向を後押ししています。

その結果、全体的な健康をサポートしながら特定の健康上の利点をもたらす機能性食品成分に対する需要が高まっています。この傾向が機能性食品成分市場を前進させています。さらに、健康の専門家や栄養士が機能性食品成分の利点を積極的に宣伝し、消費者の認識と採用を促進しています。

高い生産コストが機能性食品成分の入手を制限する

機能性食品成分市場における主な抑制要因は、これらの素材の生産と食品への組み込みに関連するコストの高さです。機能性食品成分はしばしば専門的な調達、加工、配合技術を必要とするため、生産コストが上昇する可能性があります。その結果、機能性食品製品の価格が上昇し、消費者市場の一部で機能性食品を利用しにくくなる可能性があります。

高い製造コストと限られた規模の経済性は、機能性食品に競争力のある価格設定を実現する上での課題となります。こうした市場抑制要因を克服し、品質を損なうことなく機能性食品成分のコスト効率を高める方法を見出すことは、機能性食品の市場範囲を拡大し、より幅広い消費者層が機能性食品を利用しやすくすることに役立ちます。

COVID-19影響分析

COVID-19分析には、COVID前シナリオ、COVIDシナリオ、COVID後シナリオに加え、価格動向(COVID前シナリオと比較したパンデミック中およびパンデミック後の価格変動を含む)、需給スペクトラム(取引制限、封鎖、およびその後の問題による需給の変化)、政府の取り組み(政府機関による市場、セクター、業界を活性化させる取り組み)、メーカーの戦略的取り組み(COVID問題を緩和するためにメーカーが行ったことをここで取り上げる)が含まれます。

目次

第1章 調査手法と調査範囲

第2章 市場の定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場への影響要因

- 促進要因

- 抑制要因

- 機会

- 影響分析

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 タイプ別

- ビタミン

- ミネラル

- プレバイオティクス

- オメガ3&6脂肪酸

- エッセンシャルオイル

- ハイドロコロイド

- その他

第8章 用途別

- 菓子

- 乳製品

- 大豆製品

- 果物・野菜

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第10章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第11章 企業プロファイル

- Kerry Inc.

- 企業概要

- 製品ポートフォリオと説明

- 財務概要

- 主な動向

- BENEO

- Cargill, Inc.

- Koninklijke Dsm N.V.

- Archer Daniels Midland Company

- Ingredion Inc.

- DuPont.

- Tate & Lyle

- Chr. Hansen

- Kemin Industries

第12章 付録

Market Overview

Global Functional Food Ingredients Market reached US$ 84.4 billion in 2022 and is expected to reach US$ 147.8 billion by 2030 growing with a CAGR of 7.1% during the forecast period 2023-2030. The rising trend of personalized nutrition is gaining traction in the functional food ingredients market. Consumers are seeking tailored solutions that address their specific nutritional needs and goals.

The functional food ingredients market is experiencing significant growth globally. Consumers are increasingly seeking food products that offer health benefits beyond basic nutrition. Key drivers include the rising focus on preventive healthcare and the demand for natural, health-promoting solutions. Functional food ingredients such as probiotics, fiber, and vitamins are in high demand as consumers prioritize their well-being.

The clean label trend is a prominent movement in the functional food ingredients market. Consumers are demanding greater transparency and simplicity in food product labeling, with a focus on recognizable and natural ingredients. For example, there is an increasing demand for functional food ingredients derived from plant-based sources, such as pea protein and coconut oil, as they align with the clean-label trend.

Market Dynamics

Innovation and Product Development Driving Functional Food Ingredients Market

The functional food ingredients market trend is towards Innovation and product development, which play a crucial role in driving the functional food ingredients market. With increasing consumer demand for functional foods, manufacturers are investing in research and development to create new and improved ingredients. They are exploring novel sources, extraction methods, and formulations to enhance the functionality and effectiveness of these ingredients.

This driver fuels continuous innovation and drives the market forward by introducing unique and compelling functional food ingredients to meet evolving consumer needs. Whether it's the discovery of new bioactive compounds or the development of innovative delivery systems, advancements in functional food ingredient technology contribute to the market's growth and expansion.

Growing Focus on Preventive Healthcare and Wellness Driving Functional food ingredients Market Growth

Consumers are more concerned about remaining healthy and avoiding health problems. They are introducing functional foods into their everyday meals to promote their well-being. Health-conscious people seek for functional food elements such as antioxidants, probiotics, and omega-3 fatty acids. The realization that an excellent diet is important in avoiding illnesses and preserving general well-being is driving the trend.

As a result, there is a rising demand for functional food components that provide particular health advantages while also supporting overall wellness. This tendency is propelling the functional food ingredients market forward. Additionally, health professionals and nutritionists are actively promoting the benefits of functional food ingredients, driving consumer awareness and adoption.

Higher Production Costs Limit Availability of Functional Food Ingredients

The key restraint in the functional food ingredients market is the higher cost associated with the production and incorporation of these ingredients into food products. Functional food ingredients often require specialized sourcing, processing, and formulation techniques, which can drive up production costs. This can result in higher prices for functional food products, making them less accessible to a portion of the consumer market.

The higher production costs and limited economies of scale can pose challenges in achieving competitive pricing for functional food products. Overcoming these cost-related restraints and finding ways to make functional food ingredients more cost-effective without compromising quality can help to expand their market reach and make them more accessible to a broader consumer base.

COVID-19 Impact Analysis

The COVID-19 Analysis includes Pre-COVID Scenario, COVID Scenario, and Post-COVID Scenario along with Pricing Dynamics (Including pricing change during and post-pandemic comparing it to pre-COVID scenarios), Demand-Supply Spectrum (Shift in demand and supply owing to trading restrictions, lockdown, and subsequent issues), Government Initiatives (Initiatives to revive market, sector or Industry by Government Bodies) and Manufacturers Strategic Initiatives (What manufacturers did to mitigate the COVID issues will be covered here).

Segment Analysis

The global functional food ingredients market has been segmented by type, application, and region.

Dairy Products Dominating the Functional Food Ingredients Market with a 30% Share

The global functional food ingredients market has been segmented by application into confectionaries, dairy products, soy products, and fruits & vegetables.

The highest share-holding application segment in the functional food ingredients market is dairy products, accounting for approximately 30% of the market share. Dairy products are used in various platforms for incorporating a range of functional food ingredients, including nutraceutical ingredients, bioactive ingredients, health-promoting ingredients, and fortification ingredients. Health-promoting ingredients like fiber contribute to overall well-being.

Fortification ingredients, such as minerals and essential nutrients, address nutritional deficiencies. Dairy products serve as a carrier for these functional food ingredients, providing consumers with convenient and nutritious options. The significant market share of dairy products demonstrates the popularity and importance of incorporating various functional food ingredients to enhance the nutritional value and health benefits of these products.

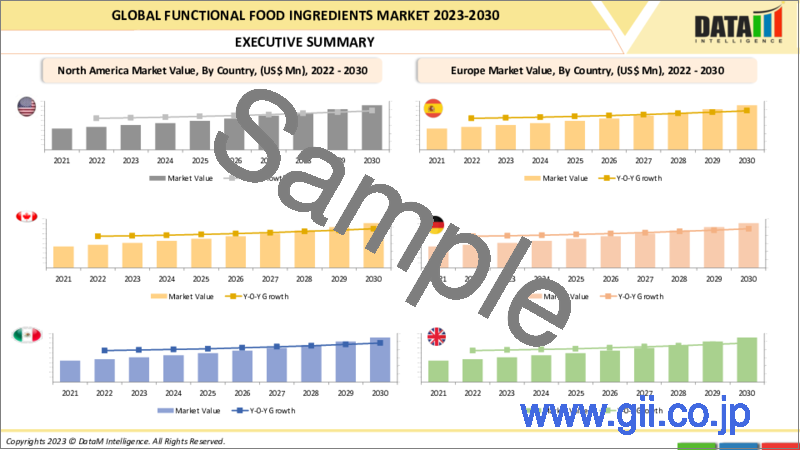

Geographical Analysis

Asia Pacific Emerges as a Growing Force in the Functional food ingredients Market

By region, the global functional food ingredients market is segmented into North America, South America, Europe, Asia-Pacific, Middle-east, and Africa.

The Asia-Pacific region's functional food ingredients market is witnessing substantial growth, driven by the increasing demand for dietary supplements, probiotics, prebiotics, fiber ingredients, and omega-3 fatty acids. These functional food ingredients cater to the rising consumer focus on health and wellness. The functional food ingredients market share in the Asia-Pacific region is expanding as consumers prioritize preventive healthcare and seek products that offer specific health benefits.

With a growing population and increasing disposable incomes, the functional food ingredients market size in the region is projected to reach significant levels. The combination of dietary supplements, probiotics, prebiotics, fiber ingredients, and omega-3 fatty acids is driving the market's growth, offering ample opportunities for manufacturers and suppliers in the Asia-Pacific functional food ingredients market.

Competitive Landscape

The major global players in the market include Kerry Inc., BENEO, Cargill, Inc., Koninklijke Dsm N.V., Archer Daniels Midland Company, Ingredion Inc., DuPont., Tate & Lyle, Chr. Hansen, and Kemin Industries.

Why Purchase the Report?

- To visualize the global functional food ingredients market segmentation based on type, application, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of functional food ingredients market-level with all segments.

- The PDF report consists of a cogently put-together market analysis after exhaustive qualitative interviews and an in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The global functional food ingredients market report would provide approximately 53 tables, 51 figures, and 190 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Market Definition and Overview

3. Executive Summary

- 3.1. Market Snippet, by Type

- 3.2. Market Snippet, by Application

- 3.3. Market Snippet, by Region

4. Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.2. Restraints

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19 on the Market

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Scenario Post COVID-19

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturer's Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Vitamins*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Minerals

- 7.4. Prebiotics

- 7.5. Omega-3 & 6 Fatty Acids

- 7.6. Essential Oils

- 7.7. Hydrocolloids

- 7.8. Others

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Confectionaries*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Dairy Products

- 8.4. Soy Products

- 8.5. Fruits & vegetables

9. By Region

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 9.1.2. Market Attractiveness Index, By Region

- 9.2. North America*

- 9.2.1. Introduction

- 9.2.2. Key Region-Specific Dynamics

- 9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1. The U.S.

- 9.2.5.2. Canada

- 9.2.5.3. Mexico

- 9.3. Europe

- 9.3.1. Introduction

- 9.3.2. Key Region-Specific Dynamics

- 9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1. Germany

- 9.3.5.2. The U.K.

- 9.3.5.3. France

- 9.3.5.4. Italy

- 9.3.5.5. Spain

- 9.3.5.6. Rest of Europe

- 9.4. South America

- 9.4.1. Introduction

- 9.4.2. Key Region-Specific Dynamics

- 9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1. Brazil

- 9.4.5.2. Argentina

- 9.4.5.3. Rest of South America

- 9.5. Asia-Pacific

- 9.5.1. Introduction

- 9.5.2. Key Region-Specific Dynamics

- 9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1. China

- 9.5.5.2. India

- 9.5.5.3. Japan

- 9.5.5.4. Australia

- 9.5.5.5. Rest of Asia-Pacific

- 9.6. Middle East and Africa

- 9.6.1. Introduction

- 9.6.2. Key Region-Specific Dynamics

- 9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10. Competitive Landscape

- 10.1. Competitive Scenario

- 10.2. Market Positioning/Share Analysis

- 10.3. Mergers and Acquisitions Analysis

11. Company Profiles

- 11.1. Kerry Inc.

- 11.1.1. Company Overview

- 11.1.2. Product Portfolio and Description

- 11.1.3. Financial Overview

- 11.1.4. Key Developments

- 11.2. BENEO

- 11.3. Cargill, Inc.

- 11.4. Koninklijke Dsm N.V.

- 11.5. Archer Daniels Midland Company

- 11.6. Ingredion Inc.

- 11.7. DuPont.

- 11.8. Tate & Lyle

- 11.9. Chr. Hansen

- 11.10. Kemin Industries

LIST NOT EXHAUSTIVE

12. Appendix

- 12.1. About Us and Services

- 12.2. Contact Us