|

|

市場調査レポート

商品コード

1319165

油糧種子加工の世界市場-2023年~2030年Global Oilseed Processing Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 油糧種子加工の世界市場-2023年~2030年 |

|

出版日: 2023年07月31日

発行: DataM Intelligence

ページ情報: 英文 151 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

世界の油糧種子加工市場は、2022年に3,125億米ドルを記録し、2030年には6,272億米ドルに達すると予測されています。予測期間2023-2030年のCAGRは4.5%です。

健康的で持続可能な食生活への注目が高まる中、植物性タンパク質源に対する需要が高まっています。油糧種子加工は、分離大豆タンパク質や濃縮大豆タンパク質のようなタンパク質が豊富な製品の生産において重要な役割を果たしています。同市場では、食品、飲料、飼料用途でこれらの製品に対する需要が増加しています。

抽出技術の絶え間ない進歩により、油糧種子加工の効率と収量が向上しています。無溶媒抽出法、酵素支援抽出法、超臨界流体抽出法などの革新的技術が脚光を浴びています。これらの技術は、溶媒使用量の削減、油の品質の向上、環境への影響の低減といった利点をもたらします。したがって、抽出技術の進歩により、油糧種子加工市場は成長しています。

市場力学

植物油の需要増加が油糧種子加工市場の成長を牽引しています

植物油は飽和脂肪含量が低く、不飽和脂肪含量が高いため、特定の動物性脂肪や固形脂肪に代わる健康的な代替品と考えられています。健康と栄養が重視されるようになり、消費者は食生活に植物油を選ぶようになっています。例えば、米国農務省によると、2022年8月の世界の植物油生産量は84万トン増の2億1,905万トンでした。心臓病のリスク低減など、植物油に関連する健康上の利点に対する認識が、これらの油の需要、ひいては油糧種子加工市場を牽引しています。

植物油には、バイオ燃料、潤滑油、油脂化学製品、パーソナルケア製品など、さまざまな産業用途があります。再生可能なエネルギー源としてのバイオ燃料の需要の増加や、化粧品やパーソナルケアなどの産業における天然で持続可能な成分の人気の高まりが、植物油の需要を促進し、油糧種子加工市場の成長を刺激しています。

バイオ燃料需要の高まりが油糧種子加工市場の成長を促進

化石燃料に比べて温室効果ガスの排出量が少ないといったバイオ燃料の環境上の利点が、その需要の増加に寄与しています。国際エネルギー機関(IEA)によると、最も可能性の高いシナリオでは、バイオ燃料の需要は2021年から2026年の間に410億リットル(28%)増加します。油糧種子由来のバイオ燃料は、従来の化石燃料よりも持続可能で環境に優しい代替燃料と考えられています。バイオ燃料原料の需要を満たすために、より多くの油糧種子が栽培・加工されるため、このような環境持続性への関心の高まりが、油糧種子加工産業の市場成長を後押ししています。

大豆、菜種、パームなどの多くの油糧種子は、バイオディーゼル生産の重要な原料として機能します。これらの油糧種子は油糧種子加工を経て油を抽出し、トランスエステル化などの変換工程を経てバイオディーゼルに変換されます。再生可能で環境に優しい代替燃料としてのバイオディーゼル需要の増加が、油糧種子加工の必要性を高め、市場の成長に寄与しています。

環境と持続可能性への懸念が市場成長の妨げになる可能性

油糧種子、特にパーム油や大豆のような作物の栽培は、特定の地域における森林伐採や土地利用の変化と関連しています。油糧種子生産のための森林伐採や土地転換は、生息地の消失、生物多様性の枯渇、炭素排出量の増加など、環境に悪影響を及ぼす可能性があります。森林伐採を減らし、持続可能な土地利用を促進することに重点を置いた意識向上と規制措置により、特定の地域における油糧種子栽培と加工の拡大を制限することができます。

消費者は、特にパーム油や大豆のような油糧種子の生産において、透明性とトレーサビリティを求めるようになっています。持続可能なパーム油に関する円卓会議(RSPO)や責任ある大豆に関する円卓会議(RTRS)のような認証制度は、持続可能な慣行を促進し、油糧種子の倫理的な調達を保証することを目的としています。認証基準を遵守し、トレーサビリティ要件を満たすことは、油糧種子加工業者にとって、特にそのサプライチェーンが複数の関係者や地域を含む場合、困難となる可能性があります。

COVID-19影響分析

COVID-19分析には、COVID前シナリオ、COVIDシナリオ、COVID後シナリオに加え、価格力学(COVID前シナリオと比較したパンデミック中およびパンデミック後の価格変動を含む)、需給スペクトラム(取引制限、封鎖、およびその後の問題による需給のシフト)、政府の取り組み(政府機関による市場、セクター、産業を復興させる取り組み)、メーカーの戦略的取り組み(COVID問題を緩和するためにメーカーが行ったことをここで取り上げる)が含まれます。

AIの影響

AIは、品質、サイズ、不純物レベルに基づいて種子の選別と等級付けを自動化することにより、種子の洗浄効率を高めるために採用することができます。マシンビジョンやディープラーニングなどのAI技術は、オイル抽出プロセスの自動化に採用できます。AIは、センサーやアクチュエーターからのデータを分析して圧搾力、温度、圧搾時間を制御することで、機械的圧搾作業を最適化することができます。

AIは、センサーやアクチュエーターからのデータを分析し、圧搾力、温度、時間を制御することで、機械的圧搾作業を最適化できます。AIは、センサーデータを解析して温度、圧力、化学物質の投与量などのパラメーターを制御することにより、石油精製プロセスを最適化することができます。 AIは、リアルタイムのセンサーデータに基づいて脱ガム剤の投与量、温度、反応時間を監視・制御することにより、脱ガムプロセスを改善することができます。AIは、処理プロセス中の水分含有量、温度、その他の環境要因を監視・制御することにより、種子のコンディショニングを最適化することができます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 圧搾量の増加と人口増加に伴う油糧種子需要の増加

- 飼料用油糧種子の使用量の増加

- 抑制要因

- 商品価格の変動

- 機会

- 多くの最終用途産業における油糧種子の使用の増加

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 製品タイプ別

- 大豆

- 菜種

- ひまわり

- 綿実

- その他

第8章 プロセス別

- 機械

- 化学

第9章 用途別

- 食品

- 飼料

- 工業

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- ADM

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Bunge Ltd.

- Cargill, Inc.

- EFKO Group

- ITOCHU Corporation

- Louis Dreyfus Company B.V.

- Richardson International Ltd.

- Wilmar International Ltd.

- Chs Inc.

- Ag Processing Inc

第13章 付録

Market Overview

The Global Oilseed Processing Market US$ 312.5 billion in 2022 and is projected to witness lucrative growth by reaching up to US$ 627.2 billion by 2030. The market is growing at a CAGR of 4.5% during the forecast period 2023-2030.

With the growing focus on healthy and sustainable diets, there is a rising demand for plant-based protein sources. Oilseed processing plays a crucial role in producing protein-rich products such as soy protein isolates and concentrates. The market is witnessing an increased demand for these products in food, beverage, and animal feed applications.

Continuous advancements in extraction technologies are improving the efficiency and yield of oilseed processing. Innovations such as solvent-free extraction methods, enzyme-assisted extraction, and supercritical fluid extraction are gaining prominence. These technologies offer benefits such as reduced solvent usage, improved oil quality, and reduced environmental impact. Hence, with Advancements in Extraction Technologies, the Oilseed Processing market is growing.

Market Dynamics

Increasing Demand for Vegetable Oils is driving the oilseed processing market's growth

Vegetable oils are considered healthier alternatives to certain animal fats and solid fats due to their lower saturated fat content and higher levels of unsaturated fats. With a growing emphasis on health and nutrition, consumers are opting for vegetable oils in their diets. For instance, according to USDA, global vegetable oil production increased by 0.84 million tonnes to 219.05 million tonnes in August 2022. The awareness of the health benefits associated with vegetable oils, such as the reduced risk of heart disease, is driving the demand for these oils and, consequently, the oilseed processing market.

Vegetable oils have various industrial applications, including biofuels, lubricants, oleo chemicals, and personal care products. The increasing demand for biofuels as a renewable energy source, as well as the growing popularity of natural and sustainable ingredients in industries such as cosmetics and personal care, is driving the demand for vegetable oils and stimulating the growth of the oilseed processing market.

Rising Demand for Biofuels is Driving the Market Growth of the Oilseed Processing Market

The environmental benefits of biofuels, such as lower greenhouse gas emissions compared to fossil fuels, contribute to their increasing demand. According to International Energy Agency, in the most likely scenario, the demand for biofuels will increase by 41 billion liters, or 28%, between 2021 and 2026. Biofuels derived from oilseeds are considered more sustainable and eco-friendly alternatives to conventional fossil fuels. This growing concern for environmental sustainability drives the market growth of the oilseed processing industry as more oilseeds are cultivated and processed to meet the demand for biofuel feedstocks.

Many oilseeds, such as soybeans, rapeseed, and palm, serve as important feedstocks for biodiesel production. These oilseeds undergo oilseed processing to extract oil, which is then converted into biodiesel through transesterification or other conversion processes. The increasing demand for biodiesel as a renewable and environmentally friendly fuel alternative drives the need for oilseed processing and contributes to market growth.

Environmental and Sustainability Concerns can Hamper the Market Growth

Oilseed cultivation, particularly for crops like palm oil and soybeans, has been associated with deforestation and land-use change in certain regions. The clearing of forests and conversion of land for oilseed production can have adverse environmental impacts, including habitat loss, biodiversity depletion, and increased carbon emissions. Increasing awareness and regulatory actions focused on reducing deforestation and promoting sustainable land use can limit the expansion of oilseed cultivation and processing in certain areas.

Increasingly, consumers are demanding transparency and traceability in the production of oilseed-based products, particularly for commodities like palm oil and soybeans. Certification schemes, such as Roundtable on Sustainable Palm Oil (RSPO) and Round Table on Responsible Soy (RTRS), aim to promote sustainable practices and ensure the ethical sourcing of oilseeds. Compliance with certification standards and meeting traceability requirements can be challenging for oilseed processors, particularly if their supply chains involve multiple actors and regions.

COVID-19 Impact Analysis

The COVID-19 Analysis includes Pre-COVID Scenario, COVID Scenario and Post-COVID Scenario along with Pricing Dynamics (Including pricing change during and post-pandemic comparing it with pre-COVID scenarios), Demand-Supply Spectrum (Shift in demand and supply owing to trading restrictions, lockdown, and subsequent issues), Government Initiatives (Initiatives to revive market, sector or Industry by Government Bodies) and Manufacturers Strategic Initiatives (What manufacturers did to mitigate the COVID issues will be covered here).

AI Impact

AI can be employed to enhance seed cleaning efficiency by automating the sorting and grading of seeds based on their quality, size, and impurity levels. AI techniques, such as machine vision and deep learning, can be employed to automate oil extraction processes. AI can optimize mechanical pressing operations by analyzing data from sensors and actuators to control the pressing force, temperature, and duration.

AI can optimize mechanical pressing operations by analyzing data from sensors and actuators to control the pressing force, temperature, and duration. AI can optimize the oil refining process by analyzing sensor data to control parameters such as temperature, pressure, and chemical dosages AI can improve degumming processes by monitoring and controlling the degumming agent dosage, temperature, and reaction time based on real-time sensor data. AI can optimize seed conditioning by monitoring and controlling the moisture content, temperature, and other environmental factors during the treatment process.

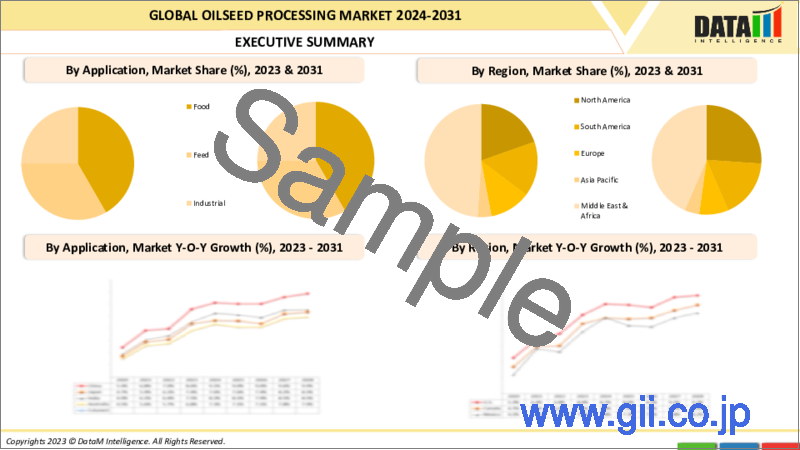

Segment Analysis

The global oilseed processing market is segmented based on product type, category, application, and region.

The Rising Demand for Soy Products is Driving the Segment's Growth

In 2022, the soybean segment accounts for the highest market share. Soybeans are one of the most widely cultivated oilseed crops globally. For instance, according to FAO, the United States produced 120707.23 kilotonnes of soybeans in 2021. Soybean are known for their high oil content, which makes them a valuable source for oil extraction. Moreover, soybeans have versatile applications, with their oil being used in various industries such as food processing, feed production, biodiesel production, and industrial applications.

Soybeans are not only processed for oil extraction but also for the production of various soy products such as soybean meal, soy protein isolates, and soy flour. Soybean meal, a byproduct of oil extraction, is widely used as a high-protein animal feed ingredient. The demand for soy products, both domestically and internationally, has driven the growth of the soybean processing industry.

Geographical Analysis

Growing Population and Consumption of Oilseed Derivatives in the Asia-Pacific Region

Asia Pacific has a large and rapidly growing population, which drives the demand for vegetable oils and oilseed-derived products. For instance, according to an FAO, November 2020 report, India, the world's top importer of vegetable oils such as palm kernel, coconut, and cottonseed oil, is expected to keep up a strong import growth of 3.2% per year because of a growing global population and rising earnings. The consumption of cooking oils, margarine, shortenings, and other edible oil products is substantial in countries across the region. As a result, the oilseed processing industry in the Asia Pacific has expanded to meet the growing domestic demand.

Economic growth in many Asia Pacific countries has led to an increase in disposable income and changes in dietary patterns. As people's income levels rise, there is a shift toward a more diversified and higher-quality diet, including an increased consumption of edible oils and oilseed-based products. This trend further stimulates the demand for oilseed processing in the region.

Competitive Landscape

The major global players include: ADM, Bunge Ltd., Cargill, Inc., EFKO Group, ITOCHU Corporation, Louis Dreyfus Company B.V., Richardson International Ltd., Wilmar International Ltd., Chs Inc., and Ag Processing

Why Purchase the Report?

- To visualize the global castor 0il market segmentation based on product type, Process, application and region understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of oilseed processing market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The Global Oilseed Processing Market Report Would Provide Approximately 61tables, 58 Figures, And 151 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product Type

- 3.2. Snippet by Process

- 3.3. Snippet by Application

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. The Rise in Demand for the Oilseed With the Increased Crushing and Growing Population

- 4.1.1.2. Increasing Usage Of Oilseeds in Animal Feed

- 4.1.2. Restraints

- 4.1.2.1. Volatility in Commodity Prices

- 4.1.3. Opportunity

- 4.1.3.1. Increasing use of Oilseed across Numerous End-Use Industries

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario Present COVID

- 6.1.3. Scenario During COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 7.1.2. Market Attractiveness Index, By Product Type

- 7.2. Soybean*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Rapeseed

- 7.4. Sunflower

- 7.5. Cottonseed

- 7.6. Others

8. By Process

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 8.1.2. Market Attractiveness Index, By Process

- 8.2. Mechanical*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Chemical

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Food*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Feed

- 9.4. Industrial

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis andY-o-Y Growth Analysis (%), By Country

- 10.2.6.1. The U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. The UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Process

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. ADM*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Bunge Ltd.

- 12.3. Cargill, Inc.

- 12.4. EFKO Group

- 12.5. ITOCHU Corporation

- 12.6. Louis Dreyfus Company B.V.

- 12.7. Richardson International Ltd.

- 12.8. Wilmar International Ltd.

- 12.9. Chs Inc.

- 12.10. Ag Processing Inc

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us