|

|

市場調査レポート

商品コード

1304556

モリブデンの世界市場-2023年~2030年Global Molybdenum Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| モリブデンの世界市場-2023年~2030年 |

|

出版日: 2023年07月07日

発行: DataM Intelligence

ページ情報: 英文 187 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

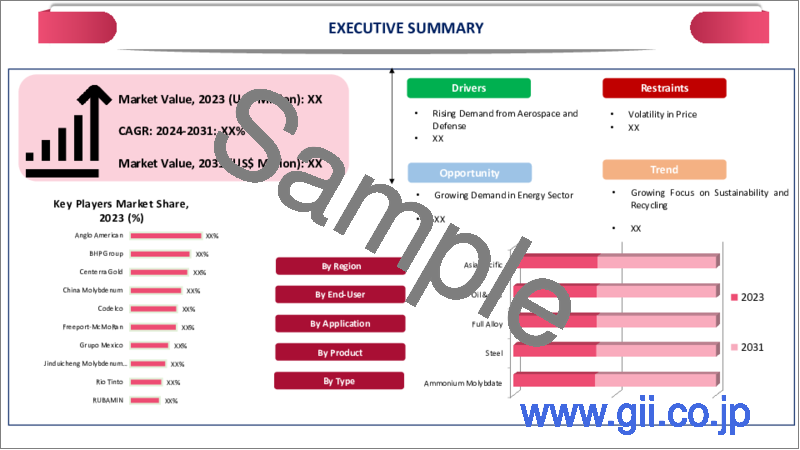

世界のモリブデン市場は、2022年に82億米ドルに達し、2023-2030年の予測期間中にCAGR 4.0%で成長し、2030年には111億米ドルに達すると予測されています。世界のモリブデン市場は、そのダイナミックな市場動向と継続的な成長を特徴としており、幅広い用途と卓越した特性に後押しされています。持続可能性と規制上の制限に関連する市場の課題にもかかわらず、市場は継続的な技術革新と研究開発への投資を通じて回復力を維持しています。

エネルギー効率を優先する産業が増える中、モリブデンは鉄鋼、化学、鋳造など様々な分野で重要な役割を果たし続けています。モリブデンは、鉄鋼、化学、鋳造など様々な分野で重要な役割を担っています。アジア太平洋地域は、人口の多さ、可処分所得の高さ、建設・自動車産業の堅調な成長などの要因により、市場シェアの4分の1以上を占める主要プレーヤーとして際立っています。

中国やインドなどの国々における急速な都市化とインフラ開拓が、鉄鋼・建設用途におけるモリブデン需要に拍車をかけ、同地域における市場機会の急増と市場参入につながっています。さらに、モリブデン製品の中では鉄鋼セグメントが最も急成長しており、市場シェアの半分近くを占めると予測されています。このセグメントの急拡大は、建設および自動車分野での広範な用途に起因しています。

市場力学

モリブデンの採掘と工業用途の増加

モリブデンの埋蔵量と採掘活動は、世界市場で重要な役割を果たしています。戦略的金属であるモリブデンの採掘は、安定供給を保証し、増大する需要を満たします。米国地質調査所(USGS)のデータによると、2020年の世界のモリブデン鉱山生産量は約55万トンに達し、中国が最大の生産国です。安定した採掘事業、持続可能な資源採取方法、採掘セクターを支援する政府の政策は、世界のモリブデン市場の重要な促進要因です。

モリブデンは、特に化学産業において多様な産業用途があります。化学反応における触媒として、また特殊化学品の生産における耐腐食性材料として広く使用されています。

さらに、モリブデンベースの合金は、電子機器の電気接点や部品の製造にも利用されています。特殊化学品の需要増とエレクトロニクス産業の世界の拡大が、モリブデン需要の増加に寄与しています。しかし、工業用途や化学物質の成長に特化した正確な統計データは、政府筋からは容易に入手できない可能性があります。

政府の取り組みと支援

航空宇宙・防衛産業は、世界のモリブデン市場の重要な促進要因です。モリブデンは、その高温強度と耐食性により、航空機部品、ミサイル部品、その他の防衛用途の生産に使用されています。

世界の防衛予算の増加と先進的な軍事技術の開発が進んでいることが、これらの分野でのモリブデン需要に寄与しています。このように、航空宇宙・防衛産業の成長は世界のモリブデン市場の成長に寄与しています。

さらに、政府の支援と有利な政策もモリブデン市場の成長に寄与しています。この地域の政府は、モリブデンの国内生産を促進し、資源の安全保障を確保し、モリブデン関連産業の技術進歩を奨励する施策を実施しています。例えば、中国政府はモリブデンの輸出を規制し、国内消費を優先し、高付加価値モリブデン製品の開発を支援する政策を実施しています。こうした取り組みが世界のモリブデン市場を強化しています。

代替材料による代替と価格変動・為替変動

モリブデン市場は、様々な用途で代替材料による代替という課題に直面しています。エネルギー分野など特定の産業では、再生可能エネルギー源へのシフトが進んでおり、従来のエネルギー用途におけるモリブデン需要が減少する可能性があります。

例えば、よりクリーンなエネルギー源を求めて石炭火力発電所の利用が減少していることは、エネルギーセクターのモリブデン需要に影響を与えます。さらに、類似または改良された特性を持つ発展がモリブデン市場の脅威となり、成長の抑制につながっています。

価格変動と為替変動は、世界のモリブデン市場に大きな課題をもたらしています。モリブデン価格は、世界の需給力学や市場の思惑に基づいて変動します。こうした価格変動はモリブデン生産者の収益性に影響を与え、市場の成長に影響を及ぼす可能性があります。

さらに、為替変動は、特にモリブデンの輸出入に大きく依存する国々にとって、市場力学をさらに複雑にする可能性があります。不利な為替レートは貿易を妨げ、市場に不確実性をもたらす可能性があります。

COVID-19影響分析

世界のモリブデン市場はパンデミック時にサプライチェーンの混乱に見舞われ、一時的な閉鎖や生産能力の低下を招いた。いくつかのモリブデン鉱山と加工工場は、労働力不足、輸送の制約、厳格な安全プロトコルのために操業上の課題に直面しました。

こうした供給制約が需要の変動と相まって、モリブデン市場の価格変動をもたらしました。米国地質調査所(USGS)のデータによると、パンデミックによる不確実性を反映して、モリブデンの平均価格は2020年と2021年に大幅な変動をもたらしました。

パンデミックによる世界貿易の混乱は、国際市場への依存度が高いモリブデン輸出国に影響を与えました。封鎖措置と主要輸入国からの需要減退がモリブデン輸出の減少につながっています。例えば、モリブデンの主要生産国であるチリと米国は、中国や欧州などの主要市場への輸出が減少しました。

チリ国家統計局のデータによると、チリからのモリブデン輸出は2020年に前年比15%減となっています。輸出の減少はこれらの国の経済に影響を及ぼし、危機の時代における輸出依存産業の脆弱性を浮き彫りにしました。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 再生可能エネルギー分野の成長

- 鉄鋼生産とインフラ開発

- モリブデンの採掘と工業用途の拡大

- 政府の取り組みと支援

- 抑制要因

- 厳しい環境規制と地政学的・貿易的不確実性

- 代替材料への代替と価格・為替の変動

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 製品別

- 鉄鋼

- 化学品

- 鋳物

- MO-金属

- ニッケル合金

第8章 エンドユーザー別

- 石油・ガス

- 化学・石油化学

- 自動車

- 工業用

- 建築・建設

- 航空宇宙・防衛

- その他

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第10章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第11章 企業プロファイル

- BHP Billiton Group

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 最近の動向

- Jinduicheng Molybdenum Co. Ltd.

- American CuMo Mining

- Compania Minera Antamina S.A

- S.A.B. de C.V

- Grupo Mexico

- Thompson Cek Metals

- Moly metal LLP

- ENF Ltd.

- Compania Minera Dona Ines De Collahuasi S.C.M.

第12章 付録

Market Overview

The Global Molybdenum Market reached US$ 8.2 billion in 2022 and is expected to reach US$ 11.1 billion by 2030, growing with a CAGR of 4.0% during the forecast period 2023-2030. The Tlobal Molybdenum Market is characterized by its dynamic market trend and continuous growth, fueled by a wide range of applications and exceptional properties. Despite the market challenges related to sustainability and regulatory restrictions, the market remains resilient through continuous innovations and investments in research and development.

As industries increasingly prioritize energy efficiency, molybdenum continues to play a significant role in various sectors such as steel, chemicals, and foundries. With ongoing advancements, the market is poised for further expansion and lucrative market opportunities in the foreseeable future. Asia-Pacific stands out as a key player, accounting for over a quarter of the market share due to factors such as the region's large population, high levels of disposable income, and robust growth in the construction and automotive industries.

Rapid urbanization and infrastructure development in countries such as China and India have spurred the demand for molybdenum in steel and construction applications, leading to a surge in market opportunities and participation in the region. Furthermore, within the Product of molybdenum, the steel segment is witnessing the fastest growth and is projected to capture nearly half of the market share. The segment's rapid expansion can be attributed to its extensive applications in construction and automotive sectors.

Market Dynamics

Growing Mining and Rising Industrial Applications of Molybdenum

The availability of molybdenum reserves and mining activities play a crucial role in the global market. As a strategic metal, molybdenum mining ensures a stable supply and meets the growing demand. According to data from the United States Geological Survey (USGS), global mine production of molybdenum reached approximately 550,000 metric tons in 2020, with China being the largest producer. Stable mining operations, sustainable resource extraction practices, and government policies supporting the mining sector are important drivers for the global molybdenum market.

Molybdenum has diverse industrial applications, especially in the chemical industry. It is widely used as a catalyst in chemical reactions and as a corrosion-resistant material in the production of specialty chemicals.

Additionally, molybdenum-based alloys are utilized in the manufacturing of electrical contacts and components for electronics. The growing demand for specialty chemicals and the expansion of the electronics industry worldwide contribute to the increasing demand for molybdenum. However, accurate statistical data specifically highlighting the growth in industrial applications and chemicals may not be readily available from government sources.

Government initiatives and Support

The aerospace and defense industries are significant drivers of the global molybdenum market. Molybdenum is used in the production of aircraft parts, missile components, and other defense applications due to its high-temperature strength and corrosion resistance.

The increasing defense budgets and the ongoing development of advanced military technologies worldwide contribute to the demand for molybdenum in these sectors. Thus, the growth of the aerospace and defense industry contributes to the growth of the Global Molybdenum Market.

Moreover, Government support and favorable policies have also contributed to the growth of the molybdenum market. Governments in the region have implemented measures to promote domestic molybdenum production, ensure resource security, and encourage technological advancements in molybdenum-related industries. For example, the Chinese government has implemented policies to regulate molybdenum exports, prioritize domestic consumption, and support the development of high-value-added molybdenum products. Such initiatives strengthen the Global Molybdenum Market.

Substitution by Alternative Materials and Volatility in Prices and Currency Fluctuations

The molybdenum market faces the challenge of substitution by alternative materials in various applications. In certain industries, such as the energy sector, there is an increasing shift towards renewable energy sources, which can reduce the demand for molybdenum in traditional energy applications.

For example, the declining use of coal-fired power plants in favor of cleaner energy sources impacts the demand for molybdenum in the energy sector. Additionally, the development of alternative materials with similar or improved properties poses a threat to the molybdenum market, leading to restrained growth.

Price volatility and currency fluctuations pose significant challenges to the global molybdenum market. Molybdenum prices are subject to fluctuations based on global supply and demand dynamics, as well as market speculation. Such price fluctuations can affect the profitability of molybdenum producers and impact market growth.

Moreover, currency fluctuations can further complicate the market dynamics, especially for countries that heavily rely on molybdenum imports or exports. Unfavorable currency exchange rates can hinder trade and create uncertainties in the market.

COVID-19 Impact Analysis

The Global Molybdenum Market experienced supply chain disruptions during the pandemic, leading to temporary closures and reduced production capacity. Several molybdenum mines and processing plants faced operational challenges due to labor shortages, transportation constraints, and strict safety protocols.

These supply constraints, coupled with the fluctuations in demand, resulted in price volatility in the molybdenum market. According to data from the United States Geological Survey (USGS), the average molybdenum price witnessed significant fluctuations in 2020 and 2021, reflecting the uncertainties caused by the pandemic.

The pandemic-induced disruptions in global trade had implications for molybdenum-exporting countries heavily reliant on international markets. Lockdown measures and reduced demand from key importers led to a decline in molybdenum exports. For instance, Chile and the United States, significant molybdenum producers, experienced a decline in their exports to major markets such as China and Europe.

According to data from the National Statistics Institute of Chile, molybdenum exports from Chile contracted by 15% in 2020 compared to the previous year. The decline in exports affected the economies of these countries and highlighted the vulnerability of export-dependent industries during times of crisis.

Segment Analysis

The Global Molybdenum Market is segmented based on end product, end-user and region.

Environmental Considerations Associated with Growing Construction Industry

Molybdenum is a valuable metal with significant applications in various industries, including steel manufacturing. As an alloying element, molybdenum enhances steel's strength, hardness, and corrosion resistance.

The Global Molybdenum Market has experienced substantial growth in recent years, driven by several factors, including the expanding steel end-user segment. Statistical data supports the positive market trends, indicating a rebound in steel production, ongoing infrastructure investments and the transition to electric vehicles.

The automotive industry is a significant consumer of molybdenum-infused steel. Molybdenum improves the strength and durability of automotive components, enabling lighter and more fuel-efficient vehicles. As countries transition towards electric vehicles and stricter emission standards, the demand for molybdenum-enhanced steel is expected to rise.

According to the International Energy Agency, global electric car sales reached 3.1 million in 2020, representing a 41% increase compared to the previous year. This shift towards electric vehicles and the ongoing demand for conventional vehicles drive the need for molybdenum-infused steel in the automotive sector.

Geographical Analysis

Robust automotive sector coupled with Expanding Construction Sector

The energy sector plays a vital role in the growth of the molybdenum market in Asia-Pacific. Molybdenum is used in energy-related applications such as exploration of oil and gas, power generation, and renewable energy. With increasing energy demand and government initiatives to promote clean and renewable energy sources, the demand for molybdenum in the energy sector has grown significantly.

For instance, China, one of the largest consumers of molybdenum, has been investing heavily in renewable energy infrastructure, including wind and solar power projects. The transition towards clean energy sources in the region further drives the demand for molybdenum.

Further, Asia-Pacific possesses significant molybdenum reserves, making it a key player in the global market. Countries such as China, Mongolia, and Australia are major molybdenum producers in the region. The abundance of mineral resources in these countries provides a competitive advantage in terms of production and supply. For instance, China holds the largest molybdenum reserves globally, accounting for a substantial share of global molybdenum production. The availability of strategic mineral reserves in Asia-Pacific ensures a steady supply of molybdenum, supporting the region's growth in the global market.

Competitive Landscape

The major global players include: BHP Billiton Group, Jinduicheng Molybdenum Co. Ltd., American CuMo Mining, Compania Minera Antamina S.A, S.A.B. de C.V, Grupo Mexico, Thompson Cek Metals, Moly metal LLP, ENF Ltd. and Compania Minera Dona Ines De Collahuasi S.C.M.

Why Purchase the Report?

- To visualize the Global Molybdenum Market segmentation based on Product, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of molybdenum market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

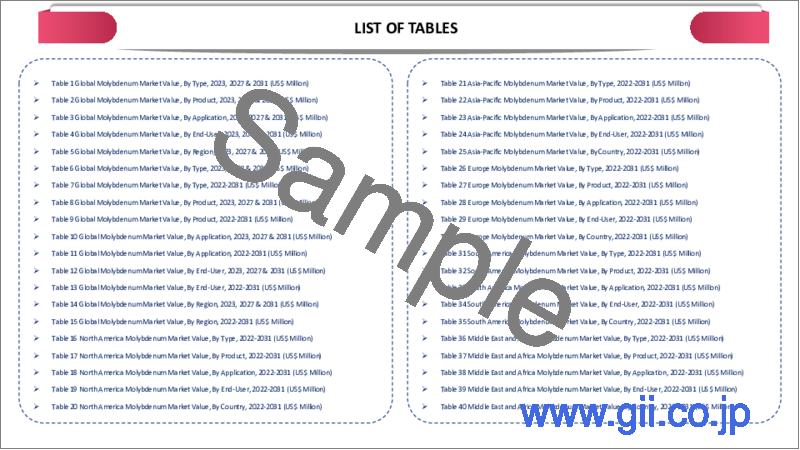

The Global Molybdenum Market Report Would Provide Approximately 53 Tables, 53 Figures And 187 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product

- 3.2. Snippet by End-User

- 3.3. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Renewable Energy Sector Growth

- 4.1.1.2. Steel Production and Infrastructure Development

- 4.1.1.3. Growing Mining and Rising Industrial Applications of Molybdenum

- 4.1.1.4. Government Initiatives and Support

- 4.1.2. Restraints

- 4.1.2.1. Stringent Environmental Regulations Coupled with Geopolitical and Trade Uncertainties

- 4.1.2.2. Substitution by Alternative Materials and Volatility in Prices and Currency Fluctuations

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2. Market Attractiveness Index, By Product

- 7.2. Steel*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Chemicals

- 7.4. Foundaries

- 7.5. MO-Metals

- 7.6. Nickel Alloys

8. By End-User

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 8.1.2. Market Attractiveness Index, By End-User

- 8.2. Oil & Gas*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Chemical and Petrochemical

- 8.4. Automotive

- 8.5. Industrial Usage

- 8.6. Building & Construction

- 8.7. Aerospace & Defence

- 8.8. Others

9. By Region

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 9.1.2. Market Attractiveness Index, By Region

- 9.2. North America

- 9.2.1. Introduction

- 9.2.2. Key Region-Specific Dynamics

- 9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1. The U.S.

- 9.2.5.2. Canada

- 9.2.5.3. Mexico

- 9.3. Europe

- 9.3.1. Introduction

- 9.3.2. Key Region-Specific Dynamics

- 9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1. Germany

- 9.3.5.2. The UK

- 9.3.5.3. France

- 9.3.5.4. Italy

- 9.3.5.5. Russia

- 9.3.5.6. Rest of Europe

- 9.4. South America

- 9.4.1. Introduction

- 9.4.2. Key Region-Specific Dynamics

- 9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1. Brazil

- 9.4.5.2. Argentina

- 9.4.5.3. Rest of South America

- 9.5. Asia-Pacific

- 9.5.1. Introduction

- 9.5.2. Key Region-Specific Dynamics

- 9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1. China

- 9.5.5.2. India

- 9.5.5.3. Japan

- 9.5.5.4. Australia

- 9.5.5.5. Rest of Asia-Pacific

- 9.6. Middle East and Africa

- 9.6.1. Introduction

- 9.6.2. Key Region-Specific Dynamics

- 9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10. Competitive Landscape

- 10.1. Competitive Scenario

- 10.2. Market Positioning/Share Analysis

- 10.3. Mergers and Acquisitions Analysis

11. Company Profiles

- 11.1. BHP Billiton Group*

- 11.1.1. Company Overview

- 11.1.2. Product Portfolio and Description

- 11.1.3. Financial Overview

- 11.1.4. Recent Developments

- 11.2. Jinduicheng Molybdenum Co. Ltd.

- 11.3. American CuMo Mining

- 11.4. Compania Minera Antamina S.A

- 11.5. S.A.B. de C.V

- 11.6. Grupo Mexico

- 11.7. Thompson Cek Metals

- 11.8. Moly metal LLP

- 11.9. ENF Ltd.

- 11.10. Compania Minera Dona Ines De Collahuasi S.C.M.

LIST NOT EXHAUSTIVE

12. Appendix

- 12.1. About Us and Services

- 12.2. Contact Us