|

|

市場調査レポート

商品コード

1304466

パンの世界市場-2023年~2030年Global Bread Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| パンの世界市場-2023年~2030年 |

|

出版日: 2023年07月07日

発行: DataM Intelligence

ページ情報: 英文 200 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

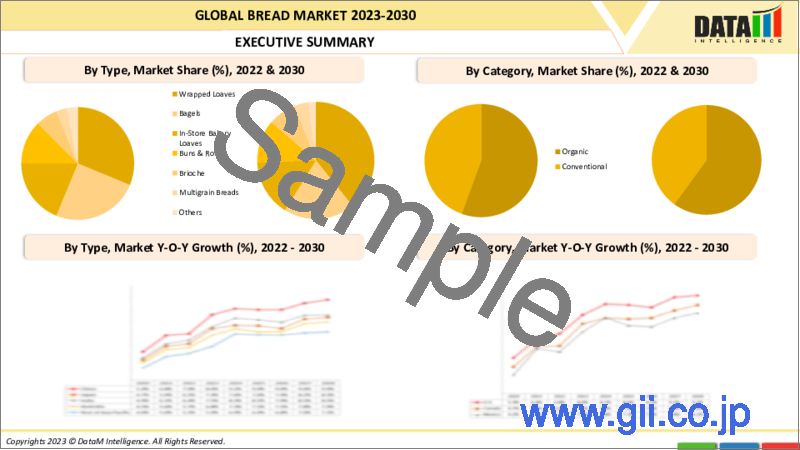

パンの世界市場は2022年に2,202億米ドルに達し、2030年には2,899億米ドルに達するなど、有利な成長が予測されています。予測期間2023-2030年のCAGRは3.5%です。

パン製品とは、主に小麦粉、水、イースト、塩、時には砂糖、脂肪、香料などの追加材料を使用し、生地から作られる多種多様な焼き菓子を指します。グルテン不耐症やセリアック病の人のために、グルテンを含む原材料を使わずに作られたパンもあります。米粉、トウモロコシ粉、アーモンド粉などの代替粉が使われることが多いです。

特殊パンのカテゴリーには、ベーグル、バンズ、ロールパン、クロワッサン、ピタパンなど幅広いパン製品が含まれ、それぞれに特徴があります。小麦粉が一般的に使用されますが、ライ麦、オーツ麦、トウモロコシなど他の穀物が特定の種類のパンに使用されることもあります。

市場力学

利便性の向上と外出先での消費がパン市場の成長を予測

パン製品は本来持ち運びが可能で、最小限の準備しか必要としないです。調理や調理器具を追加することなく簡単に食べることができるため、外出先での消費に最適です。間食文化の台頭は、便利で手軽な食品オプションの需要を高める一因となっています。パン、ビスケット、ケーキ、スープ、ソーセージ、ソースなど、スーパーマーケットで見かける食品の3分の1は小麦粉を使用しています。

さらに、Kantarによれば、英国の家庭の99.8%がパンを購入しています。小麦粉は食品産業において重要な役割を果たしています。さらに、重要なビタミンとミネラルの供給源は小麦粉です。小麦粉は鉄分摂取量の30%、カルシウムと食物繊維摂取量の3分の1を占めています。

職人パンと特殊パンの需要増がパン市場を活性化する見込み

職人パンと特殊パンの需要は、市場のプレミアム化傾向を表しています。消費者は、より高品質で、ユニークな原材料を使用し、伝統的または職人的な技術で作られたと認識されるパン製品に対して、より高い価格を支払うことを望んでいます。職人パンや特殊パンは、差別化とニッチ市場をターゲットにする機会を提供します。こうしたパン製品には、特定の地域の味、古代穀物、有機・天然成分など、独特の特徴があることが多いです。これらの製品は、ユニークで専門的な選択肢を求める消費者に対応しています。

COVID-19影響分析

COVID-19分析には、COVID前シナリオ、COVIDシナリオ、COVID後シナリオに加え、価格力学(COVID前シナリオと比較したパンデミック中およびパンデミック後の価格変動を含む)、需給スペクトラム(取引制限、封鎖、およびその後の問題による需給の変化)、政府の取り組み(政府機関による市場、セクター、業界を活性化させる取り組み)、メーカーの戦略的取り組み(COVID問題を緩和するためにメーカーが行ったことをここで取り上げる)が含まれます。

ロシア・ウクライナ戦争の影響

ロシアによる侵攻は、黒海の港からの貿易を大幅に阻害し、シカゴの基準小麦価格を世界的に40%上昇させ、すでに過去10年で最高水準にあった世界の食品インフレを加速させました。

アルバータ州のCalgary Italian Bakeryは、前年のカナダの干ばつと小麦粉とイーストの値上げに関連する支出をカバーするため、直近の小麦価格値上げの数週間前に価格を7%引き上げました。60年の歴史を持つこの家族経営の共同経営者、Louis Bontorinは現在、4~5ヶ月分の小麦粉を使い切ったら、再び値上げが必要になるのではないかと心配しています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 抑制要因

- 機会

- 影響分析

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 タイプ別

- ラップパン

- ベーグル

- 店内ベーカリーパン

- バンズ・ロール

- ブリオッシュ

- マルチグレインブレッド

- その他

第8章 ベーカリータイプ別

- 工場ベーカリー

- 店内ベーカリー

- クラフトベーカリー

第9章 流通チャネル別

- スーパーマーケット/ハイパーマーケット

- コンビニエンスストア

- 専門店

- オンライン小売

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Grupo Bimbo S.A.B. de C.V.

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Flowers Foods Inc.

- Warburtons Ltd.

- Allied Bakeries

- Hovis Ltd

- Finsbury Food Group

- The Yamazaki Baking Company Ltd.

- Aryzta AG

- George Weston Limited

- H&S Family of Bakeries

第13章 付録

Market Overview

The Global Bread Market reached US$ 220.2 billion in 2022 and is projected to witness lucrative growth by reaching up to US$ 289.9 billion by 2030. The market is growing at a CAGR of 3.5% during the forecast period 2023-2030.

Bread products refer to a wide variety of baked goods made from dough, primarily using flour, water, yeast, salt, and sometimes additional ingredients such as sugar, fat, or flavorings. Bread made without gluten-containing ingredients for individuals with gluten intolerance or celiac disease. Alternative flour like rice, corn, or almond flour are often used.

The specialty bread category includes a wide range of bread products, such as bagels, buns, rolls, croissants, pita bread, and more, each with its unique characteristics. Wheat flour is commonly used, but other grains like rye, oats, or corn may be used for specific types of bread.

Market Dynamics

Rising Convenience and On-the-Go Consumption are Anticipated to Grow the Bread Market's Growth

Bread products are inherently portable and require minimal preparation. They can be easily consumed without additional cooking or utensils, making them ideal for on-the-go consumption. The rise of snacking culture has contributed to the demand for convenient, grab-and-go food options. A third of all foods found in supermarkets, including bread, biscuits, cakes, soups, sausages, and sauces, are made using wheat flour.

Additionally, according to Kantar, 99.8% of UK homes buy bread. Flour plays a significant part in the food industry. Furthermore, a substantial source of important vitamins and minerals is wheat flour. Flour accounts for 30% of our iron intake and a third of our calcium and fiber intake.

Rising Demand for Artisan and Specialty Bread is Expected to Fuel the Bread Market

The demand for artisan and specialty bread represents a premiumization trend in the market. Consumers are willing to pay a higher price for bread products that are perceived to be of higher quality, made with unique ingredients, and crafted using traditional or artisanal techniques. Artisan and specialty bread offer opportunities for differentiation and targeting niche markets. These bread products often have distinct characteristics, such as specific regional flavors, ancient grains, or organic and natural ingredients. They cater to consumers looking for unique and specialized options.

COVID-19 Impact Analysis

The COVID-19 Analysis includes Pre-COVID Scenario, COVID Scenario, and Post-COVID Scenario along with Pricing Dynamics (Including pricing change during and post-pandemic comparing it with pre-COVID scenarios), Demand-Supply Spectrum (Shift in demand and supply owing to trading restrictions, lockdown, and subsequent issues), Government Initiatives (Initiatives to revive market, sector or Industry by Government Bodies) and Manufacturers Strategic Initiatives (What manufacturers did to mitigate the COVID issues will be covered here).

Russia-Ukraine War Impact

The invasion by Russia has significantly impeded trade from Black Sea ports, increasing Chicago benchmark wheat prices globally by 40% and accelerating food inflation globally, which was already at its highest level in a decade.

The Calgary Italian Bakery in Alberta hiked prices by 7% a few weeks before the most recent wheat price increase to cover expenditures related to the previous year's Canadian drought and increases in flour and yeast. Louis Bontorin, co-owner of the 60-year-old family business, now worries that once he has used up his four to five months' flour supply, he will need to increase prices again.

Segment Analysis

The Global Bread Market is segmented based on type, form, end-user, distribution channel, and region.

By Type of Bakeries, the Plant Bakeries Segment Accounted for the Highest Share of the Global Bread Market

Plant bakeries, or industrial or commercial bakeries, typically have larger production capacities than smaller-scale artisanal or local bakeries. They can produce bread in larger quantities to meet the demands of a broader consumer base, including retail stores, food service establishments, and institutional buyers.

Plant bakeries often have well-established distribution networks that enable them to efficiently reach a wide range of markets. Their distribution channels may include partnerships with major retailers, supermarkets, wholesalers, and food service distributors. This extensive reach helps plant bakeries capture a larger market share.

Geographical Analysis

North America is the Fastest-Growing Market in the Bread Industry

North America has a strong tradition of bread consumption, with bread being a staple food in many diets. The consistent demand for bread products, including sliced bread, buns, bagels, and specialty bread, contributes to the market growth in the region. North America is a diverse region with a multicultural population, resulting in varied bread preferences.

The market caters to a wide range of consumer tastes and preferences, offering different types of bread, such as whole grain, artisanal, gluten-free, and ethnic varieties. This diverse product offering drives market growth. North America has an increasing emphasis on health and wellness, leading to a growing demand for healthier bread options.

Competitive Landscape

The major global players include: the Bread market are Grupo Bimbo S.A.B. de C.V., Flowers Foods Inc., Warburtons Ltd., Allied Bakeries, Hovis Ltd, Finsbury Food Group, The Yamazaki Baking Company Ltd., Aryzta AG, George Weston Limited, and H&S Family of Bakeries.

Why Purchase the Report?

- To visualize the Global Bread Market segmentation based on bread type, type of bakeries, and distribution channel to understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of bread market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Bread Market Report Would Provide Approximately 61 Tables, 61 Figures And 200 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Bread Type

- 3.2. Snippet by Type of Bakeries

- 3.3. Snippet by Distribution Channel

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.2. Restraints

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Scenario Post-COVID-19

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bread Type

- 7.1.2. Market Attractiveness Index, By Bread Type

- 7.2. Wrapped Loaves*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Bagels

- 7.4. In-Store Bakery Loaves

- 7.5. Buns & Rolls

- 7.6. Brioche

- 7.7. Multigrain Breads

- 7.8. Others

8. By Type of Bakeries

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Bakeries

- 8.1.2. Market Attractiveness Index, By Type of Bakeries

- 8.2. Plant Bakeries *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. In-Store Bakeries

- 8.4. Craft Bakeries

9. By Distribution Channel

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 9.1.2. Market Attractiveness Index, By Distribution Channel

- 9.2. Supermarkets/Hypermarkets*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Convenience Stores

- 9.4. Specialist Retailers

- 9.5. Online Retail

- 9.6. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bread Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Bakeries

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. The U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bread Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Bakeries

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. The UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bread Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Bakeries

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bread Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Bakeries

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bread Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type of Bakeries

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. Grupo Bimbo S.A.B. de C.V.*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Flowers Foods Inc.

- 12.3. Warburtons Ltd.

- 12.4. Allied Bakeries

- 12.5. Hovis Ltd

- 12.6. Finsbury Food Group

- 12.7. The Yamazaki Baking Company Ltd.

- 12.8. Aryzta AG

- 12.9. George Weston Limited

- 12.10. H&S Family of Bakeries

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us