|

|

市場調査レポート

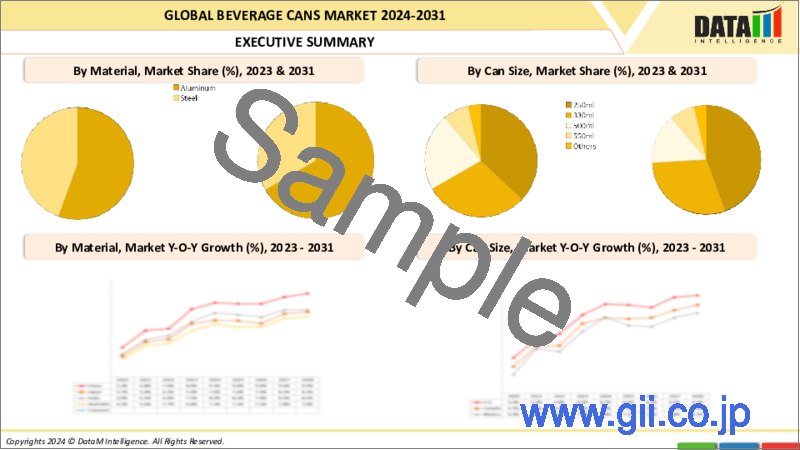

商品コード

1297849

飲料缶の世界市場-2023年~2030年Global Beverage Cans Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 飲料缶の世界市場-2023年~2030年 |

|

出版日: 2023年06月15日

発行: DataM Intelligence

ページ情報: 英文 195 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

飲料缶の世界市場は、2022年に350億米ドルに達し、2030年には530億米ドルに達し、有利な成長を示すと予測されています。予測期間2023-2030年のCAGRは5.2%と予測されます。

飲料缶は、缶の印刷や装飾、ブランディングの強化などの機能を備えた多目的なパッケージング・ソリューションです。イージーオープンエンド(EOE)は消費者の利便性を高める。これらの要素は総体的に飲料缶市場の魅力と機能性に貢献しています。飲料缶市場は、利便性と携帯性に対する消費者の需要の高まりにより力強く成長してきました。

市場は、様々なセグメントにおける缶入り飲料の人気に牽引され、大きく拡大してきました。缶製造技術の進歩や外出先での消費傾向の高まりといった動向が、飲料缶市場の持続的成長に寄与しています。消費者の嗜好の進化や持続可能なパッケージング・ソリューションへのニーズが追い風となり、市場は今後も上昇基調を続けると予想されます。

市場力学

環境意識と持続可能なパッケージングが飲料缶市場の成長を促進

飲料缶市場の分析によると、環境意識と持続可能性が飲料缶市場の重要な促進要因として浮上しています。飲料用アルミ缶はリサイクル可能でリサイクル率が高いことで知られており、環境に優しいパッケージングオプションに対する消費者の需要の高まりに合致しています。缶の成型や成形、缶のコーティングやライニングを含む飲料缶の製造工程は、持続可能な慣行や素材に重点を置いています。

こうした取り組みは、製品の完全性を確保しながら、環境への影響を最小限に抑えることを目的としています。アルミ缶の軽量特性を重視することで、輸送の排出量とエネルギー消費量をさらに削減しています。飲料業界が持続可能性を優先する中、環境に優しいアルミ飲料缶市場は成長を続けています。その結果、飲料缶の市場シェアも拡大しています。

原材料価格の変動と多様な飲料缶サイズが飲料缶市場の抑制要因に

飲料缶市場におけるもう一つの抑制要因は、原材料費、特にアルミニウムの価格変動です。飲料缶市場の分析によると、アルミニウム価格は近年大きな変動を経験しており、2016年から2020年にかけて年平均約15%の価格上昇が見込まれています。こうした変動は飲料缶の製造コストに直接影響し、メーカーの利益率に影響を与えます。その結果、飲料缶の市場シェアは影響を受ける。

さらに、飲料缶のサイズ寸法が異なるという需要は、缶の充填・包装工程をさらに複雑化させ、製造要件やコストもさまざまに変化します。こうした課題を軽減するため、業界各社はコスト削減策を実施し、サプライチェーン戦略を最適化することで、原材料コストの変動に適応し、多様な市場の需要に対応しています。

COVID-19の影響分析

COVID-19分析には、COVID前シナリオ、COVIDシナリオ、COVID後シナリオが含まれ、価格力学(COVID前シナリオと比較したパンデミック中およびパンデミック後の価格変動を含む)、需給スペクトラム(取引制限、封鎖、およびその後の問題による需要と供給のシフト)、政府の取り組み(政府機関による市場、セクター、産業を活性化させる取り組み)、メーカーの戦略的取り組み(COVID問題を緩和するためにメーカーが行ったことをここで取り上げる)が含まれます。

目次

第1章 調査手法と範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響を与える要因

- 促進要因

- 抑制要因

- 機会

- 影響分析

第5章 業界分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19の分析

第7章 構造別

- 2ピース

- 3ピース

第8章 金属別

- アルミニウム

- 鋼

第9章 缶サイズ別

- 250ml

- 330ml

- 500ml

- 550ml

- その他

第10章 アプリケーション別

- アルコール飲料

- 炭酸飲料

- 果物と野菜のジュース

- スポーツ&エナジードリンク

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東とアフリカ

第12章 競合情勢

- 競合シナリオ

- 市場ポジショニング/シェア分析

- 合併と買収の分析

第13章 企業プロファイル

- Ardagh Group SA

- 会社概要

- グレードのポートフォリオと説明

- 財務概要

- 主な発展

- Ball Corporation

- Can-Pack SA

- Crown Holdings, Inc.

- Amcor Plc

- Toyo Seikan Group Holdings, Ltd.

- Showa Denko KK

- Nampak Bevcan Ltd

- Silgan Holdings Inc.

- CPMC Holdings Ltd.

第14章 付録

Market Overview

The Global Beverage Cans Market reached US$ 35 billion in 2022 and is projected to witness lucrative growth by reaching up to US$ 53 billion by 2030. The market is expected to exhibit a CAGR of 5.2% during the forecast period 2023-2030.

Beverage cans are versatile packaging solutions with features like can printing and decoration and enhancing branding. Easy-open ends (EOEs) add convenience for consumers. These elements collectively contribute to the market's appeal and functionality of beverage cans. The beverage cans market has grown strongly due to increasing consumer demand for convenience and portability.

The market has expanded significantly, driven by the popularity of canned beverages across various segments. Factors such as advancements in can manufacturing technologies and the rising trend of on-the-go consumption have contributed to the sustained growth of the beverage cans market. The market is expected to continue its upward trajectory in the coming years, fueled by evolving consumer preferences and the need for sustainable packaging solutions.

Market Dynamics

Environmental Consciousness and Sustainable Packaging Propel Growth of Beverage Cans Market

The Beverage Cans Market analysis shows that environmental consciousness and sustainability have emerged as significant drivers of the beverage cans market. Aluminum beverage cans, known for their recyclability and high recycling rate, align with the growing consumer demand for eco-friendly packaging options. Beverage can manufacturing processes, including can forming and shaping and can coating and lining, focus on sustainable practices and materials.

These efforts aim to minimize environmental impact while ensuring product integrity. The emphasis on aluminum cans' lightweight properties further reduces transportation emissions and energy consumption. As the beverage industry prioritizes sustainability, the environmentally friendly aluminum beverage cans market continues to grow. As a result, the beverage cans market share is also increased.

Volatility in Raw Material Prices and Diverse Beverage Can Sizes Pose Restraints for the Beverage Cans Market

Another restraint in the Beverage Cans Market is the volatility in raw material costs, particularly aluminum. According to the beverage cans market analysis, the price of aluminum experienced significant fluctuations in recent years, with an average annual price increase of around 15% between 2016 and 2020. These fluctuations can directly impact the manufacturing costs of beverage cans, affecting profit margins for manufacturers. As a result, the Beverage Cans' Market share is impacted.

Additionally, the demand for different beverage can size dimensions further adds complexity to the can filling and packaging processes, with varying production requirements and costs. To mitigate these challenges, industry players implement cost-saving measures and optimize supply chain strategies to adapt to the volatility in raw material costs and meet diverse market demands.

COVID-19 Impact Analysis

The COVID-19 Analysis includes Pre-COVID Scenario, COVID Scenario and Post-COVID Scenario along with Pricing Dynamics (Including pricing change during and post-pandemic comparing it with pre-COVID scenarios), Demand-Supply Spectrum (Shift in demand and supply owing to trading restrictions, lockdown and subsequent issues), Government Initiatives (Initiatives to revive market, sector or Industry by Government Bodies) and Manufacturers Strategic Initiatives (What manufacturers did to mitigate the COVID issues will be covered here).

Segment Analysis

The Global Beverage Cans Market is segmented based on structure, metal, can size, application, and region.

330ml Can Emerge as the Preferred Choice in Beverage Cans Market, Driven by Versatility and Portability

The Beverage Cans Market is segmented by can size, including popular options such as 250ml, 330ml, 500ml, and 550ml, along with other sizes. The 330ml can have emerged as the most preferred choice due to its versatility and widespread acceptance. It caters to various beverages, balances portability and volume, and is compatible with vending machines and retail displays.

Additionally, the beverage cans market trend indicates a growing demand for smaller sizes, such as 250ml, driven by the increasing popularity of healthier and functional beverages. This trend reflects consumer preferences for portion control and convenience.

Geographical Analysis

Asia Pacific Emerges as a Powerhouse in the Beverage Cans Market with Rapid Growth and High Consumer Demand

The Global Beverage Cans Market is segmented by region into North America, South America, Europe, Asia-Pacific, and Middle-East & Africa.

The Asia Pacific Beverage Cans Market is experiencing significant growth, driven by several factors. According to the beverage cans market analysis, the region holds a substantial Global Beverage Cans Market share. The rising population, urbanization, and changing lifestyles have contributed to the increased consumption of packaged beverages in the Asia Pacific region. These all are propelling Beverage Cans' Market share. Furthermore, the convenience and portability offered by beverage cans have resonated with consumers in this market.

Studies indicate that approximately 70% of individuals in the Asia Pacific region regularly consume beverages from cans. The demand for beverage cans is particularly prominent in countries such as China, India, and Japan, which have witnessed rapid economic development and an expanding middle-class population. With a buoyant market trend and a significant consumer base, the Asia Pacific beverage cans market presents lucrative opportunities for manufacturers and suppliers in the region.

Competitive Landscape

The major global players include: Ardagh Group S.A, Ball Corporation, Can-Pack S.A., Crown Holdings, Inc., Amcor Plc, Toyo Seikan Group Holdings, Ltd., Showa Denko K.K, Nampak Bevcan Ltd, Silgan Holdings Inc., and CPMC Holdings Ltd.

Why Purchase the Report?

- To visualize the Global Beverage Cans Market segmentation based on Structure, Metal, Can Size, application, and region and understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous beverage cans market-level data points with all segments.

- The PDF report includes a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The Global Beverage Cans Market Report Would Provide Approximately 69 Tables, 67 Figures And 195 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Structure

- 3.2. Snippet by Metal

- 3.3. Snippet by Can Size

- 3.4. Snippet by Application

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.2. Restraints

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Post COVID-19 and Future Scenario

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Structure

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Structure

- 7.1.2. Market Attractiveness Index, By Structure

- 7.2. 2-Piece*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. 3-Piece

8. By Metal

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal

- 8.1.2. Market Attractiveness Index, By Metal

- 8.2. Aluminum*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Steel

9. By Can Size

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Can Size

- 9.1.2. Market Attractiveness Index, By Can Size

- 9.2. 250ml*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. 330ml

- 9.4. 500ml

- 9.5. 550ml

- 9.6. Others

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Alcoholic Beverages*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Carbonated Soft Drinks

- 10.4. Fruit & Vegetable Juices

- 10.5. Sports & Energy Drinks

- 10.6. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America*

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Structure

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Can Size

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. The U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Structure

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Can Size

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. The U.K

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Structure

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Can Size

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Structure

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Can Size

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Structure

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Metal

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Can Size

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Ardagh Group S.A

- 13.1.1. Company Overview

- 13.1.2. Grade Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Ball Corporation

- 13.3. Can-Pack S.A.

- 13.4. Crown Holdings, Inc.

- 13.5. Amcor Plc

- 13.6. Toyo Seikan Group Holdings, Ltd.

- 13.7. Showa Denko K.K

- 13.8. Nampak Bevcan Ltd

- 13.9. Silgan Holdings Inc.

- 13.10. CPMC Holdings Ltd.

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us