|

|

市場調査レポート

商品コード

1272765

電動カーゴバイクの世界市場-2023-2030Global Electric Cargo Bikes Market - 2023-2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 電動カーゴバイクの世界市場-2023-2030 |

|

出版日: 2023年05月15日

発行: DataM Intelligence

ページ情報: 英文 201 Pages

納期: 約2営業日

|

- 全表示

- 概要

- 目次

市場概要

電動カーゴバイクの世界市場は、2022年に9億4,024万米ドルに達し、2030年には最大36億5,925万米ドルに達すると予測されます。同市場は予測期間中(2023年~2030年)に17.0%のCAGRを示すと予測されています。

電動カーゴバイク市場は、持続可能で手頃な価格の効率的な輸送方法を求める人々が増えていることから、急速に成長しています。電動カーゴバイクは、通常、ラック、パニア、バスケットを使用し、電動モーターでライダーをサポートすることで、大きな荷物運搬能力を備えています。

電動カーゴバイク市場の成長には様々な地域が貢献しており、2030年までにアジア太平洋が約25%、北米が約30%貢献すると予想されています。特にオランダとデンマークでは、カーゴバイクの魅力が高まっていますが、この動向は世界的に広がりつつあります。

さらに、英国やドイツなどの国々は、欧州全体の電動カーゴバイクの市場シェアの2/3近くを占めています。パリ、ブダペスト、ビリニュスなど、多くの都市が自転車ブームに乗って、都市環境を変え、自転車専用道路を整備し、サイクリングやウォーキングのインフラ整備を急ぎました。

市場力学

環境問題への関心の高まり

電動カーゴバイクは排出ガスがゼロであるため、二酸化炭素排出量や大気汚染の低減に貢献する持続可能な交通手段です。また、世界各国の政府は、持続可能な輸送を促進し、二酸化炭素排出量を削減するために、電動カーゴバイクの導入を促進するためのインセンティブや補助金を提供しています。これらの要因が、全世界の電動カーゴバイク市場の成長を後押ししています。

また、電動カーゴバイクの環境面でのメリットも大きいです。欧州サイクリスト連盟の調査によると、電動カーゴバイク1台で、都市部では最大15台の配送バンに取って代わることができ、交通渋滞や大気汚染を大幅に軽減することができます。さらに、電動カーゴバイクは従来の配送車よりもランニングコストが低いため、企業にとってはコスト削減につながる可能性があります。

交通渋滞を増加させる傾向の高まり

特に新興経済諸国では、道路インフラが十分に整備されていないため、電動カーゴバイクの普及が進むと、交通渋滞が増加する可能性があります。

例えば、全米科学財団の報告書によると、中国では約4,000万台の電動自転車が新たに導入されています。イントロダクションよると、これらの電動バイクが経済に導入されたことで、国内のあまり発展していない地域で交通渋滞が増加しているとされています。その結果、北京や広州のメガシティを含む多くの町では、道路での電動バイクの使用が事実上禁止されています。これは電動カーゴバイク市場の大きな抑制要因となっています。

COVID-19インパクト分析

COVID-19分析では、COVID前シナリオ、COVIDシナリオ、COVID後シナリオに加え、価格ダイナミクス(COVID前シナリオとの比較による流行時・流行後の価格変動を含む)、需要-供給スペクトラム(取引制限、封鎖、その後の問題による需要と供給のシフト)、政府イニシアティブ(政府機関による市場、セクター、産業の活性化イニシアティブ)、メーカー戦略イニシアティブ(メーカーによるCOVID問題への対処をここでカバーします)を含みます。

目次

第1章 調査手法とスコープ

- 調査手法

- 調査目的および調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

- 製品別

- バッテリー別

- エンドユーザー別

- 地域別

第4章 市場力学

- 影響要因

- 促進要因

- 環境問題への関心の高まり

- 抑制要因

- 交通渋滞の増加傾向

- 機会

- 補助金や政府支援の拡大

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 法規制の分析

第6章 COVID-19の分析

- COVID-19の分析

- COVID-19登場前シナリオ

- 現在のCOVID-19シナリオ

- COVID-19後または将来のシナリオ

- COVID-19の中での価格・ダイナミクス

- 需給スペクトル

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的な取り組み

- サマリー

第7章 製品別

- 二輪

- 三輪

- 四輪

第8章 バッテリー別

- リチウムイオン

- 鉛系

- ニッケル系

第9章 エンドユーザー別

- 宅配便・小包サービス事業者

- サービスデリバリー

- 個人向け輸送

- 大手小売業様

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ地域

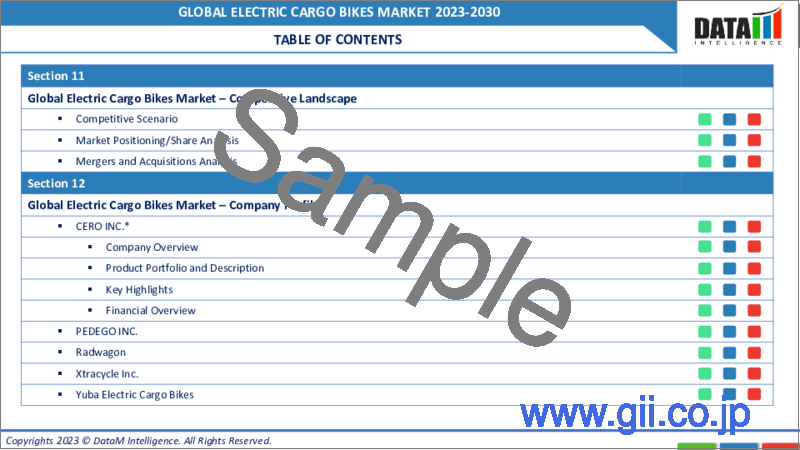

第11章 競合情勢

- 競合シナリオ

- 市況ポジショニング/シェア分析

- M&A(合併・買収)分析

第12章 企業プロファイル

- CERO INC

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展状況

- PEDEGO

- RAD POWER BIKES INC

- XTRACYCLE CARGO BIKES

- YUBA BICYCLES LLC

- Babboe

- DOUZE Factory SAS

- Riese & Muller GmbH

- Smart Urban Mobility B.V.

- BENNO BIKES LLC

第13章 付録

Market Overview

The global electric cargo bikes market reached US$ 940.24 million in 2022 and is projected to witness lucrative growth by reaching up to US$ 3,659.25 million by 2030. The market is expected to exhibit a CAGR of 17.0% during the forecast period (2023-2030).

The electric cargo bikes market is rapidly growing, as more people look for sustainable, affordable, and efficient ways to transport goods. Electric cargo bikes possess large cargo-carrying capacity, usually through the use of racks, panniers or baskets and an electric motor to assist the rider.

Various regions have contributed to the electric cargo bikes market growth, wherein Asia-Pacific is expected to contribute around 25% and North America around 30% by 2030. Netherlands and Denmark, in particular, have witnessed a rise in the appeal of cargo cycles, however, this trend is spreading globally.

Furthermore, countries like the U.K. and Germany hold nearly 2/3rd of Europe's overall electric cargo bikes market share. Many cities, including Paris, Budapest and Vilnius, took advantage of the pandemic bicycling rush to change their urban settings, add marked bike paths, and hasten the development of cycling and walking infrastructure.

Market Dynamics

Growing environmental concerns

Electric cargo bikes produce zero emissions, making them a sustainable transportation option that can help reduce carbon emissions and air pollution. Governments globally are also offering incentives and subsidies to encourage the adoption of electric cargo bikes to promote sustainable transportation and reduce carbon emissions. These factors drive the electric cargo bikes market growth across the globe.

The environmental benefits of electric cargo bikes are also significant. According to a European Cyclists' Federation study, a single electric cargo bike can replace up to 15 delivery vans in urban areas, significantly reducing traffic congestion and air pollution. Moreover, electric cargo bikes have lower operating costs than traditional delivery vehicles, which can result in cost savings for businesses.

Rising tendency to increase traffic congestion

Increased adoption of electric cargo bikes can increase traffic congestion, particularly in areas of emerging economies where the road infrastructures are not developed enough to accommodate the growing adoption of electric cargo bikes.

For instance, as per a National Science Foundation report, there are around 40 million new electric bikes in China. Studies are claiming that the introduction of these electric bikes into the economy has increased traffic congestion in less developed regions of the country. As a result, many towns, including the megacities of Beijing and Guangzhou, have effectively prohibited the use of electric bikes on the roads. This is a major restraint to the electric cargo bikes market.

COVID-19 Impact Analysis

The COVID-19 analysis includes Pre-COVID Scenario, COVID Scenario and Post-COVID Scenario along with pricing dynamics (including pricing change during and post-pandemic comparing it with pre-COVID scenarios), demand-supply spectrum (shift in demand and supply owing to trading restrictions, lockdown and subsequent issues), government initiatives (initiatives to revive market, sector or industry by government bodies) and manufacturers strategic initiatives (what manufacturers did to mitigate the COVID issues will be covered here).

Segment Analysis

The global electric cargo bikes market is segmented based on product, battery, end user and region.

The rising demand for cost-effective and environmentally friendly solutions for last-mile deliveries

Among products, two-wheeler segment holds the largest market share. Two-wheeler electric cargo bikes are a versatile solution for last-mile deliveries. They can be used for a wide range of delivery services, including food delivery, parcel delivery, and courier services due to their compact size and maneuverability.

Moreover, some electric cargo bikes are designed to be modular, which means that the cargo compartment can be easily removed or replaced, making them ideal for businesses with changing delivery needs. The demand for two-wheeler electric cargo bikes is on the rise due to the growth of e-commerce and online shopping, which has led to an increase in the number of last-mile deliveries. Two-wheeler electric cargo bikes are ideal for these types of deliveries, as they can navigate through narrow streets and congested areas, making them more efficient than traditional delivery vehicles.

Geographical Analysis

Europe government's growing investments in adopting advanced technologies

Electric cargo bikes are becoming more popular among Europeans, covering a major percentage of the global market. In Europe, according to a survey of 38 specialized producers conducted by the European cargo bike industry, the sales of cargo bikes increased by 38% in 2020 and were increased by another 66% in 2021.

A study on the most recent developments in cargo bike use cases was published by the Confederation of the European Bicycle Industry. According to their statistics, Germany is by far the largest European market, where the National Bike Association (ZIV) reported 103,000 cargo bikes sold in 2020. In Denmark, electric bike sales reached 25,000 in 2020, whereas in Netherlands and France, the sales crossed 50,000 for the second place in the business.

Furthermore, the electric cargo bikes market in Europe is expected to continue its growth trajectory in the coming years, driven by a combination of government policies, consumer demand, and technological advancements in e-bike design and manufacturing.

Competitive Landscape

The major global players in the market include CERO INC, PEDEGO, RAD POWER BIKES INC, XTRACYCLE CARGO BIKES, YUBA BICYCLES LLC, Babboe, DOUZE Factory SAS, Riese & Muller GmbH, Smart Urban Mobility B.V, and BENNO BIKES LLC.

Why Purchase the Report?

- To visualize the global electric cargo bikes market segmentation based on product, battery, end user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of electric cargo bikes market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping is available in Excel consisting of key products of all the major players.

The global electric cargo bikes market report would provide approximately 61 tables, 58 figures and 201 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Product

- 3.2. Snippet by Battery

- 3.3. Snippet by End User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing environmental concerns

- 4.1.2. Restraints

- 4.1.2.1. Rising tendency to increase traffic congestion

- 4.1.3. Opportunity

- 4.1.3.1. Growing subsidies and government support

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Before COVID-19 Scenario

- 6.1.2. Present COVID-19 Scenario

- 6.1.3. Post COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Product

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 7.1.2. Market Attractiveness Index, By Product

- 7.2. Two-wheeler *

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Three-wheeler

- 7.4. Four-wheeler

8. By Battery

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 8.1.2. Market Attractiveness Index, By Battery

- 8.2. Lithium-ion *

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Lead-based

- 8.4. Nickel-based

9. By End User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 9.1.2. Market Attractiveness Index, By End User

- 9.2. Courier & Parcel Service Providers *

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Service Delivery

- 9.4. Personal Transportation

- 9.5. Large Retail Suppliers

- 9.6. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. The U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. The U.K.

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Russia

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Battery

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End User

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. CERO INC*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. PEDEGO

- 12.3. RAD POWER BIKES INC

- 12.4. XTRACYCLE CARGO BIKES

- 12.5. YUBA BICYCLES LLC

- 12.6. Babboe

- 12.7. DOUZE Factory SAS

- 12.8. Riese & Muller GmbH

- 12.9. Smart Urban Mobility B.V.

- 12.10. BENNO BIKES LLC

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us