|

|

市場調査レポート

商品コード

1217583

衛星トランスポンダの世界市場-2023-2030Global Satellite Transponder Market - 2023-2030 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 衛星トランスポンダの世界市場-2023-2030 |

|

出版日: 2023年02月14日

発行: DataM Intelligence

ページ情報: 英文 225 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

衛星トランスポンダは、地球局(地上局とも呼ばれる)から信号を受信し、異なる周波数で地球に再送信する装置です。本来は、2つの地球局の間で衛星通信を行うための中継器です。衛星で受信した信号を増幅し、周波数シフトして地球に再送信します。衛星トランスポンダは、テレビやラジオ放送、衛星インターネット、衛星電話サービス、衛星ナビゲーション・システムなど、さまざまな用途で使用されています。また、軍事通信や政府通信、気象や天然資源の監視にも使用されています。

市場力学

衛星インターネット、衛星テレビ、衛星ラジオなど、衛星を利用した通信サービスの需要増加が、衛星トランスポンダ市場の成長を後押ししています。先進国や発展途上国で衛星通信サービスの人気が高まっていることが、増加するトラフィックを処理するためのトランスポンダの必要性を高めています。遠隔地やサービスが行き届いていない地域での衛星ベースのサービスの採用が拡大していることが、衛星トランスポンダ市場の成長を促進しています。トランスポンダを搭載した小型衛星がこれらの地域の接続に使用されており、増加するトラフィックを処理するためのトランスポンダの必要性が生じています。

地球周回軌道における小型衛星の普及は、市場拡大の一面を持つ

地球軌道上の小型衛星の増加も、衛星トランスポンダ市場の成長に寄与しています。小型衛星は、モノのインターネット(IoT)通信、リモートセンシング、地球観測など、多くの用途で利用されています。軌道上の小型衛星の数が増えるにつれて、これらのアプリケーションをサポートするための通信サービスの需要も増加しています。このため、通信量の増加に対応するため、より多くの衛星トランスポンダが必要とされています。

小型衛星は一般的に搭載するトランスポンダが小さいため、通信サービスのための帯域幅が狭くなります。軌道上の小型衛星の数が増えれば増えるほど、より多くの衛星帯域幅に対する需要も高まります。そのため、帯域幅を確保するための衛星トランスポンダの増設が求められています。軌道上の小型衛星の増加により、衛星トランスポンダのメーカー、プロバイダー、オペレータに新たなビジネスチャンスがもたらされています。衛星トランスポンダの需要は、地球周回軌道に配備される小型衛星の増加に伴い、増加すると予想されます。

したがって、地球軌道上の小型衛星の数の増加は、通信サービス、衛星帯域幅および衛星接続の需要を増加させることによって、衛星トランスポンダ市場の成長を推進しています。また、これは衛星トランスポンダ業界の企業にとって新たなビジネスチャンスを生み出すものでもあります。

中継器リースと衛星打ち上げサービスの法外な高値が市場成長の妨げに

中継器リースや衛星打ち上げサービスの法外な高値は、衛星トランスポンダ市場の成長にとって大きな障壁となりえます。中継器リースや衛星打ち上げサービスの価格が高いため、中小企業の市場参入が困難になる可能性があります。このため、市場におけるプレーヤーの数が制限され、新規参入企業の競争が困難になる可能性があります。中継器リースや衛星打上げサービスの価格が高いため、顧客がこれらのサービスを購入することが難しくなる可能性があります。これは、衛星トランスポンダの需要を減少させ、市場の成長を制限する可能性があります。中継器リースや衛星打ち上げサービスの価格が高い場合、その市場に参入している企業の利益率が低下する可能性があります。これにより、企業にとって投資の魅力が低下し、市場の成長が制限される可能性があります。

COVID-19影響度分析

パンデミックにより、衛星トランスポンダ市場の企業のサプライチェーンに混乱が生じました。このため、衛星トランスポンダやその他の部品の納入に遅れが生じ、企業の市場運営に影響を及ぼしています。パンデミックにより、多くの企業が閉鎖や事業縮小を余儀なくされ、衛星トランスポンダに対する需要が減少しました。このため、市場参加企業の収益に影響を及ぼしています。パンデミックは、発射場の閉鎖やサプライチェーンの混乱により、衛星打ち上げの遅延を引き起こしました。これは、衛星打ち上げサービスを提供する企業の業務に影響を及ぼしています。

さらに、COVID-19のパンデミックは、世界の衛星トランスポンダ市場に悪影響を及ぼし、サプライチェーンの混乱、需要の減少、衛星打ち上げの遅れ、ビジネスの遂行困難、企業の財務的影響により、市場内の企業の業務に影響を及ぼしています。

目次

第1章 衛星トランスポンダの世界市場- 調査手法と範囲

- 調査手法

- 調査目的と調査範囲

第2章 衛星トランスポンダの世界市場-市場の定義と概要

第3章 衛星トランスポンダの世界市場-エグゼクティブサマリー

- タイプ別市場内訳

- アンプタイプ別市場内訳

- 帯域幅別市場内訳

- サービス別市場内訳

- アプリケーション別市場内訳

- 地域別市場内訳

第4章 衛星トランスポンダの世界市場-市場力学

- 市場影響要因

- 促進要因

- 地球周回軌道における小型衛星の普及が、市場拡大の一因に

- 抑制要因

- トランスポンダのリースや衛星打ち上げサービスの価格が非常に高く、市場成長の妨げになります。

- ビジネスチャンス

- 影響分析

- 促進要因

第5章 衛星トランスポンダの世界市場- 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格設定分析

- 規制分析

第6章 衛星トランスポンダの世界市場-COVID-19分析

- COVID-19の市場分析

- COVID-19以前の市場シナリオ

- COVID-19の現在の市場シナリオ

- COVID-19の後、または将来のシナリオ

- COVID-19の中での価格ダイナミクス

- 需要-供給スペクトラム

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的な取り組み

- まとめ

第7章 衛星トランスポンダの世界市場- タイプ別

- ベントパイプ式トランスポンダ

- 再生型トランスポンダ

第8章 衛星トランスポンダの世界市場-アンプタイプ別

- ソリッドステートパワーアンプ(SSPA)

- 進行波管アンプ(TWTA)

第9章 衛星トランスポンダの世界市場-帯域幅別

- Cバンド

- KAバンド

- KUバンド

- Kバンド

- その他

第10章 衛星トランスポンダの世界市場- サービス別

- リース

- 保守・サポート

- その他

第11章 衛星トランスポンダの世界市場:アプリケーション別

- 商業通信

- 政府通信

- ナビゲーション

- リモートセンシング

- 研究開発(R&D)

- その他

第12章 衛星トランスポンダの世界市場- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米地域

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ地域

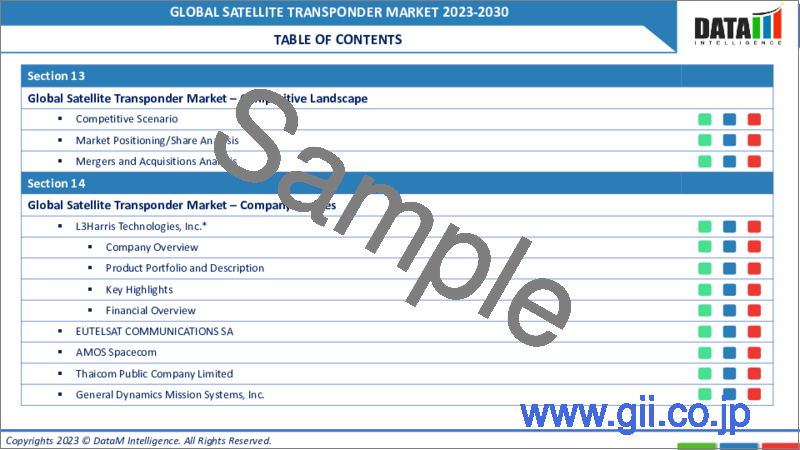

第13章 衛星トランスポンダの世界市場- 競争情勢

- 競合シナリオ

- 市況/シェア分析

- M&A(合併・買収)分析

第14章 衛星トランスポンダの世界市場-企業プロファイル

- L3Harris Technologies, Inc.

- 企業概要

- 製品ポートフォリオと説明

- 主なハイライト

- 財務概要

- EUTELSAT COMMUNICATIONS SA

- AMOS Spacecom

- Thaicom Public Company Limited

- General Dynamics Mission Systems, Inc.

- Intelsat

- Hispasat

- MEASAT

- IMT srl

- Syrlinks

第15章 衛星トランスポンダの世界市場-重要考察

第16章 衛星トランスポンダの世界市場-DataM

Market Overview

The global satellite transponder market reached US$ XX million in 2022 and is projected to record significant growth by reaching up to US$ XX million by 2030 and growing at a CAGR of XX% during the forecast period (2023-2030).

A satellite transponder is a device that receives a signal from an earth station (also known as a ground station) and retransmits it back to earth on a different frequency. It is essentially a relay that allows satellite communication between two earth stations. The signal received by satellite is amplified, frequency shifted and retransmitted back to earth. Satellite transponders are used in various applications such as television and radio broadcasting, satellite internet, satellite phone services and satellite navigation systems. They are also used for military and government communications and for monitoring weather and natural resources.

Market Dynamics

The increasing demand for satellite-based communication services, such as satellite internet, satellite television and satellite radio, is driving the growth of the satellite transponders market. The growing popularity of satellite-based services in developed and developing countries drives the need for more transponders to handle the increased traffic. The growing adoption of satellite-based services in remote and underserved areas is driving the growth of the satellite transponders market. Small satellites equipped with transponders are being used to connect these areas, creating the need for more transponders to handle the increased traffic.

Small satellite prevalence in Earth orbit is an aspect of the market's expansion

The rising number of small satellites in earth's orbit contributes to the growth of the satellite transponders market. Small satellites are used for many applications, including Internet of Things (IoT) communications, remote sensing and earth observation. As the number of small satellites in orbit increases, the demand for communication services to support these applications is also increasing. This drives the need for more satellite transponders to handle the increased traffic.

Small satellites are typically equipped with smaller transponders, which means they have less bandwidth for communication services. As the number of small satellites in orbit increases, the demand for more satellite bandwidth also increases. This is driving the need for more satellite transponders to provide additional bandwidth. The increasing number of small satellites in orbit is creating new business opportunities for manufacturers, providers and operators of satellite transponders. The demand for satellite transponders is expected to increase as more small satellites are deployed in earth orbits.

Therefore, the rising number of small satellites in the earth's orbit is driving the growth of the satellite transponders market by increasing the demand for communication services, satellite bandwidth and satellite connectivity. This also creates new business opportunities for companies in the satellite transponders industry.

Outrageously high prices for transponder leasing and satellite launch services hampers the market growth

Outrageously high prices for transponder leasing and satellite launch services can be a significant barrier to the growth of the satellite transponders market. High prices for transponder leasing and satellite launch services can make it difficult for small and medium-sized companies to enter the market. This can limit the number of players in the market and make it difficult for new companies to compete. High prices for transponder leasing and satellite launch services can make it more difficult for customers to afford these services. This can decrease demand for satellite transponders and limit the market growth. High prices for transponder leasing and satellite launch services can decrease the profit margin of companies operating in the market. This can make it less attractive for companies to invest in and limit the market growth.

COVID-19 Impact Analysis

The pandemic has caused disruptions to the supply chain of companies in the satellite transponders market. This has led to delays in delivering satellite transponders and other components, affecting companies' market operations. The pandemic has decreased demand for satellite transponders as many businesses have been forced to close or scale down their operations. This has affected the revenue of companies in the market. The pandemic has caused delays in satellite launches due to the closure of launch sites and disruptions to the supply chain. This has affected the operations of companies that provide satellite launch services.

Furthermore, the COVID-19 pandemic has had a negative impact on the global satellite transponders market, with supply chain disruptions, a decrease in demand, delays in satellite launches, difficulty in conducting business and financial impact on companies affecting the operations of companies in the market.

Segment Analysis

The global satellite transponder market is segmented based on type, amplifier type, bandwidth, service, application and region.

Owing to handle high bandwidth applications, the regenerative type of satellite transponders leads the global market

Regenerative satellite transponders are the type that has traditionally dominated the global satellite transponders market. Regenerative satellite transponders are known for their high performance and reliability, making them the preferred choice for various applications such as television and radio broadcasting, satellite internet, satellite phone services and satellite navigation systems. They work by receiving a signal from an earth station, processing it and then retransmitting it to earth on a different frequency. They can handle large amounts of data and are ideal for high-bandwidth applications.

Therefore, regenerative satellite transponders have traditionally dominated the global market due to their high performance, reliability and flexibility in handling high-bandwidth applications.

Geographical Analysis

The global satellite transponder market is segmented based on type, amplifier type, bandwidth, service, application and region.

The strong presence of major players in the region helps the North American satellite transponders market to dominate globally

North America is the region that traditionally dominates the global satellite transponders market. North America is home to many companies that manufacture and provide satellite transponders and several government agencies that use satellite transponders for various applications such as intelligence, surveillance and reconnaissance (ISR). The region has a strong economy and a high level of investment in research and development, which has enabled companies in the region to develop advanced technologies and provide high-quality products and services.

The presence of key players such as SES S.A., Intelsat S.A, Eutelsat Communications S.A and Telesat Holdings Inc. in the region also contributes to the dominance of North America in the global satellite transponders market.

Competitive Landscape

The global satellite transponders market is highly competitive, with many companies operating in the industry. The leading companies in the market are focusing on developing new and advanced technologies to gain a competitive advantage. The market is highly competitive, with many companies competing based on service quality, pricing and customer support. As the market continues to grow, we will likely see increased competition among existing players and the entry of new players into the market. The competition in the local and global markets is very high, so the primary focus areas include product launches, collaborations, strategic mergers and acquisitions. The key players in the market are L3Harris Technologies, Inc., EUTELSAT COMMUNICATIONS SA, AMOS Spacecom, Thaicom Public Company Limited, General Dynamics Mission Systems, Inc., Intelsat, Hispasat, MEASAT, IMT srl and Syrlinks.

L3Harris Technologies Inc.

Overview: L3Harris Technologies, Inc. is a technology company that provides a wide range of products and services to customers in the aerospace, defense and security industries. The company was formed in 2019 through the merger of L3 Technologies and Harris Corporation. L3Harris Technologies is headquartered in Melbourne, Florida and operates in over 100 countries worldwide. The company's portfolio includes various products and services, including communication systems, electronic systems and intelligence, surveillance and reconnaissance (ISR) systems. L3Harris Technologies also provides training, simulation systems and engineering and logistics support services. The company has corporate locations across India, Australia, Canada, Japan, Saudi Arabia, UAE, United Kingdom, Taiwan and Singapore.

Product Portfolio:

SATELLITE COMMUNICATIONS TRANSPONDER (CXS-1000): The CXS-1000 from L3Harris is a software-defined transceiver with multiple functions and a small physical footprint supports multiple bands and waveforms. For today's low-cost, short-duration small satellite applications, the CXS -1000 was developed. The multi-waveform receiver offers flexibility in channel selection, demodulation and encoding. Customers can program the frequency during production or while in orbit by uploading various waveforms. The CXS-1000 is available in L and S bands with the option of X- and Ka-band functionality and it is designed and radiation-tested for geosynchronous orbit. Unit is available as a single integrated unit or as separate transmitters and receivers for full duplex multiband missions.

Key Development: In August 2021, The multifaceted Mars Sample Return (MSR) campaign of L3Harris Technologies Inc. will collect samples from Mars. Two L3Harris transponders could be used in the mars mission, which was designed to be adaptable and complete the mission as planned. This action has helped the business become well-known in the satellite transponder market.

Why Purchase the Report?

- To visualize the global satellite transponder market segmentation based on type, amplifier type, bandwidth, service, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the global satellite transponder market by analyzing trends and co-development.

- Excel data sheet with numerous data points of satellite transponder market-level with all segments.

- PDF report consisting of cogently put together market analysis after exhaustive qualitative interviews and in-depth market study.

- Product mapping available as excel consisting of key products of all the major market players.

The global satellite transponder market report would provide approximately 77 tables, 78 figures and 225 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Global Satellite Transponder Market - Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Global Satellite Transponder Market - Market Definition and Overview

3. Global Satellite Transponder Market - Executive Summary

- 3.1. Market Snippet by Type

- 3.2. Market Snippet by Amplifier Type

- 3.3. Market Snippet by Bandwidth

- 3.4. Market Snippet by Service

- 3.5. Market Snippet by Application

- 3.6. Market Snippet by Region

4. Global Satellite Transponder Market-Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Small satellite prevalence in Earth orbit is an aspect of the market's expansion

- 4.1.1.2. XX

- 4.1.2. Restraints

- 4.1.2.1. Outrageously high prices for transponder leasing and satellite launch services hampers the market growth

- 4.1.2.2. XX

- 4.1.3. Opportunity

- 4.1.3.1. XX

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Global Satellite Transponder Market - Industry Analysis

- 5.1. Porter's Five Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. Global Satellite Transponder Market - COVID-19 Analysis

- 6.1. Analysis of COVID-19 on the Market

- 6.1.1. Before COVID-19 Market Scenario

- 6.1.2. Present COVID-19 Market Scenario

- 6.1.3. After COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. Global Satellite Transponder Market - By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Bent Pipe Transponders*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Regenerative Transponders

8. Global Satellite Transponder Market - By Amplifier Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Amplifier Type

- 8.1.2. Market Attractiveness Index, By Amplifier Type

- 8.2. Solid State Power Amplifier (SSPA)*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Travelling Wave Tube Amplifier (TWTA)

9. Global Satellite Transponder Market - By Bandwidth

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bandwidth

- 9.1.2. Market Attractiveness Index, By Bandwidth

- 9.2. C-band*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. KA-band

- 9.4. KU-band

- 9.5. K-band

- 9.6. Others

10. Global Satellite Transponder Market - By Service

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 10.1.2. Market Attractiveness Index, By Service

- 10.2. Leasing*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Maintenance and Support

- 10.4. Others

11. Global Satellite Transponder Market - By Application

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.1.2. Market Attractiveness Index, By Application

- 11.2. Commercial Communication*

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Government Communication

- 11.4. Navigation

- 11.5. Remote Sensing

- 11.6. Research And Development (R&D)

- 11.7. Others

12. Global Satellite Transponder Market - By Region

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2. Market Attractiveness Index, By Region

- 12.2. North America

- 12.2.1. Introduction

- 12.2.2. Key Region-Specific Dynamics

- 12.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Amplifier Type

- 12.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bandwidth

- 12.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 12.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1. U.S.

- 12.2.8.2. Canada

- 12.2.8.3. Mexico

- 12.3. Europe

- 12.3.1. Introduction

- 12.3.2. Key Region-Specific Dynamics

- 12.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Amplifier Type

- 12.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bandwidth

- 12.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 12.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1. Germany

- 12.3.8.2. UK

- 12.3.8.3. France

- 12.3.8.4. Italy

- 12.3.8.5. Russia

- 12.3.8.6. Rest of Europe

- 12.4. South America

- 12.4.1. Introduction

- 12.4.2. Key Region-Specific Dynamics

- 12.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Amplifier Type

- 12.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bandwidth

- 12.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 12.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1. Brazil

- 12.4.8.2. Argentina

- 12.4.8.3. Rest of South America

- 12.5. Asia-Pacific

- 12.5.1. Introduction

- 12.5.2. Key Region-Specific Dynamics

- 12.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Amplifier Type

- 12.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bandwidth

- 12.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 12.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1. China

- 12.5.8.2. India

- 12.5.8.3. Japan

- 12.5.8.4. Australia

- 12.5.8.5. Rest of Asia-Pacific

- 12.6. Middle East and Africa

- 12.6.1. Introduction

- 12.6.2. Key Region-Specific Dynamics

- 12.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Amplifier Type

- 12.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bandwidth

- 12.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 12.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

13. Global Satellite Transponder Market - Competitive Landscape

- 13.1. Competitive Scenario

- 13.2. Market Positioning/Share Analysis

- 13.3. Mergers and Acquisitions Analysis

14. Global Satellite Transponder Market- Company Profiles

- 14.1. L3Harris Technologies, Inc.*

- 14.1.1. Company Overview

- 14.1.2. Product Portfolio and Description

- 14.1.3. Key Highlights

- 14.1.4. Financial Overview

- 14.2. EUTELSAT COMMUNICATIONS SA

- 14.3. AMOS Spacecom

- 14.4. Thaicom Public Company Limited

- 14.5. General Dynamics Mission Systems, Inc.

- 14.6. Intelsat

- 14.7. Hispasat

- 14.8. MEASAT

- 14.9. IMT srl

- 14.10. Syrlinks

LIST NOT EXHAUSTIVE

15. Global Satellite Transponder Market- Premium Insights

16. Global Satellite Transponder Market- DataM

- 16.1. Appendix

- 16.2. About Us and Amplifier Type

- 16.3. Contact Us