|

|

市場調査レポート

商品コード

1576943

排便管理システム - 市場考察、競合情勢、市場予測(2030年)Bowel Management Systems - Market Insights, Competitive Landscape, and Market Forecast - 2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 排便管理システム - 市場考察、競合情勢、市場予測(2030年) |

|

出版日: 2024年10月01日

発行: DelveInsight

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

世界の排便管理システムの市場規模は、2023年に14億2,000万米ドルであり、2030年までに17億8,000万米ドルに達すると予測され、2024年~2030年の予測期間にCAGRで3.98%の成長が見込まれます。市場は、多発性硬化症を含む神経疾患の有病率の増加、製品開発活動の活発化、脊髄損傷の例の増加などにより急速に拡大しており、これらが2024年~2030年の予測期間に排便管理システム市場全体の成長を加速させると予測されます。

排便管理システムの市場力学

世界保健機関(WHO)(2024年)によると、2021年に世界で1,540万人が脊髄損傷とともに生活していました。脊髄損傷のほとんどは、転倒などの外傷や暴力行為によるもので、予防可能です。

WHO(2023年)のデータによると、世界で180万人超が多発性硬化症(MS)の影響を受けていると報告されています。多発性硬化症は、認知、感情、運動、感覚、視覚などのさまざまな機能に影響を及ぼします。免疫系が誤って脳や脊髄を攻撃することで発症します。

脊髄損傷と多発性硬化症は、両疾患とも重大な腸機能障害につながる可能性があるため、排便管理システムは脊髄損傷者と多発性硬化症患者のケアにおいて重要な役割を果たします。脊髄損傷者にとって、排便管理システムは規則的な排便を促し、便失禁などの合併症を予防し、全体的な生活の質を高めるのに役立ちます。同様に、多発性硬化症の患者も、神経障害のために排便管理に課題が生じることがよくあります。効果的な排便管理システムを導入することで、腸の機能をよりよく調節し、不快感を最小限に抑え、これらの症状に罹患している人の自立を促進することができます。

市場の主要企業による製品の発売などの製品開発活動の活発化も、市場の収益シェア拡大に寄与しています。例えば、Coloplastは2024年2月、排便障害や便漏れを抱える患者を支援するために設計された新しい経肛門灌流デバイス、Peristeen(R)Lightを発売しました。

したがって、上記の要因が総体的に排便管理システム市場全体の成長を促進します。

しかし、感染症、皮膚刺激、腸穿孔などの副作用、代替オプションの利用可能性などが、排便管理システム市場成長の課題となる可能性があります。

排便管理システム市場のセグメント分析

排便管理システム市場の製品タイプセグメントでは、神経調節デバイスのサブカテゴリが2023年に大きな収益シェアを占めると予測されます。これは、神経調節デバイスの使用と、その有用性と有効性を高める機能が広く普及しているためです。

排便管理システム用の神経調節デバイスは、電気刺激を利用して腸の機能を調節し、腸の機能障害を経験している人々に非侵襲性のソリューションを提供します。これらのデバイスは通常、調節可能な刺激設定を特徴とし、患者固有のニーズに合わせた個別の治療を可能にします。多くの場合、使いやすさとモニタリングのしやすさを考慮して、遠隔操作やアプリベースのインターフェースが搭載されています。

臨床応用では、神経調節デバイスは便失禁や便秘などの症状、特に腸のコントロールに影響を及ぼす神経の障害や外傷を持つ患者の管理に効果的です。仙骨神経を刺激することで、これらのデバイスは腸の運動性を高め、手作業による介入の必要性を減らし、全体的な腸の機能を改善し、それによって患者の生活の質を大幅に向上させることができます。

そのため、神経調節デバイスの広範な利用とさまざまな機能が性能と使いやすさを向上させ、2024年~2030年の予測期間に排便管理システム市場全体の成長に大きな影響を与えることを確実にしています。

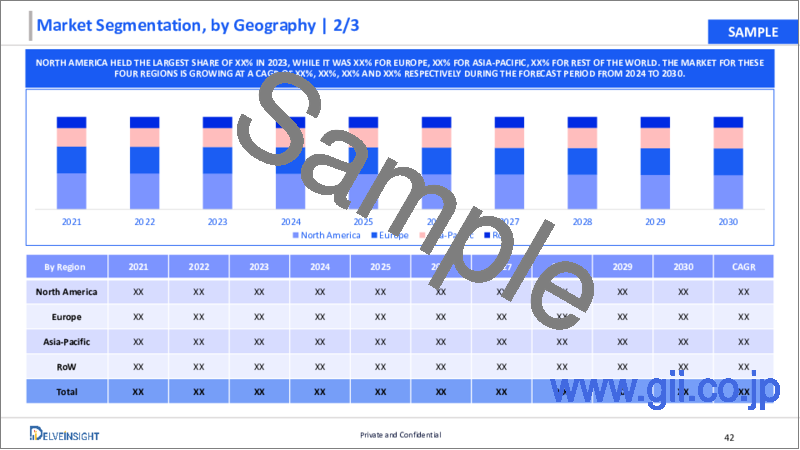

北米が排便管理システム市場全体を独占すると予測されます。

全地域の中で、北米が2023年に排便管理システム市場を独占すると予測され、予測期間にも同様と予測されます。これは、パーキンソン病の負担の増加、規制当局の承認の増加、確立された医療インフラのプレゼンスなどが、2024年~2030年の予測期間に北米の排便管理システム市場の成長に寄与する主な要因として作用しているためです。

当レポートでは、世界の排便管理システム市場について調査分析し、各地域の市場規模と予測、過去3年の製品/技術開発、市場の主要企業、将来の機会などの情報を提供しています。

目次

第1章 排便管理システム市場レポートのイントロダクション

第2章 排便管理システム市場のエグゼクティブサマリー

- 市場の概要

第3章 競合情勢

第4章 規制分析

- 米国

- 欧州

- 日本

- 中国

第5章 排便管理システム市場の主な要因の分析

- 排便管理システム市場の促進要因

- 排便管理システム市場の抑制要因と課題

- 排便管理システム市場の機会

第6章 排便管理システム市場のポーターのファイブフォース分析

第7章 排便管理システム市場の評価

- 製品タイプ別

- デバイス

- アクセサリ

- 患者タイプ別

- 成人

- 小児

- エンドユーザー別

- 病院

- 外来手術センター

- 在宅ケア

- 地域

- 北米

- 欧州

- アジア太平洋

- その他の地域

第8章 排便管理システム市場の企業と製品のプロファイル

- Coloplast Pty Ltd

- Medtronic

- ConvaTec Inc.

- Hollister Incorporated

- B. Braun Melsungen AG

- 3M

- Cardinal Health.

- BD

- Dentsply Sirona

- Norgine

- Attends Healthcare Products, Inc.

- Teleflex Incorporated

- Laborie

- Consure Medical.

- Axonics, Inc.

- Renew Medical Inc

第9章 KOLの見解

第10章 プロジェクトのアプローチ

第11章 DelveInsightについて

第12章 免責事項、お問い合わせ

List of Tables

- Table 1: Competitive Analysis

- Table 2: Bowel Management Systems Market in Global (2021-2030)

- Table 3: Bowel Management Systems Market in Global by Product Type (2021-2030)

- Table 4: Bowel Management Systems Market in Global by Patient Type (2021-2030)

- Table 5: Bowel Management Systems Market in Global by End-User (2021-2030)

- Table 6: Bowel Management Systems Market in Global by Geography (2021-2030)

- Table 7: Bowel Management Systems Market in North America (2021-2030)

- Table 8: Bowel Management Systems Market in the United States (2021-2030)

- Table 9: Bowel Management Systems Market in Canada (2021-2030)

- Table 10: Bowel Management Systems Market in Mexico (2021-2030)

- Table 11: Bowel Management Systems Market in Europe (2021-2030)

- Table 12: Bowel Management Systems Market in France (2021-2030)

- Table 13: Bowel Management Systems Market in Germany (2021-2030)

- Table 14: Bowel Management Systems Market in United Kingdom (2021-2030)

- Table 15: Bowel Management Systems Market in Italy (2021-2030)

- Table 16: Bowel Management Systems Market in Spain (2021-2030)

- Table 17: Bowel Management Systems Market in the Rest of Europe (2021-2030)

- Table 18: Bowel Management Systems Market in Asia-Pacific (2021-2030)

- Table 19: Bowel Management Systems Market in China (2021-2030)

- Table 20: Bowel Management Systems Market in Japan (2021-2030)

- Table 21: Bowel Management Systems Market in India (2021-2030)

- Table 22: Bowel Management Systems Market in Australia (2021-2030)

- Table 23: Bowel Management Systems Market in South Korea (2021-2030)

- Table 24: Bowel Management Systems Market in Rest of Asia-Pacific (2021-2030)

- Table 25: Bowel Management Systems Market in the Rest of the World (2021-2030)

- Table 26: Bowel Management Systems Market in the Middle East (2021-2030)

- Table 27: Bowel Management Systems Market in Africa (2021-2030)

- Table 28: Bowel Management Systems Market in South America (2021-2030)

List of Figures

- Figure 1: Competitive Analysis

- Figure 2: Bowel Management Systems Market in Global (2021-2030)

- Figure 3: Bowel Management Systems Market in Global by Product Type (2021-2030)

- Figure 4: Bowel Management Systems Market in Global by Patient Type (2021-2030)

- Figure 5: Bowel Management Systems Market in Global by End-User (2021-2030)

- Figure 6: Bowel Management Systems Market in Global by Geography (2021-2030)

- Figure 7: Bowel Management Systems Market in North America (2021-2030)

- Figure 8: Bowel Management Systems Market in the United States (2021-2030)

- Figure 9: Bowel Management Systems Market in Canada (2021-2030)

- Figure 10: Bowel Management Systems Market in Mexico (2021-2030)

- Figure 11: Bowel Management Systems Market in Europe (2021-2030)

- Figure 12: Bowel Management Systems Market in France (2021-2030)

- Figure 13: Bowel Management Systems Market in Germany (2021-2030)

- Figure 14: Bowel Management Systems Market in United Kingdom (2021-2030)

- Figure 15: Bowel Management Systems Market in Italy (2021-2030)

- Figure 16: Bowel Management Systems Market in Spain (2021-2030)

- Figure 17: Bowel Management Systems Market in the Rest of Europe (2021-2030)

- Figure 18: Bowel Management Systems Market in Asia-Pacific (2021-2030)

- Figure 19: Bowel Management Systems Market in China (2021-2030)

- Figure 20: Bowel Management Systems Market in Japan (2021-2030)

- Figure 21: Bowel Management Systems Market in India (2021-2030)

- Figure 22: Bowel Management Systems Market in Australia (2021-2030)

- Figure 23: Bowel Management Systems Market in South Korea (2021-2030)

- Figure 24: Bowel Management Systems Market in Rest of Asia-Pacific (2021-2030)

- Figure 25: Bowel Management Systems Market in the Rest of the World (2021-2030)

- Figure 26: Bowel Management Systems Market in the Middle East (2021-2030)

- Figure 27: Bowel Management Systems Market in Africa (2021-2030)

- Figure 28: Bowel Management Systems Market in South America (2021-2030)

- Figure 29: Market Drivers

- Figure 30: Market Barriers

- Figure 31: Marker Opportunities

- Figure 32: PORTER'S Five Force Analysis

Bowel Management Systems Market by Product Type (Devices [Irrigation Systems, Nerve Modulation Devices, and Others], and Accessories), Patient Type (Adult and Pediatrics), End-User (Hospitals, Ambulatory Surgical Centres, and Homecare), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to advance at a respectable CAGR forecast till 2030 owing to the increasing prevalence of neurological disorders and growing product developmental activities worldwide

The bowel management systems market was valued at USD 1.42 billion in 2023, growing at a CAGR of 3.98% during the forecast period from 2024 to 2030, in order to reach USD 1.78 billion by 2030. The bowel management systems market is expanding rapidly due to the increasing prevalence of neurological disorders including multiple sclerosis, growing product developmental activities, increasing instances of spinal cord injuries, and others that are expected to escalate the overall growth of the bowel management systems market during the forecast period from 2024 to 2030.

Bowel Management Systems Market Dynamics:

According to the World Health Organization (WHO) (2024) in 2021, 15.4 million people were living with spinal cord injuries globally. Most cases of spinal cord injury result from trauma, including falls, or acts of violence, and are therefore preventable.

As per data from the WHO (2023), it was reported that over 1.8 million people worldwide are affected by Multiple sclerosis (MS). It impacts various functions including cognitive, emotional, motor, sensory, and visual abilities. It occurs when the immune system mistakenly attacks the brain and spinal cord.

Bowel management systems play a crucial role in the care of individuals with spinal cord injuries and multiple sclerosis, as both conditions can lead to significant bowel dysfunction. For those with spinal cord injuries, bowel management systems help facilitate regular bowel movements and prevent complications such as fecal incontinence, enhancing overall quality of life. Similarly, patients with multiple sclerosis often experience challenges in bowel control due to neurological impairments. Implementing effective bowel management systems allows for better regulation of bowel function, minimizing discomfort and promoting independence for individuals affected by these conditions.

Rising product developmental activities such as product launches by the market key player are also contributing in increasing revenue shares for the same. For example, in February 2024, Coloplast launched Peristeen(R) Light, a new transanal irrigation device designed to assist individuals with bowel disorders, specifically those dealing with defecation issues or stool leakage.

Therefore, the factors stated above collectively will drive the overall bowel management systems market growth.

However, side-effects such as infections, skin irritation, and bowel perforation, among others, availability of alternative options, and others may prove to be challenging factors for bowel management systems market growth.

Bowel Management Systems Market Segment Analysis:

Bowel Management Systems Market by Product Type (Devices [Irrigation Systems, Nerve Modulation Devices, and Others], and Accessories), Patient Type (Adult and Pediatrics), End-User (Hospitals, Ambulatory Surgical Centres, and Homecare), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the bowel management systems market, the nerve modulation devices sub-category is expected to have a significant revenue share in the year 2023. This is because of the widespread uses and features of nerve modulation devices that enhance their utility and effectiveness.

Nerve modulation devices for bowel management systems utilize electrical stimulation to regulate bowel function, offering a non-invasive solution for individuals experiencing bowel dysfunction. These devices typically feature adjustable stimulation settings, allowing for personalized treatment tailored to the patient's specific needs. They often include remote control or app-based interfaces for ease of use and monitoring.

In clinical applications, nerve modulation devices are effective in managing conditions such as fecal incontinence and constipation, particularly in patients with neurological disorders or injuries affecting bowel control. By stimulating the sacral nerves, these devices can enhance bowel motility, reduce the need for manual interventions, and improve overall bowel function, thereby significantly enhancing patients' quality of life.

Therefore the widespread uses and various features of nerve modulation devices enhance performance and usability, solidifying the significant impact on the growth of the overall bowel management systems market during the forecast period from 2024 to 2030.

North America is expected to dominate the overall bowel management systems market:

Among all the regions, North America is expected to dominate the bowel management systems market in the year 2023 and is expected to do the same during the forecast period. This is driven by the growing burden of Parkinson's disease, increasing regulatory approval, the presence of well-established healthcare infrastructure, and others, acting as key factors contributing to the growth of the bowel management systems market in the North America region during the forecast period from 2024 to 2030.

Parkinson's Foundation in 2024 stated that, currently near about one million people in the U.S. are living with Parkinson's disease. This number is projected to increase to 1.2 million by 2030. Parkinson's disease is the second-most common neurodegenerative disorder, following Alzheimer's disease. Each year, approximately 90,000 new cases of Parkinson's are diagnosed in the US.

Bowel management systems are essential for individuals with Parkinson's disease, as the condition frequently causes gastrointestinal issues like constipation and fecal incontinence. These systems assist in effective bowel irrigation and evacuation, helping patients maintain dignity and quality of life. As the disease progresses, tailored bowel management becomes critical, enabling patients and caregivers to address bowel dysfunction challenges. Integrating these systems into care plans supports better gastrointestinal health and overall well-being for those affected by Parkinson's disease.

Rising product developmental activities by regulatory bodies in the region will further boost the market for bowel management systems. For example, in February 2022, Medtronic received the USFDA approval for the InterStim X(TM) system, the next generation of the most personalized sacral nerve stimulation therapy for bladder and bowel control.

Therefore, the interplay of all the aforementioned factors would provide a conducive growth environment for the North American bowel management systems market.

Bowel Management Systems Market key players:

Some of the key market players operating in the bowel management systems market include Coloplast Pty Ltd, Medtronic, ConvaTec Inc., Hollister Incorporated, B. Braun Melsungen AG, 3M, Cardinal Health., BD, Dentsply Sirona, Norgine, Attends Healthcare, Products, Inc., Teleflex Incorporated, Laborie, Consure Medical., Axonics, Inc., Renew Medical Inc, and others.

Recent Developmental Activities in the Bowel Management Systems Market:

- In November 2021, Medtronic announced that the U.S. Food and Drug Administration, granted 510(k) clearance for its PillCam(TM) Small Bowel 3 system, intended for remote endoscopy procedures.

- In October 2021, Laborie, acquired Pelvalon, Inc., a privately-held medical device company that developed an innovative product Eclipse(TM) System, a non-surgical, patient-controlled device for women suffering from faecal incontinence.

- In May 2021, Axonics, Inc., a global medical technology company focused on developing and commercializing novel products for the treatment of bladder and bowel dysfunction, received European CE Mark approval for its second-generation Axonics r-SNM(R) implantable neurostimulator (INS) and wireless patient remote control with SmartMRI(TM) technology.

Key Takeaways from the Bowel Management Systems Market Report Study

- Market size analysis for current bowel management systems market size (2023), and market forecast for 6 years (2024 to 2030)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened for the last 3 years

- Key companies dominating the bowel management systems market.

- Various opportunities available for the other competitors in the bowel management systems market space.

- What are the top-performing segments in 2023? How these segments will perform in 2030?

- Which are the top-performing regions and countries in the current bowel management systems market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for bowel management systems market growth in the coming future?

Target Audience who can be benefited from this Bowel Management Systems Market Report Study

- Bowel management systems product providers

- Research organizations and consulting companies

- Bowel management systems-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in bowel management systems

- Various end-users who want to know more about the bowel management systems market and the latest technological developments in the bowel management systems market

Frequently Asked Questions for the Bowel Management Systems Market:

1. What are Bowel Management Systems?

- The bowel incontinence, also known as faecal incontinence is generally the situation when the patient is not able to control bowel movements which results in involuntary loss of solid or liquid stool. The clinical devices used to manage bowel activity are called bowel management systems.

2. What is the market for Bowel Management Systems?

- The bowel management systems market was valued at USD 1.42 billion in 2023, growing at a CAGR of 3.98% during the forecast period from 2024 to 2030, to reach USD 1.78 billion by 2030.

3. What are the drivers for the Bowel Management Systems market?

- The bowel management systems market is expanding rapidly due to the increasing prevalence of neurological disorders including multiple sclerosis, growing product developmental activities, increasing instances of spinal cord injuries, and others that are expected to escalate the overall growth of the bowel management systems market during the forecast period from 2024 to 2030.

4. Who are the key players operating in the Bowel Management Systems market?

- Some of the key market players operating in bowel management systems include Coloplast Pty Ltd, Medtronic, ConvaTec Inc., Hollister Incorporated, B. Braun Melsungen AG, 3M, Cardinal Health., BD, Dentsply Sirona, Norgine, Attends Healthcare, Products, Inc., Teleflex Incorporated, Laborie, Consure Medical., Axonics, Inc., Renew Medical Inc, and others.

5. Which region has the highest share in the Bowel Management Systems market?

- Among all the regions, North America is expected to dominate the bowel management systems market in the year 2023 and is expected to do the same during the forecast period. This is driven by the growing burden of Parkinson's disease, increasing regulatory approval, the presence of well-established healthcare infrastructure, and others, acting as key factors contributing to the growth of the bowel management systems market in the North America region during the forecast period from 2024 to 2030.

Table of Contents

1. Bowel Management Systems Market Report Introduction

- 1.1. Scope of the Study

- 1.2. Market Segmentation

- 1.3. Market Assumption

2. Bowel Management Systems Market Executive Summary

- 2.1. Market at Glance

3. Competitive Landscape

4. Regulatory Analysis

- 4.1. The United States

- 4.2. Europe

- 4.3. Japan

- 4.4. China

5. Bowel Management Systems Market Key Factors Analysis

- 5.1. Bowel Management Systems Market Drivers

- 5.1.1. Increasing prevalence of neurological disorders

- 5.1.2. Growing product developmental activities

- 5.1.3. Increasing instances of spinal cord injury

- 5.1.4. Rising aging population

- 5.2. Bowel Management Systems Market Restraints and Challenges

- 5.2.1. Side-effects such as infections, skin irritation, and bowel perforation, among others

- 5.2.2. Availability of alternative options

- 5.3. Bowel Management Systems Market Opportunities

- 5.3.1. Development of more biocompatible materials

6. Bowel Management Systems Market Porter's Five Forces Analysis

- 6.1. Bargaining Power of Suppliers

- 6.2. Bargaining Power of Consumers

- 6.3. Threat of New Entrants

- 6.4. Threat of Substitutes

- 6.5. Competitive Rivalry

7. Bowel Management Systems Market Assessment

- 7.1. By Product Type

- 7.1.1. Devices

- 7.1.1.1. Irrigation Systems

- 7.1.1.2. Nerve Modulation Devices

- 7.1.1.3. Others

- 7.1.2. Accessories

- 7.1.1. Devices

- 7.2. By Patient Type

- 7.2.1. Adult

- 7.2.2. Pediatrics

- 7.3. By End-User

- 7.3.1. Hospitals

- 7.3.2. Ambulatory Surgical Centres

- 7.3.3. Home Care

- 7.4. By Geography

- 7.4.1. North America

- 7.4.1.1. United States Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.1.2. Canada Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.1.3. Mexico Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.2. Europe

- 7.4.2.1. France Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.2.2. Germany Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.2.3. United Kingdom Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.2.4. Italy Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.2.5. Spain Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.2.6. Rest of Europe Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.3. Asia-Pacific

- 7.4.3.1. China Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.3.2. Japan Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.3.3. India Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.3.4. Australia Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.3.5. South Korea Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.3.6. Rest of Asia-Pacific Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.4. Rest of the World (RoW)

- 7.4.4.1. Middle East Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.4.2. Africa Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.4.3. South America Bowel Management Systems Market Size in USD million (2021-2030)

- 7.4.1. North America

8. Bowel Management Systems Market Company and Product Profiles

- 8.1. Coloplast Pty Ltd

- 8.1.1. Company Overview

- 8.1.2. Company Snapshot

- 8.1.3. Financial Overview

- 8.1.4. Product Listing

- 8.1.5. Entropy

- 8.2. Medtronic

- 8.2.1. Company Overview

- 8.2.2. Company Snapshot

- 8.2.3. Financial Overview

- 8.2.4. Product Listing

- 8.2.5. Entropy

- 8.3. ConvaTec Inc.

- 8.3.1. Company Overview

- 8.3.2. Company Snapshot

- 8.3.3. Financial Overview

- 8.3.4. Product Listing

- 8.3.5. Entropy

- 8.4. Hollister Incorporated

- 8.4.1. Company Overview

- 8.4.2. Company Snapshot

- 8.4.3. Financial Overview

- 8.4.4. Product Listing

- 8.4.5. Entropy

- 8.5. B. Braun Melsungen AG

- 8.5.1. Company Overview

- 8.5.2. Company Snapshot

- 8.5.3. Financial Overview

- 8.5.4. Product Listing

- 8.5.5. Entropy

- 8.6. 3M

- 8.6.1. Company Overview

- 8.6.2. Company Snapshot

- 8.6.3. Financial Overview

- 8.6.4. Product Listing

- 8.6.5. Entropy

- 8.7. Cardinal Health.

- 8.7.1. Company Overview

- 8.7.2. Company Snapshot

- 8.7.3. Financial Overview

- 8.7.4. Product Listing

- 8.7.5. Entropy

- 8.8. BD

- 8.8.1. Company Overview

- 8.8.2. Company Snapshot

- 8.8.3. Financial Overview

- 8.8.4. Product Listing

- 8.8.5. Entropy

- 8.9. Dentsply Sirona

- 8.9.1. Company Overview

- 8.9.2. Company Snapshot

- 8.9.3. Financial Overview

- 8.9.4. Product Listing

- 8.9.5. Entropy

- 8.10. Norgine

- 8.10.1. Company Overview

- 8.10.2. Company Snapshot

- 8.10.3. Financial Overview

- 8.10.4. Product Listing

- 8.10.5. Entropy

- 8.11. Attends Healthcare Products, Inc.

- 8.11.1. Company Overview

- 8.11.2. Company Snapshot

- 8.11.3. Financial Overview

- 8.11.4. Product Listing

- 8.11.5. Entropy

- 8.12. Teleflex Incorporated

- 8.12.1. Company Overview

- 8.12.2. Company Snapshot

- 8.12.3. Financial Overview

- 8.12.4. Product Listing

- 8.12.5. Entropy

- 8.13. Laborie

- 8.13.1. Company Overview

- 8.13.2. Company Snapshot

- 8.13.3. Financial Overview

- 8.13.4. Product Listing

- 8.13.5. Entropy

- 8.14. Consure Medical.

- 8.14.1. Company Overview

- 8.14.2. Company Snapshot

- 8.14.3. Financial Overview

- 8.14.4. Product Listing

- 8.14.5. Entropy

- 8.15. Axonics, Inc.

- 8.15.1. Company Overview

- 8.15.2. Company Snapshot

- 8.15.3. Financial Overview

- 8.15.4. Product Listing

- 8.15.5. Entropy

- 8.16. Renew Medical Inc

- 8.16.1. Company Overview

- 8.16.2. Company Snapshot

- 8.16.3. Financial Overview

- 8.16.4. Product Listing

- 8.16.5. Entropy