|

|

市場調査レポート

商品コード

1776197

血液浄化装置の世界市場:洞察、競合情勢、市場予測:2032年Blood Purification Devices - Market Insights, Competitive Landscape, and Market Forecast - 2032 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 血液浄化装置の世界市場:洞察、競合情勢、市場予測:2032年 |

|

出版日: 2025年07月01日

発行: DelveInsight

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

血液浄化装置の市場規模は、2024年に177億3,452万米ドルとなりました。同市場は、2025年から2032年までの予測期間中にCAGR 5.40%で成長し、2032年には268億6,487万米ドルに達すると予測されています。血液浄化装置市場の需要は、急性腎障害(AKI)や慢性腎臓病(CKD)の増加、腎臓合併症の一因となる高血圧や糖尿病の症例増加に牽引され、着実な成長を遂げています。さらに、主要企業による継続的な製品開発と高度な精製技術の発売により、治療効率と患者の転帰が向上しています。こうした複合的な要因が、2025年から2032年にかけての持続的な市場拡大に向けて有利な状況を生み出しています。

血液浄化装置市場力学:

米国国立衛生研究所(National Institutes of Health)のデータ(2024年)によると、急性腎障害(AKI)は世界中で毎年約1,330万人が罹患しており、特に低・中所得国では感染症に関連する症例がかなりの部分を占めています。このような世界の発生率の高さ、特に高度ヘルスケアへのアクセスが限られている地域での発生率の高さは、血液浄化装置市場を直接的に加速させています。AKIではしばしば、生命を脅かす合併症を予防するためにタイムリーかつ効果的な体外血液浄化が必要とされるため、症例数の増加が、拡張可能で費用対効果が高く、臨床的に信頼できる治療オプションに対する需要を促進しています。このニーズは、メーカー各社に、多様なヘルスケア環境に合わせた、より適応性の高い浄化技術の開発と流通を促しています。その結果、AKI、特に感染症によるケースの負担増は、世界の血液浄化装置市場の拡大に重要な役割を果たしています。

米国国立衛生研究所(2022年)によると、CKDは世界人口の10%以上、8億人以上が罹患しており、特に高齢者、女性、人種的マイノリティ、糖尿病や高血圧の患者が影響を受けています。このような大規模で増加する患者人口は、継続的な腎支援を必要とするため、血液浄化技術に対する需要が高まっています。

さらに、UK Kidney Association(2022年)のデータでは、1年間に68万3,136件のAKIが報告されており、タイムリーで効果的な介入に対する緊急かつ広範な必要性が強調されています。CKDやAKIのような治療では、血液透析や持続的腎代替療法(CRRT)などの治療が必要となることが多く、高度な血液浄化装置の採用を後押ししています。このような腎疾患の規模と重篤度は、ヘルスケアシステムに、より効率的で信頼性が高く、利用しやすい浄化ソリューションの採用を促しており、それによって市場の成長が促進されています。

さらに、主な市場参入企業による製品開発活動の活発化が、血液浄化装置市場をエスカレートさせています。例えば、2024年6月、腎臓ケア製品とサービスの大手プロバイダーであるFresenius Medical Care(FME)は、5008X CAREsystemの更新版についてFDA 510(k)認可を取得した後、米国に大量血液濾過(HVHDF)療法を導入する第2段階を開始しました。この新バージョンは追加機能を含み、2026年の本格的な商業展開に向け、今年後半に米国で広く発売するための重要な一歩となっています。

こうした魅力的な要因に後押しされ、血液浄化装置市場は2025年から2032年までの予測期間中に大きく成長する見通しです。

しかし、血液浄化装置に関連する合併症のリスクと安全性の懸念、製品リコールの増加などは、血液浄化装置市場の成長を制限する可能性のある主要な制約事項の一部です。

血液浄化装置市場セグメント分析:

血液浄化装置市場:製品タイプ(持続的腎代替療法(CRRT)装置、血液透析装置、血液灌流装置、血漿交換装置)、エンドユーザー(病院、透析センター、その他)、地域(北米、欧州、アジア太平洋、その他の地域)

血液浄化装置市場の製品タイプ別では、持続的腎代替療法(CRRT)装置カテゴリーが2024年に最大の市場シェアを占めると予測されています。これは、特に集中治療室(ICU)に入院する重症患者の間で急性腎障害(AKI)の症例が増加していることが主な要因です。CRRTは、より緩徐に、より制御された連続的な血液浄化プロセスを提供するため、このような環境に適しており、従来の血液透析に伴う急速な体液および溶質のシフトに耐えられない血行動態が不安定な患者にとって好ましい選択肢となっています。

また、敗血症や多臓器不全のような生命を脅かす病態が増加しており、このような病態はしばしばAKIを引き起こすため、CRRTシステムの需要がさらに高まっています。このような臨床シナリオでは、緊急かつ持続的な腎支持が必要とされることが多く、CRRTはクリティカルケアにおいて不可欠な介入と位置づけられています。

同時に、技術の進歩によりCRRT装置の機能性と使いやすさが向上しました。自動輸液管理、リアルタイム・モニタリング、直感的なユーザー・インターフェースなどの技術革新により、医療従事者の操作負担が軽減される一方で、治療精度が向上しています。

このような拡大は、CRRTプラットフォームの汎用性の高まりを反映した規制上のマイルストーンによってさらに裏付けられています。例えば、2023年8月、Quanta Dialysis Technologies(R)は、同社のQuanta透析システムのCRRT適応拡大に関するFDA 510(k)認可を取得し、多機能で適応性の高い腎支援機器への動向を浮き彫りにしました。

したがって、これらの複合的な要因によって、CRRTデバイスカテゴリは大幅な成長を示し、2025年から2032年までの予測期間中に血液浄化デバイス市場全体の拡大に大きく貢献すると予想されます。

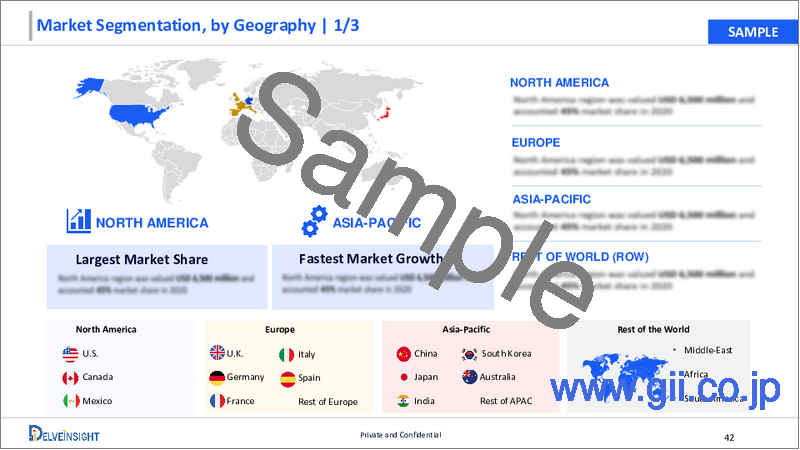

北米が血液浄化装置市場全体を支配すると予測される:

北米は、いくつかの重要な要因によって、2024年には血液浄化装置市場で最大のシェアを占めると予測されています。この地域の優位性は、慢性腎臓病(CKD)とそれに関連する高血圧や糖尿病などの危険因子が多いことが主な要因です。同地域はまた、整備されたヘルスケア・インフラ、支援的な償還政策、腎臓ケアの進展への注目の高まりなどの恩恵を受けています。これらの要因が総合的に血液浄化技術の普及に寄与しており、予測期間を通じて北米が主要市場としての地位を固めています。

米国疾病予防管理センター(CDC、2024年)によると、米国の成人の7人に1人以上、約3,550万人(人口の14%)がCKDに罹患しています。この疾患は高齢者に偏っており、65歳以上の罹患率は34%であるのに対し、45歳から64歳の罹患率は12%、18歳から44歳の罹患率は6%でした。また、CKDは男性(12%)よりも女性(14%)の方がわずかに多いです。これを裏付けるように、米国腎臓基金(2024年)は、約80万8,000人が腎不全とともに生活しており、2022年には13万5,000人が新たに腎不全と診断されたと報告しています。

このように人口統計学的に多様な患者層が増加しているため、特に病院、透析センター、クリティカルケア環境において、透析や持続的血液浄化などの腎支援療法に対する需要が高まっています。

2025年には、米国成人のほぼ半数、48.1%、約1億1,990万人が高血圧に罹患しており、収縮期血圧が130mmHg以上、拡張期血圧が80mmHg以上、またはその状態を管理するために薬を服用中と定義されます。しかし、高血圧の成人の4人に1人(22.5%、2,700万人)しか、その状態をコントロールできていません。さらに、2024年には約3,800万人が糖尿病に罹患していると報告されています。

高血圧と糖尿病はともに、CKDとAKI発症の主要な危険因子であり、体液過負荷、毒素除去、電解質不均衡を管理するために、しばしばタイムリーで効果的な血液浄化治療が必要となる疾患です。これらの慢性疾患の負担の増大は、腎支援を必要とする患者数を増加させるだけでなく、ヘルスケアプロバイダーに高度な血液浄化技術の導入を促しています。その結果、高血圧と糖尿病の罹患率の上昇が、血液浄化装置市場の成長と拡大に直接寄与しています。

さらに、この地域における製品開発活動は、血液浄化装置市場をさらに押し上げると予想されています。例えば、2024年7月、Tablo(R)は、米国に本拠を置く医療技術企業Outset Medical社によって開発された画期的な完全一体型移動式血液透析システムであり、急性および慢性腎不全患者の治療用に設計されています。

これらの臨床的、技術的、戦略的促進要因が相まって、2025年から2032年までの予測期間を通じて、米国の血液浄化装置市場の成長を大きく促進すると予想されます。

血液浄化装置市場の主要企業

血液浄化装置市場で事業を展開する主要市場参入企業には、B. Braun Melsungen AG、Asahi Kasei Corporation、Fresenius SE and Co.KGaA、Baxter、Infomed SA、Jafron Biomedical Co.Ltd.、Kaneka Corporation、Nikkiso Co., Ltd.、SWS Medical Group、Medtronic、CytoSorbents Europe GmbH、Spectral Medical Inc.、Haemonetics Corporation、Baihe Medical、ExThera Medical Corporationなどが挙げられます。

血液浄化装置市場における最近の開発活動:

- 2024年11月、Quanta Dialysis Technologies(R)は、同社のQuanta透析システムを在宅環境で使用するためのFDA 510(k)認可を取得しました。この承認により、Quantaは、末期腎不全(ESRD)患者向けに高透析液流量システム(500mL/分)を提供する唯一の企業となっています。

- 2024年7月、カリフォルニア大学ロサンゼルス校主導の研究チームが、持続的腎代替療法(CRRT)を受ける透析患者の短期生存率を正確に予測する機械学習モデルを開発しました。

- 2024年3月、米国のCerus Corporationは、輸血された血液に添加することで、病原体を予防し、急性腎障害のリスクを軽減することを目的とした化合物を評価する第III相臨床試験の良好なトップライン結果を報告しました。

血液浄化装置市場調査報告書の主な要点

- 現在の血液浄化装置市場規模(2024年)と8年間(2025年~2032年)の市場予測に関する市場規模分析

- 過去3年間に起こった主な製品/技術開発、合併、買収、提携、合弁事業。

- 血液浄化装置市場を独占する主要企業。

- 血液浄化装置市場において競合他社が利用できる様々な機会

- 2024年に上位を占めるセグメントと2032年におけるこれらのセグメントの業績

- 現在の血液浄化装置市場のシナリオにおいて、上位の業績を上げている地域と国

- 今後の血液浄化装置市場成長の機会に企業が集中すべき地域と国

血液浄化装置市場のよくある質問

1.血液浄化装置

- 血液浄化装置とは、血液から毒素、老廃物、炎症性媒介物質、または過剰な体液を除去するように設計された医療システムであり、一般的には腎不全、敗血症、自己免疫疾患、またはその他の重篤な状態の患者を対象としています。これらの装置は、血液透析、血液濾過、血液灌流、またはプラズマフェレーシスなどのさまざまな技術を用いて作動し、臓器機能をサポートし、全身の不均衡を管理するために集中治療環境で一般的に使用されます。

2.血液浄化装置市場は

- 血液浄化装置市場は、2024年に177億3,452万米ドルと評価され、2025年から2032年までの予測期間中にCAGR 5.40%で成長し、2032年には268億6,487万米ドルに達します。

3.血液浄化装置市場の促進要因

- 血液浄化装置市場の需要は、急性腎障害(AKI)や慢性腎臓病(CKD)の増加、腎臓合併症の一因となる高血圧や糖尿病の罹患率の増加により、着実な成長を遂げています。さらに、主要企業別継続的な製品開発と高度な精製技術の発売により、治療効率と患者の転帰が向上しています。こうした複合的な要因が、2025年から2032年までの持続的な市場拡大に向けて有利な状況を生み出しています。

4.血液浄化装置市場で事業を展開する主要企業

- 血液浄化装置市場に参入している主な参入企業には、B. Braun Melsungen AG、Asahi Kasei Corporation、Fresenius SE and Co.KGaA、Baxter、Infomed SA、Jafron Biomedical Co.Ltd.、Kaneka Corporation、Nikkiso Co., Ltd.、SWS Medical Group、Medtronic、CytoSorbents Europe GmbH、Spectral Medical Inc.、Haemonetics Corporation、Baihe Medical、ExThera Medical Corporationなどが挙げられます。

5.血液浄化装置市場で最もシェアが高い地域

- 北米は、いくつかの重要な要因により、2024年には血液浄化装置市場で最大のシェアを占めると予測されています。この地域の優位性は、慢性腎臓病(CKD)とそれに関連する高血圧や糖尿病などの危険因子が多いことが主な要因です。同地域はまた、整備されたヘルスケア・インフラ、支援的な償還政策、腎臓ケアの進展への注目の高まりなどの恩恵を受けています。これらの要因が総合的に血液浄化技術の普及に寄与し、予測期間を通じて北米の主導的市場としての地位を確固たるものにしています。

目次

第1章 血液浄化装置市場レポートのイントロダクション

第2章 血液浄化装置市場のエグゼクティブサマリー

第3章 競合情勢

第4章 規制分析

- 米国

- 欧州

- 日本

- 中国

第5章 血液浄化装置市場の主な要因分析

- 血液浄化装置市場促進要因

- さまざまな腎臓疾患の増加

- 高血圧や糖尿病別腎疾患の急増

- 主要参入企業別製品開発活動の拡大

- 血液浄化装置市場抑制要因と課題

- 血液浄化装置に伴う合併症のリスクと安全性の懸念

- 製品リコールの増加

- 血液浄化装置の市場機会

- 自動化の向上と血液浄化装置の遠隔監視および制御機能

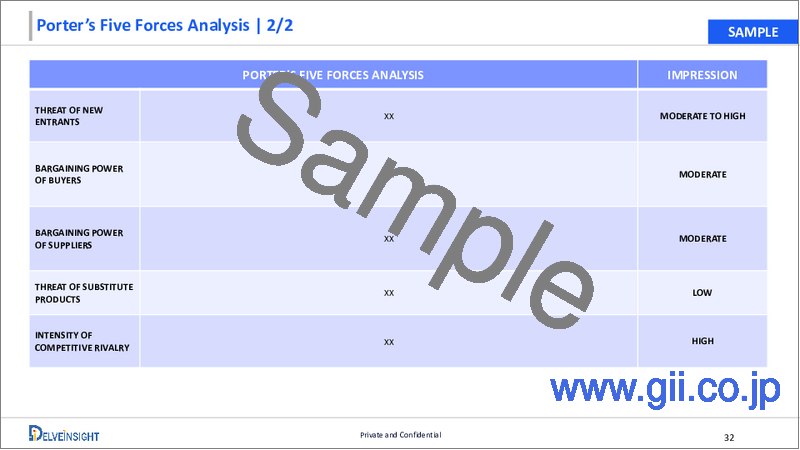

第6章 血液浄化装置市場:ポーターのファイブフォース分析

第7章 血液浄化装置市場評価

- 製品タイプ別

- 持続的腎代替療法(CRRT)装置

- 血液透析装置

- 血液灌流装置

- 血漿交換装置

- エンドユーザー別

- 病院

- 透析センター

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第8章 血液浄化装置市場の企業と製品プロファイル

- B. Braun Melsungen AG

- Asahi Kasei Corporation

- Fresenius SE and Co. KGaA

- Baxter

- Infomed SA

- Jafron Biomedical Co., Ltd.

- Kaneka Corporation

- Nikkiso Co, ltd.

- SWS Medical Group

- Medtronic

- CytoSorbents Europe GmbH

- Spectral Medical Inc

- Haemonetics Corporation

- Baihe Medical

- ExThera Medical Corporation

第9章 KOLの見解

第10章 プロジェクトアプローチ

第11章 DelveInsightについて

第12章 免責事項とお問い合わせ

List of Tables

- Table 1: Competitive Analysis

- Table 2: Blood Purification Devices Market in Global (2022-2032)

- Table 3: Blood Purification Devices Market in Global by Product Type (2022-2032)

- Table 4: Blood Purification Devices Market in Global by End-User (2022-2032)

- Table 5: Blood Purification Devices Market in Global by Geography (2022-2032)

- Table 6: Blood Purification Devices Market in North America (2022-2032)

- Table 7: Blood Purification Devices Market in the United States (2022-2032)

- Table 8: Blood Purification Devices Market in Canada (2022-2032)

- Table 9: Blood Purification Devices Market in Mexico (2022-2032)

- Table 10: Blood Purification Devices Market in Europe (2022-2032)

- Table 11: Blood Purification Devices Market in France (2022-2032)

- Table 12: Blood Purification Devices Market in Germany (2022-2032)

- Table 13: Blood Purification Devices Market in United Kingdom (2022-2032)

- Table 14: Blood Purification Devices Market in Italy (2022-2032)

- Table 15: Blood Purification Devices Market in Spain (2022-2032)

- Table 16: Blood Purification Devices Market in the Rest of Europe (2022-2032)

- Table 17: Blood Purification Devices Market in Asia-Pacific (2022-2032)

- Table 18: Blood Purification Devices Market in China (2022-2032)

- Table 19: Blood Purification Devices Market in Japan (2022-2032)

- Table 20: Blood Purification Devices Market in India (2022-2032)

- Table 21: Blood Purification Devices Market in Australia (2022-2032)

- Table 22: Blood Purification Devices Market in South Korea (2022-2032)

- Table 23: Blood Purification Devices Market in Rest of Asia-Pacific (2022-2032)

- Table 24: Blood Purification Devices Market in the Rest of the World (2022-2032)

- Table 25: Blood Purification Devices Market in the Middle East (2022-2032)

- Table 26: Blood Purification Devices Market in Africa (2022-2032)

- Table 27: Blood Purification Devices Market in South America (2022-2032)

List of Figures

- Figure 1: Competitive Analysis

- Figure 2: Blood Purification Devices Market in Global (2022-2032)

- Figure 3: Blood Purification Devices Market in Global by Product Type (2022-2032)

- Figure 4: Blood Purification Devices Market in Global by End-User (2022-2032)

- Figure 5: Blood Purification Devices Market in Global by Geography (2022-2032)

- Figure 6: Blood Purification Devices Market in North America (2022-2032)

- Figure 7: Blood Purification Devices Market in the United States (2022-2032)

- Figure 8: Blood Purification Devices Market in Canada (2022-2032)

- Figure 9: Blood Purification Devices Market in Mexico (2022-2032)

- Figure 10: Blood Purification Devices Market in Europe (2022-2032)

- Figure 11: Blood Purification Devices Market in France (2022-2032)

- Figure 12: Blood Purification Devices Market in Germany (2022-2032)

- Figure 13: Blood Purification Devices Market in United Kingdom (2022-2032)

- Figure 14: Blood Purification Devices Market in Italy (2022-2032)

- Figure 15: Blood Purification Devices Market in Spain (2022-2032)

- Figure 16: Blood Purification Devices Market in the Rest of Europe (2022-2032)

- Figure 17: Blood Purification Devices Market in Asia-Pacific (2022-2032)

- Figure 18: Blood Purification Devices Market in China (2022-2032)

- Figure 19: Blood Purification Devices Market in Japan (2022-2032)

- Figure 20: Blood Purification Devices Market in India (2022-2032)

- Figure 21: Blood Purification Devices Market in Australia (2022-2032)

- Figure 22: Blood Purification Devices Market in South Korea (2022-2032)

- Figure 23: Blood Purification Devices Market in Rest of Asia-Pacific (2022-2032)

- Figure 24: Blood Purification Devices Market in the Rest of the World (2022-2032)

- Figure 25: Blood Purification Devices Market in the Middle East (2022-2032)

- Figure 26: Blood Purification Devices Market in Africa (2022-2032)

- Figure 27: Blood Purification Devices Market in South America (2022-2032)

- Figure 28: Market Drivers

- Figure 29: Market Barriers

- Figure 30: Marker Opportunities

- Figure 31: PORTER'S Five Force Analysis

Blood Purification Devices Market by Product Type (Continuous Renal Replacement Therapy (CRRT) Device, Hemodialysis Device, Hemoperfusion Device, and Plasma Exchange Device), End-User (Hospitals, Dialysis Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World) is expected to grow at a steady CAGR forecast till 2032 owing to rising instances of various kidney diseases, surge in the cases of hypertension and diabetes leading to kidney disorders, and growing product development activities by the key players.

The blood purification devices market was valued at USD 17,734.52 million in 2024, growing at a CAGR of 5.40% during the forecast period from 2025 to 2032 to reach USD 26,864.87 million by 2032. The demand for the blood purification devices market is witnessing steady growth, driven by the rising instances of acute kidney injury (AKI) and chronic kidney disease (CKD), along with the increasing cases of hypertension and diabetes that contribute to kidney complications. Additionally, ongoing product development and the launch of advanced purification technologies by key players are enhancing treatment efficiency and patient outcomes. These are the combined factors that are creating a favorable landscape for sustained market expansion from 2025 to 2032.

Blood Purification Devices Market Dynamics:

As per data from the National Institutes of Health (2024), acute kidney injury (AKI) affects approximately 13.3 million people worldwide each year, with a significant portion of cases linked to infections, particularly in low- and lower-middle-income countries. This high global occurrence, especially in regions with limited access to advanced healthcare, is directly accelerating the market for blood purification devices. Since AKI often requires timely and effective extracorporeal blood purification to prevent life-threatening complications, the growing number of cases is driving demand for scalable, cost-effective, and clinically reliable treatment options. This need is prompting manufacturers to develop and distribute more adaptable purification technologies tailored to diverse healthcare environments. As a result, the increasing burden of AKI, particularly infection-induced cases, is playing a critical role in expanding the global blood purification devices market.

According to the National Institutes of Health (2022), CKD affects over 10% of the global population, more than 800 million individuals, particularly impacting older adults, women, racial minorities, and those with diabetes or hypertension. This large and growing patient population requires ongoing renal support, thereby increasing demand for blood purification technologies.

Additionally, data from the UK Kidney Association (2022) reported 683,136 instances of AKI in a single year, highlighting the urgent and widespread need for timely and effective interventions. Conditions like CKD and AKI often necessitate treatments such as hemodialysis and Continuous Renal Replacement Therapy (CRRT), driving the adoption of advanced blood purification devices. The scale and severity of these renal conditions are pushing healthcare systems to adopt more efficient, reliable, and accessible purification solutions, thereby propelling market growth.

Furthermore, an increase in product development activities among the key market players is escalating the market for blood purification devices. For example, in June 2024, Fresenius Medical Care (FME), a leading provider of kidney care products and services, started the second phase of bringing high-volume hemodiafiltration (HVHDF) therapy to the U.S. after receiving FDA 510(k) clearance for its updated 5008X CAREsystem. This new version included added features and marked an important step toward a wider U.S. launch later in the year, with full commercial rollout planned for 2026.

Driven by these compelling factors, the blood purification devices market is poised for substantial growth during the forecast period from 2025 to 2032.

However, the risk of complications & safety concerns associated with blood purification devices and the increasing number of product recalls, among others, are some of the key constraints that may limit the growth of the blood purification devices market.

Blood Purification Devices Market Segment Analysis:

Blood Purification Devices Market by Product Type (Continuous Renal Replacement Therapy (CRRT) Device, Hemodialysis Device, Hemoperfusion Device, and Plasma Exchange Device), End-User (Hospitals, Dialysis Centers, and Others), and Geography (North America, Europe, Asia-Pacific, and Rest of the World)

In the product type segment of the blood purification devices market, the continuous renal replacement therapy (CRRT) device category is projected to account for the largest market share in 2024. This is driven by the primary factor that is rising cases of acute kidney injury (AKI), particularly among critically ill patients admitted to intensive care units (ICUs). CRRT is uniquely suited for these settings as it delivers a slower, more controlled, and continuous blood purification process, making it the preferred option for hemodynamically unstable patients who cannot tolerate the rapid fluid and solute shifts associated with conventional hemodialysis.

Also, the growing cases of life-threatening conditions such as sepsis and multi-organ failure, which frequently result in AKI, have further intensified the demand for CRRT systems. These clinical scenarios often require immediate and sustained renal support, positioning CRRT as an essential intervention in critical care.

Simultaneously, technological advancements have enhanced the functionality and ease of use of CRRT devices. Innovations such as automated fluid management, real-time monitoring, and intuitive user interfaces have improved therapeutic precision while reducing the operational burden on healthcare providers.

This expansion is further supported by regulatory milestones that reflect the growing versatility of CRRT platforms. For example, in August 2023, Quanta Dialysis Technologies(R) received FDA 510(k) clearance for expanded CRRT indications on its Quanta Dialysis System, highlighting the trend toward multifunctional and adaptable renal support devices.

Therefore, driven by these combined factors, the CRRT device category is anticipated to witness substantial growth, significantly contributing to the overall expansion of the blood purification devices market during the forecast period from 2025 to 2032.

North America is expected to dominate the overall blood purification devices market:

North America is projected to hold the largest share of the blood purification devices market in 2024, driven by several key factors. This regional dominance is largely driven by the high instances of chronic kidney disease CKD and its associated risk factors, including hypertension and diabetes. The region also benefits from a well-developed healthcare infrastructure, supportive reimbursement policies, and an increasing focus on advancing renal care. These factors collectively contribute to the widespread adoption of blood purification technologies, solidifying North America's position as a leading market throughout the forecast period.

According to the Centers for Disease Control and Prevention (CDC, 2024), over one in seven U.S. adults, approximately 35.5 million people, or 14 percent of the population, were affected by CKD. The condition disproportionately affected older adults, with a case rate of 34 percent in those aged 65 and above, compared to 12 percent among individuals aged 45 to 64, and 6 percent in the 18 to 44 age group. CKD is also slightly more common in women (14 percent) than in men (12 percent). Supporting this, the American Kidney Fund (2024) reported that around 808,000 individuals were living with kidney failure, with 135,000 new cases diagnosed in 2022, underscoring the escalating burden of kidney-related conditions in the country.

This growing and demographically diverse patient base is fueling demand for renal support therapies such as dialysis and continuous blood purification, particularly in hospitals, dialysis centers, and critical care settings.

Same source in 2025 stated that, in 2022, nearly half of U.S. adults that is 48.1% or roughly 119.9 million people, are affected by high blood pressure, defined as having a systolic reading over 130 mm Hg, a diastolic reading over 80 mm Hg, or currently taking medication to manage the condition. However, only about 1 in 4 adults with high blood pressure (22.5%, or 27 million people) have their condition under control. Additionally, in 2024 above source reported that approximately 38 million people were affected by diabetes.

Both hypertension and diabetes are major risk factors for the development of CKD and AKI, conditions that often require timely and effective blood purification treatments to manage fluid overload, toxin removal, and electrolyte imbalances. The growing burden of these chronic diseases is not only increasing the patient pool requiring renal support but also prompting healthcare providers to adopt advanced blood purification technologies. As a result, the escalating rates of hypertension and diabetes are directly contributing to the growth and expansion of the blood purification devices market.

Moreover, product development activities in the region are further expected to boost the market for blood purification devices. For instance, in July 2024, Tablo(R) is a groundbreaking, fully integrated mobile hemodialysis system developed by Outset Medical, a U.S.-based medical technology company, designed for the treatment of patients with both acute and chronic renal failure.

Together, these clinical, technological, and strategic drivers are expected to significantly propel the growth of the U.S. blood purification devices market throughout the forecast period from 2025 to 2032.

Blood Purification Devices Market Key Players:

Some of the key market players operating in the blood purification devices market include B. Braun Melsungen AG, Asahi Kasei Corporation, Fresenius SE and Co. KGaA, Baxter, Infomed SA, Jafron Biomedical Co., Ltd., Kaneka Corporation, Nikkiso Co., Ltd., SWS Medical Group, Medtronic, CytoSorbents Europe GmbH, Spectral Medical Inc., Haemonetics Corporation, Baihe Medical, ExThera Medical Corporation, and others.

Recent Developmental Activities in the Blood Purification Devices Market:

- In November 2024, Quanta Dialysis Technologies(R) received FDA 510(k) clearance for its Quanta Dialysis System to be used in home settings. With this approval, Quanta became the only company to offer a high dialysate flow system (500 mL/min) for end-stage renal disease (ESRD) patients across the full care continuum.

- In July 2024, the University of California, Los Angeles-led team developed a machine-learning model that accurately predicted the short-term survival of dialysis patients undergoing continuous renal replacement therapy (CRRT).

- In March 2024, Cerus Corporation, a U.S.-based company, reported positive topline results from its Phase III clinical trial evaluating a compound intended to be added to transfused blood to help prevent pathogens and reduce the risk of acute kidney injury.

Key takeaways from the blood purification devices market report study

- Market size analysis for current blood purification devices market size (2024), and market forecast for 8 years (2025 to 2032)

- Top key product/technology developments, mergers, acquisitions, partnerships, and joint ventures happened over the last 3 years.

- Key companies dominating the blood purification devices market.

- Various opportunities available for the other competitors in the blood purification devices market space.

- What are the top-performing segments in 2024? How these segments will perform in 2032?

- Which are the top-performing regions and countries in the current blood purification devices market scenario?

- Which are the regions and countries where companies should have concentrated on opportunities for the blood purification devices market growth in the future?

Target audience who can benefit from this blood purification devices market report study

- Blood purification devices product providers

- Research organizations and consulting companies

- Blood purification devices-related organizations, associations, forums, and other alliances

- Government and corporate offices

- Start-up companies, venture capitalists, and private equity firms

- Distributors and traders dealing in blood purification devices

- Various end-users who want to know more about the blood purification devices market and the latest technological developments in the blood purification devices market.

Frequently Asked Questions for the Blood Purification Devices Market:

1. What are blood purification devices?

- Blood purification devices are medical systems designed to remove toxins, waste products, inflammatory mediators, or excess fluids from the blood, typically in patients with kidney failure, sepsis, autoimmune disorders, or other critical conditions. These devices operate using various techniques such as hemodialysis, hemofiltration, hemoperfusion, or plasmapheresis, and are commonly used in intensive care settings to support organ function and manage systemic imbalances.

2. What is the market for blood purification devices?

- The blood purification devices market was valued at USD 17,734.52 million in 2024, growing at a CAGR of 5.40% during the forecast period from 2025 to 2032 to reach USD 26,864.87 million by 2032.

3. What are the drivers for the blood purification devices market?

- The demand for the blood purification devices market is witnessing steady growth, driven by the rising instances of acute kidney injury (AKI) and chronic kidney disease (CKD), along with the increasing incidence of hypertension and diabetes that contribute to kidney complications. Additionally, ongoing product development and the launch of advanced purification technologies by key players are enhancing treatment efficiency and patient outcomes. These are the combined factors that are creating a favorable landscape for sustained market expansion from 2025 to 2032.

4. Who are the key players operating in the blood purification devices market?

- Some of the key market players operating in the blood purification devices market include B. Braun Melsungen AG, Asahi Kasei Corporation, Fresenius SE and Co. KGaA, Baxter, Infomed SA, Jafron Biomedical Co., Ltd., Kaneka Corporation, Nikkiso Co., Ltd., SWS Medical Group, Medtronic, CytoSorbents Europe GmbH, Spectral Medical Inc., Haemonetics Corporation, Baihe Medical, ExThera Medical Corporation, and others.

5. Which region has the highest share in the blood purification devices market?

- North America is projected to hold the largest share of the blood purification devices market in 2024, driven by several key factors. This regional dominance is largely driven by the high instances of chronic kidney disease CKD and its associated risk factors, including hypertension and diabetes. The region also benefits from a well-developed healthcare infrastructure, supportive reimbursement policies, and an increasing focus on advancing renal care. These factors collectively contribute to the widespread adoption of blood purification technologies, solidifying North America's position as a leading market throughout the forecast period.

Table of Contents

1. Blood Purification Devices Market Report Introduction

- 1.1. Scope of the Study

- 1.2. Market Segmentation

- 1.3. Market Assumption

2. Blood Purification Devices Market Executive Summary

- 2.1. Market at Glance

3. Competitive Landscape

4. Regulatory Analysis

- 4.1. The United States

- 4.2. Europe

- 4.3. Japan

- 4.4. China

5. Blood Purification Devices Market Key Factors Analysis

- 5.1. Blood Purification Devices Market Drivers

- 5.1.1. Rising cases of various kidney diseases

- 5.1.2. Surge in the cases of hypertension and diabetes leading to kidney disorders

- 5.1.3. Growing product development activities by the key players

- 5.2. Blood Purification Devices Market Restraints and Challenges

- 5.2.1. Risk of complications and safety concerns associated with blood purification devices

- 5.2.2. Increasing number of product recalls

- 5.3. Blood Purification Devices Market Opportunity

- 5.3.1. Increased automation and the ability to remotely monitor and control blood purification devices

6. Blood Purification Devices Market Porter's Five Forces Analysis

- 6.1. Bargaining Power of Suppliers

- 6.2. Bargaining Power of Consumers

- 6.3. Threat of New Entrants

- 6.4. Threat of Substitutes

- 6.5. Competitive Rivalry

7. Blood Purification Devices Market Assessment

- 7.1. By Product Type

- 7.1.1. Continuous Renal Replacement Therapy (CRRT) Device

- 7.1.2. Hemodialysis Device

- 7.1.3. Hemoperfusion Device

- 7.1.4. Plasma Exchange Device

- 7.2. By End-User

- 7.2.1. Hospitals

- 7.2.2. Dialysis Centers

- 7.2.3. Others

- 7.3. By Geography

- 7.3.1. North America

- 7.3.1.1. United States Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.1.2. Canada Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.1.3. Mexico Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.2. Europe

- 7.3.2.1. France Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.2.2. Germany Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.2.3. United Kingdom Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.2.4. Italy Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.2.5. Spain Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.2.6. Rest of Europe Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.3. Asia-Pacific

- 7.3.3.1. China Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.3.2. Japan Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.3.3. India Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.3.4. Australia Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.3.5. South Korea Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.3.6. Rest of Asia-Pacific Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.4. Rest of the World (RoW)

- 7.3.4.1. Middle East Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.4.2. Africa Blood Purification Devices Market Size in USD million (2022-2032)

- 7.3.4.3. South America Blood Purification Devices Market Size In USD Million (2022-2032)

- 7.3.1. North America

8. Blood Purification Devices Market Company and Product Profiles

- 8.1. B. Braun Melsungen AG

- 8.1.1. Company Overview

- 8.1.2. Company Snapshot

- 8.1.3. Financial Overview

- 8.1.4. Product Listing

- 8.1.5. Entropy

- 8.2. Asahi Kasei Corporation

- 8.2.1. Company Overview

- 8.2.2. Company Snapshot

- 8.2.3. Financial Overview

- 8.2.4. Product Listing

- 8.2.5. Entropy

- 8.3. Fresenius SE and Co. KGaA

- 8.3.1. Company Overview

- 8.3.2. Company Snapshot

- 8.3.3. Financial Overview

- 8.3.4. Product Listing

- 8.3.5. Entropy

- 8.4. Baxter

- 8.4.1. Company Overview

- 8.4.2. Company Snapshot

- 8.4.3. Financial Overview

- 8.4.4. Product Listing

- 8.4.5. Entropy

- 8.5. Infomed SA

- 8.5.1. Company Overview

- 8.5.2. Company Snapshot

- 8.5.3. Financial Overview

- 8.5.4. Product Listing

- 8.5.5. Entropy

- 8.6. Jafron Biomedical Co., Ltd.

- 8.6.1. Company Overview

- 8.6.2. Company Snapshot

- 8.6.3. Financial Overview

- 8.6.4. Product Listing

- 8.6.5. Entropy

- 8.7. Kaneka Corporation

- 8.7.1. Company Overview

- 8.7.2. Company Snapshot

- 8.7.3. Financial Overview

- 8.7.4. Product Listing

- 8.7.5. Entropy

- 8.8. Nikkiso Co, ltd.

- 8.8.1. Company Overview

- 8.8.2. Company Snapshot

- 8.8.3. Financial Overview

- 8.8.4. Product Listing

- 8.8.5. Entropy

- 8.9. SWS Medical Group

- 8.9.1. Company Overview

- 8.9.2. Company Snapshot

- 8.9.3. Financial Overview

- 8.9.4. Product Listing

- 8.9.5. Entropy

- 8.10. Medtronic

- 8.10.1. Company Overview

- 8.10.2. Company Snapshot

- 8.10.3. Financial Overview

- 8.10.4. Product Listing

- 8.10.5. Entropy

- 8.11. CytoSorbents Europe GmbH

- 8.11.1. Company Overview

- 8.11.2. Company Snapshot

- 8.11.3. Financial Overview

- 8.11.4. Product Listing

- 8.11.5. Entropy

- 8.12. Spectral Medical Inc

- 8.12.1. Company Overview

- 8.12.2. Company Snapshot

- 8.12.3. Financial Overview

- 8.12.4. Product Listing

- 8.12.5. Entropy

- 8.13. Haemonetics Corporation

- 8.13.1. Company Overview

- 8.13.2. Company Snapshot

- 8.13.3. Financial Overview

- 8.13.4. Product Listing

- 8.13.5. Entropy

- 8.14. Baihe Medical

- 8.14.1. Company Overview

- 8.14.2. Company Snapshot

- 8.14.3. Financial Overview

- 8.14.4. Product Listing

- 8.14.5. Entropy

- 8.15. ExThera Medical Corporation

- 8.15.1. Company Overview

- 8.15.2. Company Snapshot

- 8.15.3. Financial Overview

- 8.15.4. Product Listing

- 8.15.5. Entropy