|

|

市場調査レポート

商品コード

1376841

皮膚筋炎市場 - 市場の洞察、疫学、市場予測:2032年Dermatomyositis - Market Insight, Epidemiology and Market Forecast - 2032 |

||||||

カスタマイズ可能

|

|||||||

| 皮膚筋炎市場 - 市場の洞察、疫学、市場予測:2032年 |

|

出版日: 2023年11月01日

発行: DelveInsight

ページ情報: 英文 224 Pages

納期: 1~3営業日

|

- 全表示

- 概要

- 図表

- 目次

皮膚筋炎の診断有病率は、人口と認知度の増加により米国で増加しています。2022年、皮膚筋炎の市場規模は主要7ヶ国諸国の中で米国が最も大きく、約1億3,930万米ドルを占めました。2032年までに増加すると予想されています。

副腎皮質ステロイドが主要な治療薬として最も処方されているにもかかわらず、免疫グロブリン製剤はOCTAGAMが承認されたことにより、高コストが高収益につながったため、最大の収益を上げました。2022年の米国における免疫グロブリンの売上は8,880万米ドルで、米国における皮膚筋炎市場全体の64%近くを占めています。

皮膚筋炎の治療オプションは、コルチコステロイドを含む適応外投薬が中心ですが、これらは骨粗鬆症、感染症感受性の増加、クッシングロイドの特徴など、いくつかの副作用や有害事象を伴います。研究の進歩により、C5補体、IFNB1、FcRnを標的とする新規分子が発見され、将来有効な選択肢となる可能性があります。新たな治療薬であるブレポシチニブ(PF6700841)、ULTOMIRIS(ravulizumab)(ALXN1210)、エフガルチギモド、PF-06823859(抗βインターフェロン)、HIZENTRA(IgPro20)は、皮膚筋炎の市場規模にプラスの変化をもたらす可能性があります。

主要7ヶ国における皮膚筋炎の総市場規模は、2022年に約2億3,060万米ドルであり、予測期間中(2023-2032年)に拡大すると予測されています。

主要7ヶ国の中で米国は皮膚筋炎の市場シェアが最も大きく、2022年の収益は約1億3,930万米ドルで、疾患に対する認知度の向上、現在承認されている治療法の成長、新興治療法の上市により、調査期間中にCAGR 17.0%で拡大すると予測されています。

EU4諸国と英国の中で、2022年の皮膚筋炎の市場規模はドイツが最大で、英国がそれに続き、スペインは最下位でした。日本は主要7ヶ国の中で2番目に大きな皮膚筋炎市場を占め、2022年の収益は約3,080万米ドルであったが、予測期間中に変化することが予想されます。

当レポートでは、主要7ヶ国における皮膚筋炎市場について調査し、市場の概要とともに、疫学、患者動向、新たな治療法、2032年までの市場規模予測、および医療のアンメットニーズなどを提供しています。

目次

第1章 重要な洞察

第2章 レポートのイントロダクション

第3章 皮膚筋炎市場概要

第4章 皮膚筋炎の疫学と市場の調査手法

第5章 皮膚筋炎のエグゼクティブサマリー

第6章 主要な出来事

第7章 疾患の背景と概要

- 皮膚筋炎のイントロダクション

- 皮膚筋炎の種類

- 兆候と症状

- 皮膚筋炎の臨床症状

- 原因

- 合併症

- 病態生理学

- 診断

- 治療

第8章 患者動向

第9章 疫学と患者数

- 主な調査結果

- 仮定と根拠:主要7ヶ国

- 主要7ヶ国で診断された皮膚筋炎の蔓延症例の総数

- 米国

- EU4ヶ国と英国

- 日本

第10章 上市済み薬剤

第11章 新興薬剤

第12章 皮膚筋炎:市場分析

- 主な調査結果

- 主要な市場予測の前提条件

- 市場の見通し

- コンジョイント分析

- 主要7ヶ国における皮膚筋炎の総市場規模

- 主要7ヶ国における皮膚筋炎の総市場規模、治療法別

- 米国における皮膚筋炎の市場規模

- EU4および英国における皮膚筋炎の市場規模

- 日本における皮膚筋炎市場規模

第13章 主要なオピニオンリーダーの見解

第14章 SWOT分析

第15章 アンメットニーズ

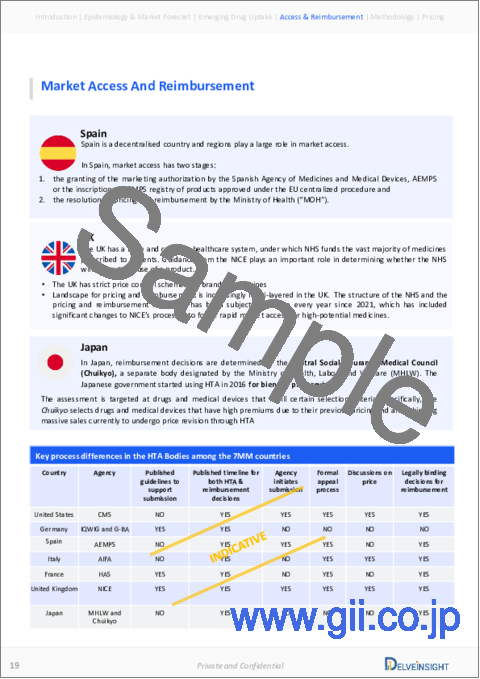

第16章 市場アクセスと償還

- 米国

- EU4ヶ国と英国

- 日本

第17章 付録

第18章 DelveInsightのサービス内容

第19章 免責事項

第20章 Delvinsightについて

List of Tables

- Table 1: Summary of Market and Epidemiology (2019-2032)

- Table 2: Key Events for Dermatomyositis

- Table 3: Comparison of Juvenile Dermatomyositis and Adult Dermatomyositis

- Table 4: Cutaneous Manifestations of Adult Dermatomyositis

- Table 5: Systemic Manifestations of Dermatomyositis in Adults and Children

- Table 6: Bohan and Peter Classification Criteria for Polymyositis and Dermatomyositis

- Table 7: Diagnostic Criteria for Dermatomyositis

- Table 8: The European League Against Rheumatism/American College of Rheumatology Classification Criteria for Adult and Juvenile IIM

- Table 9: Currently Used 'Guidance for Diagnosis in Specified Pediatric Chronic Diseases

- Table 10: Recommendations Regarding Diagnosis

- Table 11: Classification Tree for a Subtype of IIM

- Table 12: Treatment Modalities for Dermatomyositis

- Table 13: Recommendations Regarding Treatment

- Table 14: Total Diagnosed Prevalent Cases of Dermatomyositis in the 7MM (2019-2032)

- Table 15: Total Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Table 16: Age-specific Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Table 17: Gender-specific Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Table 18: Severity-specific Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Table 19: Chronicity-specific Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Table 20: Comorbidity-specific Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Table 21: Total Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK (2019-2032)

- Table 22: Age-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK (2019-2032)

- Table 23: Gender-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK (2019-2032)

- Table 24: Severity-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK (2019-2032)

- Table 25: Chronicity-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK (2019-2032)

- Table 26: Comorbidity-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK (2019-2032)

- Table 27: Total Diagnosed Prevalent Cases of Dermatomyositis in Japan (2019-2032)

- Table 28: Age-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan (2019-2032)

- Table 29: Gender-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan (2019-2032)

- Table 30: Severity-specific Diagnosed Prevalent cases of Dermatomyositis in Japan (2019-2032)

- Table 31: Chronicity-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan (2019-2032)

- Table 32: Comorbidity-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan (2019-2032)

- Table 33: Comparison of Marketed Drugs

- Table 34: OCTAGAM 10% (immunoglobulin), Clinical Trial Description, 2023

- Table 35: Comparison of Emerging Drugs

- Table 36: Brepocitinib, Clinical Trial Description, 2023

- Table 37: ULTOMIRIS (ravulizumab/ALXN1210), Clinical Trial Description, 2023

- Table 38: Efgartigimod, Clinical Trial Description, 2023

- Table 39: PF-06823859 (anti-beta interferon), Clinical Trial Description, 2023

- Table 40: HIZENTRA (IgPro20), Clinical Trial Description, 2023

- Table 41: JNJ-80202135 (nipocalimab), Clinical Trial Description, 2023

- Table 42: M-5049 (enpatoran), Clinical Trial Description, 2023

- Table 43: VIB7734/MEDI7734 (daxdilimab), Clinical Trial Description, 2023

- Table 44: KZR-616 (zetomipzomib), Clinical Trial Description, 2023

- Table 45: PF1801 (froniglutide), Clinical Trial Description, 2023

- Table 46: GLPG3667, Clinical Trial Description, 2023

- Table 47: BEGESAND/BEGEDINA (begelomab), Clinical Trial Description, 2023

- Table 48: Key Market Forecast Assumptions for Brepocitinib (PF6700841)

- Table 49: Key Market Forecast Assumptions for ULTOMIRIS (ravulizumab)

- Table 50: Key Market Forecast Assumptions for Efgartigimod

- Table 51: Key Market Forecast Assumptions for PF-06823859

- Table 52: Key Market Forecast Assumptions for HIZENTRA (IgPro20)

- Table 53: Total Market Size of Dermatomyositis in the 7MM, in USD million (2019-2032)

- Table 54: Total Market Size of Dermatomyositis by Therapies in the 7MM, in USD million (2019-2032)

- Table 55: Total Market Size of Dermatomyositis in the US, in USD million (2019-2032)

- Table 56: The Market Size of Dermatomyositis by Therapies in the US, in USD million (2019-2032)

- Table 57: Total Market Size of Dermatomyositis in EU4 and the UK, in USD million (2019-2032)

- Table 58: The Market Size of Dermatomyositis by Therapies in EU4 and the UK, in USD million (2019-2032)

- Table 59: Total Market Size of Dermatomyositis in Japan, in USD million (2019-2032)

- Table 60: The Market Size of Dermatomyositis by Therapies in Japan, in USD million (2019-2032)

List of Figures

- Figure 1: Signs and Symptoms of Dermatomyositis

- Figure 2: Contributing Factors to Dermatomyositis

- Figure 3: Causes of Dermatomyositis

- Figure 4: Complications Associated With Dermatomyositis

- Figure 5: The Vicious Pro-inflammatory Circle in Dermatomyositis

- Figure 6: Algorithm of Treatment for JDM

- Figure 7: Algorithm for Management of DM/PM-ILD

- Figure 8: Flow Chart for the Treatment of Mild/Moderate Disease in Newly Diagnosed and Refractory Patients With JDM

- Figure 9: Flow Chart for the Treatment of Severe Disease in Newly Diagnosed and Refractory Patients With JDM

- Figure 10: Patient Journey of Dermatomyositis

- Figure 11: Total Diagnosed Prevalent Cases of Dermatomyositis in the 7MM (2019-2032)

- Figure 12: Total Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Figure 13: Age-specific Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Figure 14: Gender-specific Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Figure 15: Severity-specific Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Figure 16: Chronicity-specific Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Figure 17: Comorbidity-specific Diagnosed Prevalent Cases of Dermatomyositis in the US (2019-2032)

- Figure 18: Total Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK (2019-2032)

- Figure 19: Age-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK (2019-2032)

- Figure 20: Gender-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK (2019-2032)

- Figure 21: Severity-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK (2019-2032)

- Figure 22: Chronicity-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 the UK (2019-2032)

- Figure 23: Comorbidity-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK (2019-2032)

- Figure 24: Total Diagnosed Prevalent Cases of Dermatomyositis in Japan (2019-2032)

- Figure 25: Age-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan (2019-2032)

- Figure 26: Gender-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan (2019-2032)

- Figure 27: Severity-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan (2019-2032)

- Figure 28: Chronicity-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan (2019-2032)

- Figure 29: Comorbidity-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan (2019-2032)

- Figure 30: Total Market Size of Dermatomyositis in the 7MM, in USD million (2019-2032)

- Figure 31: Total Market Size of Dermatomyositis by Therapies in the 7MM, in USD million (2019-2032)

- Figure 32: Total Market Size of Dermatomyositis in the US, in USD million (2019-2032)

- Figure 33: The Market Size of Dermatomyositis by Therapies in the US, in USD million (2019-2032)

- Figure 34: Total Market Size of Dermatomyositis in EU4 and the UK, in USD million (2019-2032)

- Figure 35: The Market Size of Dermatomyositis by Therapies in EU4 and the UK, in USD million (2019-2032)

- Figure 36: Total Market Size of Dermatomyositis in Japan, in USD million (2019-2032)

- Figure 37: The Market Size of Dermatomyositis by Therapies in Japan, in USD million (2019-2032)

- Figure 38: SWOT Analysis of Dermatomyositis

- Figure 39: Unmet Needs of Dermatomyositis

- Figure 40: Health Technology Assessment

- Figure 41: Reimbursement Process in Germany

- Figure 42: Reimbursement Process in France

- Figure 43: Reimbursement Process in Italy

- Figure 44: Reimbursement Process in Spain

- Figure 45: Reimbursement Process in the United Kingdom

- Figure 46: Reimbursement Process in Japan

Key Highlights:

- The diagnosed prevalence of dermatomyositis has been increasing in the US due to increased population and awareness.

- In 2022, the market size of dermatomyositis was highest in the US among the 7MM countries, accounting for approximately USD 139.3 million. It is expected to increase by 2032.

- Even though corticosteroids are the most prescribed class of drugs for the disease as they form the primary treatment, immunoglobulins generated maximum revenue due to the approved OCTAGAM, as high costs translated to higher revenue. Immunoglobulins generated a revenue of USD 88.8 million in the US in 2022, capturing nearly 64% of the total dermatomyositis market in the US.

- Therapeutic options for dermatomyositis center around off-label medication, including corticosteroids, which are associated with several side effects and adverse events like osteoporosis, increased susceptibility to infections, cushingoid features, and others.

- Advances in research have led to the discovery of novel molecules targeting C5 complement, IFNB1, and FcRn that may offer effective options in the future.

- Emerging therapies brepocitinib (PF6700841), ULTOMIRIS (ravulizumab) (ALXN1210), efgartigimod, PF-06823859 (anti-beta Interferon), and HIZENTRA (IgPro20) can potentially create a positive shift in the market size of dermatomyositis.

- AstraZeneca's (Alexion) ULTOMIRIS, the first and only long-acting C5 complement inhibitor that offers immediate, complete, and sustained complement inhibition, offers hope for refractory patients and is projected to have a medium uptake after its market entry in the US.

- CSL Behring's HIZENTRA (IgPro20) is anticipated to enter the US market by 2025. This immunoglobulin G is predicted to have a first-mover advantage in the market, which needs more approved products. As it quenches the thirst of patients who need add-on treatment to current corticosteroids, it is projected to generate a revenue of USD 2.1 million by 2025.

DelveInsight's "Dermatomyositis - Market Insights, Epidemiology, and Market Forecast - 2032" report delivers an in-depth understanding of the dermatomyositis historical and forecasted epidemiology as well as the market trends in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

The dermatomyositis market report provides current treatment practices, emerging drugs, market share of individual therapies, and current and forecasted 7MM dermatomyositis market size from 2019 to 2032. The report also covers current dermatomyositis treatment practices/algorithms and unmet medical needs to curate the best opportunities and assess the market's potential.

Geography Covered:

- The United States

- EU4 (Germany, France, Italy, and Spain) and the United Kingdom

- Japan

Study Period: 2019-2032

Dermatomyositis Understanding and Treatment Algorithm

Dermatomyositis Overview

Idiopathic inflammatory myopathies (IIM) are a heterogeneous group of connective tissue disorders characterized by progressive muscle weakness. IIM is the umbrella term that includes dermatomyositis, polymyositis (PM), overlap myositis (OM), sporadic inclusion body myositis (IBM), and necrotizing autoimmune myopathy (NAM), also known as immune-mediated necrotizing myopathy (IMNM).

Dermatomyositis is a rare autoimmune disorder characterized by muscle inflammation (myositis) and skin inflammation (dermatitis). Proximal muscle weakness is a hallmark feature, affecting muscles close to the trunk, such as those in the thighs and upper arms, including heliotrope rash (purplish discoloration around the eyes), Gottron's papules (reddish bumps on knuckles), and photosensitive rash on sun-exposed areas.

The onset of the disease is usually insidious or acute, with a waxing and a waning course. The signs and symptoms of dermatomyositis can appear suddenly or develop gradually over time. Individuals with dermatomyositis also develop characteristic skin changes that, in some cases, may precede muscle weakness. Systemic symptoms such as fever, malaise, and weight loss are also present.

Dermatomyositis Diagnosis

Dermatomyositis is a complex condition with variable presentations and often requires a comprehensive assessment to prevent misdiagnosis. Diagnosing dermatomyositis involves a combination of clinical evaluation, laboratory tests, imaging studies, and, in some cases, muscle biopsies.

Dermatomyositis often has elevated creatine kinase (CK) at presentation, which may also raise suspicion of the disease in a patient presenting with weakness, leading to difficulty in activities of daily living.

Key diagnostic criteria include muscle weakness, characteristic skin rash, elevated muscle enzymes, myositis-associated enzyme levels, electromyography, and muscle biopsy. Muscle biopsy is the most accurate test to confirm the diagnosis and to exclude other causes of muscle weakness or skin rash. However, choosing the right muscle for a biopsy is crucial to prevent a missing diagnosis.

Further, the development of diagnostic guidelines like the European League Against Rheumatism/American College of Rheumatology classification Criteria for Adult and Juvenile IIM, Clinical Practice Guidance for Juvenile Dermatomyositis (JDM) 2018, Japan have improved diagnosis.

Further details related to country-based variations are provided in the report…

Dermatomyositis Treatment

There is no cure for dermatomyositis; however, medication can reduce inflammation and vasculitis, invariably minimize symptomatology, and improve the patient's quality of life. The recent approval of OCTAGAM and the presence of several management guidelines have revolutionized the treatment landscape of dermatomyositis. Several other off-label medications, including corticosteroids, immunosuppressants, antimalarial drugs, antibiotics, and topical ointments, are combined to eliminate symptoms.

Management of dermatomyositis typically involves a multidisciplinary approach. Line-wise treatment aims to suppress inflammation and relieve associated symptoms. The first-line treatment is systemic glucocorticoids with or without immunosuppressant (methotrexate, cyclosporine, mycophenolate, azathioprine, and others), biologic (rituximab, abatacept, and others). Initially, prednisolone is given at high doses for the first few months until the muscle enzyme levels decline and muscle strength improves. Once alternate diagnoses are ruled out, steroid-sparing immunosuppressant can be added. If biologics fails, IVIG or a combination of immunosuppressants are used as a second-line therapy.

Moreover, exercise and physical therapy maintain muscle functioning and mobility. Treatment may also include managing internal organ involvement, such as interstitial lung disease (ILD) or cardiac issues.

Furthermore, patients who do not respond to these conventional interventions or who relapse after an initial response have refractory disease and require the initiation of more aggressive therapies. Treatment options for resistant cases include using rituximab, mycophenolate mofetil, calcineurin inhibitors, IVIG, and cyclophosphamide.

Dermatomyositis Epidemiology

As the market is derived using a patient-based model, the dermatomyositis epidemiology chapter in the report provides historical as well as forecasted epidemiology segmented by total diagnosed prevalent cases of dermatomyositis, age-specific diagnosed prevalent cases of dermatomyositis, gender-specific diagnosed prevalent cases of dermatomyositis, severity-specific diagnosed prevalent cases of dermatomyositis, chronicity-specific diagnosed prevalent cases of dermatomyositis, and comorbidity-specific diagnosed prevalent cases of dermatomyositis in the 7MM covering the United States, EU4 countries (Germany, France, Italy, and Spain) and the United Kingdom, and Japan from 2019 to 2032.

- In 2022, the total diagnosed prevalent cases of dermatomyositis were estimated to be approximately 71,351 cases in the 7MM. Among these, nearly 9% were juvenile, while 91% were adult diagnosed prevalent cases of dermatomyositis. These cases are projected to increase during the forecast period.

- In 2022, among the 7MM, the US accounted for the highest diagnosed prevalent cases of dermatomyositis, contributing nearly 54%, while Spain accounted for the least with nearly 4% of the total diagnosed prevalent cases.

- In the US, there were approximately 38,266 diagnosed prevalent cases of dermatomyositis in 2022. These cases are expected to increase by 2032.

- In 2022, Germany ranked first among EU4 and the UK, with approximately 5,280 diagnosed prevalent cases of dermatomyositis, followed by the UK and Italy with nearly 4,568 and 3,978 cases, respectively. The total cases in EU4 and the UK are expected to increase by 2032.

- In EU4 and the UK, among the age-specific diagnosed prevalent cases of dermatomyositis, the age group 60-79 years accounted for the highest number of cases, with nearly 9,181 cases, while 0-17 had the least cases in 2022. These cases are expected to increase by 2032.

In the US, females had a higher preponderance of dermatomyositis than males. There were approximately 26,051 females diagnosed with dermatomyositis while nearly 12,215 males in 2022

- In EU4 and the UK, there were more mild diagnosed prevalent cases of dermatomyositis than moderate to severe. Germany had nearly 2,950 mild cases, while, approximately 2,329 diagnosed cases were moderate to severe, in 2022.

- According to DelveInsight's estimates, in 2022, among the total diagnosed prevalent cases of dermatomyositis in the US, there were nearly 11,480 and 26,786 acute and chronic cases, projected to increase during the study period.

- In Japan, comorbidities-specific diagnosed prevalent cases, including ILD, CVD, cancer malignancy, and others (osteoporosis, dysphagia, Raynaud's syndrome, calcinosis, etc.) accounted for nearly 2,462, 2,206, 511, and 7,269 diagnosed prevalent cases, respectively, in 2022. These cases are expected to change during the study period.

Dermatomyositis Drug Chapters

The drug chapter segment of the dermatomyositis report encloses a detailed analysis of dermatomyositis, currently used drugs, and mid-stage (Phase II and Phase I) pipeline drugs. It also helps understand the dermatomyositis clinical trial details, expressive pharmacological action, agreements and collaborations, approval and patent details, advantages and disadvantages of each included drug, and the latest news and press releases.

Marketed Drugs

OCTAGAM 10% (immunoglobulin): Octapharma

OCTAGAM 10% (immune globulin intravenous) is the first and only intravenous immunoglobulin (IVIg) product indicated for the treatment of adult dermatomyositis.

IVIG replacement therapy is the apparent treatment of choice for humoral primary immunodeficiency, such as dermatomyositis, as these patients cannot mount an effective immune response toward pathogens. IVIg acts as a corticosteroid-sparing agent and represents a unique treatment option for dermatomyositis patients. They are safe and effective treatment options, especially in patients showing no response or incomplete response to corticosteroids or who experience severe side effects. It is made from healthy human blood with a high level of certain defensive substances (antibodies), which help fight infections and are also used to increase the blood count.

In July 2021, the US FDA approved Octapharma's OCTAGAM 10% for adult dermatomyositis, while in 2021, Octapharma received approval from the European authorities for OCTAGAM 10% for the treatment of adults with dermatomyositis. Following the EU approval, OCTAGAM 10% received national approval in Germany in May 2021. In May 2017, the US FDA granted Octapharma's OCTAGAM 10% orphan drug designation for treating dermatomyositis.

Emerging Drugs

Brepocitinib (PF-06700841): Priovant Therapeutics/Pfizer

Brepocitinib is a small molecule, a potential first-in-class dual inhibitor of tyrosine kinase (TYK2) and Janus kinases1 (JAK1). Its novel mechanism of action potentially provides greater efficacy in multiple highly inflammatory autoimmune diseases than agents that inhibit either TYK2 or JAK1 alone.

The drug is under investigation for dermatomyositis in a Phase III clinical trial, with top-line results expected by the second half of 2025.

ULTOMIRIS (ravulizumab/ALXN1210): AstraZeneca

ULTOMIRIS (ravulizumab/ALXN1210) is the first and only long-acting C5 complement inhibitor that offers immediate, complete, and sustained complement inhibition. Ravulizumab works by inhibiting the C5 protein in the terminal complement cascade, a part of the body's immune system. When activated uncontrolled, the complement cascade over-responds, leading the body to attack its healthy cells. ULTOMIRIS will be administered intravenously every 8 weeks in adult patients, following a loading dose. The drug is undergoing a Phase II/III clinical trial in adult participants with dermatomyositis, and according to the company, data from the trial is anticipated by Q1 2024. Further, multiple other trials are ongoing to treat NMOSD, thrombotic microangiopathy, paroxysmal nocturnal hemoglobinuria, lupus nephritis, chronic kidney disease, and others.

Note: Detailed emerging therapies assessment will be provided in the final report.

Drug Class Insights

According to most guidelines, the treatment should start with corticosteroids, and depending on the response, combination therapy should be added and/or nonpharmacologic interventions considered.

Corticosteroids, such as prednisone or prednisolone, are commonly prescribed medications in treating dermatomyositis. These medications are a mainstay in managing the inflammatory and autoimmune aspects of the disease. In dermatomyositis, inflammation plays a significant role in the muscle and skin symptoms. Corticosteroids work by suppressing the immune response and reducing inflammation in affected tissues. High doses of corticosteroids are prescribed initially, as this high-dose "induction therapy" aims to control the disease and its symptoms quickly. After the initial high-dose treatment phase, the dosage of corticosteroids is usually gradually reduced (tapered) to find the lowest effective dose to maintain symptom control. This is done to minimize the risk of side effects associated with long-term corticosteroid use.

Immunosuppressants and immunomodulators are used as adjuvants with glucocorticoids for boosting efficacy and decreasing the dose of corticosteroids. Therapy with immunosuppressants such as azathioprine, methotrexate, mycophenolate mofetil, cyclophosphamide, tacrolimus, or cyclosporine may be beneficial for some affected individuals who have an insufficient response to steroid therapy alone, dose-limiting adverse effects, or frequent relapses. Immunosuppressive drugs are prescribed to dampen autoimmune responses and reduce inflammation. They help control inflammation and reduce the need for high doses of corticosteroids, inhibit the activity of certain immune cells, and even help in symptom management.

Dermatomyositis Market Outlook

There is no cure for dermatomyositis; however, medication can reduce inflammation and vasculitis, invariably minimize symptomatology, and improve the patient's quality of life. The recent approval of OCTAGAM and the presence of several management guidelines, including the British Society for Rheumatology guideline, the Japanese Society of Rheumatology guideline, and others, have revolutionized the treatment landscape of dermatomyositis. Several other off-label medications, including corticosteroids, immunosuppressants, antimalarial drugs, antibiotics, and topical ointments, are combined to eliminate symptoms.

The current market has been covered by various symptomatic therapies like corticosteroids, including glucocorticoids, immunosuppressants like azathioprine and methotrexate, cyclosporine, mycophenolate mofetil, etc., intravenous immunoglobulins including OCTAGAM 10%, biologics like rituximab, abatacept, etc., and other therapies like NSAIDs, antimalarials, etc., especially in refractory cases or cases of relapse that are used across the 7MM, which presents minor variations in the overall prescription pattern. Corticosteroids, immunosuppressants, intravenous immunoglobulins, biologics, and other therapies like NSAIDs, antimalarials, etc., are the major drug classes considered for the current treatment in the forecast model.

Key players Priovant Therapeutics/Pfizer's brepocitinib (PF6700841), AstraZeneca's (Alexion) ULTOMIRIS (ravulizumab) (ALXN1210), Argenx's efgartigimod, Pfizer's PF-06823859 (anti-beta Interferon), and CSL Behring's HIZENTRA (IgPro20) are evaluating their lead candidates in different stages of clinical development. They aim to investigate their products for the treatment of dermatomyositis.

- The total market size of dermatomyositis in the 7MM was approximately USD 230.6 million in 2022 and is projected to increase during the forecast period (2023-2032).

- According to DelveInsight's estimates, among the 7MM, the US had the largest market share for dermatomyositis, with a revenue of approximately USD 139.3 million in 2022, and will increase at a CAGR of 17.0% during the study period due to increasing awareness of the disease, the growth of currently approved therapies and the launch of the emerging therapies.

- Among EU4 and the UK countries, Germany accounted for the maximum market size of dermatomyositis in 2022, followed by the UK, while Spain occupied the bottom of the ladder.

- Japan accounted for the second largest market of dermatomyositis among the 7MM, with a revenue of approximately USD 30.8 million in 2022, expected to change during the forecast period.

- The initial treatment in dermatomyositis is corticosteroids, including glucocorticoids with or without immunosuppressants. They are administered in both first-line and refractory cases and have a significantly large patient pool, but this does not translate into high revenue, with the class only generating a revenue of nearly USD 10.8 million in 2022 in the US.

- Intravenous Immunoglobulins also form an important treatment for dermatomyositis, especially in cases where corticosteroids alone cannot control disease progression. Moreover, the class holds a significant advantage over others because of having the only approved product for the disease, Octapharma's OCTAGAM 10%. According to DelveInsight's analysts, though the approved drug has not performed as anticipated, high costs have translated into higher revenue, with the class generating a revenue of USD 88.8 million in the US in 2022.

- Various therapies like Priovant Therapeutics/Pfizer's Brepocitinib (PF6700841), AstraZeneca's (Alexion) ULTOMIRIS (ravulizumab) (ALXN1210), Argenx's Efgartigimod, Pfizer's PF-06823859 (anti-beta Interferon), and CSL Behring's HIZENTRA (IgPro20) are projected to enter the market during the forecast period.

- CSL Behring's HIZENTRA (IgPro20) is the first to enter the market, with anticipated entry by 2025. This immunoglobulin G is predicted to have a first-mover advantage in the market, which needs more approved products. As it quenches the thirst of patients who need add-on treatment to current corticosteroids, it is projected to generate a revenue of USD 2.1 million in 2025.

- AstraZeneca's (Alexion) ULTOMIRIS, the first and only long-acting C5 complement inhibitor that offers immediate, complete, and sustained complement inhibition, offers hope for refractory patients and is projected to have a medium uptake. The drug will generate a revenue of USD 4.9 million by 2026 and will grow to capture nearly 28% of the US dermatomyositis market by 2032.

Dermatomyositis Drugs Uptake

This section focuses on the uptake rate of potential drugs expected to be launched in the market during 2019-2032. For example, Priovant Therapeutics/Pfizer's brepocitinib (PF6700841), a TYK2 and JAK1 inhibitor, with an anticipated entry by 2026 in the US, is predicted to have a slow-medium uptake during the forecast period.

Further detailed analysis of emerging therapies drug uptake in the report…

Dermatomyositis Pipeline Development Activities

The report provides insights into therapeutic candidates in Phase II and Phase I. It also analyzes key players involved in developing targeted therapeutics.

Pipeline Development Activities

The report covers information on collaborations, acquisitions and mergers, licensing, and patent details for emerging therapies for dermatomyositis.

KOL Views

To keep up with current market trends, we take KOLs and SMEs' opinions working in the domain through primary research to fill the data gaps and validate our secondary research. Industry Experts contacted for insights on the evolving treatment landscape of dermatomyositis, patient reliance on conventional therapies, patient therapy switching acceptability, and drug uptake, along with challenges related to accessibility, including Medical/scientific writers, Medical Professionals, Professors, Directors, and Others.

DelveInsight's analysts connected with 50+ KOLs to gather insights; however, interviews were conducted with 15+ KOLs in the 7MM. Centers like Southern Illinois University School of Medicine, the University of Washington, the University Hospital of Tours, Navarra Institute for Health Research, the University of Tokyo School of Medicine, and the National Center of Neurology and Psychiatry were contacted. Their opinion helps understand and validate current and emerging therapy treatment patterns or dermatomyositis market trends. This will support the clients in potential upcoming novel treatments by identifying the overall scenario of the market and the unmet needs.

Physician's View

According to our primary research analysis, an early diagnosis and the proper course of therapy are crucial to manage the illness and enhance long-term outcomes effectively. Corticosteroids, though the primary treatment, are associated with side effects, and the approved IVIG, OCTAGAM 10%, has not been able to capture the market as anticipated. The standard of care has suboptimal effectiveness and significant safety risks. Moreover, therapies centered on corticosteroids and immunosuppressants are often ineffective at controlling symptoms and/or maintaining response in many patients. Prolonged use of these therapies is associated with numerous complications that may contribute to morbidity. Common side effects of corticosteroids are osteoporosis, cardiovascular infections, and metabolic disorders like diabetes. The clinical course suggests poor prognosis and poor treatment outcomes. Despite being treated with currently available therapies, patients often experience flares contributing to disability and loss of productivity. Hence, there is a need for safer and more effective treatment options that will improve the outcomes of the patients.

Qualitative Analysis

We perform Qualitative and market Intelligence analysis using various approaches, such as SWOT and Conjoint Analysis. In the SWOT analysis, strengths, weaknesses, opportunities, and threats in terms of disease diagnosis, patient awareness, patient burden, competitive landscape, cost-effectiveness, and geographical accessibility of therapies are provided. These pointers are based on the Analyst's discretion and assessment of the patient burden, cost analysis, and existing and evolving treatment landscape.

Conjoint Analysis analyzes multiple emerging therapies based on relevant attributes such as safety, efficacy, frequency of administration, route of administration, and order of entry. Scoring is given based on these parameters to analyze the effectiveness of therapy. To analyze the effectiveness of these therapies, we have calculated their attributed analysis by giving them scores based on their effectiveness in other related conditions to analyze the effectiveness of these therapies due to the limited availability of efficacy data in dermatomyositis for most products.

The therapies' safety is evaluated wherein the acceptability, tolerability, and adverse events are majorly observed. It sets a clear understanding of the side effects posed by the drug in the trials. In addition, the scoring is also based on the route of administration, order of entry and designation, probability of success, and the addressable patient pool for each therapy. According to these parameters, the final weightage score and the ranking of the emerging therapies are decided.

Market Access and Reimbursement

Reimbursement of rare disease therapies can be limited due to lack of supporting policies and funding, challenges of high prices, lack of specific approaches to evaluating rare disease drugs given limited evidence, and payers' concerns about budget impact. The high cost of rare disease drugs usually has a limited effect on the budget due to the small number of eligible patients being prescribed the drug. The US FDA has approved several rare disease therapies in recent years. From a patient perspective, health insurance and payer coverage guidelines surrounding rare disease treatments restrict broad access to these treatments, leaving only a small number of patients who can bypass insurance and pay for products independently.

In 2017, the company started a new financial support program for immunology disease patients. The Octapharma copay assistance is available to patients receiving OCTAGAM IVIg (Human) 10% liquid preparation or having a prescription to begin the therapy in those aged 18 or older with chronic immune thrombocytopenic purpura. The new program offers eligible patients a maximum of USD 5,000 in copay assistance each calendar year for copay, co-insurance, and deductible expenses associated with their treatment without regard for their ability to pay. To participate in the program, patients must have third-party commercial insurance.

However, the company plans to offer financial assistance to help cover the cost of treating dermatomyositis. Eligible patients with commercial health insurance will access the company's Copay Assistance Program, which will cover out-of-pocket costs, such as co-insurance, copay expenses, and deductibles, up to USD 2,500 per year. This assistance is provided without regard for the ability to pay. By law in the US, the company cannot offer this coverage to those with government plans such as Medicare, Medicaid, or Tricare. Patients without insurance or who have lost their insurance may also get assistance through a compassionate use program.

Several private insurers like Cigna Policy in the US cover dermatomyositis under critical illness insurance. Cigna covers immunoglobulin products when considered medically necessary on meeting the specific medical necessity criteria by condition and non-covered product criteria.

The report provides detailed insights on the country-wise accessibility and reimbursement scenarios, cost-effectiveness scenarios, programs making accessibility easier and out-of-pocket costs more affordable, insights on patients insured under federal or state government prescription drug programs, etc.

Scope of the Report:

- The report covers a segment of key events, an executive summary, and a descriptive overview of dermatomyositis, explaining its causes, signs and symptoms, pathogenesis, and currently available therapies.

- Comprehensive insight into the epidemiology segments and forecasts, the future growth potential of diagnosis rate, disease progression, and treatment guidelines have been provided.

- Additionally, an all-inclusive account of the current and emerging therapies and the elaborative profiles of late-stage and prominent therapies will impact the current treatment landscape.

- A detailed review of the dermatomyositis market, historical and forecasted market size, market share by therapies, detailed assumptions, and rationale behind our approach is included in the report, covering the 7MM drug outreach.

- The report provides an edge while developing business strategies by understanding trends through SWOT analysis, expert insights/KOL views, patient journey, and treatment preferences that help shape and drive the 7MM dermatomyositis market.

Dermatomyositis Report Insights

- Patient Population

- Therapeutic Approaches

- Dermatomyositis Pipeline Analysis

- Dermatomyositis Market Size and Trends

- Existing and Future Market Opportunity

Dermatomyositis Report Key Strengths

- Ten years Forecast

- The 7MM Coverage

- Dermatomyositis Epidemiology Segmentation

- Key Cross Competition

- Conjoint Analysis

- Drugs Uptake and Key Market Forecast Assumptions

Dermatomyositis Report Assessment

- Current Treatment Practices

- Unmet Needs

- Pipeline Product Profiles

- Market Attractiveness

- Qualitative Analysis (SWOT and Conjoint Analysis)

Key Questions

Market Insights

- What was the total market size of dermatomyositis, the market size of dermatomyositis by therapies, market share (%) distribution in 2019, and what would it look like by 2032? What are the contributing factors for this growth?

- How will brepocitinib (PF6700841) and ULTOMIRIS (ravulizumab) affect the dermatomyositis treatment paradigm?

- How will OCTAGAM 10% compete with other off-label symptomatic treatments?

- Which drug is going to be the largest contributor by 2032?

- What are the pricing variations among different geographies for off-label therapies?

- How would future opportunities affect the market dynamics and subsequent analysis of the associated trends?

Epidemiology Insights

- What are the disease risks, burdens, and unmet needs of dermatomyositis? What will be the growth opportunities across the 7MM with respect to the patient population pertaining to dermatomyositis?

- What is the historical and forecasted patient pool of dermatomyositis in the United States, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan?

- Out of the countries mentioned above, which country would have the highest diagnosed prevalent dermatomyositis population during the forecast period (2023-2032)?

- What factors are contributing to the growth of dermatomyositis cases?

Current Treatment Scenario, Marketed Drugs, and Emerging Therapies

- What are the current options to treat dermatomyositis?

- How many companies are developing therapies for the treatment of dermatomyositis?

- How many emerging therapies are in the mid-stage and early stage of development for treating dermatomyositis?

- What are the recent novel therapies, targets, mechanisms of action, and technologies developed to overcome the limitations of existing therapies?

- What is the cost burden of current treatment on the patient?

- Patient acceptability in terms of preferred treatment options as per real-world scenarios?

- What are the accessibility issues of approved therapy in the US?

- What is the 7MM historical and forecasted market of dermatomyositis?

Reasons to Buy:

- The report will help develop business strategies by understanding the latest trends and changing treatment dynamics driving the dermatomyositis market.

- Insights on patient burden/disease prevalence, evolution in diagnosis, and factors contributing to the change in the epidemiology of the disease during the forecast years.

- Understand the existing market opportunities in varying geographies and the growth potential over the coming years.

- The distribution of historical and current patient share is based on real-world prescription data in the US, EU4 (Germany, France, Italy, and Spain) and the United Kingdom, and Japan.

- Identifying strong upcoming players in the market will help devise strategies to help get ahead of competitors.

- Detailed analysis and ranking of class-wise potential current and emerging therapies under the conjoint analysis section to provide visibility around leading classes.

- To understand Key Opinion Leaders' perspectives around the accessibility, acceptability, and compliance-related challenges of existing treatment to overcome barriers in the future.

- Detailed insights on the unmet needs of the existing market so that the upcoming players can strengthen their development and launch strategy

Table of Contents

1. Key Insights

2. Report Introduction

3. Dermatomyositis Market Overview at a Glance

- 3.1. Market Share (%) Distribution of Dermatomyositis in 2019

- 3.2. Market Share (%) Distribution of Dermatomyositis in 2032

4. Methodology of Dermatomyositis Epidemiology and Market

5. Executive Summary of Dermatomyositis

6. Key Events

7. Disease Background and Overview

- 7.1. Introduction to Dermatomyositis

- 7.2. Types of Dermatomyositis

- 7.3. Signs and Symptoms

- 7.4. Clinical Manifestation of Dermatomyositis

- 7.5. Causes

- 7.6. Complications

- 7.7. Pathophysiology

- 7.8. Diagnosis

- 7.8.1. Diagnostic Criteria

- 7.8.1.1. Bohan and Peter's Classification Criteria for Polymyositis and Dermatomyositis

- 7.8.2. The Myositis Association: Diagnostic Criteria for Dermatomyositis

- 7.8.3. Diagnostic Criteria for Polymyositis and Dermatomyositis

- 7.8.4. Differential Diagnosis

- 7.8.5. Diagnostic Guidelines

- 7.8.5.1. The European League Against Rheumatism/American College of Rheumatology Classification Criteria for Adult and Juvenile IIM

- 7.8.5.2. Clinical Practice Guidance for Juvenile Dermatomyositis (JDM) 2018: Japan

- 7.8.5.3. Single Hub and Access Point for Pediatric Rheumatology in Europe (SHARE): Consensus-based Recommendations for the Management of Juvenile Dermatomyositis

- 7.8.6. Diagnostic Algorithm

- 7.8.1. Diagnostic Criteria

- 7.9. Treatment

- 7.9.1. Treatment Guidelines

- 7.9.1.1. Single Hub and Access Point for Pediatric Rheumatology in Europe (SHARE): Consensus-based Recommendations for the Management of JDM

- 7.9.1.2. Clinical Practice Guidelines for JDM 2018: Japan

- 7.9.1.3. British Society for Rheumatology Guideline on Management of Pediatric, Adolescent, and Adult Patients With Idiopathic Inflammatory Myopathy

- 7.9.1.4. Japanese Society of Rheumatology

- 7.9.2. Treatment Algorithm

- 7.9.1. Treatment Guidelines

8. Patient Journey

9. Epidemiology and Patient Population

- 9.1. Key Findings

- 9.2. Assumptions and Rationale: The 7MM

- 9.2.1. Total Diagnosed Prevalent Cases of Dermatomyositis

- 9.2.1.1. Diagnosed Prevalent Cases of Juvenile Dermatomyositis

- 9.2.1.2. Diagnosed Prevalent Cases of Adult Dermatomyositis

- 9.2.2. Age-specific Diagnosed Prevalent Cases of Dermatomyositis

- 9.2.3. Gender-specific Diagnosed Prevalent Cases of Dermatomyositis

- 9.2.4. Severity-specific Diagnosed Prevalent Cases of Dermatomyositis

- 9.2.5. Chronicity-specific Diagnosed Prevalent Cases of Dermatomyositis

- 9.2.6. Comorbidity-specific Diagnosed Prevalent Cases of Dermatomyositis

- 9.2.1. Total Diagnosed Prevalent Cases of Dermatomyositis

- 9.3. Total Diagnosed Prevalent Cases of Dermatomyositis in the 7MM

- 9.4. The US

- 9.4.1. Total Diagnosed Prevalent Cases of Dermatomyositis in the US

- 9.4.2. Age-specific Diagnosed Prevalent Cases of Dermatomyositis in the US

- 9.4.3. Gender-specific Diagnosed Prevalent Cases of Dermatomyositis in the US

- 9.4.4. Severity-specific Diagnosed Prevalent Cases of Dermatomyositis in the US

- 9.4.5. Chronicity-specific Diagnosed Prevalent Cases of Dermatomyositis in the US

- 9.4.6. Comorbidity-specific Diagnosed Prevalent Cases of Dermatomyositis in the US

- 9.5. EU4 and the UK

- 9.5.1. Total Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK

- 9.5.2. Age-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK

- 9.5.3. Gender-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK

- 9.5.4. Severity-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK

- 9.5.5. Chronicity-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK

- 9.5.6. Comorbidity-specific Diagnosed Prevalent Cases of Dermatomyositis in EU4 and the UK

- 9.6. Japan

- 9.6.1. Total Diagnosed Prevalent Cases of Dermatomyositis in Japan

- 9.6.2. Age-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan

- 9.6.3. Gender-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan

- 9.6.4. Severity-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan

- 9.6.5. Chronicity-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan

- 9.6.6. Comorbidity-specific Diagnosed Prevalent Cases of Dermatomyositis in Japan

10. Marketed Drugs

- 10.1. Key Cross Competition

- 10.1.1. OCTAGAM 10% (immunoglobulin): Octapharma

- 10.1.2. Drug Description

- 10.1.3. Regulatory Milestones

- 10.1.4. Clinical Development

- 10.1.5. Clinical Trial Information

- 10.1.6. Safety and Efficacy

- 10.1.7. Product Profile

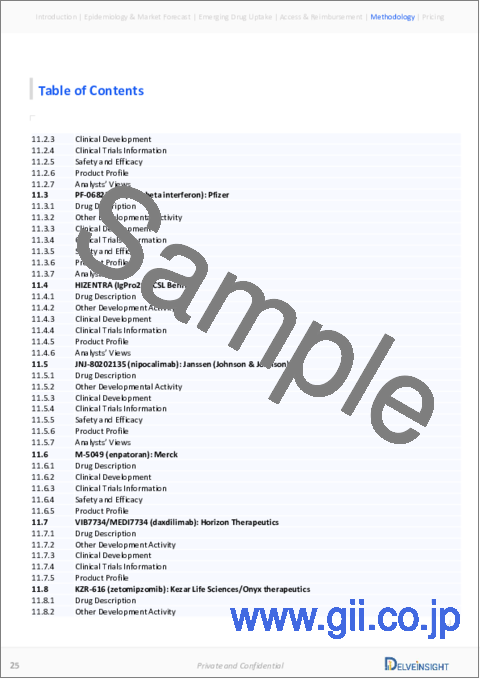

11. Emerging Drugs

- 11.1. Key Cross Competition

- 11.2. Brepocitinib (PF-06700841): Priovant Therapeutics/Pfizer

- 11.2.1. Drug Description

- 11.2.2. Other Developmental Activity

- 11.2.3. Clinical Development

- 11.2.4. Clinical Trials Information

- 11.2.5. Safety and Efficacy

- 11.2.6. Product Profile

- 11.2.7. Analysts' Views

- 11.3. ULTOMIRIS (ravulizumab/ALXN1210): AstraZeneca

- 11.3.1. Drug Description

- 11.3.2. Other Developmental Activity

- 11.3.3. Clinical Development

- 11.3.4. Clinical Trials Information

- 11.3.5. Product Profile

- 11.3.6. Analysts' Views

- 11.4. Efgartigimod: Argenx

- 11.4.1. Drug Description

- 11.4.2. Clinical Development

- 11.4.3. Clinical Trials Information

- 11.4.4. Product Profile

- 11.4.5. Analysts' Views

- 11.5. PF-06823859 (anti-beta interferon): Pfizer

- 11.5.1. Drug Description

- 11.5.2. Other Developmental Activity

- 11.5.3. Clinical Development

- 11.5.4. Clinical Trials Information

- 11.5.5. Safety and Efficacy

- 11.5.6. Product Profile

- 11.5.7. Analysts' Views

- 11.6. HIZENTRA (IgPro20): CSL Behring

- 11.6.1. Drug Description

- 11.6.2. Other Development Activity

- 11.6.3. Clinical Development

- 11.6.4. Clinical Trials Information

- 11.6.5. Product Profile

- 11.6.6. Analysts' Views

- 11.7. JNJ-80202135 (nipocalimab): Janssen (Johnson & Johnson)

- 11.7.1. Drug Description

- 11.7.2. Other Developmental Activity

- 11.7.3. Clinical Development

- 11.7.4. Clinical Trials Information

- 11.7.5. Safety and Efficacy

- 11.7.6. Product Profile

- 11.7.7. Analysts' Views

- 11.8. M-5049 (enpatoran): Merck

- 11.8.1. Drug Description

- 11.8.2. Clinical Development

- 11.8.3. Clinical Trials Information

- 11.8.4. Safety and Efficacy

- 11.8.5. Product Profile

- 11.9. VIB7734/MEDI7734 (daxdilimab): Horizon Therapeutics

- 11.9.1. Drug Description

- 11.9.2. Other Development Activity

- 11.9.3. Clinical Development

- 11.9.4. Clinical Trials Information

- 11.9.5. Product Profile

- 11.10. KZR-616 (zetomipzomib): Kezar Life Sciences/Onyx therapeutics

- 11.10.1. Drug Description

- 11.10.2. Other Development Activity

- 11.10.3. Clinical Development

- 11.10.4. Clinical Trials Information

- 11.10.5. Safety and Efficacy

- 11.10.6. Product Profile

- 11.11. PF1801 (froniglutide): Immunoforge

- 11.11.1. Drug Description

- 11.11.2. Other Developmental Activity

- 11.11.3. Clinical Development

- 11.11.4. Clinical Trials Information

- 11.11.5. Product Profile

- 11.12. GLPG3667: Galapagos NV

- 11.12.1. Drug Description

- 11.12.2. Clinical Development

- 11.12.3. Clinical Trials Information

- 11.12.4. Product Profile

- 11.13. BEGESAND/BEGEDINA (begelomab): Adienne Pharma & Biotech

- 11.13.1. Drug Description

- 11.13.2. Other Developmental Activity

- 11.13.3. Clinical Development

- 11.13.4. Clinical Trials Information

- 11.13.5. Product Profile

12. Dermatomyositis: Market Analysis

- 12.1. Key Findings

- 12.2. Key Market Forecast Assumptions

- 12.3. Market Outlook

- 12.4. Conjoint Analysis

- 12.5. Total Market Size of Dermatomyositis in the 7MM

- 12.6. Total Market Size of Dermatomyositis by Therapies in the 7MM

- 12.7. Market Size of Dermatomyositis in the US

- 12.7.1. Total Market Size of Dermatomyositis in the US

- 12.7.2. The Market Size of Dermatomyositis by Therapies in the US

- 12.8. Market Size of Dermatomyositis in EU4 and the UK

- 12.8.1. Total Market Size of Dermatomyositis in EU4 and the UK

- 12.8.2. The Market Size of Dermatomyositis by Therapies in EU4 and the UK

- 12.9. Market Size of Dermatomyositis in Japan

- 12.9.1. Total Market Size of Dermatomyositis in Japan

- 12.9.2. The Market Size of Dermatomyositis by Therapies in Japan

13. Key Opinion Leaders' Views

14. SWOT Analysis

15. Unmet Needs

16. Market Access and Reimbursement

- 16.1. The United States

- 16.1.1. Center for Medicare & Medicaid Services (CMS)

- 16.2. EU4 and the UK

- 16.2.1. Germany

- 16.2.2. France

- 16.2.3. Italy

- 16.2.4. Spain

- 16.2.5. The United Kingdom

- 16.3. Japan

- 16.3.1. MHLW

17. Appendix

- 17.1. Bibliography

- 17.2. Acronyms and Abbreviations

- 17.3. Report Methodology