|

|

市場調査レポート

商品コード

1108746

アジア太平洋の照明器具市場The Lighting Fixtures Market in Asia Pacific |

||||||

| アジア太平洋の照明器具市場 |

|

出版日: 2022年07月31日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 201 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

アジア太平洋の照明器具市場(7カ国:インドネシア、マレーシア、フィリピン、シンガポール、韓国、タイ、ベトナム)の2021年に工場出荷価格で62億6,400万米ドルとなりました。この金額にはランプ(従来型とLEDランプ)は含まれておらず、ランプはさらに15億3300万米ドルと推計され、照明全体(器具+ランプ)の販売は約78億米ドルとなります。

当レポートでは、アジア太平洋の照明器具市場について調査し、生産、国際貿易、市場規模に関する民生/住宅用と技術/プロ用照明のデータと動向(2016年~2021年)、2025年までの予測、主要企業などの情報を提供しています。

ハイライト

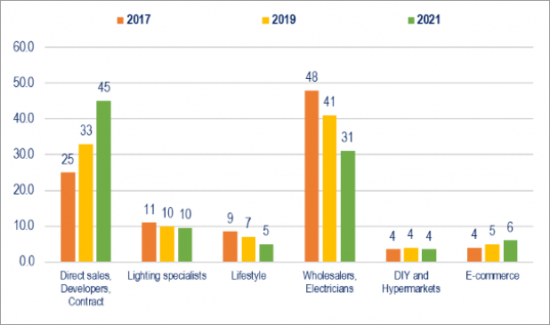

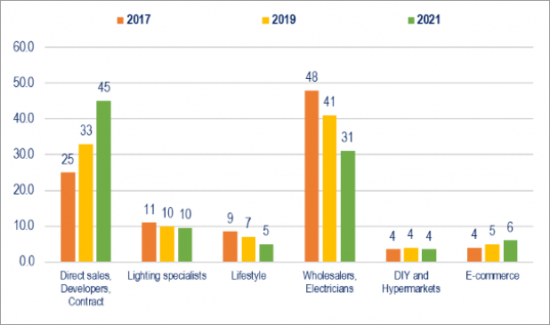

アジア太平洋の照明器具の流通チャネル別販売内訳:セクター別推計(2017年、2019年、2021年)金額ベースのシェア

主な掲載企業

Alto Lighting、Aplico、Artemide、Artolite、AZ E-Lite、Azcor Lighting、Boonthavorn Lighting、CARA Lighting、Changi Light、Chor Rungsang Lighting、Chunil、Davico、Dien Quang Lamp、Dongmyung Lighting - Raat、Duc Hau Long、Eglo、ELM Lighting、Erco、EVE Lighting、Fagerhult、Fluxlite、Focus Vina、Fokus Indo Lighting、Fosera Lighting、FSL Lighting、Fumaco、Goodlite、Hannochs、Hanssem、Hapulico Lighting、Hikari、Honyar、Hori Lighting、Kangsan Lighting、Krisbow、Kum Kang Electric、L&E Lighting and Equipment、Lamptan、Leedarson、LeKise、Ligman、Lumens、Maltani Lighting、MLS - Ledvance、Neo-Neon、NVC、Opple、PAK Lighting、Rang Dong、RZB、Saka Lighting、Signify、Solarens Ledindo、Sunil Elecomm、Tan Phat、Ushio Lighting、Wooree Lighting、XaLoTho、Yankon、Zumtobel

目次

- アジア太平洋(7カ国)の照明市場 - 照明業界の概要:照明器具の生産、国際貿易、消費、ランプの貿易と消費、照明市場全体推計

- 2025年までの国別およびアジア太平洋全体の照明市場予測

- 競争システム:主要企業.総照明、ランプ、照明器具、住宅/消費者、商業/建築、産業および屋外照明市場、LEDベースの照明に関する主要企業の推計売上データと市場シェア、企業プロファイル概略

- スタイル別、製品タイプ別、アプリケーション別、サンプル企業の流通チャネル別、およびセクター推計による照明器具の販売内訳

- アジア太平洋都市の各サンプルにおける照明需要

- 国別分析:インドネシア、マレーシア、フィリピン、シンガポール、韓国、タイ、ベトナム

調査対象国別

- 市場規模、活動の動向と予測:生産、消費、国際貿易に関する照明器具、照明市場の動向と各経済指標に関する予測

- 国際貿易:国別および仕向地/原産地の地理的エリア別の照明器具の輸出入フロー、およびランプの国際貿易に関するデータ

- 競合のシステム:各市場に存在する国内および国際的な主要企業の照明販売データ推計と市場シェア、および企業プロファイル概略

- 光源:LED照明セグメントと従来の照明源

- 流通:主な流通経路の概要と、照明事業および照明デザインスタジオに関与する各建築企業、各都市の照明需要

- 経済指標:各経済指標のデータと予測

The report, now at its fifth edition, analyses the Lighting fixtures market in 7 Asian Pacific countries (Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam), a market with an estimated consumption (at factory prices) that, in 2021, amounts to USD 6.3 billion.

The Study provides data and trend (2016-2021) on the production, the international trade and the market size of the lighting fixtures industry, broken down by consumer/residential and technical/professional lighting (divided in architectural/commercial, industrial, and outdoor). An overview of the top players in the lamps lighting market is also provided. Forecasts up to 2025 for the lighting fixtures market and selected economic indicators are included for each considered countries.

The first chapter offers an overview of the lighting industry in Asia Pacific (7 country) as a whole, ranking the top companies as total lighting sales (including: Lighting fixtures, LED and Conventional lamps), as lighting fixtures sales by segment (consumer/professional, indoor/outdoor), specific products and applications (downlights, projectors, high bays, etc.; hospitality, retail, healthcare, street lighting, etc.), light sources (LED share), distribution channels.

After a first glance of the Asian Pacific lighting market as a whole, the report is structured as follows, for each country:

- Paragraph I Market size, activity trend and forecast offers an overview of the lighting fixtures industry with data on production, consumption and international trade for the period 2016-2021 and forecast up to 2025.

- Paragraph II International trade provides detailed tables on lighting fixtures exports and imports, by country and by geographical area of destination/origin, highlighting the main destination for lighting fixtures exports and the top lighting fixtures importers, and data on international trade of lamps, pointing out the percentage share of LED based lamps on total exported and imported lamps.

- Paragraph III Competitive system offers an insight into the leading local and foreign players present in each market via detailed tables showing sales data and market shares and short company profiles.

- Paragraph IV Light sources provides an estimated breakdown of lighting fixtures sales by light sources (penetration rate of the LED lighting segment versus conventional lighting sources).

- Paragraph V Distribution channels gives an overview of the main distribution channels. A selection of architectural companies involved in the lighting business, a selection of the main associations and trade fairs, a focus on the most relevant cities for each country are also included.

- Paragraph VI Economic indicators provides data and forecasts for selected macroeconomic indicators, population and social trends, and building activity.

Highlights:

Breakdown of lighting fixtures sales in Asia Pacific by distribution channels. Sector estimate, 2017, 2019 and 2021. Percentage share in value

The lighting fixtures market in Asia Pacific (7 countries considered, in alphabetical order: Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam) was estimated to worth US$ 6,264 million at factory prices, for the year 2021.

The above mentioned value does not include lamps (Conventional and LED lamps), which are estimated to worth an additional US$ 1,533 million, while the overall lighting turnover (fixtures + lamps) is around US$ 7.8 billion.

Over 60% the share of LED based lighting fixtures.

Around 3% of these luminaires and lamps are today connected, but this share could easily to reach somewhat 10% in a 3-4 year span.

Top 50 players hold almost 40% of the lighting fixtures market in Asia Pacific.

Among the major players: Eve, Hannochs, Hansol, Ledvance, L&E, Maltani, Panasonic, Rang Dong, Signify, Tan Phat, Tospo. These players register an average 6% sales growth during 2021.

South Korea is by far the main market in the region (US$ 2.3 billion), followed by Vietnam and Thailand.

Vietnam is the country with an higher share of trade (both exports and imports). An increasing share of the Asian Pacific market for lighting fixtures is handled on a Project basis.

Selected Companies

Alto Lighting, Aplico, Artemide, Artolite, AZ E-Lite, Azcor Lighting, Boonthavorn Lighting, CARA Lighting, Changi Light, Chor Rungsang Lighting, Chunil, Davico, Dien Quang Lamp, Dongmyung Lighting - Raat, Duc Hau Long, Eglo, ELM Lighting, Erco, EVE Lighting, Fagerhult, Fluxlite, Focus Vina, Fokus Indo Lighting, Fosera Lighting, FSL Lighting, Fumaco, Goodlite, Hannochs, Hanssem, Hapulico Lighting, Hikari, Honyar, Hori Lighting, Kangsan Lighting, Krisbow, Kum Kang Electric, L&E Lighting and Equipment, Lamptan, Leedarson, LeKise, Ligman, Lumens, Maltani Lighting, MLS - Ledvance, Neo-Neon, NVC, Opple, PAK Lighting, Rang Dong, RZB, Saka Lighting, Signify, Solarens Ledindo, Sunil Elecomm, Tan Phat, Ushio Lighting, Wooree Lighting, XaLoTho, Yankon, Zumtobel.

Table of Contents

- Lighting market in Asia Pacific (7 Countries) - Lighting industry at a glance: Lighting fixtures production, international trade and consumption; trade and consumption of Lamps, estimates of total lighting market.

- Lighting market forecasts up to 2025, by country and for Asia Pacific as a whole

- Competitive system: the top players. Estimated sales data and market shares of the leading companies for: Total Lighting, Lamps, Lighting fixtures, Residential/ Consumer, Commercial/ Architectural, Industrial and Outdoor Lighting markets, LED-based lighting. Short company profiles.

- Breakdown of lighting fixtures sales by style, products type, applications, distribution channels for a sample of companies and sector estimates.

- Lighting demand in a selected sample of Asian-Pacific cities

- COUNTRY ANALYSIS: Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, Vietnam

For each country considered:

- Market size, activity trend and forecast: lighting fixtures time series on production, consumption and international trade. Forecast on the trend of the lighting market and selected economic indicators.

- International trade: export and import flows of lighting fixtures by country and by geographical area of destination/origin, and data on international trade of lamps.

- Competitive system: estimated lighting sales data and market shares among the major local and international players present in each market, as well as short company profiles

- Light sources: LED lighting segment versus conventional lighting sources

- Distribution: overview of the main distribution channels and selection of architectural companies involved in the lighting business and lighting design studios. Lighting demand in selected cities

- Economic indicators: data and forecasts for selected economic indicators