|

|

市場調査レポート

商品コード

1365856

中国の照明器具市場The Lighting Fixtures Market in China |

||||||

|

|||||||

| 中国の照明器具市場 |

|

出版日: 2023年09月30日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 205 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

ハイライト

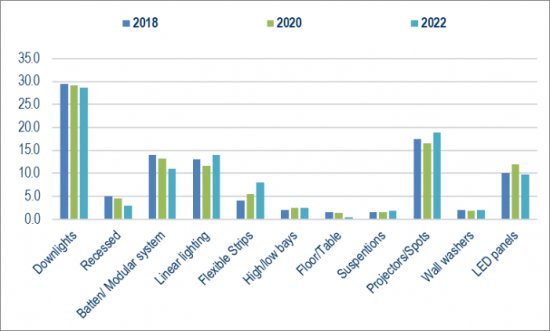

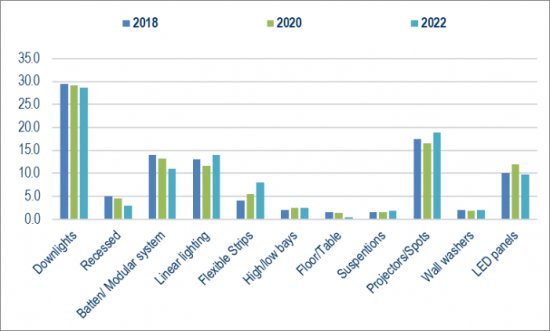

中国の商用照明器具生産

:製品タイプ別内訳 (2018-2020-2022年)

%

中国の照明器具の市場規模は、中期的に成長に転じると予想されており、ここ数年で雇用と収益性が20%減少したものの、2024年からは大幅な市場回復が見込まれています。

中国の建設産業は、2023年から2025年にかけて年平均2.4%の成長を記録すると予想されています。

2022年における中国の照明器具の生産・消費規模は、実質ベースで5年前とほぼ同水準になると推計されています。

2022年に中国でもっとも好調な照明市場区分は、屋外照明、ホスピタリティ照明、園芸用照明、防爆照明、リニア照明です。

中国の照明器具の売上は、主要60社で市場全体の40%以上を占めています。照明器具の中国輸出はそれほど集中しておらず、少なくとも5,000社の企業が関与する非常に細分化されたビジネスです。

主要企業:Signify、Yankon、Leedarson、CHINT、Haoyang、Youpon、Twinsel、Warom、Gloria Technology、Huadian、Chuang Yijia、Guanke Technologies、LEDMY、OKELI Lighting、CoreShine

インタビュー・プロファイル掲載企業:

Anchises, Arup, Boysun, Brilliance, CH Lighting, Chint, Changelight, Chuang Yijia, DP Led, Eaglerise, FarEast, Fagerhult, FSL, Flos, Gloria, Jom, Haoyang, Minkave, Honglitronic, Honyar, Huayi, Huati, Ikea, Illusion Led, Imigy, Inesa Feilo, Inventronics, Jiawei, JD.com, Kennede, Leyard, Ledman, Leedarson, LiquiDesign, Loyal Lighting, Lumbency, Luxmate, MLS-Ledvance, Nationstar, NVC, Ocean's King, Okeli, OML, Opple, PAK Lighting、Red100、Signify、Sosen、Tecnon、Torshare、Twinsel、Tospo、Unilumin、W2 Architects、Xindeco、Yankon、Yeelight、Youpon、Warom、WooJong、Xin Lichuang、Zhubo Design、Zumtobel

当レポートでは、中国の照明器具の市場を調査し、市場概要、照明器具およびランプの製造・消費・国際貿易の推移・予測、各種区分別の内訳、主要企業の財務データ、競合情勢、市場シェア、価格動向、流通システム、需要影響因子の分析などをまとめています。

目次

本書の内容・調査ツール・調査手法・注記・用語

基本データ・活動動向・予測

- 総市場:技術別

- 照明器具およびランプ (LEDランプおよび従来型ランプ) の製造・消費・国際貿易予測

- 市場セグメント別 (屋内/屋外照明・消費者/商用照明)

- M&A (一部の企業を対象)

国際貿易

- 照明 (照明器具・照明部品・ランプ) の輸出:国・仕向地/原産地別

財務分析・供給構造

- 掲載企業の主要な財務データ (売上高、EBITDA、EBIT、純利益)・収益性指標 (ROA、ROE、EBITDA、EBIT)・財務構造指標 (資産、株主資金、キャッシュフロー、流動比率、支払能力比率)・雇用動向

- LED照明への焦点:推計データ・予測

- LEDチップおよびLEDドライバーの主要サプライヤー・中国のコネクテッドライティング市場の概要

- 照明器具:主要セグメント (家庭用、商業用、産業用、屋外用照明)・スタイル・製品タイプ・用途別の内訳・部門別の推計・掲載企業の推定内訳

流通

- チャネル (受託販売、照明専門小売店、ライフスタイル、卸売業者、DIY/ホームセンター、eコマース) 別の流通システムの分析・中国の照明器具卸売業者250社・主要な建築家・インテリアデザインスタジオ・照明デザイナー

- 中国の照明器具の参考価格:製品別

競合システム

- 中国および大手国際企業の照明販売データ・市場シェア:照明、照明器具、ランプ全体

- 市場セグメント (屋内/屋外照明、消費者/業務用照明) および用途別の企業のランキング・簡単な企業プロファイル

- 主要中国企業の輸出売上と市場シェア:仕向地別 (アジア太平洋、欧州、南北アメリカ、中東・アフリカ)

需要促進要因

- マクロ経済データ (国別指標)・人口と都市化のプロセス・建設業界と不動産

付録:

- 掲載企業リスト

The 16th edition of “The Lighting Fixtures market in China” offers an accurate and in-deep analysis of the lighting fixtures industry in China, providing data and trends for the period 2017-2022 and forecasts up to 2025. From one hand, the report analyses the main trends affecting the market over the last five years, considering the production, the consumption, the imports and the exports of lighting fixtures in the country. On the other hand, it offers an analysis of the supply structure and the competitive system, an overview of the distribution system and the main players operating in the market.

International Trade

Lighting fixtures exports and imports are considered, broken down by country and by geographical area of destination/origin (total lighting, only lighting fixtures, only lighting components). The time frame considered is 2017-2022.

Supply Structure

The lighting fixtures market is divided in four main segments:

- residential-consumer

- commercial-architectural

- industrial

- outdoor

Data on consumer/residential lighting are broken down by style (traditional, modern, design) and by product type (floor, table, wall and ceiling lamps, embedded lighting, downlight/sport light, chandeliers and suspensions), while data on commercial lighting are broken down by type of product (downlights, recessed luminaires, batten and modular systems, linear, LED strips, high bays, floor and table lamps, decorative and professional suspensions, projectors/spots/track, wall washers, and LED panels) and application (hospitality, office, retail, art and museums, entertainment, schools, airports and other big infrastructures). Industrial lighting consists of lighting for industrial sites, healthcare lighting, weather resistant and explosion-proof lighting, emergency lighting, marine lighting, and horticultural lighting. Outdoor lighting includes residential outdoor lighting, lighting for urban landscape, lighting for streets and major roads, area/campus lighting, lighting for tunnels and galleries, Christmas and special events lighting.

A focus on LED Lighting trend and forecast with an overview on main suppliers of LED chips and LED drivers, as well as an overview on smart/connected lighting and other new technologies available in the market are also included.

A financial analysis, on a sample of selected number of companies operating in the market, includes profitability ratios and financial structure indicators.

Distribution Channels

The analysis of the distribution system is organized by the following channels:

- Contract/Builders

- Lighting Specialists

- Wholesalers

- Lifestyle stores (Furniture stores/chains and department Stores)

- DIY stores

- E-commerce

A selection of leading e-commerce players, architectural offices and lighting designers operating in China is also included.

Competitive System

Finally, the report offers an analysis of the leading local and foreign players present on the Chinese market and in each segment considered; through sales data, market shares and short profiles.

An address list of more than 200 lighting fixtures manufacturer active in China is included.

Highlights:

China. Breakdown of commercial lighting fixtures production

by product type, 2018-2020-2022.

Percentage values

According to CSIL estimate, Chinese lighting market is expected to return to growth in the medium-term; a significant market recovery is attended from 2024, after a reduction by 20% of employment and profitability during the last years.

China's construction industry is expected to register an average annual growth of 2.4% between 2023 and 2025.

In 2022 production and consumption of luminaires in China are estimated to be worth approximately the same levels as five years ago, in real terms.

The best performing lighting market segments in China in 2022 were: outdoor, hospitality, horticultural and explosion-proof lighting, linear lighting.

Among the top performing players are: Signify, Yankon, Leedarson, CHINT, Haoyang, Youpon, Twinsel, Warom, Gloria Technology, Huadian, Chuang Yijia, Guanke Technologies, LEDMY, OKELI Lighting, CoreShine.

The top 60 players, in term of lighting sales in China, together accounts for over 40% of the market. Less concentrated the Chinese export of lighting fixtures, which is a highly fragmented business involving at least 5,000 players.

Selected Companies

Among the companies profiled and interviewed:

Anchises, Arup, Boysun, Brilliance, CH Lighting, Chint, Changelight, Chuang Yijia, DP Led, Eaglerise, FarEast, Fagerhult, FSL, Flos, Gloria, Jom, Haoyang, Minkave, Honglitronic, Honyar, Huayi, Huati, Ikea, Illusion Led, Imigy, Inesa Feilo, Inventronics, Jiawei, JD.com, Kennede, Leyard, Ledman, Leedarson, LiquiDesign, Loyal Lighting, Lumbency, Luxmate, MLS-Ledvance, Nationstar, NVC, Ocean's King, Okeli, OML, Opple, PAK Lighting, Red100, Signify, Sosen, Tecnon, Torshare, Twinsel, Tospo, Unilumin, W2 Architects, Xindeco, Yankon, Yeelight, Youpon, Warom, WooJong, Xin Lichuang, Zhubo Design, Zumtobel.

Table of Contents

Contents of the Report; Research tools and methodological notes; Terminology

Basic Data, activity trend and forecasts

- Total lighting market by technology: lighting fixtures and lamps (LED lamps and conventional lamps); Lighting fixtures production, consumption and international trade: total and by market segment (Indoor/Outdoor Lighting, Consumer/Professional Lighting). Data available in USD and RMB. The time frame considered is 2017-2022, forecasts 2023-2025

- Mergers and acuisitions deals in the lighting sector, for a sample of companies, 2017-2023

International Trade

- Exports and imports of lighting (lighting fixtures, lighting components, lamps) by country and geographical area of destination/origin. Data 2017-2022.

Financial analysis and Supply structure

- Key financial data (turnover, EBITDA, EBIT, Net icnome) for a sample of companies; Profitability indicators (ROA, ROE, EBITDA, EBIT) in a sample of companies; Financial structure indicators (Assets, Shareholder funds, Cash flow, Current and Solvency ratio) in a sample of companies; Employment trend

- Focus on LED lighting: 2015-2022 estimated data and 2023-2025 forecasts

- Main Suppliers of LED chips and LED drivers; An overview on the Connected Lighting market in China

- Breakdown of lighting fixtures production by four main segments (residential-consumer, commercial, industrial, outdoor lighting), by style, product type and application. Sector estimates and estimated breakdown for a sample of companies

Distribution

- Analysis of the distribution system broken down by channel (Contract sales, Lighting specialist retailers, Lifestyle, Wholesalers, DIY/Home Improvement, E-commerce). Selection of 250 wholesalers of lighting fixtures and lighting equipment in China. Selection of leading architects, interior design studios and lighting designers operating in China.

- Lighting fixtures reference prices in China, by product

Competitive system

- Lighting sales data and market shares for a sample of leading Chinese and international companies: Total lighting, lighting fixtures and lamps.

- Companies' ranking by market segments (Indoor/Outdoor Lighting, Consumer/Professional Lighting) and applications. Short company profiles

- Lighting fixtures export sales and market shares by Region of destination in selected Chinese companies (Asia and Pacific, Europe, Americas, Middle East and Africa)

Demand drivers

- Macroeconomic Data (Country indicators). Population and urbanization process. Construction sector and real estate

Appendix:

- list of mentioned companies