|

|

市場調査レポート

商品コード

1646800

欧州の家具市場The Furniture Industry in Europe |

||||||

|

|||||||

| 欧州の家具市場 |

|

出版日: 2025年01月30日

発行: CSIL Centre for Industrial Studies

ページ情報: 英文 539 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

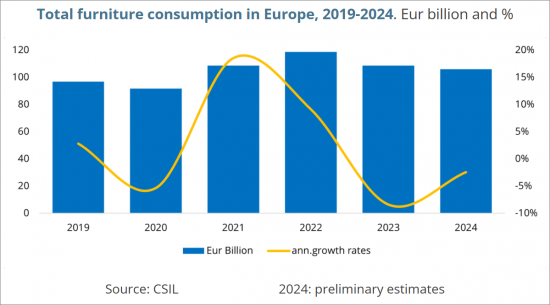

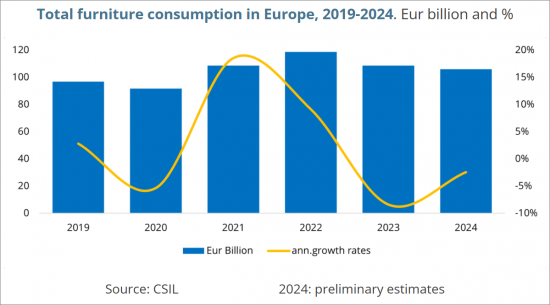

世界第2位の家具市場である欧州の消費額は約1,060億ユーロ(世界市場の4分の1以上)で、生産、市場規模、世界貿易の極めて重要な拠点として、世界の家具産業において引き続き重要な地位を占めています。

2023年から2024年にかけての厳しい市場環境にもかかわらず、このセクターはその回復力を証明し、高度な統合と市場集中に支えられて、大流行前の水準を上回って推移しています。欧州規模で事業を展開する大手小売チェーンとメーカーが市場を独占しており、市場内部の強い結束力と確立された貿易ネットワークの恩恵を受けています。この構造的な強さは、市場の安定性を支えるだけでなく、域内における輸出入の大幅な集中を推進する原動力にもなっています。同時に、欧州は国際貿易における積極的な役割を反映し、世界市場に対して継続的な開放性を維持しています。

2025年の家具需要は停滞し、中期的には徐々に回復の兆しがあると予測しています。

当レポートでは、欧州の家具市場について調査し、2019年~2024年の時系列における家具の生産、消費、輸入、輸出動向、国別ランキング、2025年と2026年の家具市場予測、主要家具メーカーのプロファイルなどをまとめています。

ハイライト

目次(要約)

エグゼクティブサマリー

欧州の家具業界

- 世界の家具産業における欧州の役割

- 欧州とその他の地域。家具の生産、消費、輸出、輸入

- 欧州における統合プロセス

- 国際家具貿易、家具輸入の目的地と原産地別の家具輸出

- 欧州の家具生産実績

- 主な家具製造国(イタリア、ドイツ、ポーランド、英国、フランス)の説明

- EU家具メーカーの競争力に影響を与える要因

- 欧州の家具競争システム

- 最近の欧州の家具メーカーの戦略、M&A

- 欧州の上場家具メーカーの最新データ

- 欧州のトップ50メーカー:総売上高ランキング

- 欧州の家具市場の動向:2019年~2024年

- 市場情報源

- 国内生産、EU市場統合、輸入フロー

- 貿易収支

- 市場の開放度の高まり

- 輸出志向

- 欧州の家具生産の分野別内訳

- 家具サブセグメントの動向

国別分析

- 市場の概略とマクロ経済動向、家具の生産、消費、輸入、輸出、国別ランキング、家具市場予測、貿易相手国、セグメント別の家具の消費と生産、製造システム、および主要な家具メーカーの簡単なプロファイル:

- オーストリア、ベルギー、ブルガリア、クロアチア、キプロス、チェコ共和国、デンマーク、エストニア、フィンランド、フランス、ドイツ、ギリシャ、ハンガリー、アイルランド、イタリア、ラトビア、リトアニア、マルタ、オランダ、ノルウェー、ポーランド、ポルトガル、ルーマニア、スロバキア、スロベニア、スペイン、スウェーデン、スイス、英国

2400社を超える欧州の家具メーカーの簡単なプロファイル:

- 活動

- 製品ポートフォリオ

- 売上高範囲

- 従業員数

- 電子メールアドレス

- Webサイト

方法論的注釈

Part of the CSIL Country Furniture Outlook Series covering 100 countries at present with CSIL furniture industry insights, "The Furniture Industry in Europe" contains all the main statistics and indicators useful to analyze the furniture sector in Europe and in 30 European countries: Austria, Belgium-Lux, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, the UK.

THE FURNITURE INDUSTRY IN EUROPE: INSIGHTS AND FORECASTS

The first part of this furniture market report goes in-depth into the future perspectives for the European furniture sector with a particular focus on the green and digital transitions shaping the industry.

European Furniture Market: Key Data and Trends

The role of Europe in the global furniture context is analysed with historical series of basic data (furniture production, consumption, and trade 2019-2024), the European furniture production performance and future perspectives, the main factors affecting the competitiveness of manufacturers (labor cost, availability of raw materials and components, investments in technology and machinery, innovations, recycling, sustainability, and circularity), imports penetration, exports orientation, description of the main furniture manufacturing countries.

The European furniture market potential, development insights, and Furniture market trends are analysed through a historical series of furniture consumption data and future perspectives of the furniture sector in Europe, with consumption forecasts for 2025 and 2026.

The Furniture manufacturing system and trends in the development of furniture production by segment (upholstered furniture, kitchen furniture, office furniture, furniture for the bedroom &dining-living room, other furniture) with trends in furniture sub-segments (available data up to 2023).

Top Furniture Manufacturers in Europe

The competitive system in Europe is covered with the recent European furniture manufacturers' strategies, mergers, and acquisitions (M&A).

The competitive system analysis includes figures for the leading 50 European furniture companies (company name, headquarters' country, furniture specialization, total turnover, and the number of employees, share of furniture on total sales) ranked by their turnover.

Financial performance analysis of a selection of publicly listed European furniture manufacturers, including aggregated key annual (2019-2023) figures such as total revenue, EBITDA, total liabilities, total shareholders' equity, and the Debt-to-Equity Ratio, and quarterly (2024) data for total revenue, gross profit, operating expense, operating income, total expense, EBIT and EBITDA, is also provided.

Over 2400 short profiles of furniture manufacturers are also provided, with information on their activity, product portfolio, turnover range, employees range, general email address -when available- and website.

COUNTRY ANALYSIS: FURNITURE INDUSTRY REPORTS FOR 30 EUROPEAN COUNTRIES

For each considered country (Austria, Belgium-Lux, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, the Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, the United Kingdom) this study offers a complete report including:

- Market Outline and macroeconomic trends

- Production, consumption, imports, and exports of furniture for the time series 2019-2024

- Comparison with the European furniture sector: country rankings on production, consumption, imports, and exports

- Furniture market forecasts for 2025 and 2026

- Trading partners: the origin of furniture imports and furniture export destination

- Value of furniture consumption and production by segment (upholstered furniture, office furniture, kitchen furniture, Furniture for bedroom, dining-living room * and other furniture)

- Manufacturing system: number of furniture firms, and size

- Short profiles of leading furniture manufacturers

Types of furniture covered: Office furniture, Upholstered furniture, Non-upholstered seats, Kitchen furniture, Bedroom furniture, Dining and living room furniture, and Other Furniture.

* For Bulgaria, Croatia, Estonia, Latvia, Lithuania, Malta, and Slovenia, the furniture consumption and production breakdown by segment is available only by upholstered furniture, office furniture, kitchen furniture, and other furniture.

Selected companies

Among the leading furniture manufacturers mentioned in this study: Aquinos, BRW Black Red White, Cotta Collection, Ekornes, Friul Intagli, Howden Joinery, IKEA, Lifestyle Design, Natuzzi, Nobilia, Nowy Styl, Polipol, Schmidt Groupe, Schuller, Fournier, Steelcase, Welle Holding.

Highlights:

Europe, the world's second-largest furniture market with a consumption value of around EUR 106 billion (over one-quarter of the global market), continues to hold a crucial position in the global furniture industry, acting as a pivotal hub for production, market size, and world trade.

Despite difficult market conditions in 2023-2024, the sector has proven its resilience, staying above pre-pandemic levels, supported by a high level of integration, and market concentration. Dominated by major retail chains and manufacturers operating on a European scale, the market benefits from strong internal cohesion and a well-established trade network. This structural strength not only underpins its stability but also drives the substantial concentration of export and import flows within the region. At the same time, Europe maintains an ongoing openness to global markets, reflecting its proactive role in international trade.

CSIL forecasts stagnant furniture demand in 2025, with signs of a gradual recovery in the medium term.

TABLE OF CONTENTS (ABSTRACT)

EXECUTIVE SUMMARY

- The future perspectives for the European furniture sector

- The global macroeconomic context and furniture market forecasts in Europe

- Green and digital transitions: a hot topic for the European furniture industry

THE EUROPEAN FURNITURE SECTOR

- The Role of Europe in the Global Furniture Context

- Europe and the rest of the world. Furniture production, consumption, exports, imports

- The integration process within Europe

- International furniture trade, furniture exports by destination and origin of furniture imports

- The European furniture production performance

- Description of the main furniture manufacturing countries (Italy, Germany, Poland, The United Kingdom, France)

- Factors affecting the competitiveness of EU furniture producers

- The furniture competitive system in Europe

- Recent European furniture manufacturers' strategies, M&A

- Recent figures of publicly listed European furniture manufacturers

- The TOP 50 European manufacturers. Ranking by total turnover

- European furniture market performance 2019-2024

- Market sources

- National production, EU market integration and import flows

- Trade balance

- The growing degree of market openness

- The export orientation

- European furniture production by segment

- Trends in furniture sub-segments

COUNTRY ANALYSIS

- Market outline and macroeconomic trends, Production, consumption, imports, and exports of furniture, Country rankings, Furniture market forecasts, Trading partners, Furniture consumption and production by segment, Manufacturing system, and short profiles of leading furniture manufacturers for:

- Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, United Kingdom

SHORT PROFILES OF OVER 2400 EUROPEAN FURNITURE COMPANIES:

- activity

- product portfolio

- turnover range

- employees range

- e-mail address

- website