|

市場調査レポート

商品コード

1341914

中国のゲルマニウム資源輸出:2023-2032年China's Germanium Resources Export Report 2023-2032 |

||||||

|

|||||||

| 中国のゲルマニウム資源輸出:2023-2032年 |

|

出版日: 2023年09月01日

発行: China Research and Intelligence

ページ情報: 英文 50 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

ゲルマニウムは、トランジスタやさまざまな電子機器の製造に広く使用される重要な半導体材料であり、光ファイバーシステム、赤外線光学、重合反応の触媒、エレクトロニクス、太陽光発電など、多様な用途があります。

サンプル

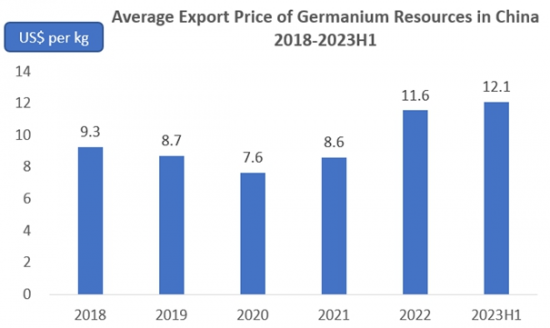

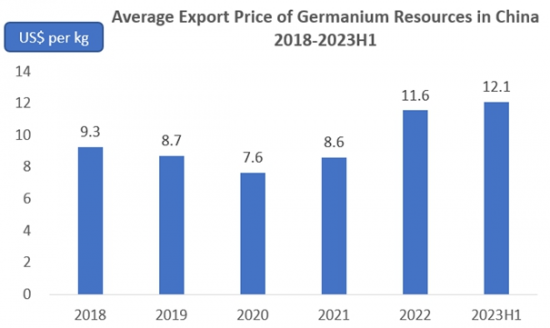

2018年から2022年までの輸出動向をみると、中国のゲルマニウム資源輸出は全体的に増加傾向を示しています。しかし、2022年は輸出額が18%増の約2億2,300万米ドルに達した一方で、輸出量は前年比12.1%減の約1万9,315トンとなりました。同期間の中国のゲルマニウム資源輸出の平均価格は変動があったものの全般的に上昇傾向であり、2018年から2023年上半期のキログラム当たりの価格は9.3米ドルから12.1米ドルまで上昇しました。

中国のゲルマニウム資源は2022年から2023年にかけて世界の約30の国と地域に輸出されました。これらの主な輸出先は日本、ドイツ、フランス、韓国、米国などです。日本は主要な受取国として浮上し、2022年の中国のゲルマニウム資源輸出総量の約30.9% (約5,960トン、約5,140万米ドル) を受け取り、同年の輸出総額の23.0%を占めました。

当レポートでは、中国のゲルマニウム資源の輸出動向を調査し、輸出量・輸出額・輸出価格の推移、輸出の主な促進要因、課題、機会の分析、市場予測、主要企業の分析と競合ベンチマーキングなどをまとめています。

目次

第1章 中国のゲルマニウム資源輸出分析:2018~2022年

- 輸出規模

- 輸出量

- 輸出額

- 輸出価格

- 主な輸出先

- 輸出量別

- 輸出額別

第2章 中国の未加工ゲルマニウム輸出分析:2018~2023年

- 未加工ゲルマニウムの輸出

- 未加工ゲルマニウムの輸出

- 未加工ゲルマニウムの輸出価格

- 未加工ゲルマニウムの輸出先

- 輸出量別

- 輸出額別

第3章 中国の鍛造および圧延ゲルマニウム輸出分析:2018~2023年

- 鍛造ゲルマニウムの輸出

- 鍛造ゲルマニウムの輸出額

- 鍛造ゲルマニウムの輸出価格

- 鍛造ゲルマニウムの輸出先

- 輸出量別

- 輸出額別

第4章 中国の酸化ゲルマニウム輸出分析:2018~2023年

- 酸化ゲルマニウムの輸出

- 酸化ゲルマニウムの輸出額

- 酸化ゲルマニウムの輸出価格

- 酸化ゲルマニウムの輸出先

- 輸出量別

- 輸出額別

第5章 中国のゲルマニウム資源の主な輸出先:2018~2023年

- 日本

- 米国

- ドイツ

- 韓国

- フランス

- その他

第6章 中国のゲルマニウム資源輸出の見通し:2018~2023年

- 中国ゲルマニウム資源の輸出に影響を与える要因

- 有利な要因

- 不利な要因

- 中国のゲルマニウム資源輸出予測:2023~2032年

- 輸出量予測

- 主な輸出先の見通し

- 主な輸出ゲルマニウム資源タイプの予測

LIST OF CHARTS

- Chart 2018-2022 China Germanium Resources Export Volume

- Chart China Germanium Resources Export Value 2018-2022

- Chart Average Price of Germanium Resources Exported from China, 2018-2022

- Chart Major Export Destinations of Chinese Germanium Resources by Export Volume, 2018-2022

- Chart Major Export Destinations of Chinese Germanium Resources by Export Value, 2018-2022

- Chart 2018-2022 China Unwrought Germanium Exports

- Chart China's Unwrought Germanium Exports 2018-2022

- Chart 2018-2022 China Unwrought Germanium Export Average Price

- Chart Main Export Destinations of Chinese Unwrought Germanium by Export Volume, 2018-2022

- Chart Main Export Destinations of Chinese Unwrought Germanium by Export Value, 2018-2022

- Chart 2018-2022 China Wrought and Rolled Germanium Exports

- Chart 2018-2022 China's wrought and rolled germanium export value

- Chart 2018-2022 China average price of wrought and rolled germanium exports

- Chart Major Export Destinations of Wrought and Rolled Germanium in China, by Export Volume, 2018-2022

- Chart Major Export Destinations of Wrought and Rolled Germanium in China, by Export Value, 2018-2022

- Chart 2018-2022 China's exported germanium resources to Japan

- Chart 2018-2022 China's Exported Germanium Resources to the United States

- Chart 2018-2022 China's exported germanium resources to South Korea

- Chart 2018-2022 China's exported germanium resources to France

- Chart 2018-2022 China's Exported Germanium Resources to Germany

- Chart 2023-2032 China Germanium Resources Export Forecast

Germanium, a critical semiconductor material used extensively in the production of transistors and various electronic devices, boasts diverse applications. These include fiber optic systems, infrared optics, catalysts for polymerization reactions, electronics, and solar power. Its innate semiconductor excellence positions it at the forefront of technologies such as semiconductors, fiber optic communications, infrared optics, solar cells, chemical catalysts, and biomedical applications.

SAMPLE VIEW

In a significant development, on July 3, 2023, China's Ministry of Commerce and the General Administration of Customs issued a proclamation. This proclamation, approved by the State Council of the People's Republic of China, establishes export controls on gallium and germanium-related items, aiming to safeguard national security and interests. These controls will be enforced starting from August 1, 2023, with administrative penalties or potential criminal liability for unauthorized exports or violations of the authorization scope.

Examining the export trends from 2018 to 2022, China's germanium resources exports displayed an overall upward trajectory. However, in 2022, export volumes dipped by 12.1% year-on-year, totaling around 19,315 tons, while the export value rose by 18%, reaching approximately 223 million U.S. dollars. During the same period, the average price of China's germanium resources exports witnessed fluctuations but generally trended upwards, increasing from USD 9.3 per kilogram in the first half of 2018-2023 to USD 12.1 per kilogram.

China's germanium resources found their way to approximately 30 countries and regions across the globe in 2022-2023. Leading destinations for these exports, in terms of value, include Japan, Germany, France, South Korea, and the United States. Japan emerged as the primary recipient, receiving around 30.9% of China's total germanium resource exports in 2022, amounting to about 5,960 tons and a value of approximately US$51.4 million, making up 23.0% of the total export value for that year.

China's prominence in the global germanium resources market is undeniable. Nevertheless, with the implementation of export restrictions effective from August 1, 2023, a notable decline in export volume and value is anticipated in 2023 compared to the previous year. This development raises questions about the future of China's germanium resource exports, which will be explored in more detail in upcoming sections. These sections will delve into key drivers, challenges, opportunities, and competitive dynamics, as well as the impact of COVID-19 and constraints on the growth of this industry.

Topics covered:

- Export Status and Main Sources of Chinese Germanium Resources, 2018-2022

- Key Drivers and Market Opportunities for China's Germanium Resources Exports

- What are the key drivers, challenges and opportunities for China's germanium resources exports during the forecast period 2023-2032?

- Which are the key players in the Chinese germanium resources export market and what are their competitive benchmarks?

- What are the expected revenues from the Chinese germanium resources export market during the forecast period of 2023-2032?

- What strategies have been adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Chinese germanium resources export market is expected to dominate the market by 2032?

- What are the competitive advantages of the key players in the Chinese germanium resources export market?

- What is the impact of COVID-19 on China's germanium resource exports?

- What are the main constraints inhibiting the growth of China's germanium resource exports?

Table of Contents

1. 2018-2022 China Germanium Resources Export Analysis

- 1.1. China's germanium resource export scale

- 1.1.1. China's germanium resource export volume

- 1.1.2. China's germanium resources export value

- 1.1.3. Chinese germanium resources export prices

- 1.2. China's main export destinations of germanium resources

- 1.2.1. by export volume

- 1.2.2. by value of exports

2. 2018-2023 China Unwrought Germanium Export Analysis

- 2.1. Unwrought germanium exports

- 2.2. exports of unwrought germanium

- 2.3. Export prices of unwrought germanium

- 2.4. Export destinations for unwrought germanium

- 2.4.1. by volume of exports

- 2.4.2. by value of exports

3. 2018-2023 China Wrought and Rolled Germanium Export Analysis

- 3.1. Exports of wrought germanium

- 3.2. Export value of wrought germanium

- 3.3. Export prices for wrought germanium

- 3.4. Export destinations of wrought germanium

- 3.4.1. by volume of exports

- 3.4.2. by value of exports

4. 2018-2023 China Germanium Oxide Export Analysis

- 4.1. Exports of germanium oxides

- 4.2. Export value of germanium oxides

- 4.3. Export prices of germanium oxides

- 4.4. Export destinations of germanium oxides

- 4.4.1. by volume of exports

- 4.4.2. by value of exports

5. Main Export Destinations of Germanium Resources in China, 2018-2023

- 5.1. Japan

- 5.2. United States of America

- 5.3. Germany

- 5.4. Korea

- 5.5. France

- 5.6. Other export destinations

6. Outlook for China's export of germanium resources, 2023-2032

- 6.1. Factors affecting the export of Chinese germanium resources

- 6.1.1. Favorable factors

- 6.1.2. Unfavorable factors

- 6.2. 2023-2032 China's Germanium Resources Export Forecasts

- 6.2.1. Export volume forecasts

- 6.2.2. Forecast of main export destinations

- 6.2.3. Forecast of major exported germanium resource types