|

|

市場調査レポート

商品コード

1339032

インドネシアの衣料品製造産業:2023-2032年Indonesia Garment Manufacturing Industry Research Report, 2023-2032 |

||||||

|

|||||||

| インドネシアの衣料品製造産業:2023-2032年 |

|

出版日: 2023年08月01日

発行: China Research and Intelligence

ページ情報: 英文 60 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

インドネシアは東南アジア最大の経済大国であり、労働力が豊富で人件費も安いです。2022年末には、インドネシアの人口は約2億7,500万人と世界第4位の人口となり、15~64歳の人口が約7割を占め、労働人口は約1億4,000万人となり、豊富な労働力と消費市場を持つことになります。CRIの分析によると、同国の若年層の多い人口構造はインドネシアの消費市場に10年から15年の成長をもたらす見通しです。

サンプル

インドネシアは世界でトップ10に入る繊維生産国です。繊維および繊維製品産業はインドネシア経済において最も重要な産業のひとつであり、370万人以上のインドネシア人に雇用を提供しています。インドネシアの繊維・衣料品の総生産量の70%は輸出されており、米国が最大の輸出国です。

CRIの分析によると、2018年から2022年まで、インドネシアの繊維・アパレル輸出額は、まず減少し、次に増加するという変化傾向を示しており、2018年から2022年までのCAGRは4.16%を示しています。2020年はCOVID-19の影響を受け、インドネシアの繊維・アパレル輸出額は58億5,700万米ドルでした。2021年にインドネシア政府が規制措置を緩和し、輸出額は2021年と2022年に急速に回復し、それぞれ69億900万米ドル、79億9,200万米ドルで、前年比17.98%、15.6%の増加となりました。

繊維産業は今やインドネシアの戦略的ターゲット産業です。インドネシアの繊維産業の将来性は、特に洗練された機械や生産設備の供給、能力構築において、投資家に絶好の機会を提供しています。その事業環境は、国民の購買力の向上とeコマースプラットフォームの普及により、より有利になっています。

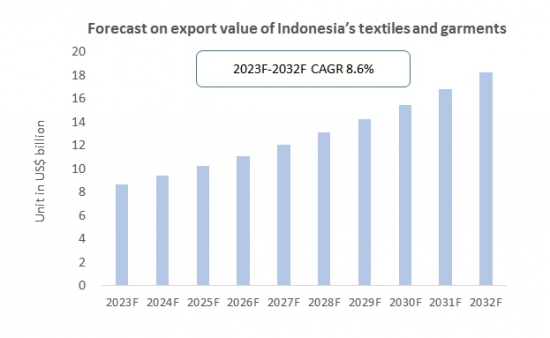

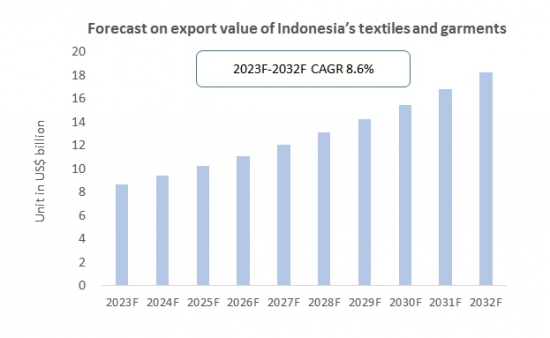

インドネシアの繊維・アパレル輸出は、今後も数年に渡って、その低コスト優位性により成長を続けると思われます。インドネシアの繊維・衣料品の輸出額は2032年に182億米ドルに達し、2023年から2032年までのCAGRは約8.6%になると予想されています。

当レポートでは、インドネシアの衣料品製造産業を調査し、インドネシアのアパレル産業の発展の経緯、衣料品製造産業の概要、競合情勢、製造コスト・価格の分析、衣料品製造の需要・供給予測など、主要製造業者のプロファイルなどをまとめています。

目次

第1章 インドネシアのアパレル産業:発展の概要

- 定義・分類

- 主要製品の分析

- インドネシアの衣料品製造業におけるCOVID-19の影響

第2章 インドネシアの衣料品製造産業の概要

- インドネシアのアパレル産業の発展環境

- インドネシアのアパレル供給の分析

- インドネシア市場のアパレル需要分析

第3章 インドネシアの繊維および衣料品産業:輸出入分析

- 輸入

- 輸出

第4章 インドネシアの衣料品製造産業における競合情勢

- 衣料品産業への参入障壁

- 衣料品製造産業の競合構造

第5章 インドネシアにおける衣料品製造:コスト・価格分析

- 製造コスト分析

- 衣料品価格分析

第6章 インドネシアの主要衣料品製造会社の概要

- PT INDONESIA TORAY SYNTHETICS

- PT ACRYL TEXTILE MILLS

- PT CENTURY TEXTILE INDUSTRY TBK

- PT PETNESIA RESINDO

- PT JABATO INTERNATIONAL

- PT INDONESIA SYNTHETICS TEXTILE MILLS

- PT EASTERNTEX

- PT OST FIBRE INDUSTRIES

第7章 インドネシアの衣料品製造業の見通し

- 衣料品製造産業の発展に影響を与える要因

- 衣料品製造業の競合情勢予測

- 衣料品製造の供給予測

- 衣料品製造市場の需要予測

Indonesia is the largest economy in Southeast Asia, and Indonesia has an abundant labor force with low labor costs. By the end of 2022, the population of Indonesia will be about 275 million, which is the fourth largest population in the world, with about 70% of the population aged 15-64, and the working population will be about 140 million, which is a plentiful labor force and consumer market. According to CRI's analysis, the young population structure will bring 10 to 15 years of growth to the Indonesian consumer market.

SAMPLE VIEW

Indonesia is one of the world's top ten textile producers, and the textile and textile products industry is one of the most important industries in the Indonesian economy, providing employment for more than 3.7 million Indonesians. The majority of Indonesia's total textile and clothing production is used to supply international demand, of which 70% is exported, with the United States of America being the largest exporter of Indonesian clothing and textiles.

As apparel companies continue to shift production out of China, Indonesia has become an attractive alternative. China's position as a global cotton importer is declining, and most cotton exports are being shifted to competing countries, including Indonesia. The USDA forecasts that China's cotton imports will increase by only 3.5 million bales over the 2021-2030 period, compared to an estimated 8.1 million bales for the major competing apparel countries Indonesia, Vietnam, Pakistan, Bangladesh, and Turkey combined. By 2030, China is expected to account for 24% of total global imports, while competing countries combined are expected to account for 47%.

Indonesia's garment industry is concentrated in West Java, Central Java, East Java and Banten, which together account for more than 85 percent of all garment, textile and footwear employment. The garment industry is labor-intensive and easy to relocate, and employers have been relocating factories to areas with lower minimum wages.

From 2018 to 2022, according to CRI analysis, Indonesia's textile and apparel export value shows a trend of change firstly decreasing and then increasing, with a CAGR of 4.16% from 2018 to 2022.In 2020, affected by the COVID-19 epidemic, Indonesia's apparel manufacturing industry contracted, and Indonesia's textile and apparel export value was 5.857 billion U.S. dollars, which was a year-on-year decline of 17.19%.In 2021 The Indonesian government relaxed the control measures, and the export of Indonesia's textile and apparel industry recovered rapidly in 2021 and 2022, and the export value of Indonesia's textile and apparel in 2021 and 2022 was US$6.909 billion and US$7.992 billion, respectively, an increase of 17.98% and 15.6% year-on-year, respectively.

The textile industry is now a strategic target industry for Indonesia. The prospects of Indonesia's textile industry offer golden opportunities for investors, especially in the supply of sophisticated machinery and production equipment and capacity building. Its business environment has become more lucrative due to the increased purchasing power of the population and the proliferation of e-commerce platforms. This aggressive consumer behavior following lifestyle trends will fuel high demand for functional textiles for apparel, automotive, fitness, sports and military applications. The recently established Industrial Services and Solutions Centre (ISSC) facility at the Centre for Standardization and Textile Industry Services (BBSPJIT) is in its prime. It provides information services, testing, calibration, product and quality system certification, technical training and consultancy, develops standards for the textile industry and provides inclusive professional assistance to the textile industry. This integrated infrastructure will not only help meet domestic demand, but also increase the competitiveness of the textile industry in the global market, especially in the EU - one of Indonesia's major export destinations. Indonesia is in the process of negotiating with the EU for an Indonesia-EU Comprehensive Economic Partnership Agreement (IEU-CEPA), and Indonesia is looking towards Vietnam and Bangladesh.

At the same time, the Indonesian Government was constantly striving to build a productive, connected and sustainable textile ecosystem. By 2030, the country is expected to become one of the top five global textile manufacturers and one of the world's top 10 economies in the Industry 4.0 era.

In the coming years, Indonesia's textile and apparel exports will continue to grow due to its low-cost advantage. CRI expects the export value of Indonesia's textiles and garments to reach US$ 18.2 billion in 2032, representing a compound annual growth rate (CAGR) of about 8.6% from 2023-2032.

Topics covered:

- Overview of the Garment Industry in Indonesia

- Economic and policy environment of Indonesia's apparel industry

- What is the impact of COVID-19 on the Indonesian garment industry?

- Indonesia Clothing Industry Market Size 2018-2022

- Analysis of major Indonesian apparel companies

- Key Drivers and Market Opportunities in Indonesia's Apparel Industry

- What are the key drivers, challenges and opportunities for the Indonesian apparel industry during the forecast period 2023-2032?

- Which are the key players in the Indonesia Garment Industry market and what are their competitive advantages?

- What is the expected revenue of Indonesia Garment Industry market during the forecast period of 2023-2032?

- What strategies have been adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Indonesia apparel industry market is expected to dominate the market by 2032?

- What are the major unfavorable factors facing the Indonesian apparel industry?

Table of Contents

1. Overview of the Development of the Apparel Industry in Indonesia

- 1.1 Definitions and Classifications

- 1.2 Analysis of Major Products

- 1.3 Impact of COVID-19 on the Garment Manufacturing Industry in Indonesia

2. Overview of Indonesia's Garment Manufacturing Industry

- 2.1 Development Environment of Indonesia's Apparel Industry

- 2.1.1 Economic Environment

- 2.1.2 Policy Environment

- 2.1.3 Social Environment

- 2.2 Indonesia Apparel Supply Analysis 2018-2022

- 2.2.1 Indonesia Garment Manufacturing Industry Major Foreign Investment Source Countries Analysis

- 2.2.2 Clothing Production

- 2.3 Indonesia Market Demand Analysis for Apparel

- 2.3.1 Major Consumer Groups of Clothing

- 2.3.2 Size of Indonesia's Domestic Apparel Market

3. Indonesia Textile and Clothing Industry Import and Export Analysis

- 3.1 Imports

- 3.1.1 Import of Raw Materials

- 3.1.2 Main Sources of Imports

- 3.2 Exports

- 3.2.1 Indonesia Garment Industry Export Analysis

- 3.2.2 Main Export Destinations

4. Competition in Indonesia's Garment Manufacturing Industry

- 4.1 Barriers to Entry in Indonesia's Clothing Industry

- 4.1.1 Government Policies

- 4.1.2 Sales Channels

- 4.1.3 Brand Barriers

- 4.2 Competitive Structure of Indonesia's Garment Manufacturing Industry

- 4.2.1 Bargaining Power of Raw Material Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Competition within the Apparel Industry

- 4.2.4 Potential Entrants

- 4.2.5 Alternatives

5. Cost and Price Analysis of Garment Manufacturing in Indonesia

- 5.1 Indonesia Garment Manufacturing Cost Analysis 2018-2022

- 5.1.1 Cost of Raw Materials

- 5.1.2 Indonesia Garment Manufacturing Labor Cost Analysis

- 5.2 Indonesia Clothing Price Analysis

6. Profile of Major Garment Manufacturing Companies in Indonesia

- 6.1 PT INDONESIA TORAY SYNTHETICS

- 6.1.1 Business Profile

- 6.1.2 Main Products

- 6.1.3 Modes of Operation

- 6.2 PT ACRYL TEXTILE MILLS

- 6.2.1 Business Profile

- 6.2.2 Main Products

- 6.2.3 Modes of Operation

- 6.3 PT CENTURY TEXTILE INDUSTRY TBK

- 6.3.1 Business Profile

- 6.3.2 Main Products

- 6.3.3 Modes of Operation

- 6.4 PT PETNESIA RESINDO

- 6.4.1 Business Profile

- 6.4.2 Main Products

- 6.4.3 Modes of Operation

- 6.5 PT JABATO INTERNATIONAL

- 6.5.1 Business Profile

- 6.5.2 Main Products

- 6.5.3 Modes of Operation

- 6.6 PT INDONESIA SYNTHETICS TEXTILE MILLS

- 6.7 PT EASTERNTEX

- 6.8 PT OST FIBRE INDUSTRIES

7. Indonesia Garment Manufacturing Outlook, 2023-2032

- 7.1 Factors Influencing the Development of Indonesia's Garment Manufacturing Industry

- 7.1.1 Drivers and Market Opportunities in Indonesia Clothing Manufacturing Industry

- 7.1.2 Threats and Challenges Facing Clothing Manufacturing Industry in Indonesia

- 7.1.3 Industry Prospects and Market Opportunities

- 7.2 Competitive Landscape Forecast for Indonesia Clothing Manufacturing Industry

- 7.3 Supply Forecast of Garment Manufacturing in Indonesia, 2023-2032

- 7.3.1 Indonesia Garment Manufacturing Raw Material Import Forecast 2023-2032

- 7.3.2 Indonesia Garment Export Forecast 2023-2032

- 7.4 Indonesia Garment Manufacturing Market Demand Forecast 2023-2032

- 7.4.1 Overall Market Demand Forecast for Garment Manufacturing in Indonesia, 2023-2032

- 7.4.2 Demand Forecast for Indonesia Garment Manufacturing Segment, 2023-2032