|

市場調査レポート

商品コード

1629624

埋葬保険市場:保険適用範囲別、保険料支払タイプ別、顧客年齢層別、流通チャネル別、地域別Burial Insurance Market, By Insurance Coverage, By Premium Payment Type, By Customer Age Group, By Distribution Channel, By Geography |

||||||

カスタマイズ可能

|

|||||||

| 埋葬保険市場:保険適用範囲別、保険料支払タイプ別、顧客年齢層別、流通チャネル別、地域別 |

|

出版日: 2024年11月27日

発行: Coherent Market Insights

ページ情報: 英文 161 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界の埋葬保険市場は、2024年に2,911億米ドルと推定され、2024年から2031年までのCAGRは5.6%を示し、2031年には4,252億米ドルに達すると予測されています。

| レポート範囲 | レポート詳細 | ||

|---|---|---|---|

| 基準年 | 2023 | 2024年の市場規模 | 2,911億米ドル |

| 実績データ | 2019年から2023年まで | 予測期間 | 2024年から2031年まで |

| 予測期間2024年~2031年 CAGR: | 5.60% | 2031年の価値予測 | 4,252億米ドル |

世界の埋葬保険市場は、近年着実な成長を遂げています。葬儀プランニング保険としても知られる埋葬保険は、生命保険の一種であり、被保険者の死亡時に埋葬または火葬に関連する費用をカバーするために保険金が支払われます。平均寿命が延び、最後の儀式やセレモニーにかかる費用が増加する中、埋葬保険を選ぶ人が増えています。健康問題や医療費の影響を受けやすい高齢者人口の増加は、こうした保険プランの必要性をさらに高めています。メーカー各社は技術的ソリューションを活用して保険金請求処理を自動化し、効率的な顧客サービスを提供することで、市場の拡大を後押ししています。しかし、個人消費に影響を及ぼす景気後退などの要因は、予測期間中に市場の進展をある程度妨げる可能性があります。

市場力学:

世界の埋葬保険市場を促進している主な要因としては、健康上の問題を抱えやすい高齢者人口の世界の急増、金銭的な保障を必要とする葬儀費用の上昇、葬儀の事前準備に関する消費者の意識の高まりなどが挙げられます。しかし、景気減速による個人消費への悪影響、保険会社による厳格な引受手続き、保険よりも代替貯蓄手段の選好といった要因によって、市場の成長は抑制される可能性があります。ビジネスチャンスとしては、保険プロセスのデジタル化、顧客のニーズに合わせたカスタマイズ・プラン、有利な政府規制などがあり、今後数年間で新たな道が開けると予想されます。

(本調査の主な特徴)

本レポートでは、世界の埋葬保険市場を詳細に分析し、2023年を基準年とした予測期間(2024年~2031年)の市場規模(10億米ドル)とCAGRを掲載しています。

また、さまざまなセグメントにわたる潜在的な収益機会を明らかにし、この市場の魅力的な投資提案のマトリックスについて説明しています。

また、市場促進要因、抑制要因、機会、新製品の発売や承認、市場動向、地域別の展望、主要企業が採用する競争戦略などに関する主要考察も提供しています。

世界の埋葬保険市場における主要企業を、企業ハイライト、製品ポートフォリオ、主要ハイライト、財務実績、戦略などのパラメータに基づいてプロファイルしています。

本調査の対象となる主要企業は、Gerber Life、Foresters Financial、Allianz Life、AIG、American National、Assurity Life Insurance Company、Transamerica、Americo Financial Life and Annuity Insurance Company、Baltimore Life、AAA Life Insurance Company、State Farm、Sagicor Life Insurance Company、Mutual of Omaha、United Home Life Insurance Company、New York Life Insurance Companyなどです。

このレポートからの洞察により、マーケティング担当者や企業の経営陣は、将来の製品発売、タイプアップ、市場拡大、マーケティング戦術に関する情報に基づいた意思決定を行うことができます。

世界の埋葬保険市場レポートは、投資家、サプライヤー、製品メーカー、流通業者、新規参入者、財務アナリストなど、この業界の様々な利害関係者に対応しています。

利害関係者は、世界の埋葬保険市場の分析に使用される様々な戦略マトリックスを通じて意思決定を容易にすることができます。

目次

第1章 調査の目的と前提条件

- 調査目的

- 前提条件

- 略語

第2章 市場の展望

- レポートの説明

- 市場の定義と範囲

- エグゼクティブサマリー

第3章 市場力学、規制、動向分析

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 影響分析

- 主な発展

- 規制シナリオ

- 製品の発売/承認

- PEST分析

- PORTERの分析

- 合併と買収のシナリオ

- 業界動向

第4章 世界の埋葬保険市場、保険適用範囲別、2019年-2031年

- 死亡給付金レベル

- 承認保証

- 修正または段階的死亡給付

第5章 世界の埋葬保険市場、保険料支払タイプ別、2019年-2031年

- 月次

- 四半期ごと

- 毎年

第6章 世界の埋葬保険市場、顧客年齢層別、2019年-2031年

- 50歳以上

- 60歳以上

- 70歳以上

- 80歳以上

第7章 世界の埋葬保険市場、流通チャネル別、2019年-2031年

- 直接販売

- 保険ブローカー

- オンラインプラットフォーム

第8章 世界の埋葬保険市場、地域別、2019年-2031年

- 北米

- ラテンアメリカ

- 欧州

- アジア太平洋

- 中東

- アフリカ

第9章 競合情勢

- Gerber Life

- Foresters Financial

- Allianz Life

- AIG

- American National

- Assurity Life Insurance Company

- Transamerica

- Americo Financial Life and Annuity Insurance Company

- Baltimore Life

- AAA Life Insurance Company

- State Farm

- Sagicor Life Insurance Company

- Mutual of Omaha

- United Home Life Insurance Company

- New York Life Insurance Company

第10章 アナリストの推奨事項

- 運命の輪

- アナリストの見解

- 一貫した機会マップ

第11章 参考文献と調査手法

- 参考文献

- 調査手法

- 出版社について

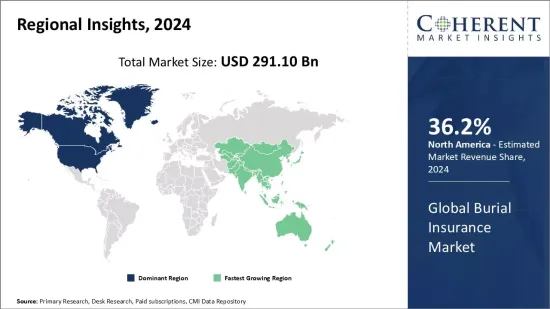

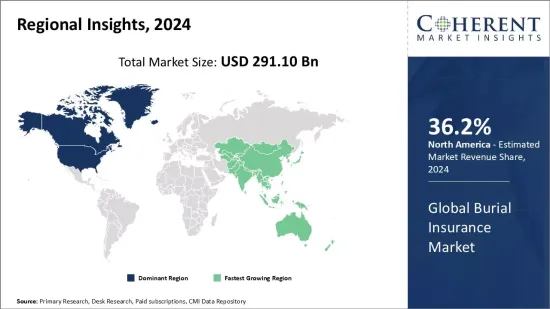

The global burial insurance market is estimated to be valued at USD 291.10 Bn in 2024 and is expected to reach USD 425.20 Bn by 2031, exhibiting a compound annual growth rate (CAGR) of 5.6% from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | US$ 291.10 Bn |

| Historical Data for: | 2019 To 2023 | Forecast Period: | 2024 To 2031 |

| Forecast Period 2024 to 2031 CAGR: | 5.60% | 2031 Value Projection: | US$ 425.20 Bn |

The global burial insurance market has been witnessing steady growth in the recent years. Burial insurance, also known as funeral planning insurance, is a type of life insurance that provides payout to cover the costs associated with burial or cremation of the insured person upon their death. With rising life expectancy and increasing costs related to last rites and ceremonies, more individuals are opting for burial insurance policies. The growing elderly population base susceptible to health issues and medical expenses further substantiates the need for such insurance plans. Manufacturers are leveraging technological solutions to automate claims processing and provide efficient customer services aiding the market expansion. However, factors like economic downturns affecting individual spending may impede the market progress to a certain extent during the forecast period.

Market Dynamics:

The key drivers fueling the global burial insurance market include rapid growth of the aged population worldwide susceptible to health issues, rising funeral costs necessitating monetary protection, and increasing awareness among consumers about pre-planning funeral arrangements. However, the market growth can be restrained by factors such as economic slowdowns negatively impacting individual spending, stringent underwriting procedures followed by insurers, and preference for alternative saving instruments over insurance. On the opportunities front, digitization of insurance processes, customized plans as per client needs, and favorable government regulations are expected to unlock new avenues for the players in the coming years.

(Key Features of the Study):

This report provides in-depth analysis of the global burial insurance market, and provides market size (USD Bn) and compound annual growth rate (CAGR%) for the forecast period (2024-2031), considering 2023 as the base year

It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

This study also provides key insights about market drivers, restraints, opportunities, new product launches or approvals, market trends, regional outlook, and competitive strategies adopted by key players

It profiles key players in the global burial insurance market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

Key companies covered as a part of this study include Gerber Life, Foresters Financial, Allianz Life, AIG, American National, Assurity Life Insurance Company, Transamerica, Americo Financial Life and Annuity Insurance Company, Baltimore Life, AAA Life Insurance Company, State Farm, Sagicor Life Insurance Company, Mutual of Omaha, United Home Life Insurance Company, and New York Life Insurance Company

Insights from this report would allow marketers and the management authorities of the companies to make informed decisions regarding their future product launches, type up-gradation, market expansion, and marketing tactics

The global burial insurance market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global burial insurance market

Market Segmentation

- Insurance Coverage Insights (Revenue, USD Bn, 2019 - 2031)

- Level Death Benefit

- Guaranteed Acceptance

- Modified or Graded Death Benefit

- Premium Payment Type Insights (Revenue, USD Bn, 2019 - 2031)

- Monthly

- Quarterly

- Annually

- Customer Age Group Insights (Revenue, USD Bn, 2019 - 2031)

- Over 50

- Over 60

- Over 70

- Over 80

- Distribution Channel Insights (Revenue, USD Bn, 2019 - 2031)

- Direct Sales

- Insurance Brokers

- Online Platforms

- Regional Insights (Revenue, USD Bn, 2019 - 2031)

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- South Africa

- North Africa

- Central Africa

- Key Players Insights

- Gerber Life

- Foresters Financial

- Allianz Life

- AIG

- American National

- Assurity Life Insurance Company

- Transamerica

- Americo Financial Life and Annuity Insurance Company

- Baltimore Life

- AAA Life Insurance Company

- State Farm

- Sagicor Life Insurance Company

- Mutual of Omaha

- United Home Life Insurance Company

- New York Life Insurance Company

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Global Burial Insurance Market, By Insurance Coverage

- Global Burial Insurance Market, By Premium Payment Type

- Global Burial Insurance Market, By Customer Age Group

- Global Burial Insurance Market, By Distribution Channel

- Global Burial Insurance Market, By Region

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Driver

- Restraint

- Opportunity

- Impact Analysis

- Key Developments

- Regulatory Scenario

- Product Launches/Approvals

- PEST Analysis

- PORTER's Analysis

- Merger and Acquisition Scenario

- Industry Trends

4. Global Burial Insurance Market, By Insurance Coverage, 2019-2031, (USD Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020 - 2031

- Segment Trends

- Level Death Benefit

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Guaranteed Acceptance

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Modified or Graded Death Benefit

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

5. Global Burial Insurance Market, By Premium Payment Type, 2019-2031, (USD Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020 - 2031

- Segment Trends

- Monthly

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Quarterly

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Annually

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

6. Global Burial Insurance Market, By Customer Age Group, 2019-2031, (USD Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020 - 2031

- Segment Trends

- Over 50

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Over 60

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Over 70

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Over 80

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

7. Global Burial Insurance Market, By Distribution Channel, 2019-2031, (USD Bn)

- Introduction

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020 - 2031

- Segment Trends

- Direct Sales

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Insurance Brokers

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

- Online Platforms

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Bn)

8. Global Burial Insurance Market, By Region, 2019 - 2031, Value (USD Bn)

- Introduction

- Market Share (%) Analysis, 2024, 2027 & 2031, Value (USD Bn)

- Market Y-o-Y Growth Analysis (%), 2020 - 2031, Value (USD Bn)

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country, 2019 - 2031, Value (USD Bn)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country, 2019 - 2031, Value (USD Bn)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country, 2019 - 2031, Value (USD Bn)

- Germany

- U.K.

- Spain

- France

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country, 2019 - 2031, Value (USD Bn)

- China

- India

- Japan

- Australia

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country, 2019 - 2031, Value (USD Bn)

- GCC Countries

- Israel

- Rest of Middle East

- Africa

- Introduction

- Market Size and Forecast, By Insurance Coverage , 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Premium Payment Type, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Customer Age Group, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Distribution Channel, 2019 - 2031, Value (USD Bn)

- Market Size and Forecast, By Country/Region, 2019 - 2031, Value (USD Bn)

- South Africa

- North Africa

- Central Africa

9. Competitive Landscape

- Gerber Life

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Foresters Financial

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Allianz Life

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- AIG

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- American National

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Assurity Life Insurance Company

- Company Highlights

- Product Portfolio

- Key Developments

- Financial Performance

- Strategies

- Transamerica

- Americo Financial Life and Annuity Insurance Company

- Baltimore Life

- AAA Life Insurance Company

- State Farm

- Sagicor Life Insurance Company

- Mutual of Omaha

- United Home Life Insurance Company

- New York Life Insurance Company

10. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. References and Research Methodology

- References

- Research Methodology

- About us