|

市場調査レポート

商品コード

1673078

サイバーセキュリティ保険市場:保険タイプ別、補償タイプ別、企業規模別、エンドユーザー別、地域別Cyber Security Insurance Market, By Insurance Type, By Coverage Type, By Enterprise Size, By End user, By Geography |

||||||

カスタマイズ可能

|

|||||||

| サイバーセキュリティ保険市場:保険タイプ別、補償タイプ別、企業規模別、エンドユーザー別、地域別 |

|

出版日: 2025年02月20日

発行: Coherent Market Insights

ページ情報: 英文 175 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

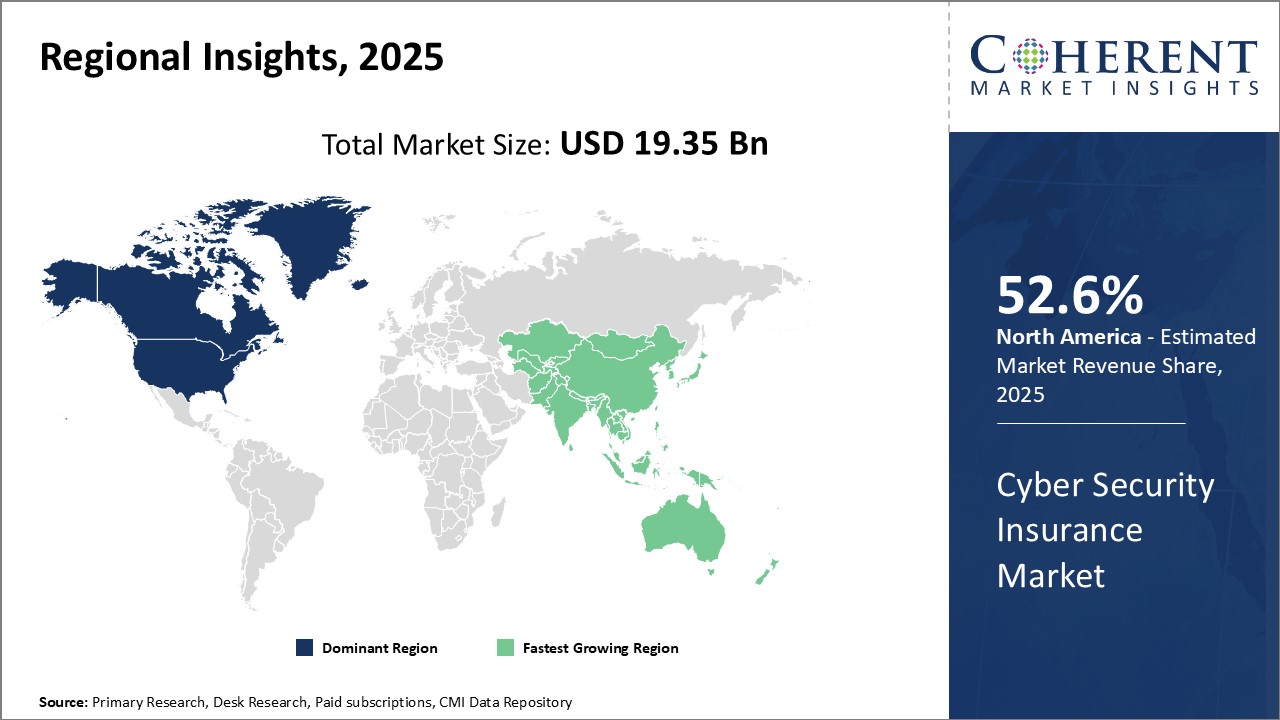

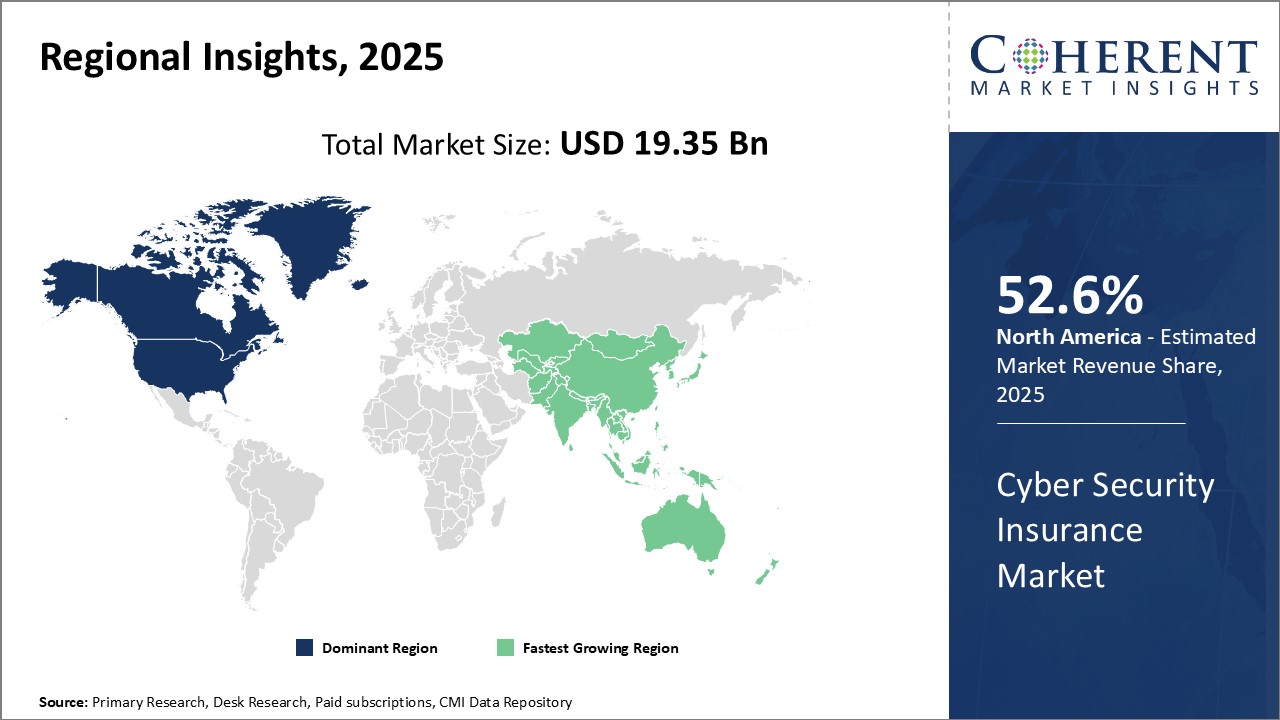

世界のサイバーセキュリティ保険市場は、2025年には193億5,000万米ドルと推定され、2032年には714億4,000万米ドルに達すると予測され、2025~2032年までの年間平均成長率(CAGR)は20.5%で成長すると予測されています。

| レポート範囲 | レポート詳細 | ||

|---|---|---|---|

| 基準年 | 2024年 | 2025年の市場規模 | 193億5,000万米ドル |

| 実績データ | 2020~2024年 | 予測期間 | 2025~2032年 |

| 予測期間:2025~2032年のCAGR | 20.50% | 2032年の金額予測 | 714億4,000万米ドル |

レポート概要

サイバー脅威の急増は、世界中の企業に大きな課題を突きつけています。サイバー攻撃の頻度と規模が拡大し続ける中、企業はセキュリティ態勢を強化し、財務リスクや風評リスクから保護するために、より多くのリソースを割くようになっています。このため、企業が一部のリスクを保険会社に移転するのに役立つサイバーセキュリティ保険の需要が高まっています。サイバーセキュリティ保険は、データ漏洩、ネットワークの混乱、ランサムウェア攻撃、プライバシー法違反に起因する訴訟などに関連する費用を補償します。サイバーセキュリティ保険は、サイバー攻撃後のリスク管理、影響の抑制、事業継続の確保において組織を支援します。

市場力学

機密データや重要インフラを狙った巧妙なサイバー攻撃の事例が増加していることが、サイバーセキュリティ保険市場を推進する主要要因となっています。報告によると、サイバー犯罪のコストは2025年までに年間10兆米ドルを超えると予測されています。保険会社はこの脅威を認識し、専門知識を活用して企業を支援しています。しかし、保険契約の定義が標準化されておらず、新たなリスクを正確に評価することができないため、保険引受業務には課題があります。保険会社は、進化する脅威の状況を把握するため、専門家チームに投資しています。一方、政府によるデータ保護の義務付けが増加し、コンプライアンスに準拠した保険への需要が高まっています。これは、保険会社が産業特有の要件に対応するカバーを革新する好機です。

本調査の主要特徴

- 本レポートでは、世界のサイバーセキュリティ保険市場を詳細に分析し、2024年を基準年とした予測期間(2025~2032年)の市場規模と複合年間成長率(CAGR %)を掲載しています。

- また、さまざまなセグメントにわたる潜在的な収益機会を明らかにし、この市場の魅力的な投資提案マトリクスについて解説しています。

- また市場促進要因、抑制要因、機会、新製品の発売や承認、市場動向、地域による展望、主要企業が採用する競争戦略などに関する重要な考察も提供しています。

- 企業のハイライト、製品ポートフォリオ、主要なハイライト、財務実績、戦略などのパラメータに基づいて、世界のサイバーセキュリティ保険市場の主要企業をプロファイルしています。

- 世界のサイバーセキュリティ保険市場レポートは、投資家、サプライヤー、製品メーカー、流通業者、新規参入者、財務アナリストなど、この産業のさまざまな利害関係者を対象としています。

- 利害関係者は、世界のサイバーセキュリティ保険市場分析に使用される様々な戦略マトリックスを通じて、意思決定を容易にすることができます。

目次

第1章 調査の目的と前提条件

- 調査目的

- 前提条件

- 略語

第2章 市場展望

- レポートの説明

- 市場の定義と範囲

- エグゼクティブサマリー

- 一貫型機会マップ(COM)

第3章 市場力学、規制、動向分析

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 規制シナリオ

- 産業動向

- 合併と買収

- 新システムの立ち上げ/承認

- COVID-19パンデミックの影響

第4章 世界のサイバーセキュリティ保険市場、保険タイプ別、2020~2032年

- イントロダクション

- スタンドアロン

- 適合型

第5章 世界のサイバーセキュリティ保険市場、補償タイプ別、2020~2032年

- イントロダクション

- 本人

- 賠償責任補償

第6章 世界のサイバーセキュリティ保険市場、企業規模別、2020~2032年

- イントロダクション

- 中小企業

- 大企業

第7章 世界のサイバーセキュリティ保険市場、エンドユーザー別、2020~2032年

- イントロダクション

- 医療

- 小売

- BFSI

- ITと通信

- 製造業

- その他(政府、旅行・観光)

第8章 世界のサイバーセキュリティ保険市場、地域別、2020~2032年

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第9章 競合情勢

- 企業プロファイル

- BitSight

- Prevalent

- RedSeal

- SecurityScorecard

- Cyber Indemnity Solutions

- Allianz

- AIG

- Aon

- Arthur J. Gallagher &Co

- Travelers Insurance

- AXA XL

- Axis

- Chubb

- Travelers Indemnity Company

- American International Group, Inc.

- Beazley Group

- CNA Financial Corporation

- AXIS Capital Holdings Limited

- BCS Financial Corporation

- Zurich Insurance

- The Hanover Insurance, Inc.

第10章 アナリストの推奨事項

- 隆盛と衰退

- 一貫型機会マップ

第11章 調査手法

- 参考文献

- 調査手法

Global Cyber Security Insurance Market is estimated to be valued at USD 19.35 Bn in 2025 and is expected to reach USD 71.44 Bn by 2032, growing at a compound annual growth rate (CAGR) of 20.5% from 2025 to 2032.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2024 | Market Size in 2025: | USD 19.35 Bn |

| Historical Data for: | 2020 To 2024 | Forecast Period: | 2025 To 2032 |

| Forecast Period 2025 to 2032 CAGR: | 20.50% | 2032 Value Projection: | USD 71.44 Bn |

Report Description:

The rapid rise in cyber threats has posed significant challenges for businesses globally. As cyberattacks continue to grow in frequency and scale, organizations are allocating greater resources to strengthen their security posture and protect against financial and reputational risks. This has boosted demand for cybersecurity insurance which helps businesses transfer some risks to insurers. Cybersecurity insurance provides coverage for costs associated with data breaches, network disruptions, ransomware attacks, and litigation arising from privacy law violations. It assists organizations in managing risks, containing impacts, and ensuring business continuity in the wake of a cyberattack.

Market Dynamics:

Growing instances of sophisticated cyberattacks targeting sensitive data and critical infrastructure is a key driver propelling the cybersecurity insurance market. According to reports, cybercrime costs are projected to surpass US$ 10 trillion annually by 2025. Insurers are recognizing this threat and leveraging their expertise to assist businesses. However, the lack of standardized policy definitions and accurately assessing emerging risks pose challenges for underwriting practices. Insurers are investing in expert teams to stay abreast of the evolving threat landscape. Meanwhile, increasing government mandates for data protection are creating demand for compliant policies. This is an opportunity for insurers to innovate covers catering to industry specific requirements.

Key features of the study:

- This report provides in-depth analysis of the global cybersecurity insurance market, and provides market size (US$ Billion) and compound annual growth rate (CAGR %) for the forecast period (2025-2032), considering 2024 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, market trends, regional outlook, and competitive strategies adopted by key players

- It profiles key players in the global cybersecurity insurance market based on the following parameters - company highlights, products portfolio, key highlights, financial performance, and strategies

- Key companies covered as a part of this study include BitSight, Prevalent, RedSeal, SecurityScorecard, Cyber Indemnity Solutions, Allianz, AIG, Aon, Arthur J. Gallagher & Co, Travelers Insurance, AXA XL, Axis, Chubb, Travelers Indemnity Company, American International Group, Inc., Beazley Group, CNA Financial Corporation, AXIS Capital Holdings Limited, BCS Financial Corporation, Zurich Insurance, and The Hanover Insurance, Inc.

- The global cybersecurity insurance market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through various strategy matrices used in analyzing the global cybersecurity insurance market.

Market Segmentation

- By Insurance Type

- Standalone

- Tailored

- By Coverage Type

- First-party

- Liability Coverage

- By Enterprise Size

- SMEs

- Large Enterprise

- By End user

- Healthcare

- Retail

- BFSI

- IT & Telecom

- Manufacturing

- Others (Government, Travel & Tourism)

- By Regional

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

- Key Players Insights

- BitSight

- Prevalent

- RedSeal

- SecurityScorecard

- Cyber Indemnity Solutions

- Allianz

- AIG

- Aon

- Arthur J. Gallagher & Co

- Travelers Insurance

- AXA XL

- Axis

- Chubb

- Travelers Indemnity Company

- American International Group, Inc.

- Beazley Group

- CNA Financial Corporation

- AXIS Capital Holdings Limited

- BCS Financial Corporation

- Zurich Insurance

- The Hanover Insurance, Inc.

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snippet, By Insurance Type

- Market Snippet, By Coverage Type

- Market Snippet, By Enterprise Size

- Market Snippet, By End user

- Market Snippet, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Regulatory Scenario

- Industry Trend

- Merger and Acquisitions

- New system Launch/Approvals

- Impact of the COVID-19 Pandemic

4. Global Cybersecurity Insurance Market, By Insurance Type, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Standalone

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Tailored

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

5. Global Cybersecurity Insurance Market, By Coverage Type, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- First-party

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Liability Coverage

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

6. Global Cybersecurity Insurance Market, By Enterprise Size, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- SMEs

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Large Enterprise

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

7. Global Cybersecurity Insurance Market, By End user, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- Segment Trends

- Healthcare

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Retail

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- BFSI

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- IT & Telecom

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Manufacturing

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

- Others (Government, Travel & Tourism)

- Introduction

- Market Size and Forecast, 2020-2032, (US$ Billion)

8. Global Cybersecurity Insurance Market, By Region, 2020-2032 (US$ Billion)

- Introduction

- Market Share Analysis, By Region, 2025 and 2032 (%)

- Y-o-Y Growth Analysis, 2021-2032

- North America

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- U.S.

- Canada

- Europe

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- U.K.

- Germany

- Italy

- France

- Russia

- Rest of Europe

- Asia Pacific

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- China

- India

- ASEAN

- Australia

- South Korea

- Japan

- Rest of Asia Pacific

- Latin America

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East and Africa

- Regional Trends

- Market Size and Forecast, By Insurance Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Coverage Type, 2020-2032 (US$ Billion)

- Market Size and Forecast, By Enterprise Size, 2020-2032 (US$ Billion)

- Market Size and Forecast, By End user, 2020-2032 (US$ Billion)

- Market Share Analysis, By Country, 2020 and 2032 (%)

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

9. Competitive Landscape

- Company Profiles

- BitSight

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Prevalent

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- RedSeal

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- SecurityScorecard

- Company Overview

- Product Portfolio

- Financial Performance

- Key Strategies

- Recent Developments/Updates

- Cyber Indemnity Solutions

- Allianz

- AIG

- Aon

- Arthur J. Gallagher & Co

- Travelers Insurance

- AXA XL

- Axis

- Chubb

- Travelers Indemnity Company

- American International Group, Inc.

- Beazley Group

- CNA Financial Corporation

- AXIS Capital Holdings Limited

- BCS Financial Corporation

- Zurich Insurance

- The Hanover Insurance, Inc.

- BitSight

10. Analyst Recommendations

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. Research Methodology

- References

- Research Methodology

- About us and Sales Contact