|

|

市場調査レポート

商品コード

1774597

サイバーセキュリティ保険の世界市場:オファリング別、保険範囲別、保険タイプ別、プロバイダータイプ別、業界別、地域別 - 2030年までの予測Cybersecurity Insurance Market by Offering (Solutions, Services), Insurance Coverage (Data Breach, Cyber Liability), Insurance Type (Packaged, Standalone), Provider Type (Technology Providers, Insurance Providers) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| サイバーセキュリティ保険の世界市場:オファリング別、保険範囲別、保険タイプ別、プロバイダータイプ別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年07月18日

発行: MarketsandMarkets

ページ情報: 英文 345 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

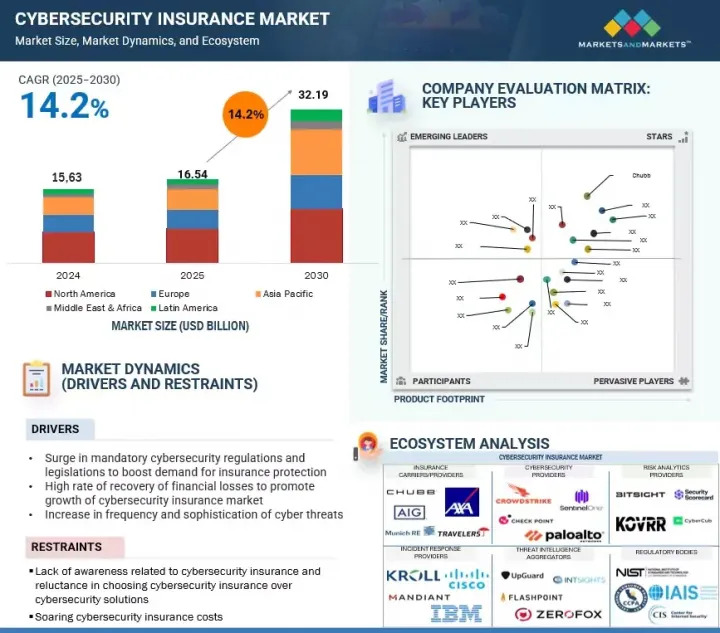

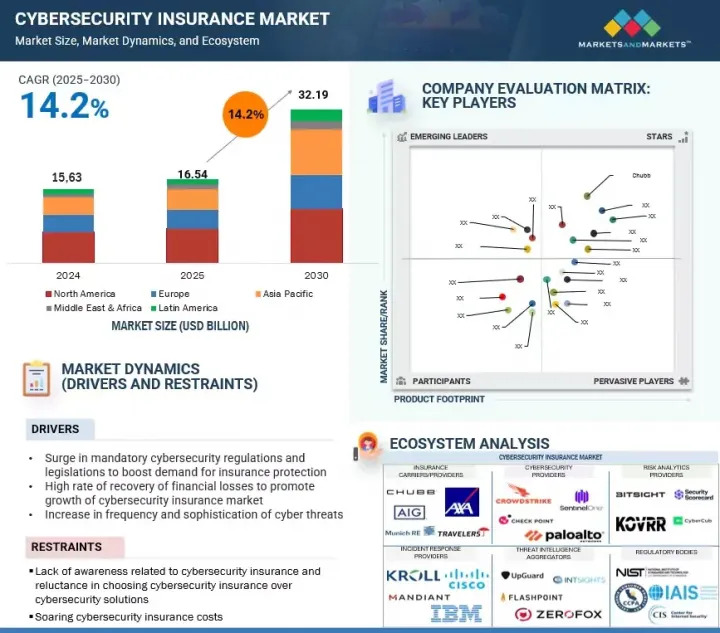

世界のサイバーセキュリティ保険の市場規模は、2025年の165億4,000万米ドルから2030年には321億9,000万米ドルに成長し、予測期間中のCAGRは14.2%になるとみられています。

サイバーセキュリティ保険市場を牽引しているのは、サイバー攻撃の頻度と巧妙さの高まりであり、企業は潜在的な損失に対する経済的保護を求めざるを得ないです。GDPRやその他のデータ保護法などの規制圧力の高まりにより、サイバー保険はコンプライアンス上必要なツールとなっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万/10億米ドル) |

| セグメント別 | オファリング別、保険範囲別、保険タイプ別、プロバイダータイプ別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

デジタル技術、リモートワーク、クラウドベースのインフラの急速な普及により、攻撃対象が拡大し、保険の必要性がさらに高まっています。知名度の高いデータ漏えいや、法的責任から事業の中断に至るまで関連するコストは、サイバー保険を戦略的な投資対象にしています。さらに、AIを活用したリスク分析の進歩により、保険会社はよりカスタマイズされた保険を提供できるようになり、市場の魅力が高まっています。しかし、市場はいくつかの抑制要因に直面しています。過去の保険数理データの不足がプライシングを難しくし、クレーム件数の増加が保険料の上昇と補償範囲の制限につながっています。保険契約の複雑さや曖昧な免責事項がクレーム紛争を引き起こすことも多く、中小企業における認知度の低さが保険導入の妨げとなっています。さらに、被保険者である顧客のサイバーセキュリティ対策が脆弱であることが損害率を高め、保険会社の参入を妨げています。また、大規模な攻撃や国家ぐるみの攻撃によるシステミック・リスクの脅威も大きな課題となっており、保険会社の財務安定性に影響を与える可能性があります。

ソリューション分野は、サイバーセキュリティ保険分析プラットフォーム、災害復旧・事業継続、サイバーセキュリティ・ソリューションで構成されます。組織の大小を問わず、特定のニーズに対応するサイバーセキュリティ保険ソリューションの恩恵を受けることができます。これらのソリューションは、プライバシー侵害、ITフォレンジック、規制手続き、民事罰、罰則から生じる潜在的な金銭的損失から企業を保護するように設計されています。これらの補償に加え、サイバーセキュリティ保険には、危機管理、顧客通知費用、サイバー恐喝、ハッカー被害費用、コンピューター・フォレンジック調査、プライバシーとセキュリティに関する賠償責任も含まれます。テクノロジープロバイダー(ブローカーや保険会社)は、リスクを測定、定量化、削減するために、リアルタイムの可視性ダッシュボードやサイバーリスクスコアを提供しています。

データ漏洩保険はサイバーセキュリティ保険の重要な構成要素であり、機密性の高い個人情報や企業情報を含むデータ漏洩が発生した場合に、企業に金銭的な保護と対応支援を提供します。この保険は、法的費用、規制上の罰金、顧客への通知、信用モニタリング、風評管理など、情報漏えいに関連する多額のコストを企業が管理できるように設計されています。この保険は、GDPR、HIPAA、CCPAなどのデータ保護法の遵守が義務付けられている今日の規制環境では特に価値があります。実務的には、データ漏えい保険は、法的責任をカバーし、フォレンジック調査に資金を提供し、データ復旧をサポートし、影響を受ける当事者とのタイムリーなコミュニケーションを可能にするために適用されます。また、ブランドへのダメージを最小限に抑えるための広報支援も含まれ、事業中断による損失を補償する場合もあります。さらに、ランサムウェアや恐喝インシデントに関連する第三者の責任やコストにも及ぶ可能性があります。金融、ヘルスケアから小売、教育に至るまで、あらゆる分野の組織がサイバー脅威の増大に直面する中、データ侵害保険はリスク軽減とインシデント回復に不可欠なツールとして機能しています。

アジア太平洋のサイバーセキュリティ保険市場は急速に拡大しており、世界的に最も急成長している地域市場となっています。この成長の原動力となっているのは、中国、インド、日本、韓国、シンガポール、オーストラリアなどの経済圏におけるデジタルトランスフォーメーションの進展と、ランサムウェア攻撃、データ侵害、規制強化の急増です。インドや中国などの国々では、特にBFSI、ヘルスケア、ITセクターにおいて、サイバー脅威の激化と規制当局の監視強化に後押しされ、サイバー保険の導入が大幅に増加しています。シンガポールやオーストラリアなどの成熟市場は、サイバーセキュリティ法や個人情報保護法改正などの法的枠組みが確立しているため、導入でリードしています。しかし、この地域は、中小企業への普及率の低さ、過去のサイバー損害データの不足、政策の明確性の欠如などの課題に直面しています。このような状況にもかかわらず、保険会社にとっては、分野特化型商品、サイバーセキュリティ・ベンダーとの提携、AIを活用した引受ソリューションを通じて補償範囲を拡大する絶好の機会となっています。しかし、コンプライアンス違反に対する罰金や罰則の急増など、規制の進展がAPACのサイバーセキュリティ保険市場の需要を押し上げると予想されます。

当レポートでは、世界のサイバーセキュリティ保険市場について調査し、オファリング別、保険範囲別、保険タイプ別、プロバイダータイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 業界動向

- サプライチェーン分析

- サイバーセキュリティ保険ソリューションの簡単な歴史

- エコシステム

- サイバーセキュリティ保険市場におけるツール、技術、フレームワーク

- 現在のビジネスモデルと新興ビジネスモデル

- ポーターのファイブフォースモデル

- 主要な利害関係者と購入基準

- 技術分析

- サイバーセキュリティ保険市場情勢の将来展望

- 顧客ビジネスに影響を与える動向/混乱

- サイバーセキュリティ保険市場におけるベストプラクティス

- 特許分析

- 価格モデル分析

- ユースケース

- 2025年の主な会議とイベント

- 規制機関、政府機関、その他の組織

- サイバーセキュリティ保険市場における主要なコンプライアンス

- 投資と資金調達のシナリオ

- 人工知能と生成AIイントロダクション

- 2025年の米国関税の影響- サイバーセキュリティ保険市場

第6章 サイバーセキュリティ保険市場(オファリング別)

- イントロダクション

- ソリューション

- サービス

第7章 サイバーセキュリティ保険市場(保険範囲別)

- イントロダクション

- データ侵害

- サイバー責任

第8章 サイバーセキュリティ保険市場(保険タイプ別)

- イントロダクション

- パッケージ

- スタンドアロン

第9章 サイバーセキュリティ保険市場(プロバイダータイプ別)

- イントロダクション

- テクノロジープロバイダー

- 保険会社

第10章 サイバーセキュリティ保険市場(業界別)

- イントロダクション

- 金融サービス

- IT・ITES

- ヘルスケア・ライフサイエンス

- 小売・Eコマース

- 通信

- 旅行、観光、ホスピタリティ

- その他

第11章 サイバーセキュリティ保険市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- オーストラリアとニュージーランド

- 東南アジア

- インド

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- その他

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年~2024年

- 収益分析、2020年~2024年

- 主要企業の市場シェア分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- ブランド/製品比較

- 企業評価と財務指標

- 競合シナリオ

第13章 企業プロファイル

- 技術プロバイダー

- BITSIGHT

- MITRATECH

- REDSEAL

- SECURITYSCORECARD

- UPGUARD

- CISCO

- MICROSOFT

- CHECK POINT

- ATTACKIQ

- SENTINELONE

- BROADCOM

- ACCENTURE

- CYLANCE

- TRELLIX

- CYBERARK

- CYE

- SECURIT360

- FOUNDER SHIELD

- 保険会社

- CHUBB

- AXA XL

- AIG

- TRAVELERS

- BEAZLEY

- ALLIANZ

- AON

- ARTHUR J. GALLAGHER

- AXIS CAPITAL

- CNA

- FAIRFAX

- LIBERTY MUTUAL

- LLOYD'S OF LONDON

- LOCKTON

- MUNICH RE

- SOMPO INTERNATIONAL

- スタートアップ/中小企業

- AT-BAY

- CYBERNANCE

- COALITION

- RESILIENCE

- KOVRR

- SAYATA LABS

- ZEGURO

- IVANTI

- SAFEBREACH

- ORCHESTRA GROUP

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2021-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 DIRECT WRITTEN PREMIUMS Y-O-Y GROWTH OF STANDALONE AND PACKAGE CYBERSECURITY INSURANCE UNDERWRITERS

- TABLE 4 CYBERSECURITY INSURANCE MARKET: ECOSYSTEM

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES ON CYBERSECURITY INSURANCE MARKET

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USER INSURANCE PROVIDERS (%)

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE END USER INSURANCE PROVIDERS

- TABLE 8 LIST OF MAJOR PATENTS, 2024-2025

- TABLE 9 CYBERSECURITY INSURANCE PREMIUM TRENDS, 2024

- TABLE 10 CYBERSECURITY INSURANCE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKETS DUE TO TARIFF IMPACT

- TABLE 17 CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 18 CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 19 OFFERING: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 20 OFFERING: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21 CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 22 CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 23 SOLUTION: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 24 SOLUTION: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 CYBERSECURITY INSURANCE ANALYTICS PLATFORMS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 26 CYBERSECURITY INSURANCE ANALYTICS PLATFORMS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 DISASTER RECOVERY AND BUSINESS CONTINUITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 28 DISASTER RECOVERY AND BUSINESS CONTINUITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 CYBERSECURITY SOLUTIONS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 30 CYBERSECURITY SOLUTIONS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 32 CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 33 SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 34 SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 CONSULTING/ADVISORY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 36 CONSULTING/ADVISORY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 SECURITY AWARENESS TRAINING: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 38 SECURITY AWARENESS TRAINING: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 OTHER SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 40 OTHER SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 42 CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 43 INSURANCE COVERAGE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 44 INSURANCE COVERAGE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 DATA BREACH: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 46 DATA BREACH: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 CYBER LIABILITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 48 CYBER LIABILITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 50 CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 51 INSURANCE TYPE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 52 INSURANCE TYPE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 PACKAGED: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 54 PACKAGED: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 STANDALONE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 56 STANDALONE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 58 CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 59 TECHNOLOGY PROVIDER: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 60 TECHNOLOGY PROVIDER: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 INSURANCE PROVIDER: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 62 INSURANCE PROVIDER: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 64 CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 65 FINANCIAL SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 66 FINANCIAL SERVICES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 IT & ITES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 68 IT & ITES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 HEALTHCARE & LIFE SCIENCES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 70 HEALTHCARE & LIFE SCIENCES: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 RETAIL & ECOMMERCE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 72 RETAIL & ECOMMERCE: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 TELECOM: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 74 TELECOM: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 TRAVEL, TOURISM, AND HOSPITALITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 76 TRAVEL, TOURISM, AND HOSPITALITY: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 OTHER VERTICALS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 78 OTHER VERTICALS: CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 CYBERSECURITY INSURANCE MARKET, BY REGION, 2019-2024 (USD MILLION)

- TABLE 80 CYBERSECURITY INSURANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 88 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 89 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 90 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 92 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 94 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 95 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 US: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 98 US: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 99 US: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 100 US: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 101 US: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 102 US: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 103 US: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 104 US: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 105 US: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 106 US: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 107 US: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 108 US: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 109 US: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 110 US: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 111 CANADA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 112 CANADA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 113 CANADA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 114 CANADA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 115 CANADA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 116 CANADA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 117 CANADA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 118 CANADA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 119 CANADA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 120 CANADA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 121 CANADA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 122 CANADA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 123 CANADA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 124 CANADA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 126 EUROPE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 128 EUROPE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 130 EUROPE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 131 EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 132 EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 134 EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 135 EUROPE: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 136 EUROPE: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 138 EUROPE: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 140 EUROPE: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 UK: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 142 UK: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 143 UK: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 144 UK: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 145 UK: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 146 UK: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 147 UK: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 148 UK: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 149 UK: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 150 UK: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 151 UK: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 152 UK: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 153 UK: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 154 UK: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 155 GERMANY: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 156 GERMANY: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 157 GERMANY: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 158 GERMANY: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 159 GERMANY: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 160 GERMANY: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 161 GERMANY: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 162 GERMANY: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 163 GERMANY: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 164 GERMANY: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 165 GERMANY: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 166 GERMANY: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 167 GERMANY: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 168 GERMANY: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 169 FRANCE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 170 FRANCE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 171 FRANCE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 172 FRANCE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 173 FRANCE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 174 FRANCE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 175 FRANCE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 176 FRANCE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 177 FRANCE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 178 FRANCE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 179 FRANCE: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 180 FRANCE: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 181 FRANCE: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 182 FRANCE: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 183 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 184 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 185 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 186 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 187 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 188 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 189 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 190 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 191 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 192 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 193 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 194 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 195 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 196 REST OF EUROPE: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 197 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 198 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 199 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 200 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 201 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 202 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 204 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 206 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 208 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 210 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 212 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 213 CHINA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 214 CHINA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 215 CHINA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 216 CHINA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 217 CHINA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 218 CHINA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 219 CHINA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 220 CHINA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 221 CHINA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 222 CHINA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 223 CHINA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 224 CHINA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 225 CHINA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 226 CHINA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 227 JAPAN: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 228 JAPAN: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 229 JAPAN: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 230 JAPAN: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 231 JAPAN: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 232 JAPAN: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 233 JAPAN: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 234 JAPAN: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 235 JAPAN: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 236 JAPAN: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 237 JAPAN: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 238 JAPAN: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 239 JAPAN: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 240 JAPAN: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 241 ANZ: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 242 ANZ: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 243 ANZ: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 244 ANZ: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 245 ANZ: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 246 ANZ: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 247 ANZ: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 248 ANZ: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 249 ANZ: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 250 ANZ: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 251 ANZ: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 252 ANZ: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 253 ANZ: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 254 ANZ: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 255 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 256 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 257 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 258 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 259 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 260 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 261 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 262 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 263 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 264 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 265 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 266 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 267 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 268 REST OF ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 270 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 271 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 272 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 276 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 280 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 284 MIDDLE EAST & AFRICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 285 KSA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 286 KSA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 287 KSA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 288 KSA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 289 KSA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 290 KSA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 291 KSA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 292 KSA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 293 KSA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 294 KSA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 295 KSA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 296 KSA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 297 KSA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 298 KSA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 299 UAE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 300 UAE: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 301 UAE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 302 UAE: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 303 UAE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 304 UAE: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 305 UAE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 306 UAE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 307 UAE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 308 UAE: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 309 UAE: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 310 UAE: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 311 UAE: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 312 UAE: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 313 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 314 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 315 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 316 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 317 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 318 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 319 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 320 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 321 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 322 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 323 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 324 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 325 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 326 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 327 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2019-2024 (USD MILLION)

- TABLE 328 LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 329 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 330 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 331 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 332 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 333 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 334 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 335 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 336 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 337 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 338 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 339 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 340 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 341 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 342 BRAZIL: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 343 MEXICO: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 344 MEXICO: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 345 MEXICO: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 346 MEXICO: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 347 MEXICO: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 348 MEXICO: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 349 MEXICO: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 350 MEXICO: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 351 MEXICO: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 352 MEXICO: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 353 MEXICO: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 354 MEXICO: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 355 MEXICO: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 356 MEXICO: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 357 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2019-2024 (USD MILLION)

- TABLE 358 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 359 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2019-2024 (USD MILLION)

- TABLE 360 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 361 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2019-2024 (USD MILLION)

- TABLE 362 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 363 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2019-2024 (USD MILLION)

- TABLE 364 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE, 2025-2030 (USD MILLION)

- TABLE 365 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2019-2024 (USD MILLION)

- TABLE 366 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 367 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2019-2024 (USD MILLION)

- TABLE 368 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE, 2025-2030 (USD MILLION)

- TABLE 369 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2019-2024 (USD MILLION)

- TABLE 370 REST OF LATIN AMERICA: CYBERSECURITY INSURANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 371 CYBERSECURITY INSURANCE MARKET: DEGREE OF COMPETITION

- TABLE 372 CYBERSECURITY INSURANCE MARKET: REGION FOOTPRINT

- TABLE 373 CYBERSECURITY INSURANCE MARKET: PROVIDER TYPE FOOTPRINT

- TABLE 374 CYBERSECURITY INSURANCE MARKET: OFFERING FOOTPRINT

- TABLE 375 CYBERSECURITY INSURANCE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 376 CYBERSECURITY INSURANCE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 377 CYBERSECURITY INSURANCE MARKET: PRODUCT LAUNCHES, 2021-2025

- TABLE 378 CYBERSECURITY INSURANCE MARKET: DEALS, 2021-2025

- TABLE 379 BITSIGHT: COMPANY OVERVIEW

- TABLE 380 BITSIGHT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 381 BITSIGHT: PRODUCT LAUNCHES

- TABLE 382 BITSIGHT: DEALS

- TABLE 383 MITRATECH: COMPANY OVERVIEW

- TABLE 384 MITRATECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 385 MITRATECH: PRODUCT LAUNCHES

- TABLE 386 MITRATECH: DEALS

- TABLE 387 REDSEAL: COMPANY OVERVIEW

- TABLE 388 REDSEAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 SECURITYSCORECARD: COMPANY OVERVIEW

- TABLE 390 SECURITYSCORECARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 391 SECURITYSCORECARD: PRODUCT LAUNCHES

- TABLE 392 SECURITYSCORECARD: DEALS

- TABLE 393 UPGUARD: COMPANY OVERVIEW

- TABLE 394 UPGUARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 395 UPGUARD: PRODUCT LAUNCHES

- TABLE 396 CISCO: COMPANY OVERVIEW

- TABLE 397 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 398 CISCO: DEALS

- TABLE 399 MICROSOFT: COMPANY OVERVIEW

- TABLE 400 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 401 MICROSOFT: PRODUCT LAUNCHES

- TABLE 402 MICROSOFT: DEALS

- TABLE 403 CHECK POINT: COMPANY OVERVIEW

- TABLE 404 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 405 CHECK POINT: PRODUCT LAUNCHES

- TABLE 406 CHECK POINT: DEALS

- TABLE 407 ATTACKIQ: COMPANY OVERVIEW

- TABLE 408 ATTACKIQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 409 ATTACKIQ: DEALS

- TABLE 410 SENTINELONE: COMPANY OVERVIEW

- TABLE 411 SENTINELONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 412 SENTINELONE: PRODUCT LAUNCHES

- TABLE 413 SENTINELONE: DEALS

- TABLE 414 CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 415 CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 416 CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 417 CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 418 CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 419 CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 420 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 421 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 422 CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 423 CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 424 CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 425 CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 426 CYBERSECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 427 CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 428 INSURANCE PLATFORM MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 429 INSURANCE PLATFORM MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 430 INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 431 INSURANCE PLATFORM MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 432 INSURANCE PLATFORM MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 433 INSURANCE PLATFORM MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 434 INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2020-2024 (USD MILLION)

- TABLE 435 INSURANCE PLATFORM MARKET, BY INSURANCE TYPE, 2025-2030 (USD MILLION)

- TABLE 436 INSURANCE PLATFORM MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 437 INSURANCE PLATFORM MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 438 INSURANCE PLATFORM MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 439 INSURANCE PLATFORM MARKET, BY REGION, 2025-2030 (USD MILLION)

List of Figures

- FIGURE 1 CYBERSECURITY INSURANCE MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF CYBERSECURITY INSURANCE VENDORS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS, SERVICES, AND INSURANCE POLICIES OF CYBERSECURITY INSURANCE VENDORS

- FIGURE 6 CYBERSECURITY INSURANCE MARKET SIZE, 2023-2030

- FIGURE 7 CYBERSECURITY INSURANCE MARKET: REGIONAL SNAPSHOT

- FIGURE 8 INCREASING CYBER AND RANSOMWARE ATTACKS TO DRIVE CYBERSECURITY INSURANCE MARKET GROWTH

- FIGURE 9 CYBERSECURITY INSURANCE ANALYTICS PLATFORMS AND CYBER LIABILITY TO ACCOUNT FOR LARGEST SHARES

- FIGURE 10 CYBERSECURITY INSURANCE ANALYTICS PLATFORMS AND CYBER LIABILITY TO ACCOUNT FOR LARGEST SHARES

- FIGURE 11 STANDALONE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 12 FINANCIAL SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CYBERSECURITY INSURANCE MARKET

- FIGURE 14 CYBERSECURITY INSURANCE MARKET: SUPPLY CHAIN

- FIGURE 15 EVOLUTION OF CYBERSECURITY INSURANCE SOLUTIONS

- FIGURE 16 CYBERSECURITY INSURANCE MARKET: ECOSYSTEM

- FIGURE 17 CYBERSECURITY INSURANCE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USER INSURANCE PROVIDERS

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE END USER INSURANCE PROVIDERS

- FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 PATENTS APPLIED AND GRANTED, 2016-2025

- FIGURE 22 CYBERSECURITY INSURANCE: AVERAGE SELLING PRICE FOR SMES, 2024

- FIGURE 23 CYBERSECURITY INSURANCE AVERAGE SELLING PRICE, BY EMPLOYEE SIZE, 2024

- FIGURE 24 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 25 USE CASES OF GENERATIVE AI IN CYBERSECURITY INSURANCE

- FIGURE 26 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 27 DISASTER RECOVERY AND BUSINESS CONTINUITY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 SECURITY AWARENESS TRAINING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 DATA BREACH SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 PACKAGED SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 TECHNOLOGY PROVIDER SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 32 FINANCIAL SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 38 SHARE OF LEADING COMPANIES IN CYBERSECURITY INSURANCE MARKET, 2024

- FIGURE 39 CYBERSECURITY INSURANCE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 COMPANY FOOTPRINT

- FIGURE 41 CYBERSECURITY INSURANCE MARKET: STARTUP/SME EVALUATION MATRIX, 2024

- FIGURE 42 BRAND/PRODUCT COMPARISON

- FIGURE 43 COMPANY VALUATION OF KEY CYBERSECURITY INSURANCE PROVIDERS

- FIGURE 44 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 45 CISCO: COMPANY SNAPSHOT

- FIGURE 46 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 47 CHECK POINT: COMPANY SNAPSHOT

- FIGURE 48 SENTINELONE: COMPANY SNAPSHOT

The global cybersecurity insurance market will grow from USD 16.54 billion in 2025 to USD 32.19 billion by 2030 at a compounded annual growth rate (CAGR) of 14.2% during the forecast period. The cybersecurity insurance market is driven by the escalating frequency and sophistication of cyberattacks, compelling businesses to seek financial protection against potential losses. Growing regulatory pressures, such as GDPR and other data protection laws, have made cyber insurance a necessary compliance tool.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By Offering, Insurance Coverage, Insurance Type, Provider Type, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The rapid adoption of digital technologies, remote work, and cloud-based infrastructure has expanded the attack surface, further emphasizing the need for coverage. High-profile data breaches and associated costs ranging from legal liabilities to business disruption have made cyber insurance a strategic investment. Additionally, advances in AI-driven risk analytics are enabling insurers to offer more tailored policies, enhancing market appeal. However, the market faces several restraints. A lack of historical actuarial data makes pricing difficult, and the increasing number of claims has led to rising premiums and restricted coverage. Policy complexity and vague exclusions often result in claim disputes, while low awareness among small and medium enterprises hampers adoption. Moreover, weak cybersecurity practices among insured clients increase loss ratios, discouraging insurer participation. The threat of systemic risks from large-scale or state-sponsored attacks also poses a significant challenge, potentially impacting the financial stability of insurers.

Based on offering, the solutions segment is expected to hold the largest market share during the forecast period.

The solutions segment comprises cybersecurity insurance analytics platforms, disaster recovery and business continuity, and cybersecurity solutions. Organizations, both large and small, can benefit from cybersecurity insurance solutions that cater to their specific needs. These solutions are designed to protect businesses from potential financial losses resulting from privacy breaches, IT forensics, regulatory proceedings, civil fines, and penalties. In addition to these coverages, cybersecurity insurance also includes crisis management, customer notification expenses, cyber extortion, hacker damage costs, computer forensic investigations, and liability for privacy and security. Technology providers (brokers and insurers) offer real-time visibility dashboards and cyber risk scores to measure, quantify, and reduce risks.

Based on insurance coverage, the data breach segment is expected to grow at the highest CAGR during the forecast period.

Data breach insurance is a critical component of cybersecurity insurance that offers financial protection and response support to organizations in the event of a data breach involving sensitive personal or business information. It is designed to help businesses manage the significant costs associated with breaches, including legal expenses, regulatory fines, customer notification, credit monitoring, and reputational management. This coverage is especially valuable in today's regulatory environment, where compliance with data protection laws such as GDPR, HIPAA, and CCPA is mandatory. In practical terms, data breach insurance is applied to cover legal liabilities, fund forensic investigations, support data recovery, and enable timely communication with affected parties. It also includes public relations support to minimize brand damage and may compensate for business interruption losses. Additionally, it can extend to third-party liabilities and costs related to ransomware or extortion incidents. As organizations across sectors, from finance and healthcare to retail and education, face growing cyber threats, data breach insurance serves as a vital tool in risk mitigation and incident recovery.

Asia Pacific is expected to grow at the highest CAGR during the forecast period.

The Asia Pacific cybersecurity insurance market is experiencing rapid expansion, positioning itself as the fastest-growing regional market globally. This growth is fueled by increasing digital transformation across economies such as China, India, Japan, South Korea, Singapore, and Australia, coupled with a sharp rise in ransomware attacks, data breaches, and regulatory mandates. Countries such as India and China are witnessing significant uptakes in cyber insurance adoption, particularly across BFSI, healthcare, and IT sectors, driven by escalating cyber threats and heightened regulatory scrutiny. Mature markets such as Singapore and Australia are leading in adoption due to well-established legal frameworks such as the Cybersecurity Act and Privacy Act reforms. However, the region faces challenges including low penetration among SMEs, a lack of historical cyber loss data, and limited policy clarity. Despite this, the market presents strong opportunities for insurers to expand coverage through sector-specific products, partnerships with cybersecurity vendors, and AI-driven underwriting solutions. However, the increase in regulatory developments, including surging fines and penalties for non-compliance, is expected to boost demand for the cybersecurity insurance market in APAC.

Breakdown of primaries

We interviewed Chief Executive Officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant cybersecurity insurance market companies.

- By Company: Tier I: 55%, Tier II: 30%, and Tier III: 15%

- By Designation: C-Level Executives: 40%, Director Level: 25%, and Others: 35%

- By Region: North America: 60%, Europe: 20%, Asia Pacific: 12%, and Rest of the World: 8%

Some of the significant cybersecurity insurance market vendors are BitSight (US), Mitratech (US), RedSeal (US), SecurityScorecard (US), UpGuard (US), Travelers (US), AXA XL (US), AIG (US), Beazley (UK), and Chubb (Switzerland).

Research coverage:

The market report covered the cybersecurity insurance market across segments. We estimated the market size and growth potential for many segments based on offerings, insurance coverage, insurance type, provider type, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product offerings, current trends, and critical market strategies.

Reasons to buy this report:

With information on the most accurate revenue estimates for the whole cybersecurity insurance industry and its subsegments, the research will benefit market leaders and recent newcomers. Stakeholders will benefit from this report's increased understanding of the competitive environment, which will help them better position their companies and develop go-to-market strategies. The research offers information on the main market drivers, constraints, opportunities, and challenges, as well as aids players in understanding the pulse of the industry.

The report provides insights on the following pointers:

Analysis of key drivers (Surge in mandatory cybersecurity regulations and legislations to boost demand for insurance protection, high rate of recovery of financial losses to promote growth of cybersecurity insurance market, and increase in frequency and sophistication of cyber threats), restraints (Lack of awareness related to cyber insurance and reluctance to choose cybersecurity insurance over cybersecurity solutions, and soaring cybersecurity insurance costs), opportunities (Exclusion of cybersecurity insurance cover from Property and Casualty (P&C) insurance, and adoption of artificial intelligence and blockchain technology for risk analytics), and challenges (Despite soaring cybersecurity risks, cyber insurers grapple to gain traction, data privacy concerns, and lack of understanding, technical knowledge, and absence of historical cyber data for effective underwriting).

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and service and product introductions in the cybersecurity insurance market.

- Market Development: In-depth details regarding profitable markets: the paper examines the global cybersecurity insurance market.

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, new goods and services, and the cybersecurity insurance market.

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and service portfolios of the top competitors in the cybersecurity insurance industry, such as BitSight (US), Mitratech (US), RedSeal (US), SecurityScorecard (US), and UpGuard (US), Cisco (US), Microsoft (US), Check Point (US), AttackIQ (US), SentinelOne (US), Broadcom (US), Accenture (Ireland), Cylance (US), Trellix (US), CyberArk (US), CYE (Israel), SecurIT360 (US), Founder Shield (US), Allianz (Germany), AIG (US), Aon (UK), Arthur J. Gallagher (US), Travelers (US), AXA XL (US), AXIS Capital (Bermuda), Beazley (UK), Chubb (Switzerland), CNA Financial (US), Fairfax (Canada), Liberty Mutual (US), Lloyds of London (UK), Lockton (US), Munich Re (Germany), Sompo International (Bermuda), At-Bay (US), Cybernance (US), Resilience (US), Coalition (US), Kovrr (Israel), Sayata Labs (Israel), Zeguro (US), Ivanti (US), SafeBreach (US), and Orchestra Group (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 SUMMARY OF CHANGES

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 CYBERSECURITY INSURANCE COVERAGE

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN CYBERSECURITY INSURANCE MARKET

- 4.2 NORTH AMERICA: CYBERSECURITY INSURANCE MARKET, BY SOLUTION AND INSURANCE COVERAGE, 2025

- 4.3 ASIA PACIFIC: CYBERSECURITY INSURANCE MARKET, BY SOLUTION AND INSURANCE COVERAGE, 2025

- 4.4 CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE

- 4.5 CYBERSECURITY INSURANCE MARKET, BY VERTICAL

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in mandatory cybersecurity regulations and legislations to boost demand for insurance protection

- 5.2.1.2 High rate of recovery of financial losses to promote cybersecurity insurance market growth

- 5.2.1.3 Increase in frequency and sophistication of cyber threats

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness related to cybersecurity insurance and reluctance in choosing cybersecurity insurance over cybersecurity solutions

- 5.2.2.2 Soaring cybersecurity insurance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Exclusion of cybersecurity insurance cover from Property and Casualty (P&C) insurance

- 5.2.3.2 Adoption of artificial intelligence and blockchain technology for risk analytics

- 5.2.4 CHALLENGES

- 5.2.4.1 Cyber insurers grapple to gain traction despite soaring cybersecurity risks

- 5.2.4.2 Data privacy concerns

- 5.2.4.3 Lack of understanding, technical knowledge, and absence of historical cyber data for effective underwriting

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 SUPPLY CHAIN ANALYSIS

- 5.3.2 BRIEF HISTORY OF CYBERSECURITY INSURANCE SOLUTIONS

- 5.3.2.1 1990-2000

- 5.3.2.2 2000-2010

- 5.3.2.3 2010-2020

- 5.3.2.4 2021-Present

- 5.3.3 ECOSYSTEM

- 5.3.4 TOOLS, TECHNIQUES, AND FRAMEWORKS IN CYBERSECURITY INSURANCE MARKET

- 5.3.5 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.6 PORTER'S FIVE FORCES MODEL

- 5.3.6.1 Threat of new entrants

- 5.3.6.2 Threat of substitutes

- 5.3.6.3 Bargaining power of suppliers

- 5.3.6.4 Bargaining power of buyers

- 5.3.6.5 Intensity of competitive rivalry

- 5.3.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.7.1 Key stakeholders in buying process

- 5.3.7.2 Buying criteria

- 5.3.8 TECHNOLOGY ANALYSIS

- 5.3.8.1 Key technologies

- 5.3.8.1.1 Artificial Intelligence and Machine Learning

- 5.3.8.1.2 Big Data Analytics

- 5.3.8.1.3 Internet of Things

- 5.3.8.2 Adjacent technologies

- 5.3.8.2.1 Blockchain

- 5.3.8.2.2 Cloud

- 5.3.8.3 Complementary technologies

- 5.3.8.3.1 Threat Intelligence

- 5.3.8.3.2 Data Breach Response

- 5.3.8.3.3 Security Monitoring & Analytics

- 5.3.8.1 Key technologies

- 5.3.9 FUTURE OF CYBERSECURITY INSURANCE MARKET LANDSCAPE

- 5.3.9.1 Short-term roadmap (2025-2026)

- 5.3.9.2 Mid-term roadmap (2027-2028)

- 5.3.9.3 Long-term roadmap (2029-2030)

- 5.3.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.11 BEST PRACTICES IN CYBERSECURITY INSURANCE MARKET

- 5.3.12 PATENT ANALYSIS

- 5.3.12.1 Methodology

- 5.3.13 PRICING MODEL ANALYSIS

- 5.3.13.1 Average selling price trends

- 5.3.13.2 Cybersecurity insurance: Average selling price for smes

- 5.3.13.3 Indictive pricing analysis of cybersecurity insurance premiums, 2024

- 5.3.14 USE CASES

- 5.3.14.1 SecurityScorecard helped cyber insurance provider better understand customer risk

- 5.3.14.2 European financial service providers leveraged BitSight for security performance management

- 5.3.14.3 Country Mutual Insurance Company leveraged CyberArk's privileged security access platform

- 5.3.14.4 Global 500 insurance company chose Prevalent's third-party risk management solution

- 5.3.14.5 AON secured financial institution's funds and data from third-party cyber risks

- 5.3.14.6 Chubb's cybersecurity insurance cover assisted SME in recovering financial losses

- 5.3.15 KEY CONFERENCES AND EVENTS, 2025

- 5.3.16 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.16.1 General Data Protection Regulation

- 5.3.16.2 Payment Card Industry-Data Security Standard

- 5.3.16.3 Health Insurance Portability and Accountability Act

- 5.3.16.4 Federal Information Security Management Act

- 5.3.16.5 Gramm-Leach-Bliley Act

- 5.3.16.6 Sarbanes-Oxley Act

- 5.3.16.7 International Organization for Standardization 27001

- 5.3.17 KEY COMPLIANCES IN CYBERSECURITY INSURANCE MARKET

- 5.3.17.1 Introduction

- 5.3.17.2 Healthcare Compliance

- 5.3.17.3 Financial Services Compliance

- 5.3.17.4 GDPR Compliance

- 5.3.17.5 Other Compliances

- 5.3.18 INVESTMENT AND FUNDING SCENARIO

- 5.3.19 INTRODUCTION TO ARTIFICIAL INTELLIGENCE AND GENERATIVE AI

- 5.3.19.1 Impact of generative AI on cybersecurity insurance

- 5.3.19.2 Use cases of generative AI in cybersecurity insurance

- 5.3.19.3 Future of generative AI in cybersecurity insurance

- 5.3.20 IMPACT OF 2025 US TARIFF - CYBERSECURITY INSURANCE MARKET

- 5.3.20.1 Introduction

- 5.3.20.2 Key tariff rates

- 5.3.20.3 Price impact analysis

- 5.3.20.4 Impact on country/region

- 5.3.20.4.1 US

- 5.3.20.4.2 Europe

- 5.3.20.4.3 Asia Pacific

- 5.3.20.5 Impact on cybersecurity insurance verticals

6 CYBERSECURITY INSURANCE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: CYBERSECURITY INSURANCE MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 CYBERSECURITY INSURANCE SOLUTIONS TO PROVIDE HIGH DATA SECURITY AND PREVENT DATA BREACHES

- 6.2.2 CYBERSECURITY INSURANCE ANALYTICS PLATFORMS

- 6.2.3 DISASTER RECOVERY AND BUSINESS CONTINUITY

- 6.2.4 CYBERSECURITY SOLUTIONS

- 6.2.4.1 Cyber risk and vulnerability assessment

- 6.2.4.2 Cybersecurity resilience

- 6.3 SERVICES

- 6.3.1 NEED FOR PROFESSIONAL CONSULTANTS TO PROVIDE 24/7 SERVICE RESPONSE

- 6.3.2 CONSULTING/ADVISORY

- 6.3.3 SECURITY AWARENESS TRAINING

- 6.3.4 OTHER SERVICES

7 CYBERSECURITY INSURANCE MARKET, BY INSURANCE COVERAGE

- 7.1 INTRODUCTION

- 7.1.1 INSURANCE COVERAGE: CYBERSECURITY INSURANCE MARKET DRIVERS

- 7.2 DATA BREACH

- 7.2.1 CYBERSECURITY INSURANCE COVERAGE TO PROTECT BUSINESSES AGAINST SECURITY AND CYBER BREACHES

- 7.2.2 DATA LOSS

- 7.2.3 DENIAL OF SERVICE AND DOWNTIME

- 7.2.4 RANSOMWARE ATTACKS

- 7.3 CYBER LIABILITY

- 7.3.1 CYBERSECURITY INSURANCE TO COVER CYBER LIABILITY, REDUCING DATA RECOVERY COSTS FROM DATA BREACHES AND CYBERATTACKS

- 7.3.2 TYPES OF CYBER LIABILITIES

- 7.3.2.1 Data protection and privacy costs

- 7.3.2.2 Non-compliance penalty

- 7.3.2.3 Brand and related intellectual property protection

- 7.3.2.4 Other cyber liability types

- 7.3.3 SOURCE/TARGET OF CYBER LIABILITIES

- 7.3.3.1 Internal

- 7.3.3.2 External

8 CYBERSECURITY INSURANCE MARKET, BY INSURANCE TYPE

- 8.1 INTRODUCTION

- 8.1.1 INSURANCE TYPE: CYBERSECURITY INSURANCE MARKET DRIVERS

- 8.2 PACKAGED

- 8.2.1 PACKAGED INSURANCE TO ENHANCE DIGITAL TRANSFORMATION AND SUPPORT TRADITIONAL POLICIES

- 8.3 STANDALONE

- 8.3.1 STANDALONE INSURANCE TO MANAGE COMPLEX CYBER RISKS AND IMPROVE CYBER RISK PROTECTION

9 CYBERSECURITY INSURANCE MARKET, BY PROVIDER TYPE

- 9.1 INTRODUCTION

- 9.1.1 PROVIDER TYPE: CYBERSECURITY INSURANCE MARKET DRIVERS

- 9.2 TECHNOLOGY PROVIDER

- 9.2.1 TECHNOLOGY PROVIDERS TO HELP INSURANCE INDUSTRY ASSESS ITS CYBERSECURITY RISKS

- 9.3 INSURANCE PROVIDER

- 9.3.1 INSURANCE PROVIDERS TO UNDERWRITE INSURANCE POLICIES FOR IMPROVING CYBERSECURITY SYSTEMS OF ORGANIZATIONS

10 CYBERSECURITY INSURANCE MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICAL: CYBERSECURITY INSURANCE MARKET DRIVERS

- 10.2 FINANCIAL SERVICES

- 10.2.1 RISING FREQUENCY AND SOPHISTICATION OF FINANCIAL FRAUD AND RANSOMWARE ATTACKS ARE DRIVING THE MARKET

- 10.2.2 FINANCIAL SERVICES: CYBERSECURITY INSURANCE APPLICATIONS

- 10.2.2.1 Risk Assessment and Mitigation

- 10.2.2.2 Cyber Extortion Coverage

- 10.2.2.3 Ransomware Protection

- 10.3 IT AND ITES

- 10.3.1 INCREASED RELIANCE ON OUTSOURCED DIGITAL SERVICES AND GROWING EXPOSURE TO THIRD-PARTY RISKS ARE FUELING DEMAND

- 10.3.2 IT AND ITES: CYBERSECURITY INSURANCE APPLICATIONS

- 10.3.2.1 Protection for Sensitive Client Data

- 10.3.2.2 Intellectual Property Protection

- 10.3.2.3 Comprehensive Coverage for IT Infrastructure

- 10.4 HEALTHCARE AND LIFE SCIENCES

- 10.4.1 PROLIFERATION OF DIGITAL HEALTH RECORDS AND HEIGHTENED VULNERABILITY TO DATA BREACHES IS ACCELERATING ADOPTION

- 10.4.2 HEALTHCARE AND LIFE SCIENCES: CYBERSECURITY INSURANCE APPLICATIONS

- 10.4.2.1 Protected Health Information (PHI) Data Breach Coverage

- 10.4.2.2 Regulatory Compliance Support

- 10.4.2.3 Cybersecurity Incident Response Support

- 10.5 RETAIL AND ECOMMERCE

- 10.5.1 SURGE IN DIGITAL TRANSACTIONS AND CONSUMER DATA HANDLING IS PROMPTING RETAILERS TO SEEK CYBER RISK PROTECTION

- 10.5.2 RETAIL AND ECOMMERCE: CYBERSECURITY INSURANCE APPLICATIONS

- 10.5.2.1 Ecommerce Website Protection

- 10.5.2.2 Supply Chain Cyber Risk Coverage

- 10.5.2.3 Brand Reputation Management

- 10.6 TELECOM

- 10.6.1 EXPANSION OF 5G AND CONNECTED INFRASTRUCTURE IS EXPOSING TELECOM OPERATORS TO NEW CYBERATTACK VECTORS, BOOSTING INSURANCE DEMAND

- 10.6.2 TELECOM: CYBERSECURITY INSURANCE APPLICATIONS

- 10.6.2.1 Network Security Coverage

- 10.6.2.2 Communication Infrastructure Protection

- 10.6.2.3 Customer Notification and Support

- 10.7 TRAVEL, TOURISM, AND HOSPITALITY

- 10.7.1 HIGH-VALUE CUSTOMER DATA AND INCREASING ONLINE BOOKING FRAUD ARE COMPELLING THE SECTOR TO ADOPT CYBERSECURITY INSURANCE

- 10.7.2 TRAVEL, TOURISM, AND HOSPITALITY: CYBERSECURITY INSURANCE APPLICATIONS

- 10.7.2.1 Reservation System and Booking Protection

- 10.7.2.2 Payment Card Data Protection

- 10.7.2.3 Data Breach Notification Costs

- 10.8 OTHER VERTICALS

11 CYBERSECURITY INSURANCE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 US

- 11.2.2.1 Numerous laws and regulations promoting proactive incorporation of cybersecurity insurance policy cover in US to drive market

- 11.2.3 CANADA

- 11.2.3.1 Presence of prominent cybersecurity insurance providers in Canada to drive market

- 11.3 EUROPE

- 11.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.2 UK

- 11.3.2.1 Cyber insurance in UK to be comparatively affordable measure against data breaches with cyber extortion cover, recovery, and compliance costs

- 11.3.3 GERMANY

- 11.3.3.1 Increasing instances of cybercrimes to drive market growth in Germany

- 11.3.4 FRANCE

- 11.3.4.1 Alarming cyber-attack rates and ransomware insurance coverage gaps in France to fuel demand for cybersecurity insurance

- 11.3.5 SPAIN

- 11.3.5.1 Rising cybersecurity incidents in Spain amidst 5G transition to drive market growth

- 11.3.6 ITALY

- 11.3.6.1 Ransomware surges and growing adoption of cybersecurity insurance in Italy to drive market growth

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.2 CHINA

- 11.4.2.1 Increasing investments in advanced technologies and ascending rates of cybercrimes to drive growth in China

- 11.4.3 JAPAN

- 11.4.3.1 Growing security breaches across verticals to present opportunities for Japanese cybersecurity insurance market

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Enforcement of Notifiable Data Breach Scheme and Australian Prudential Regulatory Authority to help enterprises improve their business resiliency toward risks

- 11.4.5 SOUTHEAST ASIA

- 11.4.5.1 Growth prospects in Southeast Asia's evolving cybersecurity landscape to drive cybersecurity insurance market

- 11.4.6 INDIA

- 11.4.6.1 Rising cybersecurity risks to accelerate cyber insurance adoption in India

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.2 KSA

- 11.5.2.1 Growing awareness to lead to increase in inquiries and adoption of cyber insurance policies among organizations

- 11.5.3 UAE

- 11.5.3.1 Increasing adoption of advanced technologies and fast development in UAE to be major factors driving adoption of cybersecurity insurance

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Companies becoming potential targets for cybercriminals due to increased mobile and internet penetration to drive growth

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.2 BRAZIL

- 11.6.2.1 Increased automation and digitalization in businesses and fear of severe penalties to lead to market growth in Brazil

- 11.6.3 MEXICO

- 11.6.3.1 Data protection regulations expected to hold great scope for market growth in Mexico

- 11.6.4 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY CYBERSECURITY INSURANCE TECHNOLOGY PLAYERS

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS OF TOP PLAYERS

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company Footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Provider Type Footprint

- 12.5.5.4 Offering Footprint

- 12.6 STARTUP/SME EVALUATION MATRIX, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 TECHNOLOGY PROVIDERS

- 13.1.1 BITSIGHT

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices made

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 MITRATECH

- 13.1.2.1 Business overview

- 13.1.2.2 Products Offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices made

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 REDSEAL

- 13.1.3.1 Business overview

- 13.1.3.2 Platform offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths/Right to win

- 13.1.3.3.2 Strategic choices made

- 13.1.3.3.3 Weaknesses and competitive threats

- 13.1.4 SECURITYSCORECARD

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices made

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 UPGUARD

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices made

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 CISCO

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 MICROSOFT

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.8 CHECK POINT

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.9 ATTACKIQ

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 SENTINELONE

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.11 BROADCOM

- 13.1.12 ACCENTURE

- 13.1.13 CYLANCE

- 13.1.14 TRELLIX

- 13.1.15 CYBERARK

- 13.1.16 CYE

- 13.1.17 SECURIT360

- 13.1.18 FOUNDER SHIELD

- 13.1.1 BITSIGHT

- 13.2 INSURANCE PROVIDERS

- 13.2.1 CHUBB

- 13.2.2 AXA XL

- 13.2.3 AIG

- 13.2.4 TRAVELERS

- 13.2.5 BEAZLEY

- 13.2.6 ALLIANZ

- 13.2.7 AON

- 13.2.8 ARTHUR J. GALLAGHER

- 13.2.9 AXIS CAPITAL

- 13.2.10 CNA

- 13.2.11 FAIRFAX

- 13.2.12 LIBERTY MUTUAL