|

|

市場調査レポート

商品コード

1475814

液化石油ガス(LPG)の世界市場規模調査・予測、供給源別、用途別、地域別分析、2023年~2030年Global Liquefied Petroleum Gas (LPG) Market Size Study & Forecast, By Source (Refinery, Associated Gas, Non - Associated Gas), By Application (Residential/Commercial, Chemical, Industrial, Autogas, Refinery, Others), and Regional Analysis, 2023-2030 |

||||||

カスタマイズ可能

|

|||||||

| 液化石油ガス(LPG)の世界市場規模調査・予測、供給源別、用途別、地域別分析、2023年~2030年 |

|

出版日: 2024年04月30日

発行: Bizwit Research & Consulting LLP

ページ情報: 英文 200 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

液化石油ガス(LPG)の世界市場は、2022年に約1,173億米ドルと評価され、予測期間2023年から2030年にかけて3.7%以上の健全な成長率で成長すると予測されています。

液化石油ガス(LPG)は、プロパンとも呼ばれる可燃性炭化水素ガスで、無毒で硫黄を含まない特性から、クリーンで環境に優しい燃料として広く利用されています。プロパン(C3H8)とブタン(C4H10)を主成分とし、微量の他の炭化水素を含むLPGは、可搬性を高める貯蔵性が評価されています。この特性により、パイプライン・ガスが利用できない地域で事業を営む企業にとって、LPGは汎用性の高いエネルギー・オプションとなっています。LPGは、硫黄分と炭素の排出量が少なく環境に優しいため、好ましいエネルギー・オプションです。引火点が高く、他の燃料に比べて温室効果ガスの排出が少ないため、プロセス産業での蒸気発生や家庭での調理に広く使用されています。LPGは、化石燃料から抽出された天然ガスまたは原油の精製から得られるため、石油精製中に分離され、中程度の圧力下でシリンダーに貯蔵されます。その汎用性と環境面での利点から、さまざまな分野で幅広く使用されています。自動車産業の成長、エネルギー効率の高い燃料に対する需要の高まり、国内消費者によるLPGの広範な採用といった要因が、世界中で市場の成長を後押ししています。LPGは石油化学の原料として、特に炭化水素分解によるエチレン生産や水蒸気転換による合成ガス生産で重要な役割を果たしています。これは、消費者がガソリンやディーゼルといった高価な従来型燃料から低コストのLPGへとシフトしていることと一致しており、市場の拡大をさらに後押ししています。さらに、産業・商業部門によるLPG利用の増加も、市場にプラスの影響を与えています。

加えて、政府の政策やイニシアティブの高まりが、世界中のLPG市場成長の触媒として作用しています。例えば、2021年3月、アブダビ国営石油会社(ADNOC)とインドネシア国営石油会社プルタミナは、約20億米ドルに相当する実質的な4年契約を締結しました。この契約は、インドネシア・エミレーツ "アメージング・ウィーク2021 "で結ばれたもので、液化石油ガス(LPG)と硫黄の供給を含み、年間契約額は約5億米ドルで、これらの商品の世界市場価格の変動に基づいて調整されます。また、2022年2月、インディアン・オイル・コーポレーション(IOC)は、インド北東部に3つの新プラントを建設する戦略的構想を発表しました。これらの工場はIOCのLPGボトリング能力を大幅に増強するためのもので、同地域の需要増に対応するため、2030年までに約53%増の年間8兆本のシリンダーを目指します。この拡張プロジェクトへの投資予定額は4,300万~4,600万米ドルの範囲に収まる見込みです。世界が温室効果ガスの排出削減と持続可能なエネルギー慣行の推進に向けた取り組みを強化する中、LPガスの採用は様々な分野で世界的に牽引力を増しています。各国政府は、LPガスの使用を促進するための支援策を実施し、補助金を提供することで、重要な役割を果たしています。例えばインドでは、政府の「PAHAL」スキームが効率的に補助金を消費者の銀行口座に直接振り込み、補助金を受け取る権利のある人々に利益をもたらしています。このスキームを補完するのが「ギブ・イット・アップ」キャンペーンで、市場価格のLPガスを購入できる消費者に対し、補助金付き製品を自主的に見送るよう促しています。このような協調的な取り組みにより、LPガスは多様な用途でますます魅力的な代替燃料となっており、推定期間中の市場成長に大きく寄与しています。さらに、バイオLPGの利用が重視されるようになり、代替燃料として輸送にLPGを採用することに注目が集まっていることも、予測期間中に様々な有利な機会をもたらしています。しかし、再生可能エネルギーとの競合の増加や高い安全性への懸念が、2023-2030年の予測期間を通じて市場成長の課題となっています。

液化石油ガス(LPG)の世界市場調査において考慮した主要地域は、アジア太平洋、北米、欧州、ラテンアメリカ、中東・アフリカです。アジア太平洋地域は、急速な人口増加、資源の高い利用可能性、エネルギーニーズの高まり、政府の支援政策と補助金、家庭の調理と給湯のための主要燃料としての広範な使用により、2022年の市場を独占しました。また、この地域の化学セクターは大幅な成長を遂げており、様々な化学品やプラスチックを製造するための主要原料としてLPガスを利用しています。COP21のような炭素排出量削減のための首脳会議に多くの国が積極的に参加しています。例えば、インドは代替調理用燃料を推進するイニシアチブの先頭に立っています。さらに、オートガス市場(輸送用燃料として使用されるLPガス)は、持続可能な輸送用燃料としてLPガスを推進する政府の強力かつ永続的な政策に支えられ、アジア太平洋で急速に発展しています。このような政府のコミットメントが、同地域の液化石油ガス市場成長の主な原動力となっています。一方、欧州は予測期間中最も高いCAGRで成長すると予想されます。この地域では、輸送にオートガスを使用する傾向が高まっており、ガソリンやディーゼルといった従来の燃料に対してオートガスの競争力を高める効果的な奨励政策に支えられています。

本調査の目的は、近年のさまざまなセグメントと国の市場規模を明らかにし、今後数年間の市場規模を予測することです。本レポートは、調査対象国における産業の質的・量的側面を盛り込むよう設計されています。

また、市場の将来的な成長を規定する促進要因や課題など、重要な側面に関する詳細情報も掲載しています。さらに、主要企業の競合情勢や製品提供の詳細な分析とともに、利害関係者が投資するためのミクロ市場における潜在的な機会も組み込んでいます。

目次

第1章 エグゼクティブサマリー

第2章 世界の液化石油ガス(LPG)市場の定義と範囲

- 調査目的

- 市場の定義と範囲

- 産業の進化

- 調査範囲

- 調査対象年

- 通貨換算レート

第3章 世界の液化石油ガス(LPG)市場力学

- 液化石油ガス(LPG)市場の影響分析(2020年~2030年)

- 市場促進要因

- 国内消費者によるLPG採用の増加

- 政府の政策とイニシアチブの高まり

- 市場の課題

- 再生可能エネルギーとの競合激化

- 高い安全性への懸念

- 市場機会

- バイオLPGの利用重視の高まり

- 代替燃料としての輸送におけるLPG採用への注目の高まり

- 市場促進要因

第4章 世界の液化石油ガス(LPG)市場産業分析

- ポーターのファイブフォースモデル

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- ポーターのファイブフォース影響分析

- PEST分析

- 政治

- 経済

- 社会

- 技術

- 環境

- 法律

- 主な投資機会

- 主要成功戦略

- COVID-19影響分析

- 破壊的動向

- 業界専門家の視点

- アナリストの結論・提言

第5章 液化石油ガス(LPG)の世界市場:供給源別

- 市場スナップショット

- 液化石油ガス(LPG)の供給源別世界市場、実績 - ポテンシャル分析

- 液化石油ガス(LPG)の世界市場推定・予測、供給源別:2020年~2030年

- 液化石油ガス(LPG)市場、サブセグメント分析

- 精製所

- 関連ガス

- 非関連ガス

第6章 液化石油ガス(LPG)の世界市場:用途別

- 市場スナップショット

- 液化石油ガス(LPG)の世界市場:用途別、実績 - ポテンシャル分析

- 液化石油ガス(LPG)の世界市場:用途別推定・予測、2020年~2030年

- 液化石油ガス(LPG)市場、サブセグメント分析

- 住宅用/商業用

- 化学

- 産業用

- オートガス

- 精製

- その他

第7章 液化石油ガス(LPG)の世界市場、地域分析

- 主要国

- 主な新興国

- 液化石油ガス(LPG)市場の地域別市場概況

- 北米

- 米国

- 供給源の推定・予測、2020-2030年

- 用途別推定・予測、2020年~2030年

- カナダ

- 米国

- 欧州の液化石油ガス(LPG)市場スナップショット

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- その他の欧州

- アジア太平洋の液化石油ガス(LPG)市場スナップショット

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカの液化石油ガス(LPG)市場スナップショット

- ブラジル

- メキシコ

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

第8章 競合情報

- 主要企業のSWOT分析

- 主要市場戦略

- 企業プロファイル

- Repsol S.A.

- 主要情報

- 概要

- 財務(データの入手可能性によります)

- 製品概要

- 最近の動向

- China Gas Holdings Ltd

- Saudi Arabian Oil Co.

- FLAGA Gmbh

- Bharat Petroleum Corporation Limited

- JGC HOLDINGS CORPORATION

- Chevron Corporation

- Reliance Industries Limited

- Exxon Mobil Corporation

- PetroChina Company Limited

- Repsol S.A.

第9章 調査プロセス

- 調査プロセス

- データマイニング

- 分析

- 市場推定

- 検証

- 出版

- 調査属性

- 調査前提条件

LIST OF TABLES

- TABLE 1.Global Liquefied Petroleum Gas (LPG) Market, report scope

- TABLE 2.Global Liquefied Petroleum Gas (LPG) Market estimates & forecasts by Region 2020-2030 (USD Billion)

- TABLE 3.Global Liquefied Petroleum Gas (LPG) Market estimates & forecasts by Source 2020-2030 (USD Billion)

- TABLE 4.Global Liquefied Petroleum Gas (LPG) Market estimates & forecasts by Application 2020-2030 (USD Billion)

- TABLE 5.Global Liquefied Petroleum Gas (LPG) Market by segment, estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 6.Global Liquefied Petroleum Gas (LPG) Market by region, estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 7.Global Liquefied Petroleum Gas (LPG) Market by segment, estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 8.Global Liquefied Petroleum Gas (LPG) Market by region, estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 9.Global Liquefied Petroleum Gas (LPG) Market by segment, estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 10.Global Liquefied Petroleum Gas (LPG) Market by region, estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 11.Global Liquefied Petroleum Gas (LPG) Market by segment, estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 12.Global Liquefied Petroleum Gas (LPG) Market by region, estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 13.Global Liquefied Petroleum Gas (LPG) Market by segment, estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 14.Global Liquefied Petroleum Gas (LPG) Market by region, estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 15.U.S. Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 16.U.S. Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 17.U.S. Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 18.Canada Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 19.Canada Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 20.Canada Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 21.UK Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 22.UK Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 23.UK Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 24.Germany Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 25.Germany Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 26.Germany Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 27.France Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 28.France Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 29.France Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 30.Italy Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 31.Italy Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 32.Italy Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 33.Spain Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 34.Spain Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 35.Spain Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 36.RoE Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 37.RoE Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 38.RoE Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 39.China Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 40.China Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 41.China Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 42.India Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 43.India Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 44.India Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 45.Japan Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 46.Japan Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 47.Japan Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 48.South Korea Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 49.South Korea Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 50.South Korea Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 51.Australia Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 52.Australia Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 53.Australia Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 54.RoAPAC Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 55.RoAPAC Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 56.RoAPAC Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 57.Brazil Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 58.Brazil Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 59.Brazil Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 60.Mexico Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 61.Mexico Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 62.Mexico Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 63.RoLA Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 64.RoLA Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 65.RoLA Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 66.Saudi Arabia Liquefied Petroleum Gas (LPG) Market estimates & forecasts, 2020-2030 (USD Billion)

- TABLE 67.South Africa Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 68.RoMEA Liquefied Petroleum Gas (LPG) Market estimates & forecasts by segment 2020-2030 (USD Billion)

- TABLE 69.List of secondary sources, used in the study of Global Liquefied Petroleum Gas (LPG) Market

- TABLE 70.List of primary sources, used in the study of Global Liquefied Petroleum Gas (LPG) Market

- TABLE 71.Years considered for the study

- TABLE 72.Exchange rates considered

List of tables and figures and dummy in nature, final lists may vary in the final deliverable

LIST OF FIGURES

- FIG 1.Global Liquefied Petroleum Gas (LPG) Market, research methodology

- FIG 2.Global Liquefied Petroleum Gas (LPG) Market, Market estimation techniques

- FIG 3.Global Market size estimates & forecast methods

- FIG 4.Global Liquefied Petroleum Gas (LPG) Market, key trends 2022

- FIG 5.Global Liquefied Petroleum Gas (LPG) Market, growth prospects 2023-2030

- FIG 6.Global Liquefied Petroleum Gas (LPG) Market, porters 5 force model

- FIG 7.Global Liquefied Petroleum Gas (LPG) Market, pest analysis

- FIG 8.Global Liquefied Petroleum Gas (LPG) Market, value chain analysis

- FIG 9.Global Liquefied Petroleum Gas (LPG) Market by segment, 2020 & 2030 (USD Billion)

- FIG 10.Global Liquefied Petroleum Gas (LPG) Market by segment, 2020 & 2030 (USD Billion)

- FIG 11.Global Liquefied Petroleum Gas (LPG) Market by segment, 2020 & 2030 (USD Billion)

- FIG 12.Global Liquefied Petroleum Gas (LPG) Market by segment, 2020 & 2030 (USD Billion)

- FIG 13.Global Liquefied Petroleum Gas (LPG) Market by segment, 2020 & 2030 (USD Billion)

- FIG 14.Global Liquefied Petroleum Gas (LPG) Market, regional snapshot 2020 & 2030

- FIG 15.North America Liquefied Petroleum Gas (LPG) Market 2020 & 2030 (USD Billion)

- FIG 16.Europe Liquefied Petroleum Gas (LPG) Market 2020 & 2030 (USD Billion)

- FIG 17.Asia Pacific Liquefied Petroleum Gas (LPG) Market 2020 & 2030 (USD Billion)

- FIG 18.Latin America Liquefied Petroleum Gas (LPG) Market 2020 & 2030 (USD Billion)

- FIG 19.Middle East & Africa Liquefied Petroleum Gas (LPG) Market 2020 & 2030 (USD Billion)

List of tables and figures and dummy in nature, final lists may vary in the final deliverable

Global Liquefied Petroleum Gas (LPG) Market is valued at approximately USD 117.3 billion in 2022 and is anticipated to grow with a healthy growth rate of more than 3.7% over the forecast period 2023-2030. Liquefied Petroleum Gas (LPG), also referred to as propane, is a flammable hydrocarbon gas widely utilized as a clean and environmentally friendly fuel due to its non-toxic and sulfur-free properties. LPG, which mainly contains propane (C3H8) and butane (C4H10) along with trace quantities of other hydrocarbons, is valued for its storability which enhances its portability. This characteristic makes it a versatile energy option for businesses operating in regions that lack access to piped gas. LPG is a preferred energy option due to its lower sulfur and carbon emissions, making it environmentally friendly. It is widely used in process industries for steam generation and household cooking, owing to its high flash point and minimal greenhouse gas emissions compared to other fuels. LPG is separated during oil refining and stored in cylinders under moderate pressure as it is obtained from the refining of natural gas or crude oil extracted from fossil fuels. Its versatility and environmental benefits drive its extensive use across different sectors. Factors such as the growing automotive industry the rising demand for energy-efficient fuel, and the widespread adoption of LPG by domestic consumers are fueling market growth across the globe. LPG plays a crucial role as a feedstock for petrochemicals, particularly in ethylene production via hydrocarbon cracking and syngas production through steam conversion. This aligns with consumers' shift towards low-cost LPG from more expensive conventional fuels like petrol and diesel, further boosting market expansion. Additionally, the market is positively influenced by the increased utilization of LPG by industrial and commercial sectors.

In addition, the rising government policies and initiatives are acting as a catalyzing factor for LPG market growth across the globe. For instance, in March 2021, Abu Dhabi National Oil Company (ADNOC) and Indonesian national oil company Pertamina finalized a substantial four-year contract valued at approximately USD 2 billion. This agreement, forged during the Indonesia-Emirates "Amazing Week 2021," encompasses the supply of liquefied petroleum gas (LPG) and sulfur, with an annual contract value of about USD 500 million, subject to adjustments based on global market price fluctuations for these commodities. Also, in February 2022, Indian Oil Corp. (IOC) unveiled its strategic initiative to build three new plants in Northeast India. These plants are designed to significantly boost IOC's LPG bottling capacity, aiming for an increase of nearly 53% to reach 8 crore cylinders annually by 2030, in response to the rising demand in the region. The planned investment for this expansion project is expected to fall within the range of USD 43-46 million. Along with this, the adoption of LP gas is gaining traction globally across various sectors as the world intensifies efforts to reduce greenhouse gas emissions and promote sustainable energy practices. Governments are playing an essential role by implementing supportive initiatives and providing subsidies to promote the use of LP gas. For instance, in India the government's "PAHAL" scheme efficiently channels subsidies directly into consumers' bank accounts, benefiting those entitled to subsidies. Complementing this scheme is the "give it up" campaign, urging consumers who can afford market-priced LPG to voluntarily forgo subsidized products. This concerted effort is making LP gas an increasingly appealing alternative fuel across diverse applications, contributing significantly to the market growth during the estimated period. Moreover, the increasing emphasis on the utilization of BioLPG, as well as the growing focus on the adoption of LPG in transportation as an alternative fuel present various lucrative opportunities over the forecast years. However, the increasing competition from renewable energy sources and the high safety concerns are challenging the market growth throughout the forecast period of 2023-2030.

The key regions considered for the Global Liquefied Petroleum Gas (LPG) Market study include Asia Pacific, North America, Europe, Latin America, and Middle East & Africa. Asia Pacific dominated the market in 2022 owing to the rapidly growing population, high availability of resources, escalating energy needs, supportive government policies & subsidies, along the widespread use as a primary fuel for household cooking and water heating. Also, the chemical sector in the region has experienced substantial growth, utilizing LP gas as a key feedstock for manufacturing various chemicals and plastics. Many countries are actively participating in summit meetings like COP21 to reduce carbon emissions globally. For instance, India is spearheading initiatives to promote alternative cooking fuels. Furthermore, the autogas market (LP gas used as a transport fuel) has rapidly developed in the Asia Pacific, supported by governments' strong and enduring policies promoting LP gas as a sustainable transport fuel. This governmental commitment is a key driver of the growing liquefied petroleum gas market in the region. Whereas, Europe is expected to grow at the highest CAGR over the forecast years. The region witnesses an increasing trend in using autogas for transportation, supported by effective incentive policies that make autogas more competitive against traditional fuels like gasoline and diesel, providing a strong financial motive for consumers to switch to Autogas significantly propelling the market demand across the region.

Major market players included in this report are:

- Repsol S.A.

- China Gas Holdings Ltd.

- Saudi Arabian Oil Co.

- FLAGA Gmbh

- Bharat Petroleum Corporation Limited

- JGC HOLDINGS CORPORATION

- Chevron Corporation

- Reliance Industries Limited

- Exxon Mobil Corporation

- PetroChina Company Limited

Recent Developments in the Market:

- In June 2021, Astomos Energy Corporation and Shell International Eastern Trading Company reached an agreement for the purchase of a carbon-neutral liquefied petroleum gas cargo destined for Japan. This cargo is a VLGC-size LPG shipment. It has achieved carbon neutrality through the offsetting of CO2 lifecycle emissions using verified nature-based carbon credits. Shell's global portfolio of nature-based projects will provide the credits necessary to offset emissions across the entire value chain, including production, transportation, and consumption stages. These projects focus on land protection, transformation, and restoration, allowing nature to absorb CO2 emissions and contribute oxygen to the atmosphere.

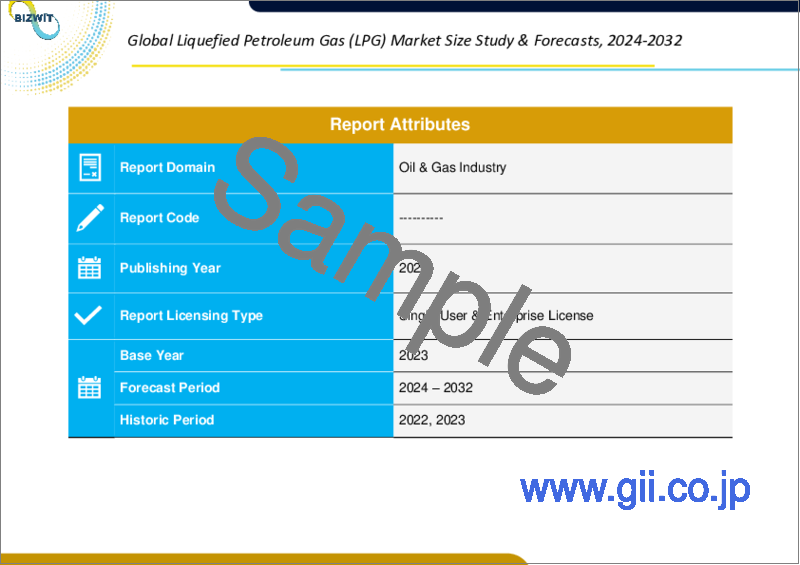

Global Liquefied Petroleum Gas (LPG) Market Report Scope:

- Historical Data - 2020 - 2021

- Base Year for Estimation - 2022

- Forecast period - 2023-2030

- Report Coverage - Revenue forecast, Company Ranking, Competitive Landscape, Growth factors, and Trends

- Segments Covered - Source, Application, Region

- Regional Scope - North America; Europe; Asia Pacific; Latin America; Middle East & Africa

- Customization Scope - Free report customization (equivalent to 8 analyst's working hours) with purchase. Addition or alteration to country, regional & segment scope*

The objective of the study is to define the market sizes of different segments & countries in recent years and to forecast the values for the coming years. The report is designed to incorporate both qualitative and quantitative aspects of the industry within countries involved in the study.

The report also caters to detailed information about the crucial aspects such as driving factors & challenges that will define the future growth of the market. Additionally, it also incorporates potential opportunities in micro markets for stakeholders to invest along with a detailed analysis of the competitive landscape and product offerings of key players. The detailed segments and sub-segment of the market are explained below:

By Source:

- Refinery

- Associated Gas

- Non - Associated Gas

By Application:

- Residential/Commercial

- Chemical

- Industrial

- Autogas

- Refinery

- Others

By Region:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Spain

- Italy

- ROE

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- RoAPAC

- Latin America

- Brazil

- Mexico

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

Table of Contents

Chapter 1.Executive Summary

- 1.1.Market Snapshot

- 1.2.Global & Segmental Market Estimates & Forecasts, 2020-2030 (USD Billion)

- 1.2.1.Liquefied Petroleum Gas (LPG) Market, by Region, 2020-2030 (USD Billion)

- 1.2.2.Liquefied Petroleum Gas (LPG) Market, by Source, 2020-2030 (USD Billion)

- 1.2.3.Liquefied Petroleum Gas (LPG) Market, by Application, 2020-2030 (USD Billion)

- 1.3.Key Trends

- 1.4.Estimation Methodology

- 1.5.Research Assumption

Chapter 2.Global Liquefied Petroleum Gas (LPG) Market Definition and Scope

- 2.1.Objective of the Study

- 2.2.Market Definition & Scope

- 2.2.1.Industry Evolution

- 2.2.2.Scope of the Study

- 2.3.Years Considered for the Study

- 2.4.Currency Conversion Rates

Chapter 3.Global Liquefied Petroleum Gas (LPG) Market Dynamics

- 3.1.Liquefied Petroleum Gas (LPG) Market Impact Analysis (2020-2030)

- 3.1.1.Market Drivers

- 3.1.1.1.Increasing Adoption of LPG By Domestic Consumers

- 3.1.1.2.Rising Government Policies and Initiatives

- 3.1.2.Market Challenges

- 3.1.2.1.Increasing Competition from Renewable Energy Sources

- 3.1.2.2.High Safety Concerns

- 3.1.3.Market Opportunities

- 3.1.3.1.Increasing Emphasis on Utilization of Bio-LPG

- 3.1.3.2.Growing Focus on Adoption of LPG in Transportation As An Alternative Fuel

- 3.1.1.Market Drivers

Chapter 4.Global Liquefied Petroleum Gas (LPG) Market Industry Analysis

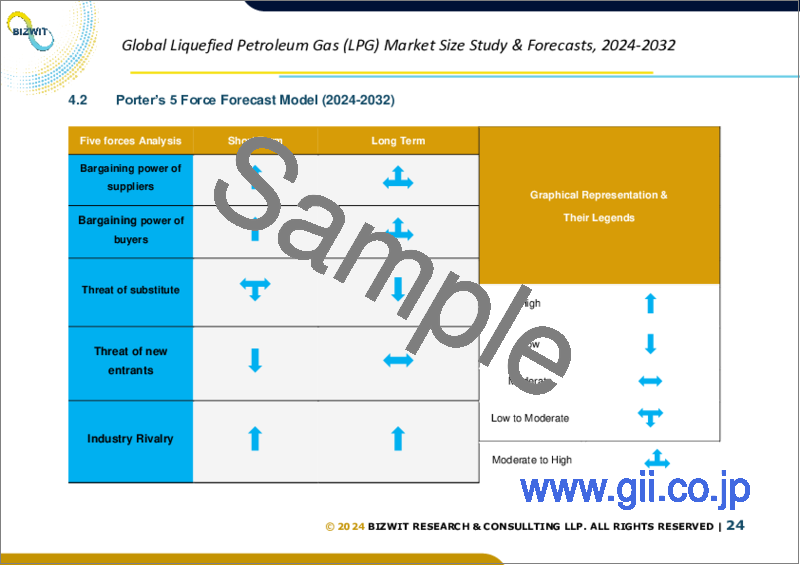

- 4.1.Porter's 5 Force Model

- 4.1.1.Bargaining Power of Suppliers

- 4.1.2.Bargaining Power of Buyers

- 4.1.3.Threat of New Entrants

- 4.1.4.Threat of Substitutes

- 4.1.5.Competitive Rivalry

- 4.2.Porter's 5 Force Impact Analysis

- 4.3.PEST Analysis

- 4.3.1.Political

- 4.3.2.Economical

- 4.3.3.Social

- 4.3.4.Technological

- 4.3.5.Environmental

- 4.3.6.Legal

- 4.4.Top investment opportunity

- 4.5.Top winning strategies

- 4.6.COVID-19 Impact Analysis

- 4.7.Disruptive Trends

- 4.8.Industry Expert Perspective

- 4.9.Analyst Recommendation & Conclusion

Chapter 5.Global Liquefied Petroleum Gas (LPG) Market, by Source

- 5.1.Market Snapshot

- 5.2.Global Liquefied Petroleum Gas (LPG) Market by Source, Performance - Potential Analysis

- 5.3.Global Liquefied Petroleum Gas (LPG) Market Estimates & Forecasts by Source 2020-2030 (USD Billion)

- 5.4.Liquefied Petroleum Gas (LPG) Market, Sub Segment Analysis

- 5.4.1.Refinery

- 5.4.2.Associated Gas

- 5.4.3.Non - Associated Gas

Chapter 6.Global Liquefied Petroleum Gas (LPG) Market, by Application

- 6.1.Market Snapshot

- 6.2.Global Liquefied Petroleum Gas (LPG) Market by Application, Performance - Potential Analysis

- 6.3.Global Liquefied Petroleum Gas (LPG) Market Estimates & Forecasts by Application 2020-2030 (USD Billion)

- 6.4.Liquefied Petroleum Gas (LPG) Market, Sub Segment Analysis

- 6.4.1.Residential/Commercial

- 6.4.2.Chemical

- 6.4.3.Industrial

- 6.4.4.Autogas

- 6.4.5.Refinery

- 6.4.6.Others

Chapter 7.Global Liquefied Petroleum Gas (LPG) Market, Regional Analysis

- 7.1.Top Leading Countries

- 7.2.Top Emerging Countries

- 7.3.Liquefied Petroleum Gas (LPG) Market, Regional Market Snapshot

- 7.4.North America Liquefied Petroleum Gas (LPG) Market

- 7.4.1.U.S. Liquefied Petroleum Gas (LPG) Market

- 7.4.1.1.Source breakdown estimates & forecasts, 2020-2030

- 7.4.1.2.Application breakdown estimates & forecasts, 2020-2030

- 7.4.2.Canada Liquefied Petroleum Gas (LPG) Market

- 7.4.1.U.S. Liquefied Petroleum Gas (LPG) Market

- 7.5.Europe Liquefied Petroleum Gas (LPG) Market Snapshot

- 7.5.1.U.K. Liquefied Petroleum Gas (LPG) Market

- 7.5.2.Germany Liquefied Petroleum Gas (LPG) Market

- 7.5.3.France Liquefied Petroleum Gas (LPG) Market

- 7.5.4.Spain Liquefied Petroleum Gas (LPG) Market

- 7.5.5.Italy Liquefied Petroleum Gas (LPG) Market

- 7.5.6.Rest of Europe Liquefied Petroleum Gas (LPG) Market

- 7.6.Asia-Pacific Liquefied Petroleum Gas (LPG) Market Snapshot

- 7.6.1.China Liquefied Petroleum Gas (LPG) Market

- 7.6.2.India Liquefied Petroleum Gas (LPG) Market

- 7.6.3.Japan Liquefied Petroleum Gas (LPG) Market

- 7.6.4.Australia Liquefied Petroleum Gas (LPG) Market

- 7.6.5.South Korea Liquefied Petroleum Gas (LPG) Market

- 7.6.6.Rest of Asia Pacific Liquefied Petroleum Gas (LPG) Market

- 7.7.Latin America Liquefied Petroleum Gas (LPG) Market Snapshot

- 7.7.1.Brazil Liquefied Petroleum Gas (LPG) Market

- 7.7.2.Mexico Liquefied Petroleum Gas (LPG) Market

- 7.8.Middle East & Africa Liquefied Petroleum Gas (LPG) Market

- 7.8.1.Saudi Arabia Liquefied Petroleum Gas (LPG) Market

- 7.8.2.South Africa Liquefied Petroleum Gas (LPG) Market

- 7.8.3.Rest of Middle East & Africa Liquefied Petroleum Gas (LPG) Market

Chapter 8.Competitive Intelligence

- 8.1.Key Company SWOT Analysis

- 8.2.Top Market Strategies

- 8.3.Company Profiles

- 8.3.1. Repsol S.A.

- 8.3.1.1.Key Information

- 8.3.1.2.Overview

- 8.3.1.3.Financial (Subject to Data Availability)

- 8.3.1.4.Product Summary

- 8.3.1.5.Recent Developments

- 8.3.2.China Gas Holdings Ltd

- 8.3.3.Saudi Arabian Oil Co.

- 8.3.4.FLAGA Gmbh

- 8.3.5.Bharat Petroleum Corporation Limited

- 8.3.6.JGC HOLDINGS CORPORATION

- 8.3.7.Chevron Corporation

- 8.3.8.Reliance Industries Limited

- 8.3.9.Exxon Mobil Corporation

- 8.3.10.PetroChina Company Limited

- 8.3.1. Repsol S.A.

Chapter 9.Research Process

- 9.1.Research Process

- 9.1.1.Data Mining

- 9.1.2.Analysis

- 9.1.3.Market Estimation

- 9.1.4.Validation

- 9.1.5.Publishing

- 9.2.Research Attributes

- 9.3.Research Assumption