|

|

市場調査レポート

商品コード

1181101

電気化学水素コンプレッサーの世界市場:市場規模、シェア、動向分析、機会、予測:タイプ別、技術別、エンドユーザー別、地域別(2023年~2029年)Electrochemical Hydrogen Compressor Market - Global Size, Share, Trend Analysis, Opportunity and Forecast Report, 2023-2029, Segmented By Type ; By Technology ; By End User ; By Region |

||||||

| 電気化学水素コンプレッサーの世界市場:市場規模、シェア、動向分析、機会、予測:タイプ別、技術別、エンドユーザー別、地域別(2023年~2029年) |

|

出版日: 2022年12月28日

発行: Blueweave Consulting

ページ情報: 英文 200 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界の電気化学水素コンプレッサーの市場規模は、2022年に548億4,000万米ドルに達し、2029年には897億2,000万米ドルに達し、2023年~2029年の予測期間中にCAGRで8.6%の成長が予測されています。

世界の市場拡大の主な要因として、化学、石油・ガス、自動車産業などのエンドユーザーセクターにおける電気化学水素コンプレッサーの利用拡大、二酸化炭素排出量削減の必要性が高まっていることが挙げられます。

当レポートでは、世界の電気化学水素コンプレッサー市場について調査し、市場の洞察、タイプ・技術・エンドユーザー・地域別の市場分析、競合情勢、企業プロファイル等に関する情報を提供しています。

目次

第1章 調査の枠組み

第2章 エグゼクティブサマリー

第3章 世界の電気化学水素コンプレッサー市場の洞察

- 業界バリューチェーン分析

- DROC分析

- 成長促進要因

- エンドユーザーによる水素消費量の増加

- オイルベースコンプレッサーの需要急増

- 大気汚染の影響に対する認知度の向上

- 抑制要因

- 高いメンテナンス費

- 機会

- 水素パイプラインインフラの建設

- 製油所での水素利用に対する関心の高まり

- 課題

- 原材料価格の変動性

- 水素コンプレッサーの高コスト

- 製品の進歩/最近の開発

- 規制の枠組み

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入者の脅威

- 代替品の脅威

- 競合の激しさ

- 成長促進要因

第4章 世界の電気化学水素コンプレッサーの市場概要

- 市場規模・予測、2019年~2029年

- 金額別(100万米ドル)

- 市場シェア・予測

- タイプ別

- オイルベース

- オイルフリー

- 技術別

- 単段式

- 多段式

- エンドユーザー別

- 化学

- 石油・ガス

- 公益事業

- 給油所

- その他

- 地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- タイプ別

第5章 北米の電気化学水素コンプレッサー市場

- 市場規模・予測、2019年~2029年

- 金額別(100万米ドル)

- 市場シェア・予測

- タイプ別

- 技術別

- エンドユーザー別

- 国別

- 米国

- カナダ

第6章 欧州の電気化学水素コンプレッサー市場

- 市場規模・予測、2019年~2029年

- 金額別(100万米ドル)

- 市場シェア・予測

- タイプ別

- 技術別

- エンドユーザー別

- 国別

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- オランダ

- ベルギー

- 北欧諸国

- その他の欧州

第7章 アジア太平洋の電気化学水素コンプレッサー市場

- 市場規模・予測、2019年~2029年

- 金額別(100万米ドル)

- 市場シェア・予測

- タイプ別

- 技術別

- エンドユーザー別

- 国別

- 中国

- インド

- 日本

- 韓国

- オーストラリア・ニュージーランド

- インドネシア

- マレーシア

- シンガポール

- フィリピン

- ベトナム

- その他のアジア太平洋

第8章 ラテンアメリカの電気化学水素コンプレッサー市場

- 市場規模・予測、2019年~2029年

- 金額別(100万米ドル)

- 市場シェア・予測

- タイプ別

- 技術別

- エンドユーザー別

- 国別

- ブラジル

- メキシコ

- アルゼンチン

- ペルー

- コロンビア

- その他のラテンアメリカ

第9章 中東・アフリカの電気化学水素コンプレッサー市場

- 市場規模・予測、2019年~2029年

- 金額別(100万米ドル)

- 市場シェア・予測

- タイプ別

- 技術別

- エンドユーザー別

- 国別

- サウジアラビア

- アラブ首長国連邦

- カタール

- クウェート

- イラン

- 南アフリカ

- ナイジェリア

- ケニア

- エジプト

- モロッコ

- アルジェリア

- その他の中東・アフリカ

第10章 競合情勢

- 主要企業とその製品リスト

- 世界の電気化学水素コンプレッサー企業の市場シェア分析、2022年

- 競合ベンチマーキング:運営パラメータ別

- 主要な戦略的展開(合併、買収、パートナーシップなど)

第11章 世界の電気化学水素コンプレッサー市場におけるCOVID-19の影響

第12章 企業プロファイル

- Atlas Copco AB

- Burckhardt Compression AG

- Fluitron, Inc.

- Gardner Denver Nash, LLC

- Howden Group

- HAUG Sauer Kompressoren AG

- NEUMAN & ESSER GROUP

- Hydro-Pac, Inc.

- Lenhardt & Wagner GmbH

- PDC Machines Inc.

- HyET Group

- Black & Veatch Holding Company

- Fortescue Future Industries

- Nuvera Fuel Cells, LLC

- Fuelcell Energy, Inc.

- Skyre Inc.

- Giner Inc.

- Proton Technologies Canada Inc.

- Keepwin Technology Hebei Co. Ltd.

- Taizhou Toplong Electrical & Mechanical Co., Ltd.

- その他の有力企業

第13章 主要な戦略的推奨事項

第14章 調査手法

Global Electrochemical Hydrogen Compressor Market Size Set to Cross USD 89.7 Billion by 2029

Global electrochemical hydrogen compressor market is flourishing because of rising hydrogen consumption by end users, high adoption of oil-based compressors, and growing public awareness about the use of hydrogen in tackling air pollution caused by high usage of fossil fuels.

BlueWeave Consulting, a leading strategic consulting and market research firm, in its recent study, estimates global electrochemical hydrogen compressor market size at USD 54.84 billion in 2022. During the forecast period between 2023 and 2029, BlueWeave expects global electrochemical hydrogen compressor market size to grow at a significant CAGR of 8.6% reaching a value of USD 89.72 billion by 2029. Major factors for the expansion of global electrochemical hydrogen compressor market include increasing utilization Electrochemical Hydrogen Compressors (EHCs) by end-user sectors, such as the chemicals, oil and gas, and automobile industries, as well as rising necessity to reduce carbon dioxide emissions. The high adoption of oil-based compressors due to their capacity to provide various advantages over oil-free compressors, including improved efficiency and government initiatives promoting the utilization of eco-friendly energy sources, is expected to boost the overall market expansion. The rising popularity of hydrogen fuel cell vehicles because of increasing awareness about the negative environmental impact of carbon emissions by burning conventional fossil fuels is projected to influence market demand during the forecast period. However, high cost of maintenance is anticipated to restrain the growth of global electrochemical hydrogen compressor market.

Global Electrochemical Hydrogen Compressor Market - Overview

An electrochemical hydrogen compressor (EHC) compresses hydrogen gas using the electrolysis process before collecting the compressed hydrogen from the cathode. Electrochemical hydrogen compressors employ the electrochemical concept to compress low-pressure hydrogen into high-pressure hydrogen. Due to hydrogen oxidation at anodes and hydrogen reduction at cathodes, voltage application can generate a localized pressure difference.

Impact of COVID-19 on Global Electrochemical Hydrogen Compressor Market

COVID-19 had a detrimental impact on electrochemical hydrogen compressor market due to disruption of international supply chain and halted global trade. The pandemic has disturbed economies and businesses in numerous countries because of travel restrictions, mass lockdowns, and commercial shutdowns. The imposition of the lockdown has resulted in reduced output of commodities, goods, and services, as well as the cessation of supply chain activity at various nodes. Chemical, oil and gas, energy and electricity, and other industries have seen a decrease in operations because of the temporary stoppage of activity. Furthermore, the economic crisis caused by the spread of COVID-19 caused a delay in the adoption and commercialization of clean hydrogen. Furthermore, it may irrevocably jeopardize the clean hydrogen sector's ability to serve as the missing link in the shift to clean energy. However, the clean hydrogen sector has now achieved pre-commercialization and is set to play an important role in decarbonizing economies. Also, major economies, such as Germany, the United Kingdom, Spain, the Netherlands, China, and Japan, will remain to be leaders in the use of hydrogen for a variety of end uses.

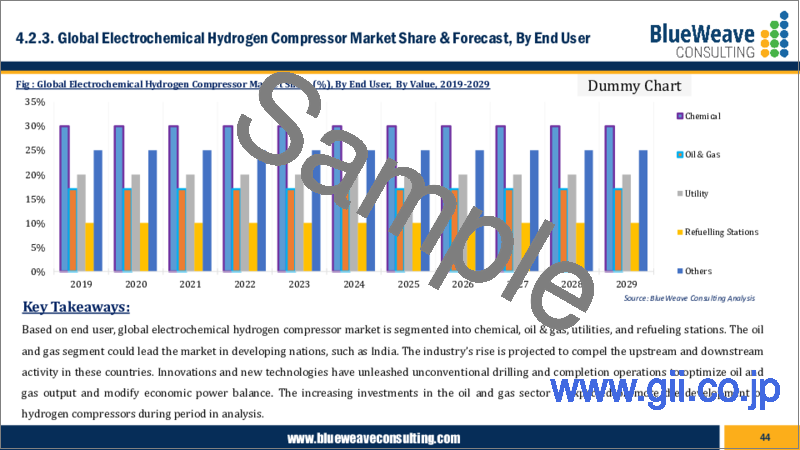

Global Electrochemical Hydrogen Compressor Market - By End User

Based on end user, global electrochemical hydrogen compressor market is segmented into Chemical, Oil & Gas, Utility, and Refueling Stations. The oil and gas segment could lead the market in developing countries, such as India. The industry's rise is projected to compel the upstream and downstream activities in the emerging economies. Innovations and new technologies have unleashed unconventional drilling and completion operations to optimize oil and gas output and modify economic power balance. The increasing investments in the oil and gas sector are expected promote the development of hydrogen compressors during the period in analysis.

Competitive Landscape

Major players operating in global electrochemical hydrogen compressor market include Atlas Copco AB, Burckhardt Compression AG, Fluitron, Inc., Gardner Denver Nash, LLC, Howden Group, HAUG Sauer Kompressoren AG, NEUMAN & ESSER GROUP, Hydro-Pac, Inc., Lenhardt & Wagner GmbH, PDC Machines Inc., HyET Group, Black & Veatch Holding Company, Fortescue Future Industries, Nuvera Fuel Cells, LLC, Fuelcell Energy, Inc., Skyre Inc., Giner Inc., Proton Technologies Canada Inc., Keepwin Technology Hebei Co. Ltd., and Taizhou Toplong Electrical & Mechanical Co., Ltd. To further enhance their market share, these companies employ various strategies, including mergers and acquisitions, partnerships, joint ventures, license agreements, and new product launches.

The in-depth analysis of the report provides information about growth potential, upcoming trends, and statistics of Global Electrochemical Hydrogen Compressor Market. It also highlights the factors driving forecasts of total market size. The report promises to provide recent technology trends in Global Electrochemical Hydrogen Compressor Market and industry insights to help decision-makers make sound strategic decisions. Furthermore, the report also analyzes the growth drivers, challenges, and competitive dynamics of the market.

Table of Contents

1. Research Framework

- 1.1. Research Objective

- 1.2. Product Overview

- 1.3. Market Segmentation

2. Executive Summary

3. Global Electrochemical Hydrogen Compressor Market Insights

- 3.1. Industry Value Chain Analysis

- 3.2. DROC Analysis

- 3.2.1. Growth Drivers

- 3.2.1.1. Increase in hydrogen consumption by end-users

- 3.2.1.2. Surging demand of oil-based compressors

- 3.2.1.3. Rise in public awareness about the consequences of air pollution

- 3.2.2. Restraints

- 3.2.2.1. High cost of maintenance

- 3.2.3. Opportunity

- 3.2.3.1. Construction of hydrogen pipeline infrastructure

- 3.2.3.2. Rising focus on hydrogen usage in refineries

- 3.2.4. Challenges

- 3.2.4.1. Volatility of raw material prices

- 3.2.4.2. High cost of hydrogen compressors

- 3.2.1. Growth Drivers

- 3.3. Product Advancements/Recent Developments

- 3.4. Regulatory Framework

- 3.5. Porter's Five Forces Analysis

- 3.5.1. Bargaining Power of Suppliers

- 3.5.2. Bargaining Power of Buyers

- 3.5.3. Threat of New Entrants

- 3.5.4. Threat of Substitutes

- 3.5.5. Intensity of Rivalry

4. Global Electrochemical Hydrogen Compressor Market Overview

- 4.1. Market Size & Forecast, 2019-2029

- 4.1.1. By Value (USD Million)

- 4.2. Market Share & Forecast

- 4.2.1. By Type

- 4.2.1.1. Oil-based

- 4.2.1.2. Oil-free

- 4.2.2. By Technology

- 4.2.2.1. Single-stage

- 4.2.2.2. Multi-stage

- 4.2.3. By End User

- 4.2.3.1. Chemical

- 4.2.3.2. Oil & Gas

- 4.2.3.3. Utilities

- 4.2.3.4. Refueling Stations

- 4.2.3.5. Others

- 4.2.4. By Region

- 4.2.4.1. North America

- 4.2.4.2. Europe

- 4.2.4.3. Asia Pacific

- 4.2.4.4. Latin America

- 4.2.4.5. Middle East and Africa

- 4.2.1. By Type

5. North America Electrochemical Hydrogen Compressor Market

- 5.1.1. Market Size & Forecast, 2019-2029

- 5.1.2. By Value (USD Million)

- 5.2. Market Share & Forecast

- 5.2.1. By Type

- 5.2.2. By Technology

- 5.2.3. By End User

- 5.2.4. By Country

- 5.2.4.1. US

- 5.2.4.1.1. By Type

- 5.2.4.1.2. By Technology

- 5.2.4.1.3. By End User

- 5.2.4.2. Canada

- 5.2.4.2.1. By Type

- 5.2.4.2.2. By Technology

- 5.2.4.2.3. By End User

6. Europe Electrochemical Hydrogen Compressor Market

- 6.1. Market Size & Forecast, 2019-2029

- 6.1.1. By Value (USD Million)

- 6.2. Market Share & Forecast

- 6.2.1. By Type

- 6.2.2. By Technology

- 6.2.3. By End User

- 6.2.4. By Country

- 6.2.4.1. Germany

- 6.2.4.1.1. By Type

- 6.2.4.1.2. By Technology

- 6.2.4.1.3. By End User

- 6.2.4.2. UK

- 6.2.4.2.1. By Type

- 6.2.4.2.2. By Technology

- 6.2.4.2.3. By End User

- 6.2.4.3. Italy

- 6.2.4.3.1. By Type

- 6.2.4.3.2. By Technology

- 6.2.4.3.3. By End User

- 6.2.4.4. France

- 6.2.4.4.1. By Type

- 6.2.4.4.2. By Technology

- 6.2.4.4.3. By End User

- 6.2.4.5. Spain

- 6.2.4.5.1. By Type

- 6.2.4.5.2. By Technology

- 6.2.4.5.3. By End User

- 6.2.4.6. The Netherlands

- 6.2.4.6.1. By Type

- 6.2.4.6.2. By Technology

- 6.2.4.6.3. By End User

- 6.2.4.7. Belgium

- 6.2.4.7.1. By Type

- 6.2.4.7.2. By Technology

- 6.2.4.7.3. By End User

- 6.2.4.8. NORDIC Countries

- 6.2.4.8.1. By Type

- 6.2.4.8.2. By Technology

- 6.2.4.8.3. By End User

- 6.2.4.9. Rest of Europe

- 6.2.4.9.1. By Type

- 6.2.4.9.2. By Technology

- 6.2.4.9.3. By End User

7. Asia Pacific Electrochemical Hydrogen Compressor Market

- 7.1. Market Size & Forecast, 2019-2029

- 7.1.1. By Value (USD Million)

- 7.2. Market Share & Forecast

- 7.2.1. By Type

- 7.2.2. By Technology

- 7.2.3. By End User

- 7.2.4. By Country

- 7.2.4.1. China

- 7.2.4.1.1. By Type

- 7.2.4.1.2. By Technology

- 7.2.4.1.3. By End User

- 7.2.4.2. India

- 7.2.4.2.1. By Type

- 7.2.4.2.2. By Technology

- 7.2.4.2.3. By End User

- 7.2.4.3. Japan

- 7.2.4.3.1. By Type

- 7.2.4.3.2. By Technology

- 7.2.4.3.3. By End User

- 7.2.4.4. South Korea

- 7.2.4.4.1. By Type

- 7.2.4.4.2. By Technology

- 7.2.4.4.3. By End User

- 7.2.4.5. Australia & New Zealand

- 7.2.4.5.1. By Type

- 7.2.4.5.2. By Technology

- 7.2.4.5.3. By End User

- 7.2.4.6. Indonesia

- 7.2.4.6.1. By Type

- 7.2.4.6.2. By Technology

- 7.2.4.6.3. By End User

- 7.2.4.7. Malaysia

- 7.2.4.7.1. By Type

- 7.2.4.7.2. By Technology

- 7.2.4.7.3. By End User

- 7.2.4.8. Singapore

- 7.2.4.8.1. By Type

- 7.2.4.8.2. By Technology

- 7.2.4.8.3. By End User

- 7.2.4.9. Philippines

- 7.2.4.9.1. By Type

- 7.2.4.9.2. By Technology

- 7.2.4.9.3. By End User

- 7.2.4.10. Vietnam

- 7.2.4.10.1. By Type

- 7.2.4.10.2. By Technology

- 7.2.4.10.3. By End User

- 7.2.4.11. Rest of Asia Pacific

- 7.2.4.11.1. By Type

- 7.2.4.11.2. By Technology

- 7.2.4.11.3. By End User

8. Latin America Electrochemical Hydrogen Compressor Market

- 8.1. Market Size & Forecast, 2019-2029

- 8.1.1. By Value (USD Million)

- 8.2. Market Share & Forecast

- 8.2.1. By Type

- 8.2.2. By Technology

- 8.2.3. By End User

- 8.2.4. By Country

- 8.2.4.1. Brazil

- 8.2.4.1.1. By Type

- 8.2.4.1.2. By Technology

- 8.2.4.1.3. By End User

- 8.2.4.2. Mexico

- 8.2.4.2.1. By Type

- 8.2.4.2.2. By Technology

- 8.2.4.2.3. By End User

- 8.2.4.3. Argentina

- 8.2.4.3.1. By Type

- 8.2.4.3.2. By Technology

- 8.2.4.3.3. By End User

- 8.2.4.4. Peru

- 8.2.4.4.1. By Type

- 8.2.4.4.2. By Technology

- 8.2.4.4.3. By End User

- 8.2.4.5. Colombia

- 8.2.4.5.1. By Type

- 8.2.4.5.2. By Technology

- 8.2.4.5.3. By End User

- 8.2.4.6. Rest of Latin America

- 8.2.4.6.1. By Type

- 8.2.4.6.2. By Technology

- 8.2.4.6.3. By End User

9. Middle East and Africa Electrochemical Hydrogen Compressor Market

- 9.1. Market Size & Forecast, 2019-2029

- 9.1.1. By Value (USD Million)

- 9.2. Market Share & Forecast

- 9.2.1. By Type

- 9.2.2. By Technology

- 9.2.3. By End User

- 9.2.4. By Country

- 9.2.4.1. Saudi Arabia

- 9.2.4.1.1. By Type

- 9.2.4.1.2. By Technology

- 9.2.4.1.3. By End User

- 9.2.4.2. UAE

- 9.2.4.2.1. By Type

- 9.2.4.2.2. By Technology

- 9.2.4.2.3. By End User

- 9.2.4.3. Qatar

- 9.2.4.3.1. By Type

- 9.2.4.3.2. By Technology

- 9.2.4.3.3. By End User

- 9.2.4.4. Kuwait

- 9.2.4.4.1. By Type

- 9.2.4.4.2. By Technology

- 9.2.4.4.3. By End User

- 9.2.4.5. Iran

- 9.2.4.5.1. By Type

- 9.2.4.5.2. By Technology

- 9.2.4.5.3. By End User

- 9.2.4.6. South Africa

- 9.2.4.6.1. By Type

- 9.2.4.6.2. By Technology

- 9.2.4.6.3. By End User

- 9.2.4.7. Nigeria

- 9.2.4.7.1. By Type

- 9.2.4.7.2. By Technology

- 9.2.4.7.3. By End User

- 9.2.4.8. Kenya

- 9.2.4.8.1. By Type

- 9.2.4.8.2. By Technology

- 9.2.4.8.3. By End User

- 9.2.4.9. Egypt

- 9.2.4.9.1. By Type

- 9.2.4.9.2. By Technology

- 9.2.4.9.3. By End User

- 9.2.4.10. Morocco

- 9.2.4.10.1. By Type

- 9.2.4.10.2. By Technology

- 9.2.4.10.3. By End User

- 9.2.4.11. Algeria

- 9.2.4.11.1. By Type

- 9.2.4.11.2. By Technology

- 9.2.4.11.3. By End User

- 9.2.4.12. Rest of Middle East and Africa

- 9.2.4.12.1. By Type

- 9.2.4.12.2. By Technology

- 9.2.4.12.3. By End User

10. Competitive Landscape

- 10.1. List of Key Players and Their Offerings

- 10.2. Global Electrochemical Hydrogen Compressor Company Market Share Analysis, 2022

- 10.3. Competitive Benchmarking, By Operating Parameters

- 10.4. Key Strategic Developments (Mergers, Acquisitions, Partnerships, and others)

11. Impact of Covid-19 on Global Electrochemical Hydrogen Compressor Market

12. Company Profile (Company Overview, Financial Matrix, Competitive Landscape, Key Personnel, Key Competitors, Contact Address, Strategic Outlook, SWOT)

- 12.1. Atlas Copco AB

- 12.2. Burckhardt Compression AG

- 12.3. Fluitron, Inc.

- 12.4. Gardner Denver Nash, LLC

- 12.5. Howden Group

- 12.6. HAUG Sauer Kompressoren AG

- 12.7. NEUMAN & ESSER GROUP

- 12.8. Hydro-Pac, Inc.

- 12.9. Lenhardt & Wagner GmbH

- 12.10. PDC Machines Inc.

- 12.11. HyET Group

- 12.12. Black & Veatch Holding Company

- 12.13. Fortescue Future Industries

- 12.14. Nuvera Fuel Cells, LLC

- 12.15. Fuelcell Energy, Inc.

- 12.16. Skyre Inc.

- 12.17. Giner Inc.

- 12.18. Proton Technologies Canada Inc.

- 12.19. Keepwin Technology Hebei Co. Ltd.

- 12.20. Taizhou Toplong Electrical & Mechanical Co., Ltd.

- 12.21. Other Prominent Players

13. Key Strategic Recommendations

14. Research Methodology

- 14.1. Qualitative Research

- 14.1.1. Primary & Secondary Research

- 14.2. Quantitative Research

- 14.3. Market Breakdown & Data Triangulation

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.4. Breakdown of Primary Research Respondents, By Region

- 14.5. Assumptions & Limitations