|

|

市場調査レポート

商品コード

1802932

アグリテック向けデータ管理・分析市場- 世界および地域別分析:データ取得方法と支援技術、用途別、ソリューション別、地域別 - 分析と予測(2025年~2035年)Data Management and Analysis Market for Agritech - A Global and Regional Analysis: Focus on Data Capturing Methods and Supporting Technologies, Application, Product, and Regional Analysis - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| アグリテック向けデータ管理・分析市場- 世界および地域別分析:データ取得方法と支援技術、用途別、ソリューション別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年09月03日

発行: BIS Research

ページ情報: 英文 141 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アグリテック向けデータ管理・分析市場は、主に持続可能性と食糧安全保障に対するニーズの高まりにより、急成長しています。

市場の成長を増大させるもう1つの重要な要因は、気候変動に関連するリスクです。害虫、雑草、不安定な気象条件に関連するリスクにより、デジタル農業はもはやオプションではなく、農業に不可欠なものとなっています。それが直接的に市場を刺激しています。市場の高成長は、アプリケーション・ポートフォリオの多様化などの要因にも起因しています。農業とは別に最も明確に目に見えるアプリケーションは、家畜管理におけるデジタルツールの使用です。例えば、米国を拠点とするアグリテック企業であるPrecision Livestock Technologies社は2024年、予測分析の助けを借りて牛の栄養戦略を強化する目的で、AIベースの飼料摂取量モニタリング・ソリューションを発表しました。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価 | 35億7,400万米ドル |

| 2035年の予測 | 102億4,300万米ドル |

| CAGR | 11.1% |

しかし、アプリケーションが増加した後も、小規模農場にとっては初期費用が高くROIが不明確であること、断片的な規格や相互運用性の問題など、特定の要因によって市場の成長が妨げられています。普遍的に受け入れられているデータ・プロトコルや標準がないため、機器同士の通信が困難なのです。市場は、政府からの支援やアグリテック分野の民間組織による技術開拓により、課題に対処しています。

市場概要

アグリテック向けデータ管理・分析市場の収益は、2024年には32億150万米ドルでしたが、2035年には102億4,300万米ドルに達し、予測期間中(2025年~2035年)のCAGRは11.10%で推移すると予測されます。農家、農業関連企業、政策立案者が生産性の向上、資源効率の改善、食糧生産の持続可能性の確保を目指す中、アグリテック向けのデータ管理・分析は、世界的な農業変革の極めて重要な実現要因として浮上しています。このセクターは、AI、ML、IoTセンサー、衛星画像、クラウドベースのコンピューティングなどの先進技術を組み合わせて活用し、膨大な量の農場データとサプライチェーンデータを収集、処理、分析しています。これにより利害関係者は、作物の収量を向上させ、投入資材の無駄を削減し、天候の変動、害虫、市場の変動に伴うリスクを軽減する、データ主導の意思決定を行うことができます。

産業への影響

アグリテックのデータ管理・分析市場は、意思決定を経験ベースの判断からエビデンスベースのリアルタイム・インテリジェンスに移行することで、農業業界を再構築しています。土壌水分センサーやドローン画像から衛星天気予報や市場価格フィードに至るまで、複数のデータソースを統合することで、これらのプラットフォームは農家や農業関連企業がかつてない精度で活動できるようにしています。その結果、収量予測、投入資材の最適化、リスクの軽減が改善され、測定可能な生産性の向上が実現すると同時に、環境への影響も低減しています。

最も大きな影響のひとつは、資源効率です。AI主導の可変レート技術(VRT)推奨と予測灌漑スケジューリングは、生産者が肥料、農薬、水の使用量を2桁削減するのに役立っており、持続可能性目標や規制遵守要件に合致しています。また、新興市場の小規模農家は、モバイル・ファーストのアナリティクス・プラットフォームを活用して農学的アドバイスにアクセスし、回復力と市場参入を向上させています。

市場セグメンテーション:

セグメンテーション1:用途別

- 精密農業

- 林業

- 家畜管理

- 水産養殖

精密農業が市場をリード(用途別)

精密農業は、データ管理と分析の他のアプリケーション、または他のタイプの農業を凌駕しているが、それはある重要な理由のためです。精密農業は、GPS、IoT、リモートセンシングを利用して正確な量の投入物(水、肥料、農薬など)を散布し、無駄を省いて効率を高める。自動化された意思決定システムは、手作業による介入や人的ミスを最小限に抑えます。立地別作物管理(SSCM)により、農家は土地利用を拡大することなく、1ヘクタールあたりの生産量を増やすことができます。また、排出量、土壌浸食、二酸化炭素排出量、水の使用量を削減し、気候変動と土地の劣化という重大な問題に対処することができます。

この分野で起こっている技術開発も、トップランナーとしての地位に貢献しています。2025年には、DJIブラジルがソフトウェア製品「Software Drone Powered Farming」を発表しました。これは、ドローンを使った作物散布、マッピング、分析機能の拡張を紹介するもので、ブラジルで開催されたAgrishow2025で発表され、デジタル圃場作業のための新しいソフトウェアドローン統合を強調しました。

セグメンテーション2:ソリューション別

- フルスタックのデジタル農業プラットフォーム

- OEM統合データプラットフォーム

- 農学的意思決定支援スイート

- 精密灌漑および土壌健康管理プラットフォーム

- リモートセンシングと画像解析スイート

- 農場ERPおよび財務統合プラットフォーム

フルスタックのデジタル農業プラットフォームが市場を独占(ソリューション別)

フルスタックのデジタル農業プラットフォームは、データ収集や農学分析から農場運営、投入資材調達、サプライチェーン、市場連携まですべてを統合したエンドツーエンドのソリューションを提供するため、世界中で需要が高まっています。一点集中型のデジタル農業ソリューション(単なる天候アプリや収量予測ツールなど)とは異なり、フルスタック・プラットフォームは、農業バリューチェーン全体の多様な利害関係者に対し、シームレスで拡張性があり、実行可能なエコシステムを提供します。これは、精密農業、金融ツール、アドバイザリー、投入資材調達、サプライチェーン管理、生産物マーケティングを組み合わせたワンストップ・ソリューションであり、技術の断片化を減らします。すべての農場作業(土壌の健康状態、天候、作物のステージ、機械、市場価格)は、単一の真実の情報源を通じて接続され、リアルタイムの意思決定が改善されます。

多くの農業関連企業が、このソリューションを農業技術に組み込んでいます。Corteva Agriscience社のGranular Insightsは、農業経営の収益追跡を強化するために設計された農場管理ソフトウェア(FMS)です。生産者とアドバイザーが協力して計画、栽培、圃場分析を行うのに役立ちます。衛星画像、ビジュアル分析、履歴データなどの機能を利用することで、農家は収量実績や予測についてより詳しい情報を得ることができます。

セグメンテーション3:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

北米が市場をリード(地域別)

北米が市場をリードしています。同地域では持続可能な農業へのニーズが高く、これが農業におけるデジタル技術導入の最も大きな原動力となっているためです。資源保全と食糧安全保障への注力、気候変動への耐性のニーズの高まりも、同地域の市場を牽引しています。

北米では農業におけるデジタル技術の導入が急速に進んでおり、米国が同地域をリードしています。これは、米国政府が気候変動に対応した農作物のパートナーシップなど、気候変動に対応した農業の実践に向けたイニシアチブを取っているためです。また、米国はこの分野に多額の投資を行っています。例えば2022年、米国政府はデジタル農業プロジェクトに約31億米ドルを割り当てた。カナダ政府も、スマート農業のためのAI、ロボット工学、IoT、デジタル・プラットフォームを支援するプログラム「CAAIN(Canadian Agri-food Automation and Intelligence Network)」を立ち上げました。政府もデジタル農業に約4,950万米ドルを投資しました。メキシコでも、デジタル農業の急成長は政府の取り組みと資源最適化の必要性によって後押しされています。同国は2024年にAgTechプログラムを開始しました。

アグリテック向けデータ管理・分析市場の最近の動向

- 2022年、BASFはXarvio Field Managerを一部の農場経営に統合しました。この統合は、特に2022年のHortaの意思決定支援システム(DSS)と植物成長モデルの買収別、園芸分野におけるBASFのデジタル提供を拡大する広範な戦略の一環でした。

- 2025年初頭、BASFはXarvio Field Manager for Fruits &Veggiesを発表し、欧州とトルコのワインとテーブルグレープの生産者をターゲットにしました。

- 2025年8月、英国の新興企業Spottaは、もともとホテル用に設計された害虫モニタリングIoTセンサーを、ナツメヤシ農園におけるアカヤシゾウムシの侵入をリアルタイムで検出するために応用しました。

当レポートは、アグリテック向けデータ管理・分析市場を用途別、ソリューション別に詳細に分析しています。精密農業、林業、家畜管理、水産養殖など複数の用途向けに、フルスタックのデジタル農業プラットフォーム、OEM統合データプラットフォーム、農学的意思決定支援スイート、精密灌漑・土壌健全性管理プラットフォーム、リモートセンシング・画像分析スイート、農場ERP・財務統合プラットフォームなど、さまざまなソリューションを取り上げています。当レポートは、イノベーターが現在の提供状況におけるギャップを特定し、製品ロードマップを適応させることで、差別化され、拡張性があり、規制状況に準拠したソリューションを提供するのに役立ちます。

アグリテック向けデータ管理・分析市場は急速に発展しており、大手企業は市場ポジションを強化するため、生産能力の拡大、戦略的提携、試験的導入に取り組んでいます。当レポートは、こうした開発を追跡し、主要企業がどのようにアプリケーション分野に参入または拡大しているかについての洞察を提供します。当レポートは、マーケティングチームが高成長分野を特定し、価値提案をエンドユーザーの期待に合致させ、地域力学と技術的準備に基づき的を絞った市場参入戦略を策定する際の支援となります。

徹底的な競合情勢を提供し、製品提供、技術革新のパイプライン、パートナーシップ、拡大計画に基づいて主要プレーヤーをプロファイリングしています。競合ベンチマーキングにより、読者は製品タイプやアプリケーション分野での各社の位置付けを評価することができます。

主要市場参入企業と競合の要約

アグリテック向けデータ管理・分析市場は、農業セクターの精密農業、IoT対応モニタリング、AI搭載意思決定支援ツールの導入加速に牽引され、力強い牽引力を増しています。2023年から2025年にかけて、この分野では、土壌センサー、衛星画像、天気予報、サプライチェーン入力などのマルチソースデータストリームが、生産者や農業関連企業にリアルタイムの洞察を提供する統合プラットフォームに統合されつつあります。

2025年3月、Climate LLC(バイエル)は、機械学習主導の収量予測と局所的な病害虫リスクモデリングを統合した次世代Climate FieldView分析モジュールを発表し、農家がシーズン中により正確な意思決定を行えるようにしました。2025年2月、TELUS Agricultureは、生産分析と川下トレーサビリティを結びつけ、生産性とコンプライアンスの両方の要求に対応する、農場から食品までの完全統合サプライチェーンデータプラットフォームを発表しました。SemiosはAgworldと共同で、2025年1月に果樹園とブドウ園の分析スイートを拡張し、リアルタイムの害虫捕獲データと高価値作物の水ストレス監視を統合しました。

この市場で設立された著名な企業は以下の通りです。

- Climate LLC

- TELUS Agriculture

- SemiosBio Technologies Inc.

- Deere & Company

- Trimble Inc.

- Corteva (Granular)

- Bushel Inc.

- Ag Leader Technology

- AgriWebb

- Conservis

- BASF (xarvio)

- Yara International (Atfarm, etc.)

- CropX Inc.

- Arable Labs

- Valmont Industries (Valley)

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 市場力学

- 動向

- マルチソースデータ統合とAI/ML分析

- ハイパーローカル監視のためのIoTとエッジ対応スマートセンサーネットワーク

- LLM意思決定システムとSAGDAの導入

- 市場促進要因

- 炭素市場の成長と検証可能な排出データの必要性

- 農業データと金融・保険サービスの統合

- 気候変動リスクの高まり

- 世界中で家畜・家禽管理を拡大

- 市場の課題

- 小規模農家にとって、初期費用が高く、投資収益率が不明確

- 断片化されたデータ標準とプラットフォーム間の相互運用性の問題

- サードパーティの統合と組み込み技術による目に見えないデータの外部性

- 市場機会

- リアルタイム生体認証を用いた家畜向けAI栄養モデリング

- 技術開発

- 農業データイノベーションのための共同研究開発エコシステム

- 規制および政策の影響分析

- 特許分析

- 特許出願動向(国別)

- 特許出願動向(企業別)

- スタートアップの情勢

- 現在の採用状況

第2章 用途

- 用途のサマリー

- アグリテック向けデータ管理・分析市場(用途別)

第3章 製品

- 製品のサマリー

- アグリテック向けデータ管理・分析市場(ソリューション別)

第4章 地域

- 地域サマリー

- 北米

- 地域市場

- 米国

- カナダ

- メキシコ

- 欧州

- 地域市場

- ドイツ

- フランス

- ロシア

- スペイン

- 英国

- トルコ

- その他

- アジア太平洋

- 地域市場

- 中国

- 日本

- インド

- オーストラリア

- インドネシア

- その他

- その他の地域

- 地域市場

- 南米

- 中東・アフリカ

第5章 市場-競合ベンチマーキングと企業プロファイル

- Climate LLC

- TELUS

- SemiosBio Technologies Inc.

- Deere & Company

- Trimble Inc.

- Corteva

- Bushel Inc.

- Ag Leader Technology

- AgriWebb

- Conservis

- BASF

- Yara

- CropX Inc.

- Arable

- Valmont Industries, Inc.

第6章 調査手法

List of Figures

- Figure 1: Data Management and Analysis Market for Agritech (by Scenario), $Million, 2024, 2028, and 2035

- Figure 2: Global Data Management and Analysis Market for Agritech, 2024-2035

- Figure 3: Global Market Snapshot, 2024

- Figure 4: Global Data Management and Analysis Market for Agritech, $Million, 2024 and 2035

- Figure 5: Data Management and Analysis Market for Agritech (by Application), $Million, 2024, 2028, and 2035

- Figure 6: Data Management and Analysis Market for Agritech (by Solution), $Million, 2024, 2028, and 2035

- Figure 7: Data Management and Analysis Market for Agritech Segmentation

- Figure 8: Patent Filing Trend, by Country (January 2022-June 2025)

- Figure 9: Patent Filing Trend, by Company (January 2022-June 2025)

- Figure 10: Penetration of Digital Agriculture in Total Utilized Agricultural Land

- Figure 11: Data Management and Analysis Market for Agritech, by Application, $Million, 2024, 2030, and 2035

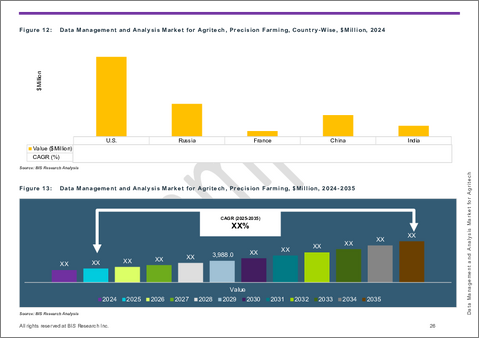

- Figure 12: Data Management and Analysis Market for Agritech, Precision Farming, Country-Wise, $Million, 2024

- Figure 13: Data Management and Analysis Market for Agritech, Precision Farming, $Million, 2024-2035

- Figure 14: Data Management and Analysis Market for Agritech, Forestry, Country-Wise, $Million, 2024

- Figure 15: Data Management and Analysis Market for Agritech, Forestry, $Million, 2024-2035

- Figure 16: Data Management and Analysis Market for Agritech, Livestock Management, Country-Wise, $Million, 2024

- Figure 17: Data Management and Analysis Market for Agritech, Livestock Management, $Million, 2024-2035

- Figure 18: Data Management and Analysis Market for Agritech, Aquaculture, Country-Wise, $Million, 2024

- Figure 19: Data Management and Analysis Market for Agritech, Aquaculture, $Million, 2024-2035

- Figure 20: Data Management and Analysis Market for Agritech, by Solution, $Million, 2024, 2030, and 2035

- Figure 21: Data Management and Analysis Market for Agritech, Full-Stack Digital Farming Platforms, Country-Wise, $Million, 2024

- Figure 22: Data Management and Analysis Market for Agritech, Full-Stack Digital Farming Platforms, $Million, 2024-2035

- Figure 23: Data Management and Analysis Market for Agritech, OEM-Integrated Data Platforms, Country Wise, $Million, 2024

- Figure 24: Data Management and Analysis Market for Agritech, OEM-Integrated Data Platforms, $Million, 2024-2035

- Figure 25: Data Management and Analysis Market for Agritech, Agronomic Decision Support Suites, Country-Wise, $Million, 2024

- Figure 26: Data Management and Analysis Market for Agritech, Agronomic Decision Support Suites, $Million, 2024-2035

- Figure 27: Data Management and Analysis Market for Agritech, Precision Irrigation and Soil Health Management Platforms, Country-Wise, $Million, 2024

- Figure 28: Data Management and Analysis Market for Agritech, Precision Irrigation and Soil Health Management Platforms, $Million, 2024-2035

- Figure 29: Data Management and Analysis Market for Agritech, Remote Sensing and Imagery Analysis Suites, Country-Wise, $Million, 2024

- Figure 30: Data Management and Analysis Market for Agritech, Remote Sensing and Imagery Analysis Suites, $Million, 2024-2035

- Figure 31: Data Management and Analysis Market for Agritech, Farm ERP and Finance-Integrated Platforms, Country-Wise, $Million, 2024

- Figure 32: Data Management and Analysis Market for Agritech, Farm ERP and Finance-Integrated Platforms, $Million, 2024-2035

- Figure 33: Strategic Initiatives, January 2022-April 2025

- Figure 34: Data Triangulation

- Figure 35: Top-Down and Bottom-Up Approach

- Figure 36: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Competitive Landscape Snapshot

- Table 3: Software Used for Data Management and Analysis in Hyperlocal Monitoring

- Table 4: Core Components of IoT-Enabled Sensor Networks

- Table 5: Ag-Tech Software Platforms for Carbon Trading

- Table 6: Key Capabilities of Data Management Software

- Table 7: How Digital Technologies Help in Sustainability and Food Security

- Table 8: Projected Changes in Pest and Disease Risks across Regions

- Table 9: Software Trends for Digital Livestock Management

- Table 10: Financial Challenges for Data Management Services in Digital Agriculture

- Table 11: Latest Data Management Software Product Launches for Digital Agriculture

- Table 12: Rules and Regulations Set by the Respective Governments and Related Incentives

- Table 13: New Businesses in Data Analytics - Agritech

- Table 14: Digital Aquaculture Value Chain

- Table 15: Key Industry Players and their Product Portfolios

- Table 16: Key Functions of OEM-Integrated Data Platforms and Impact on Digital Agriculture

- Table 17: Popular Agronomic Decision Support Suites

- Table 18: Popular and Trusted Software Tools in the Precision Irrigation Domain

- Table 19: Popular and Trusted Software Tools in the Soil Health Monitoring Domain

- Table 20: Popular Remote Sensing and Imagery Analysis Suites

- Table 21: Popular Farm ERP and Finance-Integrated Platforms

- Table 22: Data Management and Analysis Market for Agritech (by Region), $Million, 2024-2035

- Table 23: North America Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 24: North America Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 25: U.S. Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 26: U.S. Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 27: Canada Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 28: Canada Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 29: Mexico Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 30: Mexico Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 31: Europe Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 32: Europe Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 33: Germany Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 34: Germany Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 35: France Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 36: France Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 37: Russia Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 38: Russia Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 39: Spain Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 40: Spain Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 41: U.K. Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 42: U.K. Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 43: Turkey Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 44: Turkey Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 45: Rest-of-Europe Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 46: Rest-of-Europe Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 47: Asia-Pacific Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 48: Asia-Pacific Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 49: China Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 50: China Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 51: Japan Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 52: Japan Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 53: India Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 54: India Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 55: Australia Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 56: Australia Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 57: Indonesia Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 58: Indonesia Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 59: Rest-of-Asia-Pacific Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 60: Rest-of-Asia-Pacific Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 61: Rest-of-the-World Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 62: Rest-of-the-World Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 63: South America Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 64: South America Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 65: Middle East and Africa Data Management and Analysis Market for Agritech (by Application), $Million, 2024-2035

- Table 66: Middle East and Africa Data Management and Analysis Market for Agritech (by Solution), $Million, 2024-2035

- Table 67: Global Market Share, 2024

This report can be delivered within 1 working day.

Introduction of Data Management and Analysis Market for Agritech

The data management and analysis market for agritech is growing at a pace mainly due to the growing need for sustainability and food security. The other significant factor that contributes to the augmented growth of the market is the risk associated with climate change. The risks related to pests, weeds, and volatile weather conditions make digital agriculture no longer optional; it has become an indispensable part of agriculture. It directly stimulates the market. The high market growth is also attributed to factors such as the diversification in the application portfolio. The most explicitly visible application, apart from farming, is the use of digital tools in livestock management. For instance, in 2024, Precision Livestock Technologies, a U.S.-based agritech organization, launched an AI-based feed intake monitoring solution, with the motive of enhancing cattle nutrition strategies with the help of predictive analytics.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $3,574.0 Million |

| 2035 Forecast | $10,243.0 Million |

| CAGR | 11.1% |

However, even after increasing applications, the market growth has been hampered by certain factors such as high up-front costs and unclear ROI for smaller farms, and fragmented standards and interoperability issues. In the absence of universally accepted data protocols or standards, it is difficult for the devices to communicate with each other. The market is still able to cope with the challenges with the help of support from governments and technological developments by private organizations in the agritech arena.

Market Overview

The data management and analysis market for agritech's revenue was $3,201.5 million in 2024, and it is expected to reach $10,243.0 million by 2035, advancing at a CAGR of 11.10% during the forecast period (2025-2035). Data management and analysis for agritech has emerged as a pivotal enabler of the global agricultural transformation, as farmers, agribusinesses, and policymakers seek to increase productivity, improve resource efficiency, and ensure sustainability in food production. The sector leverages a combination of advanced technologies, such as AI, ML, IoT sensors, satellite imagery, and cloud-based computing, to collect, process, and analyze vast volumes of farm and supply chain data. This enables stakeholders to make data-driven decisions that enhance crop yields, reduce input waste, and mitigate risks associated with weather variability, pests, and market fluctuations.

Industrial Impact

The data management and analysis market for agritech is reshaping the agricultural industry by transitioning decision-making from experience-based judgment to evidence-based, real-time intelligence. By integrating multiple data sources, ranging from soil moisture sensors and drone imagery to satellite weather forecasts and market price feeds, these platforms are enabling farmers and agribusinesses to operate with unprecedented precision. The resulting improvements in yield forecasting, input optimization, and risk mitigation are delivering measurable productivity gains while lowering environmental impact.

One of the most significant impacts is on resource efficiency. AI-driven variable rate technology (VRT) recommendations and predictive irrigation scheduling are helping producers reduce fertilizer, pesticide, and water usage by double-digit percentages, aligning with sustainability targets and regulatory compliance requirements. Large-scale commercial farms are using advanced analytics to benchmark performance across fields and seasons, while smallholders in emerging markets are leveraging mobile-first analytics platforms to access agronomic advice, improving resilience and market participation.

Market Segmentation:

Segmentation 1: by Application

- Precision Farming

- Forestry

- Livestock Management

- Aquaculture

Precision Farming Leads the Market (by Application)

Precision farming has outpaced other applications of data management and analysis, or other types of agriculture, due to one significant reason, i.e., lower input costs and higher profitability than other categories. Precision farming uses GPS, IoT, and remote sensing to apply exact amounts of inputs (such as water, fertilizer, and pesticides), reducing waste and increasing efficiency. Automated decision-making systems minimize manual intervention and human error. With site-specific crop management (SSCM), farmers can increase output per hectare without expanding land use. Also, it helps reduce emissions, soil erosion, carbon footprint, and water usage, addressing critical issues of climate change and land degradation.

The technological developments happening in the field also contribute to its position as the frontrunner. In 2025, a software product, "Software Drone Powered Farming," was launched by DJI Brazil. It showcased expanded drone-based crop spraying, mapping, and analytics capabilities, unveiled at Agrishow?2025 in Brazil, highlighting new software drone integration for digital field operations.

Segmentation 2: by Solution

- Full-Stack Digital Farming Platforms

- OEM-Integrated Data Platforms

- Agronomic Decision Support Suites

- Precision Irrigation and Soil Health Management Platforms

- Remote Sensing and Imagery Analysis Suites

- Farm ERP and Finance-Integrated Platforms

Full-Stack Digital Farming Platforms Dominate the Market (by Solution)

Full-stack digital farming platforms are in growing demand across the world because they offer integrated, end-to-end solutions, unifying everything from data collection and agronomic analytics to farm operations, input sourcing, supply chain, and market linkages. Unlike single-point digital ag solutions (e.g., just weather apps or yield prediction tools), full-stack platforms provide a seamless, scalable, and actionable ecosystem for diverse stakeholders across the agricultural value chain. It is a one-stop solution that combines precision agriculture, financial tools, advisory, input procurement, supply chain management, and output marketing, reducing tech fragmentation. All farm operations (soil health, weather, crop stage, machinery, and market pricing) are connected via a single source of truth, improving real-time decisions.

Many agribusinesses are integrating the solution into their farming techniques. Granular Insights by Corteva Agriscience is farm management software (FMS) designed to enhance the profitability tracking of agricultural operations. It helps growers and advisors collaborate on planning, growing, and analyzing fields. Using features such as satellite imagery, visual analysis, and historical data, farmers can be more informed about yield performance and predictions.

Segmentation 3: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

North America Leads the Market (by Region)

North America is the leader in the market. This is because the need for sustainable farming is high in the region, which is the most significant driver for the adoption of digital technologies in agriculture. The focus on resource conservation and food security, and the surging need for climate resilience, are also driving the market in the region.

North America is swiftly adopting digital technologies in agriculture, with the U.S. leading in the region. This is because the U.S. government has taken initiatives for climate-smart farming practices, such as partnerships for climate-smart commodities. Also, the country has been investing heavily in this field. For instance, in 2022, the U.S. government allocated around $3.1 billion for digital agricultural projects. The Canadian government also launched a program, "Canadian Agri-food Automation and Intelligence Network (CAAIN)" to support AI, robotics, IoT, and digital platforms for smart agriculture. The government also invested around $49.5 million in digital agriculture. In Mexico, the rapid growth of digital agriculture has also been fueled by the government efforts and the need for resource optimization. The country launched an AgTech program in 2024.

Recent Developments in the Data Management and Analysis Market for Agritech

- In 2022, BASF integrated Xarvio Field Manager into select farm operations. This integration was part of a broader strategy to expand BASF's digital offerings in the horticultural sector, particularly with the acquisition of Horta's Decision Support System (DSS) and plant growth models in 2022.

- In early 2025, BASF unveiled Xarvio Field Manager for Fruits & Veggies, targeting wine and table grape growers in Europe and Turkiye.

- In August 2025, U.K. startup Spotta adapted its pest-monitoring IoT sensors, originally designed for hotels, to detect red palm weevil infestations in date plantations in real-time.

How can this report add value to an organization?

Product/Innovation Strategy: This report provides a detailed analysis of the data management and analysis market for agritech, segmented by application and solution. It covers various solutions, such as full-stack digital farming platforms, OEM-integrated data platforms, agronomic decision support suites, precision irrigation and soil health management platforms, remote sensing and imagery analysis suites, and farm ERP and finance-integrated platforms, for several applications such as precision farming, forestry, livestock management, and aquaculture. The report helps innovators identify gaps in the current offering landscape and adapt product roadmaps to deliver differentiated, scalable, and regulatory-compliant solutions.

Growth/Marketing Strategy: The data management and analysis market for agritech has been rapidly evolving, with major players engaging in capacity expansion, strategic alliances, and pilot deployments to strengthen their market position. This report tracks those developments and provides insights into how key companies are entering or expanding into application segments. It supports marketing teams in identifying high-growth sectors, aligning value propositions with end-user expectations, and crafting targeted go-to-market strategies based on regional dynamics and technological readiness.

Competitive Strategy: A thorough competitive landscape is provided, profiling leading players based on their product offerings, innovation pipelines, partnerships, and expansion plans. Competitive benchmarking enables readers to evaluate how companies are positioned across product types and application areas.

Research Methodology

Data Sources

Primary Data Sources

The primary sources involve industry experts from the data management and analysis market for agritech and various stakeholders in the ecosystem. Respondents, including CEOs, vice presidents, marketing directors, and technology and innovation directors, have been interviewed to gather and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of report segmentations and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of several categories

- percentage split of individual markets for geographical analysis

Secondary Data Sources

This research study involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to core data sources, the study referenced insights from reputable organizations and websites, such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), National Institute of Food and Agriculture (NIFA), Farm Bureau Federation (FBF), Canadian Agri-Food Automation and Intelligence Network (CAAIN), Smart Agriculture Council Mexico, Ministry of Agriculture, Food and Rural Affairs (MAFRA), Korea National Agricultural Cooperative Federation (NACF), Ministry of Agriculture and Rural Affairs (MARA), International Cooperative Agricultural Organization (ICAO), and others, to understand trends in the adoption of data management and analysis solutions for agritech.

Secondary research has been done to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players in the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Data Triangulation

This research study utilizes extensive secondary sources, including certified publications, articles by recognized authors, white papers, company annual reports, directories, and major databases, to collect useful and effective information for a comprehensive, technical, market-oriented, and commercial study of the data management and analysis market for agritech.

The process of market engineering involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes has been explained in further sections). A primary research study has been undertaken to gather information and validate market numbers for segmentation types and industry trends among key players in the market.

Key Market Players and Competition Synopsis

The data management and analysis market for agritech has been gaining strong traction, driven by the agriculture sector's accelerated adoption of precision farming, IoT-enabled monitoring, and AI-powered decision support tools. Between 2023 and 2025, the sector has witnessed an increasing integration of multi-source data streams, including soil sensors, satellite imagery, weather forecasts, and supply chain inputs, into unified platforms that provide real-time insights for growers and agribusinesses.

In March 2025, Climate LLC (Bayer) launched a next-generation Climate FieldView analytics module integrating machine learning-driven yield prediction with localized pest and disease risk modeling, enabling farmers to make more accurate in-season decisions. In February 2025, TELUS Agriculture unveiled its fully integrated farm-to-food supply chain data platform, connecting production analytics with downstream traceability, addressing both productivity and compliance demands. Semios, in collaboration with Agworld, expanded its orchard and vineyard analytics suite in January 2025, integrating real-time pest trapping data with water stress monitoring for high-value crops.

Some prominent names established in this market are:

- Climate LLC

- TELUS Agriculture

- SemiosBio Technologies Inc.

- Deere & Company

- Trimble Inc.

- Corteva (Granular)

- Bushel Inc.

- Ag Leader Technology

- AgriWebb

- Conservis

- BASF (xarvio)

- Yara International (Atfarm, etc.)

- CropX Inc.

- Arable Labs

- Valmont Industries (Valley)

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Market Dynamics

- 1.1.1 Trends, Drivers, Challenges, and Opportunities: Current and Future Impact Assessment

- 1.2 Trends

- 1.2.1 Multi-Source Data Integration and AI/ML Analytics

- 1.2.2 IoT and Edge-Enabled Smart Sensor Networks for Hyperlocal Monitoring

- 1.2.3 Introduction of LLM Decision Systems and SAGDA

- 1.3 Market Drivers

- 1.3.1 Growth of Carbon Markets and Need for Verifiable Emissions Data

- 1.3.2 Integration of Agriculture Data with Financial and Insurance Services

- 1.3.3 Rising Climate Change Risks

- 1.3.4 Livestock and Poultry Management Expansion across the Globe

- 1.4 Market Challenges

- 1.4.1 High Up-Front Costs and Unclear ROI for Small Farms

- 1.4.2 Fragmented Data Standards and Interoperability Issues between Platforms

- 1.4.3 Invisible Data Externalities from Third-Party Integrations and Embedded Technologies

- 1.5 Market Opportunities

- 1.5.1 AI-Powered Nutritional Modeling for Livestock Using Real-Time Biometrics

- 1.5.2 Technological Developments

- 1.5.3 Collaborative R&D Ecosystems for Agricultural Data Innovation

- 1.6 Regulatory and Policy Impact Analysis

- 1.7 Patent Analysis

- 1.7.1 Patent Filing Trend (by Country)

- 1.7.2 Patent Filing Trend (by Company)

- 1.8 Start-Up Landscape

- 1.9 Current State of Adoption

2 Application

- 2.1 Application Summary

- 2.1.1 Data Management and Analysis Market for Agritech (by Application)

- 2.1.1.1 Precision Farming

- 2.1.1.2 Forestry

- 2.1.1.3 Livestock Management

- 2.1.1.4 Aquaculture

- 2.1.1 Data Management and Analysis Market for Agritech (by Application)

3 Products

- 3.1 Product Summary

- 3.1.1 Data Management and Analysis Market for Agritech (by Solution)

- 3.1.1.1 Full-Stack Digital Farming Platforms

- 3.1.1.2 OEM-Integrated Data Platforms

- 3.1.1.3 Agronomic Decision Support Suites

- 3.1.1.4 Precision Irrigation and Soil Health Management Platforms

- 3.1.1.5 Remote Sensing and Imagery Analysis Suites

- 3.1.1.6 Farm ERP and Finance-Integrated Platforms

- 3.1.1 Data Management and Analysis Market for Agritech (by Solution)

4 Region

- 4.1 Regional Summary

- 4.2 North America

- 4.2.1 Regional Market

- 4.2.1.1 Application

- 4.2.1.2 Product

- 4.2.2 U.S.

- 4.2.2.1 Application

- 4.2.2.2 Product

- 4.2.3 Canada

- 4.2.3.1 Application

- 4.2.3.2 Product

- 4.2.4 Mexico

- 4.2.4.1 Application

- 4.2.4.2 Product

- 4.2.1 Regional Market

- 4.3 Europe

- 4.3.1 Regional Market

- 4.3.1.1 Application

- 4.3.1.2 Product

- 4.3.2 Germany

- 4.3.2.1 Application

- 4.3.2.2 Product

- 4.3.3 France

- 4.3.3.1 Application

- 4.3.3.2 Product

- 4.3.4 Russia

- 4.3.4.1 Application

- 4.3.4.2 Product

- 4.3.5 Spain

- 4.3.5.1 Application

- 4.3.5.2 Product

- 4.3.6 U.K.

- 4.3.6.1 Application

- 4.3.6.2 Product

- 4.3.7 Turkey

- 4.3.7.1 Application

- 4.3.7.2 Product

- 4.3.8 Rest-of-Europe

- 4.3.8.1 Application

- 4.3.8.2 Product

- 4.3.1 Regional Market

- 4.4 Asia-Pacific

- 4.4.1 Regional Market

- 4.4.1.1 Application

- 4.4.1.2 Product

- 4.4.2 China

- 4.4.2.1 Application

- 4.4.2.2 Product

- 4.4.3 Japan

- 4.4.3.1 Application

- 4.4.3.2 Product

- 4.4.4 India

- 4.4.4.1 Application

- 4.4.4.2 Product

- 4.4.5 Australia

- 4.4.5.1 Application

- 4.4.5.2 Product

- 4.4.6 Indonesia

- 4.4.6.1 Application

- 4.4.6.2 Product

- 4.4.7 Rest-of-Asia-Pacific

- 4.4.7.1 Application

- 4.4.7.2 Product

- 4.4.1 Regional Market

- 4.5 Rest-of-the-World

- 4.5.1 Regional Market

- 4.5.1.1 Application

- 4.5.1.2 Product

- 4.5.2 South America

- 4.5.2.1 Application

- 4.5.2.2 Product

- 4.5.3 Middle East and Africa

- 4.5.3.1 Application

- 4.5.3.2 Product

- 4.5.1 Regional Market

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Climate LLC

- 5.1.1 Overview

- 5.1.2 Top Products/Product Portfolio

- 5.1.3 Top Competitors

- 5.1.4 Target Customers

- 5.1.5 Key Personal

- 5.1.6 Analyst View

- 5.1.7 Market Share, 2024

- 5.2 TELUS

- 5.2.1 Overview

- 5.2.2 Top Products/Product Portfolio

- 5.2.3 Top Competitors

- 5.2.4 Target Customers

- 5.2.5 Key Personal

- 5.2.6 Analyst View

- 5.2.7 Market Share, 2024

- 5.3 SemiosBio Technologies Inc.

- 5.3.1 Overview

- 5.3.2 Top Products/Product Portfolio

- 5.3.3 Top Competitors

- 5.3.4 Target Customers

- 5.3.5 Key Personal

- 5.3.6 Analyst View

- 5.3.7 Market Share, 2024

- 5.4 Deere & Company

- 5.4.1 Overview

- 5.4.2 Top Products/Product Portfolio

- 5.4.3 Top Competitors

- 5.4.4 Target Customers

- 5.4.5 Key Personal

- 5.4.6 Analyst View

- 5.4.7 Market Share, 2024

- 5.5 Trimble Inc.

- 5.5.1 Overview

- 5.5.2 Top Products/Product Portfolio

- 5.5.3 Top Competitors

- 5.5.4 Target Customers

- 5.5.5 Key Personal

- 5.5.6 Analyst View

- 5.5.7 Market Share, 2024

- 5.6 Corteva

- 5.6.1 Overview

- 5.6.2 Top Products/Product Portfolio

- 5.6.3 Top Competitors

- 5.6.4 Target Customers

- 5.6.5 Key Personal

- 5.6.6 Analyst View

- 5.6.7 Market Share, 2024

- 5.7 Bushel Inc.

- 5.7.1 Overview

- 5.7.2 Top Products/Product Portfolio

- 5.7.3 Top Competitors

- 5.7.4 Target Customers

- 5.7.5 Key Personal

- 5.7.6 Analyst View

- 5.7.7 Market Share, 2024

- 5.8 Ag Leader Technology

- 5.8.1 Overview

- 5.8.2 Top Products/Product Portfolio

- 5.8.3 Top Competitors

- 5.8.4 Target Customers

- 5.8.5 Key Personal

- 5.8.6 Analyst View

- 5.8.7 Market Share, 2024

- 5.9 AgriWebb

- 5.9.1 Overview

- 5.9.2 Top Products/Product Portfolio

- 5.9.3 Top Competitors

- 5.9.4 Target Customers

- 5.9.5 Key Personal

- 5.9.6 Analyst View

- 5.9.7 Market Share, 2024

- 5.1 Conservis

- 5.10.1 Overview

- 5.10.2 Top Products/Product Portfolio

- 5.10.3 Top Competitors

- 5.10.4 Target Customers

- 5.10.5 Key Personal

- 5.10.6 Analyst View

- 5.10.7 Market Share, 2024

- 5.11 BASF

- 5.11.1 Overview

- 5.11.2 Top Products/Product Portfolio

- 5.11.3 Top Competitors

- 5.11.4 Target Customers

- 5.11.5 Key Personal

- 5.11.6 Analyst View

- 5.11.7 Market Share, 2024

- 5.12 Yara

- 5.12.1 Overview

- 5.12.2 Top Products/Product Portfolio

- 5.12.3 Top Competitors

- 5.12.4 Target Customers

- 5.12.5 Key Personal

- 5.12.6 Analyst View

- 5.12.7 Market Share, 2024

- 5.13 CropX Inc.

- 5.13.1 Overview

- 5.13.2 Top Products/Product Portfolio

- 5.13.3 Top Competitors

- 5.13.4 Target Customers

- 5.13.5 Key Personal

- 5.13.6 Analyst View

- 5.13.7 Market Share, 2024

- 5.14 Arable

- 5.14.1 Overview

- 5.14.2 Top Products/Product Portfolio

- 5.14.3 Top Competitors

- 5.14.4 Target Customers

- 5.14.5 Key Personal

- 5.14.6 Analyst View

- 5.14.7 Market Share, 2024

- 5.15 Valmont Industries, Inc.

- 5.15.1 Overview

- 5.15.2 Top Products/Product Portfolio

- 5.15.3 Top Competitors

- 5.15.4 Target Customers

- 5.15.5 Key Personal

- 5.15.6 Analyst View

- 5.15.7 Market Share, 2024

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast