|

|

市場調査レポート

商品コード

1800748

アジア太平洋の架空送電線検査市場:資産別、エンドユーザー別、ソリューション別、提供方法別、電圧別地域別 - 分析と予測(2025年~2035年)Asia-Pacific Overhead Line Inspection Market: Focus on Application, Product, and Country - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋の架空送電線検査市場:資産別、エンドユーザー別、ソリューション別、提供方法別、電圧別地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年08月30日

発行: BIS Research

ページ情報: 英文 81 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の架空送電線検査の市場規模は、2024年の12億7,100万米ドルから2035年には27億8,100万米ドルに達し、予測期間の2025年~2035年のCAGRは7.31%になると予測されています。

アジア太平洋の架空送電線検査市場は、地域全体で継続的に成長する送電網の安全性、有効性、信頼性にますます依存しています。この業界は、都市化、老朽化したインフラを維持する必要性、電力需要の増加などの要因により、着実に拡大しています。点検精度を高め、ダウンタイムを最小限に抑え、メンテナンスコストを最大化するため、公益事業者やサービスプロバイダーは、ドローン、人工知能、機械学習などの最先端技術を導入しています。これらのソリューションは、混雑した大都市から孤立した手の届きにくい場所まで、アジア太平洋のさまざまな地域で特に役立っています。最先端の検査技術の採用は、スマートグリッドプロジェクト、再生可能エネルギー統合、グリッド近代化構想への政府支出によってさらに加速しています。予測分析、リアルタイムのモニタリング、自動化された検査は、ユーティリティ企業の業務効率を高め、電力の安定供給を保証する上で役立っています。架空送電線の定期的な検査と監視は、この地域がよりクリーンなエネルギーとより堅牢なインフラを目指すようになるにつれ、戦略的な目標として浮上してきました。その結果、アジアの架空送電線検査市場は急速に開発され、現地企業と国際的なテクノロジー・サプライヤーの双方に市場開拓の可能性をもたらしています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価 | 13億7,340万米ドル |

| 2035年予測 | 27億8,100万米ドル |

| CAGR | 7.31% |

アジア太平洋では、各国が既存の送配電網の開発と更新に力を入れているため、架空送電線検査市場が大幅に拡大しています。信頼性が高く効果的な検査ソリューションへのニーズは、再生可能エネルギーの大規模統合、電力需要の増加、急速な都市化などの要因によって高まっています。この業界は歴史的に人による点検とヘリコプターによる調査が主流だったが、赤外線サーモグラフィ、LiDARマッピング、衛星モニタリング、ドローンによる空中点検、AI主導の分析など、より高度な技術への移行傾向が顕著になっています。公益事業者は、危険な状況下での作業員の安全性を高め、検査コストを削減し、精度を向上させるために、これらの技術を利用しています。

遠く離れた到達困難な農村地域と人口密度の高い都市中心部の両方を含むアジア太平洋地域の不均一な地形は、明確な機会を生み出しています。送電網の回復力を高め、ダウンタイムを減らすために、政府と公益事業会社はデジタルツインテクノロジー、自動ドローン、植生管理システムの導入を進めています。有利な法的枠組みとスマートグリッド開発への投資により、中国、インド、日本、オーストラリアなどの国々が最先端の検査技術の採用の先陣を切っています。アジア太平洋の架空送電線検査市場は、持続可能性、エネルギー効率、再生可能エネルギーの統合への注目が高まっていることから、急成長が見込まれています。これは、地域および国際的なサービスプロバイダーにとって多くのビジネスチャンスとなります。

市場セグメンテーション:

セグメンテーション1:資産別

- 線路/導体

- タワー/ポール

- 絶縁体/ハードウェア

- 植生回廊

セグメント2:エンドユーザー別

- 送電システム事業者(TSOs)

- 配電システム事業者(DSO)

- 総合公益事業者

- 政府/公共機関

セグメンテーション3:ソリューション別

- 目視観察

- 赤外線サーモグラフィ

- コロナ/部分放電検出

- LiDARと写真測量

- AIベースの分析別高解像度ビジュアル(写真/ビデオ)

- 植生管理(衛星画像と航空LiDAR)

- その他

セグメンテーション4:提供方法別

- ヘリコプター

- ドローン

- ロボット

- 地上

セグメンテーション5:電圧別

- 送電(66 kV以上)

- 配電(66 kV未満)

セグメンテーション6:地域別

- アジア太平洋地域

アジア太平洋架空送電線検査の市場動向と促進要因・課題

動向

- 中国、インド、日本、オーストラリア全域で、手動検査やヘリコプター調査からドローンベースの空中検査への強いシフト

- 故障検出、腐食評価、植生モニタリングのためのAI/ML搭載アナリティクスの採用

- より正確な資産評価のためのマルチセンサーペイロード(LiDAR、赤外線サーモグラフィ、UVカメラ、高解像度RGB)の使用の増加

- 送電網の信頼性を向上させるためのデジタルツインモデルと予知保全ソリューションの成長

- 継続的モニタリングのための自動ドローン・イン・ア・ボックス・システムやロボット・クローラーの導入拡大

- 電力会社とテクノロジープロバイダー間の官民パートナーシップとコラボレーションの拡大

促進要因

- 急速な都市化と工業化がアジア太平洋経済圏全体の電力需要の急増につながる

- 老朽化した送電網インフラと、近代化とメンテナンスの緊急ニーズ

- より強固な送配電網を必要とする大規模な再生可能エネルギー(太陽光と風力)の統合

- スマートグリッド開発とエネルギー転換イニシアティブに対する政府投資の増加

- リスクの高い手動検査をドローンや自動化システムに置き換えること別コストと安全性のメリット

- 幅広い地理的多様性(山岳地域、農村地域、沿岸グリッド)が、拡張可能な検査技術の需要を促進

課題

- アジア太平洋諸国における規制の断片化が、BVLOS(Beyond Visual Line of Sight)ドローン運用の採用を遅らせている

- 過酷な気象条件(モンスーン、台風、猛暑)が検査の信頼性に影響

- 検査データと既存のユーティリティ管理システムとの統合の問題

- ドローン操作、データ処理、AI導入のための熟練労働力の制限

- 高度な検査システムとソフトウェア・プラットフォームへの高額な先行投資

- クラウドベースの監視・分析ソリューションにおけるサイバーセキュリティとデータプライバシーへの懸念

製品/イノベーション戦略:製品タイプは、読者がアジア太平洋で利用可能なさまざまなタイプのサービスを理解するのに役立ちます。さらに、配信方法、ソリューション、電圧に基づく製品別の架空送電線検査市場の詳細な理解を読者に提供します。

成長/マーケティング戦略:アジア太平洋の架空送電線検査市場では、事業拡大、提携、協力、合弁など、市場で事業を展開する主要企業による主要な開拓が見られます。各社が好む戦略は、アジア太平洋架空送電線検査市場における地位を強化するためのシナジー活動です。

競合戦略:架空送電線検査市場の主要企業は、架空送電線検査製品の研究で分析され、プロファイル化されています。さらに、架空送電線検査市場で事業を展開するプレイヤーの詳細な競合ベンチマーキングを行い、読者が参入企業同士のスタックを理解できるようにし、明確な市場情勢を提示しています。さらに、パートナーシップ、協定、協力などの包括的な競合戦略は、読者が市場の未開拓の収益ポケットを理解するのに役立ちます。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- 空中検査におけるドローン/UAVの導入

- AIを活用した分析と自動化の統合

- 研究開発レビュー

- 規制状況

- ステークホルダー分析

- 市場力学

- ケーススタディ

第2章 地域

- 地域サマリー

- アジア太平洋

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 用途

- 製品

- アジア太平洋(国別)

第3章 市場-競合ベンチマーキングと企業プロファイル

- Aerodyne Group

- AUAV

- DJI

- Garuda Aerospace

第4章 調査手法

List of Figures

- Figure 1: Asia-Pacific Overhead Line Inspection Market (by Scenario), $Million, 2025, 2030, and 2035

- Figure 2: Market Snapshot, 2024

- Figure 3: Overhead Line Inspection Market, $Million, 2024 and 2035

- Figure 4: Asia-Pacific Overhead Line Inspection Market (by Asset), $Million, 2024, 2030, and 2035

- Figure 5: Asia-Pacific Overhead Line Inspection Market (by End Users), $Million, 2024, 2030, and 2035

- Figure 6: Asia-Pacific Overhead Line Inspection Market (by Solution), $Million, 2024, 2030, and 2035

- Figure 7: Asia-Pacific Overhead Line Inspection Market (by Method of Delivery), $Million, 2024, 2030, and 2035

- Figure 8: Asia-Pacific Overhead Line Inspection Market (by Voltage), $Million, 2024, 2030, and 2035

- Figure 9: Patent Analysis (by Country and Company), January 2021- December 2024

- Figure 10: Stakeholder Analysis

- Figure 11: Regulations Mandating Inspections

- Figure 12: Case Study: Enhancing Power Line Inspection Efficiency Using AlphaAir 450 UAV LiDAR Technology

- Figure 13: Case Study: Guangxi Power Grid Enhances Vegetation Management with JOUAV LiDAR Drone Technology

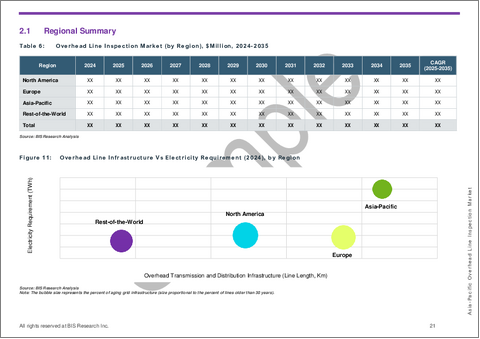

- Figure 14: Overhead Line Infrastructure Vs Electricity Requirement (2024), by Region

- Figure 15: Developments in Overhead Line Inspection Market (by Region), January 2021-April 2025

- Figure 16: China Overhead Line Inspection Market, $Million, 2024-2035

- Figure 17: Japan Overhead Line Inspection Market, $Million, 2024-2035

- Figure 18: India Overhead Line Inspection Market, $Million, 2024-2035

- Figure 19: South Korea Overhead Line Inspection Market, $Million, 2024-2035

- Figure 20: Indonesia Overhead Line Inspection Market, $Million, 2024-2035

- Figure 21: Malaysia Overhead Line Inspection Market, $Million, 2024-2035

- Figure 22: Rest-of-Asia-Pacific Overhead Line Inspection Market, $Million, 2024-2035

- Figure 23: Strategic Initiatives, January 2022-April 2025

- Figure 24: Data Triangulation

- Figure 25: Top-Down and Bottom-Up Approach

- Figure 26: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Competitive Landscape Snapshot

- Table 3: Trends: Current and Future Impact Assessment

- Table 4: Regulatory Landscape

- Table 5: Drivers, Challenges, and Opportunities, 2025-2035

- Table 6: Overhead Line Inspection Market (by Region), $Million, 2024-2035

- Table 7: Asia-Pacific Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 8: Asia-Pacific Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 9: Asia-Pacific Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 10: Asia-Pacific Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 11: Asia-Pacific Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 12: China Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 13: China Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 14: China Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 15: China Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 16: China Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 17: Japan Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 18: Japan Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 19: Japan Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 20: Japan Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 21: Japan Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 22: India Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 23: India Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 24: India Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 25: India Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 26: India Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 27: South Korea Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 28: South Korea Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 29: South Korea Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 30: South Korea Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 31: South Korea Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 32: Indonesia Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 33: Indonesia Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 34: Indonesia Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 35: Indonesia Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 36: Indonesia Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 37: Malaysia Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 38: Malaysia Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 39: Malaysia Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 40: Malaysia Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 41: Malaysia Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 42: Rest-of-Asia-Pacific Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 43: Rest-of-Asia-Pacific Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 44: Rest-of-Asia-Pacific Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 45: Rest-of-Asia-Pacific Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 46: Rest-of-Asia-Pacific Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 47: Market Share, 2024

This report can be delivered in 2 working days.

Introduction to Asia-Pacific Overhead Line Inspection Market

The Asia-Pacific overhead line inspection market is projected to reach $2,781.0 million by 2035 from $1,271.0 million in 2024, growing at a CAGR of 7.31% during the forecast period 2025-2035. The safety, effectiveness, and dependability of the continuously growing power transmission networks throughout the area depend more and more on the APAC overhead line inspection market. The industry is expanding steadily due to factors such urbanization, the need to maintain aged infrastructure, and rising electricity demand. In order to improve inspection accuracy, minimize downtime, and maximize maintenance costs, utilities and service providers are implementing cutting-edge technology like drones, artificial intelligence, and machine learning. These solutions are particularly helpful in the varied regions of Asia-Pacific, which range from crowded metropolis to isolated, difficult-to-reach places. Adoption of cutting-edge inspection techniques is being further accelerated by government expenditures in smart grid projects, renewable energy integration, and grid modernization initiatives. Predictive analytics, real-time monitoring, and automated inspections are assisting utilities in increasing operational effectiveness and guaranteeing a steady supply of electricity. Regular overhead line inspection and monitoring has emerged as a strategic goal as the area moves toward cleaner energy and more robust infrastructure. As a result, the market for overhead line inspection in Asia is developing quickly, providing prospects for expansion for both local firms and international technology suppliers.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $1,373.4 Million |

| 2035 Forecast | $2,781.0 Million |

| CAGR | 7.31% |

Market Introduction

Due to the region's nations' emphasis on developing and updating existing power transmission and distribution networks, the Asia-Pacific (APAC) overhead line inspection market is expanding significantly. The need for trustworthy and effective inspection solutions is being driven by factors such as the large-scale integration of renewable energy sources, increasing electricity demand, and rapid urbanization. The industry has historically been dominated by human inspections and helicopter surveys, but there is a noticeable trend toward more sophisticated techniques including infrared thermography, LiDAR mapping, satellite monitoring, drone-based aerial inspections, and AI-driven analytics. Utilities are using these technologies to increase worker safety in hazardous conditions, decrease inspection costs, and improve accuracy.

The heterogeneous terrain of the APAC region, which includes both distant and challenging-to-reach rural areas and densely populated urban centers, creates distinct opportunities. To increase grid resilience and decrease downtime, governments and utilities are progressively implementing digital twin technologies, automated drones, and vegetation management systems. With the help of advantageous legislative frameworks and investments in the development of smart grids, nations like China, India, Japan, and Australia are spearheading the adoption of cutting-edge inspection technology. The APAC overhead line inspection market is expected to grow rapidly because to the increased focus on sustainability, energy efficiency, and renewable integration. This presents a number of opportunities for both regional and international service providers.

Market Segmentation:

Segmentation 1: by Asset

- Lines/Conductors

- Towers/Poles

- Insulators/Hardware

- Vegetation Corridor

Segmentation 2: by End User

- Transmission System Operators (TSOs)

- Distribution System Operators (DSOs)

- Integrated Utilities

- Government/Public Agencies

Segmentation 3: by Solution

- Visual Observation

- Infrared Thermography

- Corona/Partial Discharge Detection

- LiDAR and Photogrammetry

- High-resolution Visual (Photo/Video) with AI-based analytics

- Vegetation Management (Satellite Imagery and Aerial LiDAR)

- Others

Segmentation 4: by Method of Delivery

- Helicopters

- Drones

- Robots

- Ground

Segmentation 5: by Voltage

- Transmission (>=66 kV)

- Distribution (<66 kV)

Segmentation 6: by Region

- Asia-Pacific

APAC Overhead Line Inspection Market Trends, Drivers and Challenges

Trends

- Strong shift from manual inspections and helicopter surveys to drone-based aerial inspections across China, India, Japan, and Australia.

- Adoption of AI/ML-powered analytics for fault detection, corrosion assessment, and vegetation monitoring.

- Increasing use of multi-sensor payloads (LiDAR, infrared thermography, UV cameras, and high-resolution RGB) for more accurate asset assessment.

- Growth of digital twin models and predictive maintenance solutions to improve grid reliability.

- Rising deployment of automated drone-in-a-box systems and robotic crawlers for continuous monitoring.

- Expansion of public-private partnerships and collaborations between utilities and technology providers.

Drivers

- Rapid urbanization and industrialization leading to surging electricity demand across APAC economies.

- Aging grid infrastructure and the urgent need for modernization and maintenance.

- Large-scale renewable energy integration (solar and wind) requiring stronger transmission and distribution networks.

- Rising government investments in smart grid development and energy transition initiatives.

- Cost and safety benefits of replacing high-risk manual inspections with drones and automated systems.

- Wide geographic diversity (mountainous regions, rural areas, coastal grids) driving demand for scalable inspection technologies.

Challenges

- Regulatory fragmentation across APAC countries slowing adoption of BVLOS (Beyond Visual Line of Sight) drone operations.

- Harsh weather conditions (monsoons, typhoons, extreme heat) affecting inspection reliability.

- Integration issues between inspection data and existing utility management systems.

- Limited skilled workforce for drone operations, data processing, and AI adoption.

- High upfront capital investment for advanced inspection systems and software platforms.

- Cybersecurity and data privacy concerns with cloud-based monitoring and analytics solutions.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of services available in APAC Region. Moreover, the study provides the reader with a detailed understanding of the overhead line inspection market by products based on method of delivery, solution, and voltage.

Growth/Marketing Strategy: The APAC overhead line inspection market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been synergistic activities to strengthen their position in the APAC overhead line inspection market.

Competitive Strategy: Key players in the overhead line inspection market have been analyzed and profiled in the study of overhead line inspection products. Moreover, a detailed competitive benchmarking of the players operating in the overhead line inspection market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Adoption of Drones/UAVs for Aerial Inspections

- 1.1.2 Integration of AI-powered Analytics and Automation

- 1.2 Research and Development Review

- 1.2.1 Patent Filing Trend (by Number of Patents, by Country, and Company)

- 1.3 Regulatory Landscape

- 1.4 Stakeholder Analysis

- 1.5 Market Dynamics

- 1.5.1 Market Drivers

- 1.5.1.1 Growing Demand for Grid Reliability and Aging Infrastructure

- 1.5.1.2 Increasing Grid Infrastructure

- 1.5.2 Market Challenges

- 1.5.2.1 Skilled Workforce Shortage

- 1.5.2.2 Growth of Underground Distribution Line in Developed Countries

- 1.5.3 Market Opportunities

- 1.5.3.1 AI and Machine Learning Integration

- 1.5.3.2 Public-Private Funding Models

- 1.5.1 Market Drivers

- 1.6 Case Study

2 Region

- 2.1 Regional Summary

- 2.2 Asia-Pacific

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Application

- 2.2.5 Product

- 2.2.6 Asia-Pacific (by Country)

- 2.2.6.1 China

- 2.2.6.1.1 Application

- 2.2.6.1.2 Product

- 2.2.6.2 Japan

- 2.2.6.2.1 Application

- 2.2.6.2.2 Product

- 2.2.6.3 India

- 2.2.6.3.1 Application

- 2.2.6.3.2 Product

- 2.2.6.4 South Korea

- 2.2.6.4.1 Application

- 2.2.6.4.2 Product

- 2.2.6.5 Indonesia

- 2.2.6.5.1 Application

- 2.2.6.5.2 Product

- 2.2.6.6 Malaysia

- 2.2.6.6.1 Application

- 2.2.6.6.2 Product

- 2.2.6.7 Rest-of-Asia-Pacific

- 2.2.6.7.1 Application

- 2.2.6.7.2 Product

- 2.2.6.1 China

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Aerodyne Group

- 3.1.1 Overview

- 3.1.2 Top Products/Product Portfolio

- 3.1.3 Top Competitors

- 3.1.4 Target Customers

- 3.1.5 Key Personal

- 3.1.6 Analyst View

- 3.1.7 Market Share, 2024

- 3.2 AUAV

- 3.2.1 Overview

- 3.2.2 Top Products/Product Portfolio

- 3.2.3 Top Competitors

- 3.2.4 Target Customers

- 3.2.5 Key Personal

- 3.2.6 Analyst View

- 3.2.7 Market Share, 2024

- 3.3 DJI

- 3.3.1 Overview

- 3.3.2 Top Products/Product Portfolio

- 3.3.3 Top Competitors

- 3.3.4 Target Customers

- 3.3.5 Key Personal

- 3.3.6 Analyst View

- 3.3.7 Market Share, 2024

- 3.4 Garuda Aerospace

- 3.4.1 Overview

- 3.4.2 Top Products/Product Portfolio

- 3.4.3 Top Competitors

- 3.4.4 Target Customers

- 3.4.5 Key Personal

- 3.4.6 Analyst View

- 3.4.7 Market Share, 2024

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast