|

|

市場調査レポート

商品コード

1789840

架線検査市場- 世界および地域別分析:用途別、製品別、地域別 - 分析と予測(2025年~2035年)Overhead Line Inspection Market - A Global and Regional Analysis: Focus on Application, Product, and Regional Analysis - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 架線検査市場- 世界および地域別分析:用途別、製品別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年08月14日

発行: BIS Research

ページ情報: 英文 202 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

架線検査市場は、ドローンによる空中検査、赤外線サーモグラフィ、AIを活用した分析、植生管理技術など、送電インフラの維持に欠かせない多様なソリューションで構成されています。

この市場を牽引しているのは、老朽化した送電網インフラや拡大する電力網を支えるため、信頼性が高く効率的な検査手法へのニーズが高まっていることです。自動ドローンや高解像度イメージングなどの検査技術の革新は、正確で費用対効果の高い架線検査ソリューションに対する需要の高まりに対応しています。架線検査市場は競争が激しく、Kinectrics、Siemens Energy、Cyberhawkなどの主要企業が業界の進歩をリードしています。さらに、送電網の信頼性、持続可能性、スマートグリッド統合への注目の高まりが市場動向を形成し、投資を促進しています。その結果、架線検査市場は、最新の送電システムの課題に対応するため、急速な進化を続けています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価 | 30億6,220万米ドル |

| 2035年の予測 | 60億190万米ドル |

| CAGR | 6.96% |

市場イントロダクション

架線検査市場は、世界中の送電網の信頼性と安全性を確保する上で重要な役割を果たしています。電力需要の増大と老朽化したインフラを維持する必要性から、同市場は大きな成長を遂げています。効率的で正確な架線検査のために、ドローン、人工知能、機械学習などの先端技術の採用が進んでいます。これらの技術革新は、ダウンタイムの削減とメンテナンスコストの最小化に役立ち、市場拡大を後押ししています。架線検査市場は、スマートグリッドプロジェクトへの政府投資の増加や再生可能エネルギー源へのシフトからも恩恵を受けています。その結果、電力会社やサービスプロバイダーは、送電網の性能を高め、故障を防止するために、架空送電線の定期的な検査と監視を優先するようになっています。

産業への影響

架線検査市場は、信頼性の高い送電・配電インフラに対する需要の高まりに牽引され、着実な成長を遂げています。架線検査は、故障を検出し停電を防止することで、送電網の安全性と効率を維持するために不可欠です。無人航空機(UAV)、人工知能(AI)、機械学習などの先端技術の統合により、市場は急速に進化しています。これらの技術革新により、従来の方法と比較して、より正確で迅速、かつ費用対効果の高い架空送電線の検査が可能になります。さらに、スマートグリッドの近代化と再生可能エネルギープロジェクトへの投資の高まりが、架線検査ソリューションの採用を世界的に促進しています。電力会社がダウンタイムの最小化と送電網の信頼性向上に注力していることから、架線検査市場は今後数年で大きく拡大すると予想されます。

市場セグメンテーション

セグメンテーション1:資産別

- ライン/導体

- タワー/ポール

- 絶縁体/ハードウェア

- 植生コリドー

架線検査市場を独占するタワー/ポール(資産別)

架線検査市場を資産別に見ると、タワーと電柱が大半を占めています。タワー/ポール分野は、2024年には8億9,900万米ドルと評価され、2035年には17億6,760万米ドルに達すると予測され、CAGRは6.26%と堅調です。このセグメントの力強い成長は、鉄塔と電柱が架空送電線を支える重要な役割を担っており、送電ネットワークの信頼性と安全性を確保するために検査が不可欠であることに起因しています。さらに、送電網の近代化に向けた投資の増加、メンテナンスに関する厳しい規制基準、鉄塔や電柱専用に設計されたドローンやセンサーなどの高度な検査技術の採用が、市場の拡大をさらに加速させています。これらの要因が相まって、予測期間中、鉄塔と電柱が架線検査市場を独占すると予想される理由を裏付けています。

セグメンテーション2:エンドユーザー別

- 送電システム事業者(TSOs)

- 配電システム事業者(DSO)

- 統合公益事業者

- 政府/公共機関

セグメンテーション3:ソリューション別

- 目視観察

- 赤外線サーモグラフィ

- コロナ/部分放電検出

- LiDARと写真測量

- AIベースの分析による高解像度ビジュアル(写真/ビデオ)

- 植生管理(衛星画像と航空LiDAR)

- その他

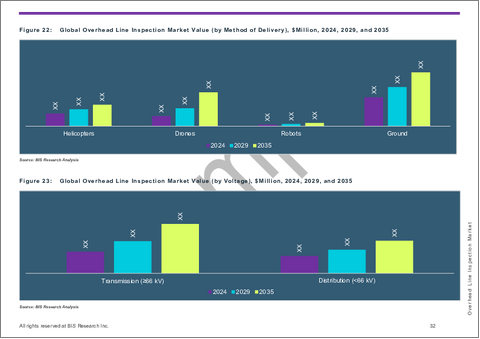

セグメンテーション4:提供方法別

- ヘリコプター

- ドローン

- ロボット

- 地上

セグメンテーション5:電圧別

- 送電(66 kV以上)

- 配電(66 kV未満)

セグメンテーション6:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

架線検査市場の最近の動向

- 2024年11月7日、Kinectricsはケンタッキー州ルイビルに新施設を開設し、架線検査市場での地位を強化しました。この最新鋭センターは、通電中の架空送電線をリアルタイムで監視するLineVueデバイスのような先進的な現場ソリューションなど、架線検査サービスを拡大するものです。この開発により、米国全域で送電網の性能を向上させる信頼性の高い革新的な試験・検査サポートを提供し、架線検査市場におけるKinectricsの役割が強化されます。

- 2024年9月9日から10月4日まで、ITC Holdings Corp.はミシガン州の架空送電線を点検するために空中パトロールを実施しました。この低空飛行により、クルーは架空送電線に沿って損傷した設備や植生の危険を特定することができました。これらの空中点検は、送電網の安全性と信頼性の維持に貢献し、架空送電線点検市場で重要な役割を果たしました。

- 2023年、AirpelagoはE.ONスウェーデンと提携し、自動化されたドローンを使用したグリーンで効率的な架線検査ソリューションを推進しました。約10,000kmをカバーするこれらのドローン検査は、炭素排出量を35トン大幅に削減し、架線検査市場における持続可能な技術の役割が高まっていることを実証しました。このコラボレーションは、環境に優しく拡張性のある検査方法への市場のシフトを浮き彫りにしています。

- インドのテランガナ州政府は、送電線と鉄塔の架線検査にドローンを使用するパイロットプロジェクトを成功裏に完了しました。このプロジェクトは、ドローン技術と人工知能を組み合わせることで、従来の手作業別方法よりも検査効率を向上させることを目的としていました。この取り組みは架線検査市場における重要な開拓であり、送電インフラに対するドローンを用いた検査手法の拡大が計画されています。

製品/イノベーション戦略:製品タイプは、読者が世界的に利用可能なさまざまなタイプのサービスを理解するのに役立ちます。さらに、配信方法、ソリューション、電圧に基づく製品別の架線検査市場の詳細な理解を読者に提供します。

成長/マーケティング戦略:架線検査市場では、事業拡大、提携、協力、合弁など、市場で事業を展開する主要企業による主要な開拓が見られます。各社が好む戦略は、架線検査市場における地位を強化するためのシナジー活動です。

競合戦略:架線検査市場の主要企業は、架線検査製品の調査で分析され、プロファイル化されています。さらに、架線検査市場で事業を展開する参入企業の詳細な競合ベンチマーキングを行い、読者が参入企業同士のスタックを理解できるようにし、明確な市場情勢を提示しています。さらに、パートナーシップ、協定、協力などの包括的な競合戦略は、読者が市場の未開拓の収益ポケットを理解するのに役立ちます。

調査手法:この調査に採用した調査手法には、一次情報と二次情報から収集したデータを組み合わせています。予測モデルの構築には、分析ツールとともに、1次調査と2次調査(主要企業、市場リーダー、社内専門家)の両方が採用されています。

架線検査市場には、技術革新と成長を牽引する複数の主要企業が存在します。Kinectrics、Siemens Energy、eSmart Systemsなどの主要企業は、高度な検査技術とサービスを提供しています。Cyberhawk、Sharper Shape、Pergam Technical Servicesといったドローンに特化した企業は、効率的な空中検査ソリューションを提供することで市場ダイナミクスを強化しています。DJI、Skydio、Garuda AerospaceなどのUAVメーカーは、正確なデータ取得のための最先端プラットフォームに貢献しています。その他の主要企業であるEDM International、CBH Aviation、AUAVは、電力会社向けにカスタマイズされたソリューションを提供しています。Buzz SolutionsとAerodyne Groupも、ハードウェアとソフトウェアの統合サービスでポートフォリオを拡大しています。架線検査市場の競争は激しく、各社は信頼性が高く費用対効果の高い検査サービスに対する需要の増加に対応するため、技術に多額の投資を行い、世界の事業展開を進めています。AI、機械学習、ドローン技術の継続的な進歩により、競合情勢はさらに強化されると予想されます。

この市場に設立された著名な企業は以下の通りです。

- Kinectrics

- eSmart Systems

- Siemens Energy

- Ofil Systems

- Pergarm Technical Services

- Cyberhawk

- Sharper Shape Inc.

- Aerodyne Group

- EDM International, Inc.

- CBH Aviation

- AUAV

- Skydio, Inc.

- DJI

- Garuda Aerospace

- BUZZ, Inc.

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- 空中検査におけるドローン/UAVの導入

- AIを活用した分析と自動化の統合

- 研究開発レビュー

- 規制状況

- ステークホルダー分析

- 市場力学

- ケーススタディ

第2章 用途

- 用途のサマリー

- 架線検査市場(資産別)

- 線路/導体

- タワー/ポール

- 絶縁体/ハードウェア

- 植生回廊

- 架線検査市場(エンドユーザー別)

- 送電システム運用者(TSO)

- 配電事業者(DSO)

- 統合ユーティリティ

- 政府/公共機関

第3章 製品

- 製品のサマリー

- 架線検査市場(ソリューション別)

- 視覚観察

- 赤外線サーモグラフィ

- コロナ/部分放電検出

- LiDARと写真測量

- 植生管理(衛星画像と航空LiDAR)

- その他

- 架線検査市場(提供方法別)

- ヘリコプター

- ドローン

- ロボット

- 地上

- 架線検査市場(電圧別)

- 伝電(66 kV以上)

- 配電(66 kV未満)

第4章 地域

- 地域のサマリー

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- Kinectrics

- eSmart Systems AS

- Siemens Energy

- Ofil Systems

- Pergam Technical Services

- Cyberhawk

- Sharper Shape Inc.

- Aerodyne Group

- EDM International, Inc.

- CBH Aviation

- AUAV

- Skydio, Inc.

- DJI

- Garuda Aerospace

- BUZZ, Inc.

第6章 調査手法

List of Figures

- Figure 1: Overhead Line Inspection Market (by Scenario), $Million, 2025, 2030, and 2035

- Figure 2: Global Overhead Line Inspection Market, 2024 and 2035

- Figure 3: Top 10 Countries, Global Overhead Line Inspection Market, $Million, 2024

- Figure 4: Global Market Snapshot, 2024

- Figure 5: Global Overhead Line Inspection Market, $Million, 2024 and 2035

- Figure 6: Overhead Line Inspection Market (by Asset), $Million, 2024, 2030, and 2035

- Figure 7: Overhead Line Inspection Market (by End Users), $Million, 2024, 2030, and 2035

- Figure 8: Overhead Line Inspection Market (by Solution), $Million, 2024, 2030, and 2035

- Figure 9: Overhead Line Inspection Market (by Method of Delivery), $Million, 2024, 2030, and 2035

- Figure 10: Overhead Line Inspection Market (by Voltage), $Million, 2024, 2030, and 2035

- Figure 11: Overhead Line Inspection Market Segmentation

- Figure 12: Patent Analysis (by Country and Company), January 2021- December 2024

- Figure 13: Stakeholder Analysis

- Figure 14: Regulations Mandating Inspections

- Figure 15: Case Study: Enhancing Power Line Inspection Efficiency Using AlphaAir 450 UAV LiDAR Technology

- Figure 16: Case Study: Guangxi Power Grid Enhances Vegetation Management with JOUAV LiDAR Drone Technology

- Figure 17: Case Study: Autonomous Drone Inspection Enhances Asset Management for Energinet, Denmark's TSO

- Figure 18: Case Study: Airpelago Enhances High-Voltage Power Line Inspection for Electricity North West in England

- Figure 19: Global Overhead Line Inspection Market (by Asset), $Million, 2024, 2029, and 2035

- Figure 20: Global Overhead Line Inspection Market (by End User), $Million, 2024, 2029, and 2035

- Figure 21: Global Overhead Line Inspection Market, Lines/Conductors Country Wise, $Million, 2024

- Figure 22: Global Overhead Line Inspection Market, Lines/Conductors Value $Million, 2024-2035

- Figure 23: Global Overhead Line Inspection Market, Towers/Poles Value Country Wise, $Million, 2024

- Figure 24: Global Overhead Line Inspection Market, Towers/Poles Value $Million, 2024-2035

- Figure 25: Global Overhead Line Inspection Market, Insulators/Hardware Value Country Wise, $Million, 2024

- Figure 26: Global Overhead Line Inspection Market, Insulators/Hardware Value $Million, 2024-2035

- Figure 27: Global Overhead Line Inspection Market, Vegetation Corridor Value Country Wise, $Million, 2024

- Figure 28: Global Overhead Line Inspection Market, Vegetation Corridor Value $Million, 2024-2035

- Figure 29: Global Overhead Line Inspection Market, Transmission System Operators (TSOs), $Million, 2024

- Figure 30: Global Overhead Line Inspection Market, Transmission System Operators (TSOs), Value $Million, 2024-2035

- Figure 31: Global Overhead Line Inspection Market, Distribution System Operators (DSOs), Value Country Wise, $Million, 2024

- Figure 32: Global Overhead Line Inspection Market, Distribution System Operators (DSOs) Value, $Million, 2024-2035

- Figure 33: Global Overhead Line Inspection Market, Integrated Utilities Value Country Wise, $Million, 2024

- Figure 34: Global Overhead Line Inspection Market, Integrated Utilities Value, $Million, 2024-2035

- Figure 35: Global Overhead Line Inspection Market, Government/Public Agencies Value Country Wise, $Million, 2024

- Figure 36: Global Overhead Line Inspection Market, Government/Public Agencies Value, $Million, 2024-2035

- Figure 37: Global Overhead Line Inspection Market Value (by Solution), $Million, 2024, 2029, and 2035

- Figure 38: Global Overhead Line Inspection Market Value (by Method of Delivery), $Million, 2024, 2029, and 2035

- Figure 39: Global Overhead Line Inspection Market Value (by Voltage), $Million, 2024, 2029, and 2035

- Figure 40: Global Overhead Line Inspection Market, Visual Observation Value, $Million, 2024

- Figure 41: Global Overhead Line Inspection Market, Visual Observation Value, $Million, 2024-2035

- Figure 42: Global Overhead Line Inspection Market, Infrared Thermography Value, $Million, 2024

- Figure 43: Global Overhead Line Inspection Market, Infrared Thermography Value, $Million, 2024-2035

- Figure 44: Global Overhead Line Inspection Market, Corona/Partial Discharge Detection Value, $Million, 2024

- Figure 45: Global Overhead Line Inspection Market, Corona/Partial Discharge Detection Value, $Million, 2024-2035

- Figure 46: Global Overhead Line Inspection Market, LiDAR and Photogrammetry Value, $Million, 2024

- Figure 47: Global Overhead Line Inspection Market, LiDAR and Photogrammetry Value, $Million, 2024-2035

- Figure 48: Global Overhead Line Inspection Market, High-Resolution Visual (Photo/Video) with AI-Based Analytics Value, $Million, 2024

- Figure 49: Global Overhead Line Inspection Market, High-Resolution Visual (Photo/Video) with AI-Based Analytics Value, $Million, 2024-2035

- Figure 50: Global Overhead Line Inspection Market, Vegetation Management (Satellite Imagery and Aerial LiDAR) Value, $Million, 2024

- Figure 51: Global Overhead Line Inspection Market, Vegetation Management (Satellite Imagery and Aerial LiDAR) Value, $Million, 2024-2035

- Figure 52: Global Overhead Line Inspection Market, Others Value, $Million, 2024

- Figure 53: Global Overhead Line Inspection Market, Others Value, $Million, 2024-2035

- Figure 54: Global Overhead Line Inspection Market, Helicopters Value, $Million, 2024

- Figure 55: Global Overhead Line Inspection Market, Helicopters Value, $Million, 2024-2035

- Figure 56: Global Overhead Line Inspection Market, Drones Value, $Million, 2024

- Figure 57: Global Overhead Line Inspection Market, Drones Value, $Million, 2024-2035

- Figure 58: Global Overhead Line Inspection Market, Robots Value, $Million, 2024

- Figure 59: Global Overhead Line Inspection Market, Robots Value, $Million, 2024-2035

- Figure 60: Global Overhead Line Inspection Market, Ground Value, $Million, 2024

- Figure 61: Global Overhead Line Inspection Market, Ground Value, $Million, 2024-2035

- Figure 62: Global Overhead Line Inspection Market, Transmission (>=66 kV) Value, $Million, 2024

- Figure 63: Global Overhead Line Inspection Market, Transmission (>=66 kV) Value, $Million, 2024-2035

- Figure 64: Global Overhead Line Inspection Market, Distribution (<66 kV) Value, $Million, 2024

- Figure 65: Global Overhead Line Inspection Market, Transmission (<66 kV) Value, $Million, 2024-2035

- Figure 66: Overhead Line Infrastructure Vs Electricity Requirement (2024), by Region

- Figure 67: Developments in Overhead Line Inspection Market (by Region), January 2021-April 2025

- Figure 68: U.S. Overhead Line Inspection Market, $Million, 2024-2035

- Figure 69: Canada Overhead Line Inspection Market, $Million, 2024-2035

- Figure 70: Mexico Overhead Line Inspection Market, $Million, 2024-2035

- Figure 71: Germany Overhead Line Inspection Market, $Million, 2024-2035

- Figure 72: U.K. Overhead Line Inspection Market, $Million, 2024-2035

- Figure 73: Southern and Mediterranean Europe Overhead Line Inspection Market, $Million, 2024-2035

- Figure 74: Eastern Europe Overhead Line Inspection Market, $Million, 2024-2035

- Figure 75: Nordic Europe Overhead Line Inspection Market, $Million, 2024-2035

- Figure 76: China Overhead Line Inspection Market, $Million, 2024-2035

- Figure 77: Japan Overhead Line Inspection Market, $Million, 2024-2035

- Figure 78: India Overhead Line Inspection Market, $Million, 2024-2035

- Figure 79: South Korea Overhead Line Inspection Market, $Million, 2024-2035

- Figure 80: Indonesia Overhead Line Inspection Market, $Million, 2024-2035

- Figure 81: Malaysia Overhead Line Inspection Market, $Million, 2024-2035

- Figure 82: Rest-of-Asia-Pacific Overhead Line Inspection Market, $Million, 2024-2035

- Figure 83: South America Overhead Line Inspection Market, $Million, 2024-2035

- Figure 84: Middle East and Africa Overhead Line Inspection Market, $Million, 2024-2035

- Figure 85: Strategic Initiatives, January 2022-April 2025

- Figure 86: Data Triangulation

- Figure 87: Top-Down and Bottom-Up Approach

- Figure 88: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Competitive Landscape Snapshot

- Table 3: Trends: Current and Future Impact Assessment

- Table 4: Regulatory Landscape

- Table 5: Drivers, Challenges, and Opportunities, 2025-2035

- Table 6: Companies Using Helicopters for Overhead Line Inspection

- Table 7: Overhead Line Inspection Market (by Region), $Million, 2024-2035

- Table 8: North America Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 9: North America Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 10: North America Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 11: North America Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 12: North America Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 13: U.S. Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 14: U.S. Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 15: U.S. Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 16: U.S. Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 17: U.S. Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 18: Canada Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 19: Canada Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 20: Canada Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 21: Canada Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 22: Canada Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 23: Mexico Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 24: Mexico Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 25: Mexico Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 26: Mexico Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 27: Mexico Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 28: Europe Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 29: Europe Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 30: Europe Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 31: Europe Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 32: Europe Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 33: Germany Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 34: Germany Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 35: Germany Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 36: Germany Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 37: Germany Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 38: U.K. Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 39: U.K. Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 40: U.K. Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 41: U.K. Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 42: U.K. Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 43: Southern and Mediterranean Europe Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 44: Southern and Mediterranean Europe Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 45: Southern and Mediterranean Europe Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 46: Southern and Mediterranean Europe Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 47: Southern and Mediterranean Europe Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 48: Eastern Europe Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 49: Eastern Europe Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 50: Eastern Europe Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 51: Eastern Europe Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 52: Eastern Europe Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 53: Nordic Europe Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 54: Nordic Europe Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 55: Nordic Europe Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 56: Nordic Europe Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 57: Nordic Europe Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 58: Asia-Pacific Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 59: Asia-Pacific Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 60: Asia-Pacific Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 61: Asia-Pacific Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 62: Asia-Pacific Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 63: China Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 64: China Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 65: China Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 66: China Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 67: China Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 68: Japan Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 69: Japan Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 70: Japan Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 71: Japan Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 72: Japan Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 73: India Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 74: India Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 75: India Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 76: India Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 77: India Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 78: South Korea Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 79: South Korea Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 80: South Korea Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 81: South Korea Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 82: South Korea Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 83: Indonesia Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 84: Indonesia Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 85: Indonesia Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 86: Indonesia Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 87: Indonesia Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 88: Malaysia Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 89: Malaysia Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 90: Malaysia Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 91: Malaysia Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 92: Malaysia Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 93: Rest-of-Asia-Pacific Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 94: Rest-of-Asia-Pacific Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 95: Rest-of-Asia-Pacific Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 96: Rest-of-Asia-Pacific Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 97: Rest-of-Asia-Pacific Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 98: Rest-of-the-World Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 99: Rest-of-the-World Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 100: Rest-of-the-World Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 101: Rest-of-the-World Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 102: Rest-of-the-World Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 103: South America Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 104: South America Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 105: South America Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 106: South America Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 107: South America Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 108: Middle East and Africa Overhead Line Inspection Market (by Asset), $Million, 2024-2035

- Table 109: Middle East and Africa Overhead Line Inspection Market (by End Users), $Million, 2024-2035

- Table 110: Middle East and Africa Overhead Line Inspection Market (by Solution), $Million, 2024-2035

- Table 111: Middle East and Africa Overhead Line Inspection Market (by Method of Delivery), $Million, 2024-2035

- Table 112: Middle East and Africa Overhead Line Inspection Market (by Voltage), $Million, 2024-2035

- Table 113: Global Market Share, 2024

This report can be delivered within 1 working day.

Introduction of Overhead Line Inspection Market

The overhead line inspection market comprises diverse solutions, including drone-based aerial inspections, infrared thermography, AI-powered analytics, and vegetation management technologies, all essential for maintaining power transmission infrastructure. This market has been driven by the increasing need for reliable and efficient inspection methods to support aging grid infrastructure and expanding power networks. Innovations in inspection technologies, such as automated drones and high-resolution imaging, address the growing demand for accurate and cost-effective overhead line inspection solutions. The overhead line inspection market is highly competitive, with key players such as Kinectrics, Siemens Energy, and Cyberhawk leading advancements in the industry. Moreover, the rising focus on grid reliability, sustainability, and smart grid integration shapes market trends and drives investments. As a result, the overhead line inspection market continues to evolve rapidly to meet the challenges of modern power transmission systems.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $3,062.2 Million |

| 2035 Forecast | $6,001.9 Million |

| CAGR | 6.96% |

Market Introduction

The overhead line inspection market plays a crucial role in ensuring the reliability and safety of power transmission networks worldwide. With the growing demand for electricity and the need to maintain aging infrastructure, the market has been witnessing significant growth. Advanced technologies such as drones, artificial intelligence, and machine learning are increasingly adopted for efficient and accurate overhead line inspection. These innovations help reduce downtime and minimize maintenance costs, driving market expansion. The overhead line inspection market also benefits from rising government investments in smart grid projects and the shift toward renewable energy sources. As a result, utilities and service providers have been prioritizing regular inspection and monitoring of overhead lines to enhance grid performance and prevent failures.

Industrial Impact

The overhead line inspection market has been witnessing steady growth driven by the increasing demand for reliable power transmission and distribution infrastructure. Overhead line inspection is essential for maintaining the safety and efficiency of electrical grids by detecting faults and preventing outages. The market is evolving rapidly due to the integration of advanced technologies such as unmanned aerial vehicles (UAVs), artificial intelligence (AI), and machine learning. These innovations enable more accurate, faster, and cost-effective inspection of overhead lines compared to traditional methods. Furthermore, rising investments in smart grid modernization and renewable energy projects have been fueling the adoption of overhead line inspection solutions globally. As power utilities focus on minimizing downtime and improving grid reliability, the overhead line inspection market is expected to expand significantly in the coming years.

Market Segmentation:

Segmentation 1: by Asset

- Lines/Conductors

- Towers/Poles

- Insulators/Hardware

- Vegetation Corridor

Tower/Poles to Dominate the Overhead Line Inspection Market (by Asset)

The overhead line inspection market, by asset, is predominantly driven by towers and poles. The towers/poles segment was valued at $899.0 million in 2024 and is projected to reach $1,767.6 million by 2035, exhibiting a robust CAGR of 6.26%. This segment's strong growth is attributed to the critical role that towers and poles play in supporting overhead power lines, making their inspection essential for ensuring the reliability and safety of power transmission networks. Moreover, the increasing investments in grid modernization, stringent regulatory standards for maintenance, and the adoption of advanced inspection technologies such as drones and sensors specifically designed for towers and poles further accelerate market expansion. These factors combined underline why towers and poles are expected to dominate the overhead line inspection market over the forecast period.

Segmentation 2: by End User

- Transmission System Operators (TSOs)

- Distribution System Operators (DSOs)

- Integrated Utilities

- Government/Public Agencies

Segmentation 3: by Solution

- Visual Observation

- Infrared Thermography

- Corona/Partial Discharge Detection

- LiDAR and Photogrammetry

- High-resolution Visual (Photo/Video) with AI-based analytics

- Vegetation Management (Satellite Imagery and Aerial LiDAR)

- Others

Segmentation 4: by Method of Delivery

- Helicopters

- Drones

- Robots

- Ground

Segmentation 5: by Voltage

- Transmission (>=66 kV)

- Distribution (<66 kV)

Segmentation 6: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Recent Developments in the Overhead Line Inspection Market

- On November 7, 2024, Kinectrics inaugurated a new facility in Louisville, KY, enhancing its position in the overhead line inspection market. The state-of-the-art center expands overhead line inspection services, including advanced in-field solutions like the LineVue device, which monitors energized overhead lines in real-time This development strengthens Kinectrics' role in the overhead line inspection market by providing reliable, innovative testing and inspection support to improve grid performance across the U.S.

- From September 9 to October 4, 2024, ITC Holdings Corp. conducted aerial patrols to inspect overhead transmission lines in Michigan. The low-altitude flights allowed crews to identify damaged equipment and vegetation hazards along the overhead lines. These aerial inspections played an important role in the overhead line inspection market by helping maintain the safety and reliability of the transmission network.

- In 2023, Airpelago partnered with E.ON Sweden to advance green and efficient overhead line inspection solutions using automated drones. Covering around 10,000 km, these drone inspections significantly reduced carbon emissions by 35 tons, demonstrating the growing role of sustainable technologies in the overhead line inspection market. This collaboration highlights the market's shift towards eco-friendly and scalable inspection methods.

- The Telangana government in India successfully completed a pilot project using drones for overhead line inspection of power lines and towers. The project aimed to improve inspection efficiency over traditional manual methods by combining drone technology with artificial intelligence. This initiative marks a significant development in the overhead line inspection market, with plans to scale up the drone-based inspection approach for transmission infrastructure.

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader understand the different types of services available globally. Moreover, the study provides the reader with a detailed understanding of the overhead line inspection market by products based on method of delivery, solution, and voltage.

Growth/Marketing Strategy: The overhead line inspection market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been synergistic activities to strengthen their position in the overhead line inspection market.

Competitive Strategy: Key players in the overhead line inspection market have been analyzed and profiled in the study of overhead line inspection products. Moreover, a detailed competitive benchmarking of the players operating in the overhead line inspection market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Methodology: The research methodology design adopted for this specific study includes a mix of data collected from primary and secondary data sources. Both primary resources (key players, market leaders, and in-house experts) and secondary research (a host of paid and unpaid databases), along with analytical tools, have been employed to build the predictive and forecast models.

Data and validation have been taken into consideration from both primary sources as well as secondary sources.

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research has been done to ensure maximum coverage of manufacturers/suppliers operational in a country.

- To a certain extent, exact revenue information has been extracted for each company from secondary sources and databases. Revenues specific to product/service/technology were then estimated based on fact-based proxy indicators as well as primary inputs.

- The average selling price (ASP) has been calculated using the weighted average method based on the classification.

- The currency conversion rate has been taken from the historical exchange rate of Oanda and/or other relevant websites.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- The base currency considered for the market analysis is US$. Considering the average conversion rate for that particular year, currencies other than the US$ have been converted to the US$ for all statistical calculations.

- The term "product" in this document may refer to "service" or "technology" as and where relevant.

- The term "manufacturers/suppliers" may refer to "service providers" or "technology providers" as and where relevant.

Primary Research

The primary sources involve industry experts from the overhead line inspection industry, including overhead line inspection product providers. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

Secondary Research

This study involves the usage of extensive secondary research, company websites, directories, and annual reports. It also makes use of databases, such as Businessweek and others, to collect effective and useful information for a market-oriented, technical, commercial, and extensive study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites.

Secondary research was done to obtain critical information about the industry's value chain, the market's monetary chain, revenue models, the total pool of key players, and the current and potential use cases and applications.

Key Market Players and Competition Synopsis

The overhead line inspection market features several key players driving innovation and growth. Leading companies such as Kinectrics, Siemens Energy, and eSmart Systems offer advanced inspection technologies and services. Drone-focused firms such as Cyberhawk, Sharper Shape, and Pergam Technical Services enhance market dynamics by providing efficient aerial inspection solutions. UAV manufacturers, including DJI, Skydio, and Garuda Aerospace, contribute cutting-edge platforms for accurate data capture. Other notable players, such as EDM International, CBH Aviation, and AUAV, support tailored solutions for power utilities. Buzz Solutions and Aerodyne Group have also been expanding their portfolios with integrated hardware and software services. The competition in the overhead line inspection market is intense, with companies investing heavily in technology and expanding their global reach to meet increasing demand for reliable and cost-effective inspection services. Continuous advancements in AI, machine learning, and drone technology are expected to strengthen the competitive landscape further.

Some prominent names established in this market are:

- Kinectrics

- eSmart Systems

- Siemens Energy

- Ofil Systems

- Pergarm Technical Services

- Cyberhawk

- Sharper Shape Inc.

- Aerodyne Group

- EDM International, Inc.

- CBH Aviation

- AUAV

- Skydio, Inc.

- DJI

- Garuda Aerospace

- BUZZ, Inc.

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Adoption of Drones/UAVs for Aerial Inspections

- 1.1.2 Integration of AI-powered Analytics and Automation

- 1.2 Research and Development Review

- 1.2.1 Patent Filing Trend (by Number of Patents, by Country, and Company)

- 1.3 Regulatory Landscape

- 1.4 Stakeholder Analysis

- 1.5 Market Dynamics

- 1.5.1 Market Drivers

- 1.5.1.1 Growing Demand for Grid Reliability and Aging Infrastructure

- 1.5.1.2 Increasing Grid Infrastructure

- 1.5.2 Market Challenges

- 1.5.2.1 Skilled Workforce Shortage

- 1.5.2.2 Growth of Underground Distribution Line in Developed Countries

- 1.5.3 Market Opportunities

- 1.5.3.1 AI and Machine Learning Integration

- 1.5.3.2 Public-Private Funding Models

- 1.5.1 Market Drivers

- 1.6 Case Study

2 Application

- 2.1 Application Summary

- 2.2 Overhead Line Inspection Market (by Asset)

- 2.2.1 Lines/Conductors

- 2.2.2 Towers/Poles

- 2.2.3 Insulators/Hardware

- 2.2.4 Vegetation Corridor

- 2.3 Overhead Line Inspection Market (by End User)

- 2.3.1 Transmission System Operators (TSOs)

- 2.3.2 Distribution System Operators (DSOs)

- 2.3.3 Integrated Utilities

- 2.3.4 Government/Public Agencies

3 Products

- 3.1 Product Summary

- 3.2 Overhead Line Inspection Market (by Solution)

- 3.2.1 Visual Observation

- 3.2.2 Infrared Thermography

- 3.2.3 Corona/Partial Discharge Detection

- 3.2.4 LiDAR and Photogrammetry

- 3.2.5 Vegetation Management (Satellite Imagery and Aerial LiDAR)

- 3.2.6 Others

- 3.3 Overhead Line Inspection Market (by Method of Delivery)

- 3.3.1 Helicopters

- 3.3.2 Drones

- 3.3.3 Robots

- 3.3.4 Ground

- 3.4 Overhead Line Inspection Market (by Voltage)

- 3.4.1 Transmission (>=66 kV)

- 3.4.2 Distribution (<66 kV)

4 Region

- 4.1 Regional Summary

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Application

- 4.2.6.1.2 Product

- 4.2.6.2 Canada

- 4.2.6.2.1 Application

- 4.2.6.2.2 Product

- 4.2.6.3 Mexico

- 4.2.6.3.1 Application

- 4.2.6.3.2 Product

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe (by Country)

- 4.3.6.1 Germany

- 4.3.6.1.1 Application

- 4.3.6.1.2 Product

- 4.3.6.2 U.K.

- 4.3.6.2.1 Application

- 4.3.6.2.2 Product

- 4.3.6.3 Southern and Mediterranean Europe

- 4.3.6.3.1 Application

- 4.3.6.3.2 Product

- 4.3.6.4 Eastern Europe

- 4.3.6.4.1 Application

- 4.3.6.4.2 Product

- 4.3.6.5 Nordic Europe

- 4.3.6.5.1 Application

- 4.3.6.5.2 Product

- 4.3.6.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Application

- 4.4.6.1.2 Product

- 4.4.6.2 Japan

- 4.4.6.2.1 Application

- 4.4.6.2.2 Product

- 4.4.6.3 India

- 4.4.6.3.1 Application

- 4.4.6.3.2 Product

- 4.4.6.4 South Korea

- 4.4.6.4.1 Application

- 4.4.6.4.2 Product

- 4.4.6.5 Indonesia

- 4.4.6.5.1 Application

- 4.4.6.5.2 Product

- 4.4.6.6 Malaysia

- 4.4.6.6.1 Application

- 4.4.6.6.2 Product

- 4.4.6.7 Rest-of-Asia-Pacific

- 4.4.6.7.1 Application

- 4.4.6.7.2 Product

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World (by Region)

- 4.5.6.1 South America

- 4.5.6.1.1 Application

- 4.5.6.1.2 Product

- 4.5.6.2 Middle East and Africa

- 4.5.6.2.1 Application

- 4.5.6.2.2 Product

- 4.5.6.1 South America

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Kinectrics

- 5.1.1 Overview

- 5.1.2 Top Products/Product Portfolio

- 5.1.3 Top Competitors

- 5.1.4 Target Customers

- 5.1.5 Key Personal

- 5.1.6 Analyst View

- 5.1.7 Market Share, 2024

- 5.2 eSmart Systems AS

- 5.2.1 Overview

- 5.2.2 Top Products/Product Portfolio

- 5.2.3 Top Competitors

- 5.2.4 Target Customers

- 5.2.5 Key Personal

- 5.2.6 Analyst View

- 5.2.7 Market Share, 2024

- 5.3 Siemens Energy

- 5.3.1 Overview

- 5.3.2 Company Financials

- 5.3.3 Top Products/Product Portfolio

- 5.3.4 Top Competitors

- 5.3.5 Target Customers

- 5.3.6 Key Personal

- 5.3.7 Analyst View

- 5.3.8 Market Share, 2024

- 5.4 Ofil Systems

- 5.4.1 Overview

- 5.4.2 Top Products/Product Portfolio

- 5.4.3 Top Competitors

- 5.4.4 Target Customers

- 5.4.5 Key Personal

- 5.4.6 Analyst View

- 5.4.7 Market Share, 2024

- 5.5 Pergam Technical Services

- 5.5.1 Overview

- 5.5.2 Top Products/Product Portfolio

- 5.5.3 Top Competitors

- 5.5.4 Target Customers

- 5.5.5 Key Personal

- 5.5.6 Analyst View

- 5.5.7 Market Share, 2024

- 5.6 Cyberhawk

- 5.6.1 Overview

- 5.6.2 Top Products/Product Portfolio

- 5.6.3 Top Competitors

- 5.6.4 Target Customers

- 5.6.5 Key Personal

- 5.6.6 Analyst View

- 5.6.7 Market Share, 2024

- 5.7 Sharper Shape Inc.

- 5.7.1 Overview

- 5.7.2 Top Products/Product Portfolio

- 5.7.3 Top Competitors

- 5.7.4 Target Customers

- 5.7.5 Key Personal

- 5.7.6 Analyst View

- 5.7.7 Market Share, 2024

- 5.8 Aerodyne Group

- 5.8.1 Overview

- 5.8.2 Top Products/Product Portfolio

- 5.8.3 Top Competitors

- 5.8.4 Target Customers

- 5.8.5 Key Personal

- 5.8.6 Analyst View

- 5.8.7 Market Share, 2024

- 5.9 EDM International, Inc.

- 5.9.1 Overview

- 5.9.2 Top Products/Product Portfolio

- 5.9.3 Top Competitors

- 5.9.4 Target Customers

- 5.9.5 Key Personal

- 5.9.6 Analyst View

- 5.9.7 Market Share, 2024

- 5.1 CBH Aviation

- 5.10.1 Overview

- 5.10.2 Top Products/Product Portfolio

- 5.10.3 Top Competitors

- 5.10.4 Target Customers

- 5.10.5 Key Personal

- 5.10.6 Analyst View

- 5.10.7 Market Share, 2024

- 5.11 AUAV

- 5.11.1 Overview

- 5.11.2 Top Products/Product Portfolio

- 5.11.3 Top Competitors

- 5.11.4 Target Customers

- 5.11.5 Key Personal

- 5.11.6 Analyst View

- 5.11.7 Market Share, 2024

- 5.12 Skydio, Inc.

- 5.12.1 Overview

- 5.12.2 Top Products/Product Portfolio

- 5.12.3 Top Competitors

- 5.12.4 Target Customers

- 5.12.5 Key Personal

- 5.12.6 Analyst View

- 5.12.7 Market Share, 2024

- 5.13 DJI

- 5.13.1 Overview

- 5.13.2 Top Products/Product Portfolio

- 5.13.3 Top Competitors

- 5.13.4 Target Customers

- 5.13.5 Key Personal

- 5.13.6 Analyst View

- 5.13.7 Market Share, 2024

- 5.14 Garuda Aerospace

- 5.14.1 Overview

- 5.14.2 Top Products/Product Portfolio

- 5.14.3 Top Competitors

- 5.14.4 Target Customers

- 5.14.5 Key Personal

- 5.14.6 Analyst View

- 5.14.7 Market Share, 2024

- 5.15 BUZZ, Inc.

- 5.15.1 Overview

- 5.15.2 Top Products/Product Portfolio

- 5.15.3 Top Competitors

- 5.15.4 Target Customers

- 5.15.5 Key Personal

- 5.15.6 Analyst View

- 5.15.7 Market Share, 2024

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast