|

|

市場調査レポート

商品コード

1786314

次世代インターベンション(介入性)心臓病学市場 - 世界および地域別分析:製品タイプ別、適応症タイプ別、エンドユーザー別、地域別 - 分析と予測(2025年~2035年)Next-Generation Intervention Cardiology Market - A Global and Regional Analysis: Focus on Product Type, Indication Type, End User, and Regional Analysis - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 次世代インターベンション(介入性)心臓病学市場 - 世界および地域別分析:製品タイプ別、適応症タイプ別、エンドユーザー別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年08月08日

発行: BIS Research

ページ情報: 英文 238 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

次世代インターベンション(介入性)心臓病学は、冠動脈疾患、心臓の構造的欠陥、弁膜症などの複雑な心血管系疾患を治療するために、高度で精密なガイドを用いた低侵襲技術を適用します。

この革新的な分野は、心臓治療のパラダイムシフトを象徴するものであり、従来の開心術を越えて、より安全で標的を絞った、患者固有のカテーテルを用いたインターベンションへと移行しています。ロボット工学、AIを駆使した画像処理、そして最先端の機器技術を組み合わせることで、次世代インターベンション心臓学は、臨床医がより高い精度、効率性、安全性をもってオーダーメイドの治療を提供することを可能にします。このアプローチは臨床転帰を改善し、合併症と回復時間を短縮し、ヘルスケアリソースを最適化します。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価 | 228億8,630万米ドル |

| 2035年の予測 | 468億2,100万米ドル |

| CAGR | 7.21% |

市場イントロダクション

世界の次世代インターベンション心臓病学市場は、冠動脈疾患、構造的心臓欠陥、弁膜症などの心血管系疾患の負担が増大しており、開心術に代わるより安全で精密な治療が求められていることから、2035年には468億2,100万米ドルに達すると予測され、大幅な拡大が見込まれています。この市場は、高度なロボット工学とAIガイド付き画像診断を統合した低侵襲のカテーテルベースのソリューションに支えられており、優れた手技精度、迅速な回復、患者アクセスの拡大を実現します。

次世代インターベンション心臓病学は、自動化、データ主導の精度、オペレーターの人間工学を組み合わせることで、労働災害を軽減しながら転帰を改善するパラダイムシフトを象徴しています。Robocath社のR-One(現在市販されている唯一のR-PCIプラットフォーム)のようなロボット支援PCIシステムの商業的発売と採用などの重要なマイルストーンは、これらの破壊的アプローチを検証し、経カテーテル僧帽弁置換術(TMVR)プラットフォームのCEマークは、カテーテルベースの治療の標準化と拡張性へのシフトを強調しました。

市場の拡大は、米国、欧州連合(EU)、日本における支援的な償還と規制の道筋に加え、カテーテルラボの近代化、オペレーターのトレーニング、デジタル統合に対する官民セクターの投資によってさらに後押しされています。北米、欧州、アジア太平洋諸国はインフラを拡大し、イノベーションハブを育成しており、インドやブラジルのような新興国は次世代インターベンション心臓病学市場にとって未開拓の大きな可能性を秘めています。

AIを活用したOCT/IVUSイメージング、遠隔ロボットPCIプラットフォーム、生体吸収性足場などの技術革新により、手技の質と長期的転帰の両方が向上し、技術の収束が成長を加速させています。ロボット支援PCIと血管内画像診断が次世代インターベンション心臓学の支配的な分野であることに変わりはないが、構造的インターベンション、末梢動脈疾患、先天性心疾患の修復における新たな応用により、次世代インターベンション心臓学の範囲は冠動脈疾患以外にも拡大しています。

このような勢いにもかかわらず、資本コストの高さ、トレーニング基準の分断、技術へのアクセスの不均等といった課題は、世界の次世代インターベンション心臓病学の展望に根強く残っています。しかし、ペイヤーによる支援の拡大や産学連携により、これらの障壁は着実に解決されつつあり、次世代インターベンション心臓病学ソリューションの幅広い導入が可能となっています。

アボット社、Abbott.、Medtronic plc、Boston Scientific Corporation、Terumo Corporationなどの競合情勢を形成している大手企業は、ファースト・イン・クラスの機器を開発し、ポートフォリオを拡大し、臨床検証や商品化に投資して、次世代インターベンション心臓治療における足場を固めています。

ヘルスケアにおいて精密医療、患者中心のケア、低侵襲ソリューションの優先順位が高まる中、次世代インターベンション心臓病学は心血管イノベーションの最前線に立ち、ケアパラダイムを再定義し、世界中の多様な患者集団の転帰を改善する態勢を整えています。

産業への影響

次世代インターベンション心臓病学は、幅広い心臓疾患において転帰を改善し、回復時間を短縮する低侵襲で精密な誘導治療を提供することで、心血管治療に変革をもたらしつつあります。例えば、CorPath GRXのようなロボット支援経皮的冠動脈インターベンション(R-PCI)プラットフォームは、冠動脈疾患管理における手技の精度とオペレーターの安全性を再定義し、従来のPCIと比較してステント留置の強化と放射線被曝の低減を可能にしました。この技術主導の患者中心のアプローチは、手技のリスクと入院期間を最小限に抑えながら、長期的な心血管系の健康を改善しています。

個々のインターベンションにとどまらず、次世代インターベンション心臓病学は、手技エコシステムと臨床ワークフローの革新を促進しています。AI誘導画像、遠隔インターベンション・プラットフォーム、高度な生体吸収性デバイスの統合は、診断を合理化し、リアルタイムの手技最適化を可能にし、サービスが行き届いていない地域における最先端治療へのアクセスを拡大しています。インドのSSイノベーションズのような企業や、アボットやメドトロニックのような世界的大手企業は、ロボットやAI支援技術に対する償還や規制当局の認識の高まりに支えられ、構造的心臓病や弁膜症のインターベンションにおける後期段階のプログラムを進めています。

同時に、官民の協力とデジタルヘルスインフラへの投資により、ヘルスケア提供ネットワークが強化され、遠隔地での専門知識に対する能力が構築され、心血管疾患の負担に対するシステム全体の回復力が向上しています。これらの進歩は、個々の患者のケアを向上させるだけでなく、手技のばらつきを減らし、資源利用を改善し、高度な心血管治療への公平なアクセスを促進しています。

次世代インターベンション心臓学の世界市場(セグメンテーション)

セグメンテーション1:製品タイプ別

- ロボット

- ロボット支援経皮的冠動脈インターベンション(R-PCI)

- ロボット支援冠動脈バイパス術(RA-CABG)

- ロボット支援僧帽弁置換術(RMVR)

- ロボット支援大動脈弁置換術

- ロボット以外

- IVUS

- OCT

- その他

- ステント

- カテーテル

- ガイドワイヤー

- PTCAバルーン

- その他

世界の次世代インターベンション心臓病学市場において、非ロボティクスは製品タイプ別で主要セグメントであり続け、2024年の市場シェアは84.41%、予測期間の2025年~2035年のCAGRは6.98%と予測されています。主なサブセグメントでは、IVUS、OCT、ステント、カテーテル、ガイドワイヤー、PTCAバルーン、その他が、広く臨床に採用されていること、有効性が実証されていること、ロボットプラットフォームに比べ手技の複雑性が低いことなどから、最大の貢献をしています。非ロボット型ソリューションは、費用対効果、既存のカテ室への組み込みやすさ、待機的手技と緊急手技の両方における広範な使用により、市場を独占しています。

セグメンテーション2:適応症タイプ別

- 構造的心臓病

- 冠動脈性心疾患

- 心臓弁膜症

- 末梢動脈疾患

- 先天性心疾患

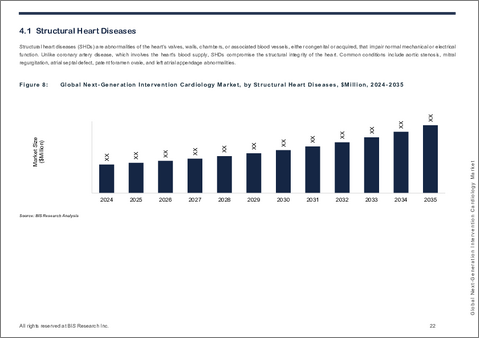

適応症別に見ると、世界の次世代インターベンション心臓病学市場は構造的心疾患分野が牽引し、2024年の市場シェアは45.67%を占めました。構造的心疾患へのインターベンションは、特に高齢化社会における大動脈弁狭窄症、僧帽弁閉鎖不全症、左心房付属器関連の脳卒中リスクの世界の負担増により、優位性を維持すると予測されます。TAVRやLAA閉塞術のような開心術に比べ、カテーテルを用いた簡便で低侵襲な心臓構造手術は、臨床医と患者を問わず広く採用されています。確立された有効性、良好な安全性プロファイル、臨床適応の拡大が一貫した需要を支え続けている一方で、機器の設計と長期的な治療結果における継続的な進歩が、多様な患者グループにおける治療の可能性をさらに高めています。

セグメント3:エンドユーザー別

- 病院および診療所

- 心臓センター

- 外来手術センター

エンドユーザー別に見ると、世界の次世代インターベンション心臓病学市場は病院・診療所が牽引し、2024年のシェアは70.47%でした。病院と診療所は、高度で低侵襲な心臓血管処置を実施するための主要拠点であり続けるため、その優位性を維持すると予想されます。カテーテル検査室、熟練したインターベンショナル・カーディオロジスト、最先端の画像診断やロボット・プラットフォームへの包括的なアクセスが、ロボットPCI、RA-CABG、ロボット僧帽弁修復などの複雑なインターベンションに最適です。大量の手技を管理し、患者を確実にモニタリングし、集学的治療を提供する能力は、こうした環境における次世代インターベンション技術の強力な採用を支えています。

区分4:地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 日本

- インド

- 中国

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 南アフリカ

- 南アフリカ

- その他

アジア太平洋の次世代インターベンション心臓病学市場は、成熟度やアクセスは依然として不均一ではありますが、心血管疾患有病率の上昇、ヘルスケアインフラの開拓、支援政策に牽引されて急速に拡大しています。中国は、地域格差と償還格差があるにもかかわらず、高い疾病負担、国内の技術革新、カテ室の拡大によって推進され、規模と成長でリードしています。日本と韓国は、成熟したイノベーション主導の市場であり、強力な保険支援と次世代インターベンション心臓病学における先進的治療法の高い導入率を誇っているが、コスト圧力と持続可能性への懸念は根強いです。インドの大規模で未浸透の市場は、次世代インターベンション心臓病学における注目すべき土着のイノベーションとともに、需要の増加を目の当たりにしています。特にSS Innovationsは、インド初の国産手術ロボットであるSSi Mantra手術ロボットシステムを開発しました。オーストラリアは、次世代インターベンション心臓病学技術の強力な償還と民間採用の恩恵を受けています。シンガポール、香港、マレーシアを含むアジア太平洋の小規模市場は、都市部に特化したプレミアムな機会を提供していますが、インドネシア、ベトナム、フィリピンはインフラと資金調達の課題に直面しています。全体として、アジア太平洋の成長の可能性は、技術革新、手頃な価格、公平なアクセスのバランスをとることにかかっており、国ごとの戦略と固有の技術革新が、持続可能な発展の鍵を握る重要な役割を果たしています。

次世代インターベンション心臓病学市場における最近の動向

- 2025年5月、Koninklijke Philips N.V.は欧州でVeriSight Pro 3D ICEカテーテルを発売し、リアルタイムの3D心臓内イメージングを提供することで、低侵襲心臓手術へのアクセスを拡大した。この技術は、全身麻酔を必要としない心臓構造インターベンションの手技ガイダンスを強化し、低侵襲心臓治療の効率と患者の快適性を向上させます。

- 2025年5月、コーディスはSELUTION Global Coronary Registryを開始しました。これは、SELUTION SLR薬剤溶出バルーンの長期転帰を5年間にわたって追跡する、最大1万人の患者を登録する実臨床前向き試験です。

- 2025年4月、Edwards Lifesciences Corporationは、手術や経カテーテル的エッジ・トゥ・エッジ(TEER)治療が不適格な症候性(中等度から重度の僧帽弁閉鎖不全症)患者に対する初の経カテーテル治療用TMVRデバイスであるSAPIEN M3経カテーテル僧帽弁システムのCEマーク承認を取得しました。

- 2025年3月、Abbottは、ステント留置前の重度石灰化冠動脈を治療する冠動脈血管内結石破砕(IVL)システムを評価するFDA IDE承認のTECTONIC試験を開始し、米国47施設で最大335人の患者を登録しました。

- 2025年3月、Terumo Corporationはシロリムス溶出ステントUltimaster NagomiおよびUltimaster TanseiのEU MDR承認を取得しました。Ultimaster NagomiおよびUltimaster Tanseiは、最短1ヶ月の二重抗血小板療法(DAPT)対象患者を含む高出血リスク(HBR)患者に適応されます。

需要-促進要因、課題、機会

市場需要促進要因

- 高齢者人口の増加、高度な心臓インターベンションの需要促進

次世代心臓インターベンション市場の主な促進要因は、心血管疾患のリスクが著しく高い世界の高齢化人口の急増です。特に65歳以上の高齢者は、大動脈弁狭窄症、冠動脈疾患、心不全、心房細動などの疾患を患う可能性が高いです。この年齢層が拡大し続けるにつれて、高リスクの患者に合わせた、より低侵襲で、より安全で、より長持ちする治療法を提供する高度な心臓インターベンションに対する需要が高まっています。大動脈弁狭窄症(AS)、僧帽弁閉鎖不全症(MR)、心房細動(AF)のような病態はますます蔓延しており、高齢者ではしばしば併存しているため、高度で低侵襲な心臓インターベンションに対する臨床的ニーズが高まっています。

高齢者の心血管疾患負荷

世界保健機関(WHO)によると(2024年)、WHO欧州地域では毎日10,000人以上が心血管疾患で死亡しており、CVDは欧州全体の主要な死因となっており、年間400万人近くが死亡しています。米国では、CDCの報告によると、心臓病が原因で毎年695,000人以上が死亡しており、これは死亡者の5人に1人に相当し、33秒に1人が心血管系が原因で死亡しています。そのリスクは特に65歳以上で高く、これらの症例の大部分を占めています。大動脈弁狭窄症は65歳以上の約2%が罹患し、80歳以上では7%に上昇します。僧帽弁閉鎖不全症は、一般人口の2%以上が罹患し、その有病率は年齢とともに増加します。一方、心房細動は先進国の成人の約3.5%に影響を与え、80歳以上では14%に上昇し、重症のAS患者の15%にみられます。これらの数字は、高齢化社会を重要な市場促進要因として浮き彫りにしており、高齢患者に蔓延する複雑な心血管系疾患に効果的に対処できる革新的で低侵襲な心臓インターベンションの必要性を強化し、より安全で耐久性があり、患者中心の治療ソリューションに対する需要の高まりを支えています。

さらに、経カテーテル的大動脈弁置換術(TAVR)、左心房付属器閉鎖術(LAAC)、僧帽弁クリップなどのインターベンションは、従来の開心術の理想的な候補者ではない高齢者集団でますます使用されるようになっています。これらの低侵襲手技は、より少ない手技リスクとより早い回復により、生存成績と生活の質を向上させます。

- ロボット支援インターベンションの登場- 手技の正確性とオペレーターのコントロールの向上

市場の課題

- AI主導型心臓病学におけるデータの標準化と臨床検証のギャップ

人工知能(AI)と機械学習(ML)は精密心臓病学の進歩を牽引してきたが、データの質の一貫性の欠如、標準化の欠如、限られた外部検証により、その臨床導入は大きな課題に直面しています。多くのAIモデルは、サイロ化された単一施設のデータセットを用いて開発されており、実臨床で遭遇する多様な患者属性、併存疾患、複雑な手技を捉えることができないです。このことは、特に十分なサービスを受けていない集団や民族的に多様な集団に適用する場合、アルゴリズムの偏りに関する懸念を引き起こします。さらに、厳格な多施設臨床試験が行われる従来の医療機器とは異なり、インターベンション心臓病学においてAIツールを検証するための普遍的に受け入れられた枠組みは存在しません。

例えば、2023年の心臓病学におけるAIの調査範囲レビューでは、無作為化臨床試験は全体の17.2%に過ぎず、前向きRCTレベルのヒトによる検証を実証した研究は64件中11件に過ぎなかっています。同様に、心血管疾患のAIリスクモデルのプレプリントレビューでは、外部検証を受けたモデルは約20%に過ぎず、実世界のワークフローにおける臨床的影響を評価したものはありません。このようなギャップは、広く臨床に採用される前に、より強固で標準化された検証プロセスが必要であることを浮き彫りにしています。

市場成長を阻むその他の課題には、以下のようなものがあります。

- 次世代血管インプラントの安全性と臨床検証の障壁

市場機会

- 次世代の使用事例を生み出すステントとバルーンの革新

ステントとバルーンは、冠動脈疾患(CAD)や末梢動脈疾患(PAD)の治療において、長い間基礎的な役割を担ってきました。材料、薬剤コーティング、構造設計における最近の進歩は、臨床応用を拡大し、患者の転帰を改善し、次世代インターベンション心臓病学の成長を牽引しています。

薬剤コーティングバルーン技術の進歩

注目すべき技術革新の一つは、ステント内再狭窄(ISR)の治療に薬剤コーティングバルーン(DCB)の使用が拡大していることです。抗増殖作用のある薬剤を血管壁に直接注入することで、永久的な留置物を残すことなく、将来の治療選択肢を維持し、追加のステント留置に伴うリスクを軽減することができます。2024年3月、FDAはBoston ScientificのAGENTパクリタキセルコーティングバルーンを、ISRに対して米国で承認された最初の冠動脈DCBとして承認しました。AGENT IDE試験のデータでは、標準的なバルーン血管形成術と比較して、狭窄の再発率が減少し、主要な心臓有害事象の増加がないことが示されました。

市場成長の機会を生み出すその他の要因には、以下のようなものがあります。

- 遠隔およびロボットによる新興市場への進出

市場動向:

- 低侵襲・経皮的手技へのシフトが治療パラダイムを変える

心臓治療の分野は、回復時間の短縮、手技リスクの低減、医療費の削減を実現する低侵襲のカテーテルベースの手技へとますますシフトしており、特に高齢者や高リスクの患者にとって有益です。経カテーテル的大動脈弁置換術(TAVR)、左心房付属器閉鎖術(LAAC)、MitraClip、ロボットによる経皮的冠動脈インターベンション(PCI)などの治療法は、従来の開心術に取って代わりつつあり、さまざまな心臓疾患に対する標準治療としての地位を確立しつつあります。MitraClipの使用は、より広範な規制当局の承認と償還政策に支えられ、近年大幅に拡大しています。

この分野を牽引する現在の動向

- .インターベンショナル心臓病学におけるAI、予測知能の統合

製品/イノベーション戦略:当レポートは、次世代インターベンション心臓病学における最新技術の進歩に関する深い洞察を提供し、企業がイノベーションを推進し、市場のニーズに合わせた最先端の製品を開発することを可能にします。

成長/マーケティング戦略:包括的な市場分析を提供し、主要な成長機会を特定することで、企業は的を絞ったマーケティング戦略を立案し、市場でのプレゼンスを効果的に拡大するための知識を得ることができます。

競合戦略:当レポートには徹底的な競合情勢分析が含まれており、次世代インターベンション心臓治療における競合他社の強みと弱みを理解し、市場における競争優位性を獲得するための効果的な戦略を立てることができます。

規制とコンプライアンス戦略:次世代インターベンション心臓病学に特化した進化する規制の枠組み、承認、業界ガイドラインに関する最新情報を提供し、企業がコンプライアンスを維持し、新しい次世代インターベンション心臓病学への市場参入を加速できるようにします。

投資および事業拡大戦略:市場動向、資金調達パターン、提携機会を分析することで、企業が十分な情報に基づいた投資決定を下し、事業成長のための潜在的なM&A機会を特定できるよう支援します。

企業プロファイルは、一次専門家から収集したインプット、および企業カバレッジ、製品ポートフォリオ、市場浸透度の分析に基づいて選定しています。

この市場の主要企業には、ロボット支援PCIシステム、血管内イメージングプラットフォーム、次世代ステントやスキャフォールドなど、包括的な先進インターベンショナルソリューションを提供する世界の主要医療機器企業が含まれます。Abbott、Medtronic、 Boston Scientificのような老舗企業は、冠動脈、構造、末梢のインターベンションを網羅する広範なポートフォリオを有し、圧倒的な存在感を示しています。

イノベーターはまた、高度なOCTやIVUSシステムなど、AIを活用した画像モダリティを開発し、手技計画と治療成績を向上させています。バイオテクノロジーに触発された医療技術企業は、血管の治癒を促進し再狭窄を減少させる生体吸収性スキャフォールド、薬剤コーティングバルーン、新規血管インプラントを開拓しています。新興企業や地域の参入企業は、十分なサービスを受けていない新興市場をターゲットに、費用対効果の高いロボットシステム、携帯型イメージングツール、遠隔インターベンションプラットフォームなどの破壊的ソリューションで参入しています。これらの企業が一体となって技術的進歩を推進し、先進医療へのアクセスを拡大し、精密誘導低侵襲心臓血管インターベンションにおける満たされていないニーズに対応しています。

この市場で確立された著名な企業は以下の通りです。

- Medtronic plc

- Boston Scientific Corporation

- Abbott.

- Terumo Corporation

- Edwards Lifesciences

- Koninklijke Philips N.V.

- Siemens Healthineers

目次

エグゼクティブサマリー

第1章 世界の次世代インターベンション心臓病学市場:業界展望

- 競合情勢

- ビジネス戦略

- 次世代インターベンション心臓病学市場:診断と管理

- 冠動脈インターベンションの進歩

- 冠動脈インターベンションにおける将来の方向性と新興技術

- 次世代インターベンション心臓病学市場におけるパイプライン製品

- 規制状況

- 米国

- 欧州

- アジア太平洋

第2章 市場力学

- 動向

- 次世代インターベンション心臓病学市場の動向

- 市場力学

- 動向、促進要因、課題、機会:現在および将来の影響評価

- 市場の促進要因

- 市場の抑制要因

- 市場の機会

- 市場の課題

第3章 次世代インターベンション心臓病学市場(製品タイプ別)、金額、2024年~2035年

- ロボット工学

- 非ロボット工学

第4章 次世代インターベンション心臓病学市場(適応症タイプ別)、金額、2024年~2035年

- 構造的心疾患

- 冠動脈疾患

- 心臓弁膜症

- 末梢動脈疾患

- 先天性心疾患

第5章 次世代インターベンション心臓病学市場(エンドユーザー別)、金額、2024年~2035年

- 病院と診療所

- 心臓センター

- 外来手術センター

第6章 次世代インターベンション心臓病学市場(地域別)、金額、2024年~2035年

- 地域サマリー

- 北米

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 米国

- カナダ

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 英国

- フランス

- ドイツ

- イタリア

- スペイン

- その他

- アジア太平洋

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- サウジアラビア

- 南アフリカ

- その他

第7章 競合情勢と企業プロファイル

- 企業プロファイル

- Medtronic plc

- Abbott.

- Boston Scientific Corporation

- Terumo Corporation

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- Edwards Lifesciences Corporation

- B. Braun SE

- Cordis

- Teleflex Incorporated

- Supira Medical, Inc.

- Intuitive Surgical Operations, Inc

第8章 調査手法

List of Figures

- Figure 1: Next-Generation Intervention Cardiology Market (by Scenario), $Million, 2024, 2028, and 2035

- Figure 2: Global Next-Generation Intervention Cardiology Market, 2024-2035

- Figure 3: Top 10 Countries, Global Next-Generation Intervention Cardiology Market, $Million, 2024

- Figure 4: Global Next-Generation Intervention Cardiology Market Snapshot

- Figure 5: Global Next-Generation Intervention Cardiology Market, $Million, 2024 and 2035

- Figure 6: Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024, 2028, and 2035

- Figure 7: Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024, 2028, and 2035

- Figure 8: Next-Generation Intervention Cardiology Market (by End User), $Million, 2024, 2028, and 2035

- Figure 9: Next-Generation Intervention Cardiology Market Segmentation

- Figure 10: Cardiovascular Disease Statistics

- Figure 11: Global Next-Generation Intervention Cardiology Market, by Robotics, $Million, 2024-2035

- Figure 12: Comparison between Manual PCI and Robotic-Assisted PCI:

- Figure 13: Key Events in Robotics-Assisted Percutaneous Intervention:

- Figure 14: Global Next-Generation Intervention Cardiology Market, by Percutaneous Coronary Intervention, $Million, 2024-2035

- Figure 15: Global Next-Generation Intervention Cardiology Market, by RA-CABG, $Million, 2024-2035

- Figure 16: Global Next-Generation Intervention Cardiology Market, by RMVR, $Million, 2024-2035

- Figure 17: Global Next-Generation Intervention Cardiology Market, by RAVR, $Million, 2024-2035

- Figure 18: Global Next-Generation Intervention Cardiology Market, by Non-Robotics, $Million, 2024-2035

- Figure 19: Global Next-Generation Intervention Cardiology Market, by Intravascular Ultrasound, $Million, 2024-2035

- Figure 20: Global Next-Generation Intervention Cardiology Market, by Optical Coherence Tomography, $Million, 2024-2035

- Figure 21: Global Next-Generation Intervention Cardiology Market, by Other Interventions, $Million, 2024-2035

- Figure 22: Global Next-Generation Intervention Cardiology Market, by Stents, $Million, 2024-2035

- Figure 23: Global Next-Generation Intervention Cardiology Market, by Bioresorbable Stents, $Million, 2024-2035

- Figure 24: Global Next-Generation Intervention Cardiology Market, by Drug- Eluting Stents, $Million, 2024-2035

- Figure 25: Global Next-Generation Intervention Cardiology Market, by Bare-Metal Stents, $Million, 2024-2035

- Figure 26: Global Next-Generation Intervention Cardiology Market, by Catheters, $Million, 2024-2035

- Figure 27: Projected Global Ischemic Heart Disease (IHD) Burden by 2050

- Figure 28: Global Next-Generation Intervention Cardiology Market, by PTCA Balloons, $Million, 2024-2035

- Figure 29: Global Next-Generation Intervention Cardiology Market, by Guidewires, $Million, 2024-2035

- Figure 30: Global Next-Generation Intervention Cardiology Market, by Others, $Million, 2024-2035

- Figure 31: Global Next-Generation Intervention Cardiology Market, by Structural Heart Diseases, $Million, 2024-2035

- Figure 32: Coronary Heart Diseases: U.S. Statistics

- Figure 33: Global Next-Generation Intervention Cardiology Market, by Coronary Heart Diseases, $Million, 2024-2035

- Figure 34: Global Next-Generation Intervention Cardiology Market, by Valvular Heart Diseases, $Million, 2024-2035

- Figure 35: Epidemiology and Burden of Peripheral Artery Diseases:

- Figure 36: Global Next-Generation Intervention Cardiology Market, by Peripheral Artery Diseases, $Million, 2024-2035

- Figure 37: Global Next-Generation Intervention Cardiology Market, by Congenital Heart Diseases, $Million, 2024-2035

- Figure 38: Global Next-Generation Intervention Cardiology Market, by Hospitals and Clinics, $Million, 2024-2035

- Figure 39: Global Next-Generation Intervention Cardiology Market, by Cardiac Centers, $Million, 2024-2035

- Figure 40: Global Next-Generation Intervention Cardiology Market, by Ambulatory Surgical Centers, $Million, 2024-2035

- Figure 41: Inclusion and Exclusion Criteria for Global Next-Generation Intervention Cardiology Market

- Figure 42: Data Triangulation

- Figure 43: Top-Down and Bottom-Up Approach

- Figure 44: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Pipeline Products in Next-Generation Intervention Cardiology Market

- Table 3: Company Providing IVUS Imaging system with AI Features

- Table 4: Company Providing OCT Imaging system with AI Features

- Table 5: Major Companies Providing Stents:

- Table 6: Major Companies Offering Catheters

- Table 7: Major Companies Offering Guidewires

- Table 8: Global Next-Generation Intervention Cardiology Market (by Region), $Million, 2024-2035

- Table 9: North America Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 10: North America Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 11: North America Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 12: North America Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 13: North America Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 14: North America Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 15: North America Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 16: U.S. Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 17: U.S. Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 18: U.S. Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 19: U.S. Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 20: U.S. Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 21: U.S. Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 22: U.S. Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 23: Canada Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 24: Canada Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 25: Canada Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 26: Canada Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 27: Canada Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 28: Canada Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 29: Canada Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 30: Europe Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 31: Europe Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 32: Europe Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 33: Europe Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 34: Europe Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 35: Europe Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 36: Europe Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 37: U.K. Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 38: U.K. Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 39: U.K. Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 40: U.K. Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 41: U.K. Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 42: U.K. Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 43: U.K. Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 44: France Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 45: France Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 46: France Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 47: France Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 48: France Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 49: France Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 50: France Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 51: Germany Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 52: Germany Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 53: Germany Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 54: Germany Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 55: Germany Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 56: Germany Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 57: Germany Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 58: Italy Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 59: Italy Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 60: Italy Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 61: Italy Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 62: Italy Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 63: Italy Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 64: Italy Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 65: Spain Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 66: Spain Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 67: Spain Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 68: Spain Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 69: Spain Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 70: Spain Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 71: Spain Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 72: Rest-of-Europe Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 73: Rest-of-Europe Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 74: Rest-of-Europe Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 75: Rest-of-Europe Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 76: Rest-of-Europe Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 77: Rest-of-Europe Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 78: Rest-of-Europe Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 79: Asia-Pacific Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 80: Asia-Pacific Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 81: Asia-Pacific Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 82: Asia-Pacific Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 83: Asia-Pacific Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 84: Asia-Pacific Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 85: Asia-Pacific Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 86: Japan Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 87: Japan Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 88: Japan Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 89: Japan Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 90: Japan Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 91: Japan Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 92: Japan Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 93: China Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 94: China Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 95: China Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 96: China Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 97: China Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 98: China Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 99: China Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 100: India Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 101: India Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 102: India Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 103: India Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 104: India Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 105: India Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 106: India Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 107: Australia Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 108: Australia Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 109: Australia Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 110: Australia Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 111: Australia Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 112: Australia Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 113: Australia Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 114: South Korea Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 115: South Korea Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 116: South Korea Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 117: South Korea Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 118: South Korea Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 119: South Korea Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 120: South Korea Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 121: Rest-of-Asia-Pacific Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 122: Rest-of-Asia-Pacific Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 123: Rest-of-Asia-Pacific Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 124: Rest-of-Asia-Pacific Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 125: Rest-of-Asia-Pacific Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 126: Rest-of-Asia-Pacific Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 127: Rest-of-Asia-Pacific Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 128: Latin America Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 129: Latin America Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 130: Latin America Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 131: Latin America Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 132: Latin America Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 133: Latin America Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 134: Latin America Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 135: Brazil Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 136: Brazil Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 137: Brazil Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 138: Brazil Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 139: Brazil Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 140: Brazil Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 141: Brazil Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 142: Mexico Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 143: Mexico Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 144: Mexico Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 145: Mexico Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 146: Mexico Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 147: Mexico Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 148: Mexico Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 149: Rest-of-Latin America Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 150: Rest-of-Latin America Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 151: Rest-of-Latin America Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 152: Rest-of-Latin America Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 153: Rest-of-Latin America Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 154: Rest-of-Latin America Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 155: Rest-of-Latin America Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 156: Middle East and Africa Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 157: Middle East and Africa Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 158: Middle East and Africa Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 159: Middle East and Africa Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 160: Middle East and Africa Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 161: Middle East and Africa Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 162: Middle East and Africa Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 163: K.S.A Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 164: K.S.A Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 165: K.S.A Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 166: K.S.A Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 167: K.S.A Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 168: K.S.A Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 169: K.S.A Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 170: South Africa Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 171: South Africa Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 172: South Africa Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 173: South Africa Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 174: South Africa Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 175: South Africa Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 176: South Africa Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

- Table 177: Rest-of-Middle East and Africa Next-Generation Intervention Cardiology Market (by Product Type), $Million, 2024-2035

- Table 178: Rest-of-Middle East and Africa Next-Generation Intervention Cardiology Market (by Robotics), $Million, 2024-2035

- Table 179: Rest-of-Middle East and Africa Next-Generation Intervention Cardiology Market (by Non-Robotics), $Million, 2024-2035

- Table 180: Rest-of-Middle East and Africa Next-Generation Intervention Cardiology Market (by Other Interventions), $Million, 2024-2035

- Table 181: Rest-of-Middle East and Africa Next-Generation Intervention Cardiology Market (by Stents Type), $Million, 2024-2035

- Table 182: Rest-of-Middle East and Africa Next-Generation Intervention Cardiology Market (by Indication Type), $Million, 2024-2035

- Table 183: Rest-of-Middle East and Africa Next-Generation Intervention Cardiology Market (by End User), $Million, 2024-2035

This report can be delivered within 1 working day.

Introduction of Next-generation Intervention Cardiology

Next-generation intervention cardiology applies advanced, precision-guided, minimally invasive techniques to treat complex cardiovascular conditions, including coronary artery disease, structural heart defects, and valvular disorders. This innovative field represents a paradigm shift in cardiac care, moving beyond traditional open-heart surgeries toward safer, more targeted, and patient-specific catheter-based interventions. By combining robotics, AI-driven imaging, and cutting-edge device technologies, next-generation intervention cardiology enables clinicians to deliver tailored therapies with enhanced accuracy, efficiency, and safety. This approach improves clinical outcomes, reduces complications and recovery time, and optimizes healthcare resources.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $22,886.3 Million |

| 2035 Forecast | $46,821.0 Million |

| CAGR | 7.21% |

Market Introduction

The global next-generation intervention cardiology market is expected to witness significant expansion, projected to reach $46,821.0 million by 2035, driven by the escalating burden of cardiovascular diseases- including coronary artery disease, structural heart defects, and valvular disorders-that demand safer, more precise alternatives to open-heart surgery. This market is anchored in minimally invasive, catheter-based solutions that integrate advanced robotics, and AI-guided imaging to deliver superior procedural accuracy, faster recovery, and expanded patient access.

Next-generation intervention cardiology represents a paradigm shift, combining automation, data-driven precision, and operator ergonomics to improve outcomes while reducing occupational hazards. Key milestones, such as the commercial launch and adoption of robotic-assisted PCI systems like Robocath's R-One-currently the only commercially available R-PCI platform-have validated these disruptive approaches and and the CE Mark for transcatheter mitral valve replacement (TMVR) platforms, underscored the shift toward standardization and scalability of catheter-based therapies.

Market expansion is further bolstered by supportive reimbursement and regulatory pathways in the U.S., EU, and Japan, alongside investments by public and private sectors in cath lab modernization, operator training, and digital integration. Countries across North America, Europe, and Asia-Pacific are scaling infrastructure and fostering innovation hubs, with emerging economies such as India and Brazil offering significant untapped potential for next-generation intervention cardiology market.

Technological convergence is accelerating growth, with innovations such as AI-enabled OCT/IVUS imaging, remote robotic PCI platforms, and bioresorbable scaffolds enhancing both procedural quality and long-term outcomes. While robotic-assisted PCI and intravascular imaging remain dominant segments of next-generation intervention cardiology, newer applications in structural interventions, peripheral artery disease, and congenital heart repairs are expanding the scope of next-generation intervention cardiology beyond coronary disease.

Despite this momentum, challenges such as high capital costs, fragmented training standards, and uneven access to technology persist in the global next-generation intervention cardiology landscape. However, growing payer support, and industry-academic collaborations are steadily addressing these barriers, enabling wider adoption of of next-generation intervention cardiology solutions.

Leading players such as Abbott., Medtronic plc, Boston Scientific Corporation, and Terumo Corporation are shaping the competitive landscape, advancing first-in-class devices, expanding portfolios, and investing in clinical validation and commercialization to strengthen their foothold in next-generation intervention cardiology.

As healthcare increasingly prioritizes precision medicine, patient-centric care, and minimally invasive solutions, next-generation intervention cardiology stands at the forefront of cardiovascular innovation, poised to redefine care paradigms and improve outcomes for diverse patient populations worldwide.

Industrial Impact

Next-generation intervention cardiology is transforming cardiovascular care by delivering minimally invasive, precision-guided treatments that improve outcomes and reduce recovery times across a wide spectrum of heart diseases. For example, robotic-assisted percutaneous coronary intervention (R-PCI) platforms, such as CorPath GRX, have redefined procedural accuracy and operator safety in coronary artery disease management, enabling enhanced stent placement and reduced radiation exposure compared to conventional PCI. This technology-driven, patient-centric approach is improving long-term cardiovascular health while minimizing procedural risks and hospital stays.

Beyond individual interventions, next-generation intervention cardiology is fostering innovation in procedural ecosystems and clinical workflows. The integration of AI-guided imaging, remote tele-intervention platforms, and advanced bioresorbable devices is streamlining diagnostics, enabling real-time procedural optimization, and expanding access to cutting-edge therapies in underserved regions. Companies like SS Innovations in India and global leaders such as Abbott and Medtronic are advancing late-stage programs in structural and valvular heart disease interventions, supported by growing reimbursement and regulatory recognition of robotic and AI-assisted technologies.

Simultaneously, public-private collaborations and investments in digital health infrastructure are strengthening healthcare delivery networks, building capacity for remote expertise, and improving system-wide resilience against cardiovascular disease burdens. These advancements are not only elevating individual patient care but also reducing procedural variability, improving resource utilization, and driving equitable access to advanced cardiovascular therapies.

Global Next-Generation Intervention Cardiology Market (Segmentation)

Segmentation 1: By Product Type

- Robotics

- Robotic-Assisted Percutaneous Coronary Intervention (R-PCI)

- Robotic-Assisted Coronary Artery Bypass Grafting (RA-CABG)

- Robotic Assisted Mitral Valve-Replacement (RMVR)

- Robotic Assisted Aortic Valve Replacement

- Non-Robotics

- IVUS

- OCT

- Other Interventions

- Stents

- Catheters

- Guidewires

- PTCA Balloons

- Others

Non-robotics remains the leading segment by product type in the global next-generation intervention cardiology market, holding an 84.41% market share in 2024, with a projected CAGR of 6.98% during the forecast period 2025-2035. Among its key subsegments-IVUS, OCT, stents, catheters, guidewires, PTCA balloons, and others drive the largest contributions, owing to their widespread clinical adoption, proven efficacy, and lower procedural complexity compared to robotic platforms. Non-robotic solutions dominated the market due to their cost-effectiveness, ease of integration into existing cath labs, and extensive use in both elective and emergency procedures.

Segmentation 2: By Indication Type

- Structural Heart Disease

- Coronary Heart Diseases

- Valvular Heart Diseases

- Peripheral Artery Diseases

- Congenital Heart Diseases

Based on indication type, the global next-generation intervention cardiology market was led by the structural heart disease segment, which accounted for a 45.67% market share in 2024. Structural heart disease interventions are projected to maintain dominance due to the growing global burden of aortic stenosis, mitral regurgitation, and left atrial appendage-related stroke risk, particularly among aging populations. The simpler, catheter-based, and minimally invasive nature of structural heart procedures compared to open-heart surgery-such as TAVR and LAA occlusion-has driven widespread adoption by clinicians and patients alike. Their established efficacy, favorable safety profiles, and expanding clinical indications continue to support consistent demand, while ongoing advancements in device design and long-term outcomes are further enhancing their therapeutic potential across diverse patient groups.

Segmentation 3: By End User

- Hospitals and Clinics

- Cardiac Centers

- Ambulatory Surgical Centers

Based on end user, the global next-generation intervention cardiology market was led by the Hospitals and Clinics segment, which held a 70.47% share in 2024. Hospitals and clinics are expected to maintain their dominance as they remain the primary hubs for performing advanced, minimally invasive cardiovascular procedures. Their comprehensive access to catheterization labs, skilled interventional cardiologists, and state-of-the-art imaging and robotic platforms makes them best suited for complex interventions such as, robotic PCI, RA-CABG and Robotic mitral valve repair. The ability to manage high procedural volumes, ensure patient monitoring, and deliver multidisciplinary care supports the strong adoption of next-generation interventional technologies in these settings.

Segmentation 4: By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest-of-Europe

- Asia-Pacific

- Japan

- India

- China

- Australia

- South Korea

- Rest-of-Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest-of-Latin America

- Middle East and Africa

- K.S.A

- South Africa

- Rest-of-Middle East and Africa

The next-generation intervention cardiology market in the Asia-Pacific region is expanding rapidly, driven by rising cardiovascular disease prevalence, healthcare infrastructure development, and supportive policies, though the region remains heterogeneous in maturity and access. China leads in scale and growth, propelled by high disease burden, domestic innovation, and cath lab expansion despite regional and reimbursement disparities. Japan and South Korea are mature, innovation-led markets with strong insurance support and high uptake of advanced therapies in the next-generation intervention cardiology, though cost pressures and sustainability concerns persist. India's large, underpenetrated market is witnessing increasing demand alongside notable indigenous innovations in the next-generation intervention cardiology. Notably, SS Innovations has developed the SSi Mantra surgical robotic system, India's first homegrown surgical robot. Australia benefits from strong reimbursement and private adoption of next-generation intervention cardiology technologies. Smaller APAC markets, including Singapore, Hong Kong, and Malaysia, offer premium, urban-focused opportunities. whereas Indonesia, Vietnam, and the Philippines face infrastructure and funding challenges. Overall, APAC's growth potential hinges on balancing innovation, affordability, and equitable access, with country-specific strategies and indigenous innovation playing a key role in unlocking sustainable development.

Recent Developments in the Next-Generation Intervention Cardiology Market

- In May 2025, Koninklijke Philips N.V. launched VeriSight Pro 3D ICE catheter in Europe, delivering real-time 3D intracardiac imaging to expand access to minimally invasive heart procedures. Technology enhances procedural guidance for structural heart interventions without requiring general anesthesia, improving efficiency and patient comfort in minimally invasive cardiac care.

- In May 2025, Cordis launched the SELUTION Global Coronary Registry, a real-world, prospective study enrolling up to 10,000 patients to track long-term outcomes of SELUTION SLR drug-eluting balloon over five years.

- In April 2025, Edwards Lifesciences Corporation received CE Mark approval for the SAPIEN M3 Transcatheter Mitral Valve System, the first TMVR device for transcatheter treatment of patients with symptomatic (moderate-to-severe mitral regurgitation) who are ineligible for surgery or transcatheter edge-to-edge (TEER) therapy.

- In March 2025, Abbott launched an FDA IDE-approved TECTONIC trial to evaluate its Coronary Intravascular Lithotripsy (IVL) System for treating severely calcified coronary arteries prior to stenting, enrolling up to 335 patients across 47 U.S. sites.

- In March 2025, Terumo Corporation received EU MDR approval for Ultimaster Nagomi and Ultimaster Tansei sirolimus-eluting stents, indicated for high bleeding risk (HBR) patients, including those eligible for dual antiplatelet therapy (DAPT) as short as one month.

Demand -Drivers, Challenges, and Opportunities

Market Demand Drivers:

- Rising Elderly Population, Driving Demand for Advanced Cardiac Interventions

A major driver of the next-generation intervention cardiology market is the rapid growth of the global aging population, which faces a significantly higher risk of cardiovascular diseases. Older adults, particularly those aged 65 and above, are more likely to suffer from conditions like aortic stenosis, coronary artery disease, heart failure, and atrial fibrillation. As this age group continues to expand, there is a growing demand for advanced cardiac interventions that offer less invasive, safer, and longer-lasting treatment options tailored to high-risk patients. Conditions such as aortic stenosis (AS), mitral regurgitation (MR), and atrial fibrillation (AF) are increasingly prevalent and often coexist in aging individuals, elevating the clinical need for advanced, minimally invasive cardiac interventions.

Cardiovascular Disease Burden in the Elderly

According to the World Health Organization (2024), cardiovascular diseases kill over 10,000 people daily in the WHO European Region, making CVD the leading cause of death across Europe, accounting for nearly 4 million deaths annually. In the U.S., the CDC reports that heart disease causes over 695,000 deaths each year, equal to 1 in every five deaths, with one person dying every 33 seconds due to cardiovascular causes. The risk is especially high in individuals aged 65 and older, who account for the majority of these cases. Aortic stenosis affects approximately 2% of people aged 65 years and older, rising to 7% among individuals above 80, making it one of the most common and deadly forms of valvular heart disease in the elderly. Mitral regurgitation, another highly prevalent valve disorder, affects over 2% of the general population and has a prevalence that increases with age. Meanwhile, atrial fibrillation impacts approximately 3.5% of adults in developed countries, rising to 14% in people over 80 years old, and is present in 15% of patients with severe AS. These figures highlight the aging population as a critical market driver, reinforcing the need for innovative, minimally invasive cardiac interventions that can effectively address the complex cardiovascular conditions prevalent in elderly patients and support the growing demand for safer, durable, and patient-centric treatment solutions.

Furthermore, interventions such as Transcatheter Aortic Valve Replacement (TAVR), Left Atrial Appendage Closure (LAAC), and Mitral Clip are increasingly used in elderly populations who are not ideal candidates for traditional open-heart surgery. These minimally invasive techniques improve survival outcomes and quality of life with fewer procedural risks and faster recovery.Some of the other driving factors include:

- Emergence of Robotic-Assisted Interventions-Enhancing Procedural Accuracy and Operator Control

Market Challenges:

- Data Standardization and Clinical Validation Gaps in AI-Driven Cardiology

While artificial intelligence (AI) and machine learning (ML) have been driving advances in precision cardiology, their clinical implementation faces significant challenges due to inconsistent data quality, lack of standardization, and limited external validation. Many AI models are developed using siloed, single-center datasets that fail to capture the diversity of patient demographics, comorbidities, and procedural complexities encountered in real-world practice. This raises concerns about algorithmic bias, particularly when applied to underserved or ethnically diverse populations. Furthermore, unlike traditional medical devices that undergo rigorous multicenter clinical trials, there is no universally accepted framework for validating AI tools in intervention cardiology.

For example, a 2023 scoping review of AI in cardiology reported that only 17.2% of studies were randomized clinical trials, with just 11 of 64 demonstrating prospective, RCT-level human validation. Similarly, a preprint review of AI risk models for cardiovascular disease found that only about 20% of models had been externally validated, with none having assessed their clinical impact in real-world workflows. These gaps highlight the need for more robust, standardized validation processes before widespread clinical adoption.

Some of the other factors challenging the market growth include:

- Safety and Clinical Validation Barriers for Next-Generation Vascular Implants

Market Opportunities:

- Stent and Balloon Innovation Unlocking Next-Generation Use Cases

Stents and balloons have long been foundational in treating coronary artery disease (CAD) and peripheral arterial disease (PAD). Recent advancements in materials, drug coatings, and structural designs have been expanding their clinical applications, improving patient outcomes, and driving growth in next-generation intervention cardiology.

Advancements in Drug-Coated Balloon Technologies

One notable innovation is the growing use of drug-coated balloons (DCBs) for treating in-stent restenosis (ISR). By delivering antiproliferative drugs directly to the vessel wall without leaving a permanent implant, DCBs preserve future treatment options and reduce risks associated with additional stenting. In March 2024, the FDA approved Boston Scientific's AGENT paclitaxel-coated balloon, the first coronary DCB approved in the U.S. for ISR. Data from the AGENT IDE trial demonstrated reduced rates of repeat narrowing and no increase in major adverse cardiac events compared to standard balloon angioplasty.

Some of the other factors creating an opportunity for market growth include:

- Remote and Robotic-Enabled Expansion into Emerging Markets

Market Trends:

- Shift Towards Minimally Invasive and Percutaneous Procedures Transforming Treatment Paradigms

The field of cardiac care is increasingly shifting toward minimally invasive, catheter-based interventions that offer shorter recovery times, reduced procedural risks, and lower healthcare costs-particularly beneficial for elderly and high-risk patients. Techniques such as Transcatheter Aortic Valve Replacement (TAVR), Left Atrial Appendage Closure (LAAC), MitraClip, and robotic Percutaneous Coronary Intervention (PCI) are progressively replacing traditional open-heart surgeries, establishing themselves as standard-of-care treatments for various cardiac conditions. The use of MitraClip has expanded significantly in recent years, supported by broader regulatory approvals and reimbursement policies.

Current Trends Driving the Field:

- . Integration of AI, Predictive Intelligence in Interventional Cardiology

How can this report add value to an organization?

Product/Innovation Strategy: The report offers in-depth insights into the latest technological advancements in next-generation intervention cardiology, enabling organizations to drive innovation and develop cutting-edge products tailored to market needs.

Growth/Marketing Strategy: By providing comprehensive market analysis and identifying key growth opportunities, the report equips organizations with the knowledge to craft targeted marketing strategies and expand their market presence effectively.

Competitive Strategy: The report includes a thorough competitive landscape analysis, helping organizations understand their competitors' strengths and weaknesses in next-generation intervention cardiology and allowing them to strategize effectively to gain a competitive edge in the market.

Regulatory and Compliance Strategy: It provides updates on evolving regulatory frameworks, approvals, and industry guidelines specific to next-generation intervention cardiology, ensuring organizations stay compliant and accelerate market entry for new next-generation intervention cardiology

Investment and Business Expansion Strategy: By analyzing market trends, funding patterns, and partnership opportunities, the report assists organizations in making informed investment decisions and identifying potential M&A opportunities for business growth.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2024. A historical year analysis has been done for the period FY2023. The market size has been estimated for FY2024 and projected for the period FY2025-FY2035.

- The scope of this report has been carefully derived based on extensive interactions with experts and stakeholders across leading companies and research institutions worldwide. This report provides a comprehensive market analysis of robotics and non-robotics within the next-generation intervention cardiology market.

- Revenues of the companies have been referenced from their annual reports for FY2023 and FY2024. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, market collaborations, and operational history.

- The market has been mapped based on the available next-generation intervention cardiology products. All the key companies with significant offerings in this field have been considered and profiled in this report.

Primary Research:

The primary sources involve industry experts in next-generation intervention cardiology, including the market players offering products and services. Resources such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the market in focus

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- Certified publications, articles from recognized authors, white papers, directories, and major databases, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their product portfolio

- Gold standard magazines, journals, white papers, press releases, and news articles

- Paid databases

The key data points taken from the secondary sources include:

- Segmentations and percentage shares

- Data for market value

- Key industry trends of the top players of the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

Profiled companies have been selected based on inputs gathered from primary experts, as well as analyzing company coverage, product portfolio, and market penetration.

Key players in this market include leading global medical device companies offering a comprehensive range of advanced interventional solutions, such as robotic-assisted PCI systems, intravascular imaging platforms, and next-generation stents and scaffolds. Established firms like Abbott, Medtronic, and Boston Scientific dominate with extensive portfolios spanning coronary, structural, and peripheral interventions.

Innovators are also developing AI-driven imaging modalities, such as advanced OCT and IVUS systems, to improve procedural planning and outcomes. Biotech-inspired medtech firms are pioneering bioresorbable scaffolds, drug-coated balloons, and novel vascular implants that enhance vessel healing and reduce restenosis. Start-ups and regional players are entering with disruptive solutions, such as cost-effective robotic systems, portable imaging tools, and tele-interventional platforms targeting underserved and emerging markets. Together, these companies are driving technological progress, expanding access to advanced care, and addressing unmet needs in precision-guided, minimally invasive cardiovascular interventions.

Some prominent names established in this market are:

- Medtronic plc

- Boston Scientific Corporation

- Abbott.

- Terumo Corporation

- Edwards Lifesciences

- Koninklijke Philips N.V.

- Siemens Healthineers

Table of Contents

Executive Summary

Scope and Definition

1 Global Next-Generation Intervention Cardiology Market: Industry Outlook

- 1.1 Competitive Landscape

- 1.1.1 Business Strategies

- 1.1.1.1 Product Developments in Next-Generation Intervention Cardiology Market

- 1.1.1 Business Strategies

- 1.2 Next-Generation Intervention Cardiology Market: Diagnosis and Management

- 1.3 Advancements in Coronary Intervention

- 1.4 Future Direction and Emerging Technologies in Coronary Interventions

- 1.5 Pipeline Products in the Next-Generation Intervention Cardiology Market

- 1.6 Regulatory Landscape

- 1.6.1 U.S.

- 1.6.2 Europe

- 1.6.3 Asia-Pacific

- 1.6.3.1 Japan

- 1.6.3.2 China

- 1.6.3.3 India

2 Market Dynamics

- 2.1 Trends

- 2.1.1 Trends in the Next-Generation Intervention Cardiology Market

- 2.1.1.1 Shift towards Minimally Invasive and Percutaneous Procedures Transforming Treatment Paradigms

- 2.1.1.2 Integration of AI-Predictive Intelligence in Intervention Cardiology

- 2.1.1.2.1 AI in Imaging, Lesion Assessment, and Diagnostics

- 2.1.1 Trends in the Next-Generation Intervention Cardiology Market

- 2.2 Market Dynamics

- 2.2.1 Trends, Drivers, Challenges, and Opportunities: Current and Future Impact Assessment

- 2.2.2 Market Drivers

- 2.2.2.1 Rising Elderly Population, Driving Demand for Advanced Cardiac Interventions

- 2.2.2.1.1 Cardiovascular Disease Burden in the Elderly

- 2.2.2.2 Emergence of Robotic-Assisted Interventions- Enhancing Procedural Accuracy and Operator Control

- 2.2.2.1 Rising Elderly Population, Driving Demand for Advanced Cardiac Interventions

- 2.2.3 Market Restraints

- 2.2.3.1 High Procedural Cost and Infrastructure Burden Limiting Broad Adoption

- 2.2.3.2 Regulatory Complexity and Prolonged Approval Timelines Hindering Innovation

- 2.2.3.2.1 Lengthy Approval Pathways for High-Risk Devices

- 2.2.3.2.2 Lack of Harmonization across Geographies

- 2.2.3.2.3 Regulatory Gaps for AI and Software-Driven Devices

- 2.2.4 Market Opportunities

- 2.2.4.1 Stent and Balloon Innovation Unlocking Next-Generation Use Cases

- 2.2.4.1.1 Advancements in Drug-Coated Balloon Technologies

- 2.2.4.2 Remote and Robotic-Enabled Expansion into Emerging Markets

- 2.2.4.2.1 Bridging Access Gaps through Remote Robotics

- 2.2.4.1 Stent and Balloon Innovation Unlocking Next-Generation Use Cases

- 2.2.5 Market Challenges

- 2.2.5.1 Data Standardization and Clinical Validation Gaps in AI-Driven Cardiology

- 2.2.5.2 Safety and Clinical Validation Barriers for Next-Generation Vascular Implants

3 Next-Generation Intervention Cardiology Market (Product Type), Value ($million), 2024-2035

- 3.1 Robotics

- 3.1.1 Robotic-Assisted Percutaneous Coronary Intervention (R-PCI)

- 3.1.2 Robotic-Assisted Coronary Artery Bypass Grafting (RA-CABG)

- 3.1.3 Robotic-Assisted Mitral Valve Repair (RMVR)

- 3.1.4 Robotic-Assisted Valve Replacement (RAVR)

- 3.2 Non-Robotics

- 3.2.1 Intravascular Ultrasound

- 3.2.2 Optical Coherence Tomography

- 3.2.3 Other Interventions

- 3.2.3.1 Stents

- 3.2.3.1.1 Bioresorbable Stents

- 3.2.3.1.2 Drug-Eluting Stents (DES)

- 3.2.3.1.3 Bare-Metal Stents (BMS)

- 3.2.3.2 Catheters

- 3.2.3.3 PTCA Balloons

- 3.2.3.4 Guidewires

- 3.2.3.5 Others

- 3.2.3.1 Stents

4 Next-Generation Intervention Cardiology Market (Indication Type), Value ($million), 2024-2035

- 4.1 Structural Heart Diseases

- 4.2 Coronary Heart Diseases

- 4.3 Valvular Heart Diseases

- 4.4 Peripheral Artery Diseases

- 4.5 Congenital Heart Diseases

5 Next-Generation Intervention Cardiology Market (End User), Value ($million), 2024-2035

- 5.1 Hospitals and Clinics

- 5.2 Cardiac Centers

- 5.3 Ambulatory Surgical Centers

6 Next-Generation Intervention Cardiology Market (Region), Value ($million), 2024-2035

- 6.1 Regional Summary

- 6.2 North America

- 6.2.1 Regional Overview

- 6.2.2 Driving Factors for Market Growth

- 6.2.3 Factors Challenging the Market

- 6.2.4 U.S.

- 6.2.5 Canada

- 6.3 Europe

- 6.3.1 Regional Overview

- 6.3.2 Driving Factors for Market Growth

- 6.3.3 Factors Challenging the Market

- 6.3.4 U.K.

- 6.3.5 France

- 6.3.6 Germany

- 6.3.7 Italy

- 6.3.8 Spain

- 6.3.9 Rest-of-Europe

- 6.4 Asia-Pacific

- 6.4.1 Regional Overview

- 6.4.2 Driving Factors for Market Growth

- 6.4.3 Factors Challenging the Market

- 6.4.4 Japan

- 6.4.5 China

- 6.4.6 India

- 6.4.7 Australia

- 6.4.8 South Korea

- 6.4.9 Rest-of-Asia-Pacific

- 6.5 Latin America

- 6.5.1 Regional Overview

- 6.5.2 Driving Factors for Market Growth

- 6.5.3 Factors Challenging the Market

- 6.5.4 Brazil

- 6.5.5 Mexico

- 6.5.6 Rest-of-Latin America

- 6.6 Middle East and Africa

- 6.6.1 Regional Overview

- 6.6.2 Driving Factors for Market Growth

- 6.6.3 Factors Challenging the Market

- 6.6.4 K.S.A.

- 6.6.5 South Africa

- 6.6.6 Rest-of-Middle East and Africa

7 Competitive Landscape and Company Profiles

- 7.1 Company Profiles

- 7.1.1 Medtronic plc

- 7.1.1.1 Overview

- 7.1.1.2 Top Products/Product Portfolio

- 7.1.1.3 Top Competitors

- 7.1.1.4 Target Customers

- 7.1.1.5 Strategic Positioning and Market Impact

- 7.1.1.6 Analyst View

- 7.1.1.7 Pipeline and Research Initiatives

- 7.1.2 Abbott.

- 7.1.2.1 Overview

- 7.1.2.2 Top Products/Product Portfolio

- 7.1.2.3 Top Competitors

- 7.1.2.4 Target Customers

- 7.1.2.5 Strategic Positioning and Market Impact

- 7.1.2.6 Analyst View

- 7.1.2.7 Pipeline and Research Initiatives

- 7.1.3 Boston Scientific Corporation

- 7.1.3.1 Overview

- 7.1.3.2 Top Products/Product Portfolio

- 7.1.3.3 Top Competitors

- 7.1.3.4 Target Customers

- 7.1.3.5 Strategic Positioning and Market Impact

- 7.1.3.6 Analyst View

- 7.1.3.7 Pipeline and Research Initiatives

- 7.1.4 Terumo Corporation

- 7.1.4.1 Overview

- 7.1.4.2 Top Products/Product Portfolio

- 7.1.4.3 Top Competitors

- 7.1.4.4 Target Customers

- 7.1.4.5 Strategic Positioning and Market Impact

- 7.1.4.6 Analyst View

- 7.1.4.7 Pipeline and Research Initiatives

- 7.1.5 Siemens Healthineers AG

- 7.1.5.1 Overview

- 7.1.5.2 Top Products/Product Portfolio

- 7.1.5.3 Top Competitors

- 7.1.5.4 Target Customers

- 7.1.5.5 Strategic Positioning and Market Impact

- 7.1.5.6 Analyst View

- 7.1.5.7 Pipeline and Research Initiatives

- 7.1.6 Koninklijke Philips N.V.

- 7.1.6.1 Overview

- 7.1.6.2 Top Products/Product Portfolio

- 7.1.6.3 Top Competitors

- 7.1.6.4 Target Customers

- 7.1.6.5 Strategic Positioning and Market Impact

- 7.1.6.6 Analyst View

- 7.1.6.7 Pipeline and Research Initiatives

- 7.1.7 Edwards Lifesciences Corporation

- 7.1.7.1 Overview

- 7.1.7.2 Top Products/Product Portfolio

- 7.1.7.3 Top Competitors

- 7.1.7.4 Target Customers

- 7.1.7.5 Strategic Positioning and Market Impact

- 7.1.7.6 Analyst View

- 7.1.7.7 Pipeline and Research Initiatives

- 7.1.8 B. Braun SE

- 7.1.8.1 Overview

- 7.1.8.2 Top Products/Product Portfolio

- 7.1.8.3 Top Competitors

- 7.1.8.4 Target Customers

- 7.1.8.5 Strategic Positioning and Market Impact

- 7.1.8.6 Analyst View

- 7.1.8.7 Pipeline and Research Initiatives

- 7.1.9 Cordis

- 7.1.9.1 Overview

- 7.1.9.2 Top Products/Product Portfolio

- 7.1.9.3 Top Competitors

- 7.1.9.4 Target Customers

- 7.1.9.5 Strategic Positioning and Market Impact

- 7.1.9.6 Analyst View

- 7.1.9.7 Pipeline and Research Initiatives

- 7.1.10 Teleflex Incorporated

- 7.1.10.1 Overview

- 7.1.10.2 Top Products/Product Portfolio

- 7.1.10.3 Top Competitors

- 7.1.10.4 Target Customers

- 7.1.10.5 Strategic Positioning and Market Impact

- 7.1.10.6 Analyst View

- 7.1.10.7 Pipeline and Research Initiatives

- 7.1.11 Supira Medical, Inc.

- 7.1.11.1 Overview

- 7.1.11.2 Top Products/Product Portfolio

- 7.1.11.3 Top Competitors

- 7.1.11.4 Target Customers

- 7.1.11.5 Strategic Positioning and Market Impact

- 7.1.11.6 Analyst View

- 7.1.11.7 Pipeline and Research Initiatives

- 7.1.12 Intuitive Surgical Operations, Inc

- 7.1.12.1 Overview

- 7.1.12.2 Top Products/Product Portfolio

- 7.1.12.3 Top Competitors

- 7.1.12.4 Target Customers

- 7.1.12.5 Strategic Positioning and Market Impact

- 7.1.12.6 Analyst View

- 7.1.12.7 Pipeline and Research Initiatives

- 7.1.1 Medtronic plc

8 Research Methodology

- 8.1 Data Sources

- 8.1.1 Primary Data Sources

- 8.1.2 Secondary Data Sources

- 8.1.3 Inclusion and Exclusion

- 8.1.4 Data Triangulation

- 8.2 Market Estimation and Forecast