|

|

市場調査レポート

商品コード

1781115

欧州の小型モジュール炉市場:用途・製品タイプ・国別の分析・予測 (2025-2035年)Europe Small Modular Reactor Market: Focus on Application Type, Product Type, and Country - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の小型モジュール炉市場:用途・製品タイプ・国別の分析・予測 (2025-2035年) |

|

出版日: 2025年07月31日

発行: BIS Research

ページ情報: 英文 65 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の小型モジュール炉の市場規模は、2024年の5,940万米ドルから、予測期間中はCAGR 39.72%で推移し、2035年には16億530万米ドルに成長すると予測されています。

欧州でのモジュール型原子炉の導入拡大により、小型モジュール炉 (SMR) 市場は成長を続けています。これらの技術は、標準化された設計、スケーラブルな展開、工場での事前製造が特徴です。欧州各国が信頼性の高い低炭素エネルギー源への移行を進める中、SMRは遠隔地、工業地域、老朽化した送電網の支援手段としての需要が高まっています。気候変動目標の増加、安全性向上の必要性、建築期限短縮の差し迫った必要性など、すべてがこの動向に寄与しています。欧州は、原子炉設計、デジタル統合、製造効率の開発により、長期的なエネルギー転換を支援し、SMRの展開を促進するのに有利な立場にあります。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2035年 |

| 2025年の評価 | 5,660万米ドル |

| 2035年予測 | 16億530万米ドル |

| CAGR | 39.72% |

脱炭素化目標の達成とエネルギー安全保障の向上のために、各国がより信頼性が高く、柔軟でクリーンなエネルギーオプションを模索しているため、欧州のSMR市場は拡大しています。SMRは小型でモジュール設計が可能であり、展開の拡張性があるため、従来の大型原子力施設の代替に適しています。これらの原子炉は工場で製造し、現地で組み立てることができるため、効率と安全性を高めながら、建設時間と費用を大幅に削減することができます。

SMRは、孤立した地域や工業用地に電力を供給し、老朽化したエネルギーインフラを支え、再生可能エネルギー源を補強する方法として、欧州でますます開発が進められています。温室効果ガスの排出削減やEUの気候目標の達成に対する圧力の高まりが、SMRを含む次世代原子力技術への投資を後押ししています。フィンランド、英国、フランスなどの国々が、パイロットプログラムや支援的な法制度の整備を通じてこの分野をリードしています。

燃料効率、デジタル制御、原子炉設計の技術開発によっても開発は加速しています。技術革新と商業化への取り組みも、政府組織、民間企業、学術機関を横断する戦略的パートナーシップによって後押しされています。SMRは、欧州のエネルギー情勢が低炭素の未来へとシフトする中、安全で持続可能かつ拡張可能な原子力電力を地域全体に供給する上で不可欠な存在になると予想されています。

市場の分類:

セグメンテーション1:用途別

- 発電

- 熱電併給(CHP:Combined Heat and Power)

- 海水淡水化

- オフグリッド用途

セグメンテーション2:原子炉タイプ別

- 水冷式原子炉

- 液体金属冷却高速中性子スペクトル炉

- 溶融塩炉

- 高温ガス冷却炉

セグメンテーション3:発電容量別

- 25 mw未満

- 25-100 mw

- 101-300 mw

- 300 mw超

セグメンテーション4:地域別

- ロシア、フランス、その他

当レポートでは、欧州の小型モジュール炉 (SMR) の市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の分析、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

範囲と定義

第1章 市場

- 動向:現状と将来への影響評価

- クリーンエネルギーソリューションへの関心の高まり

- 規制と政策支援

- サプライチェーンの概要

- バリューチェーン分析

- 研究開発レビュー

- 特許出願動向(年・特許庁別の特許件数)

- 規制状況

- SMRの経済前提のサマリー

- SMR設計の推定CAPEXおよびOPEXコンポーネントコスト

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 地域

- 地域サマリー

- 欧州

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 欧州(国別)

第3章 市場:競合ベンチマーキングと企業プロファイル

- 次のフロンティア

- 市場シェアと戦略的取り組み

- 企業プロファイル

- The State Atomic Energy Corporation ROSATOM

- JSC NIKIET

- Rolls-Royce plc

- EDF

第4章 調査手法

List of Figures

- Figure 1: Europe Small Modular Reactor Market (by Scenario), $Million, 2025, 2029, and 2035

- Figure 2: Europe Small Modular Reactor Market, 2025-2035

- Figure 3: Market Snapshot, 2024

- Figure 4: Small Modular Reactor Market, $Million, 2024 and 2035

- Figure 5: Europe Small Modular Reactor Market (by Application), $Million, 2024, 2029, and 2035

- Figure 6: Europe Small Modular Reactor Market (by Reactor Type), $Million, 2024, 2029, and 2035

- Figure 7: Europe Small Modular Reactor Market (by Power Generation Capacity), $Million, 2024, 2029, and 2035

- Figure 8: Small Modular Reactors Segmentation

- Figure 9: Supply Chain Analysis for Small Modular Reactor Market

- Figure 10: Value Chain Analysis for Small Modular Reactor Market

- Figure 11: Patent Analysis (by Year and Patent Office), January 2022-June 2025

- Figure 12: Impact Analysis of Market Navigating Factors, 2024-2035

- Figure 13: Russia Small Modular Reactors Market, $Million, 2024-2035

- Figure 14: France Small Modular Reactors Market, $Million, 2024-2035

- Figure 15: Rest-of-Europe Small Modular Reactors Market, $Million, 2024-2035

- Figure 16: Strategic Initiatives, January 2022-June 2025

- Figure 17: Data Triangulation

- Figure 18: Top-Down and Bottom-Up Approach

- Figure 19: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Competitive Landscape Snapshot

- Table 3: Trends Overview

- Table 4: Regulatory Landscape of Small Modular Reactor Market

- Table 5: Summary of Economic Assumptions for SMRs in Terms of FOAK and NOAK

- Table 6: CAPEX Component Costs for Selected SMR Designs ($/kW)

- Table 7: OPEX Component Costs for Selected SMR Designs ($/kW)

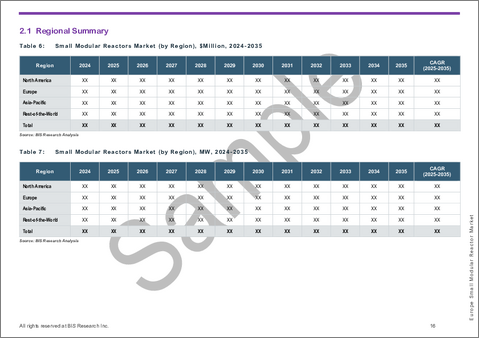

- Table 8: Small Modular Reactors Market (by Region), $Million, 2024-2035

- Table 9: Small Modular Reactors Market (by Region), MW, 2024-2035

- Table 10: Europe Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 11: Europe Small Modular Reactors Market (by Application), MW, 2024-2035

- Table 12: Europe Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 13: Europe Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 14: Europe Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 15: Europe Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 16: Russia Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 17: Russia Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 18: Russia Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 19: Russia Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 20: Russia Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 21: Russia Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 22: France Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 23: France Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 24: France Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 25: France Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 26: France Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 27: France Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 28: Rest-of-Europe Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 29: Rest-of-Europe Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 30: Rest-of-Europe Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 31: Rest-of-Europe Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 32: Rest-of-Europe Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 33: Rest-of-Europe Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 34: Market Share, 2023

This report can be delivered in 2 working days.

Introduction to Europe Small Modular Reactor Market

The Europe small modular reactor market was valued at $59.4 million in 2024 and is projected to grow at a CAGR of 39.72%, reaching $1,605.3 million by 2035. The market is expanding as a result of Europe's increasing use of modular nuclear reactor technologies, which are distinguished by their standardized designs, scalable deployment, and factory-built components. The need for SMRs to support remote areas, industrial centers, and outdated grid infrastructure is growing as European countries move toward dependable, low-carbon energy sources. Increased climate targets, the need for improved safety, and the pressing need to shorten building deadlines all contribute to this trend. Europe is better positioned to support its long-term energy transition and expedite the deployment of SMRs because to developments in reactor design, digital integration, and manufacturing efficiency.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $56.6 Million |

| 2035 Forecast | $1,605.3 Million |

| CAGR | 39.72% |

Market Introduction

The market for small modular reactors (SMRs) in Europe is expanding as nations look for more dependable, flexible, and clean energy options to help them achieve decarbonization targets and improve energy security. SMRs are a good substitute for conventional large-scale nuclear facilities because of their small size, modular design, and scalable deployment. These reactors can be manufactured in a factory and put together on location, greatly cutting down on construction time and expense while enhancing efficiency and safety.

SMRs are being explored more and more in Europe as a way to power isolated areas and industrial sites, support aging energy infrastructure, and augment renewable energy sources. Increased investment in next-generation nuclear technology, such as SMRs, is being driven by the growing pressure to cut greenhouse gas emissions and fulfill EU climate targets. Leading the way with pilot programs and encouraging legislative frameworks are nations like Finland, the United Kingdom, and France.

Development is also being accelerated by technological developments in fuel efficiency, digital controls, and reactor design. Innovation and commercialization initiatives are also being fueled by strategic partnerships across government organizations, commercial businesses, and academic institutions. SMRs are anticipated to be essential in providing safe, sustainable, and scalable nuclear electricity throughout the area as the European energy landscape shifts to a low-carbon future.

Market Segmentation:

Segmentation 1: by Application

- Electricity Production

- Combined Heat and Power

- Desalination

- Off-grid application

Segmentation 2: by Reactor Type

- Water-Cooled Reactors

- Liquid Metal-Cooled Fast Neutron Spectrum Reactors

- Molten Salt Reactors

- High-Temperature Gas-Cooled Reactors

Segmentation 3: by Power Generation Capacity

- <25 MW

- 25-100 MW

- 101-300 MW

- >300 MW

Segmentation 4: by Region

- Europe - Russia, France, and Rest-of Europe

Europe Small Modular Reactor (SMR) Market - Trends, Drivers, and Challenges

Trends

- Growing momentum toward low-carbon nuclear energy as part of Europe's net-zero transition.

- Development of domestic and cross-border pilot SMR projects in countries like the UK, France, Poland, and Estonia.

- Rising interest in integrating SMRs with renewable energy for grid stability and decarbonized baseload power.

- Technological advances in Generation III+ and IV SMR designs, with enhanced safety and efficiency features.

- Collaboration among EU member states, research institutions, and private firms for innovation and commercialization.

Drivers

- Urgent need to replace aging nuclear and fossil fuel-based power infrastructure.

- Strong policy support under the EU Green Deal and inclusion of nuclear in the EU Taxonomy for sustainable investments.

- Demand for flexible, smaller-scale nuclear options to support industrial applications and regional power needs.

- Public sector funding and strategic investment into nuclear innovation and infrastructure.

- Improved construction timelines and cost efficiencies through modular factory-built reactor components.

Challenges

- Regulatory fragmentation across European countries delaying standardization and approvals.

- Political and public concerns over nuclear safety, waste disposal, and potential accidents.

- High capital investment and lengthy development timelines for commercial-scale SMR deployment.

- Competition from established renewable energy sources, especially wind and solar.

- Uncertainty in nuclear fuel supply chains and long-term waste management solutions.

How can this report add value to an organization?

Product/Innovation Strategy: The Europe small modular reactor market has been segmented based on application, reactor type, power generation capacity, and end-user category, providing valuable insights into deployment strategies and technology preferences. Application segmentation includes electricity production, combined heat and power, desalination, and off-grid power. By reactor type, the market has been divided into water-cooled reactors, liquid metal-cooled fast neutron spectrum reactors, molten salt reactors, and high-temperature gas-cooled reactors. Capacity segmentation covers units under 25 MW, 25-100 MW, 101-300 MW, and above 300 MW. The end user segmentation includes utilities, industrial operators, off-grid microgrid providers, and desalination plant operators. This segmentation framework supports targeted market analysis and strategic planning by stakeholders across technology development, policy, and finance.

Growth/Marketing Strategy: The Europe small modular reactor market has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include product development.

Competitive Strategy: The key players in the Europe small modular reactor market analyzed and profiled in the study include professionals with expertise in the small modular reactor domain. Additionally, a comprehensive competitive landscape, such as partnerships, agreements, and collaborations, is expected to aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled in the Europe small modular reactor market have been selected based on inputs gathered from primary experts who have analyzed company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- The State Atomic Energy Corporation ROSATOM

- JSC NIKIET

- Rolls-Royce plc

- EDF

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Growing Interest in Clean Energy Solutions

- 1.1.2 Regulatory and Policy Support

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (Number of Patents by Year and by Patent Office)

- 1.4 Regulatory Landscape

- 1.5 Summary of Economic Assumptions for SMRs

- 1.6 Estimated CAPEX and OPEX Component Costs for SMR Designs ($/kW)

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Advancements in Nuclear Technology

- 1.7.1.2 Growing Research and Development Activities to Achieve Near Zero Emissions

- 1.7.2 Market Restraints

- 1.7.2.1 High Initial Costs and Infrastructure Limitations

- 1.7.2.2 Regulatory and Licensing Hurdles

- 1.7.3 Market Opportunities

- 1.7.3.1 Surge in Decarbonization Policies

- 1.7.3.2 Energy Access in Remote and Off-Grid Areas

- 1.7.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Application

- 2.2.5 Product

- 2.2.6 Europe (by Country)

- 2.2.6.1 Russia

- 2.2.6.1.1 Application

- 2.2.6.1.2 Product

- 2.2.6.2 France

- 2.2.6.2.1 Application

- 2.2.6.2.2 Product

- 2.2.6.3 Rest-of-Europe

- 2.2.6.3.1 Application

- 2.2.6.3.2 Product

- 2.2.6.1 Russia

3 Markets - Competitive Benchmarking and Company Profiles

- 3.1 Next Frontiers

- 3.2 Market Share and Strategic Initiatives

- 3.3 Company Profiles

- 3.3.1 The State Atomic Energy Corporation ROSATOM

- 3.3.1.1 Overview

- 3.3.1.2 Top Products/Product Portfolio

- 3.3.1.3 Top Competitors

- 3.3.1.4 Target Customers/End Users

- 3.3.1.5 Key Personnel

- 3.3.1.6 Analyst View

- 3.3.2 JSC NIKIET

- 3.3.2.1 Overview

- 3.3.2.2 Top Products/Product Portfolio

- 3.3.2.3 Top Competitors

- 3.3.2.4 Target Customers/End Users

- 3.3.2.5 Key Personnel

- 3.3.2.6 Analyst View

- 3.3.3 Rolls-Royce plc

- 3.3.3.1 Overview

- 3.3.3.2 Top Products/Product Portfolio

- 3.3.3.3 Top Competitors

- 3.3.3.4 Target Customers/End Users

- 3.3.3.5 Key Personnel

- 3.3.3.6 Analyst View

- 3.3.4 EDF

- 3.3.4.1 Overview

- 3.3.4.2 Top Products/Product Portfolio

- 3.3.4.3 Top Competitors

- 3.3.4.4 Target Customers/End Users

- 3.3.4.5 Key Personnel

- 3.3.4.6 Analyst View

- 3.3.1 The State Atomic Energy Corporation ROSATOM

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast