|

|

市場調査レポート

商品コード

1764669

小型モジュール炉の世界市場:用途・製品タイプ・地域別の分析・予測 (2025-2035年)Small Modular Reactor Market - A Global and Regional Analysis: Focus on Application Type, Product Type, and Region - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 小型モジュール炉の世界市場:用途・製品タイプ・地域別の分析・予測 (2025-2035年) |

|

出版日: 2025年07月09日

発行: BIS Research

ページ情報: 英文 138 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

小型モジュール炉 (SMR) の市場規模は、2024年の1億5,940万ドルから、予測期間中は42.31%のCAGRで推移し、2035年には51億7,960万ドルに達すると予測されています。

この市場の成長は、工場での製造、標準化、モジュール方式による導入といったモジュール型原子炉技術の採用拡大によって促進されています。エネルギー業界が低炭素でレジリエンスのある電源へと移行する中で、遠隔地や産業施設向け、あるいは既存電力網の補完としてのSMRへの需要が高まると期待されています。さらに、温室効果ガス排出の削減、安全性能の向上、プロジェクト期間の短縮への関心の高まりも、市場成長の後押しとなっています。近年では、先進的な原子炉設計、デジタルシステムの統合、製造効率の向上といった分野での進展により、今後10年間で大きな拡大が見込まれています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2035年 |

| 2025年評価 | 1億5,210万米ドル |

| 2035年予測 | 51億7,960万米ドル |

| CAGR | 42.31% |

用途別:市場をリードする電力生産

電力生産は、クリーンで信頼性の高いエネルギーへのニーズの高まりがその成長を牽引しています。SMRは、高効率かつ安全な電力出力を提供し、さまざまな導入シナリオに対応できる柔軟性を持っています。2023年8月には、カナダ原子力研究所 (Canadian Nuclear Laboratories) とUltra Safe Nuclear Corporationが、商業化可能な溶融塩型SMRの開発を推進するための提携を発表し、次世代炉技術への業界の取り組み姿勢を示しました。

SMRの大きな利点の一つが設置場所の柔軟性です。これらの原子炉は、従来型発電所では適さない隔離地域や小規模コミュニティなどでも稼働可能で、地域ごとのエネルギー需要に対応し、エネルギー安全保障を強化する手段として注目されています。2023年10月には、NuScaleがアルゼンチンのINVAPとMoUを締結し、VOYGR SMRシステムの導入に向けた評価を行うことが発表されました。これは、世界的にSMRを活用した電力ソリューションへの関心が高まっていることを示す好例です。

炉型別:水冷式原子炉が市場をリード

この優位性は、原子力分野における実績のある性能、設計の単純さ、堅牢な安全機能に基づいています。さらに、水冷式原子炉用コンポーネントに関する確立されたサプライチェーンが存在するため、新興炉型と比較して開発コストが抑えられ、プロジェクトのスケジュールも短縮されます。また、規制当局も水冷式炉の認可や監督に関して豊富な経験を有しているため、SMR導入時の承認プロセスが円滑になるという利点もあります。

中国は、2024年1月に加圧水型原子炉ACP100 SMRを国家送電網に接続し、この動向を実証しました。溶融塩や高温ガス冷却設計など、代替原子炉コンセプトの研究も続けられていますが、市場予測では、水冷式SMRが引き続き信頼性と実績のある技術基盤により優位を維持し、低排出電力の主力ソリューションとしての地位を確保すると見られています。

当レポートでは、世界の小型モジュール炉の市場を調査し、主要動向、市場影響因子の分析、法規制環境、臨床試験の動向、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現状と将来への影響評価

- クリーンエネルギーソリューションへの関心の高まり

- 規制と政策支援

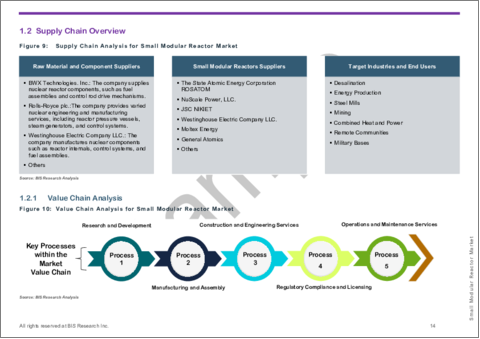

- サプライチェーンの概要

- バリューチェーン分析

- 研究開発レビュー

- 特許出願動向 (年・特許庁別の特許件数)

- 規制状況

- SMRの経済前提のサマリー

- SMR設計の推定CAPEXおよびOPEXコンポーネントコスト

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 用途

- 用途のサマリー

- 小型モジュール炉市場 (用途別)

- 電力生産

- 熱電併給

- 淡水化

- オフグリッド用途

第3章 製品

- 製品サマリー

- 小型モジュール炉市場 (炉タイプ別)

- 水冷式原子炉

- 液体金属冷却高速中性子炉

- 溶融塩炉

- 高温ガス冷却炉

- 小型モジュール炉市場 (発電容量別)

- 25MW未満

- 25~100MW

- 101~300MW

- 300MW以上

第4章 地域

- 地域サマリー

- 北米

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 北米 (国別)

- 欧州

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- 欧州 (国別)

- アジア太平洋

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

- アジア太平洋 (国別)

- その他の地域

- 地域概要

- 市場成長の原動力

- 市場課題

- 用途

- 製品

第5章 市場:競合ベンチマーキング・企業プロファイル

- 次のフロンティア

- 市場シェアと戦略的取り組み

- 企業プロファイル

- The State Atomic Energy Corporation ROSATOM

- Tsinghua University

- Japan Atomic Energy Agency

- NuScale Power, LLC.

- JSC NIKIET

- Westinghouse Electric Company LLC

- China National Nuclear Corporation

- Rolls-Royce plc

- State Power Investment Corporation Limited

- BWX Technologies. Inc.

- Terrestrial Energy Inc.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- EDF

- Moltex Energy

- General Atomics

第6章 調査手法

List of Figures

- Figure 1: Small Modular Reactor Market (by Scenario), $Million, 2025, 2029, and 2035

- Figure 2: Global Small Modular Reactor Market, 2025-2035

- Figure 3: Global Market Snapshot, 2024

- Figure 4: Small Modular Reactor Market, $Million, 2024 and 2035

- Figure 5: Small Modular Reactor Market (by Application), $Million, 2024, 2029, and 2035

- Figure 6: Small Modular Reactor Market (by Reactor Type), $Million, 2024, 2029, and 2035

- Figure 7: Small Modular Reactor Market (by Power Generation Capacity), $Million, 2024, 2029, and 2035

- Figure 8: Small Modular Reactors Segmentation

- Figure 9: Supply Chain Analysis for Small Modular Reactor Market

- Figure 10: Value Chain Analysis for Small Modular Reactor Market

- Figure 11: Patent Analysis (by Year and Patent Office), January 2022-June 2025

- Figure 12: Impact Analysis of Market Navigating Factors, 2024-2035

- Figure 13: Small Modular Reactors Market, by Application, MW, 2024, 2029 and 2035

- Figure 14: Small Modular Reactors Market, by Application, $Million, 2024, 2029 and 2035

- Figure 15: Small Modular Reactor Market (by Electricity Production), $Million, 2024

- Figure 16: Small Modular Reactors Market, Electricity Production Value, $Million, (2024-2035)

- Figure 17: Small Modular Reactors Market, Electricity Production Volume, MW, (2024-2035)

- Figure 18: Small Modular Reactor Market (by Combined Heat and Power), $Million, 2024

- Figure 19: Small Modular Reactors Market, Combined Heat and Power Value, $Million, (2024-2035)

- Figure 20: Small Modular Reactors Market, Combined Heat and Power Volume, MW, (2024-2035)

- Figure 21: Small Modular Reactor Market (by Desalination), $Million, 2024

- Figure 22: Small Modular Reactors Market, Desalination Value, $Million, (2024-2035)

- Figure 23: Small Modular Reactors Market, Desalination Volume, MW, (2024-2035)

- Figure 24: Small Modular Reactor Market (by Off-Grid Application), $Million, 2024

- Figure 25: Small Modular Reactors Market, Off-Grid Application Value, $Million, (2024-2035)

- Figure 26: Small Modular Reactors Market, Off-Grid Application Volume, MW, (2024-2035)

- Figure 27: Small Modular Reactors Market, by Reactor Type, MW, 2024, 2029 and 2035

- Figure 28: Small Modular Reactors Market, by Reactor Type, $Million, 2024, 2029 and 2035

- Figure 29: Small Modular Reactors Market, by Power Generation Capacity, MW, 2024, 2029 and 2035

- Figure 30: Small Modular Reactors Market, by Power Generation Capacity, $Million, 2024, 2029 and 2035

- Figure 31: Small Modular Reactor Market (by Water-Cooled Reactors), $Million, 2024

- Figure 32: Small Modular Reactors Market, Water-Cooled Reactors Value, $Million, (2024-2035)

- Figure 33: Small Modular Reactors Market, Water-Cooled Reactors Volume, MW, (2024-2035)

- Figure 34: Small Modular Reactor Market (by Liquid Metal-Cooled Fast Neutron Spectrum Reactors MW), $Million, 2024

- Figure 35: Small Modular Reactors Market, Liquid Metal-Cooled Fast Neutron Spectrum Reactors Value, $Million, (2024-2035)

- Figure 36: Small Modular Reactors Market, Liquid Metal-Cooled Fast Neutron Spectrum Reactors Volume, MW, (2024-2035)

- Figure 37: Small Modular Reactor Market (by Molten Salt Reactors), $Million, 2024

- Figure 38: Small Modular Reactors Market, Molten Salt Reactors Value, $Million, (2024-2035)

- Figure 39: Small Modular Reactors Market, Molten Salt Reactors Volume, MW, (2024-2035)

- Figure 40: Small Modular Reactor Market (by High-Temperature Gas-Cooled Reactors), $Million, 2024

- Figure 41: Small Modular Reactors Market, High-Temperature Gas-Cooled Reactors Value, $Million, (2024-2035)

- Figure 42: Small Modular Reactors Market, High-Temperature Gas-Cooled Reactors Volume, MW, (2024-2035)

- Figure 43: Small Modular Reactor Market (by <25 MW), $Million, 2024

- Figure 44: Small Modular Reactors Market, <25 MW Value, $Million, (2024-2035)

- Figure 45: Small Modular Reactors Market, <25 MW Volume, MW, (2024-2035)

- Figure 46: Small Modular Reactor Market (by 25-100 MW), $Million, 2024

- Figure 47: Small Modular Reactors Market, 25-100 MW Value, $Million, (2024-2035)

- Figure 48: Small Modular Reactors Market, 25-100 MW Volume, MW, (2024-2035)

- Figure 49: Small Modular Reactor Market (by 101-300 MW), $Million, 2024

- Figure 50: Small Modular Reactors Market, 101-300 MW Value, $Million, (2024-2035)

- Figure 51: Small Modular Reactors Market, 101-300 MW Volume, MW, (2024-2035)

- Figure 52: Small Modular Reactor Market (by >300 MW), $Million, 2024

- Figure 53: Small Modular Reactors Market, >300 MW Value, $Million, (2024-2035)

- Figure 54: Small Modular Reactors Market, >300 MW Volume, MW, (2024-2035)

- Figure 55: U.S. Small Modular Reactors Market, $Million, 2024-2035

- Figure 56: Canada Small Modular Reactors Market, $Million, 2024-2035

- Figure 57: Russia Small Modular Reactors Market, $Million, 2024-2035

- Figure 58: France Small Modular Reactors Market, $Million, 2024-2035

- Figure 59: Rest-of-Europe Small Modular Reactors Market, $Million, 2024-2035

- Figure 60: China Small Modular Reactors Market, $Million, 2024-2035

- Figure 61: Japan Small Modular Reactors Market, $Million, 2024-2035

- Figure 62: Strategic Initiatives, January 2022-June 2025

- Figure 63: Data Triangulation

- Figure 64: Top-Down and Bottom-Up Approach

- Figure 65: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Competitive Landscape Snapshot

- Table 3: Trends Overview

- Table 4: Regulatory Landscape of Small Modular Reactor Market

- Table 5: Summary of Economic Assumptions for SMRs in Terms of FOAK and NOAK

- Table 6: CAPEX Component Costs for Selected SMR Designs ($/kW)

- Table 7: OPEX Component Costs for Selected SMR Designs ($/kW)

- Table 8: Small Modular Reactors Market (by Region), $Million, 2024-2035

- Table 9: Small Modular Reactors Market (by Region), MW, 2024-2035

- Table 10: North America Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 11: North America Small Modular Reactors Market (by Application), MW, 2024-2035

- Table 12: North America Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 13: North America Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 14: North America Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 15: North America Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 16: U.S. Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 17: U.S. Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 18: U.S. Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 19: U.S. Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 20: U.S. Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 21: U.S. Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 22: Canada Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 23: Canada Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 24: Canada Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 25: Canada Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 26: Canada Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 27: Canada Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 28: Europe Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 29: Europe Small Modular Reactors Market (by Application), MW, 2024-2035

- Table 30: Europe Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 31: Europe Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 32: Europe Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 33: Europe Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 34: Russia Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 35: Russia Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 36: Russia Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 37: Russia Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 38: Russia Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 39: Russia Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 40: France Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 41: France Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 42: France Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 43: France Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 44: France Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 45: France Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 46: Rest-of-Europe Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 47: Rest-of-Europe Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 48: Rest-of-Europe Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 49: Rest-of-Europe Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 50: Rest-of-Europe Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 51: Rest-of-Europe Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 52: Asia-Pacific Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 53: Asia-Pacific Small Modular Reactors Market (by Application), MW, 2024-2035

- Table 54: Asia-Pacific Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 55: Asia-Pacific Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 56: Asia-Pacific Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 57: Asia-Pacific Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 58: China Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 59: China Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 60: China Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 61: China Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 62: China Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 63: China Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 64: Japan Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 65: Japan Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 66: Japan Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 67: Japan Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 68: Japan Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 69: Japan Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 70: Rest-of-the-World Small Modular Reactors Market (by Application), $Million, 2024-2035

- Table 71: Rest-of-the-World Small Modular Reactors Market (by Application), MW, 2024-2035

- Table 72: Rest-of-the-World Small Modular Reactors Market (by Reactor Type), $Million, 2024-2035

- Table 73: Rest-of-the-World Small Modular Reactors Market (by Reactor Type), MW, 2024-2035

- Table 74: Rest-of-the-World Small Modular Reactors Market (by Power Generation Capacity), $Million, 2024-2035

- Table 75: Rest-of-the-World Small Modular Reactors Market (by Power Generation Capacity), MW, 2024-2035

- Table 76: Market Share, 2023

This report can be delivered within 1 working day.

Small Modular Reactor Market Overview

The small modular reactor market was valued at $159.4 million in 2024 and is projected to grow at a CAGR of 42.31%, reaching $5,179.6 million by 2035. The increasing adoption of modular nuclear reactor technology, including factory fabrication, standardization, and modular deployment, is driving this market growth. As the energy sector transitions to low-carbon and resilient power sources, demand for SMRs that can serve remote sites and industrial facilities and supplement existing grids is expected to rise. Additionally, the growing focus on reducing greenhouse gas emissions, improving safety performance, and shortening project timelines are contributing factors. Recent progress in advanced reactor designs, digital system integration, and manufacturing efficiencies has positioned the SMR market for significant expansion in the coming decade.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $152.1 Million |

| 2035 Forecast | $5,179.6 Million |

| CAGR | 42.31% |

Introduction to the Small Modular Reactor Market

The small modular reactor (SMR) market focuses on the adoption of modular nuclear power solutions designed to reduce project risk, enhance scalability, and optimize resource utilization. This market is driven by the demand for low-carbon, reliable energy sources across utility, industrial, and remote applications, including grid support, process heat, and microgrid integration. Modular fabrication and standardized components lower construction costs and shorten project schedules, reducing upfront capital requirements and supply chain complexity. The policy emphasis on decarbonization has prompted developers to advance SMR designs to deliver cost-competitive power, improve safety performance, and comply with stricter regulatory standards. These practices contribute to environmental sustainability by lowering greenhouse gas emissions and supporting national decarbonization objectives.

Market Introduction

The SMR market is experiencing significant growth as the energy sector transitions to low-carbon power solutions and strengthens energy resilience. This market is driven by the adoption of modular reactor technology, standardization, and factory fabrication, which reduce capital expenditures and accelerate project schedules. Ongoing advancements in reactor design and digital systems further reduce costs and improve safety. Utilities and industrial operators are increasingly deploying SMRs for remote sites, process heat applications, and grid support to meet decarbonization goals, control construction risk, and simplify supply chains. As global demand for reliable, low-emission energy sources rises, the SMR market is set to play a critical role in advancing sustainable power generation.

Industrial Impact

The industrial impact of the small modular reactor (SMR) market is transformative across multiple sectors, including energy production, manufacturing, and supply chains. By adopting modular reactor technology, the market is driving significant improvements in plant construction efficiency, reducing on-site assembly time, and enhancing safety standards in the nuclear industry. The use of factory-fabricated reactor modules, standardized components, and digital monitoring systems optimizes procurement, lowers capital costs, and expands accessibility for utilities and industrial operators. This transition promotes innovation in manufacturing methods, project management, and regulatory frameworks and encourages the growth of engineering firms and nuclear service providers.

The companies involved in the small modular reactor market include major industry players such as The State Atomic Energy Corporation ROSATOM, Tsinghua University, Japan Atomic Energy Agency, NuScale Power, LLC., JSC NIKIET, Westinghouse Electric Company LLC, China National Nuclear Corporation, Rolls-Royce plc, STATE POWER INVESTMENT CORPORATION LIMITED, BWX Technologies Inc., Terrestrial Energy Inc., MITSUBISHI HEAVY INDUSTRIES, LTD., EDF, Moltex Energy, and General Atomics. These companies are enhancing their capabilities through strategic partnerships, collaborations, and technology advancements to improve the resilience and performance of small modular reactors in demanding environments. Their continued investments in research and development are driving the growth of the market while supporting the broader trends in small modular reactors.

Market Segmentation:

Segmentation 1: by Application

- Electricity Production

- Combined Heat and Power

- Desalination

- Off-Grid Application

Electricity Production to Lead the Market (by Application)

Electricity production represents the largest application segment in the small modular reactor market, driven by growing requirements for clean and reliable energy. SMRs deliver efficient and safe electrical output, supporting diverse deployment scenarios. In August 2023, Canadian Nuclear Laboratories and Ultra Safe Nuclear Corporation announced a partnership to advance a commercially viable molten salt SMR, demonstrating industry commitment to next-generation reactor technology.

SMR site flexibility is a significant advantage for power applications. These reactors can operate in locations unsuitable for conventional facilities, including isolated areas and small communities. This capability addresses localized energy demands and strengthens energy security. In October 2023, NuScale executed a memorandum of understanding with Argentina's Investigacion Aplicada (INVAP) to assess the deployment of the VOYGR SMR system, reflecting global interest in SMR-based electricity solutions.

Expansion of the SMR sector in power generation is set to reshape the energy market by introducing a lower-emission, sustainable alternative to conventional power plants.

Segmentation 2: by Reactor Type

- Water-Cooled Reactors

- Liquid Metal-Cooled Fast Neutron Spectrum Reactors

- Molten Salt Reactors

- High-Temperature Gas-Cooled Reactors

Water-Cooled Reactors to Lead the Market (by Reactor Type)

Water-cooled reactors represent the largest product segment in the small modular reactor market by reactor type. Their dominance reflects a proven performance record in the nuclear sector, straightforward design, and robust safety features. An established supply chain for water-cooled components reduces development costs and accelerates project schedules compared to emerging reactor technologies. Regulatory agencies possess extensive experience in licensing and supervising water-cooled reactors, which streamlines approval processes for SMR deployments.

China demonstrated this trend in January 2024 when its ACP100 SMR, a pressurized water reactor, was connected to the national grid. Research into alternative reactor concepts, including molten salt and high-temperature gas-cooled designs, continues. Market projections indicate that water-cooled SMRs will maintain their leading position due to their reliability and proven technological base, ensuring their status as the preferred solution for low-emission electricity production.

Segmentation 3: by Power Generation Capacity

- <25 MW

- 25-100 MW

- 101-300 MW

- >300 MW

- 25-100 MW to Lead the Market (by Power Generation Capacity)

The small modular reactor market is shifting to reactors with a production capacity of 25 to 100 MW, establishing this segment as the leading category in power output capacity. Several factors contribute to this segment's prominence, including versatility, cost-effectiveness, and suitability for a variety of applications.

This capacity range delivers a strong balance between scalability, cost-effectiveness, and grid compatibility, positioning it as the industry's preferred segment. It supports a broader array of deployments than smaller units, delivering dependable power to remote communities and industrial sites and supplementing existing power grids. Modular design enables incremental capacity expansion by adding individual units, reducing upfront capital requirements compared to a single, large-scale reactor.

Recent developments highlight the 25-100 MW segment's lead. Government plans announced in November 2023 will deploy a fleet of next-generation SMRs rated between 40 and 70 MW, highlighting official support for this class of low-emission baseload power. Future SMR designs may diversify market offerings. Smaller units under 25 MW can serve niche requirements, and larger designs above 100 MW can cater to densely populated regions and major industrial complexes. The 25-100 MW segment is expected to maintain its leading position.

Its scalability, cost structure, and grid compatibility make 25-100 MW SMRs an adaptable and attractive choice for diverse power generation needs.

Segmentation 4: by Region

- North America: U.S., Canada

- Europe: Russia, France, and Rest-of-Europe

- Asia-Pacific: China, Japan, and Rest-of-Asia-Pacific

- Rest-of-the-World

North America is expected to lead the small modular reactor (SMR) market, supported by robust regulatory frameworks, technological advancements, and strategic investments in advanced nuclear projects. The U.S. Department of Energy and Canadian Nuclear Laboratories have sponsored SMR research, demonstration projects, and streamlined licensing initiatives. Strong public-private partnerships, federal funding programs, and growing interest in SMR applications for grid resilience and process heat are driving regional growth.

North America's focus on reducing greenhouse gas emissions, enhancing energy security, and modernizing power infrastructure positions it as the leading region for SMR deployment, setting the stage for a low-carbon energy future.

Recent Developments in the Small Modular Reactor Market

- Tsinghua University's Institute of Nuclear and New Energy Technology (INET) has demonstrated significant expertise in advancing innovative nuclear technologies, highlighted by the successful operation of the high-temperature gas-cooled reactor pebble-bed module (HTR-PM) demo project in December 2023.

- In September 2023, the Japan Atomic Energy Agency (JAEA) signed an agreement with the U.K.'s National Nuclear Laboratory to accelerate global SMR deployment, focusing on collaborative advancements in HTGR technologies. Continued innovation and strategic partnerships will be essential for JAEA to capitalize on the increasing demand for SMRs and strengthen its position in the global market.

- Westinghouse Electric Company LLC.'s agreements and acquisitions mark significant progress in the small modular reactor (SMR) market. The company's collaboration with Community Nuclear Power, Ltd. (CNP) in February 2023 to deploy the U.K.'s first privately funded SMR fleet highlights its commitment to developing innovative energy solutions. The expected commercial operation by the early 2030s reflects a long-term vision and dedication to expanding the SMR sector.

Demand - Drivers, Limitations, and Opportunities

Market Drivers: Advancements in Nuclear Technology

Advancements in nuclear technology are key drivers in the growth of the small modular reactor market. Technological innovations in reactor design, such as enhanced safety features, modular construction, and advanced fuel cycles, have made SMRs more efficient and safer compared to traditional nuclear reactors. These advancements have enabled SMRs to meet the growing demand for reliable and clean energy sources while addressing long-standing concerns related to nuclear energy, such as waste management and the risks associated with large-scale nuclear plants.

Several companies are already capitalizing on these technological advancements. For instance, NuScale Power has developed the NuScale Power Module (NPM), a small modular reactor that incorporates passive safety features, significantly reducing the risk of accidents. In addition, Rolls-Royce is advancing its SMR designs, incorporating innovative engineering to achieve a compact, scalable solution for nuclear energy. Furthermore, the integration of advanced technologies such as digital monitoring and automation is making it easier to manage the operation of SMRs, enhancing their economic viability.

Looking ahead, advancements in nuclear technology have the potential to transform the energy landscape. As further technological breakthroughs occur, SMRs are expected to become even more cost-effective, efficient, and safer. The development of new reactor designs, including molten salt reactors and high-temperature gas-cooled reactors, will likely open up new markets for SMRs, especially in industrial applications requiring high-temperature heat.

Market Challenges: High Initial Costs and Infrastructure Limitations

High initial costs and infrastructure limitations represent significant restraints in the small modular reactor market, hindering the widespread adoption of this technology. The capital required for research, development, and construction of SMRs is considerable, and despite the promise of long-term cost savings, the upfront investment can be a deterrent for potential investors and governments. Additionally, building the necessary infrastructure, such as specialized manufacturing facilities and qualified labor forces, requires substantial investment, which may be challenging for countries or regions without the financial resources or technical expertise.

Several industry players are facing these challenges as they attempt to develop and deploy SMRs. In some cases, government subsidies or financing models are needed to support initial costs, but these mechanisms are not always readily available, particularly in countries with budget constraints. The lack of existing infrastructure for SMR-specific components, such as specialized factories for reactor components, can also delay production timelines and further increase costs.

In the near future, the small modular reactor market has the potential to overcome these barriers through continued technological advancements and the development of standardized, cost-effective manufacturing processes. As the industry matures, economies of scale and more efficient construction methods are expected to reduce costs, making SMRs more affordable for widespread deployment.

Market Opportunities: Surge in Decarbonization Policies

The surge in decarbonization policies across the globe presents a significant opportunity for the small modular reactor market. As governments increasingly prioritize climate change mitigation, clean energy technologies are gaining attention. SMRs, offering a reliable and low-carbon power generation solution, align well with these policies. Their ability to provide a steady supply of energy without contributing to carbon emissions positions them as a key technology in achieving net-zero emissions targets.

Industry players are already responding to this opportunity by aligning their strategies with decarbonization goals. For instance, the U.S. Department of Energy (DOE) has shown strong support for SMR development through funding initiatives and collaboration with private industry. In Canada, the government's commitment to reducing carbon emissions has led to regulatory and financial support for SMR projects, such as Terrestrial Energy's efforts to deploy an Integral Molten Salt Reactor (IMSR). These industry efforts reflect the growing alignment between SMR technology and global decarbonization objectives, showcasing the increasing recognition of SMRs as a viable solution to meet emissions reduction targets.

Overall, the continued push for decarbonization is likely to create even greater demand for SMRs. As countries adopt stricter carbon reduction goals and implement more robust clean energy policies, SMRs are well-positioned to meet the need for reliable, scalable, and zero-emission energy sources. The integration of SMRs into national energy strategies is expected to contribute significantly to the transition from fossil fuels to cleaner energy alternatives. As governments continue to invest in low-carbon technologies, the SMR market is expected to expand, and SMRs will increasingly play a critical role in the global energy infrastructure.

How can this report add value to an organization?

Product/Innovation Strategy: The small modular reactor market has been segmented based on application, reactor type, power generation capacity, and end-user category, providing valuable insights into deployment strategies and technology preferences. Application segmentation includes electricity production, combined heat and power, desalination, and off-grid power. By reactor type, the market has been divided into water-cooled reactors, liquid metal-cooled fast neutron spectrum reactors, molten salt reactors, and high-temperature gas-cooled reactors. Capacity segmentation covers units under 25 MW, 25-100 MW, 101-300 MW, and above 300 MW. The end user segmentation includes utilities, industrial operators, off-grid microgrid providers, and desalination plant operators. This segmentation framework supports targeted market analysis and strategic planning by stakeholders across technology development, policy, and finance.

Growth/Marketing Strategy: The small modular reactor market has been growing at a rapid pace. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include product development.

Competitive Strategy: The key players in the small modular reactor market analyzed and profiled in the study include professionals with expertise in the small modular reactor domain. Additionally, a comprehensive competitive landscape, such as partnerships, agreements, and collaborations, is expected to aid the reader in understanding the untapped revenue pockets in the market.

Research Methodology

Factors for Data Prediction and Modelling

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The currency conversion rate was taken from the historical exchange rate on the Oanda website.

- Nearly all the recent developments from January 2022 to June 2025 have been considered in this research study.

- The information rendered in the report is a result of in-depth primary interviews, surveys, and secondary analysis.

- Where relevant information was not available, proxy indicators and extrapolation were employed.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- Technologies currently used are expected to persist through the forecast with no major technological breakthroughs.

Market Estimation and Forecast

This research study involves the usage of extensive secondary sources, such as certified publications, articles from recognized authors, white papers, annual reports of companies, directories, and major databases, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the small modular reactor market.

The market engineering process involves the calculation of the market statistics, market size estimation, market forecast, market crackdown, and data triangulation (the methodology for such quantitative data processes is explained in further sections). The primary research study has been undertaken to gather information and validate the market numbers for segmentation types and industry trends of the key players in the market.

Primary Research

The primary sources involve industry experts from the small modular reactor market and various stakeholders in the ecosystem. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from primary sources include:

- validation and triangulation of all the numbers and graphs

- validation of reports segmentation and key qualitative findings

- understanding the competitive landscape

- validation of the numbers of various markets for market type

- percentage split of individual markets for geographical analysis

Secondary Research

This research study of the small modular reactor market involves the usage of extensive secondary research, directories, company websites, and annual reports. It also makes use of databases, such as Hoovers, Bloomberg, Businessweek, and Factiva, to collect useful and effective information for an extensive, technical, market-oriented, and commercial study of the global market. In addition to the aforementioned data sources, the study has been undertaken with the help of other data sources and websites, such as IRENA and IEA.

Secondary research was done in order to obtain crucial information about the industry's value chain, revenue models, the market's monetary chain, the total pool of key players, and the current and potential use cases and applications.

The key data points taken from secondary research include:

- segmentations and percentage shares

- data for market value

- key industry trends of the top players of the market

- qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies that are profiled in the small modular reactor market have been selected based on inputs gathered from primary experts who have analyzed company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- The State Atomic Energy Corporation ROSATOM

- Tsinghua University

- Japan Atomic Energy Agency

- NuScale Power, LLC.

- JSC NIKIET

- Westinghouse Electric Company LLC

- China National Nuclear Corporation

- Rolls-Royce plc

- State Power Investment Corporation Limited

- BWX Technologies. Inc.

- Terrestrial Energy Inc.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- EDF

- Moltex Energy

- General Atomics

Companies not part of the aforementioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Growing Interest in Clean Energy Solutions

- 1.1.2 Regulatory and Policy Support

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (Number of Patents by Year and by Patent Office)

- 1.4 Regulatory Landscape

- 1.5 Summary of Economic Assumptions for SMRs

- 1.6 Estimated CAPEX and OPEX Component Costs for SMR Designs ($/kW)

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Advancements in Nuclear Technology

- 1.7.1.2 Growing Research and Development Activities to Achieve Near Zero Emissions

- 1.7.2 Market Restraints

- 1.7.2.1 High Initial Costs and Infrastructure Limitations

- 1.7.2.2 Regulatory and Licensing Hurdles

- 1.7.3 Market Opportunities

- 1.7.3.1 Surge in Decarbonization Policies

- 1.7.3.2 Energy Access in Remote and Off-Grid Areas

- 1.7.1 Market Drivers

2 Application

- 2.1 Application Summary

- 2.2 Small Modular Reactor Market (by Application)

- 2.2.1 Electricity Production

- 2.2.2 Combined Heat and Power

- 2.2.3 Desalination

- 2.2.4 Off-Grid Application

3 Products

- 3.1 Product Summary

- 3.2 Small Modular Reactor Market (by Reactor Type)

- 3.2.1 Water-Cooled Reactors

- 3.2.2 Liquid Metal-Cooled Fast Neutron Spectrum Reactors

- 3.2.3 Molten Salt Reactors

- 3.2.4 High-Temperature Gas-Cooled Reactors

- 3.3 Small Modular Reactor Market (by Power Generation Capacity)

- 3.3.1 <25 MW

- 3.3.2 25-100 MW

- 3.3.3 101-300 MW

- 3.3.4 >300 MW

4 Regions

- 4.1 Regional Summary

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Application

- 4.2.6.1.2 Product

- 4.2.6.2 Canada

- 4.2.6.2.1 Application

- 4.2.6.2.2 Product

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe (by Country)

- 4.3.6.1 Russia

- 4.3.6.1.1 Application

- 4.3.6.1.2 Product

- 4.3.6.2 France

- 4.3.6.2.1 Application

- 4.3.6.2.2 Product

- 4.3.6.3 Rest-of-Europe

- 4.3.6.3.1 Application

- 4.3.6.3.2 Product

- 4.3.6.1 Russia

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Application

- 4.4.6.1.2 Product

- 4.4.6.2 Japan

- 4.4.6.2.1 Application

- 4.4.6.2.2 Product

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

5 Markets - Competitive Benchmarking and Company Profiles

- 5.1 Next Frontiers

- 5.2 Market Share and Strategic Initiatives

- 5.3 Company Profiles

- 5.3.1 The State Atomic Energy Corporation ROSATOM

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers/End Users

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.2 Tsinghua University

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers/End Users

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.3 Japan Atomic Energy Agency

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers/End Users

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.4 NuScale Power, LLC.

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers/End Users

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.5 JSC NIKIET

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers/End Users

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.6 Westinghouse Electric Company LLC

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers/End Users

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.7 China National Nuclear Corporation

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers/End Users

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.8 Rolls-Royce plc

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers/End Users

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.9 State Power Investment Corporation Limited

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers/End Users

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.10 BWX Technologies. Inc.

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers/End Users

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.11 Terrestrial Energy Inc.

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers/End Users

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.12 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers/End Users

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.13 EDF

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers/End Users

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.14 Moltex Energy

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers/End Users

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.15 General Atomics

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers/End Users

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.1 The State Atomic Energy Corporation ROSATOM

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast