|

|

市場調査レポート

商品コード

1774229

統合型LED光源内視鏡市場- 世界と地域別分析:製品別、内視鏡タイプ別、エンドユーザー別、地域別 - 分析と予測(2025年~2035年)Integrated LED Light Source Endoscope Market - A Global and Regional Analysis: Focus on Product, Endoscope Type, End User, and Regional - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 統合型LED光源内視鏡市場- 世界と地域別分析:製品別、内視鏡タイプ別、エンドユーザー別、地域別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年07月23日

発行: BIS Research

ページ情報: 英文 138 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の統合型LED光源内視鏡の市場規模は、2024年に7億300万米ドルとなりました。

同市場は、2035年までに37億9,950万米ドルに急増し、2025年から2035年までの期間に15.50%のCAGRで拡大し、大幅な成長を示すと予測されています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価 | 8億9,930万米ドル |

| 2035年の予測 | 37億9,950万米ドル |

| CAGR | 15.5% |

同市場は、慢性疾患の増加、光源の継続的な技術進歩、高齢化人口の増加によって2桁成長を遂げています。

LED光源一体型内視鏡市場は、光源技術の継続的な進歩が大きな原動力となって、近年大きな成長を遂げています。光源は内視鏡システムに不可欠なコンポーネントであり、外科医や医師が内臓を可視化し、低侵襲処置を実施するために重要な照明を提供します。より効率的で先進的な光源技術、特にLEDベースのシステムの開発は、この分野に変革をもたらしました。これらの改良は、画質を向上させるだけでなく、患者の安全性、費用対効果、手技の全体的な有効性を向上させる。ここでは、光源における主な技術進歩の概要と、統合型LED光源内視鏡市場への影響を紹介します。

市場イントロダクション

一体型LED光源内視鏡市場は、手術精度と患者の予後を向上させる技術革新と戦略的提携によって急速に進展しています。例えば、Scivita Medical Technology Co., Ltd.はBoston Scientific Corporationとの提携を拡大した。同社はBoston Scientificとの関係を拡大し、戦略的共同開発や世界な販売活動を展開していきます。一方、KARL STORZ SE &Co.KGは、ベルギー、ルクセンブルグ、オランダでの直接販売を拡大するため、StoplerのKARL STORZ関連事業を買収しました。最近の製品発売では、Ambu A/SがAmbu aScope Gastro LargeとAmbu aBox 2を欧州で発売しました。同社は消化器内科のポートフォリオを拡大しています。これらの開発は、一体型LED光源内視鏡に対する需要の高まりを裏付けるものであり、この分野における技術革新と臨床応用の拡大を後押ししています。

産業への影響

Ambu A/S、Becton Dickinson and Company、Boston Scientific Corporation、Clarus Medical LLC、Flexicare Medical Limitedなどの業界主要企業が牽引する世界の一体型LED光源内視鏡市場は、一体型LED光源内視鏡の展望を大きく変えています。人工知能(AI)とLED内視鏡の統合は、医療イメージングと低侵襲手術の分野における変革的進歩です。AIはLEDベースの内視鏡システムの機能を強化し、より効率的で正確、臨床医にリアルタイムの意思決定支援を提供できるようにします。この統合は、医療処置中にインテリジェントな自動画像解析と最適化を提供することで、診断精度を大幅に向上させ、ワークフローを合理化し、患者の転帰を高めることができます。AIを搭載したLED内視鏡は、処置中に照明条件、コントラスト、明るさを動的に調整し、画像が鮮明で最適な状態を維持できるようにします。例えば、AIシステムは、可視化される組織の種類に基づいて、光強度を増加または調整する必要がある領域を検出することができます。

市場セグメンテーション

セグメンテーション1:製品別

- 気管支鏡

- 膀胱鏡

- 尿管鏡

- 喉頭鏡

- その他

気管支鏡セグメントがLED光源一体型内視鏡市場を独占(製品別)

製品別では、一体型LED光源内視鏡の世界市場は気管支鏡がリードしており、2024年のシェアは43.0%。このセグメントが市場を独占している主な理由は、その高度な技術能力、胸部に関連する症状の特定と診断、持続的な肺虚脱の評価、体液サンプルの採取や生検の実施などのより安全なオプションに対する需要です。

セグメンテーション2:内視鏡タイプ別

- 単回使用内視鏡

- 再利用型内視鏡

LED光源一体型内視鏡市場を独占する単回使用内視鏡セグメント(内視鏡タイプ別)

内視鏡タイプ別では、世界の一体型LED光源内視鏡市場は、2024年に99.9%のシェアを占める単回使用内視鏡セグメントがリードしています。単回使用内視鏡が一体型LED光源内視鏡市場を独占しているのは、感染管理の必要性、コスト削減、LED照明の技術進歩によるもの。さらに、低侵襲手術への動向の高まり、慢性疾患の有病率の上昇、単回使用医療機器へのシフトが市場成長の原動力になると見られています。

セグメンテーション3:エンドユーザー別

- 病院

- 外来手術センター

病院セグメントが統合型LED光源内視鏡市場を独占(エンドユーザー別)

エンドユーザ別では、世界の集積型LED光源内視鏡市場は病院セグメントがリードしており、2024年のシェアは82.8%となっています。病院は、泌尿器系や消化器系疾患、呼吸器系疾患などの慢性疾患の増加、低侵襲手術の認知度向上により、統合型LED光源内視鏡市場を独占しています。

セグメンテーション4:地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- デンマーク

- オランダ

- スイス

- その他

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- その他の地域

北米地域のLED光源一体型内視鏡市場は、予測期間中に大幅な成長率が見込まれています。この顕著な成長は、高度なヘルスケアインフラ、革新的技術の高い採用、強力な研究開発能力など、いくつかの主な要因に起因しています。この地域には世界有数の病院、医療センター、学術機関があり、最先端の設備と熟練した専門家が揃っています。このようなインフラが、一体型LED光源内視鏡のような最先端技術の採用を促進しています。さらに、北米は慢性疾患の有病率が高いです。この地域のヘルスケアシステムは、高度な治療への幅広いアクセスを提供し、一体型LED光源内視鏡が不可欠な低侵襲手術の使用を後押ししています。さらに、米国とカナダは強固な規制環境と技術革新への強力な支援を持っており、Becton, Dickinson and CompanyやBoston Scientific Corporationなどの企業が一体型LED光源内視鏡技術の開発を主要企業としてリードしているため、この市場における北米のリーダーシップはさらに強固なものとなっています。

LED光源一体型内視鏡市場の最近の動向

- 2025年2月、Ambu A/SはAmbu aScope 5 Cysto HDソリューションの欧州規制認可(CEマーク)を拡大した。この新たな認可により、特殊な泌尿器科手術用に特別に設計された単回使用のフレキシブル膀胱鏡として、アンビューのHD技術の使用が可能になっています。

- 2024年6月には、単回使用のaScope 5 UreteroとフルHDのaBox 2内視鏡システムを含む尿管鏡ソリューションについて、米国FDAから510(k)認可を取得しました。

- 2023年2月、同社はLithoVue Elite Single-use Digital Flexible Ureteroscope SystemのFDA 510(k)認可を取得しました。LithoVue Eliteは、尿管鏡検査中に腎内圧をリアルタイムでモニタリングできる初の尿管鏡です。

需要-促進要因、課題、機会

市場促進要因

慢性疾患の増加による内視鏡検査の需要の増加 - 呼吸器疾患、泌尿器疾患、消化器疾患などの慢性疾患の有病率の上昇は、この市場の主な促進要因です。このような慢性疾患の急増は、早期診断、モニタリング、治療のための高画質画像を提供する先進的な内視鏡装置を含む、効果的な診断ツールに対する需要の高まりにつながっています。例えば、NCBIが2023年に発表した「Urinary Incontinence(尿失禁)」と題する論文によると、世界中で20歳以上の推定4億2,300万人が何らかの尿失禁の影響を受けています。このような症状が蔓延しているため、効果的な管理ソリューションに対する需要が高まっており、排尿ケア分野での技術革新と拡大が推進されています。

市場の課題

LED内視鏡の高コスト:世界の統合型LED光源内視鏡市場、特に内視鏡検査や低侵襲手術における重要な課題の1つは、先進的なLEDシステムのコストが高いことです。LEDベースの照明には、エネルギー効率、長寿命、優れた画質など数多くの利点があるが、これらのシステムの初期初期費用は、特に予算が限られているヘルスケアプロバイダーや開発途上地域の医療機関にとっては大きな障壁となります。LED内視鏡には、高解像度の画像センサー、高度なライトガイド、洗練された光学系が組み込まれており、診断処置や外科的介入時に鮮明で正確な視覚化を提供するために不可欠です。これらの高度なシステムは、最先端の製造と研究開発への投資を必要とし、病院、診療所、医療センターのコスト上昇につながります。

市場機会

新興国におけるヘルスケア産業の成長:インド、中国、ブラジル、メキシコなどの新興国は著しい経済成長を遂げており、その結果、可処分所得が増加し、ヘルスケア・サービスへの需要が高まっています。新興国市場におけるヘルスケアシステムの急速な開拓により、高度な診断ツールに対するニーズが高まっています。明るく鮮明で高精細な画像を提供するLED内視鏡は、消化器疾患、呼吸器疾患、泌尿器疾患、がんの診断に重要な役割を果たしています。新興経済国でのヘルスケア産業の成長は、統合型LED光源内視鏡市場に大きな機会をもたらしています。これらの経済諸国が経済成長、ヘルスケアインフラ開発、ヘルスケアニーズの増加に伴い、LED光源内視鏡のような先進医療技術への需要が拡大しています。

製品/イノベーション戦略:LED光源一体型内視鏡の世界市場は、製品、エンドユーザー、地域などの様々なカテゴリーに基づいて広範囲にセグメント化されています。これにより、読者は、どのセグメントが最大のシェアを占めているのか、また、どのセグメントが今後数年間で成長するのに有利な位置にあるのかを明確に把握することができます。

成長/マーケティング戦略:製品承認が主要開発の最大数を占め、世界の統合型LED光源内視鏡市場の総開発の約76.9%は2022年1月から2025年6月の間に行われました。

競合戦略:世界の一体型LED光源内視鏡市場には、製品ポートフォリオを持つ数多くの既存企業が存在します。本調査で分析・プロファイルした世界の集積型LED光源内視鏡市場の主要企業には、集積型LED光源内視鏡向け製品を提供する既存企業が含まれます。

当レポートでは、世界の統合型LED光源内視鏡市場について調査し、市場の概要とともに、製品別、内視鏡タイプ別、エンドユーザー別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界見通し

- 市場概要とエコシステム

- 一体型LED光源内視鏡市場概要

- 再利用型内視鏡におけるLEDの浸透:現状と将来のシナリオ

- 市場動向

- 低侵襲手術への移行

- 単回使用内視鏡機器の採用拡大

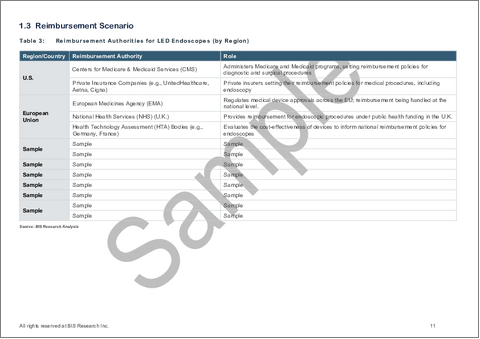

- 償還シナリオ

- 米国における償還シナリオ

- 規制状況/コンプライアンス

- 米国

- 欧州

- 日本

- 中国

- その他の地域

- サプライチェーン分析

- 内視鏡の費用

- 特許分析

- 特許出願動向(国別、年別)

- 市場力学

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 世界の統合型LED光源内視鏡市場(製品別)、100万米ドル、2023年~2035年

- 気管支鏡

- 膀胱鏡

- 尿管鏡

- 喉頭鏡

- その他

第3章 世界の統合型LED光源内視鏡市場(内視鏡タイプ別)、100万米ドル、2023年~2035年

- 単回使用内視鏡

- 軟性単回使用内視鏡

- 硬性単回使用内視鏡

- 再利用型内視鏡

- 近位再利用可能内視鏡

- 遠位再利用可能内視鏡

第4章 世界の統合型LED光源内視鏡市場(エンドユーザー別)、100万米ドル、2023年~2035年

- 病院

- 外来手術センター(ASC)

第5章 世界の統合型LED光源内視鏡市場(地域別)、100万米ドル、2023年~2035年

- 北米

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 米国

- カナダ

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- オランダ

- デンマーク

- スイス

- その他

- アジア太平洋

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他

- その他の地域

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

第6章 市場-競合ベンチマーキングと企業プロファイル

- 主要戦略と開発

- 企業プロファイル

- Ambu A/S

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Clarus Medical LLC

- Flexicare (Group) Limited

- GI View Ltd.

- HOYA Corporation (Pentax Medical)

- KARL STORZ

- OTU Medical

- Richard Wolf GmbH

- Verathon Inc.

- Innovex Medical Co., Ltd.

- MacroLux Medical Technology Co., Ltd.

- NeoScope Inc.

- Uroviu Corporation

第7章 調査手法

List of Figures

- Figure 1: Global Integrated LED Light Source Endoscope Market (by Scenario), $Million, 2025, 2029, and 2035

- Figure 2: Global Integrated LED Light Source Endoscope Market, $Million, 2024 and 2035

- Figure 3: Integrated LED Light Source Endoscope (by End User), in Million, 2024, 2029, and 2035

- Figure 4: LED Roadmap

- Figure 5: Organization of the Health System in the U.S.

- Figure 6: Overview of Regulatory Landscape in the U.S.

- Figure 7: Overview of Regulatory Landscape in Europe

- Figure 8: NHS Classification

- Figure 9: Japan Federation of Medical Devices Associations (JFMDA) Classification

- Figure 10: NMPA Classification

- Figure 11: Supply Chain and Risks within the Supply Chain

- Figure 12: Global Integrated LED Light Source Endoscope Market, Patent Analysis (by Country), January 2019-April 2025

- Figure 13: Global Integrated LED Light Source Endoscope Market, Patent Analysis (by Year), January 2019-May 2025

- Figure 14: Number of Chronic Respiratory Disease (by Region), in Million, 2018-2021

- Figure 15: Increasing Aging Population Globally, Million, 2020-2023

- Figure 16: Global Integrated LED Light Source Endoscope Market (by Product Type), $Million, 2024,2029, and 2035

- Figure 17: Global Integrated LED Light Source Endoscope Market (Bronchoscope), $Million, 2023-2035

- Figure 18: Global Integrated LED Light Source Endoscope Market (Cystoscope), $Million, 2023-2035

- Figure 19: Global Integrated LED Light Source Endoscope Market (Ureteroscope), $Million, 2023-2035

- Figure 20: Global Integrated LED Light Source Endoscope Market (Laryngoscopes), $Million, 2023-2035

- Figure 21: Global Integrated LED Light Source Endoscope Market (Others), $Million, 2023-2035

- Figure 22: Global Integrated LED Light Source Market (by Endoscope Type), $Million, 2024, 2029, and 2035

- Figure 23: Global Integrated LED Light Source Endoscope Market (Single-Use Endoscope), $Million, 2023-2035

- Figure 24: Global Integrated LED Light Source Endoscope Market (Flexible Single-Use Endoscope), $Million, 2023-2035

- Figure 25: Global Integrated LED Light Source Endoscope Market (Rigid Single-Use Endoscope), $Million, 2023-2035

- Figure 26: Global Integrated LED Light Source Endoscope Market (Reusable Endoscope), $Million, 2023-2035

- Figure 27: Global Integrated LED Light Source Endoscope Market (Proximal Reusable Endoscope), $Million, 2023-2035

- Figure 28: Global Integrated LED Light Source Endoscope Market (Distal Reusable Endoscope), $Million, 2023-2035

- Figure 29: Global Integrated LED Light Source Endoscope Market (by End User), $Million, 2024,2029, and 2035

- Figure 30: Global Integrated LED Light Source Endoscope Market (Hospitals), $Million, 2023-2035

- Figure 31: Increasing Ambulatory Surgical Centers in the U.S., 2017 and 2022

- Figure 32: Global Integrated LED Light Source Endoscope Market (ASCs), $Million, 2023-2035

- Figure 33: North America Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 34: Incidence of Bladder Cancer in the U.S., 2022-2050

- Figure 35: U.S Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 36: Incidence of Bladder Cancer in Canada, 2022-2050

- Figure 37: Canada Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 38: Europe Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 39: Incidence of Bladder Cancer in Germany, 2022-2050

- Figure 40: Germany Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 41: Incidence of Bladder Cancer in France, 2022-2050

- Figure 42: France Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 43: Incidence of Bladder Cancer in the U.K., 2022-2050

- Figure 44: U.K. Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 45: Incidence of Bladder Cancer in Italy, 2022-2050

- Figure 46: Italy Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 47: Incidence of Bladder Cancer in Spain, 2022-2050

- Figure 48: Spain Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 49: Incidence of Bladder Cancer in the Netherlands, 2022-2050

- Figure 50: Netherlands Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 51: Incidence of Bladder Cancer in Denmark, 2022-2050

- Figure 52: Denmark Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 53: Incidence of Bladder Cancer in Switzerland, 2022-2050

- Figure 54: Switzerland Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 55: Incidence of Bladder Cancer in Rest-of-Europe, 2022-2050

- Figure 56: Rest-of-Europe Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 57: Asia-Pacific Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 58: Incidence of Bladder Cancer in China, 2022-2050

- Figure 59: China Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 60: Incidence of Bladder Cancer in Japan, 2022-2050

- Figure 61: Japan Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 62: Incidence of Bladder Cancer in India, 2022-2050

- Figure 63: India Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 64: Incidence of Bladder Cancer in South Korea, 2022-2050

- Figure 65: South Korea Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 66: Incidence of Bladder Cancer in Australia, 2022-2050

- Figure 67: Australia Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 68: Incidence of Bladder Cancer in Rest-of-Asia-Pacific, 2022-2050

- Figure 69: Rest-of-Asia-Pacific Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 70: Rest-of-the-World Integrated LED Light Source Endoscope Market, $Million, 2023-2035

- Figure 71: Strategic Initiatives, January 2022-June 2025

- Figure 72: Data Triangulation

- Figure 73: Top-Down and Bottom-Up Approach

- Figure 74: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Trends: Current and Future Impact Assessment

- Table 3: Reimbursement Authorities for LED Endoscopes (by Region)

- Table 4: Medical Devices Classification: Medical Devices in Japan

- Table 5: Regulatory Process in RoW

- Table 6: Cost Comparison for Bronchoscopy (by Components)

- Table 7: Cost Comparison for Reusable Vs. Single-Use Endoscopy

- Table 8: Drivers, Opportunities, and Challenges: Current and Future Impact Assessment

- Table 9: Some of the Developments of Technological Advancement

- Table 10: Price Comparison for Integrated LED Vs. External LED Endoscopy

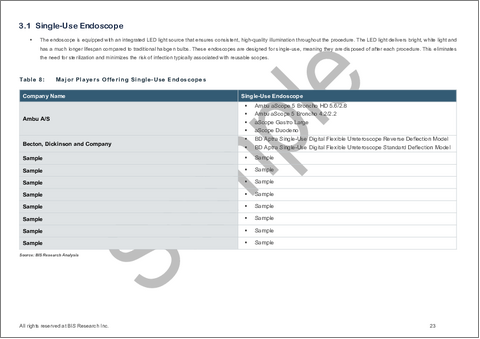

- Table 11: Major Players Offering Single-Use Endoscopes

- Table 12: Global Integrated LED Light Source Endoscope Market (Single-Use Endoscope), Units Sold, in Units, 2023-2035

- Table 13: Major Players offering Reusable Endoscopes

- Table 14: Global Integrated LED Light Source Endoscope Market (Reusable Endoscope), Type, Units Sold, in Units, 2023-2035

- Table 15: Global Integrated LED Light Source Endoscope Market (Reusable Endoscope), Type, Units Sold, in Units, 2023-2035

- Table 16: Global Integrated LED Light Source Endoscope Market (Reusable Endoscope), Type, Units Sold, in Units, 2023-2035

- Table 17: Global Integrated LED Light Source Endoscope Market (by Region), $Million, 2023-2035

- Table 18: North America Integrated LED Light Source Endoscope Market (by Type), Units Sold, Units, 2023-2035

- Table 19: North America Integrated LED Light Source Endoscope Market (by Type), $Million, 2023-2035

- Table 20: Europe Integrated LED Light Source Endoscope Market (by Type), Units Sold, Units, 2023-2035

- Table 21: Europe Integrated LED Light Source Endoscope Market (by Type), $Million, 2023-2035

- Table 22: Asia-Pacific Integrated LED Light Source Endoscope Market (by Type), Units Sold, Units, 2023-2035

- Table 23: Asia-Pacific Integrated LED Light Source Endoscope Market (by Type), $Million, 2023-2035

- Table 24: Rest-of-the-World Integrated LED Light Source Endoscope Market (by Type), Units Sold, Units, 2023-2035

- Table 25: Rest-of-the-World Integrated LED Light Source Endoscope Market (by Type), $Million, 2023-2035

- Table 26: Key Strategies, January 2022-June 2025

This report can be delivered within 1 working day.

Introduction of the Integrated LED Light Source Endoscope Market

The global integrated LED light source endoscope market, initially valued at $703.0 million in 2024, is projected to witness substantial growth, surging to $3,799.5 million by 2035, marking a remarkable compound annual growth rate (CAGR) of 15.50% over the period from 2025 to 2035.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $899.3 Million |

| 2035 Forecast | $3,799.5 Million |

| CAGR | 15.5% |

The market has been witnessing double-digit growth, driven by the rising prevalence of chronic disease, continuous technological advancement in light sources, and rising aging population.

The integrated LED light source endoscope market has experienced significant growth in recent years, largely driven by ongoing advancements in light source technology. Light sources are essential components in endoscopic systems, providing crucial illumination for surgeons and physicians to visualize internal organs and carry out minimally invasive procedures. The development of more efficient and advanced light source technologies, particularly LED-based systems, has transformed the field. These improvements not only enhance image quality but also improve patient safety, cost-effectiveness, and the overall efficacy of procedures. Here is an overview of the key technological advancements in light sources and their influence on the integrated LED light source endoscope market.

Market Introduction

The integrated LED light source endoscope market has been rapidly advancing, driven by technological innovations and strategic collaborations that enhance surgical precision and patient outcomes. Partnerships, such as Scivita Medical Technology Co., Ltd., extended their partnership with Boston Scientific Corporation. The company will be expanding its relationship with Boston Scientific for strategic co-development and global distribution activities. Meanwhile, companies such as KARL STORZ SE & Co. KG acquired Stopler's KARL STORZ-related business to expand direct sales in Belgium, Luxembourg, and the Netherlands. Recent product launches, including Ambu A/S, launched the Ambu aScope Gastro Large and Ambu aBox 2 in Europe. The company is expanding its gastroenterology portfolio. These developments underscore the increasing demand for integrated LED light source endoscopes, driving innovation and expanding clinical applications in the field.

Industrial Impact

The global integrated LED light source endoscope market, driven by industry leaders such as Ambu A/S, Becton Dickinson and Company, Boston Scientific Corporation, Clarus Medical LLC, and Flexicare Medical Limited, has been transforming the landscape of integrated LED light source endoscopes. The integration of Artificial Intelligence (AI) with LED endoscopes is a transformative advancement in the field of medical imaging and minimally invasive surgery. AI enhances the capabilities of LED-based endoscopic systems, making them more efficient, accurate, and capable of providing real-time decision-making support to clinicians. This integration can significantly improve diagnostic accuracy, streamline workflows, and enhance patient outcomes by providing intelligent, automated image analysis and optimization during medical procedures. AI-powered LED endoscopes can dynamically adjust lighting conditions, contrast, and brightness during procedures to ensure that images remain clear and optimal. For example, the AI system can detect areas where light intensity needs to be increased or adjusted based on the tissue type being visualized.

Market Segmentation

Segmentation 1: by Product

- Bronchoscopes

- Cystoscopes

- Ureteroscopes

- Laryngoscopes

- Others

Bronchoscopes Segment to Dominate the Integrated LED Light Source Endoscope Market (by Product)

Based on product, the global integrated LED light source endoscope market was led by the bronchoscopes, which held a 43.0% share in 2024. The segment dominates the market primarily due to its advanced technological capabilities, demand for safer options for identifying and diagnosing symptoms related to the chest, evaluating persistent lung collapse, and collecting fluid samples or performing biopsies.

Segmentation 2: by Endoscope Type

- Single-Use Endoscope

- Reusable Endoscope

Single-Use Endoscope Segment to Dominate the Integrated LED Light Source Endoscope Market (by Endoscope Type)

Based on endoscope type, the global integrated LED light source endoscope market was led by the single-use endoscope segment, which held a 99.9% share in 2024. Single-use endoscope dominates the integrated LED light source endoscope market due to the need for infection control, cost savings, and technological advancements in LED illumination. Additionally, the growing trend toward minimally invasive surgery, the increasing prevalence of chronic diseases, and the shift toward single-use medical devices are expected to drive the market growth.

Segmentation 3: by End User

- Hospitals

- Ambulatory Surgical Centers

Hospitals Segment to Dominate the Integrated LED Light Source Endoscope Market (by End User)

Based on end user, the global integrated LED light source endoscope market was led by the hospitals segment, which held an 82.8% share in 2024. The hospitals dominate the integrated LED light source endoscope market due to the increasing incidences of chronic diseases such as urological and gastrointestinal disorders, and respiratory diseases, and growing awareness of minimally invasive surgeries.

Segmentation 4: by Region

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Denmark

- Netherland

- Switzerland

- Rest-of-Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest-of-Asia Pacific

- Rest-of-the-World

The integrated LED light source endoscope market in the North America region is expected to witness a significant growth rate during the forecast period. This notable growth can be attributed to several key factors, including advanced healthcare infrastructure, high adoption of innovative technologies, and strong research and development capabilities. The region is home to some of the world's leading hospitals, medical centers, and academic institutions, which are equipped with state-of-the-art facilities and highly skilled professionals. This infrastructure facilitates the adoption of cutting-edge technologies such as integrated LED light source endoscopes. Additionally, North America has a high prevalence of chronic disease conditions. The region's healthcare system, which provides wide access to advanced treatments, drives the use of minimally invasive surgeries where the integrated LED light source endoscope is essential. Furthermore, the U.S. and Canada have robust regulatory environments and strong support for innovation, with companies such as Becton, Dickinson and Company and Boston Scientific Corporation leading the development of integrated LED light source endoscope technologies, thereby further cementing North America's leadership in this market.

Recent Developments in the Integrated LED Light Source Endoscope Market

- In February 2025, Ambu A/S expanded its European regulatory approval (CE mark) for the Ambu aScope 5 Cysto HD solution. This new clearance enables the use of Ambu's HD technology as a single-use flexible cystonephroscope, specifically designed for a specialized urological procedure.

- In June 2024, the company received 510(k) clearance from the U.S. FDA for its ureteroscopy solution, which includes the single-use aScope 5 Uretero and the full-HD aBox two endoscopy system.

- In February 2023, the company received FDA 510(k) clearance for the LithoVue Elite Single-Use Digital Flexible Ureteroscope System, the first ureteroscope capable of monitoring intrarenal pressure in real-time during ureteroscopy procedures.

Demand - Drivers, Challenges, and Opportunities

Market Drivers

Increasing Prevalence of Chronic Diseases Upsurge the Demand for Endoscopy Procedures: The increasing prevalence of chronic diseases, such as respiratory diseases, urological and gastrointestinal disorders, is the major driving factor of this market. This surge in chronic health conditions has led to greater demand for effective diagnostic tools, including advanced endoscopic devices that provide high-quality imaging for early diagnosis, monitoring, and treatment. For instance, according to an article titled "Urinary Incontinence," published by NCBI in 2023, an estimated 423 million individuals aged 20 years and older worldwide are affected by some form of urinary incontinence. This widespread condition has led to an increased demand for effective management solutions, driving innovation and expansion within the urinary care sector.

Market Challenges

High Cost of LED Endoscope: One of the significant challenges in the global integrated LED light source endoscope market, particularly in the context of endoscopy and minimally invasive surgeries, is the high cost of advanced LED systems. While LED-based lighting offers numerous benefits such as energy efficiency, longer lifespan, and superior image quality, the initial upfront cost of these systems can be a significant barrier, especially for healthcare providers with limited budgets or in developing regions. LED endoscopes incorporate high-definition imaging sensors, advanced light guides, and sophisticated optics, which are essential for providing clear and precise visualization during diagnostic procedures and surgical interventions. These advanced systems require state-of-the-art manufacturing and R&D investments, leading to higher costs for hospitals, clinics, and medical centers.

Market Opportunities

Growing Healthcare Industry in Emerging Countries: Emerging economies, such as India, China, Brazil, and Mexico, have experienced significant economic growth, resulting in a rise in disposable incomes and increased demand for healthcare services. The rapid development of healthcare systems in emerging markets creates an increasing need for advanced diagnostic tools. LED endoscopes, which provide bright, clear, and high-definition imaging, play a crucial role in diagnosing gastrointestinal disorders, respiratory diseases, urological conditions, and cancers. The growing healthcare industry in emerging economies presents a significant opportunity for the integrated LED light source endoscope market. As these economies experience economic growth, healthcare infrastructure development, and an increase in healthcare needs, the demand for advanced medical technologies, such as LED-powered endoscopes, is expanding.

How can this report add value to an organization?

Product/Innovation Strategy: The global integrated LED light source endoscope market has been extensively segmented based on various categories, such as product, end user, and region. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years.

Growth/Marketing Strategy: Product approvals accounted for the maximum number of key developments, i.e., nearly 76.9% of the total developments in the global integrated LED light source endoscope market were between January 2022 and June 2025.

Competitive Strategy: The global integrated LED light source endoscope market has numerous established players with product portfolios. Key players in the global integrated LED light source endoscope market analyzed and profiled in the study include established players offering products for the integrated LED light source endoscope.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2024. A historical year analysis has been done for the period FY2020-FY2023. The market size has been estimated for FY2024 and projected for the period FY2025-FY2035.

- The scope of this report has been carefully derived based on interactions with experts in different companies across the world. This report presents a comprehensive market study of the upstream and downstream products in the integrated LED light source endoscope market.

- The market contribution of the integrated LED light source endoscope is anticipated to be launched in the future and has been calculated based on the historical analysis of the solutions.

- Revenues of the companies have been referenced from their annual reports for FY2023 and FY2024. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, market collaborations, and operational history.

- The market has been mapped based on the available integrated LED light source endoscope. All the key companies with significant offerings in this field have been considered and profiled in this report.

Primary Research

The primary sources involve industry experts in the integrated LED light source endoscope market, including the market players offering products and services. Resources such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the market in focus

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- Certified publications, articles from recognized authors, white papers, directories, and major databases, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and a detailed study of their product portfolio

- Gold standard magazines, journals, white papers, press releases, and news articles

- Paid databases

The key data points taken from the secondary sources include:

- Segmentations and percentage shares

- Data for market value

- Key industry trends of the top players in the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The companies profiled have been selected based on inputs gathered from primary experts and an analysis of company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- Ambu A/S

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Clarus Medical LLC

- Flexicare (Group) Limited

- GI View Ltd.

- HOYA Corporation (Pentax Medical)

- KARL STORZ

- OTU Medical

- Richard Wolf GmbH

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Market Overview and Ecosystem

- 1.1.1 Integrated LED Light Source Endoscope Market Overview

- 1.1.2 LED Penetration in Reusable Endoscopes: Current vs. Future Scenario

- 1.2 Market Trends

- 1.2.1 Shifts toward Minimal Invasive Surgeries

- 1.2.2 Growing Adoption of Single-Use Endoscope Devices

- 1.3 Reimbursement Scenario

- 1.3.1 Reimbursement Scenario in the U.S.

- 1.4 Regulatory Landscape/Compliance

- 1.4.1 U.S.

- 1.4.2 Europe

- 1.4.2.1 U.K.

- 1.4.3 Japan

- 1.4.4 China

- 1.4.5 Rest-of-the-World (RoW)

- 1.5 Supply Chain Analysis

- 1.6 Cost of the Endoscope

- 1.7 Patent Analysis

- 1.7.1 Patent Filing Trend (by Country, Year)

- 1.8 Market Dynamics

- 1.8.1 Market Drivers

- 1.8.1.1 Increasing Prevalence of Chronic Diseases Upsurge the Demand for Endoscopy Procedures

- 1.8.1.2 Rising Aging Population

- 1.8.1.3 Continuous Technological Advancements in Light Sources

- 1.8.2 Market Restraints

- 1.8.2.1 Efficient Light Coupling and Heat Dissipation in LED-Based Endoscopic Illumination

- 1.8.2.2 High Cost of LED Endoscope

- 1.8.3 Market Opportunities

- 1.8.3.1 Growing Healthcare Industry in Emerging Countries

- 1.8.1 Market Drivers

2 Global Integrated LED Light Source Endoscope Market (By Product), $Million, 2023-2035

- 2.1 Bronchoscopes

- 2.2 Cystoscope

- 2.3 Ureteroscope

- 2.4 Laryngoscopes

- 2.5 Others

3 Global Integrated LED Light Source Endoscope Market (By Endoscope Type), $Million, 2023-2035

- 3.1 Single-Use Endoscope

- 3.1.1 Flexible Single-Use Endoscope

- 3.1.2 Rigid Single-Use Endoscope

- 3.2 Reusable Endoscope

- 3.2.1 Proximal Reusable Endoscope

- 3.2.2 Distal Reusable Endoscope

4 Global Integrated LED Light Source Endoscope Market (By End User), $Million, 2023-2035

- 4.1 Hospitals

- 4.2 Ambulatory Surgical Centers (ASCs)

5 Global Integrated LED Light Source Endoscope Market (By Region), $Million, 2023-2035

- 5.1 North America

- 5.1.1 Regional Overview

- 5.1.2 Driving Factors for Market Growth

- 5.1.3 Factors Challenging the Market

- 5.1.5 U.S.

- 5.1.6 Canada

- 5.2 Europe

- 5.2.1 Regional Overview

- 5.2.2 Driving Factors for Market Growth

- 5.2.3 Factors Challenging the Market

- 5.2.4 Germany

- 5.2.5 France

- 5.2.6 U.K.

- 5.2.7 Italy

- 5.2.8 Spain

- 5.2.9 Netherlands

- 5.2.10 Denmark

- 5.2.11 Switzerland

- 5.2.12 Rest-of-Europe

- 5.3 Asia-Pacific

- 5.3.1 Regional Overview

- 5.3.2 Driving Factors for Market Growth

- 5.3.3 Factors Challenging the Market

- 5.3.4 China

- 5.3.5 Japan

- 5.3.6 India

- 5.3.7 South Korea

- 5.3.8 Australia

- 5.3.9 Rest-of-Asia Pacific

- 5.4 Rest-of-the-World

- 5.4.1 Regional Overview

- 5.4.2 Driving Factors for Market Growth

- 5.4.3 Factors Challenging the Market

6 Markets - Competitive Benchmarking & Company Profiles

- 6.1 Key Strategies and Developments

- 6.2 Company Profiles

- 6.2.1 Ambu A/S

- 6.2.1.1 Overview

- 6.2.1.2 Top Products/Product Portfolio

- 6.2.1.3 Top Competitors

- 6.2.1.4 Target Customers

- 6.2.1.5 Key Personal

- 6.2.1.6 Analyst View

- 6.2.2 Becton, Dickinson and Company

- 6.2.2.1 Overview

- 6.2.2.2 Top Products/Product Portfolio

- 6.2.2.3 Top Competitors

- 6.2.2.4 Target Customers

- 6.2.2.5 Key Personal

- 6.2.2.6 Analyst View

- 6.2.3 Boston Scientific Corporation

- 6.2.3.1 Overview

- 6.2.3.2 Top Products/Product Portfolio

- 6.2.3.3 Top Competitors

- 6.2.3.4 Target Customers

- 6.2.3.5 Key Personal

- 6.2.3.6 Analyst View

- 6.2.4 Clarus Medical LLC

- 6.2.4.1 Overview

- 6.2.4.2 Top Products/Product Portfolio

- 6.2.4.3 Top Competitors

- 6.2.4.4 Target Customers

- 6.2.4.5 Key Personal

- 6.2.4.6 Analyst View

- 6.2.5 Flexicare (Group) Limited

- 6.2.5.1 Overview

- 6.2.5.2 Top Products/Product Portfolio

- 6.2.5.3 Top Competitors

- 6.2.5.4 Target Customers

- 6.2.5.5 Key Personal

- 6.2.5.6 Analyst View

- 6.2.6 GI View Ltd.

- 6.2.6.1 Overview

- 6.2.6.2 Top Products/Product Portfolio

- 6.2.6.3 Top Competitors

- 6.2.6.4 Target Customers

- 6.2.6.5 Key Personal

- 6.2.6.6 Analyst View

- 6.2.7 HOYA Corporation (Pentax Medical)

- 6.2.7.1 Overview

- 6.2.7.2 Top Products/Product Portfolio

- 6.2.7.3 Top Competitors

- 6.2.7.4 Target Customers

- 6.2.7.5 Key Personal

- 6.2.7.6 Analyst View

- 6.2.8 KARL STORZ

- 6.2.8.1 Overview

- 6.2.8.2 Top Products/Product Portfolio

- 6.2.8.3 Top Competitors

- 6.2.8.4 Target Customers

- 6.2.8.5 Key Personal

- 6.2.8.6 Analyst View

- 6.2.9 OTU Medical

- 6.2.9.1 Overview

- 6.2.9.2 Top Products/Product Portfolio

- 6.2.9.3 Top Competitors

- 6.2.9.4 Target Customers

- 6.2.9.5 Key Personal

- 6.2.9.6 Analyst View

- 6.2.10 Richard Wolf GmbH

- 6.2.10.1 Overview

- 6.2.10.2 Top Products/Product Portfolio

- 6.2.10.3 Top Competitors

- 6.2.10.4 Target Customers

- 6.2.10.5 Key Personal

- 6.2.10.6 Analyst View

- 6.2.11 Verathon Inc.

- 6.2.11.1 Overview

- 6.2.11.2 Top Products/Product Portfolio

- 6.2.11.3 Top Competitors

- 6.2.11.4 Target Customers

- 6.2.11.5 Key Personal

- 6.2.11.6 Analyst View

- 6.2.12 Innovex Medical Co., Ltd.

- 6.2.12.1 Overview

- 6.2.12.2 Top Products/Product Portfolio

- 6.2.12.3 Top Competitors

- 6.2.12.4 Target Customers

- 6.2.12.5 Key Personal

- 6.2.12.6 Analyst View

- 6.2.13 MacroLux Medical Technology Co., Ltd.

- 6.2.13.1 Overview

- 6.2.13.2 Top Products/Product Portfolio

- 6.2.13.3 Top Competitors

- 6.2.13.4 Target Customers

- 6.2.13.5 Key Personal

- 6.2.13.6 Analyst View

- 6.2.14 NeoScope Inc.

- 6.2.14.1 Overview

- 6.2.14.2 Top Products/Product Portfolio

- 6.2.14.3 Top Competitors

- 6.2.14.4 Target Customers

- 6.2.14.5 Key Personal

- 6.2.14.6 Analyst View

- 6.2.15 Uroviu Corporation

- 6.2.15.1 Overview

- 6.2.15.2 Top Products/Product Portfolio

- 6.2.15.3 Top Competitors

- 6.2.15.4 Target Customers

- 6.2.15.5 Key Personal

- 6.2.15.6 Analyst View

- 6.2.1 Ambu A/S

7 Research Methodology

- 7.1 Data Sources

- 7.1.1 Primary Data Sources

- 7.1.2 Secondary Data Sources

- 7.1.3 Data Triangulation

- 7.2 Market Estimation and Forecast