|

|

市場調査レポート

商品コード

1764706

細胞シートベースの遺伝子治療市場:技術タイプ・細胞シートタイプ・由来・用途・エンドユーザー・地域別の分析・予測 (2025-2035年)Cell Sheet-based Gene Therapy Market - A Global and Regional Analysis: Focus on Technology Type, Cell-sheet Type, Source Type, Application Type, End User, and Regional Analysis - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 細胞シートベースの遺伝子治療市場:技術タイプ・細胞シートタイプ・由来・用途・エンドユーザー・地域別の分析・予測 (2025-2035年) |

|

出版日: 2025年07月09日

発行: BIS Research

ページ情報: 英文 128 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

細胞シートベースの遺伝子治療市場における主要企業には、Abeona Therapeutics, Inc. や Foundation ENEA Tech Biomedical といった先進的なバイオテクノロジー企業および再生医療企業が含まれており、これに加えて CellSeed Inc. や J-TECなどの既存の大手企業も存在感を示しています。

Abeonaは、米国オハイオ州クリーブランドにcGMP準拠の統合型製造施設を有しており、臨床および商業規模での先端治療製品の製造を可能にしています。同社の主力製品である ZEVASKYN (prademagene zamikeracel) は、劣性栄養障害性表皮水疱症 (RDEB) に対する自己由来・遺伝子補正細胞治療薬であり、希少な皮膚疾患分野において高い商業的可能性を示しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2035年 |

| 2025年評価額 | 8億5,470万米ドル |

| 2035年予測 | 33億5,510万米ドル |

| CAGR | 14.48% |

世界の細胞シートベースの遺伝子治療の市場は大幅な成長が見込まれており、2035年には33億3,510万米ドルに達すると予測されています。この成長を牽引しているのは、四肢幹細胞欠損症、虚血性心疾患、遺伝性皮膚疾患など、従来の治療法では十分な効果が得られない慢性疾患、変性疾患、希少疾患の有病率の上昇です。細胞シートを用いた遺伝子治療は、再生能力を持つ足場不要のアプローチであり、損傷組織に対して完全な機能性細胞層を直接送達することで、優れた組織修復、組織との一体化、局所的な遺伝子発現を実現します。

この革新的なプラットフォームは、再生医療と遺伝子送達技術を融合させたものであり、個別化された、低侵襲の治療介入を可能にします。角膜再生を目的としたHoloclarのEMA承認や、RDEB (劣性栄養障害性表皮水疱症) に対するZevaskynのFDA承認といった重要な臨床的マイルストーンが、この治療モデルの有効性を裏付けており、自己由来かつ遺伝子補正型の再生治療の新たな領域を確立しています。

この分野の成長は、FDAのRMAT指定、EMAのATMP制度、日本の条件付き承認制度といった、各国の支援的な制度枠組みによってさらに加速しています。また、米国のNIH、日本のAMED、欧州のHorizon Europeといった公的機関による研究助成がトランスレーショナルリサーチを推進しています。さらに、イタリア、米国、韓国、ドイツなどの国々では、GMP認証を受けたインフラや製造能力の拡充が進められています。

技術面では、温度応答性ポリマー、遺伝子編集との統合、凍結保存技術などの革新によって、より安定的でスケーラブルな製品供給が可能になってきています。現在は単層の細胞シート、自己由来細胞、がん領域での応用が主流となっていますが、眼科、循環器、皮膚科などへの適応拡大も進んでおり、幅広い治療分野での有用性が示されています。

当レポートでは、世界の細胞シートベースの遺伝子治療の市場を調査し、主要動向、市場影響因子の分析、法規制環境、臨床試験の動向、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 世界の細胞シートベースの遺伝子治療市場:業界展望

- 細胞シートを用いた遺伝子治療市場の動向

- 再生医療と遺伝子工学の新たな融合

- 競合情勢

- 事業戦略

- 企業戦略

- 承認薬

- パイプライン医薬品

- 規制状況

- 米国

- 欧州

- アジア太平洋

- 市場力学

- 動向、促進要因、課題、機会:現在および将来の影響評価

- 市場促進要因

- 市場抑制要因

- 市場機会

- 市場の課題

- 規制当局の承認と倫理的問題

第2章 細胞シートベースの遺伝子治療市場:技術タイプ別

- 細胞シートベースの工学技術

- 光誘導型細胞分離技術

- 温度応答性培養表面

- 足場不要技術

- 多層積層技術

- その他

- 遺伝子送達法

- ウイルスベクターベース

- 非ウイルスベクターベース

- CRISP/Cas9

- その他

第3章 細胞シートベースの遺伝子治療市場:由来別

- 自己由来

- 同種由来 (既製品)

- 幹細胞由来

第4章 細胞シートベースの遺伝子治療市場:細胞シートタイプ別

- 単層細胞シート

- 共培養細胞シート

- 多層細胞シート

- その他

第5章 細胞シートベースの遺伝子治療市場:用途別

- 用途の概要

- 腫瘍

- 眼科

- 遺伝性疾患

- 心臓病

- その他

第6章 細胞シートベースの遺伝子治療市場:エンドユーザー別

- 病院・診療所

- 研究・学術機関

- バイオテクノロジー・製薬会社

- その他

第7章 世界の細胞シートベースの遺伝子治療市場:地域別

- 地域サマリー

- 北米

- 地域概要

- 市場成長の原動力

- 市場課題

- 米国

- カナダ

- 欧州

- 地域概要

- 市場成長の原動力

- 市場課題

- 英国

- フランス

- ドイツ

- イタリア

- スペイン

- その他

- アジア太平洋

- 地域概要

- 市場成長の原動力

- 市場課題

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他

- その他の地域

- 地域概要

- 市場成長の原動力

- 市場課題

第8章 市場:競合ベンチマーキング・企業プロファイル

- Abeona Therapeutics Inc.

- Emmaus Medical, Inc

- CellSeed Inc.

- Fujifilm Cellular Dynamics, Inc. (FCDI) (FUJIFILM Holdings Corporation)

- Japan Tissue Engineering Co. Ltd.

- Foundation ENEA Tech Biomedical

第9章 調査手法

List of Figures

- Figure 1: Cell Sheet-based Gene Therapy Market (by Scenario), $Million, 2024, 2028, and 2035

- Figure 2: Global Cell Sheet-based Gene Therapy Market, 2024-2035

- Figure 3: Top 10 Countries, Global Cell Sheet-based Gene Therapy Market, $Million, 2024

- Figure 4: Global Cell Sheet-based Gene Therapy Market Snapshot

- Figure 5: Global Cell Sheet-based Gene Therapy Market, $Million, 2024 and 2035

- Figure 6: Cell Sheet-based Gene Therapy Market (by Technology Type), $Million, 2024, 2028, and 2035

- Figure 7: Cell Sheet-based Gene Therapy Market (by Cell-Sheet Type), $Million, 2024, 2028, and 2035

- Figure 8: Cell Sheet-based Gene Therapy Market (by Source Type), $Million, 2024, 2028, and 2035

- Figure 9: Cell Sheet-based Gene Therapy Market (by Application Type), $Million, 2024, 2028, and 2035

- Figure 10: Cell Sheet-based Gene Therapy Market (by End User), $Million, 2024, 2028, and 2035

- Figure 11: Cell Sheet-based Gene Therapy Market Segmentation

- Figure 12: Global Cell Sheet based-Gene Therapy Market, by Cell sheet Engineering Technique, $Million, 2023-2035

- Figure 13: Global Cell Sheet-based Gene Therapy Market, by Light-Induced Cell Technology, $Million, 2023-2035

- Figure 14: Global Cell Sheet-based Gene Therapy Market, by Temperature Responsive Culture Surfaces, $Million, 2023-2035

- Figure 15: Global Cell Sheet-based Gene Therapy Market, by Scaffold-Free Techniques, $Million, 2023-2035

- Figure 16: Global Cell Sheet-based Gene Therapy Market, by Layer by Layer Assembly, $Million, 2023-2035

- Figure 17: Global Cell Sheet-based Gene Therapy Market, by Other Techniques, $Million, 2023-2035

- Figure 18: Global Cell Sheet-based Gene Therapy Market, by Gene Delivery Methods, $Million, 2023-2035

- Figure 19: Workflow of Cell Sheet Formation using Viral-Vector Method:

- Figure 20: Several Types of Viral Vectors Used in Gene Therapy

- Figure 21: Global Cell Sheet-based Gene Therapy Market, by Viral-Vector based Method, $Million, 2023-2035

- Figure 22: Global Cell Sheet-based Gene Therapy Market, by Non-Viral Vector based Method, $Million, 2023-2035

- Figure 23: Global Cell Sheet-based Gene Therapy Market, by CRISPR/CAS9 Method, $Million, 2023-2035

- Figure 24: Global Cell Sheet-based Gene Therapy Market, by Other Methods, $Million, 2023-2035

- Figure 25: Cell Sheet Production Process using Autologous Cell Source

- Figure 26: Global Cell Sheet-based Gene Therapy Market, by Autologous Type, $Million, 2023-2035

- Figure 27: Global Cell Sheet-based Gene Therapy Market, by Allogenic Type, $Million, 2023-2035

- Figure 28: Global Cell Sheet-based Gene Therapy Market, by Stem-cell Derived Type, $Million, 2023-2035

- Figure 29: Global Cell Sheet-based Gene Therapy Market, by Monolayered Cell Sheet Type, $Million, 2023-2035

- Figure 30: Application of Monolayered Cell Sheet Type

- Figure 31: Global Cell Sheet-based Gene Therapy Market, by Co-Cultured Cell Sheet Type, $Million, 2023-2035

- Figure 32: Global Cell Sheet-based Gene Therapy Market, by Multilayered Cell Sheet Type, $Million, 2023-2035

- Figure 33: Global Cell Sheet-based Gene Therapy Market, by Other Cell Sheet Type, $Million, 2023-2035

- Figure 34: Major Applications of Cell Sheet-based Gene Therapy

- Figure 35: Global Cell Sheet-based Gene Therapy Market (by Oncology), $Million, 2023-2035

- Figure 36: Global Cell Sheet-based Gene Therapy Market (by Ophthalmology), $Million, 2023-2035

- Figure 37: Global Cell Sheet-based Gene Therapy Market (by Genetic Disorders), $Million, 2023-2035

- Figure 38: Global Cell Sheet-based Gene Therapy Market (by Cardiology), $Million, 2023-2035

- Figure 39: Global Cell Sheet-based Gene Therapy Market (by Other Applications), $Million, 2023-2035

- Figure 40: Global Cell Sheet-based Gene Therapy Market (by Hospitals and Clinics), $Million, 2023-2035

- Figure 41: Global Cell Sheet-based Gene Therapy Market (by Research and Academic Institutions), $Million, 2023-2035

- Figure 42: Global Cell Sheet-based Gene Therapy Market (by Biotech and Pharma Companies), $Million, 2023-2035

- Figure 43: Global Cell Sheet-based Gene Therapy Market (by Other End Users), $Million, 2023-2035

- Figure 44: U.S. Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 45: Canada Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 46: U.K. Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 47: France Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 48: Germany Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 49: Italy Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 50: Spain Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 51: Rest of Europe Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 52: Japan Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 53: China Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 54: India Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 55: Australia Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 56: South Korea Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 57: Rest of Asia-Pacific Cell Sheet-based Gene Therapy Market, $Million, 2023-2035

- Figure 58: Inclusion and Exclusion Criteria for Global Cell Sheet-based Gene Therapy Market

- Figure 59: Data Triangulation

- Figure 60: Top-Down and Bottom-Up Approach

- Figure 61: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Approved Drugs in Cell-Sheet based Gene Therapy Market

- Table 3: Pipeline Drugs in Cell-Sheet based Gene Therapy Market

- Table 4: Global Cell Sheet-based Gene Therapy Market (by Region), $Million, 2023-2035

- Table 5: North America Cell Sheet-based Gene Therapy Market (by Technology Type), $Million, 2023-2035

- Table 6: North America Cell Sheet-based Gene Therapy Market (by Cell sheet-based Engineering Techniques Type), $Million, 2023-2035

- Table 7: North America Cell Sheet-based Gene Therapy Market (by Gene Delivery Methods), $Million, 2023-2035

- Table 8: North America Cell Sheet-based Gene Therapy Market (by Cell-sheet Type), $Million, 2023-2035

- Table 9: North America Cell Sheet-based Gene Therapy Market (by Source Type), $Million, 2023-2035

- Table 10: North America Cell Sheet-based Gene Therapy Market (by Application Type), $Million, 2023-2035

- Table 11: North America Cell Sheet-based Gene Therapy Market (by End User), $Million, 2023-2035

- Table 12: Europe Cell Sheet-based Gene Therapy Market (by Technology Type), $Million, 2023-2035

- Table 13: Europe Cell Sheet-based Gene Therapy Market (by Cell sheet-based Engineering Techniques Type), $Million, 2023-2035

- Table 14: Europe Cell Sheet-based Gene Therapy Market (by Gene Delivery Methods), $Million, 2023-2035

- Table 15: Europe Cell Sheet-based Gene Therapy Market (by Cell-sheet Type), $Million, 2023-2035

- Table 16: Europe Cell Sheet-based Gene Therapy Market (by Source Type), $Million, 2023-2035

- Table 17: Europe Cell Sheet-based Gene Therapy Market (by Application Type), $Million, 2023-2035

- Table 18: Europe Cell Sheet-based Gene Therapy Market (by End User), $Million, 2023-2035

- Table 19: Asia-Pacific Cell Sheet-based Gene Therapy Market (by Technology Type), $Million, 2023-2035

- Table 20: Asia-Pacific Cell Sheet-based Gene Therapy Market (by Cell sheet-based Engineering Techniques Type), $Million, 2023-2035

- Table 21: Asia-Pacific Cell Sheet-based Gene Therapy Market (by Gene Delivery Methods), $Million, 2023-2035

- Table 22: Asia-Pacific Cell Sheet-based Gene Therapy Market (by Cell-sheet Type), $Million, 2023-2035

- Table 23: Asia-Pacific Cell Sheet-based Gene Therapy Market (by Source Type), $Million, 2023-2035

- Table 24: Asia-Pacific Cell Sheet-based Gene Therapy Market (by Application Type), $Million, 2023-2035

- Table 25: Asia-Pacific Cell Sheet-based Gene Therapy Market (by End User), $Million, 2023-2035

- Table 26: Rest-of-the-World Cell Sheet-based Gene Therapy Market (by Technology Type), $Million, 2023-2035

- Table 27: Rest-of-the-World Cell Sheet-based Gene Therapy Market (by Cell sheet-based Engineering Techniques Type), $Million, 2023-2035

- Table 28: Rest-of-the-World Cell Sheet-based Gene Therapy Market (by Gene Delivery Methods), $Million, 2023-2035

- Table 29: Rest-of-the-World Cell Sheet-based Gene Therapy Market (by Cell-sheet Type), $Million, 2023-2035

- Table 30: Rest-of-the-World Cell Sheet-based Gene Therapy Market (by Source Type), $Million, 2023-2035

- Table 31: Rest-of-the-World Cell Sheet-based Gene Therapy Market (by Application Type), $Million, 2023-2035

- Table 32: Rest-of-the-World Cell Sheet-based Gene Therapy Market (by End User), $Million, 2023-2035

This report can be delivered within 1 working day.

Introduction of Cell Sheet-based Gene Therapy

Key players in the cell sheet-based gene therapy market include leading biotech and regenerative medicine firms such as Abeona Therapeutics, Inc. and Foundation ENEA Tech Biomedical, alongside established players such as CellSeed Inc. and J-TEC. Abeona operates a fully integrated, cGMP-compliant manufacturing facility in Cleveland, Ohio, enabling clinical and commercial-scale production of advanced therapies. Its flagship product, ZEVASKYN (prademagene zamikeracel), is an autologous, gene-corrected cell therapy for recessive dystrophic epidermolysis bullosa (RDEB), demonstrating strong commercial potential in rare dermatological conditions.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $854.7 Million |

| 2035 Forecast | $3,355.1 Million |

| CAGR | 14.48% |

Foundation ENEA Tech Biomedical has significantly expanded its regenerative medicine portfolio through the acquisition of Holostem S.r.l. in December 2023. Holostem, the first biotech company dedicated to epithelial stem cell-based ATMPs, is behind therapies Holoclar, targeting corneal regeneration. ENEA is building national biomedical hubs to connect translational research with clinical application, emphasizing industrial scalability and public-private collaboration. These strategic efforts aim to advance therapies for complex epithelial diseases affecting the skin and eye, while safeguarding Italy's biomedical autonomy.

Market Introduction

The global cell sheet-based gene therapy market is expected to witness significant expansion, projected to reach $3,335.1 million by 2035. This growth is driven by the rising prevalence of chronic, degenerative, and rare conditions such as limbal stem cell deficiency, ischemic heart disease, and inherited skin disorders that are poorly served by conventional therapies. Cell sheet-based gene therapy offers a regenerative, scaffold-free solution that delivers intact, functional cell layers directly to damaged tissues, enabling superior tissue repair, integration, and localized gene expression.

This transformative platform merges regenerative medicine with gene delivery, allowing for personalized, minimally invasive interventions. Key clinical milestones such as EMA's approval of Holoclar for corneal regeneration and FDA's approval of Zevaskyn for RDEB have validated the therapeutic model, establishing a new frontier in autologous and gene-corrected regenerative treatments.

Growth is further fueled by supportive global frameworks such as FDA's RMAT designation, EMA's ATMP pathway, and Japan's conditional approval model, which have accelerated the clinical and regulatory trajectory of these therapies. Public investments through NIH (U.S.), AMED (Japan), and Horizon Europe are fostering translational research, while countries such as Italy, the U.S., South Korea, and Germany are scaling GMP-certified infrastructure and manufacturing capacity.

The market is also witnessing technological convergence with innovations in temperature-responsive polymers, gene editing integration, and cryopreservation techniques, enabling more stable and scalable product delivery. While monolayer cell sheets, autologous cell sources, and oncology applications currently dominate, expanding indications in ophthalmology, cardiology, and dermatology signal broad therapeutic relevance.

Despite this momentum, challenges such as high manufacturing costs, limited reimbursement clarity, and fragmented late-stage clinical data remain. However, growing payer confidence, successful real-world outcomes, and cross-sector partnerships are steadily addressing these barriers.

The competitive landscape is led by companies such as Abeona Therapeutics, CellSeed Inc., Japan Tissue Engineering Co. (J-TEC), and Holostem, all of which are advancing first-in-class therapies and building robust commercialization strategies. As healthcare systems increasingly embrace regenerative, precision-based approaches, cell sheet-based gene therapy stands at the intersection of high clinical need and disruptive innovation, with the potential to redefine treatment paradigms across multiple medical disciplines.

Industrial Impact

Cell sheet-based gene therapy is reshaping the healthcare industry by introducing regenerative, patient-specific treatments that offer improved healing and functional recovery across a range of conditions. For instance, in ophthalmology, Holoclar, a stem cell-based cell sheet therapy, has transformed treatment for limbal stem cell deficiency, enabling vision restoration using the patient's own epithelial cells. This personalized approach enhances safety and long-term outcomes by eliminating the risks associated with immune rejection.

Beyond individual patient care, cell sheet-based gene therapy is driving innovation across biomanufacturing and clinical delivery systems. The integration of temperature-responsive culture surfaces and scaffold-free platforms is enabling the scalable production of high-integrity cell sheets, which is revolutionizing how advanced tissue therapies are developed and deployed. Companies such as J-TEC and CellSeed Inc. are pioneering late-stage clinical programs for indications such as cartilage repair and skin regeneration, backed by robust regulatory support in markets such as Japan.

In parallel, public-private partnerships such as those initiated by Foundation ENEA Tech Biomedical in Europe are establishing biomedical hubs that bridge translational research with commercial-scale deployment, reinforcing industrial scalability and healthcare resilience. These advancements are not only improving individual outcomes but also optimizing treatment workflows, reducing surgical complications, and accelerating the pathway to broader access in regenerative care.

The continued evolution of cell sheet-based therapies promises to redefine the role of regenerative medicine in mainstream healthcare by promoting durable, biologically integrated treatments that align with the growing shift toward precision and minimally invasive care.

Market Segmentation

Segmentation 1: By Technology Type

- Cell sheet-based Engineering Techniques

- Light-induced cell sheet technology

- Temperature-Responsive Culture Surfaces

- Scaffold-Free Techniques

- Layer-by-Layer Assembly

- Other Techniques

- Gene Delivery Methods

- Viral Vector-Based (e.g., Lentivirus, Adenovirus)

- Non-Viral Vector-Based (e.g., Liposomes, Nanoparticles)

- CRISPR/Cas9

- Other Gene Delivery Methods

Cell sheet-based engineering techniques remain the leading segment by technology type in the cell sheet-based gene therapy market, holding a 75.32% market share in 2024 with a projected CAGR of 14.79% during the forecast period 2025-2035. Among its key subsegments-Light-induced cell sheet technology, Temperature-Responsive Culture Surfaces, Scaffold-Free Techniques, and Layer-by-Layer Assembly-Light-induced cell sheet technology leads the market, owing to its precise control over cell detachment and viability without chemical or enzymatic treatments. This technology is gaining traction for its ability to preserve cell functionality, improve sheet integrity, and support advanced tissue engineering applications across ophthalmology, dermatology, and orthopedics.

Segmentation 2: By Cell-Sheet Type

- Monolayer Cell-sheet Type

- Co-culture Cell-sheet Type

- Multilayered Cell-sheet Type

- Others

Based on cell sheet type, the global cell sheet-based gene therapy market was led by the Monolayer Cell-sheet Type segment, which held a 35.69% share in 2024. Monolayer cell sheets are projected to maintain dominance due to their simpler fabrication process, preserved cell-cell junctions, and suitability for early-stage regenerative applications. Their widespread use in skin, ocular, and mucosal therapies supports consistent demand, while ongoing clinical advancements continue to expand their therapeutic potential across various indications.

Segmentation 3: By Source Type

- Autologous

- Allogenic

- Stem-cell Derived

Based on source type, the global cell sheet-based gene therapy market was led by the Autologous segment, which held a 78.65% share in 2024. Autologous cell sources are expected to continue dominating the market due to their lower risk of immune rejection, better biocompatibility, and established clinical outcomes. These therapies are particularly favored in personalized regenerative treatments, offering safer and more effective options for conditions such as skin injuries, corneal damage, and cartilage repair.

Segmentation 4: By Application

- Oncology

- Ophthalmology

- Genetic Disorders

- Cardiology

- Others

Based on application type, the global cell sheet-based gene therapy market was led by the Oncology segment, which held a 43.46% share in 2024. Oncology is expected to continue leading the market due to the rising demand for innovative, localized treatment approaches that offer enhanced tissue regeneration and targeted delivery. Cell sheet therapies show strong potential in solid tumor management by supporting reconstruction post-resection and improving therapeutic outcomes through scaffold-free, biocompatible platforms.

Segmentation 5: By End-User

- Hospitals and Clinics

- Research and Academic Institutions

- Biotech and Pharma Companies

- Others

Based on end-user, the global cell sheet-based gene therapy market was led by the Hospitals and Clinics segment, which held a 40.18% share in 2024. Hospitals and clinics are expected to dominate the market as they serve as primary centers for administering advanced regenerative therapies. Their access to specialized surgical infrastructure, trained professionals, and controlled clinical settings makes them ideal for cell sheet transplantation procedures, especially in oncology, ophthalmology, and orthopedic indications.

Segmentation 6: By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest-of-Europe

- Asia-Pacific

- Japan

- India

- China

- Australia

- South Korea

- Rest-of-Asia-Pacific

- Rest-of-the-World

The cell sheet-based gene therapy market in the Asia-Pacific region is expected to witness substantial growth over the next five years, driven by Japan's progressive regulatory environment, expanding clinical activity, and strong academic-industry collaboration. The region benefits from advanced regenerative medicine frameworks such as Japan's Act on the Safety of Regenerative Medicine and the PMDA's fast-track approval pathways, which have accelerated the development and approval of therapies such as JACC and Holoclar. Key developments include the late-stage clinical advancement of autologous and allogeneic cartilage cell sheets for osteoarthritis and ongoing efforts in iPS cell-derived retinal therapies. Companies such as CellSeed, J-TEC, and Abeona Therapeutics are actively exploring scalable, clinically viable platforms with a focus on skin, corneal, and cartilage repair. Additionally, public-private initiatives and academic partnerships are fostering translational research, while increasing investment in biomanufacturing and infrastructure is expected to support broader commercialization and access.

Recent Developments in the Cell Sheet-based Gene Therapy Market

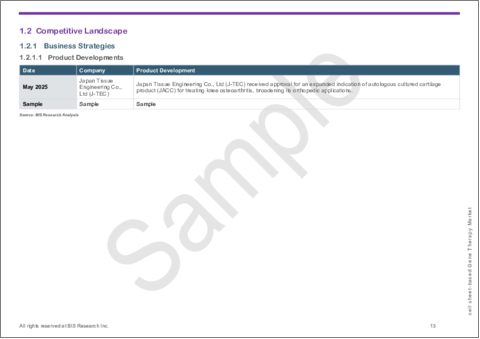

- In May 2025, Japan Tissue Engineering Co., Ltd (J-TEC) received regulatory approval for an expanded indication of its autologous cultured cartilage product, JACC, to include the treatment of knee osteoarthritis, extending its orthopedic applications beyond initial indications.

- In September 2023, CellSeed Inc. submitted a Phase III clinical trial notification for an allogeneic chondrocyte sheet targeting knee osteoarthritis, marking a major milestone toward commercialization of off-the-shelf regenerative cartilage therapies.

- In December 2024, J-TEC entered a capital and business alliance with VCCT Inc. to jointly develop iPS cell-derived retinal regenerative therapies using cell sheet engineering. VCCT will support preclinical development and pipeline scale-up, reinforcing both companies' positions in the ophthalmic regenerative space.

- In February 2023, CellSeed Inc. partnered with Tokai University to conduct a clinical trial for CLS2701C, an autologous cartilage cell sheet therapy for knee cartilage defects. Tokai University is leading surgical procedures and clinical feasibility studies under ethical oversight at its affiliated hospital.

Demand -Drivers, Challenges, and Opportunities

Market Demand Drivers:

- Advancement in Regenerative Medicine: One of the main drivers of the market is the advancement in regenerative medicine technologies. Cell sheet-based gene therapy leverages stem cells and other cell types to regenerate damaged or degenerated tissues. As the understanding of stem cell biology and tissue engineering grows, the feasibility and effectiveness of cell-sheet therapies become more prominent. These technologies enable the repair of tissues that cannot naturally regenerate, such as cartilage in joints, heart muscle after a heart attack, and corneal tissue in the eye.

Cell Sheet Engineering and Culture Technology

Thermoresponsive Culture Systems: One of the significant innovations in cell-sheet technology is the use of thermoresponsive culture dishes, which allow cells to be grown in sheets and then detached easily without the need for harsh enzymatic treatments. This innovation helps preserve the integrity of the cells, ensuring that they are viable for transplantation.'A study published in Stem Cell Research & Therapy in 2024' discusses the use of thermoresponsive culture dishes for fabricating patterned cell sheets. These sheets, when transplanted, have shown improved survival and functionality due to the preservation of native cell structures during harvesting.

Stem Cells in Regenerative Medicine: Stem cells are central to regenerative medicine, as they can differentiate into a variety of cell types, aiding in tissue regeneration. In cell-sheet-based gene therapy, stem cells (especially mesenchymal stem cells and induced pluripotent stem cells) are often used to form cell sheets. According to a 2018 report by the National Institutes of Health (NIH), stem cell-based therapies have seen a 25-30% increase in successful clinical outcomes for patients with heart disease and cartilage regeneration when combined with cell-sheet technology.

Some of the other driving factors include:

- Growing Investment in Personalized Medicine

- Technological Advancements in Cell Sheet Therapy

Note: All of the above factors will be evaluated in detail in the report.

Market Challenges:

- Regulatory Approval and Ethical Issues: Gene therapies, particularly those involving complex technologies such as cell-sheet engineering, face stringent regulatory scrutiny from bodies such as the FDA and EMA. The approval process can be long, expensive, and uncertain, and the regulatory frameworks for these therapies are still evolving. The lengthy and costly regulatory approval process delays the availability of these therapies to patients and adds to the overall cost of development. There is also the challenge of establishing clear guidelines for cell-sheet-based gene therapies, as these therapies are still relatively new to the field.

Genetic editing raises significant ethical concerns, particularly when it involves altering human DNA. In gene therapies involving cell-sheet technology, concerns include the potential for germline editing (altering DNA in a way that affects future generations) and the risk of unforeseen consequences from permanent genetic modifications. Ethical concerns can lead to public resistance, regulatory delays, and heightened scrutiny, all of which may slow down the development and acceptance of cell-sheet-based gene therapies.

Some of the other factors challenging the market growth include:

- Limited Commercial Scalability

Note: All of the above factors will be evaluated in detail in the report.

Market Opportunities:

- Substantial Surge in the Rise of Cell Sheet Approaches: Cell sheet-based gene therapy stands at a strategic inflection point, anchored in the multi-billion-dollar growth of CGT, clinical expansion into diverse indications, validated ultra-high pricing models, parental-level investments in manufacturing, and emerging reimbursement frameworks. Taken together, these signal strong momentum for accelerating clinical translation and commercial adoption of this transformative platform.

Cell sheet-based gene therapy is expected to witness significant growth, driven by powerful trends across the cell and gene therapy (CGT) and regenerative medicine sectors. With the global CGT market valued at over $21 billion in 2024 and projected to exceed $100 billion by the early 2030s, opportunities for cell-sheet technologies are expanding rapidly. The regenerative medicine segment alone is expected to grow from around $35 billion to over $90 billion by 2030. Cell sheet therapies are particularly well-positioned to meet the growing demand for personalized, non-oncology treatments, as evidenced by the increasing share of gene therapy trials targeting non-cancer conditions

Some of the other factors creating an opportunity for market growth include:

- Rising Application for Localized and Minimally Invasive Treatments

Note: All of the above factors will be evaluated in detail in the report.

Market Trends:

- Emerging Convergence of Regenerative Medicine and Genetic Engineering: Cell sheet-based gene therapy has transitioned from foundational tissue engineering into a clinically and commercially viable modality. Practices have been advancing from preclinical demonstrations to early clinical use, enhanced by gene editing integration and improved manufacturing processes. Positioned within the rapidly expanding cell and gene therapy market, this hybrid technology is set to expand across fields such as regenerative medicine, ophthalmology, and orthopedics, driven by robust regulatory support and emerging investment trends.

Current Trends Driving the Field:

- Scaffold free, extracellular matrix preserving techniques: These methods support complex tissue regeneration (e.g., cartilage, cardiac patches, cornea) with high viability, enhancing clinical translation.

Some of the other emerging trends in the market include:

- Expansion into Oncology and Cardiology

Note: All of the above trends will be evaluated in detail in the report.

How can this report add value to an organization?

Product/Innovation Strategy: The report offers in-depth insights into the latest technological advancements in cell sheet-based gene therapy, enabling organizations to drive innovation and develop cutting-edge products tailored to market needs.

Growth/Marketing Strategy: By providing comprehensive market analysis and identifying key growth opportunities, the report equips organizations with the knowledge to craft targeted marketing strategies and expand their market presence effectively.

Competitive Strategy: The report includes a thorough competitive landscape analysis, helping organizations understand their competitors' strengths and weaknesses and allowing them to strategize effectively to gain a competitive edge in the market.

Regulatory and Compliance Strategy: It provides updates on evolving regulatory frameworks, approvals, and industry guidelines, ensuring organizations stay compliant and accelerate market entry for new cell sheet-based gene therapy.

Investment and Business Expansion Strategy: By analyzing market trends, funding patterns, and partnership opportunities, the report assists organizations in making informed investment decisions and identifying potential M&A opportunities for business growth.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2024. A historical year analysis has been done for the period FY2023. The market size has been estimated for FY2024 and projected for the period FY2025-FY2035.

- The scope of this report has been carefully derived based on extensive interactions with experts and stakeholders across leading companies and research institutions worldwide. This report provides a comprehensive market analysis of regenerative medicine, cell-based engineering technologies, and gene-modified therapies within the cell sheet-based gene therapy market.

- The market contribution of the precision therapeutics anticipated to be launched in the future has been calculated based on the historical analysis of the products.

- Revenues of the companies have been referenced from their annual reports for FY2023 and FY2024. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, market collaborations, and operational history.

- The market has been mapped based on the available cell sheet-based gene therapy. All the key companies with significant offerings in this field have been considered and profiled in this report.

Primary Research:

The primary sources involve industry experts in cell sheet-based gene therapy , including the market players offering products and services. Resources such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report's segmentation and key qualitative findings

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Validation of the numbers of the different segments of the market in focus

- Percentage split of individual markets for regional analysis

Secondary Research:

Open Sources

- Certified publications, articles from recognized authors, white papers, directories, and major databases, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their product portfolio

- Gold standard magazines, journals, white papers, press releases, and news articles

- Paid databases

The key data points taken from the secondary sources include:

- Segmentations and percentage shares

- Data for market value

- Key industry trends of the top players of the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

Profiled companies have been selected based on inputs gathered from primary experts, as well as analyzing company coverage, product portfolio, and market penetration.

Key players in the cell sheet-based gene therapy market include leading biotech and regenerative medicine firms such as Abeona Therapeutics, Inc. and Foundation ENEA Tech Biomedical, alongside established players such as CellSeed Inc. and J-TEC. Abeona operates a fully integrated, cGMP-compliant manufacturing facility in Cleveland, Ohio, enabling clinical and commercial-scale production of advanced therapies. Its flagship product, ZEVASKYN (prademagene zamikeracel), is an autologous, gene-corrected cell therapy for recessive dystrophic epidermolysis bullosa (RDEB), demonstrating strong commercial potential in rare dermatological conditions.

Foundation ENEA Tech Biomedical has significantly expanded its regenerative medicine portfolio through the acquisition of Holostem S.r.l. in December 2023. Holostem, the first biotech company dedicated to epithelial stem cell-based ATMPs, is behind therapies such as Holoclar, targeting corneal regeneration. ENEA is building national biomedical hubs to connect translational research with clinical application, emphasizing industrial scalability and public-private collaboration. These strategic efforts aim to advance therapies for complex epithelial diseases affecting the skin and eye, while safeguarding Italy's biomedical autonomy.

Some prominent names established in this market are:

- Abeona Therapeutics, Inc.

- Foundation ENEA Tech Biomedical

- Fujifilm Cellular Dynamics, Inc. (FCDI)

- CellSeed Inc.

- Japan Tissue Engineering Co., Ltd

- Emmaus Medical, Inc.

Table of Contents

Executive Summary

Scope and Definition

1 Global Cell sheet-based Gene Therapy Market: Industry Outlook

- 1.1 Trends in Cell Sheet-based Gene Therapy Market

- 1.1.1 Emerging Convergence of Regenerative Medicine and Genetic Engineering

- 1.2 Competitive Landscape

- 1.2.1 Business Strategies

- 1.2.1.1 Product Developments

- 1.2.2 Corporate Strategies

- 1.2.2.1 Partnerships and Joint Ventures

- 1.2.1 Business Strategies

- 1.3 Approved Drugs, Cell sheet-based Gene Therapy

- 1.4 Pipeline Drugs, Cell sheet-based Gene Therapy

- 1.5 Regulatory Landscape

- 1.5.1 U.S.

- 1.5.2 Europe

- 1.5.3 Asia-Pacific

- 1.5.3.1 Japan

- 1.5.3.2 China

- 1.5.3.3 South Korea

- 1.6 Market Dynamics

- 1.6.1 Trends, Drivers, Challenges, and Opportunities: Current and Future Impact Assessment

- 1.6.2 Market Drivers

- 1.6.2.1 Advancement in Regenerative Medicine

- 1.6.2.2 Growing Investment in Personalized Medicine

- 1.6.2.3 Technological Advancements in Cell Sheet Therapy

- 1.6.3 Market Restraints

- 1.6.3.1 Rising Cost of Development and Manufacturing

- 1.6.4 Market Opportunities

- 1.6.4.1 Substantial Surge in the Rise of Cell Sheet Approaches

- 1.6.4.2 Rising Application for Localized and Minimally Invasive Treatments

- 1.7 Market Challenges

- 1.7.1 Regulatory Approval and Ethical Issues

2 Cell Sheet-based Gene Therapy Market (Technology Type), Value ($million), 2023-2035

- 2.1 Cell Sheet-based Engineering Techniques

- 2.1.1 Light-Induced Cell Technology

- 2.1.2 Temperature-Responsive Culture Surfaces

- 2.1.3 Scaffold-Free Techniques

- 2.1.4 Layer-by-Layer Assembly

- 2.1.5 Other Techniques

- 2.2 Gene Delivery Methods

- 2.2.1 Viral-Vector based

- 2.2.2 Non-Viral Vector based

- 2.2.3 CRISP/Cas9

- 2.2.4 Other Methods

3 Cell Sheet-based Gene Therapy Market (Source Type), Value ($million), 2023-2035

- 3.1 Autologous

- 3.2 Allogenic (''of the shelf'' Product)

- 3.3 Stem-Cell Derived

4 Cell Sheet-based Gene Therapy Market (Cell Sheet Type), Value ($million), 2023-2035

- 4.1 Monolayered Cell Sheet Type

- 4.2 Co-Cultured Cell Sheet Type

- 4.3 Multilayered Cell Sheet Type

- 4.4 Other Cell Sheet Type

5 Cell Sheet-based Gene Therapy Market (Application Type), Value ($million), 2023-2035

- 5.1 Application Overview

- 5.2 Oncology

- 5.3 Ophthalmology

- 5.4 Genetic Disorders

- 5.5 Cardiology

- 5.6 Other Applications

6 Cell Sheet-based Gene Therapy Market (End User), Value ($million), 2023-2035

- 6.1 Hospitals and Clinics

- 6.2 Research and Academic Institutions

- 6.3 Biotech and Pharma Companies

- 6.4 Other End Users

7 Global Cell Sheet-based Gene Therapy Market (by Region), Value ($million), 2023-2035

- 7.1 Regional Summary

- 7.2 North America

- 7.2.1 Regional Overview

- 7.2.2 Driving Factors for Market Growth

- 7.2.3 Factors Challenging the Market

- 7.2.4 U.S.

- 7.2.5 Canada

- 7.3 Europe

- 7.3.1 Regional Overview

- 7.3.2 Driving Factors for Market Growth

- 7.3.3 Factors Challenging the Market

- 7.3.4 U.K.

- 7.3.5 France

- 7.3.6 Germany

- 7.3.7 Italy

- 7.3.8 Spain

- 7.3.9 Rest-of-Europe

- 7.4 Asia-Pacific

- 7.4.1 Regional Overview

- 7.4.2 Driving Factors for Market Growth

- 7.4.3 Factors Challenging the Market

- 7.4.4 Japan

- 7.4.5 China

- 7.4.6 India

- 7.4.7 Australia

- 7.4.8 South Korea

- 7.4.9 Rest-of-Asia-Pacific

- 7.5 Rest-of-the-World

- 7.5.1 Regional Overview

- 7.5.2 Driving Factors for Market Growth

- 7.5.3 Factors Challenging the Market

8 Markets - Competitive Benchmarking & Company Profiles

- 8.1 Abeona Therapeutics Inc.

- 8.1.1 Overview

- 8.1.2 Top Products/Product Portfolio

- 8.1.3 Top Competitors

- 8.1.4 Target Customers

- 8.1.5 Strategic Positioning and Market Impact

- 8.1.6 Analyst View

- 8.1.7 Pipeline and Research Initiatives

- 8.2 Emmaus Medical, Inc

- 8.2.1 Overview

- 8.2.2 Top Products/Product Portfolio

- 8.2.3 Top Competitors

- 8.2.4 Strategic Positioning and Market Impact

- 8.2.5 Key Personal

- 8.2.6 Analyst View

- 8.2.7 Research Initiatives

- 8.3 CellSeed Inc.

- 8.3.1 Overview

- 8.3.2 Top Products/Product Portfolio

- 8.3.3 Top Competitors

- 8.3.4 Target Customers

- 8.3.5 Strategic Positioning and Market Impact

- 8.3.6 Analyst View

- 8.3.7 Research Initiatives

- 8.4 Fujifilm Cellular Dynamics, Inc. (FCDI) (FUJIFILM Holdings Corporation)

- 8.4.1 Overview

- 8.4.2 Top Products/Product Portfolio

- 8.4.3 Top Competitors

- 8.4.4 Target Customers

- 8.4.5 Strategic Positioning and Market Impact

- 8.4.6 Analyst View

- 8.4.7 Research Initiatives

- 8.5 Japan Tissue Engineering Co. Ltd.

- 8.5.1 Overview

- 8.5.2 Top Products/Product Portfolio

- 8.5.3 Top Competitors

- 8.5.4 Target Customers

- 8.5.5 Strategic Positioning and Market Impact

- 8.5.6 Analyst View

- 8.5.7 Pipeline and Research Initiatives

- 8.6 Foundation ENEA Tech Biomedical

- 8.6.1 Overview

- 8.6.2 Top Products/Product Portfolio

- 8.6.3 Top Competitors

- 8.6.4 Target Customers

- 8.6.5 Strategic Positioning and Market Impact

- 8.6.6 Analyst View

- 8.6.7 Pipeline and Research Initiatives

9 Research Methodology

- 9.1 Data Sources

- 9.1.1 Primary Data Sources

- 9.1.2 Secondary Data Sources

- 9.1.3 Inclusion and Exclusion

- 9.1.4 Data Triangulation

- 9.2 Market Estimation and Forecast