|

|

市場調査レポート

商品コード

1757391

自動車内装曲面用フレキシブルプリント回路(FPC)市場 - 世界と地域別分析:用途別、車両タイプ別、推進タイプ別、製品タイプ別、販売チャネル別、国別 - 分析と予測(2025年~2035年)Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market - A Global and Regional Analysis: Focus on Application, Vehicle Type, Propulsion Type, Product Type, Sales Channel, and Country-Level Analysis - Analysis and Forecast, 2025-2035 |

||||||

カスタマイズ可能

|

|||||||

| 自動車内装曲面用フレキシブルプリント回路(FPC)市場 - 世界と地域別分析:用途別、車両タイプ別、推進タイプ別、製品タイプ別、販売チャネル別、国別 - 分析と予測(2025年~2035年) |

|

出版日: 2025年06月27日

発行: BIS Research

ページ情報: 英文 140 Pages

納期: 1~5営業日

|

全表示

- 概要

- 目次

フレキシブルプリント回路(FPC)は、3次元空間での複雑な回路配線を可能にする柔軟なポリマー基板から作られた特殊な相互接続システムです。

自動車産業、特に自動車の内装において、FPCは曲面に適合する能力により、スマートでスペース効率に優れ、軽量な電子アーキテクチャを可能にすることで人気を集めています。これらの回路は、インフォテインメント・システム、環境照明制御、触覚フィードバック・インターフェース、デジタル・ダッシュボードなどのアプリケーションで極めて重要であり、特に電気自動車や高級乗用車では、フォームファクターの柔軟性、高密度信号配線、軽量化が高度な車両設計に不可欠です。

自動車の曲面インテリア用フレキシブルプリント回路(FPC)の需要は、主に洗練された車内デジタル体験に対する消費者の嗜好の高まりが原動力となっています。自動車メーカーは美的魅力と機能性を高めるため、曲面ディスプレイと先進的なヒューマン・マシン・インターフェース(HMI)を急速に採用しています。電気自動車や自律走行車が牽引するデジタルコックピットへの動向は、高信頼性と省スペースの回路ソリューションを必要とし、FPCを好ましい技術として位置付けています。さらに、インフォテインメント・システム、OLEDおよびAMOLEDディスプレイ、静電容量式タッチセンサーの採用が急増し、コンパクトな自動車内装にシームレスに統合できる曲面回路アーキテクチャのニーズが加速しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2035年 |

| 2025年の評価額 | 7億4,960万米ドル |

| 2035年予測 | 15億3,570万米ドル |

| CAGR | 7.44% |

自動車の曲面内装用フレキシブルプリント回路(FPC)市場のもう1つの大きな成長要因は、排出ガス規制やエネルギー効率規制を満たすために自動車の軽量化を推進していることです。FPCは従来のワイヤーハーネスやリジッドPCBよりも優れた軽量化を実現し、車両全体の軽量化戦略に貢献しています。さらに、自動車エレクトロニクス、特にコネクテッドカーやADAS(先進運転支援システム)への投資の増加により、コックピットや車内環境におけるFPCの応用範囲が拡大しています。

しかし、力強い成長の勢いにもかかわらず、自動車の曲面内装用フレキシブルプリント回路(FPC)市場はいくつかの課題に直面しています。主な阻害要因の1つは、車載グレードの多層FPC製造の初期コストの高さと複雑さです。フレキシブル・フォーマットにおける長期的な熱安定性、耐振動性、電磁干渉(EMI)シールドの確保は、依然として技術的なハードルとなっています。さらに、車載用電子機器の厳しい認定基準やレガシーシステムとの統合の難しさが、特にコストに敏感なOEMやティア1サプライヤーの間で、大規模な展開を遅らせる可能性があります。

自動車の曲面内装用フレキシブルプリント回路(FPC)市場では、拡張現実ヘッドアップディスプレイ(AR-HUD)、環境照明システム、透明タッチコントロール面の統合が進み、機会が広がっています。これらの進歩により、ドアトリム、インストルメントクラスター、センターコンソール、シートマウントコントロールユニットなどにおける曲面FPCの新たな使用事例が実現しつつあります。電動化とデジタル化が進む中、FPCメーカーは自動車メーカーと共同で、特に高級車やEVセグメント向けに、機能性とデザイン性の双方を提供するデザイン特化型ソリューションを開発する機会があります。

アジア太平洋の自動車内装曲面用フレキシブルプリント回路(FPC)市場は、中国、日本、韓国の自動車エレクトロニクスメーカーの存在感が強いため、内装曲面用FPCの高成長ハブとして台頭しています。この地域は、コスト効率の高い製造エコシステム、急速なEVの普及、主要なディスプレイ技術プロバイダーなどの恩恵を受けています。中国のOEMは、EVモデルに大判の曲面ディスプレイやスマートサーフェスを搭載するようになっており、川下で旺盛な需要を生み出しています。さらに、インドや中国などの国々では、EVの生産を促進する政府の政策や研究開発補助金が、中級車へのFPCの展開を促進しています。

市場ライフサイクルステージ

世界の自動車内装曲面用フレキシブルプリント回路(FPC)市場は成長段階にあり、初期成熟に向けて移行しています。フレキシブル回路は民生用電子機器では以前から存在していたが、自動車内装、特に曲面や多機能表面への展開はまだ急速な開発段階にあります。ライフサイクル段階では、製品の標準化が進み、設計ガイドラインが登場し、プロトタイプから生産への移行が急増します。自動車のデジタル化の需要が強まるにつれ、エコシステムとの協力関係の深化、生産量の増加、コストの合理化によって、市場は進化していくと予想されます。

自動車の曲面内装用フレキシブルプリント回路(FPC)の世界市場のセグメンテーション

セグメンテーション1:用途別

- ディスプレイ

- ADAS(先進運転支援システム)

- 照明システム

- その他(あれば)

セグメンテーション2:車両タイプ別

- 乗用車

- 商用車

- 小型商用車

- 大型商用車

乗用車は、世界の自動車内装曲面用フレキシブルプリント回路(FPC)市場で顕著な応用セグメントの1つです。

セグメンテーション3:推進タイプ別

- 内燃機関(ICE)車

- 電気自動車(EV)

セグメンテーション4:製品タイプ別

- 両面FPC

- 多層FPC

- 片面FPC

セグメンテーション5:販売チャネル別

- OEM

- アフターマーケット

セグメンテーション6:地域別

- 北米- 米国、カナダ、メキシコ

- 欧州- ドイツ、フランス、英国、イタリア、スペイン、その他

- アジア太平洋地域- 中国、日本、韓国、インド、オーストラリア、その他

- その他地域- 南米、中東・アフリカ

世界の自動車内装曲面用フレキシブルプリント回路(FPC)市場では、アジア太平洋地域が継続的な成長と主要メーカーの存在により、生産面で牽引力を増すと予想されます。

主要市場参入企業と競合情勢

世界の自動車用曲面内装フレキシブルプリント回路(FPC)市場は、NOK CORPORATION、Sumitomo Electric Printed Circuits, Inc.、Fujikura Printed Circuits Ltd.などの主要企業が存在し、大きく成長しています。これらの企業は、広範な流通網と大規模な製造能力を有し、広範な研究開発、自動車メーカーとの戦略的提携を行っています。新興企業は、高性能電気自動車の需要拡大に対応するため、持続可能でコスト効率の高いソリューションに注力しています。同市場は、技術の進歩、規制遵守、自動車生産の増加による激しい競合によって特徴付けられ、自動車のバリューチェーン全体にわたって急速な技術革新と協力をもたらしています。

当レポートでは、世界の自動車内装曲面用フレキシブルプリント回路(FPC)市場について調査し、市場の概要とともに、用途別、車両タイプ別、推進タイプ別、製品タイプ別、販売チャネル別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

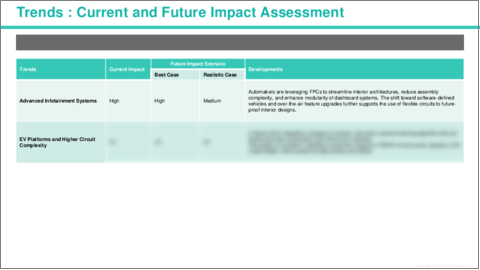

- 動向:現状と将来への影響評価

- 動向:概要

- EVプラットフォームと回路の複雑さの増大

- 高度なインフォテインメントシステム

- サプライチェーンの概要

- バリューチェーン分析

- 市場マップ

- 研究開発レビュー

- 国別・企業別特許出願動向

- 規制状況

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

第2章 用途

- 用途のセグメンテーション

- 用途のサマリー

- 自動車内装曲面用フレキシブルプリント回路(FPC)市場(用途別)

- ディスプレイ

- ADAS(先進運転支援システム)(ADAS)

- 照明システム

- その他

- 自動車内装曲面用フレキシブルプリント回路(FPC)市場(車両タイプ別)

- 乗用車

- 商用車

- 自動車内装曲面用フレキシブルプリント回路(FPC)市場(推進タイプ別)

- 内燃機関(ICE)車

- 電気自動車(EV)

第3章 製品

- 製品のセグメンテーション

- 製品のサマリー

- 自動車内装曲面用フレキシブルプリント回路(FPC)市場(製品タイプ別)

- 両面FPC

- 多層FPC

- 片面FPC

- 自動車内装曲面用フレキシブルプリント回路(FPC)市場(販売チャネル別)

- OEM

- アフターマーケット

第4章 地域

- 地域のサマリー

- 促進要因と抑制要因

- 北米

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 応用

- 製品

- 北米の自動車内装曲面用フレキシブルプリント回路(FPC)市場(国別)

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 応用

- 製品

- 欧州の自動車内装曲面用フレキシブルプリント回路(FPC)市場(国別)

- アジア太平洋

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 応用

- 製品

- アジア太平洋の自動車内装曲面用フレキシブルプリント回路(FPC)市場(国別)

- その他の地域

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 応用

- 製品

- その他の自動車内装曲面用フレキシブルプリント回路(FPC)市場(地域別)

第5章 市場-競合情勢と企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- NOK CORPORATION

- Sumitomo Electric Printed Circuits, Inc.

- Fujikura Printed Circuits Ltd.

- Interflex co.,ltd.

- Flexium Interconnect

- Career Technology (Mfg.) Co., Ltd.

- MFS Technology

- SI FLEX Co., Ltd.

- bhflex Co. Ltd.

- ICHIA Fabs

- Yougn Poong Electronics co., Ltd.

- Molex, LLC

- Wonderful PCB

- Guangdong Onte Electronic Technology Co., Ltd.

- Cicor Group

- その他の主要参入企業のリスト

第6章 調査手法

Global Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market : Industry Overview

Flexible Printed Circuits (FPCs) are specialized interconnect systems made from flexible polymer substrates that allow for complex circuit routing in three-dimensional spaces. In the automotive industry, particularly within vehicle interiors, FPCs are gaining traction due to their ability to conform to curved surfaces, enabling sleek, space-efficient, and lightweight electronic architectures. These circuits are pivotal in applications such as infotainment systems, ambient lighting controls, haptic feedback interfaces, and digital dashboards, where form factor flexibility, high-density signal routing, and weight reduction are critical for advanced vehicle design, especially in electric and premium passenger vehicles.

The demand for flexible printed circuit (FPC) for curved interior in vehicles market is primarily driven by the increasing consumer preference for sophisticated in-cabin digital experiences. Automakers are rapidly adopting curved displays and advanced Human-Machine Interfaces (HMI) to enhance aesthetic appeal and functionality. The trend towards digital cockpits, driven by electric and autonomous vehicles, requires high-reliability and space-saving circuit solutions, positioning FPCs as a preferred technology. Moreover, the surge in adoption of infotainment systems, OLED and AMOLED displays, and capacitive touch sensors is accelerating the need for curved circuit architectures that can be seamlessly integrated within compact automotive interiors.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2035 |

| 2025 Evaluation | $749.6 Million |

| 2035 Forecast | $1,535.7 Million |

| CAGR | 7.44% |

Another significant growth driver for the flexible printed circuit (FPC) for curved interior in vehicles market is the push toward weight optimization in vehicles to meet emissions and energy efficiency regulations. FPCs offer superior weight reduction over traditional wire harnesses and rigid PCBs, contributing to overall vehicle light-weighting strategies. Additionally, increased investments in automotive electronics, particularly in connected vehicles and advanced driver-assistance systems (ADAS), are expanding the scope of FPC applications within the cockpit and cabin environment.

However, despite the strong growth momentum, the flexible printed circuit (FPC) for curved interior in vehicles market faces several challenges. One key restraint is the high initial cost and complexity of manufacturing multilayer FPCs for automotive-grade applications. Ensuring long-term thermal stability, vibration resistance, and electromagnetic interference (EMI) shielding in flexible formats remains a technical hurdle. Moreover, stringent qualification standards for automotive electronics and integration difficulties with legacy systems can slow down large-scale deployment, especially among cost-sensitive OEMs and Tier 1 suppliers.

Opportunities in the flexible printed circuit (FPC) for curved interior in vehicles market are unfolding with the growing integration of augmented reality head-up displays (AR-HUD), ambient lighting systems, and transparent touch-control surfaces. These advancements are enabling new use cases for curved FPCs in door trims, instrument clusters, center consoles, and seat-mounted control units. With increasing electrification and digitalization, FPC manufacturers have opportunities to co-develop design-specific solutions with automakers that offer both functional and design versatility, particularly for luxury and EV segments.

The Asia-Pacific flexible printed circuit (FPC) for curved interior in vehicles market is emerging as a high-growth hub for curved interior FPCs due to the strong presence of automotive electronics manufacturers in China, Japan, and South Korea. The region benefits from cost-effective manufacturing ecosystems, rapid EV adoption, and leading display technology providers. OEMs in China are increasingly incorporating large-format curved displays and smart surfaces in EV models, creating robust downstream demand. Furthermore, government policies promoting EV production and R&D subsidies in countries such as India and China are catalyzing FPC deployment across mid-range vehicles as well.

Market Lifecycle Stage

The global flexible printed circuit (FPC) for curved interior in vehicles market is in a growth stage, transitioning toward early maturity. While flexible circuits have long existed in consumer electronics, their deployment in automotive interiors, especially for curved and multifunctional surfaces, is still in a rapid development phase. The lifecycle stage is marked by increasing product standardization, emerging design guidelines, and a surge in prototype-to-production transitions. As demand for vehicle digitalization intensifies, the market is expected to evolve with deeper ecosystem collaboration, higher production volumes, and cost rationalization.

Global Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market Segmentation:

Segmentation 1: by Application

- Displays

- Advanced Driver Assistance Systems (ADAS)

- Lighting Systems

- Others (If Any)

Segmentation 2: by Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger vehicles is one of the prominent application segments in the global flexible printed circuit (FPC) for curved interior in vehicles market.

Segmentation 3: by Propulsion Type

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EV)

Segmentation 4: by Product Type

- Double-Sided FPC

- Multi-Layer FPC

- Single-Sided FPC

Segmentation 5: by Sales Channel

- OEM

- Aftermarket

Segmentation 6: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, U.K., Italy, Spain, and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, Australia, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

In the global flexible printed circuit (FPC) for curved interior in vehicles market, Asia-Pacific is anticipated to gain traction in terms of production, owing to the continuous growth and the presence of key manufacturers in the region.

Key Market Players and Competition Synopsis

The global flexible printed circuit (FPC) for curved interior in vehicles market is growing considerably with presence key players including NOK CORPORATION, Sumitomo Electric Printed Circuits, Inc., and Fujikura Printed Circuits Ltd. among others. These companies having wide large manufacturing capacities with wide distribution network, extensive research and development, and strategic partnerships with automakers. Emerging players are focusing on sustainable and cost-effective solutions to meet the growing demand for high-performance electric vehicles. The market is characterized by intense competition driven by technological advancements, regulatory compliance, and increasing vehicle production, leading to rapid innovation and collaboration across the automotive value chain.

Some of the prominent established names in the flexible printed circuit (FPC) for curved interior in vehicles market are:

- NOK CORPORATION

- Sumitomo Electric Printed Circuits, Inc.

- Fujikura Printed Circuits Ltd.

- Interflex co.,ltd.

- Flexium Interconnect

- Career Technology (Mfg.) Co., Ltd.

- MFS Technology

- SI FLEX Co., Ltd.

- bhflex Co. Ltd.

- ICHIA Fabs

- Yougn Poong Electronics co., Ltd.

- Molex, LLC

- Wonderful PCB

- Guangdong Onte Electronic Technology Co., Ltd.

- Cicor Group

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

1. Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Trends: Overview

- 1.1.2 EV Platforms and Higher Circuit Complexity

- 1.1.3 Advanced Infotainment Systems

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Market Map

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend by Country and by Company

- 1.4 Regulatory Landscape

- 1.5 Market Dynamics Overview

- 1.5.1 Market Drivers

- 1.5.2 Market Restraints

- 1.5.3 Market Opportunities

2. Application

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application)

- 2.3.1 Displays

- 2.3.2 Advanced Driver Assistance Systems (ADAS)

- 2.3.3 Lighting systems

- 2.3.4 Others (If Any)

- 2.4 Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Vehicle Type)

- 2.4.1 Passenger Vehicles

- 2.4.2 Commercial Vehicles

- 2.4.2.1 Light Commercial Vehicles

- 2.4.2.2 Heavy Commercial Vehicles

- 2.5 Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Propulsion Type)

- 2.5.1 Internal Combustion Engine (ICE) Vehicles

- 2.5.2 Electric Vehicles (EV)

3. Product

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product Type)

- 3.3.1 Double-Sided FPC

- 3.3.2 Multi-Layer FPC

- 3.3.3 Single-Sided FPC

- 3.4 Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Sales Channel)

- 3.4.1 OEM

- 3.4.2 Aftermarket

4. Region

- 4.1 Regional Summary

- 4.2 Drivers and Restraints

- 4.3 North America

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 North America Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Country)

- 4.3.6.1 U.S.

- 4.3.6.1.1 Market by Application

- 4.3.6.1.2 Market by Product

- 4.3.6.2 Canada

- 4.3.6.2.1 Market by Application

- 4.3.6.2.2 Market by Product

- 4.3.6.3 Mexico

- 4.3.6.3.1 Market by Application

- 4.3.6.3.2 Market by Product

- 4.3.6.1 U.S.

- 4.4 Europe

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Europe Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Country)

- 4.4.6.1 Germany

- 4.4.6.1.1 Market by Application

- 4.4.6.1.2 Market by Product

- 4.4.6.2 France

- 4.4.6.2.1 Market by Application

- 4.4.6.2.2 Market by Product

- 4.4.6.3 U.K.

- 4.4.6.3.1 Market by Application

- 4.4.6.3.2 Market by Product

- 4.4.6.4 Italy

- 4.4.6.4.1 Market by Application

- 4.4.6.4.2 Market by Product

- 4.4.6.5 Spain

- 4.4.6.5.1 Market by Application

- 4.4.6.5.2 Market by Product

- 4.4.6.6 Rest-of-Europe

- 4.4.6.6.1 Market by Application

- 4.4.6.6.2 Market by Product

- 4.4.6.1 Germany

- 4.5 Asia-Pacific

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Asia-Pacific Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Country)

- 4.5.6.1 China

- 4.5.6.1.1 Market by Application

- 4.5.6.1.2 Market by Product

- 4.5.6.2 Japan

- 4.5.6.2.1 Market by Application

- 4.5.6.2.2 Market by Product

- 4.5.6.3 South Korea

- 4.5.6.3.1 Market by Application

- 4.5.6.3.2 Market by Product

- 4.5.6.4 India

- 4.5.6.4.1 Market by Application

- 4.5.6.4.2 Market by Product

- 4.5.6.5 Australia

- 4.5.6.5.1 Market by Application

- 4.5.6.5.2 Market by Product

- 4.5.6.6 Rest-of-Asia-Pacific

- 4.5.6.6.1 Market by Application

- 4.5.6.6.2 Market by Product

- 4.5.6.1 China

- 4.6 Rest-of-the-World

- 4.6.1 Regional Overview

- 4.6.2 Driving Factors for Market Growth

- 4.6.3 Factors Challenging the Market

- 4.6.4 Application

- 4.6.5 Product

- 4.6.6 Rest-of-the-World Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Region)

- 4.6.6.1 South America

- 4.6.6.1.1 Market by Application

- 4.6.6.1.2 Market by Product

- 4.6.6.2 Middle East and Africa

- 4.6.6.2.1 Market by Application

- 4.6.6.2.2 Market by Product

- 4.6.6.1 South America

5. Markets - Competitive Landscape & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 NOK CORPORATION

- 5.3.1.1 Overview

- 5.3.1.2 Top Products / Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers/End-Users

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Sumitomo Electric Printed Circuits, Inc.

- 5.3.2.1 Overview

- 5.3.2.2 Top Products / Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers/End-Users

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 Fujikura Printed Circuits Ltd.

- 5.3.3.1 Overview

- 5.3.3.2 Top Products / Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers/End-Users

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Interflex co.,ltd.

- 5.3.4.1 Overview

- 5.3.4.2 Top Products / Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers/End-Users

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Flexium Interconnect

- 5.3.5.1 Overview

- 5.3.5.2 Top Products / Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers/End-Users

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 Career Technology (Mfg.) Co., Ltd.

- 5.3.6.1 Overview

- 5.3.6.2 Top Products / Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers/End-Users

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 MFS Technology

- 5.3.7.1 Overview

- 5.3.7.2 Top Products / Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers/End-Users

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 SI FLEX Co., Ltd.

- 5.3.8.1 Overview

- 5.3.8.2 Top Products / Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers/End-Users

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 bhflex Co. Ltd.

- 5.3.9.1 Overview

- 5.3.9.2 Top Products / Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers/End-Users

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 ICHIA Fabs

- 5.3.10.1 Overview

- 5.3.10.2 Top Products / Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers/End-Users

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 Yougn Poong Electronics co., Ltd.

- 5.3.11.1 Overview

- 5.3.11.2 Top Products / Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers/End-Users

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 Molex, LLC

- 5.3.12.1 Overview

- 5.3.12.2 Top Products / Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers/End-Users

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 Wonderful PCB

- 5.3.13.1 Overview

- 5.3.13.2 Top Products / Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers/End-Users

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 Guangdong Onte Electronic Technology Co., Ltd.

- 5.3.14.1 Overview

- 5.3.14.2 Top Products / Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers/End-Users

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 Cicor Group

- 5.3.15.1 Overview

- 5.3.15.2 Top Products / Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers/End-Users

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.1 NOK CORPORATION

- 5.4 List of Other Key Players

6. Research Methodology

List of Figure

- Figure 1: Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Scenario), $Million, 2025, 2028, and 2035

- Figure 2: Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Region), $Million, 2024, 2027, and 2035

- Figure 3: Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024, 2028, and 2035

- Figure 4: Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024, 2025, and 2035

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-June 2025

- Figure 9: Patent Analysis (by Company), January 2021-June 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2035

- Figure 11: U.S. Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 12: Canada Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 13: Mexico Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 14: Germany Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 15: France Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 16: U.K. Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 17: Italy Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 18: Spain Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 19: Rest-of-Europe Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 20: China Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 21: Japan Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 22: South Korea Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 23: India Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 24: Australia Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 25: Rest-of-Asia-Pacific Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 26: South America Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 27: Middle East and Africa Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market, $Million, 2024-2035

- Figure 28: Strategic Initiatives (by Company), 2021-2025

- Figure 29: Share of Strategic Initiatives, 2021-2025

- Figure 30: Data Triangulation

- Figure 31: Top-Down and Bottom-Up Approach

- Figure 32: Assumptions and Limitations

List of Table

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market Pricing Forecast, 2024-2035

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Region), $Million, 2024-2035

- Table 8: North America Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 9: North America Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 10: U.S. Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 11: U.S. Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 12: Canada Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 13: Canada Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 14: Mexico Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 15: Mexico Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 16: Europe Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 17: Europe Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 18: Germany Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 19: Germany Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 20: France Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 21: France Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 22: U.K. Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 23: U.K. Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 24: Italy Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 25: Italy Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 26: Spain Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 27: Spain Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 28: Rest-of-Europe Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 29: Rest-of-Europe Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 30: Asia-Pacific Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 31: Asia-Pacific Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 32: China Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 33: China Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 34: Japan Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 35: Japan Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 36: South Korea Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 37: South Korea Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 38: India Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 39: India Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 40: Australia Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 41: Australia Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 42: Rest-of-Asia-Pacific Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 43: Rest-of-Asia-Pacific Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 44: Rest-of-the-World Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 45: Rest-of-the-World Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 46: South America Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 47: South America Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 48: Middle East and Africa Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Application), $Million, 2024-2035

- Table 49: Middle East and Africa Flexible Printed Circuit (FPC) for Curved Interior in Vehicles Market (by Product), $Million, 2024-2035

- Table 50: Market Share