|

|

市場調査レポート

商品コード

1749761

自動車用熱管理圧力センサー市場- 世界および地域別分析:センサータイプ別、車両タイプ別、用途別、エンドユーザー別、国別 - 分析と予測(2025年~2034年)Automotive Thermal Management Pressure Sensors Market - A Global and Regional Analysis: Focus on Sensor Type, Vehicle Type, Application, End-User, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用熱管理圧力センサー市場- 世界および地域別分析:センサータイプ別、車両タイプ別、用途別、エンドユーザー別、国別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年06月18日

発行: BIS Research

ページ情報: 英文 140 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

自動車用熱管理圧力センサー市場は、電気自動車(EV)、ハイブリッド電気自動車(HEV)の普及拡大、環境規制の強化など、いくつかの主な要因により大きな成長を遂げています。

自動車業界が車両の性能と効率の向上に注力し続ける中、熱管理システムは、特にパワートレイン、バッテリーシステム、HVACシステムなど、車両のさまざまなシステム全体の温度を調整するための重要なコンポーネントとなっています。これらのシステムで使用される圧力センサーは、最適な性能、安全性、エネルギー効率を確保するために不可欠です。

自動車用熱管理圧力センサーは、熱システム内の圧力を監視および制御します。これは、適切な温度レベルを維持し、過熱を防止し、車両のコンポーネントの安全性を確保するために極めて重要です。現代の自動車、特に電動化された自動車の複雑さが増すにつれて、これらのセンサーは温度と圧力のリアルタイムデータを提供するために不可欠なものとなり、自動車メーカーが自動車を安全かつ効率的に運用できるよう支援しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 13億8,000万米ドル |

| 2034年予測 | 21億7,000万米ドル |

| CAGR | 5.16% |

自動車用熱管理圧力センサー市場:ライフサイクルステージ

自動車用熱管理圧力センサー市場は、電気自動車やハイブリッド車の需要拡大に牽引され、研究開発の後期段階と商業化の初期段階にあります。これらのセンサーがパワートレイン、バッテリー、HVACの熱システムの管理に不可欠になるにつれ、センサーの設計、耐久性、統合の改善に多額の投資が集中しています。この技術は初期のプロトタイプを越えてパイロットテストに移行しつつあるが、EVとHEVの生産台数が増加し、規制基準が進化するにつれて、圧力センサーがすべての車両タイプの標準部品となり、2020年代半ばまでに広範な採用が見込まれています。

自動車用熱管理圧力センサー市場のセグメンテーション:

セグメンテーション1:センサータイプ別

- 圧電センサー

- ピエゾ抵抗センサー

- 静電容量式センサー

- ひずみゲージ式センサー

セグメンテーション2:車両タイプ別

- 乗用車

- 商用車

- 電気自動車(EV)

- ハイブリッド車

セグメンテーション3:用途別

- エンジン冷却システム

- HVACシステム

- ターボチャージャー、排気ガス再循環(EGR)

- バッテリー熱管理システム(BTMS)

- トランスミッション、ギアボックス・システム

- その他

セグメンテーション4:エンドユーザー別

- OEM

- アフターマーケットサプライヤー

セグメンテーション5:地域別

- 北米:米国、カナダ、メキシコ

- 欧州:ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋:中国、日本、韓国、インド、その他

- その他:南米、中東・アフリカ

自動車用熱管理圧力センサー市場では、電気自動車の継続的な普及と主要メーカーの存在により、アジア太平洋地域が牽引力を増すと予想されます。

自動車用熱管理圧力センサー市場需要- 促進要因と限界

自動車用熱管理圧力センサー市場の需要促進要因は以下の通りです:

- 電気自動車(EV)の成長

- ADAS(先進運転支援システム)と自律走行車の台頭

- 厳しい排ガス規制

自動車用熱管理圧力センサー市場は、以下の課題によっていくつかの制限にも直面すると予想されます:

- 先進センサーの高コスト

- 自動車システムとの複雑な統合

- 信頼性と耐久性への懸念

主要市場参入企業と競合の要約

企業プロファイルは、1次調査と2次調査に基づいて選定しています。2次調査には、企業範囲の分析、製品ポートフォリオ、市場浸透度、1次専門家から収集した知見などが含まれます。

自動車用熱管理圧力センサー市場は競争が激しく、パワートレイン、バッテリー、HVACシステムで使用される高度なセンサーを開発しているRobert Bosch GmbH、DENSO corporation、Continental AG、STマイクロエレクトロニクスなどの主要企業が牽引しています。センサタ・テクノロジー(Sensata Technologies)のような企業は、電気自動車やハイブリッド車の熱管理を強化するため、圧力や温度のセンシング技術で革新を進めています。センサーの精度向上、コスト削減、新たな規制への対応に注力する自動車メーカー、ティア1サプライヤー、学術機関との戦略的提携により、競合はさらに激化しています。EVやHEVの需要が高まるにつれ、圧力センサーは、より効率的で安全、かつ環境に優しい車両設計を実現するための重要な要素になりつつあります。

当レポートでは、世界の自動車用熱管理圧力センサー市場について調査し、市場の概要とともに、センサータイプ別、車両タイプ別、用途別、エンドユーザー別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- 市場力学の概要

- 規制および政策影響分析

- 特許分析

- スタートアップの情勢

- 投資情勢と研究開発動向

- 将来展望と市場ロードマップ

- バリューチェーン分析

- 世界価格分析

- 業界の魅力

第2章 自動車用熱管理圧力センサー市場(センサータイプ別)

- 圧電センサー

- ピエゾ抵抗型センサー

- 静電容量センサー

- ひずみゲージセンサー

第3章 自動車用熱管理圧力センサー市場(車両タイプ別)

- 乗用車

- 商用車

- 電気自動車(EV)

- ハイブリッド車

第4章 自動車用熱管理圧力センサー市場(用途別)

- エンジン冷却システム

- HVACシステム

- ターボチャージャー、排気ガス再循環(EGR)

- バッテリー熱管理システム(BTMS)

- トランスミッション、ギアボックスシステム

- その他

第5章 自動車用熱管理圧力センサー市場(エンドユーザー別)

- OEM

- アフターマーケットサプライヤー

第6章 自動車用熱管理圧力センサー市場(地域別)

- 自動車用熱管理圧力センサー市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第7章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Robert Bosch GmbH

- DENSO Corporation

- Continental AG

- Sensata Technologies

- STMicroelectronics

- Infineon Technologies AG

- NXP Semiconductors

- Valeo

- Delphi Technologies

- Elmos Semiconductor SE

- Aptiv PLC

- Honeywell International Inc.

- Bourns, Inc.

- Kistler Group

- TE Connectivity Ltd.

- その他の主要企業

第8章 調査手法

List of Figures

- Figure 1: Automotive Thermal Management Pressure Sensors Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Automotive Thermal Management Pressure Sensors Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024, 2027, and 2034

- Figure 4: Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024, 2027, and 2034

- Figure 5: Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024, 2027, and 2034

- Figure 6: Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024, 2027, and 2034

- Figure 7: Competitive Landscape Snapshot

- Figure 8: Supply Chain Analysis

- Figure 9: Value Chain Analysis

- Figure 10: Patent Analysis (by Country), January 2021-April 2025

- Figure 11: Patent Analysis (by Company), January 2021-April 2025

- Figure 12: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 13: U.S. Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 14: Canada Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 15: Mexico Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 16: Germany Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 17: France Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 18: Italy Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 19: Spain Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 20: U.K. Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 21: Rest-of-Europe Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 22: China Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 23: Japan Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 24: India Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 25: South Korea Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 26: Rest-of-Asia-Pacific Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 27: South America Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

- Figure 28: Middle East and Africa Automotive Thermal Management Pressure Sensors Market, $Billion, 2024-2034

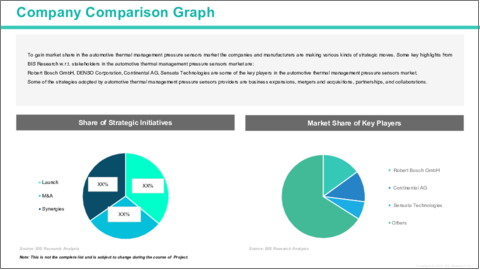

- Figure 29: Strategic Initiatives (by Company), 2021-2025

- Figure 30: Share of Strategic Initiatives, 2021-2025

- Figure 31: Data Triangulation

- Figure 32: Top-Down and Bottom-Up Approach

- Figure 33: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Automotive Thermal Management Pressure Sensors Market (by Region), $Billion, 2024-2034

- Table 5: Automotive Thermal Management Pressure Sensors Market Pricing Forecast, 2024-2034

- Table 6: North America Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 7: North America Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 8: North America Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 9: North America Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 10: U.S. Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 11: U.S. Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 12: U.S. Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 13: U.S. Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 14: Canada Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 15: Canada Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 16: Canada Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 17: Canada Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 18: Mexico Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 19: Mexico Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 20: Mexico Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 21: Mexico Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 22: Europe Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 23: Europe Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 24: Europe Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 25: Europe Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 26: Germany Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 27: Germany Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 28: Germany Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 29: Germany Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 30: France Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 31: France Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 32: France Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 33: France Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 34: Italy Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 35: Italy Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 36: Italy Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 37: Italy Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 38: Spain Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 39: Spain Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 40: Spain Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 41: Spain Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 42: U.K. Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 43: U.K. Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 44: U.K. Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 45: U.K. Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 46: Rest-of-Europe Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 47: Rest-of-Europe Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 48: Rest-of-Europe Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 49: Rest-of-Europe Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 50: China Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 51: China Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 52: China Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 53: China Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 54: Japan Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 55: Japan Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 56: Japan Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 57: Japan Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 58: India Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 59: India Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 60: India Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 61: India Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 62: South Korea Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 63: South Korea Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 64: South Korea Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 65: South Korea Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 66: Rest-of-Asia-Pacific Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 67: Rest-of-Asia-Pacific Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 68: Rest-of-Asia-Pacific Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 69: Rest-of-Asia-Pacific Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 70: Rest-of-the-World Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 71: Rest-of-the-World Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 72: Rest-of-the-World Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 73: Rest-of-the-World Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 74: South America Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 75: South America Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 76: South America Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 77: South America Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 78: Middle East and Africa Automotive Thermal Management Pressure Sensors Market (by Sensor Type), $Billion, 2024-2034

- Table 79: Middle East and Africa Automotive Thermal Management Pressure Sensors Market (by Vehicle Type), $Billion, 2024-2034

- Table 80: Middle East and Africa Automotive Thermal Management Pressure Sensors Market (by Application Area), $Billion, 2024-2034

- Table 81: Middle East and Africa Automotive Thermal Management Pressure Sensors Market (by End-User), $Billion, 2024-2034

- Table 82: Market Share

Automotive Thermal Management Pressure Sensors Market: Industry Overview

The automotive thermal management pressure sensors market is experiencing significant growth due to several key factors, including the increasing adoption of electric vehicles (EVs), hybrid electric vehicles (HEVs), and stricter environmental regulations. As the automotive industry continues to focus on enhancing vehicle performance and efficiency, thermal management systems have become a critical component for regulating temperatures across various systems in vehicles, especially in the powertrain, battery systems, and HVAC systems. The pressure sensors used in these systems are essential for ensuring optimal performance, safety, and energy efficiency.

Automotive thermal management pressure sensors monitor and control the pressures within thermal systems, which is crucial for maintaining the proper temperature levels, preventing overheating, and ensuring the safety of the vehicle's components. As the complexity of modern vehicles, particularly electrified vehicles, increases, these sensors have become indispensable for providing real-time data on temperature and pressure, helping automakers ensure that their vehicles operate safely and efficiently.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $1.38 Billion |

| 2034 Forecast | $2.17 Billion |

| CAGR | 5.16% |

Automotive Thermal Management Pressure Sensors Market: Lifecycle Stage

The automotive thermal management pressure sensors market is in the late-stage R&D and early commercialization phase, driven by the growing demand for electric and hybrid vehicles. As these sensors become essential for managing thermal systems in powertrains, batteries, and HVAC, significant investments are focused on improving sensor design, durability, and integration. While the technology is moving past initial prototypes and entering pilot testing, widespread adoption is expected by the mid-2020s, with pressure sensors becoming standard components in all vehicle types as EV and HEV production rises, and regulatory standards evolve.

Automotive Thermal Management Pressure Sensors Market Segmentation:

Segmentation 1: by Sensor Type

- Piezoelectric Sensors

- Piezoresistive Sensors

- Capacitive Sensors

- Strain Gauge Sensors

Segmentation 2: by Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

- Hybrid Vehicles

Segmentation 3: by Application

- Engine Cooling Systems

- HVAC Systems

- Turbochargers and Exhaust Gas Recirculation (EGR)

- Battery Thermal Management Systems (BTMS)

- Transmission and Gearbox Systems

- Other Automotive Applications

Segmentation 4: by End-User

- OEM (Original Equipment Manufacturers)

- Aftermarket Suppliers

Segmentation 5: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

In the automotive thermal management pressure sensors market, Asia-Pacific is anticipated to gain traction owing to the continuous growth in the adoption of electric vehicles and the presence of key manufacturers in the regions.

Automotive Thermal Management Pressure Sensors Market: Demand - Drivers and Limitations

The following are the demand drivers for the automotive thermal management pressure sensors market:

- Growth of Electric Vehicles (EVs)

- Rise of Advanced Driver-Assistance Systems (ADAS) and Autonomous Vehicles

- Stringent Emission Regulations

The automotive thermal management pressure sensors market is expected to face some limitations as well due to the following challenges:

- High Cost of Advanced Sensors

- Complex Integration with Automotive Systems

- Reliability and Durability Concerns

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on thorough secondary research, which includes analysing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

The automotive thermal management pressure sensors market is highly competitive, driven by major players such as Robert Bosch GmbH, DENSO corporation, Continental AG, STMicroelectronics, who are developing advanced sensors for use in powertrains, batteries, and HVAC systems. Companies like Sensata technologies is innovating with pressure and temperature sensing technologies to enhance thermal management in electric and hybrid vehicles. Competition is further intensified by strategic collaborations with automotive manufacturers, tier-1 suppliers, and academic institutions, focusing on improving sensor accuracy, reducing costs, and ensuring compliance with emerging regulations. As the demand for EVs and HEVs grows, pressure sensors are becoming a critical component in achieving more efficient, safe, and environmentally friendly vehicle designs.

Some prominent names established in this automotive thermal management pressure sensors market are:

- Robert Bosch GmbH

- DENSO Corporation

- Continental AG

- Sensata Technologies

- STMicroelectronics

- Infineon Technologies AG

- NXP Semiconductors

- Valeo

- Delphi Technologies

- Elmos Semiconductor SE

- Aptiv PLC

- Honeywell International Inc.

- Bourns, Inc.

- Kistler Group

- TE Connectivity Ltd.

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Market Dynamics Overview

- 1.2.1 Market Drivers

- 1.2.2 Market Restraints

- 1.2.3 Market Opportunities

- 1.3 Regulatory & Policy Impact Analysis

- 1.4 Patent Analysis

- 1.5 Start-Up Landscape

- 1.6 Investment Landscape and R&D Trends

- 1.7 Future Outlook and Market Roadmap

- 1.8 Value Chain Analysis

- 1.9 Global Pricing Analysis

- 1.10 Industry Attractiveness

2. Automotive Thermal Management Pressure Sensors Market (By Sensor Type)

- 2.1 Piezoelectric Sensors

- 2.2 Piezoresistive Sensors

- 2.3 Capacitive Sensors

- 2.4 Strain Gauge Sensors

3. Automotive Thermal Management Pressure Sensors Market (by Vehicle Type)

- 3.1 Passenger Vehicles

- 3.2 Commercial Vehicles

- 3.3 Electric Vehicles (EVs)

- 3.4 Hybrid Vehicles

4. Automotive Thermal Management Pressure Sensors Market (by Application Area)

- 4.1 Engine Cooling Systems

- 4.2 HVAC Systems

- 4.3 Turbochargers and Exhaust Gas Recirculation (EGR)

- 4.4 Battery Thermal Management Systems (BTMS)

- 4.5 Transmission and Gearbox Systems

- 4.6 Other Automotive Applications

5. Automotive Thermal Management Pressure Sensors Market (by End-User)

- 5.1 OEMs (Original Equipment Manufacturers)

- 5.2 Aftermarket Suppliers

6. Automotive Thermal Management Pressure Sensors Market (by Region)

- 6.1 Automotive Thermal Management Pressure Sensors Market (by Region)

- 6.2 North America

- 6.2.1 Regional Overview

- 6.2.2 Driving Factors for Market Growth

- 6.2.3 Factors Challenging the Market

- 6.2.4 Key Companies

- 6.2.5 Sensor Type

- 6.2.6 Vehicle Type

- 6.2.7 Application Area

- 6.2.8 End-User

- 6.2.9 North America (by Country)

- 6.2.9.1 U.S.

- 6.2.9.1.1 Market by Sensor Type

- 6.2.9.1.2 Market by Vehicle Type

- 6.2.9.1.3 Market by Application Area

- 6.2.9.1.4 Market by End-User

- 6.2.9.2 Canada

- 6.2.9.2.1 Market by Sensor Type

- 6.2.9.2.2 Market by Vehicle Type

- 6.2.9.2.3 Market by Application Area

- 6.2.9.2.4 Market by End-User

- 6.2.9.3 Mexico

- 6.2.9.3.1 Market by Sensor Type

- 6.2.9.3.2 Market by Vehicle Type

- 6.2.9.3.3 Market by Application Area

- 6.2.9.3.4 Market by End-User

- 6.2.9.1 U.S.

- 6.3 Europe

- 6.3.1 Regional Overview

- 6.3.2 Driving Factors for Market Growth

- 6.3.3 Factors Challenging the Market

- 6.3.4 Key Companies

- 6.3.5 Sensor Type

- 6.3.6 Vehicle Type

- 6.3.7 Application Area

- 6.3.8 End-User

- 6.3.9 Europe (by Country)

- 6.3.9.1 Germany

- 6.3.9.1.1 Market by Sensor Type

- 6.3.9.1.2 Market by Vehicle Type

- 6.3.9.1.3 Market by Application Area

- 6.3.9.1.4 Market by End-User

- 6.3.9.2 France

- 6.3.9.2.1 Market by Sensor Type

- 6.3.9.2.2 Market by Vehicle Type

- 6.3.9.2.3 Market by Application Area

- 6.3.9.2.4 Market by End-User

- 6.3.9.3 Italy

- 6.3.9.3.1 Market by Sensor Type

- 6.3.9.3.2 Market by Vehicle Type

- 6.3.9.3.3 Market by Application Area

- 6.3.9.3.4 Market by End-User

- 6.3.9.4 Spain

- 6.3.9.4.1 Market by Sensor Type

- 6.3.9.4.2 Market by Vehicle Type

- 6.3.9.4.3 Market by Application Area

- 6.3.9.4.4 Market by End-User

- 6.3.9.5 U.K.

- 6.3.9.5.1 Market by Sensor Type

- 6.3.9.5.2 Market by Vehicle Type

- 6.3.9.5.3 Market by Application Area

- 6.3.9.5.4 Market by End-User

- 6.3.9.6 Rest-of-Europe

- 6.3.9.6.1 Market by Sensor Type

- 6.3.9.6.2 Market by Vehicle Type

- 6.3.9.6.3 Market by Application Area

- 6.3.9.6.4 Market by End-User

- 6.3.9.1 Germany

- 6.4 Asia-Pacific

- 6.4.1 Regional Overview

- 6.4.2 Driving Factors for Market Growth

- 6.4.3 Factors Challenging the Market

- 6.4.4 Ongoing Projects

- 6.4.5 Key Companies

- 6.4.6 Sensor Type

- 6.4.7 Vehicle Type

- 6.4.8 Application Area

- 6.4.9 End-User

- 6.4.10 Asia-Pacific (by Country)

- 6.4.10.1 China

- 6.4.10.1.1 Market by Sensor Type

- 6.4.10.1.2 Market by Vehicle Type

- 6.4.10.1.3 Market by Application Area

- 6.4.10.1.4 Market by End-User

- 6.4.10.2 Japan

- 6.4.10.2.1 Market by Sensor Type

- 6.4.10.2.2 Market by Vehicle Type

- 6.4.10.2.3 Market by Application Area

- 6.4.10.2.4 Market by End-User

- 6.4.10.3 India

- 6.4.10.3.1 Market by Sensor Type

- 6.4.10.3.2 Market by Vehicle Type

- 6.4.10.3.3 Market by Application Area

- 6.4.10.3.4 Market by End-User

- 6.4.10.4 South Korea

- 6.4.10.4.1 Market by Sensor Type

- 6.4.10.4.2 Market by Vehicle Type

- 6.4.10.4.3 Market by Application Area

- 6.4.10.4.4 Market by End-User

- 6.4.10.5 Rest-of-Asia-Pacific

- 6.4.10.5.1 Market by Sensor Type

- 6.4.10.5.2 Market by Vehicle Type

- 6.4.10.5.3 Market by Application Area

- 6.4.10.5.4 Market by End-User

- 6.4.10.1 China

- 6.5 Rest-of-the-World

- 6.5.1 Regional Overview

- 6.5.2 Driving Factors for Market Growth

- 6.5.3 Factors Challenging the Market

- 6.5.4 Ongoing Projects

- 6.5.5 Key Companies

- 6.5.6 Sensor Type

- 6.5.7 Vehicle Type

- 6.5.8 Application Area

- 6.5.9 End-User

- 6.5.10 Rest-of-the-World (by Region)

- 6.5.10.1 South America

- 6.5.10.1.1 Market by Sensor Type

- 6.5.10.1.2 Market by Vehicle Type

- 6.5.10.1.3 Market by Application Area

- 6.5.10.1.4 Market by End-User

- 6.5.10.2 Middle East and Africa

- 6.5.10.2.1 Market by Sensor Type

- 6.5.10.2.2 Market by Vehicle Type

- 6.5.10.2.3 Market by Application Area

- 6.5.10.2.4 Market by End-User

- 6.5.10.1 South America

7. Markets - Competitive Benchmarking & Company Profiles

- 7.1 Next Frontiers

- 7.2 Geographic Assessment

- 7.3 Company Profiles

- 7.3.1 Robert Bosch GmbH

- 7.3.1.1 Overview

- 7.3.1.2 Top Products/Product Portfolio

- 7.3.1.3 Top Competitors

- 7.3.1.4 Target Customers

- 7.3.1.5 Key Personnel

- 7.3.1.6 Analyst View

- 7.3.1.7 Market Share

- 7.3.2 DENSO Corporation

- 7.3.2.1 Overview

- 7.3.2.2 Top Products/Product Portfolio

- 7.3.2.3 Top Competitors

- 7.3.2.4 Target Customers

- 7.3.2.5 Key Personnel

- 7.3.2.6 Analyst View

- 7.3.2.7 Market Share

- 7.3.3 Continental AG

- 7.3.3.1 Overview

- 7.3.3.2 Top Products/Product Portfolio

- 7.3.3.3 Top Competitors

- 7.3.3.4 Target Customers

- 7.3.3.5 Key Personnel

- 7.3.3.6 Analyst View

- 7.3.3.7 Market Share

- 7.3.4 Sensata Technologies

- 7.3.4.1 Overview

- 7.3.4.2 Top Products/Product Portfolio

- 7.3.4.3 Top Competitors

- 7.3.4.4 Target Customers

- 7.3.4.5 Key Personnel

- 7.3.4.6 Analyst View

- 7.3.4.7 Market Share

- 7.3.5 STMicroelectronics

- 7.3.5.1 Overview

- 7.3.5.2 Top Products/Product Portfolio

- 7.3.5.3 Top Competitors

- 7.3.5.4 Target Customers

- 7.3.5.5 Key Personnel

- 7.3.5.6 Analyst View

- 7.3.5.7 Market Share

- 7.3.6 Infineon Technologies AG

- 7.3.6.1 Overview

- 7.3.6.2 Top Products/Product Portfolio

- 7.3.6.3 Top Competitors

- 7.3.6.4 Target Customers

- 7.3.6.5 Key Personnel

- 7.3.6.6 Analyst View

- 7.3.6.7 Market Share

- 7.3.7 NXP Semiconductors

- 7.3.7.1 Overview

- 7.3.7.2 Top Products/Product Portfolio

- 7.3.7.3 Top Competitors

- 7.3.7.4 Target Customers

- 7.3.7.5 Key Personnel

- 7.3.7.6 Analyst View

- 7.3.7.7 Market Share

- 7.3.8 Valeo

- 7.3.8.1 Overview

- 7.3.8.2 Top Products/Product Portfolio

- 7.3.8.3 Top Competitors

- 7.3.8.4 Target Customers

- 7.3.8.5 Key Personnel

- 7.3.8.6 Analyst View

- 7.3.8.7 Market Share

- 7.3.9 Delphi Technologies

- 7.3.9.1 Overview

- 7.3.9.2 Top Products/Product Portfolio

- 7.3.9.3 Top Competitors

- 7.3.9.4 Target Customers

- 7.3.9.5 Key Personnel

- 7.3.9.6 Analyst View

- 7.3.9.7 Market Share

- 7.3.10 Elmos Semiconductor SE

- 7.3.10.1 Overview

- 7.3.10.2 Top Products/Product Portfolio

- 7.3.10.3 Top Competitors

- 7.3.10.4 Target Customers

- 7.3.10.5 Key Personnel

- 7.3.10.6 Analyst View

- 7.3.10.7 Market Share

- 7.3.10.8 Share

- 7.3.11 Aptiv PLC

- 7.3.11.1 Overview

- 7.3.11.2 Top Products/Product Portfolio

- 7.3.11.3 Top Competitors

- 7.3.11.4 Target Customers

- 7.3.11.5 Key Personnel

- 7.3.11.6 Analyst View

- 7.3.11.7 Market Share

- 7.3.11.8 Share

- 7.3.12 Honeywell International Inc.

- 7.3.12.1 Overview

- 7.3.12.2 Top Products/Product Portfolio

- 7.3.12.3 Top Competitors

- 7.3.12.4 Target Customers

- 7.3.12.5 Key Personnel

- 7.3.12.6 Analyst View

- 7.3.12.7 Market Share

- 7.3.12.8 Share

- 7.3.13 Bourns, Inc.

- 7.3.13.1 Overview

- 7.3.13.2 Top Products/Product Portfolio

- 7.3.13.3 Top Competitors

- 7.3.13.4 Target Customers

- 7.3.13.5 Key Personnel

- 7.3.13.6 Analyst View

- 7.3.13.7 Market Share

- 7.3.13.8 Share

- 7.3.14 Kistler Group

- 7.3.14.1 Overview

- 7.3.14.2 Top Products/Product Portfolio

- 7.3.14.3 Top Competitors

- 7.3.14.4 Target Customers

- 7.3.14.5 Key Personnel

- 7.3.14.6 Analyst View

- 7.3.14.7 Market Share

- 7.3.14.8 Share

- 7.3.15 TE Connectivity Ltd.

- 7.3.15.1 Overview

- 7.3.15.2 Top Products/Product Portfolio

- 7.3.15.3 Top Competitors

- 7.3.15.4 Target Customers

- 7.3.15.5 Key Personnel

- 7.3.15.6 Analyst View

- 7.3.15.7 Market Share

- 7.3.15.8 Share

- 7.3.1 Robert Bosch GmbH

- 7.4 Other Key Companies