|

|

市場調査レポート

商品コード

1742150

データ収集システムの世界市場:用途・製品・地域別の分析・予測・競合情勢 (2025年~2034年)Data Acquisition System Market - A Global and Regional Analysis: Focus on Application, Product, Region, and Competitive Landscape - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| データ収集システムの世界市場:用途・製品・地域別の分析・予測・競合情勢 (2025年~2034年) |

|

出版日: 2025年06月05日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のデータ収集システムの市場は、リアルタイムでのデータ収集、分析、監視を可能にする高度なソリューションへの需要の高まりによって牽引されています。

これらのシステムは、運用効率の向上、法規制の遵守、製品性能の強化において極めて重要な役割を果たします。同市場は、技術の進歩、データに基づくインサイトへのニーズの拡大、自動車、航空宇宙、エネルギーといった産業におけるスマート製造の台頭といった要因の影響を受けています。主要な技術には、センサー、モジュールシステム、クラウド統合、リアルタイムデータ処理などが含まれます。産業界が自動化とデジタル化をますます推進する中で、データ収集システム市場は今後数年間で大きな成長が見込まれています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025-2034年 |

| 2025年評価 | 24億5,000万米ドル |

| 2034年予測 | 35億1,000万米ドル |

| CAGR | 4.08% |

世界のデータ収集システム市場は、現在ライフサイクルの成長期にあります。産業オートメーションの進展、リアルタイムでのデータ収集・分析に対する需要の高まり、スマート技術の普及を背景に、この市場は急速に拡大しています。センサー技術、クラウド統合、リアルタイムデータ処理の革新が市場需要を後押ししています。産業界が運用効率の向上や法規制の遵守を目指す中で、市場は今後も着実な成長が見込まれます。さらに、IoTやAIを活用したソリューションの導入が進むことで、データ収集システムには大きな成長機会が生まれ、特に自動車、航空宇宙、製造業などの分野で、技術革新に伴うさらなる市場拡大が期待されています。

世界のデータ収集システム市場の分類

セグメンテーション1:用途別

- 研究開発

- フィールド

- 製造

セグメンテーション2:エンドユーザー産業別

- 自動車・運輸

- 航空宇宙・防衛

- 無線通信&インフラ

- 電力・エネルギー

- 環境モニタリング

- ヘルスケア

- 食品・飲料

- その他

セグメンテーション3:速度別

- 高速 (100 KS/s超)

- 低速 (100 KS/s未満)

セグメント4:システム別

- ハードウェア

- 外部シャーシ・モジュール

- プラグインアナログI/Oボード

- ソフトウェア

- バンドル

- サードパーティ

セグメンテーション5:地域別

- 北米:米国、カナダ、メキシコ

- 欧州:ドイツ、フランス、イタリア、英国、その他

- アジア太平洋:中国、日本、韓国、オーストラリア、その他

- その他の地域:南米、中東・アフリカ

当レポートでは、世界のデータ収集システムの市場を調査し、主要動向、市場影響因子の分析、法規制環境、技術・特許の分析、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- サプライチェーンの概要

- バリューチェーン分析

- 価格予測

- R&Dレビュー

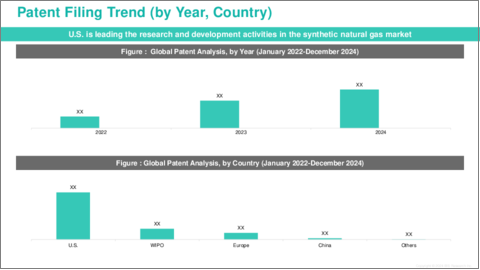

- 国・企業別特許出願動向

- 規制状況

- ステークホルダー分析

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- スタートアップ資金調達のサマリー

第2章 データ収集システム市場:用途別

- 用途のサマリー

- データ収集システム市場:用途別

- 研究開発

- フィールド

- 製造

- データ収集システム市場:エンドユーザー産業別

- 自動車・輸送

- 航空宇宙・防衛

- 無線通信・インフラ

- 電力・エネルギー

- 環境モニタリング

- ヘルスケア

- 食品・飲料

- その他

第3章 データ収集システム市場:製品別

- 製品サマリー

- データ収集システム市場:速度別

- 高速 (100 KS/s超)

- 低速 (100 KS/s未満)

- データ収集システム市場:システム別

- ハードウェア

- ソフトウェア

第4章 データ収集システム市場:地域別

- 北米

- 地域概要

- 用途

- 製品

- 北米 (国別)

- 欧州

- 地域概要

- 用途

- 製品

- 欧州 (国別)

- アジア太平洋

- 地域概要

- 用途

- 製品

- アジア太平洋 (国別)

- その他の地域

- 地域概要

- 用途

- 製品

- その他の地域 (地域別)

第5章 市場:競合ベンチマーキングと企業プロファイル

- 次のフロンティア

- 地域分析

- 競合ベンチマーキング

- 企業プロファイル

- ABB

- AMETEK Inc.

- Emerson Electric Co.

- Fortive Corporation

- General Electric (GE) Company

- Honeywell International Inc.

- Keysight Technologies

- National Instruments Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens

- Spectris PLC

- Yokogawa Electric Company

- AVL

- Fluke Corporation

第6章 調査手法

List of Figures

- Figure 1: Data Acquisition System Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Data Acquisition System Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Data Acquisition System Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 4: Data Acquisition System Market (by Product), $Billion, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Data Acquisition System Market, $Billion, 2024-2034

- Figure 12: Canada Data Acquisition System Market, $Billion, 2024-2034

- Figure 13: Mexico Data Acquisition System Market, $Billion, 2024-2034

- Figure 14: Germany Data Acquisition System Market, $Billion, 2024-2034

- Figure 15: France Data Acquisition System Market, $Billion, 2024-2034

- Figure 16: U.K. Data Acquisition System Market, $Billion, 2024-2034

- Figure 17: Italy Data Acquisition System Market, $Billion, 2024-2034

- Figure 18: Rest-of-Europe Data Acquisition System Market, $Billion, 2024-2034

- Figure 19: China Data Acquisition System Market, $Billion, 2024-2034

- Figure 20: Japan Data Acquisition System Market, $Billion, 2024-2034

- Figure 21: Australia Data Acquisition System Market, $Billion, 2024-2034

- Figure 22: South Korea Data Acquisition System Market, $Billion, 2024-2034

- Figure 23: Rest-of-Asia-Pacific Data Acquisition System Market, $Billion, 2024-2034

- Figure 24: South America Data Acquisition System Market, $Billion, 2024-2034

- Figure 25: Middle East and Africa Data Acquisition System Market, $Billion, 2024-2034

- Figure 26: Strategic Initiatives (by Company), 2021-2025

- Figure 27: Share of Strategic Initiatives, 2021-2025

- Figure 28: Data Triangulation

- Figure 29: Top-Down and Bottom-Up Approach

- Figure 30: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Data Acquisition System Market Pricing Forecast, 2024-2034

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Data Acquisition System Market (by Region), $Billion, 2024-2034

- Table 8: North America Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 9: North America Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 10: U.S. Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 11: U.S. Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 12: Canada Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 13: Canada Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 14: Mexico Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 15: Mexico Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 16: Europe Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 17: Europe Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 18: Germany Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 19: Germany Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 20: France Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 21: France Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 22: U.K. Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 23: U.K. Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 24: Italy Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 25: Italy Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 26: Rest-of-Europe Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 27: Rest-of-Europe Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 28: Asia-Pacific Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 29: Asia-Pacific Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 30: China Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 31: China Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 32: Japan Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 33: Japan Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 34: Australia Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 35: Australia Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 36: South Korea Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 37: South Korea Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 38: Rest-of-Asia-Pacific Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 39: Rest-of-Asia-Pacific Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 40: Rest-of-the-World Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 41: Rest-of-the-World Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 42: South America Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 43: South America Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 44: Middle East and Africa Data Acquisition System Market (by Application), $Billion, 2024-2034

- Table 45: Middle East and Africa Data Acquisition System Market (by Product), $Billion, 2024-2034

- Table 46: Market Share

Global Data Acquisition System Market: Industry Overview

The global data acquisition system market is driven by the increasing demand for advanced solutions that enable real-time data collection, analysis, and monitoring across various industries. These systems are crucial for improving operational efficiency, ensuring regulatory compliance, and enhancing product performance. The market is influenced by technological advancements, the growing need for data-driven insights, and the rise of smart manufacturing, particularly in industries such as automotive, aerospace, and energy. Key technologies include sensors, modular systems, cloud integration, and real-time data processing. As industries continue to embrace automation and digitization, the market for data acquisition systems is expected to experience substantial growth in the coming years.

Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $2.45 Billion |

| 2034 Forecast | $3.51 Billion |

| CAGR | 4.08% |

The global data acquisition system market is currently in the growth stage of its lifecycle. Driven by advancements in industrial automation, the increasing demand for real-time data collection and analysis, and the rise of smart technologies, this market is expanding rapidly. Innovations in sensor technology, cloud integration, and real-time data processing are fueling market demand. As industries seek to enhance operational efficiency and meet regulatory standards, the market is expected to experience steady growth. The increasing adoption of IoT and AI-driven solutions presents significant opportunities for data acquisition systems, leading to further expansion as technological advancements continue to shape industries such as automotive, aerospace, and manufacturing.

Global Data Acquisition System Market Segmentation:

Segmentation 1: by Application

- R&D

- Field

- Manufacturing

R&D is one of the prominent application segments in the global data acquisition system market.

Segmentation 2: by End Use Industry

- Automotive & Transportation

- Aerospace & Defense

- Wireless Communications & Infrastructure

- Power & Energy

- Environmental Monitoring

- Healthcare

- Food & beverage

- Others

The global data acquisition system market is estimated to be led by the aerospace and defense.

Segmentation 3: by Speed

- High Speed (>100 KS/s)

- Low Speed (<100 KS/s)

High-speed (>100 KS/s) is one of the prominent product segments in the global data acquisition system market.

Segmentation 4: by System

- Hardware

- External Chassis and Modules

- Plug-In Analog I/O Boards

- Software

- Bundled

- 3rd Party

Hardware is one of the prominent product segments in the global data acquisition system market.

Segmentation 5: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, Australia, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

In the global data acquisition system market, North America is anticipated to gain traction in terms of production, owing to the continuous growth and the presence of key manufacturers in the region.

Demand - Drivers and Limitations

The following are the demand drivers for the Global Data Acquisition System Market :

- Growing Need for Real-Time Data

- Technological Advancements

The Global Data Acquisition System Market is expected to face some limitations as well due to the following challenges:

- High Initial Costs

- Compatibility Issues

Key Market Players and Competition Synopsis

The global data acquisition system market is highly competitive, with key players like National Instruments, Honeywell, ABB, and General Electric dominating through advanced manufacturing techniques and strong research and development capabilities. These companies focus on delivering high-precision, scalable systems that meet diverse industry needs. Emerging players are prioritizing cost-effective and sustainable solutions, catering to the growing demand for smart, automated systems. The market is further driven by technological advancements, regulatory compliance, and the increasing need for real-time data in sectors like automotive, energy, and aerospace. Strategic partnerships with automakers and industrial firms enhance innovation and market expansion.

Some prominent names established in this market are:

- ABB Group

- AMETEK Inc.

- Emerson Electric Co.

- Fortive Corporation

- General Electric (GE) Company

- Honeywell International Inc.

- Keysight Technologies

- National Instruments Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens

- Spectris PLC

- Yokogawa Electric Company

- AVL

- Fluke Corporation

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Forecast

- 1.3 R&D Review

- 1.3.1 Patent Filing Trend by Country, by Company

- 1.4 Regulatory Landscape

- 1.5 Stakeholder Analysis

- 1.6 Market Dynamics Overview

- 1.6.1 Market Drivers

- 1.6.2 Market Restraints

- 1.6.3 Market Opportunities

- 1.7 Startup Funding Summary

2. Data Acquisition System Market by Application

- 2.1 Application Summary

- 2.2 Data Acquisition System Market, by Application, Value, 2024-2034

- 2.2.1 R&D

- 2.2.2 Field

- 2.2.3 Manufacturing

- 2.3 Data Acquisition System Market, by End Use Industry, Value, 2024-2034

- 2.3.1 Automotive & Transportation

- 2.3.2 Aerospace & Defense

- 2.3.3 Wireless Communications & Infrastructure

- 2.3.4 Power & Energy

- 2.3.5 Environmental Monitoring

- 2.3.6 Healthcare

- 2.3.7 Food & beverage

- 2.3.8 Others

3. Data Acquisition System Market by Products

- 3.1 Product Summary

- 3.2 Data Acquisition System Market, by Speed, Value, 2024-2034

- 3.2.1 High Speed (>100 KS/s)

- 3.2.2 Low Speed (<100 KS/s)

- 3.3 Data Acquisition System Market, by System, Value, 2024-2034

- 3.3.1 Hardware

- 3.3.1.1 External Chassis and Modules

- 3.3.1.2 Plug-In Analog I/O Boards

- 3.3.2 Software

- 3.3.2.1 Bundled

- 3.3.2.2 3rd Party

- 3.3.1 Hardware

4. Data Acquisition System Market by Region

- 4.1 Data Acquisition System Market - by Region

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.1.1 Driving Factors for Market Growth

- 4.2.1.2 Factors Challenging the Market

- 4.2.2 Application

- 4.2.3 Product

- 4.2.4 North America (by Country)

- 4.2.4.1 U.S.

- 4.2.4.1.1 Market by Application

- 4.2.4.1.2 Market by Product

- 4.2.4.2 Canada

- 4.2.4.2.1 Market by Application

- 4.2.4.2.2 Market by Product

- 4.2.4.3 Mexico

- 4.2.4.3.1 Market by Application

- 4.2.4.3.2 Market by Product

- 4.2.4.1 U.S.

- 4.2.1 Regional Overview

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.1.1 Driving Factors for Market Growth

- 4.3.1.2 Factors Challenging the Market

- 4.3.2 Application

- 4.3.3 Product

- 4.3.4 Europe (by Country)

- 4.3.4.1 Germany

- 4.3.4.1.1 Market by Application

- 4.3.4.1.2 Market by Product

- 4.3.4.2 France

- 4.3.4.2.1 Market by Application

- 4.3.4.2.2 Market by Product

- 4.3.4.3 U.K

- 4.3.4.3.1 Market by Application

- 4.3.4.3.2 Market by Product

- 4.3.4.4 Italy

- 4.3.4.4.1 Market by Application

- 4.3.4.4.2 Market by Product

- 4.3.4.5 Rest-of-Europe

- 4.3.4.5.1 Market by Application

- 4.3.4.5.2 Market by Product

- 4.3.4.1 Germany

- 4.3.1 Regional Overview

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.1.1 Driving Factors for Market Growth

- 4.4.1.2 Factors Challenging the Market

- 4.4.2 Application

- 4.4.3 Product

- 4.4.4 Asia-Pacific (by Country)

- 4.4.4.1 China

- 4.4.4.1.1 Market by Application

- 4.4.4.1.2 Market by Product

- 4.4.4.2 Japan

- 4.4.4.2.1 Market by Application

- 4.4.4.2.2 Market by Product

- 4.4.4.3 Australia

- 4.4.4.3.1 Market by Application

- 4.4.4.3.2 Market by Product

- 4.4.4.4 South Korea

- 4.4.4.4.1 Market by Application

- 4.4.4.4.2 Market by Product

- 4.4.4.5 Rest-of-Asia-Pacific

- 4.4.4.5.1 Market by Application

- 4.4.4.5.2 Market by Product

- 4.4.4.1 China

- 4.4.1 Regional Overview

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.1.1 Driving Factors for Market Growth

- 4.5.1.2 Factors Challenging the Market

- 4.5.2 Application

- 4.5.3 Product

- 4.5.4 Rest-of-the-World (by Region)

- 4.5.4.1 South America

- 4.5.4.1.1 Market by Application

- 4.5.4.1.2 Market by Product

- 4.5.4.2 Middle East and Africa

- 4.5.4.2.1 Market by Application

- 4.5.4.2.2 Market by Product

- 4.5.4.1 South America

- 4.5.1 Regional Overview

5. Markets- Competitive Benchmarking and Companies Profiled

- 5.1 Next Frontier

- 5.2 Geographical Analysis

- 5.3 Competitive Benchmarking

- 5.4 Company Profiles

- 5.4.1 ABB

- 5.4.1.1 Overview

- 5.4.1.2 Top Products / Product Portfolio

- 5.4.1.3 Top Competitors

- 5.4.1.4 Target Customers/End-Users

- 5.4.1.5 Key Personnel

- 5.4.1.6 Analyst View

- 5.4.1.7 Market Share

- 5.4.2 AMETEK Inc.

- 5.4.2.1 Overview

- 5.4.2.2 Top Products / Product Portfolio

- 5.4.2.3 Top Competitors

- 5.4.2.4 Target Customers/End-Users

- 5.4.2.5 Key Personnel

- 5.4.2.6 Analyst View

- 5.4.2.7 Market Share

- 5.4.3 Emerson Electric Co.

- 5.4.3.1 Overview

- 5.4.3.2 Top Products / Product Portfolio

- 5.4.3.3 Top Competitors

- 5.4.3.4 Target Customers/End-Users

- 5.4.3.5 Key Personnel

- 5.4.3.6 Analyst View

- 5.4.3.7 Market Share

- 5.4.4 Fortive Corporation

- 5.4.4.1 Overview

- 5.4.4.2 Top Products / Product Portfolio

- 5.4.4.3 Top Competitors

- 5.4.4.4 Target Customers/End-Users

- 5.4.4.5 Key Personnel

- 5.4.4.6 Analyst View

- 5.4.4.7 Market Share

- 5.4.5 General Electric (GE) Company

- 5.4.5.1 Overview

- 5.4.5.2 Top Products / Product Portfolio

- 5.4.5.3 Top Competitors

- 5.4.5.4 Target Customers/End-Users

- 5.4.5.5 Key Personnel

- 5.4.5.6 Analyst View

- 5.4.5.7 Market Share

- 5.4.6 Honeywell International Inc.

- 5.4.6.1 Overview

- 5.4.6.2 Top Products / Product Portfolio

- 5.4.6.3 Top Competitors

- 5.4.6.4 Target Customers/End-Users

- 5.4.6.5 Key Personnel

- 5.4.6.6 Analyst View

- 5.4.6.7 Market Share

- 5.4.7 Keysight Technologies

- 5.4.7.1 Overview

- 5.4.7.2 Top Products / Product Portfolio

- 5.4.7.3 Top Competitors

- 5.4.7.4 Target Customers/End-Users

- 5.4.7.5 Key Personnel

- 5.4.7.6 Analyst View

- 5.4.7.7 Market Share

- 5.4.8 National Instruments Corporation

- 5.4.8.1 Overview

- 5.4.8.2 Top Products / Product Portfolio

- 5.4.8.3 Top Competitors

- 5.4.8.4 Target Customers/End-Users

- 5.4.8.5 Key Personnel

- 5.4.8.6 Analyst View

- 5.4.8.7 Market Share

- 5.4.9 Rockwell Automation Inc.

- 5.4.9.1 Overview

- 5.4.9.2 Top Products / Product Portfolio

- 5.4.9.3 Top Competitors

- 5.4.9.4 Target Customers/End-Users

- 5.4.9.5 Key Personnel

- 5.4.9.6 Analyst View

- 5.4.10 Schneider Electric SE

- 5.4.10.1 Overview

- 5.4.10.2 Top Products / Product Portfolio

- 5.4.10.3 Top Competitors

- 5.4.10.4 Target Customers/End-Users

- 5.4.10.5 Key Personnel

- 5.4.10.6 Analyst View

- 5.4.11 Siemens

- 5.4.11.1 Overview

- 5.4.11.2 Top Products / Product Portfolio

- 5.4.11.3 Top Competitors

- 5.4.11.4 Target Customers/End-Users

- 5.4.11.5 Key Personnel

- 5.4.11.6 Analyst View

- 5.4.12 Spectris PLC

- 5.4.12.1 Overview

- 5.4.12.2 Top Products / Product Portfolio

- 5.4.12.3 Top Competitors

- 5.4.12.4 Target Customers/End-Users

- 5.4.12.5 Key Personnel

- 5.4.12.6 Analyst View

- 5.4.13 Yokogawa Electric Company

- 5.4.13.1 Overview

- 5.4.13.2 Top Products / Product Portfolio

- 5.4.13.3 Top Competitors

- 5.4.13.4 Target Customers/End-Users

- 5.4.13.5 Key Personnel

- 5.4.13.6 Analyst View

- 5.4.14 AVL

- 5.4.14.1 Overview

- 5.4.14.2 Top Products / Product Portfolio

- 5.4.14.3 Top Competitors

- 5.4.14.4 Target Customers/End-Users

- 5.4.14.5 Key Personnel

- 5.4.14.6 Analyst View

- 5.4.15 Fluke Corporation

- 5.4.15.1 Overview

- 5.4.15.2 Top Products / Product Portfolio

- 5.4.15.3 Top Competitors

- 5.4.15.4 Target Customers/End-Users

- 5.4.15.5 Key Personnel

- 5.4.15.6 Analyst View

- 5.4.1 ABB