|

|

市場調査レポート

商品コード

1742149

調達技術とサービス市場 - 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2025年~2034年)Procurement Technologies and Services Market - A Global and Regional Analysis: Focus on Application, Product, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 調達技術とサービス市場 - 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年06月05日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

今日の調達技術・サービス市場には、eソーシングや支出分析からサプライヤーリスク管理、完全なas-a-サービス調達まで、幅広い機能が含まれており、オンプレミス、クラウドネイティブ、ハイブリッドの展開モデルで提供されています。

大手企業のバイヤーは、定型的なワークフローを自動化し、処方的なソーシングの洞察を可能にし、リアルタイムのESG指標を統合するAI主導のプラットフォームに投資しています。一方、中堅市場や中小企業のセグメントでは、初期コストを削減し、価値実現までの時間を短縮するために、モジュール式のProcurement-as-a-Service(PaaS)ソリューションの採用が増加しています。このダイナミックなエコシステムを支えているのは、拡大する既存ベンダー(SAP Ariba、Coupa、Ivalua)と、より深い分析、シームレスなERP統合、サプライヤー・コラボレーション・ツールの強化を目指す新興企業(EcoVadis、Scoutbee、Simfoni)です。

調達技術・サービス市場のライフサイクルステージ

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 79億3,000万米ドル |

| 2034年の予測 | 212億3,000万米ドル |

| CAGR | 11.56% |

市場は成長段階にあり、普及曲線の加速、製品イノベーションの多発、競争激化が顕著です。初期参入企業は基本的な電子調達や契約管理モジュールに注力していたが、過去1年半の間に、高度なAI/ML機能、クラウドネイティブアーキテクチャ、業種に特化したサービスバンドルが続々と登場しています。戦略的買収を行う企業による機能の統合や、ベンチャー企業による次世代アナリティクスやコラボレーション・プラットフォームの導入など、投資水準は高いです。統合の複雑さとデータ・プライバシーの要件が標準化されたベストプラクティスへと成熟するにつれ、市場は成熟へと移行しつつあり、統合と差別化が今後24カ月の決定的なテーマとなっています。

調達技術とサービスの市場セグメンテーション:

セグメンテーション1:用途別

- 製造業

- BFSI

- エネルギー

- 旅行・ホスピタリティ

- ヘルスケア

- その他

市場セグメンテーションは、世界の調達技術・サービス市場において顕著な用途セグメントの一つです。

セグメンテーション2:コンポーネント別

- 戦略的ソーシング

- 支出管理

- カテゴリー管理

- プロセス管理

- 契約管理

- 取引管理

世界の調達技術とサービス市場は、戦略的ソーシングセグメントが構成比でリードすると推定されます。

セグメンテーション3:地域別

- 北米- 米国、カナダ

- 欧州- ドイツ、フランス、イタリア、スペイン、英国、その他

- アジア太平洋地域- 中国、日本、韓国、インド、その他

- その他の地域- 南米、中東アフリカ

調達技術・サービス市場では、北米がデジタル化需要の増加と政府のイニシアティブにより牽引力を増すと予想されます。

需要- 促進要因と抑制要因

世界の調達技術・サービス市場の需要促進要因は以下の通りです:

- AI別デジタルトランスフォーメーション

世界の調達技術・サービス市場は、以下の課題により、いくつかの制限にも直面すると予想される:

- データセキュリティとプライバシー規制

調達技術とサービス市場の主要企業と競合の概要

調達技術・サービス市場は、SAP Ariba(SAP SE)、Coupa Software、Oracle Procurement Cloud、Ivalua、Jaggaerを筆頭に、Zycus、GEP、Proactisなどの専門ベンダーを擁する既存ソフトウェアプロバイダー群によって支配されています。これらのリーダーは、差別化されたバリュー・プロポジションによって優位性を競っています。SAP AribaはERPとの深い統合と広範なパートナーエコシステムを活用し、Coupaはコミュニティが提供する豊富なベンチマークデータベースを備えたAIネイティブの統合支出管理プラットフォームを重視し、オラクルは自律的なクラウドインフラストラクチャを活用して調達先から支払いまでのワークフロー全体に高度な分析を組み込み、IvaluaとJaggaerは複雑な調達シナリオのための設定可能性と迅速な価値実現に重点を置いています。サプライヤーリスク管理のIBM Emptoris、コンフィギュレーション可能なe-ソーシングのSynerTrade、モジュール型のProcurement-as-a-Serviceを提供する革新的な新興企業など、ニッチ参入企業の出現によって競争はさらに激化しています。

当レポートでは、世界の調達技術とサービス市場について調査し、市場の概要とともに、用途別、製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- ステークホルダー分析

- 市場力学の概要

- 投資情勢と研究開発動向

- サプライチェーン分析

- 将来展望と市場ロードマップ

第2章 調達技術とサービス市場(用途別)

- 用途のセグメンテーション

- 用途のサマリー

- 調達技術とサービス市場(エンドユーザー別)

- 製造業

- BFSI

- エネルギー

- 旅行とホスピタリティ

- ヘルスケア

- その他

第3章 調達技術とサービス市場(製品別)

- 製品セグメンテーション

- 製品サマリー

- 調達技術とサービス市場(コンポーネント別)

- 戦略的調達

- 支出管理

- カテゴリーマネジメント

- プロセス管理

- 契約管理

- トランザクション管理

- 調達技術とサービス市場(企業規模別)

- 中小企業

- 大企業

第4章 調達技術とサービス市場(地域別)

- 調達技術とサービス市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- Accenture

- Infosys

- GEP

- Genpact

- Proxima

- WNS

- Capgemini

- IBM

- Wipro

- HCL

- TCS

- Xchanging

- Aegis

- Corbus

- CA Technologies

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: Procurement Technologies and Services Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Procurement Technologies and Services Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Procurement Technologies and Services Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 4: Procurement Technologies and Services Market (by Product), $Billion, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 12: Canada Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 13: Germany Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 14: France Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 15: Italy Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 16: Spain Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 17: U.K. Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 18: Rest-of-Europe Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 19: China Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 20: Japan Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 21: India Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 22: South Korea Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 23: Rest-of-Asia-Pacific Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 24: South America Procurement Technologies and Services Market, $Billion, 2024-2034

- Figure 25: Middle East and Africa Procurement Technologies and Services Market, $Billion, 2024-2034

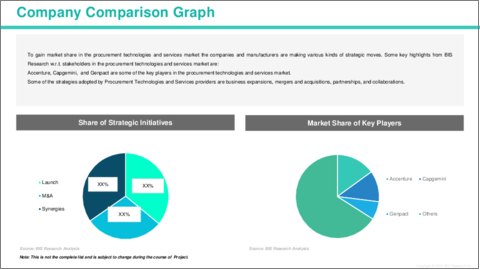

- Figure 26: Strategic Initiatives (by Company), 2021-2025

- Figure 27: Share of Strategic Initiatives, 2021-2025

- Figure 28: Data Triangulation

- Figure 29: Top-Down and Bottom-Up Approach

- Figure 30: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Procurement Technologies and Services Market Pricing Forecast, 2024-2034

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Procurement Technologies and Services Market (by Region), $Billion, 2024-2034

- Table 8: North America Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 9: North America Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 10: U.S. Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 11: U.S. Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 12: Canada Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 13: Canada Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 14: Europe Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 15: Europe Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 16: Germany Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 17: Germany Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 18: France Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 19: France Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 20: Italy Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 21: Italy Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 22: Spain Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 23: Spain Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 24: U.K. Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 25: U.K. Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 26: Rest-of-Europe Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 27: Rest-of-Europe Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 28: Asia-Pacific Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 29: Asia-Pacific Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 30: China Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 31: China Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 32: Japan Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 33: Japan Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 34: India Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 35: India Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 36: South Korea Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 37: South Korea Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 38: Rest-of-Asia-Pacific Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 39: Rest-of-Asia-Pacific Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 40: Rest-of-the-World Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 41: Rest-of-the-World Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 42: South America Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 43: South America Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 44: Middle East and Africa Procurement Technologies and Services Market (by Application), $Billion, 2024-2034

- Table 45: Middle East and Africa Procurement Technologies and Services Market (by Product), $Billion, 2024-2034

- Table 46: Market Share

Global Procurement Technologies and Services Market: Industry Overview

The Procurement Technologies and Services market today encompasses a broad suite of capabilities-ranging from e-sourcing and spend analytics to supplier-risk management and full procurement-as-a-service offerings-delivered via on-premise, cloud-native and hybrid deployment models. Major enterprise buyers are investing in AI-driven platforms that automate routine workflows, enable prescriptive sourcing insights and integrate real-time ESG metrics, while mid-market and SMB segments are increasingly adopting modular Procurement-as-a-Service (PaaS) solutions to lower upfront costs and accelerate time-to-value. This dynamic ecosystem is supported by an expanding roster of incumbent vendors (SAP Ariba, Coupa, Ivalua) alongside a wave of specialized startups (EcoVadis, Scoutbee, Simfoni), all vying to deliver deeper analytics, seamless ERP integration and enhanced supplier collaboration tools.

Procurement Technologies and Services Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $7.93 Billion |

| 2034 Forecast | $21.23 Billion |

| CAGR | 11.56% |

The market is firmly in its growth stage, marked by accelerating adoption curves, prolific product innovation and rising competitive intensity. While early entrants focused on basic e-procurement and contract-management modules, the past 18 months have seen an influx of advanced AI/ML capabilities, cloud-native architectures and vertical-specific service bundles. Investment levels are high-both from strategic acquirers seeking to consolidate capabilities and from venture-backed challengers introducing next-generation analytics and collaboration platforms. As integration complexity and data-privacy requirements mature into standardized best practices, the market is transitioning toward maturity, with consolidation and differentiation becoming the defining themes of the next 24 months.

Procurement Technologies and Services Market Segmentation:

Segmentation 1: by Application

- Manufacturing

- BFSI

- Energy

- Travel and Hospitality

- Healthcare

- Others

Manufacturing is one of the prominent application segments in the global procurement technologies and services market.

Segmentation 2: by Component

- Strategic Sourcing

- Spend Management

- Category Management

- Process Management

- Contract Management

- Transactions Management

The global procurement technologies and services market is estimated to be led by the strategic sourcing segment in terms of component.

Segmentation 3: by Region

- North America - U.S., and Canada

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

In the procurement technologies and services market, North America is anticipated to gain traction with increasing digitalization demand and government initiatives

Demand - Drivers and Limitations

The following are the demand drivers for the global procurement technologies and services market:

- AI-Driven Digital Transformation

The global procurement technologies and services market is expected to face some limitations as well due to the following challenges:

- Data Security and Privacy Regulations

Procurement Technologies and Services Market Key Players and Competition Synopsis

The Procurement Technologies and Services market is dominated by a cohort of established software providers-led by SAP Ariba (SAP SE), Coupa Software, Oracle Procurement Cloud, Ivalua and Jaggaer-alongside specialist vendors such as Zycus, GEP and Proactis. These leaders vie for prominence through differentiated value propositions: SAP Ariba leverages deep ERP integration and expansive partner ecosystems; Coupa emphasizes a unified, AI-native spend-management platform with a rich community-sourced benchmark database; Oracle capitalizes on its autonomous cloud infrastructure to embed advanced analytics across source-to-pay workflows; Ivalua and Jaggaer focus on configurability and rapid time-to-value for complex sourcing scenarios. Competition is further intensified by the emergence of niche players-IBM Emptoris in supplier risk management, SynerTrade for configurable e-sourcing, and innovative startups delivering modular Procurement-as-a-Service offerings-prompting continuous feature expansion, strategic acquisitions and ecosystem alliances aimed at capturing both large-enterprise and mid-market segments.

Some prominent names established in the procurement technologies and services market are:

- Accenture

- Infosys

- GEP

- Genpact

- Proxima

- WNS

- Capgemini

- IBM

- Wipro

- HCL

- TCS

- Xchanging

- Aegis

- Corbus

- CA Technologies

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Investment Landscape and R&D Trends

- 1.5 Supply Chain Analysis

- 1.6 Future Outlook and Market Roadmap

2. Procurement Technologies and Services Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Procurement Technologies and Services Market (by End User)

- 2.3.1 Manufacturing

- 2.3.2 BFSI

- 2.3.3 Energy

- 2.3.4 Travel and Hospitality

- 2.3.5 Healthcare

- 2.3.6 Others

3. Procurement Technologies and Services Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Procurement Technologies and Services Market (by Component)

- 3.3.1 Strategic Sourcing

- 3.3.2 Spend Management

- 3.3.3 Category Management

- 3.3.4 Process Management

- 3.3.5 Contract Management

- 3.3.6 Transactions Management

- 3.4 Procurement Technologies and Services Market (by Enterprise Size)

- 3.4.1 Small Medium Enterprises

- 3.4.2 Large Enterprises

4. Procurement Technologies and Services Market (by Region)

- 4.1 Procurement Technologies and Services Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Application

- 4.2.5 Product

- 4.2.6 North America (by Country)

- 4.2.6.1 U.S.

- 4.2.6.1.1 Market by Application

- 4.2.6.1.2 Market by Product

- 4.2.6.2 Canada

- 4.2.6.2.1 Market by Application

- 4.2.6.2.2 Market by Product

- 4.2.6.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Application

- 4.3.5 Product

- 4.3.6 Europe (by Country)

- 4.3.6.1 Germany

- 4.3.6.1.1 Market by Application

- 4.3.6.1.2 Market by Product

- 4.3.6.2 France

- 4.3.6.2.1 Market by Application

- 4.3.6.2.2 Market by Product

- 4.3.6.3 Italy

- 4.3.6.3.1 Market by Application

- 4.3.6.3.2 Market by Product

- 4.3.6.4 Spain

- 4.3.6.4.1 Market by Application

- 4.3.6.4.2 Market by Product

- 4.3.6.5 U.K.

- 4.3.6.5.1 Market by Application

- 4.3.6.5.2 Market by Product

- 4.3.6.6 Rest-of-Europe

- 4.3.6.6.1 Market by Application

- 4.3.6.6.2 Market by Product

- 4.3.6.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Application

- 4.4.5 Product

- 4.4.6 Asia-Pacific (by Country)

- 4.4.6.1 China

- 4.4.6.1.1 Market by Application

- 4.4.6.1.2 Market by Product

- 4.4.6.2 Japan

- 4.4.6.2.1 Market by Application

- 4.4.6.2.2 Market by Product

- 4.4.6.3 India

- 4.4.6.3.1 Market by Application

- 4.4.6.3.2 Market by Product

- 4.4.6.4 South Korea

- 4.4.6.4.1 Market by Application

- 4.4.6.4.2 Market by Product

- 4.4.6.5 Rest-of-Asia-Pacific

- 4.4.6.5.1 Market by Application

- 4.4.6.5.2 Market by Product

- 4.4.6.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Application

- 4.5.5 Product

- 4.5.6 Rest-of-the-World (by Region)

- 4.5.6.1 South America

- 4.5.6.1.1 Market by Application

- 4.5.6.1.2 Market by Product

- 4.5.6.2 Middle East and Africa

- 4.5.6.2.1 Market by Application

- 4.5.6.2.2 Market by Product

- 4.5.6.1 South America

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 Accenture

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 Infosys

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 GEP

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 Genpact

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 Proxima

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 WNS

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 Capgemini

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 IBM

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 Wipro

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 HCL

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 TCS

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 Xchanging

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.13 Aegis

- 5.3.13.1 Overview

- 5.3.13.2 Top Products/Product Portfolio

- 5.3.13.3 Top Competitors

- 5.3.13.4 Target Customers

- 5.3.13.5 Key Personnel

- 5.3.13.6 Analyst View

- 5.3.13.7 Market Share

- 5.3.14 Corbus

- 5.3.14.1 Overview

- 5.3.14.2 Top Products/Product Portfolio

- 5.3.14.3 Top Competitors

- 5.3.14.4 Target Customers

- 5.3.14.5 Key Personnel

- 5.3.14.6 Analyst View

- 5.3.14.7 Market Share

- 5.3.15 CA Technologies

- 5.3.15.1 Overview

- 5.3.15.2 Top Products/Product Portfolio

- 5.3.15.3 Top Competitors

- 5.3.15.4 Target Customers

- 5.3.15.5 Key Personnel

- 5.3.15.6 Analyst View

- 5.3.15.7 Market Share

- 5.3.1 Accenture

- 5.4 Other Key Companies