|

|

市場調査レポート

商品コード

1729042

近接場タグアンテナ市場- 世界および地域別分析:製品別、用途別、国別 - 分析と予測(2025年~2034年)Near-Field Tag Antennas Market - A Global and Regional Analysis: Focus on Product, Application, and Country Analysis - Analysis and Forecast, 2025-2034 |

||||||

カスタマイズ可能

|

|||||||

| 近接場タグアンテナ市場- 世界および地域別分析:製品別、用途別、国別 - 分析と予測(2025年~2034年) |

|

出版日: 2025年05月21日

発行: BIS Research

ページ情報: 英文 120 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の近接場タグアンテナの市場規模は、様々な分野での非接触技術の採用増加により、力強い成長を遂げています。

この市場に不可欠な近距離無線通信(NFC)タグは、モバイル決済、資産追跡、入退室管理などの用途で安全かつ効率的なデータ交換を促進します。スマートフォンやウェアラブル端末を含むNFC対応機器の普及により、同市場は大幅に拡大しています。業界の主要企業は、製品提供を強化し、シームレスな接続ソリューションに対する需要の高まりに対応するため、技術革新と戦略的パートナーシップに注力しています。

市場ライフサイクルステージ

| 主要市場統計 | |

|---|---|

| 予測期間 | 2025年~2034年 |

| 2025年の評価 | 22億2,000万米ドル |

| 2034年の予測 | 79億7,000万米ドル |

| CAGR | 15.26% |

世界の近接場タグアンテナ市場は現在、ライフサイクルの成長段階にあります。この段階の特徴は、急速な技術進歩、様々な産業での採用拡大、応用分野の拡大です。NFC対応デバイスの普及、非接触型決済ソリューションの増加、ヘルスケア、運輸、小売などの分野におけるNFC技術の統合などの要因によって、市場は著しい拡大を経験しています。

世界のニアフィールドタグアンテナ市場において、北米は継続的な成長と主要メーカーの存在により、生産面で牽引役となると予想されます。

需要- 促進要因と限界

近距離無線タグアンテナの世界市場の需要促進要因は以下の通りです:

- 小売業と交通機関における非接触型取引への嗜好の高まりが需要を後押し

- NFC搭載スマートフォンの普及

世界の近距離無線タグアンテナ市場は、以下の課題によりいくつかの制約にも直面すると予想される:

- 異なるNFCデバイス間の互換性の課題

- 不正なデータアクセスとサイバー脅威の可能性

主要市場参入企業と競合情勢

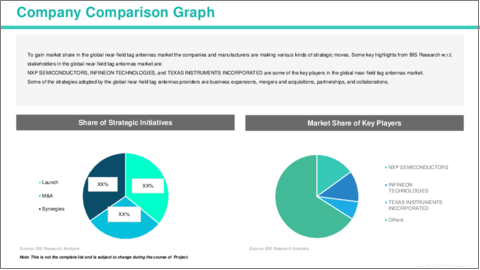

世界の近接場タグアンテナ市場は、既存の半導体およびエレクトロニクス企業間の熾烈な競争を特徴としています。大手企業としては、NXP Semiconductors、Broadcom、Qualcomm Technologies、STMicroelectronics、Sony Corporation、Texas Instruments、Infineon Technologies, Avery Dennison, HID、Global (Assa Abloy)、Samsung Electronicsなどが挙げられます。これらの企業は、戦略的パートナーシップ、技術的進歩、地域拡大を活用して、市場のリーダーシップを維持しています。市場の成長は、非接触決済ソリューション、IoT統合、さまざまな業界にわたる自動化に対する需要の増加によってさらに促進されます。

当レポートでは、世界の近接場タグアンテナ市場について調査し、市場の概要とともに、製品別、用途別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

- ステークホルダー分析

- 市場力学の概要

- 規制および政策影響分析

- 特許分析

- スタートアップの情勢

- 総アドレス可能市場

- 投資情勢と研究開発動向

- 将来展望と市場ロードマップ

- サプライチェーン分析

- バリューチェーン分析

- 世界価格分析

- 業界の魅力

第2章 世界の近接場タグアンテナ市場(用途別)

- 用途のセグメンテーション

- 用途のサマリー

- 世界の近接場タグアンテナ市場(用途別)

- スマートカード

- トラッキング

- 決済

- その他

第3章 世界の近接場タグアンテナ市場(製品別)

- 製品のセグメンテーション

- 製品のサマリー

- 世界の近接場タグアンテナ市場(タグタイプ別)

第4章 世界の近接場タグアンテナ市場(地域別)

- 世界の近接場タグアンテナ市場(地域別)

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 企業プロファイル

- NXP SEMICONDUCTORS

- INFINEON TECHNOLOGIES

- TEXAS INSTRUMENTS INCORPORATED

- QUALCOMM TECHNOLOGIES, INC

- BROADCOM INC.

- SAMSUNG ELECTRONICS CO. LTD

- STMICROELECTRONICS N.V.

- SONY CORPORATION

- THALES GROUP

- IDENTIV, INC.

- Renesas Electronics Corporation

- ams-OSRAM AG

- その他の主要企業

第6章 調査手法

List of Figures

- Figure 1: Near-Field Tag Antennas Market (by Scenario), $Billion, 2025, 2028, and 2034

- Figure 2: Near-Field Tag Antennas Market (by Region), $Billion, 2024, 2027, and 2034

- Figure 3: Near-Field Tag Antennas Market (by Application), $Billion, 2024, 2027, and 2034

- Figure 4: Near-Field Tag Antennas Market (by Product), $Billion, 2024, 2027, and 2034

- Figure 5: Competitive Landscape Snapshot

- Figure 6: Supply Chain Analysis

- Figure 7: Value Chain Analysis

- Figure 8: Patent Analysis (by Country), January 2021-April 2025

- Figure 9: Patent Analysis (by Company), January 2021-April 2025

- Figure 10: Impact Analysis of Market Navigating Factors, 2024-2034

- Figure 11: U.S. Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 12: Canada Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 13: Mexico Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 14: Germany Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 15: France Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 16: Italy Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 17: Spain Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 18: U.K. Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 19: Rest-of-Europe Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 20: China Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 21: Japan Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 22: India Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 23: South Korea Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 24: Rest-of-Asia-Pacific Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 25: South America Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 26: Middle East and Africa Near-Field Tag Antennas Market, $Billion, 2024-2034

- Figure 27: Strategic Initiatives (by Company), 2021-2025

- Figure 28: Share of Strategic Initiatives, 2021-2025

- Figure 29: Data Triangulation

- Figure 30: Top-Down and Bottom-Up Approach

- Figure 31: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Trends Overview

- Table 4: Near-Field Tag Antennas Market Pricing Forecast, 2024-2034

- Table 5: Application Summary (by Application)

- Table 6: Product Summary (by Product)

- Table 7: Near-Field Tag Antennas Market (by Region), $Billion, 2024-2034

- Table 8: North America Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 9: North America Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 10: U.S. Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 11: U.S. Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 12: Canada Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 13: Canada Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 14: Mexico Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 15: Mexico Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 16: Europe Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 17: Europe Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 18: Germany Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 19: Germany Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 20: France Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 21: France Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 22: Italy Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 23: Italy Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 24: Spain Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 25: Spain Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 26: U.K. Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 27: U.K. Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 28: Rest-of-Europe Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 29: Rest-of-Europe Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 30: Asia-Pacific Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 31: Asia-Pacific Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 32: China Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 33: China Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 34: Japan Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 35: Japan Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 36: India Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 37: India Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 38: South Korea Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 39: South Korea Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 40: Rest-of-Asia-Pacific Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 41: Rest-of-Asia-Pacific Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 42: Rest-of-the-World Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 43: Rest-of-the-World Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 44: South America Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 45: South America Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 46: Middle East and Africa Near-Field Tag Antennas Market (by Application), $Billion, 2024-2034

- Table 47: Middle East and Africa Near-Field Tag Antennas Market (by Product), $Billion, 2024-2034

- Table 48: Market Share

Global Near-Field Tag Antennas Market: Industry Overview

The global near-field tag antennas market is experiencing robust growth, driven by the increasing adoption of contactless technologies across various sectors. Near Field Communication (NFC) tags, integral to this market, facilitate secure and efficient data exchange in applications such as mobile payments, asset tracking, and access control. The proliferation of NFC-enabled devices, including smartphones and wearables, has significantly expanded the market's reach. Key industry players are focusing on innovation and strategic partnerships to enhance product offerings and cater to the rising demand for seamless connectivity solutions.

Market Lifecycle Stage

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2025 - 2034 |

| 2025 Evaluation | $2.22 Billion |

| 2034 Forecast | $7.97 Billion |

| CAGR | 15.26% |

The global near-field tag antennas market is currently in the growth phase of its lifecycle. This stage is characterized by rapid technological advancements, increasing adoption across various industries, and expanding application areas. The market is experiencing significant expansion, driven by factors such as the proliferation of NFC-enabled devices, the rise in contactless payment solutions, and the integration of NFC technology in sectors like healthcare, transportation, and retail.

Global Near-Field Tag Antennas Market Segmentation:

Segmentation 1: by Application

- Smart Card

- Tracking

- Payments

- Others

Paymets is one of the prominent application segments in the global near-field tag antennas market.

Segmentation 2: by Product Type

- Type 1

- Type 2

- Type 3

- Type 4

- Type 5

The global near-field tag antennas market is estimated to be led by Type 1.

Segmentation 3: by Region

- North America - U.S., Canada, and Mexico

- Europe - Germany, France, Italy, Spain, U.K., and Rest-of-Europe

- Asia-Pacific - China, Japan, South Korea, India, and Rest-of-Asia-Pacific

- Rest-of-the-World - South America and Middle East and Africa

In the global near-field tag antennas market, North America is anticipated to gain traction in terms of production, owing to the continuous growth and the presence of key manufacturers in the region.

Demand - Drivers and Limitations

The following are the demand drivers for the global near-field tag antennas market:

- Growing Preference for Contactless Transactions in Retail and Transportation Boosting Demand

- Widespread Adoption of NFC-Enabled Smartphones

The global near-field tag antennas market is expected to face some limitations as well due to the following challenges:

- Compatibility Challenges between Different NFC Devices

- Potential for Unauthorized Data Access and Cyber Threats

Key Market Players and Competition Synopsis

The global near-field tag antennas market is characterized by intense competition among established semiconductor and electronics firms. Leading players include NXP Semiconductors, Broadcom, Qualcomm Technologies, STMicroelectronics, Sony Corporation, Texas Instruments, Infineon Technologies, Avery Dennison, HID Global (Assa Abloy), and Samsung Electronics. These companies leverage strategic partnerships, technological advancements, and regional expansions to maintain market leadership. The market's growth is further propelled by the increasing demand for contactless payment solutions, IoT integration, and automation across various industries.

Some of the prominent established names in global near-field tag antennas market are:

- NXP Semiconductors

- Infineon Technologies

- Texas Instruments Incorporated

- Qualcomm Technologies, Inc.

- Broadcom Inc.

- Samsung Electronics Co. Ltd

- STMicroelectronics N.V.

- Sony Corporation

- Thales Group

- Identiv, Inc.

- Renesas Electronics Corporation

- ams-OSRAM AG

Companies that are not a part of the previously mentioned pool have been well represented across different sections of the report (wherever applicable).

Table of Contents

Executive Summary

Scope and Definition

Market/Product Definition

Key Questions Answered

Analysis and Forecast Note

1. Markets: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.2 Stakeholder Analysis

- 1.2.1 Use Case

- 1.2.2 End User and Buying Criteria

- 1.3 Market Dynamics Overview

- 1.3.1 Market Drivers

- 1.3.2 Market Restraints

- 1.3.3 Market Opportunities

- 1.4 Regulatory & Policy Impact Analysis

- 1.5 Patent Analysis

- 1.6 Start-Up Landscape

- 1.7 Total Addressable Market

- 1.8 Investment Landscape and R&D Trends

- 1.9 Future Outlook and Market Roadmap

- 1.10 Supply Chain Analysis

- 1.11 Value Chain Analysis

- 1.12 Global Pricing Analysis

- 1.13 Industry Attractiveness

2. Global Near-Field Tag Antennas Market (by Application)

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Global Near-Field Tag Antennas Market (by Application)

- 2.3.1 Smart Card

- 2.3.2 Tracking

- 2.3.3 Payments

- 2.3.4 Others

3. Global Near-Field Tag Antennas Market (by Product)

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Global Near-Field Tag Antennas Market (by Tag Type)

- 3.3.1 Type 1

- 3.3.2 Type 2

- 3.3.3 Type 3

- 3.3.4 Type 4

- 3.3.5 Type 5

4. Global Near-Field Tag Antennas Market (by Region)

- 4.1 Global Near-Field Tag Antennas Market (by Region)

- 4.2 North America

- 4.2.1 Regional Overview

- 4.2.2 Driving Factors for Market Growth

- 4.2.3 Factors Challenging the Market

- 4.2.4 Key Companies

- 4.2.5 Application

- 4.2.6 Product

- 4.2.7 North America (by Country)

- 4.2.7.1 U.S.

- 4.2.7.1.1 Market by Application

- 4.2.7.1.2 Market by Product

- 4.2.7.2 Canada

- 4.2.7.2.1 Market by Application

- 4.2.7.2.2 Market by Product

- 4.2.7.3 Mexico

- 4.2.7.3.1 Market by Application

- 4.2.7.3.2 Market by Product

- 4.2.7.1 U.S.

- 4.3 Europe

- 4.3.1 Regional Overview

- 4.3.2 Driving Factors for Market Growth

- 4.3.3 Factors Challenging the Market

- 4.3.4 Key Companies

- 4.3.5 Application

- 4.3.6 Product

- 4.3.7 Europe (by Country)

- 4.3.7.1 Germany

- 4.3.7.1.1 Market by Application

- 4.3.7.1.2 Market by Product

- 4.3.7.2 France

- 4.3.7.2.1 Market by Application

- 4.3.7.2.2 Market by Product

- 4.3.7.3 Italy

- 4.3.7.3.1 Market by Application

- 4.3.7.3.2 Market by Product

- 4.3.7.4 Spain

- 4.3.7.4.1 Market by Application

- 4.3.7.4.2 Market by Product

- 4.3.7.5 U.K.

- 4.3.7.5.1 Market by Application

- 4.3.7.5.2 Market by Product

- 4.3.7.6 Rest-of-Europe

- 4.3.7.6.1 Market by Application

- 4.3.7.6.2 Market by Product

- 4.3.7.1 Germany

- 4.4 Asia-Pacific

- 4.4.1 Regional Overview

- 4.4.2 Driving Factors for Market Growth

- 4.4.3 Factors Challenging the Market

- 4.4.4 Key Companies

- 4.4.5 Application

- 4.4.6 Product

- 4.4.7 Asia-Pacific (by Country)

- 4.4.7.1 China

- 4.4.7.1.1 Market by Application

- 4.4.7.1.2 Market by Product

- 4.4.7.2 Japan

- 4.4.7.2.1 Market by Application

- 4.4.7.2.2 Market by Product

- 4.4.7.3 India

- 4.4.7.3.1 Market by Application

- 4.4.7.3.2 Market by Product

- 4.4.7.4 South Korea

- 4.4.7.4.1 Market by Application

- 4.4.7.4.2 Market by Product

- 4.4.7.5 Rest-of-Asia-Pacific

- 4.4.7.5.1 Market by Application

- 4.4.7.5.2 Market by Product

- 4.4.7.1 China

- 4.5 Rest-of-the-World

- 4.5.1 Regional Overview

- 4.5.2 Driving Factors for Market Growth

- 4.5.3 Factors Challenging the Market

- 4.5.4 Key Companies

- 4.5.5 Application

- 4.5.6 Product

- 4.5.7 Rest-of-the-World (by Region)

- 4.5.7.1 South America

- 4.5.7.1.1 Market by Application

- 4.5.7.1.2 Market by Product

- 4.5.7.2 Middle East and Africa

- 4.5.7.2.1 Market by Application

- 4.5.7.2.2 Market by Product

- 4.5.7.1 South America

5. Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Company Profiles

- 5.3.1 NXP SEMICONDUCTORS

- 5.3.1.1 Overview

- 5.3.1.2 Top Products/Product Portfolio

- 5.3.1.3 Top Competitors

- 5.3.1.4 Target Customers

- 5.3.1.5 Key Personnel

- 5.3.1.6 Analyst View

- 5.3.1.7 Market Share

- 5.3.2 INFINEON TECHNOLOGIES

- 5.3.2.1 Overview

- 5.3.2.2 Top Products/Product Portfolio

- 5.3.2.3 Top Competitors

- 5.3.2.4 Target Customers

- 5.3.2.5 Key Personnel

- 5.3.2.6 Analyst View

- 5.3.2.7 Market Share

- 5.3.3 TEXAS INSTRUMENTS INCORPORATED

- 5.3.3.1 Overview

- 5.3.3.2 Top Products/Product Portfolio

- 5.3.3.3 Top Competitors

- 5.3.3.4 Target Customers

- 5.3.3.5 Key Personnel

- 5.3.3.6 Analyst View

- 5.3.3.7 Market Share

- 5.3.4 QUALCOMM TECHNOLOGIES, INC

- 5.3.4.1 Overview

- 5.3.4.2 Top Products/Product Portfolio

- 5.3.4.3 Top Competitors

- 5.3.4.4 Target Customers

- 5.3.4.5 Key Personnel

- 5.3.4.6 Analyst View

- 5.3.4.7 Market Share

- 5.3.5 BROADCOM INC.

- 5.3.5.1 Overview

- 5.3.5.2 Top Products/Product Portfolio

- 5.3.5.3 Top Competitors

- 5.3.5.4 Target Customers

- 5.3.5.5 Key Personnel

- 5.3.5.6 Analyst View

- 5.3.5.7 Market Share

- 5.3.6 SAMSUNG ELECTRONICS CO. LTD

- 5.3.6.1 Overview

- 5.3.6.2 Top Products/Product Portfolio

- 5.3.6.3 Top Competitors

- 5.3.6.4 Target Customers

- 5.3.6.5 Key Personnel

- 5.3.6.6 Analyst View

- 5.3.6.7 Market Share

- 5.3.7 STMICROELECTRONICS N.V.

- 5.3.7.1 Overview

- 5.3.7.2 Top Products/Product Portfolio

- 5.3.7.3 Top Competitors

- 5.3.7.4 Target Customers

- 5.3.7.5 Key Personnel

- 5.3.7.6 Analyst View

- 5.3.7.7 Market Share

- 5.3.8 SONY CORPORATION

- 5.3.8.1 Overview

- 5.3.8.2 Top Products/Product Portfolio

- 5.3.8.3 Top Competitors

- 5.3.8.4 Target Customers

- 5.3.8.5 Key Personnel

- 5.3.8.6 Analyst View

- 5.3.8.7 Market Share

- 5.3.9 THALES GROUP

- 5.3.9.1 Overview

- 5.3.9.2 Top Products/Product Portfolio

- 5.3.9.3 Top Competitors

- 5.3.9.4 Target Customers

- 5.3.9.5 Key Personnel

- 5.3.9.6 Analyst View

- 5.3.9.7 Market Share

- 5.3.10 IDENTIV, INC.

- 5.3.10.1 Overview

- 5.3.10.2 Top Products/Product Portfolio

- 5.3.10.3 Top Competitors

- 5.3.10.4 Target Customers

- 5.3.10.5 Key Personnel

- 5.3.10.6 Analyst View

- 5.3.10.7 Market Share

- 5.3.11 Renesas Electronics Corporation

- 5.3.11.1 Overview

- 5.3.11.2 Top Products/Product Portfolio

- 5.3.11.3 Top Competitors

- 5.3.11.4 Target Customers

- 5.3.11.5 Key Personnel

- 5.3.11.6 Analyst View

- 5.3.11.7 Market Share

- 5.3.12 ams-OSRAM AG

- 5.3.12.1 Overview

- 5.3.12.2 Top Products/Product Portfolio

- 5.3.12.3 Top Competitors

- 5.3.12.4 Target Customers

- 5.3.12.5 Key Personnel

- 5.3.12.6 Analyst View

- 5.3.12.7 Market Share

- 5.3.1 NXP SEMICONDUCTORS

- 5.4 Other Key Companies