|

|

市場調査レポート

商品コード

1719321

欧州の高度道路交通システム市場:用途別、製品別、国別 - 分析と予測(2024年~2033年)Europe Intelligent Transportation Systems Market: Focus on Application, Product, and Country - Analysis and Forecast, 2024-2033 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の高度道路交通システム市場:用途別、製品別、国別 - 分析と予測(2024年~2033年) |

|

出版日: 2025年05月07日

発行: BIS Research

ページ情報: 英文 102 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の高度道路交通システム(ITS)の市場規模は、2024年の79億米ドルから2033年には146億2,000万米ドルに達し、予測期間の2024年~2033年のCAGRは7.08%になると予測されています。

欧州のITS市場を構成する主な用途は、交通安全、公共交通運営、貨物物流、交通管理であり、中でも交通管理がリードしています。スマートシティ・イニシアチブ、国境を越えたC-ITS回廊、自律走行車パイロット・プログラムに対するEUや各国の投資が、ITS導入における欧州のリーダーシップを後押ししています。最新のAIを活用した交通管理、広範なIoT接続、5G対応のV2Xソリューションのすべてが、この地域の都市モビリティネットワーク全体でITS導入の急速な拡大に寄与しています。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2033年 |

| 2024年の評価 | 79億米ドル |

| 2033年の予測 | 146億2,000万米ドル |

| CAGR | 7.08% |

欧州の高度道路交通システム(ITS)市場は急速に発展しており、同地域のスマートモビリティ戦略の重要な要素になりつつあります。高度なセンシング、通信、分析を駆使したITSソリューションは、従来のインフラをデータ駆動型の相互接続ネットワークに変え、適応型交通管理、道路利用者の安全システム、公共交通の調整、貨物物流の最適化などの用途を包含します。交通量の削減、排出量の削減、ネットワークの弾力性向上のため、欧州の各都市では、大都市のダイナミックな信号制御から路面電車やバス路線のリアルタイムの乗客情報に至るまで、高度道路交通システム(ITS)を活用しています。

動向

- 適応的信号制御と渋滞緩和のためのAI主導型交通管理プラットフォームの普及。

- 車両とインフラのシームレスな連携と複数モダルの協調を可能にする、国境を越えたC-ITSコリドーの拡大。

- 統一されたモビリティ・エコシステムへのEV充電ステーションとスマート・パーキング・ソリューションの統合。

- 予知保全とネットワーク計画のためのリアルタイムデータ分析とデジタルツインシミュレーションの展開。

促進要因

- スマートシティ、CEF、グリーンディールプログラムの下でのEUおよび国別多額の資金援助。

- 厳しい脱炭素化と大気質規制が、環境に優しいモビリティ・ソリューションへの投資を促進。

- 急速な都市化と渋滞の増加により、インテリジェントで需要に対応した交通サービスへの需要の高まり。

- 低遅延ITSを支える5G、IoTセンサーネットワーク、エッジコンピューティング・インフラの成熟。

課題

- 加盟国間で断片化した規制の枠組みと技術標準が相互運用性を妨げています。

- レガシーインフラのアップグレードのバランスをとる自治体にとって、高額な設備投資と不透明なROIスケジュール。

- 複雑なGDPRとNIS2のコンプライアンス要件が、サイバーセキュリティ、プライバシー、データ主権にかかるコストを引き上げています。

- 老朽化した交通システムとの統合の難しさと、高度なITS展開のための熟練労働力の不足。

当レポートは、欧州の高度道路交通システム(ITS)市場に関する包括的な洞察を提供し、データ主導の意思決定と戦略立案を可能にすることで、組織に付加価値をもたらします。当レポートは、新たな動向、技術的進歩、競合のダイナミクスを浮き彫りにし、企業が成長機会を特定し、提供する製品を業界の需要に適合させるのに役立ちます。また、規制の枠組み、持続可能性への取り組み、サイバーセキュリティ対策などを網羅することで、進化する交通とスマートシティの標準への準拠を保証します。当レポートを活用することで、企業は業務効率を高め、ITSインフラへの投資を最適化し、急速に進化するインテリジェントモビリティエコシステムにおいて競合優位性を獲得し、長期的な持続可能性とイノベーションを確保することができます。

当レポートでは、欧州の高度道路交通システム市場について調査し、市場の概要とともに、用途別、製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- インテリジェント交通システム市場:現状と将来

- ITSにおける人工知能と機械学習の役割

- IoTとスマートシティインフラの統合

- 交通管理におけるビッグデータ分析と予測モデリング

- データのセキュリティと透明性のためのブロックチェーン

- リアルタイムデータ処理のための5Gとエッジコンピューティング

- 持続可能性の動向:排出量とエネルギー使用量を削減するITS

- サプライチェーンの概要

- 特許分析

- 規制状況

- 地域および世界のITS規制

- データプライバシーとセキュリティ規制のITSへの影響

- V2X(車車間通信)規制枠組み

- 環境政策とグリーンITS推進におけるその役割

- ケーススタディ

- 主要な世界的出来事の影響分析

- 市場力学の概要

第2章 地域

- 地域のサマリー

- 欧州

- 地域概要

- 欧州の主要市場参入企業

- 市場成長促進要因

- 市場成長抑制要因

- 用途

- 製品

- 欧州(国別)

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- Siemens

- Kapsch TrafficCom AG

- TomTom International BV

- Q-Free

- EFKON GmbH

- PTV Planung Transport Verkehr GmbH

- SWARCO

- その他

第4章 調査手法

List of Figures

- Figure 1: Europe Intelligent Transportation Systems Market (by Scenario), $Billion, 2024, 2027, and 2033

- Figure 2: Intelligent Transportation Systems Market (by Region), $Million, 2023, 2027, and 2033

- Figure 3: Europe Intelligent Transportation Systems Market (by End User), $Million, 2023, 2027, and 2033

- Figure 4: Europe Intelligent Transportation Systems Market (by Application), $Million, 2023, 2027, and 2033

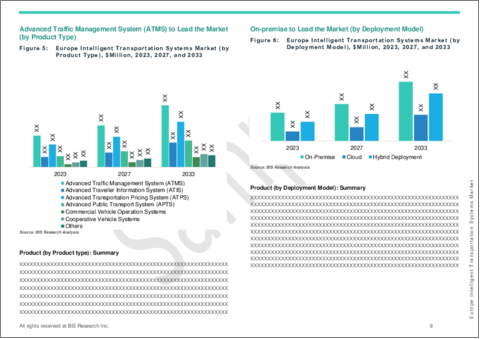

- Figure 5: Europe Intelligent Transportation Systems Market (by Product Type), $Million, 2023, 2027, and 2033

- Figure 6: Europe Intelligent Transportation Systems Market (by Deployment Model), $Million, 2023, 2027, and 2033

- Figure 7: Europe Intelligent Transportation Systems Market (by Component type), $Million, 2023, 2027, and 2033

- Figure 8: Key Events

- Figure 9: Supply Chain and Risks within the Supply Chain

- Figure 10: Value Chain Analysis

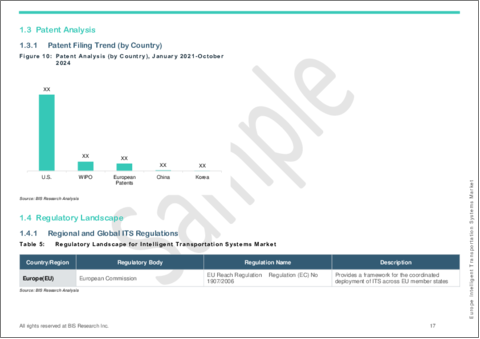

- Figure 11: Patent Analysis (by Country), January 2021-October 2024

- Figure 12: Patent Analysis (by Company), January 2021-October 2024

- Figure 13: Case Study on Emergency and Disaster Response Applications

- Figure 14: Impact Analysis of Market Navigating Factors, 2023-2033

- Figure 15: Germany Intelligent Transportation Systems Market, $Million, 2023-2033

- Figure 16: France Intelligent Transportation Systems Market, $Million, 2023-2033

- Figure 17: U.K. Intelligent Transportation Systems Market, $Million, 2023-2033

- Figure 18: Italy Intelligent Transportation Systems Market, $Million, 2023-2033

- Figure 19: Spain Intelligent Transportation Systems Market, $Million, 2023-2033

- Figure 20: Rest-of-Europe Intelligent Transportation Systems Market, $Million, 2023-2033

- Figure 21: Strategic Initiatives, January 2021-November 2024

- Figure 22: Share of Strategic Initiatives, January 2021-November 2024

- Figure 23: Data Triangulation

- Figure 24: Top-Down and Bottom-Up Approach

- Figure 25: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Competitive Landscape Snapshot

- Table 4: Trends: Overview

- Table 5: Regulatory Landscape for Intelligent Transportation Systems Market

- Table 6: List of Regulations Related to Cybersecurity

- Table 7: List of Vehicle-to-Everything (V2X) Regulations

- Table 8: List of Environmental Policies

- Table 9: Intelligent Transportation Systems Market (by Region), $Million, 2023-2033

- Table 10: Europe Intelligent Transportation Systems Market (by Application), $Million, 2023-2033

- Table 11: Europe Intelligent Transportation Systems Market (by End User), $Million, 2023-2033

- Table 12: Europe Intelligent Transportation Systems Market (by Product Type), $Million, 2023-2033

- Table 13: Europe Intelligent Transportation Systems Market (by Deployment Model), $Million, 2023-2033

- Table 14: Europe Intelligent Transportation Systems Market (by Component Type), $Million, 2023-2033

- Table 15: Germany Intelligent Transportation Systems Market (by Application), $Million, 2023-2033

- Table 16: Germany Intelligent Transportation Systems Market (by End User), $Million, 2023-2033

- Table 17: Germany Intelligent Transportation Systems Market (by Product Type), $Million, 2023-2033

- Table 18: Germany Intelligent Transportation Systems Market (by Deployment Model), $Million, 2023-2033

- Table 19: Germany Intelligent Transportation Systems Market (by Component Type), $Million, 2023-2033

- Table 20: France Intelligent Transportation Systems Market (by Application), $Million, 2023-2033

- Table 21: France Intelligent Transportation Systems Market (by End User), $Million, 2023-2033

- Table 22: France Intelligent Transportation Systems Market (by Product Type), $Million, 2023-2033

- Table 23: France Intelligent Transportation Systems Market (by Deployment Model), $Million, 2023-2033

- Table 24: France Intelligent Transportation Systems Market (by Component Type), $Million, 2023-2033

- Table 25: U.K. Intelligent Transportation Systems Market (by Application), $Million, 2023-2033

- Table 26: U.K. Intelligent Transportation Systems Market (by End User), $Million, 2023-2033

- Table 27: U.K. Intelligent Transportation Systems Market (by Product Type), $Million, 2023-2033

- Table 28: U.K. Intelligent Transportation Systems Market (by Deployment Model), $Million, 2023-2033

- Table 29: U.K. Intelligent Transportation Systems Market (by Component Type), $Million, 2023-2033

- Table 30: Italy Intelligent Transportation Systems Market (by Application), $Million, 2023-2033

- Table 31: Italy Intelligent Transportation Systems Market (by End User), $Million, 2023-2033

- Table 32: Italy Intelligent Transportation Systems Market (by Product Type), $Million, 2023-2033

- Table 33: Italy Intelligent Transportation Systems Market (by Deployment Model), $Million, 2023-2033

- Table 34: Italy Intelligent Transportation Systems Market (by Component Type), $Million, 2023-2033

- Table 35: Spain Intelligent Transportation Systems Market (by Application), $Million, 2023-2033

- Table 36: Spain Intelligent Transportation Systems Market (by End User), $Million, 2023-2033

- Table 37: Spain Intelligent Transportation Systems Market (by Product Type), $Million, 2023-2033

- Table 38: Spain Intelligent Transportation Systems Market (by Deployment Model), $Million, 2023-2033

- Table 39: Spain Intelligent Transportation Systems Market (by Component Type), $Million, 2023-2033

- Table 40: Rest-of-Europe Intelligent Transportation Systems Market (by Application), $Million, 2023-2033

- Table 41: Rest-of-Europe Intelligent Transportation Systems Market (by End User), $Million, 2023-2033

- Table 42: Rest-of-Europe Intelligent Transportation Systems Market (by Product Type), $Million, 2023-2033

- Table 43: Rest-of-Europe Intelligent Transportation Systems Market (by Deployment Model), $Million, 2023-2033

- Table 44: Rest-of-Europe Intelligent Transportation Systems Market (by Component Type), $Million, 2023-2033

Introduction to Europe Intelligent Transportation Systems Market

The Europe intelligent transportation systems (ITS) market is projected to reach $14.62 billion by 2033 from $7.90 billion in 2024, growing at a CAGR of 7.08% during the forecast period 2024-2033. Road safety, public transport operations, freight logistics, and traffic management are the main applications that make up the European ITS market, with traffic management leading the way. EU and national investments in smart-city initiatives, cross-border C-ITS corridors, and autonomous vehicle pilot programs are what propel Europe's leadership in ITS adoption. Modern AI-powered traffic management, extensive IoT connection, and 5G-capable V2X solutions are all contributing to the rapid expansion of ITS deployment throughout the urban mobility networks in the region.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2033 |

| 2024 Evaluation | $7.90 Billion |

| 2033 Forecast | $14.62 Billion |

| CAGR | 7.08% |

The market for Intelligent Transport Systems (ITS) in Europe is developing quickly and is becoming a key component of the region's smart-mobility strategy. Using advanced sensing, communications, and analytics, ITS solutions turn legacy infrastructure into data-driven, interconnected networks, encompassing applications like adaptive traffic management, road-user safety systems, public transportation coordination, and freight-logistics optimisation. In order to reduce traffic, cut emissions, and improve network resilience, European cities are using Intelligent Transportation Systems (ITS) for anything from dynamic signal control in large cities to real-time passenger information on tram and bus lines.

Market Segmentation

Segmentation 1: by Application

- Traffic Management

- Traffic Congestion and Incident Management

- Parking Management

- Road Safety and Surveillance

- Red Light and Speed Enforcement

- Traffic Violation Detection

- Emergency Vehicle Notification Systems

- Public Transport Operations

- Real-Time Passenger Information

- Bus Rapid Transit (BRT) Systems

- Freight and Commercial Management

- Fleet and Freight Management

- Cargo Monitoring and Security

- Environmental Protection and Emissions Control

- Toll Management

- Others

Segmentation 2: by End User

- Government and Public Sector

- Commercial Fleet and Freight Operators

- Toll and Parking Infrastructure Management

- Others

Segmentation 3: by Product Type

- Advanced Traffic Management Systems (ATMS)

- Advanced Public Transportation Systems (APTS)

- Advanced Traveler Information Systems (ATIS)

- Commercial Vehicle Operation (CVO) Systems

- Cooperative Vehicle Systems (CVS)

- Advanced Transportation Pricing System (ATPS)

- Others

Segmentation 4: by Deployment Model

- On-Premise

- Cloud-Based

- Hybrid Deployment

Segmentation 5: by Component Type

- Hardware

- Sensors (Radar, LiDAR, Ultrasonic, Infrared, Cameras)

- Interface Boards and Communication Devices

- Roadside Units (RSUs)

- Others

- Software

- Traffic Management Software

- Real-Time Monitoring and Incident Detection

- Compliance and Regulatory Management

- Others

- Services

Segmentation 6: by Region

- Europe (Germany, France, U.K., Italy, Spain, and Rest-of-Europe)

Europe Intelligent Transportation System Market Trends, Drivers and Challenges-

Trends

- Proliferation of AI-driven traffic management platforms for adaptive signal control and congestion mitigation.

- Expansion of cross-border C-ITS corridors enabling seamless vehicle-to-infrastructure and multimodal coordination.

- Integration of EV charging stations and smart-parking solutions into unified mobility ecosystems.

- Deployment of real-time data analytics and digital-twin simulations for predictive maintenance and network planning.

Drivers

- Substantial EU and national funding under Smart Cities, CEF and Green Deal programmes.

- Stringent decarbonisation and air-quality mandates pushing investments in eco-friendly mobility solutions.

- Rapid urbanisation and rising congestion driving demand for intelligent, demand-responsive transport services.

- Maturation of 5G, IoT sensor networks and edge-computing infrastructures that underpin low-latency ITS applications.

Challenges

- Fragmented regulatory frameworks and technical standards across member states hindering interoperability.

- High capex and uncertain ROI timelines for municipalities balancing legacy infrastructure upgrades.

- Complex GDPR and NIS2 compliance requirements raising cybersecurity, privacy and data-sovereignty costs.

- Integration difficulties with ageing transport systems and insufficient skilled workforce for advanced ITS deployment.

How can this report add value to an organization?

This report adds value to an organization by providing comprehensive insights into the Europe intelligent transportation systems (ITS) market, enabling data-driven decision-making and strategic planning. It highlights emerging trends, technological advancements, and competitive dynamics, helping organizations identify growth opportunities and align their offerings with industry demands. The report's detailed segmentation and regional analysis support targeted market expansion strategies, while its coverage of regulatory frameworks, sustainability initiatives, and cybersecurity measures ensures compliance with evolving transportation and smart city standards. By leveraging this report, organizations can enhance operational efficiency, optimize investments in ITS infrastructure, and gain a competitive edge in the rapidly evolving intelligent mobility ecosystem, ensuring long-term sustainability and innovation.

Key Market Players and Competition Synopsis

The companies that are profiled in the Europe intelligent transportation systems market have been selected based on inputs gathered from primary experts who have analyzed company coverage, product portfolio, and market penetration.

Some of the prominent names in this market are:

- Siemens AG

- Kapsch TrafficCom AG

- TomTom International BV

- Q-Free

- EFKON GmbH

- PTV Planung Transport Verkehr GmbH

- SWARCO

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Intelligent Transportation Systems Market: Current and Future

- 1.1.1 Role of Artificial Intelligence and Machine Learning in ITS

- 1.1.2 Integration of IoT and Smart City Infrastructure

- 1.1.3 Big Data Analytics and Predictive Modeling in Traffic Management

- 1.1.4 Blockchain for Data Security and Transparency

- 1.1.5 5G and Edge Computing for Real-Time Data Processing

- 1.1.6 Sustainability Trends: ITS for Reducing Emissions and Energy Use

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.2.2 Pricing Trends in Key ITS Components

- 1.3 Patent Analysis

- 1.3.1 Patent Filing Trend (by Country)

- 1.3.2 Patent Filing Trend (by Company)

- 1.4 Regulatory Landscape

- 1.4.1 Regional and Global ITS Regulations

- 1.4.2 Data Privacy and Security Regulations Impact on ITS

- 1.4.3 Vehicle-to-Everything (V2X) Regulatory Frameworks

- 1.4.4 Environmental Policies and their Role in Promoting Green ITS

- 1.5 Case Study

- 1.5.1 Emergency and Disaster Response Applications

- 1.6 Impact Analysis for Key Global Events

- 1.6.1 Covid-19 Impact

- 1.6.2 Russia-Ukraine War

- 1.7 Market Dynamics Overview

- 1.7.1 Market Drivers

- 1.7.1.1 Evolving Multimodal Transportation and Mobility-as-a-Service (MaaS)

- 1.7.1.2 Growing Need for Freight and Logistics Optimization

- 1.7.2 Market Restraints

- 1.7.2.1 High Initial Infrastructure and Deployment Costs

- 1.7.2.2 Technical Challenges with Integrating Legacy Systems

- 1.7.3 Market Opportunities

- 1.7.3.1 Rising Investments in Smart Cities Initiatives

- 1.7.3.2 Growing Adoption of Autonomous and Connected Vehicles

- 1.7.1 Market Drivers

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Key Market Participants in Europe

- 2.2.3 Driving Factors for Market Growth

- 2.2.4 Factors Challenging the Market

- 2.2.5 Application

- 2.2.6 Product

- 2.2.7 Europe (by Country)

- 2.2.7.1 Germany

- 2.2.7.1.1 Application

- 2.2.7.1.2 Product

- 2.2.7.2 France

- 2.2.7.2.1 Application

- 2.2.7.2.2 Product

- 2.2.7.3 U.K.

- 2.2.7.3.1 Application

- 2.2.7.3.2 Product

- 2.2.7.4 Italy

- 2.2.7.4.1 Application

- 2.2.7.4.2 Product

- 2.2.7.5 Spain

- 2.2.7.5.1 Application

- 2.2.7.5.2 Product

- 2.2.7.6 Rest-of-Europe

- 2.2.7.6.1 Application

- 2.2.7.6.2 Product

- 2.2.7.1 Germany

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 Siemens

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.1.7 Market Share, 2023

- 3.2.2 Kapsch TrafficCom AG

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.2.7 Market Share, 2023

- 3.2.3 TomTom International BV

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.3.7 Market Share, 2023

- 3.2.4 Q-Free

- 3.2.4.1 Overview

- 3.2.4.2 Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.4.7 Market Share, 2023

- 3.2.5 EFKON GmbH

- 3.2.5.1 Overview

- 3.2.5.2 Top Products/Product Portfolio

- 3.2.5.3 Top Competitors

- 3.2.5.4 Target Customers

- 3.2.5.5 Key Personnel

- 3.2.5.6 Analyst View

- 3.2.5.7 Market Share, 2023

- 3.2.6 PTV Planung Transport Verkehr GmbH

- 3.2.6.1 Overview

- 3.2.6.2 Top Products/Product Portfolio

- 3.2.6.3 Top Competitors

- 3.2.6.4 Target Customers

- 3.2.6.5 Key Personnel

- 3.2.6.6 Analyst View

- 3.2.6.7 Market Share, 2023

- 3.2.7 SWARCO

- 3.2.7.1 Overview

- 3.2.7.2 Top Products/Product Portfolio

- 3.2.7.3 Top Competitors

- 3.2.7.4 Target Customers

- 3.2.7.5 Key Personnel

- 3.2.7.6 Analyst View

- 3.2.7.7 Market Share, 2023

- 3.2.8 Other Key Players

- 3.2.1 Siemens

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast