|

|

市場調査レポート

商品コード

1714080

宇宙用電源市場- 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2024年~2034年)Space Power Supply Market - A Global and Regional Analysis: Focus on Application, Product, and Country Level Analysis - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 宇宙用電源市場- 世界および地域別分析:用途別、製品別、国別 - 分析と予測(2024年~2034年) |

|

出版日: 2025年04月28日

発行: BIS Research

ページ情報: 英文 189 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

宇宙用電源市場には、太陽光発電システム、バッテリー、エネルギー貯蔵装置、電力管理技術など、宇宙用途に不可欠な幅広いソリューションが含まれます。

この市場は、衛星、宇宙船、宇宙ステーションのための、より効率的で信頼性の高い電源に対する需要の高まりによって牽引されています。高度なソーラーパネルや大容量エネルギー貯蔵システムなど、宇宙用電源技術の革新は、宇宙探査における持続可能なエネルギー・ソリューションに対するニーズの高まりに応えています。宇宙用電源市場は競争が激しく、AirbusやRocket Lab USAなどの主要企業が業界をリードしています。さらに、コスト効率、持続可能性、長期にわたる宇宙ミッションが重視されるようになったことで、消費者や業界の嗜好が形成され、企業は最先端技術と革新的な電源ソリューションへの投資を促しています。このダイナミックな市場は、宇宙探査と衛星運用の需要に対応するために絶えず進化しています。

市場イントロダクション

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 94億4,992万500米ドル |

| 2034年予測 | 147億8,699万5,700米ドル |

| CAGR | 4.58% |

宇宙用電源市場には、太陽光発電システム、バッテリー、エネルギー貯蔵装置、電力管理技術など、宇宙ミッションに不可欠なさまざまなソリューションが含まれます。この市場は、人工衛星、宇宙船、宇宙ステーションのための効率的で信頼性の高い電源に対する需要が高まるにつれて拡大しています。先進的なソーラーパネルや大容量のエネルギー貯蔵ソリューションなどの技術革新は、長期間の宇宙探査に持続可能な電力を提供し、人気を集めています。Airbus、Boeing、Lockheed Martinなどの主要企業が市場を独占しており、競争力を維持するために絶えず技術を進化させています。さらに、持続可能性と費用対効果への注目の高まりが市場に影響を与え、環境に優しい電源ソリューションとエネルギー効率の高いシステムへの投資を促しています。宇宙電源市場は、宇宙探査と衛星運用の増大するニーズに対応するため、急速に進化しています。

宇宙用電源装置市場は産業界に大きな影響を与えており、航空宇宙およびエネルギー部門における多大な経済活動と雇用を促進しています。Airbus、Boeing、Lockheed Martinなどの大手企業は、研究、製造、流通に多額の投資を行い、サプライヤー、請負業者、サービス・プロバイダーの幅広いネットワークを支えています。ソーラーパネル、バッテリー、電力管理システムなどの先端技術に対する需要は、エネルギー貯蔵と電力効率の革新を促進し、エレクトロニクス、材料科学、再生可能エネルギー産業に利益をもたらしています。

宇宙用電源市場はまた、長期間の宇宙ミッションや衛星運用に電力ソリューションが不可欠な衛星産業など、関連分野の成長も支えています。宇宙用電源システムの革新はエネルギー効率の向上につながり、世界のエネルギー市場や最先端技術の開発に影響を与えます。持続可能性への注目の高まりは、再生可能エネルギー・ソリューションやより効率的な電力管理への投資を促し、宇宙ミッションが環境に与える影響を軽減しています。

さらに、宇宙探査と通信インフラのサポートに重点が置かれることで、宇宙機関、研究機関、非公開会社との協力が促進され、技術の進歩がさらに促進され、より持続可能な宇宙経済が創出されます。全体として、宇宙用電源装置は、技術革新、経済成長、宇宙探査の未来に貢献する重要な市場です。

宇宙用電源装置の用途別市場は、主に人工衛星が牽引しています。衛星セグメントは2023年に84億8,047万9,700米ドルと評価され、2034年には131億9,152万4,000米ドルに達すると予測されています。この分野は、商業衛星と政府衛星の両方の運用において、より効率的で信頼性の高い電力ソリューションへの需要が高まっているため、大きな成長を遂げています。さらに、太陽光発電システム、エネルギー貯蔵技術、電力管理ソリューションの進歩がこの成長をさらに後押ししており、より長時間のミッションをサポートし、衛星の性能を向上させています。

宇宙用電源市場の最近の動向

- 5N Plus Inc.は、子会社のAZUR SPACE Solar Power GmbHが2024年の生産能力拡張に成功し、当初の目標であった30%を上回る35%の増産を達成したと発表しました。AZURは2025年末までに、追加投資を最小限に抑えながら、太陽電池の生産量をさらに30%増やす計画です。この拡張は、宇宙用電源ソリューションに対する需要の高まりに対応するもので、AZURは宇宙用電源市場、特に先進的な太陽電池技術における主要参入企業としての役割を強化します。

- Rocket Labは2024年6月11日、宇宙用太陽電池の生産を拡大するため、CHIPS法に基づき最大2,390万米ドルの資金提供を受ける予備契約を締結したと発表しました。この投資により、Rocket Labは宇宙船や人工衛星に使用される半導体の製造能力を強化し、ニューメキシコ州アルバカーキで100人以上の新規雇用を創出します。宇宙用太陽電池は、NASAのArtemisやジェイムズ・ウェッブ宇宙望遠鏡のような国防や宇宙探査計画に不可欠であり、Rocket Labは宇宙用電源市場の主要参入企業として位置づけられています。

- 2022年1月31日、Ascent Solar Technologiesは、Momentus, Inc.に採用され、実証配備可能なPVアレイ用のフレキシブルCIGS太陽光発電(PV)モジュールを製造すると発表しました。これらのモジュールは、2022年に低軌道飛行を予定しているVigoride宇宙船に電力を供給します。この提携は、軽量でフレキシブルな宇宙用PV技術で宇宙用電源ソリューションを推進するアセントソーラーの役割を浮き彫りにするものです。

- EaglePicherは、同社のバッテリーがNASAのArtemis iミッションに不可欠であり、Orion宇宙船のクルーモジュールとSpace Launch System(SLS)飛行終了システムの両方に電力を供給していると発表しました。同社は、緊急時に推進力を停止させるSLSの飛行終了システムに電力を供給することで、飛行の安全性を確保するため、32ボルト、10Ahの銀-亜鉛バッテリーを2個供給しました。このコラボレーションは、宇宙用電源のためのバッテリー技術を発展させ、深宇宙探査ミッションをサポートするEaglePicher社の役割を浮き彫りにしています。

成長/マーケティング戦略:宇宙用電源市場は、事業拡大、提携、協力、合弁など、市場で事業を展開する主要企業による主要な開拓が見られます。各社が好む戦略は、宇宙用電源装置市場における地位を強化するためのシナジー活動です。

競合戦略:宇宙用電源製品の研究では、宇宙用電源市場の主要企業が分析され、プロファイル化されています。さらに、宇宙用電源装置市場で事業展開している参入企業の詳細な競合ベンチマーキングを行い、読者が参入企業同士のスタックを理解できるようにし、明確な市場情勢を提示しています。さらに、パートナーシップ、協定、提携などの包括的な競合戦略は、読者が市場の未開拓の収益ポケットを理解するのに役立ちます。

当レポートでは、世界の宇宙用電源市場について調査し、市場の概要とともに、用途別、製品別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場:業界展望

- 動向:現状と将来への影響評価

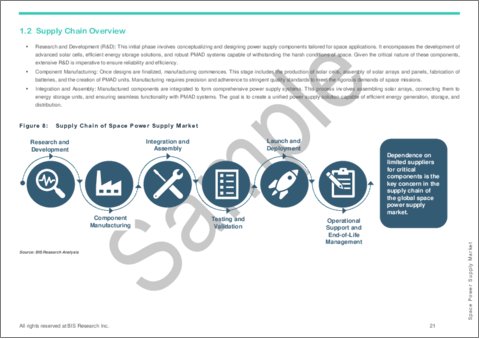

- サプライチェーンの概要

- 特許分析

- 規制状況と業界の取り組み

- 市場力学の概要

- 市場促進要因

- 市場抑制要因

- 市場機会

- メガコンステレーションの太陽光発電需要への影響と従来の衛星配備との比較

第2章 用途

- 用途のセグメンテーション

- 用途のサマリー

- 宇宙電源市場(用途別)

- 衛星向け宇宙電源市場(軌道別)

- 衛星向け宇宙電源市場(衛星種別)

第3章 製品

- 製品のセグメンテーション

- 製品のサマリー

- 宇宙電源市場(部品別)

第4章 地域

- 地域のサマリー

- 北米

- 欧州

- アジア太平洋

- その他の地域

第5章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- 主要な宇宙電力供給プログラム

- 宇宙電力供給プログラムにおける主要な技術優先

- 宇宙電力供給市場におけるプライムコントラクターの情勢

- 企業プロファイル

- 宇宙太陽光発電ソリューション

- 宇宙バッテリー電源ソリューション

- その他の主要参入企業

第6章 調査手法

List of Figures

- Figure 1: Space Power Supply Market Scenarios, 2024, 2029, 2034

- Figure 2: Space Power Supply Market (by Region), $Thousand, 2024, 2029, and 2034

- Figure 3: Space Power Supply Market (by Application), $Thousand, 2024, 2029, and 2034

- Figure 4: Space Power Supply Market (by Orbit), $Thousand, 2024, 2029, and 2034

- Figure 5: Space Power Supply Market (by Satellite Type), $Thousand, 2024, 2029, and 2034

- Figure 6: Space Power Supply Market (by Component Type), $Thousand, 2024, 2029, and 2034

- Figure 7: Space Power Supply Market, Recent Developments

- Figure 8: Supply Chain of Space Power Supply Market

- Figure 9: Space Power Supply Market (by Country), January 2022-December 2024

- Figure 10: Space Power Supply Market (by Company), January 2022-December 2024

- Figure 11: Estimated Satellites in Space

- Figure 12: Specifications to be Considered when Choosing Batteries for Space Flight Applications

- Figure 13: U.S. Space Power Supply Market, $Thousand, 2023-2034

- Figure 14: Canada Space Power Supply Market, $Thousand, 2023-2034

- Figure 15: Germany Space Power Supply Market, $Thousand, 2023-2034

- Figure 16: France Space Power Supply Market, $Thousand, 2024-2034

- Figure 17: U.K. Space Power Supply Market, $Thousand, 2024-2034

- Figure 18: Russia Space Power Supply Market, $Thousand, 2024-2034

- Figure 19: Rest-of-Europe Space Power Supply Market, $Thousand, 2024-2034

- Figure 20: China Space Power Supply Market, $Thousand, 2024-2034

- Figure 21: Japan Space Power Supply Market, $Thousand, 2024-2034

- Figure 22: India Space Power Supply Market, $Thousand, 2024-2034

- Figure 23: Rest-of-Asia-Pacific Space Power Supply Market, $Thousand, 2024-2034

- Figure 24: Strategic Initiatives, 2022-2025

- Figure 25: Share of Strategic Initiatives, 2022-2025

- Figure 26: Data Triangulation

- Figure 27: Top-Down and Bottom-Up Approach

- Figure 28: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Regions

- Table 3: Trends: Overview

- Table 4: Impact Analysis of Market Navigating Factors, 2024-2034

- Table 5: Global Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 6: Global Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 7: Global Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 8: Global Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 9: Types Of Batteries

- Table 10: Solar Cells Product Table

- Table 11: Solar Array/Panel Products

- Table 12: Battery (Pack) Product Table

- Table 13: Power Management and Distribution System Products

- Table 15: North America Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 16: North America Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 17: North America Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 18: North America Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 19: U.S. Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 20: U.S. Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 21: U.S. Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 22: U.S. Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 23: Canada Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 24: Canada Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 25: Canada Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 26: Canada Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 27: Europe Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 28: Europe Space Power Supply Market for Satellite (by Orbit), $Thousand, 2023-2034

- Table 29: Europe Space Power Supply Market for Satellite (by Satellite Type), $Thousand, 2023-2034

- Table 30: Europe Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 31: Germany Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 32: Germany Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 33: Germany Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 34: Germany Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 35: France Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 36: France Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 37: France Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 38: France Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 39: U.K. Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 40: U.K. Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 41: U.K. Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 42: U.K. Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 43: Russia Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 44: Russia Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 45: Russia Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 46: Russia Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 47: Rest-of-Europe Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 48: Rest-of-Europe Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 49: Rest-of-Europe Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 50: Rest-of-Europe Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 51: Asia-Pacific Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 52: Asia-Pacific Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 53: Asia-Pacific Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 54: Asia-Pacific Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 55: China Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 56: China Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 57: China Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 58: China Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 59: Japan Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 60: Japan Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 61: Japan Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 62: Japan Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 63: India Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 64: India Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 65: India Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 66: India Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 67: Rest-of-Asia-Pacific Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 68: Rest-of-Asia-Pacific Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 69: Rest-of-Asia-Pacific Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 70: Rest-of-Asia-Pacific Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 71: Rest-of-the-World Space Power Supply Market (by Application), $Thousand, 2023-2034

- Table 72: Rest-of-the-World Space Power Supply Market for Satellites (by Orbit), $Thousand, 2023-2034

- Table 73: Rest-of-the-World Space Power Supply Market for Satellites (by Satellite Type), $Thousand, 2023-2034

- Table 74: Rest-of-the-World Space Power Supply Market (by Component Type), $Thousand, 2023-2034

- Table 75: Market Share, 2023

- Table 76: Key Space Power Supply Programs

- Table 77: Key Technologies for Space Power Supply Programs (Ongoing, Future)

Introduction of Space Power Supply Market

The space power supply market includes a broad range of solutions, such as solar power systems, batteries, energy storage devices, and power management technologies, all crucial for space applications. This market has been driven by increasing demand for more efficient and reliable power sources for satellites, spacecraft, and space stations. Innovations in space power technologies, including advanced solar panels and high-capacity energy storage systems, are responding to the growing need for sustainable energy solutions in space exploration. The space power supply market is highly competitive, with key players such as Airbus and Rocket Lab USA leading the industry. Additionally, the growing emphasis on cost-efficiency, sustainability, and long-duration space missions is shaping consumer and industry preferences, prompting companies to invest in cutting-edge technologies and innovative power solutions. This dynamic market is continuously evolving to meet the demands of space exploration and satellite operations.

Market Introduction

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $9,449,920.5 Thousand |

| 2034 Forecast | $14,786,995.7 Thousand |

| CAGR | 4.58% |

The space power supply market encompasses various solutions, including solar power systems, batteries, energy storage devices, and power management technologies, all essential for space missions. This market has been expanding as demand grows for efficient and reliable power sources for satellites, spacecraft, and space stations. Innovations such as advanced solar panels and high-capacity energy storage solutions have been gaining traction, providing sustainable power for long-duration space exploration. Leading companies such as Airbus, Boeing, and Lockheed Martin dominate the market, continually advancing their technologies to remain competitive. Additionally, increasing focus on sustainability and cost-effectiveness has been influencing the market, prompting investment in eco-friendly power solutions and energy-efficient systems. The space power supply market is evolving rapidly to meet the growing needs of space exploration and satellite operations.

Industrial Impact

The space power supply market has a significant industrial impact, driving considerable economic activity and employment in the aerospace and energy sectors. Major players such as Airbus, Boeing, and Lockheed Martin invest heavily in research, manufacturing, and distribution, supporting a wide network of suppliers, contractors, and service providers. The demand for advanced technologies such as solar panels, batteries, and power management systems fosters innovation in energy storage and power efficiency, benefiting electronics, materials science, and renewable energy industries.

The space power supply market also supports the growth of related sectors, including the satellite industry, where power solutions are critical for long-duration space missions and satellite operations. Innovations in space power systems lead to advancements in energy efficiency, which influence global energy markets and the development of cutting-edge technologies. The increasing focus on sustainability is prompting investments in renewable energy solutions and more efficient power management, reducing the environmental impact of space missions.

Moreover, the market's emphasis on supporting space exploration and communication infrastructure drives collaborations with space agencies, research institutions, and private companies, further enhancing technological advancements and creating a more sustainable space economy. Overall, the space power supply market is a key contributor to technological innovation, economic growth, and the future of space exploration.

Market Segmentation:

Segmentation 1: by Application

- Satellites

- Space Exploration and Deep-Space Missions

- Land

- Rover

- Orbiter

- Space Stations and Habitats

- Launch Vehicles

- Small and Medium-Lift Launch Vehicles

- Heavy and Super Heavy-Lift Launch Vehicles

Satellites to Dominate the Space Power Supply Market (by Application)

The space power supply market, by application, is predominantly driven by satellites. The satellite segment was valued at $8,480,479.7 thousand in 2023 and is projected to reach $13,191,524.0 thousand by 2034. This segment has been experiencing significant growth due to the increasing demand for more efficient and reliable power solutions for both commercial and governmental satellite operations. Additionally, advancements in solar power systems, energy storage technologies, and power management solutions have been further fueling this growth, supporting longer-duration missions and enhancing satellite performance.

Segmentation 2: by Satellite Orbit

- Low Earth Orbit (LEO) Satellites

- Geostationary Earth Orbit (GEO) Satellites

- Medium Earth Orbit (MEO) Satellites

- Beyond Earth Orbit Satellites

Segmentation 3: by Satellite Type

- Small Satellites (CubeSats, NanoSats) (1-10 kW)

- Medium Satellites (10-15 kW)

- Large Satellites (Above 15 kW)

Segmentation 4: by Component Type

- Solar Power Systems

- Solar Cells

- Solar Array/Panel

- Battery Systems

- Power Management and Distribution (PMAD) Systems

Segmentation 5: by Region

- North America

- Europe

- Asia-Pacific

- Rest-of-the-World

Recent Developments in the Space Power Supply Market

- 5N Plus Inc. has announced that its subsidiary, AZUR SPACE Solar Power GmbH, successfully completed its 2024 production capacity expansion, increasing output by 35%, surpassing the original 30% target. By the end of 2025, AZUR plans to further boost solar cell production by an additional 30%, with minimal extra investment. This expansion will help meet the rising demand for space power supply solutions, enhancing AZUR's role as a key player in the space power supply market, particularly in advanced solar cell technology.

- On June 11th, 2024, Rocket Lab announced that it had signed a preliminary agreement to receive up to $23.9 million in funding under the CHIPS Act to expand the production of space-grade solar cells. This investment will enhance Rocket Lab's manufacturing capacity for semiconductors used in spacecraft and satellites, creating over 100 new jobs in Albuquerque, New Mexico. The space-grade solar cells, crucial for national defense and space exploration programs such as NASA's Artemis and the James Webb Space Telescope, position Rocket Lab as a key player in the space power supply market.

- On January 31, 2022, Ascent Solar Technologies announced that it was selected by Momentus, Inc. to produce flexible CIGS photovoltaic (PV) modules for a demonstration deployable PV array. These modules will provide power to the Vigoride spacecraft, scheduled for a Low Earth Orbit flight in 2022. This collaboration highlights Ascent Solar's role in advancing space power supply solutions with lightweight, flexible PV technology for space applications.

- EaglePicher announced that its batteries are critical to NASA's Artemis I mission, providing power for both the Orion spacecraft crew module and the Space Launch System (SLS) flight termination system. The company supplied two 32-volt, 10 Ah silver-zinc batteries to ensure flight safety by powering the SLS's flight termination system, which turns off propulsion in case of an emergency. This collaboration highlights EaglePicher's role in advancing battery technology for space power supply and supporting deep space exploration missions.

How can this report add value to an organization?

Growth/Marketing Strategy: The space power supply market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been synergistic activities to strengthen their position in the space power supply market.

Competitive Strategy: Key players in the space power supply market have been analyzed and profiled in the study of space power supply products. Moreover, a detailed competitive benchmarking of the players operating in the space power supply market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Methodology: The research methodology design adopted for this specific study includes a mix of data collected from primary and secondary data sources. Both primary resources (key players, market leaders, and in-house experts) and secondary research (a host of paid and unpaid databases), along with analytical tools, have been employed to build the predictive and forecast models.

Data and validation have been taken into consideration from both primary sources as well as secondary sources.

Key Considerations and Assumptions in Market Engineering and Validation

- Detailed secondary research has been done to ensure maximum coverage of manufacturers/suppliers operational in a country.

- To a certain extent, exact revenue information has been extracted for each company from secondary sources and databases. Revenues specific to product/service/technology were then estimated based on fact-based proxy indicators as well as primary inputs.

- The average selling price (ASP) has been calculated using the weighted average method based on the classification.

- The currency conversion rate has been taken from the historical exchange rate of Oanda and/or other relevant websites.

- Any economic downturn in the future has not been taken into consideration for the market estimation and forecast.

- The base currency considered for the market analysis is US$. Currencies other than the US$ have been converted to the US$ for all statistical calculations, considering the average conversion rate for that particular year.

- The term "product" in this document may refer to "service" or "technology" as and where relevant.

- The term "manufacturers/suppliers" may refer to "service providers" or "technology providers" as and where relevant.

Primary Research

The primary sources involve industry experts from the space power supply industry, including space power supply product providers. Respondents such as CEOs, vice presidents, marketing directors, and technology and innovation directors have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.

Secondary Research

This study involves the usage of extensive secondary research, company websites, directories, and annual reports. It also makes use of databases, such as Businessweek and others, to collect effective and useful information for a market-oriented, technical, commercial, and extensive study of the global market. In addition to the data sources, the study has been undertaken with the help of other data sources and websites.

Secondary research was done to obtain critical information about the industry's value chain, the market's monetary chain, revenue models, the total pool of key players, and the current and potential use cases and applications.

Key Market Players and Competition Synopsis

Profiled companies have been selected based on thorough secondary research, which includes analyzing company coverage, product portfolio, market penetration, and insights gathered from primary experts.

The space power supply market is characterized by a mix of established industry leaders and emerging innovators. Major companies such as Airbus and EnerSys are prominent players that offer advanced power solutions for space applications. These companies maintain their dominance by consistently investing in research and development driving technological advancements in solar power systems, batteries, and power management solutions for space missions. Emerging startups and niche players are also making notable strides in the space power supply market, focusing on cutting-edge technologies such as micro-power systems and more efficient energy storage solutions.

Some prominent names established in this market are:

- AZUR SPACE Solar Power GmbH

- Spectrolab

- Rocket Lab USA

- SHARP CORPORATION

- Shanghai Institute of Space Power-Sources

- MicroLink Devices, Inc.

- Mitsubishi Electric Corporation

- Bharat Electronics Limited (BEL)

- Ascent Solar Technologies, Inc.

- CESI S.p.A.

- EaglePicher Technologies

- S.A.B. Aerospace Srl

- AIRBUS

- Saft

- EnerSys

Table of Contents

Executive Summary

Scope and Definition

1 Market: Industry Outlook

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Advancements in Multi-Junction Solar Cells for Space Applications

- 1.1.1.1 Innovations in Multi-Junction Silicon Solar Cells for Space Applications

- 1.1.2 Development of Thin-Film and Flexible Solar Cells for Satellites

- 1.1.3 Efficiency Improvements and Power Density Advancements in Solar Panels

- 1.1.4 Innovations in Space-Based Solar Power (SBSP) Systems for Long-duration Missions

- 1.1.1 Advancements in Multi-Junction Solar Cells for Space Applications

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.3 Patent Analysis

- 1.3.1 Patent Filing Trend (by Country)

- 1.3.2 Patent Filing Trend (by Company)

- 1.4 Regulatory Landscape and Industry Initiatives

- 1.4.1 Regulations and Policies

- 1.4.2 Impact Analysis for Key Global Events

- 1.4.2.1 U.S. Trade Tariffs and Global Economic Impact

- 1.5 Market Dynamics Overview

- 1.5.1 Market Drivers

- 1.5.1.1 Growing Satellite Deployments and Mega-Constellations (e.g., Starlink, Amazon Kuiper)

- 1.5.1.2 Rising Investments in Space-Based Solar Power Systems (SBSP)

- 1.5.1.3 Increased Demand for LEO, GEO, and MEO Satellites

- 1.5.2 Market Restraints

- 1.5.2.1 High Production Costs of Solar Power Systems for Space

- 1.5.2.2 Durability and Reliability of Solar Cells in Harsh Space Environments

- 1.5.2.3 Regulatory and Compliance Challenges for Solar-Based Power Systems

- 1.5.3 Market Opportunities

- 1.5.3.1 Impact of Mega-Constellations on Solar Cell Demand

- 1.5.3.2 Expansion of CubeSats and Small Satellites Market and Their Power Needs

- 1.5.3.3 Growing Role of Solar Power in Deep Space Exploration Missions

- 1.5.3.4 Strategic Collaborations Between Governments and Private Space Companies

- 1.5.1 Market Drivers

- 1.6 Impact of Mega-Constellations on Solar Power Demand and Comparison with Traditional Satellite Deployments

2 Applications

- 2.1 Application Segmentation

- 2.2 Application Summary

- 2.3 Space Power Supply Market (by Application)

- 2.3.1 Satellites

- 2.3.2 Space Exploration and Deep-Space Missions

- 2.3.2.1 Land

- 2.3.2.2 Rover

- 2.3.2.3 Orbiter

- 2.3.3 Space Stations and Habitats

- 2.3.4 Launch Vehicles

- 2.3.4.1 Small and Medium-Lift Launch Vehicles

- 2.3.4.2 Heavy and Super Heavy-Lift Launch Vehicles

- 2.4 Space Power Supply Market for Satellites (by Orbit)

- 2.4.1 Low Earth Orbit (LEO) Satellites

- 2.4.2 Geostationary Earth Orbit (GEO) Satellites

- 2.4.3 Medium Earth Orbit (MEO) Satellites

- 2.4.4 Beyond Earth Orbit Satellites

- 2.5 Space Power Supply Market for Satellites (by Satellite Type)

- 2.5.1 Small Satellites (CubeSats, NanoSats) (1-10 kW)

- 2.5.2 Medium Satellites (10-15 kW)

- 2.5.3 Large Satellites (Above 15 kW)

3 Products

- 3.1 Product Segmentation

- 3.2 Product Summary

- 3.3 Space Power Supply Market (by Component Type)

- 3.3.1 Solar Power Systems

- 3.3.1.1 Solar Cells

- 3.3.1.2 Solar Array/Panel

- 3.3.2 Battery Systems

- 3.3.3 Power Management and Distribution (PMAD) Systems

- 3.3.1 Solar Power Systems

4 Regions

- 4.1 Regional Summary

- 4.2 North America

- 4.2.1 Markets

- 4.2.1.1 Key Market Participants in North America

- 4.2.1.2 Business Drivers

- 4.2.1.3 Business Challenges

- 4.2.2 Application

- 4.2.3 Product

- 4.2.4 North America (by Country)

- 4.2.4.1 U.S.

- 4.2.4.1.1 Market (By Application)

- 4.2.4.1.2 Market (By Product)

- 4.2.4.2 Canada

- 4.2.4.2.1 Market (By Application)

- 4.2.4.2.2 Market (By Product)

- 4.2.4.1 U.S.

- 4.2.1 Markets

- 4.3 Europe

- 4.3.1 Markets

- 4.3.1.1 Key Market Participants in Europe

- 4.3.1.2 Business Drivers

- 4.3.1.3 Business Challenges

- 4.3.2 Application

- 4.3.3 Product

- 4.3.4 Europe (by Country)

- 4.3.4.1 Germany

- 4.3.4.1.1 Market (By Application)

- 4.3.4.1.2 Market (By Product)

- 4.3.4.2 France

- 4.3.4.2.1 Market (By Application)

- 4.3.4.2.2 Market (By Product)

- 4.3.4.3 U.K.

- 4.3.4.3.1 Market (By Application)

- 4.3.4.3.2 Market (By Product)

- 4.3.4.4 Russia

- 4.3.4.4.1 Market (By Application)

- 4.3.4.4.2 Market (By Product)

- 4.3.4.5 Rest-of-Europe

- 4.3.4.5.1 Market (By Application)

- 4.3.4.5.2 Market (By Product)

- 4.3.4.1 Germany

- 4.3.1 Markets

- 4.4 Asia-Pacific

- 4.4.1 Markets

- 4.4.1.1 Key Market Participants in Asia-Pacific

- 4.4.1.2 Business Drivers

- 4.4.1.3 Business Challenges

- 4.4.2 Application

- 4.4.3 Product

- 4.4.4 Asia-Pacific (by Country)

- 4.4.4.1 China

- 4.4.4.1.1 Market (By Application)

- 4.4.4.1.2 Market (By Product)

- 4.4.4.2 Japan

- 4.4.4.2.1 Market (By Application)

- 4.4.4.2.2 Market (By Product)

- 4.4.4.3 India

- 4.4.4.3.1 Market (By Application)

- 4.4.4.3.2 Market (By Product)

- 4.4.4.4 Rest-of-Asia-Pacific

- 4.4.4.4.1 Market (By Application)

- 4.4.4.4.2 Market (By Product)

- 4.4.4.1 China

- 4.4.1 Markets

- 4.5 Rest-of-the-World

- 4.5.1 Markets

- 4.5.1.1 Key Market Participants in Rest-of-the-World

- 4.5.1.2 Business Drivers

- 4.5.1.3 Business Challenges

- 4.5.2 Application

- 4.5.3 Product

- 4.5.1 Markets

5 Markets - Competitive Benchmarking & Company Profiles

- 5.1 Next Frontiers

- 5.2 Geographic Assessment

- 5.3 Key Space Power Supply Programs

- 5.4 Key Technology Preferences for Space Power Supply Programs

- 5.5 Prime Contractor Landscape for Space Power Supply Market

- 5.6 Company Profiles

- 5.6.1 Space Solar Power Solutions

- 5.6.1.1 AZUR SPACE Solar Power GmbH

- 5.6.1.1.1 Overview

- 5.6.1.1.2 Top Products/Product Portfolio

- 5.6.1.1.3 Top Competitors

- 5.6.1.1.4 Target Customers

- 5.6.1.1.5 Key Personnel

- 5.6.1.1.6 Analyst View

- 5.6.1.1.7 Market Share, 2023

- 5.6.1.2 Spectrolab

- 5.6.1.2.1 Overview

- 5.6.1.2.2 Top Products/Product Portfolio

- 5.6.1.2.3 Top Competitors

- 5.6.1.2.4 Target Customers

- 5.6.1.2.5 Key Personnel

- 5.6.1.2.6 Analyst View

- 5.6.1.2.7 Market Share, 2023

- 5.6.1.3 Rocket Lab USA

- 5.6.1.3.1 Overview

- 5.6.1.3.2 Top Products/Product Portfolio

- 5.6.1.3.3 Top Competitors

- 5.6.1.3.4 Target Customers

- 5.6.1.3.5 Key Personnel

- 5.6.1.3.6 Analyst View

- 5.6.1.3.7 Market Share, 2024

- 5.6.1.4 SHARP CORPORATION

- 5.6.1.4.1 Overview

- 5.6.1.4.2 Top Products/Product Portfolio

- 5.6.1.4.3 Top Competitors

- 5.6.1.4.4 Target Customers

- 5.6.1.4.5 Key Personnel

- 5.6.1.4.6 Analyst View

- 5.6.1.4.7 Market Share, 2023

- 5.6.1.5 Shanghai Institute of Space Power-Sources

- 5.6.1.5.1 Overview

- 5.6.1.5.2 Top Products/Product Portfolio

- 5.6.1.5.3 Top Competitors

- 5.6.1.5.4 Target Customers

- 5.6.1.5.5 Key Personnel

- 5.6.1.5.6 Analyst View

- 5.6.1.5.7 Market Share, 2023

- 5.6.1.6 MicroLink Devices, Inc.

- 5.6.1.6.1 Overview

- 5.6.1.6.2 Top Products/Product Portfolio

- 5.6.1.6.3 Top Competitors

- 5.6.1.6.4 Target Customers

- 5.6.1.6.5 Key Personnel

- 5.6.1.6.6 Analyst View

- 5.6.1.6.7 Market Share, 2023

- 5.6.1.7 Mitsubishi Electric Corporation

- 5.6.1.7.1 Overview

- 5.6.1.7.2 Top Products/Product Portfolio

- 5.6.1.7.3 Top Competitors

- 5.6.1.7.4 Target Customers

- 5.6.1.7.5 Key Personnel

- 5.6.1.7.6 Analyst View

- 5.6.1.7.7 Market Share, 2023

- 5.6.1.8 Bharat Electronics Limited (BEL)

- 5.6.1.8.1 Overview

- 5.6.1.8.2 Top Products/Product Portfolio

- 5.6.1.8.3 Top Competitors

- 5.6.1.8.4 Target Customers

- 5.6.1.8.5 Key Personnel

- 5.6.1.8.6 Analyst View

- 5.6.1.8.7 Market Share, 2023

- 5.6.1.9 Ascent Solar Technologies, Inc.

- 5.6.1.9.1 Overview

- 5.6.1.9.2 Top Products/Product Portfolio

- 5.6.1.9.3 Top Competitors

- 5.6.1.9.4 Target Customers

- 5.6.1.9.5 Key Personnel

- 5.6.1.9.6 Analyst View

- 5.6.1.9.7 Market Share, 2023

- 5.6.1.10 CESI S.p.A.

- 5.6.1.10.1 Overview

- 5.6.1.10.2 Top Products/Product Portfolio

- 5.6.1.10.3 Top Competitors

- 5.6.1.10.4 Target Customers

- 5.6.1.10.5 Key Personnel

- 5.6.1.10.6 Analyst View

- 5.6.1.10.7 Market Share, 2023

- 5.6.1.1 AZUR SPACE Solar Power GmbH

- 5.6.2 Space Battery Power Solutions

- 5.6.2.1 EaglePicher Technologies

- 5.6.2.1.1 Overview

- 5.6.2.1.2 Top Products/Product Portfolio

- 5.6.2.1.3 Top Competitors

- 5.6.2.1.4 Target Customers

- 5.6.2.1.5 Key Personnel

- 5.6.2.1.6 Analyst View

- 5.6.2.1.7 Market Share, 2023

- 5.6.2.2 S.A.B. Aerospace Srl

- 5.6.2.2.1 Overview

- 5.6.2.2.2 Top Products/Product Portfolio

- 5.6.2.2.3 Top Competitors

- 5.6.2.2.4 Target Customers

- 5.6.2.2.5 Key Personnel

- 5.6.2.2.6 Analyst View

- 5.6.2.2.7 Market Share, 2023

- 5.6.2.3 AIRBUS

- 5.6.2.3.1 Overview

- 5.6.2.3.2 Top Products/Product Portfolio

- 5.6.2.3.3 Top Competitors

- 5.6.2.3.4 Target Customers

- 5.6.2.3.5 Key Personnel

- 5.6.2.3.6 Analyst View

- 5.6.2.3.7 Market Share, 2023

- 5.6.2.4 Saft

- 5.6.2.4.1 Overview

- 5.6.2.4.2 Top Products/Product Portfolio

- 5.6.2.4.3 Top Competitors

- 5.6.2.4.4 Target Customers

- 5.6.2.4.5 Key Personnel

- 5.6.2.4.6 Analyst View

- 5.6.2.4.7 Market Share, 2023

- 5.6.2.5 EnerSys

- 5.6.2.5.1 Overview

- 5.6.2.5.2 Top Products/Product Portfolio

- 5.6.2.5.3 Top Competitors

- 5.6.2.5.4 Target Customers

- 5.6.2.5.5 Key Personnel

- 5.6.2.5.6 Analyst View

- 5.6.2.5.7 Market Share, 2023

- 5.6.2.1 EaglePicher Technologies

- 5.6.3 Other Key Players

- 5.6.1 Space Solar Power Solutions

6 Research Methodology

- 6.1 Data Sources

- 6.1.1 Primary Data Sources

- 6.1.2 Secondary Data Sources

- 6.1.3 Data Triangulation

- 6.2 Market Estimation and Forecast