|

|

市場調査レポート

商品コード

1707992

欧州の直接空気回収技術(DAC)市場:用途別、エンドユーザー別、技術別、国別 - 分析と予測(2024年~2034年)Europe Direct Air Capture (DAC) Market: Focus on Application, End User, Technology, and Country - Analysis and Forecast, 2024-2034 |

||||||

カスタマイズ可能

|

|||||||

| 欧州の直接空気回収技術(DAC)市場:用途別、エンドユーザー別、技術別、国別 - 分析と予測(2024年~2034年) |

|

出版日: 2025年04月18日

発行: BIS Research

ページ情報: 英文 75 Pages

納期: 1~5営業日

|

全表示

- 概要

- 図表

- 目次

欧州の直接空気回収技術(DAC)の市場規模は、2024年の60万米ドルから2034年には45億3,890万米ドルに達し、予測期間の2024年~2034年のCAGRは142.98%となると予測されています。

この地域の厳しいネットゼロの野心と気候変動対策への献身が、欧州の直接空気回収技術(DAC)市場を牽引しています。液体溶媒や固体吸着剤などの新しいDAC技術は拡張性と効率を高めており、炭素利用(EOR、合成燃料など)との統合は新たな収益源を生み出しています。

市場が乗り越えなければならない地域的な障害には、高いセットアップ・運転コスト、エネルギー集約的なCO2回収、炭素の貯蔵・利用のためのインフラ不足などがあります。とはいえ、こうした障害は、EUの資金援助拡大、再生可能エネルギーの統合、欧州の大手業界関係者の参入拡大によって解決されつつあります。

| 主要市場統計 | |

|---|---|

| 予測期間 | 2024年~2034年 |

| 2024年の評価 | 60万米ドル |

| 2034年予測 | 45億3,890万米ドル |

| CAGR | 142.98% |

DACは、技術の進歩とコストの低下により、企業が排出量を相殺し、循環型炭素経済を支援できるようになるため、欧州の脱炭素化戦略にとって極めて重要な要素となりつつあります。

欧州における直接空気回収技術(DAC)市場は、気候変動と闘い、積極的なネットゼロ排出目標を達成するための地域計画の重要な一部となりつつあります。周囲の空気から積極的に炭素を吸収するDAC技術は、大気中のCO2を削減し、循環型炭素経済を支える実行可能な方法を提示します。欧州の厳しい環境規制、強力な法的枠組み、クリーン技術開発への大規模な政府投資の結果、DACシステムへの投資が増加しています。

技術の進歩、特に効率的な固体吸着剤と液体溶媒の進歩は、DACソリューションの性能とスケーラビリティを大幅に向上させています。再生可能エネルギーの統合がますます普及するにつれて、DACプロセスのエネルギー集約的な性質が緩和され、実現可能性がさらに高まっています。欧州の大手企業や研究機関は、DACの応用を積極的に模索し、この分野全体の技術革新と協力を促進しています。

資本コストや運転コストの高さといった課題にもかかわらず、炭素除去ソリューションに対する需要の高まりと持続可能性へのコミットメントの高まりが、市場の成長を促進すると予想されます。DACシステムがより広範な炭素利用戦略に統合されることで、市場は利害関係者にとって、欧州における長期的な脱炭素化への取り組みを支援する環境に優しい技術に投資する大きな機会を提供しています。

野心的な気候変動目標とネットゼロの目標が、欧州の直接空気回収技術(DAC)分野の成長を促進しています。DAC技術の急速な開発、合成燃料のような炭素利用の用途との統合の強化、政府および民間セクターの投資の増加は、主要な動向の一部です。クリーン技術への資金提供の増加、有利なEU法、CO2濃度の上昇が重要な動機となっています。高い資本・運転費用、CO2を貯蔵するためのインフラの不足、DAC手順のエネルギー集約的な性質は、市場の障害のひとつでもあります。この分野で広く採用され、長期的に市場が存続するためには、これらの障害を取り除かなければなりません。

当レポートは、欧州の直接空気回収技術市場における包括的な製品・イノベーション戦略を提供し、市場参入の機会、技術的進歩、持続可能な実践にスポットを当てています。組織が炭素削減目標を達成し、様々なセクターで高まる直接空気回収技術の需要を活用できるよう、実用的な洞察を提供します。

当レポートでは、欧州の直接空気回収市場に特化した強固な成長・マーケティング戦略を概説しています。ニッチ市場セグメントを特定し、競合優位性を確立し、市場シェアと財務実績を最適化する革新的なマーケティング施策を実施するための的を絞ったアプローチを強調しています。これらの戦略的提言を活用することで、企業は市場でのプレゼンスを強化し、新たな機会を開拓し、効率的に収益成長を推進することができます。

当レポートは、欧州の直接空気回収技術市場向けに設計された強力な競争戦略を策定しています。主要市場参入企業を評価し、差別化戦術を提案し、競争力を維持するための指針を提供します。これらの戦略的指示に従うことで、企業は競合他社に対して効果的なポジショニングをとることができ、急速に進化する市場において長期的な成功と収益性を確保することができます。

欧州の直接空気回収技術市場でプロファイルされている企業は、主要な専門家から収集した情報に基づいて選択されており、企業のカバレッジ、プロジェクトポートフォリオ、市場浸透度を分析しています。

当レポートでは、欧州の直接空気回収技術(DAC)市場について調査し、市場の概要とともに、用途別、エンドユーザー別、技術別、国別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

エグゼクティブサマリー

第1章 市場

- 動向:現状と将来への影響評価

- サプライチェーンの概要

- 研究開発レビュー

- 規制状況

- 資金調達分析

- ステークホルダー分析

- 主要な世界的出来事の影響分析

- 市場力学の概要

- 技術経済評価

第2章 地域

- 地域サマリー

- 欧州

- 地域概要

- 市場成長促進要因

- 市場成長抑制要因

- 用途

- 製品

- 欧州(国別)

第3章 市場-競合ベンチマーキングと企業プロファイル

- 今後の見通し

- 地理的評価

- Climeworks

- Soletair Power

- Avnos, Inc.

- Skytree

- Carbyon

第4章 調査手法

List of Figures

- Figure 1: Europe Direct Air Capture (DAC) Market, $Million, 2024, 2027, and 2034

- Figure 2: Direct Air Capture (DAC) Market (by Region), $Million, 2023, 2027, and 2034

- Figure 3: Europe Direct Air Capture (DAC) Market (by Application), $Million, 2023, 2027, and 2034

- Figure 4: Europe Direct Air Capture (DAC) Market (by End User), $Million, 2023, 2027, and 2034

- Figure 5: Europe Direct Air Capture (DAC) Market (by Technology), $Million, 2023, 2027, and 2034

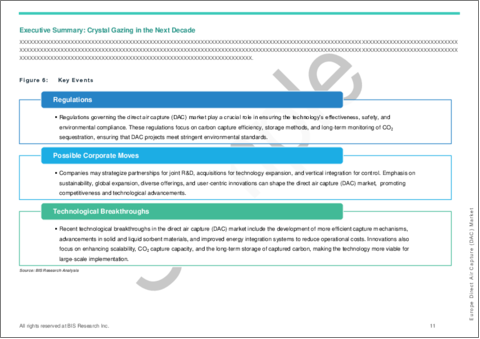

- Figure 6: Key Events

- Figure 7: Supply Chain and Risks within the Supply Chain

- Figure 8: Value Chain Analysis

- Figure 9: Patent Analysis (by Country), January 2021-December 2024

- Figure 10: Patent Analysis (by Company), January 2021-December 2024

- Figure 11: Investment in All Carbon Dioxide Removal Technologies, 2023

- Figure 12: Impact Analysis of Market Navigating Factors, 2023-2034

- Figure 13: Number of Companies with Net Zero Targets (by Year and Sector)

- Figure 14: Investment in All Carbon Dioxide Removal (by Category), 2023

- Figure 15: Status of CO2 Storage Infrastructure in Development vs. Planned Capture Capacity (by Region), 2023

- Figure 16: Indicative Cost and Scale Evolution of Carbon Dioxide Removal (CDR), in 2023, $/tCDR

- Figure 17: Cost Analysis of Direct Air Capture (DAC)

- Figure 18: Estimated Breakeven Costs for DACCS

- Figure 19: Iceland Direct Air Capture (DAC) Market, $Million, 2023-2034

- Figure 20: Norway Direct Air Capture (DAC) Market, $Million, 2026-2034

- Figure 21: U.K. Direct Air Capture (DAC) Market, $Million, 2026-2034

- Figure 22: Strategic Initiatives, January 2021-December 2024

- Figure 23: Share of Strategic Initiatives, 2023

- Figure 24: Data Triangulation

- Figure 25: Top-Down and Bottom-Up Approach

- Figure 26: Assumptions and Limitations

List of Tables

- Table 1: Market Snapshot

- Table 2: Opportunities across Region

- Table 3: Competitive Landscape Snapshot

- Table 4: Trends Overview

- Table 5: Major Programs/Initiatives in Direct Air Capture (DAC) Market

- Table 6: Startups and Their Funding

- Table 7: Policy Instruments for DAC Development and Deployment

- Table 8: Comparative Analysis and Key Features of the Main CDR Approaches and Technologies

- Table 9: Direct Air Capture (DAC) Market (by Region), $Million, 2023-2034

- Table 10: Direct Air Capture (DAC) Market (by Region), Tons CO2/Year, 2023-2034

- Table 11: Some DAC Projects with Public Funding in Europe

- Table 12: Europe Direct Air Capture (DAC) Market (by Application), $Million, 2023-2034

- Table 13: Europe Direct Air Capture (DAC) Market (by Application), Tons CO2/Year, 2023-2034

- Table 14: Europe Direct Air Capture (DAC) Market (by End User), $Million, 2023-2034

- Table 15: Europe Direct Air Capture (DAC) Market (by End User), Tons CO2/Year, 2023-2034

- Table 16: Europe Direct Air Capture (DAC) Market (by Technology), $Million, 2023-2034

- Table 17: Europe Direct Air Capture (DAC) Market (by Technology), Tons CO2/Year, 2023-2034

- Table 18: Iceland Direct Air Capture (DAC) Market (by Application), $Million, 2023-2034

- Table 19: Iceland Direct Air Capture (DAC) Market (by Application), Tons CO2/Year, 2023-2034

- Table 20: Iceland Direct Air Capture (DAC) Market (by End User), $Million, 2023-2034

- Table 21: Iceland Direct Air Capture (DAC) Market (by End User), Tons CO2/Year, 2023-2034

- Table 22: Iceland Direct Air Capture (DAC) Market (by Technology), $Million, 2023-2034

- Table 23: Iceland Direct Air Capture (DAC) Market (by Technology), Tons CO2/Year, 2023-2034

- Table 24: Norway Direct Air Capture (DAC) Market (by Application), $Million, 2026-2034

- Table 25: Norway Direct Air Capture (DAC) Market (by Application), Tons CO2/Year, 2026-2034

- Table 26: Norway Direct Air Capture (DAC) Market (by End User), $Million, 2026-2034

- Table 27: Norway Direct Air Capture (DAC) Market (by End User), Tons CO2/Year, 2026-2034

- Table 28: Norway Direct Air Capture (DAC) Market (by Technology), $Million, 2026-2034

- Table 29: Norway Direct Air Capture (DAC) Market (by Technology), Tons CO2/Year, 2026-2034

- Table 30: U.K. Direct Air Capture (DAC) Market (by Application), $Million, 2026-2034

- Table 31: U.K. Direct Air Capture (DAC) Market (by Application), Tons CO2/Year, 2026-2034

- Table 32: U.K. Direct Air Capture (DAC) Market (by End User), $Million, 2026-2034

- Table 33: U.K. Direct Air Capture (DAC) Market (by End User), Tons CO2/Year, 2026-2034

- Table 34: U.K. Direct Air Capture (DAC) Market (by Technology), $Million, 2026-2034

- Table 35: U.K. Direct Air Capture (DAC) Market (by Technology), Tons CO2/Year, 2026-2034

- Table 36: Market Share of Companies with Operating Direct Air Capture Plants, 2023

Introduction to Europe Direct Air Capture (DAC) Market

The Europe direct air capture (DAC) market is projected to reach $4,538.9 million by 2034 from $0.6 million in 2024, growing at a CAGR of 142.98% during the forecast period 2024-2034. The region's stringent net-zero ambitions and dedication to climate action are driving the direct air capture (DAC) market in Europe. New DAC technologies, such as liquid solvents and solid sorbents, are increasing scalability and efficiency, and their integration with carbon utilisation (e.g., EOR, synthetic fuels) creates new revenue streams.

Regional obstacles that the market must overcome include high setup and operation costs, energy-intensive CO2 capture, and a lack of infrastructure for the storage and use of carbon. Nevertheless, these obstacles are being addressed by greater EU funding, the integration of renewable energy, and growing participation from significant European industry players.

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2024 - 2034 |

| 2024 Evaluation | $0.6 Million |

| 2034 Forecast | $4,538.9 Million |

| CAGR | 142.98% |

DAC is becoming a crucial component of Europe's decarbonisation strategy as technology advances and costs come down, allowing businesses to offset emissions and support a circular carbon economy.

Market Introduction

The market for direct air capture (DAC) in Europe is becoming a vital part of the region's plan to combat climate change and meet aggressive net-zero emissions goals. By actively absorbing carbon from the surrounding air, DAC technology presents a viable way to lower atmospheric CO2 and support a circular carbon economy. Investment in DAC systems has increased as a result of Europe's strict environmental regulations, strong legal frameworks, and large government investments in the development of clean technologies.

Technological advancements, particularly in efficient solid sorbents and liquid solvents, are driving significant improvements in the performance and scalability of DAC solutions. As renewable energy integration becomes increasingly prevalent, the energy-intensive nature of DAC processes is being mitigated, further enhancing viability. Major European companies and research institutions are actively exploring DAC applications, fostering innovation and collaboration across the sector.

Despite challenges such as high capital and operational costs, the growing demand for carbon removal solutions and increasing commitment to sustainability are expected to propel market growth. With the integration of DAC systems into broader carbon utilization strategies, the market offers vast opportunities for stakeholders to invest in eco-friendly technologies that support long-term decarbonization efforts in Europe.

Market Segmentation

Segmentation 1: by Application

- Carbon Capture and Storage

- Carbon Capture, Utilization, and Storage

Segmentation 2: by End User

- Chemicals and Fuels

- Carbon Mineralization

- Oil and Gas

- Others

Segmentation 3: by Technology

- Solid DAC

- Liquid DAC

Segmentation 4: by Country

- Iceland

- Norway

- U.K.

Market Trends, Drivers and Challenges of Europe Direct Air Capture Market

Ambitious climate goals and net-zero aspirations are driving the growth of the Europe Direct Air Capture (DAC) sector. Rapid developments in DAC technology, enhanced integration with carbon utilisation applications such as synthetic fuels, and rising governmental and private sector investments are some of the major trends. Increased funding for clean technology, favourable EU legislation, and rising CO2 levels are important motivators. High capital and operating expenses, a lack of infrastructure for storing CO2, and the energy-intensive nature of DAC procedures are among of the market's obstacles, too. For broad adoption and long-term market viability in the area, these obstacles must be removed.

How can this report add value to an organization?

Product/Innovation Strategy: This report provides a comprehensive product and innovation strategy for the Europe direct air capture market, highlighting opportunities for market entry, technological advancements, and sustainable practices. It offers actionable insights that enable organizations to meet carbon reduction goals and capitalize on the increasing demand for direct air capture across various sectors.

Growth/Marketing Strategy: This report outlines a robust growth and marketing strategy specifically tailored for the Europe direct air capture market. It emphasizes a targeted approach to identifying niche market segments, establishing competitive advantages, and implementing innovative marketing initiatives to optimize market share and financial performance. By leveraging these strategic recommendations, organizations can strengthen their market presence, exploit emerging opportunities, and drive revenue growth effectively.

Competitive Strategy: This report formulates a strong competitive strategy designed for the Europe direct air capture market. It assesses key market players, suggests differentiation tactics, and provides guidance for maintaining a competitive edge. By following these strategic directives, companies can effectively position themselves against competitors, ensuring long-term success and profitability in a rapidly evolving market.

Key Market Players and Competition Synopsis

The companies that are profiled in the Europe direct air capture market have been selected based on input gathered from primary experts and analyzing company coverage, project portfolio, and market penetration.

Some of the prominent names in this market are:

- Climeworks

- Soletair Power

- Avnos, Inc.

- Skytree

- Carbyon

Table of Contents

Executive Summary

Scope and Definition

1 Markets

- 1.1 Trends: Current and Future Impact Assessment

- 1.1.1 Advancement in Modular and Scalable Designs

- 1.1.2 Collaboration Between Public and Private Sectors

- 1.2 Supply Chain Overview

- 1.2.1 Value Chain Analysis

- 1.3 Research and Development Review

- 1.3.1 Patent Filing Trend (by Country and Company)

- 1.4 Regulatory Landscape

- 1.5 Funding Analysis

- 1.6 Stakeholder Analysis

- 1.6.1 Startup Landscape

- 1.6.2 Use Case

- 1.6.3 End User and Buying Criteria

- 1.7 Impact Analysis for Key Global Events

- 1.7.1 COVID-19 Impact

- 1.7.2 Russia/Ukraine War

- 1.8 Market Dynamics Overview

- 1.8.1 Market Drivers

- 1.8.1.1 Growing Focus on Achieving Global Net-Zero Emission Targets

- 1.8.1.2 Technological Advancements and Government Incentives

- 1.8.1.3 Increased Investment in Carbon Removal Technologies

- 1.8.2 Market Restraints

- 1.8.2.1 Limited CO2 Storage Infrastructure

- 1.8.2.2 High Operational and Capital Costs

- 1.8.3 Market Opportunities

- 1.8.3.1 Emergence of Carbon Utilization Markets

- 1.8.3.2 Integration with Renewable Energy Sources

- 1.8.1 Market Drivers

- 1.9 Techno-Economic Assessment

- 1.9.1 Cost Analysis

- 1.9.2 Breakeven Analysis

- 1.9.3 Comparative Analysis with Other Technologies

2 Regions

- 2.1 Regional Summary

- 2.2 Europe

- 2.2.1 Regional Overview

- 2.2.2 Driving Factors for Market Growth

- 2.2.3 Factors Challenging the Market

- 2.2.4 Application

- 2.2.5 Product

- 2.2.6 Europe (by Country)

- 2.2.6.1 Iceland

- 2.2.6.1.1 Application

- 2.2.6.1.2 Product

- 2.2.6.2 Norway

- 2.2.6.2.1 Application

- 2.2.6.2.2 Product

- 2.2.6.3 U.K.

- 2.2.6.3.1 Application

- 2.2.6.3.2 Product

- 2.2.6.4 Switzerland

- 2.2.6.1 Iceland

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Next Frontiers

- 3.2 Geographic Assessment

- 3.2.1 Climeworks

- 3.2.1.1 Overview

- 3.2.1.2 Top Products/Product Portfolio

- 3.2.1.3 Top Competitors

- 3.2.1.4 Target Customers/End Users

- 3.2.1.5 Key Personnel

- 3.2.1.6 Analyst View

- 3.2.2 Soletair Power

- 3.2.2.1 Overview

- 3.2.2.2 Top Products/Product Portfolio

- 3.2.2.3 Top Competitors

- 3.2.2.4 Target Customers/End Users

- 3.2.2.5 Key Personnel

- 3.2.2.6 Analyst View

- 3.2.3 Avnos, Inc.

- 3.2.3.1 Overview

- 3.2.3.2 Top Products/Product Portfolio

- 3.2.3.3 Top Competitors

- 3.2.3.4 Target Customers/End Users

- 3.2.3.5 Key Personnel

- 3.2.3.6 Analyst View

- 3.2.4 Skytree

- 3.2.4.1 Overview

- 3.2.4.2 Top Products/Product Portfolio

- 3.2.4.3 Top Competitors

- 3.2.4.4 Target Customers/End Users

- 3.2.4.5 Key Personnel

- 3.2.4.6 Analyst View

- 3.2.5 Carbyon

- 3.2.5.1 Overview

- 3.2.5.2 Top Products/Product Portfolio

- 3.2.5.3 Top Competitors

- 3.2.5.4 Target Customers/End Users

- 3.2.5.5 Key Personnel

- 3.2.5.6 Analyst View

- 3.2.1 Climeworks

4 Research Methodology

- 4.1 Data Sources

- 4.1.1 Primary Data Sources

- 4.1.2 Secondary Data Sources

- 4.1.3 Data Triangulation

- 4.2 Market Estimation and Forecast